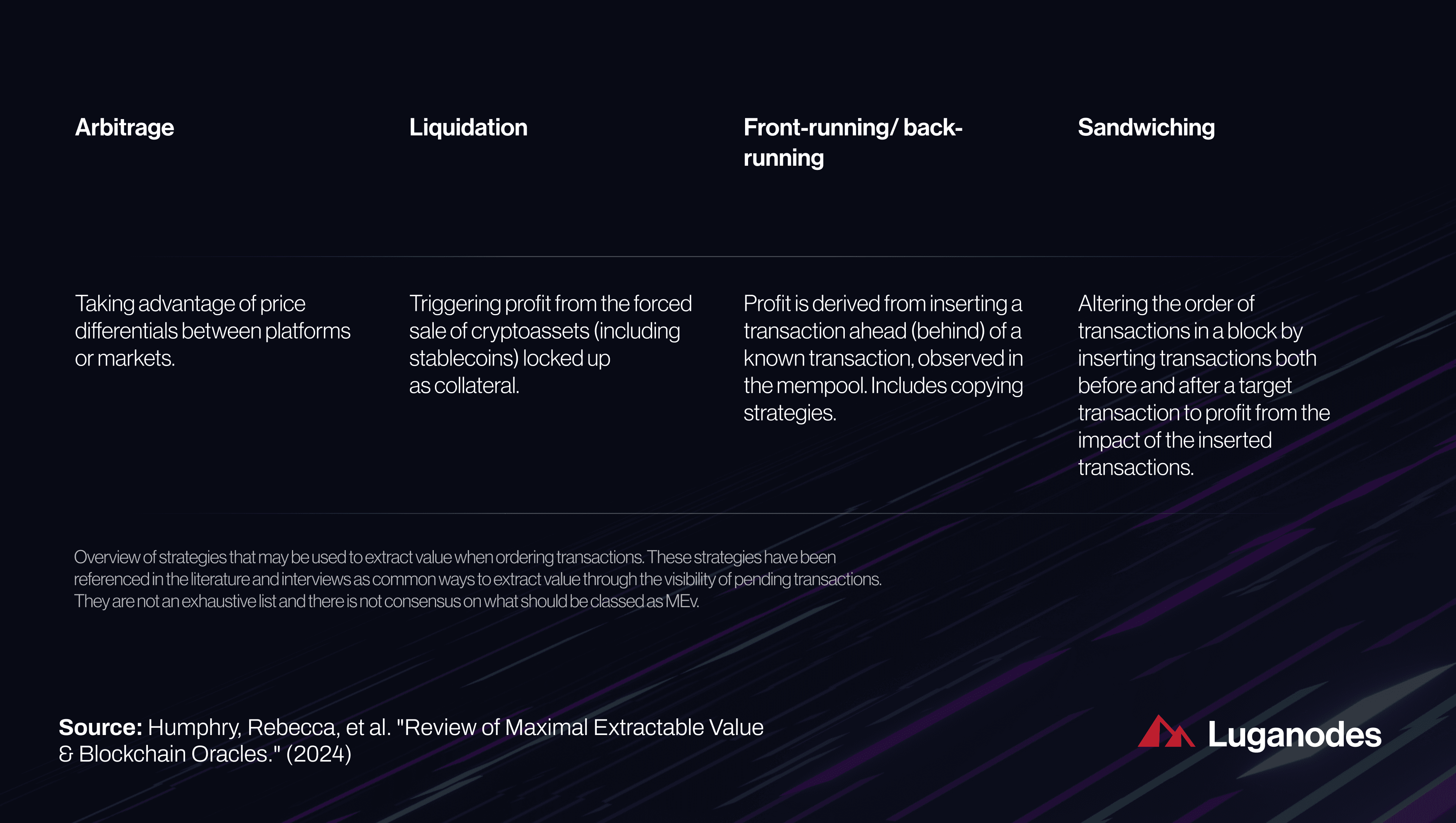

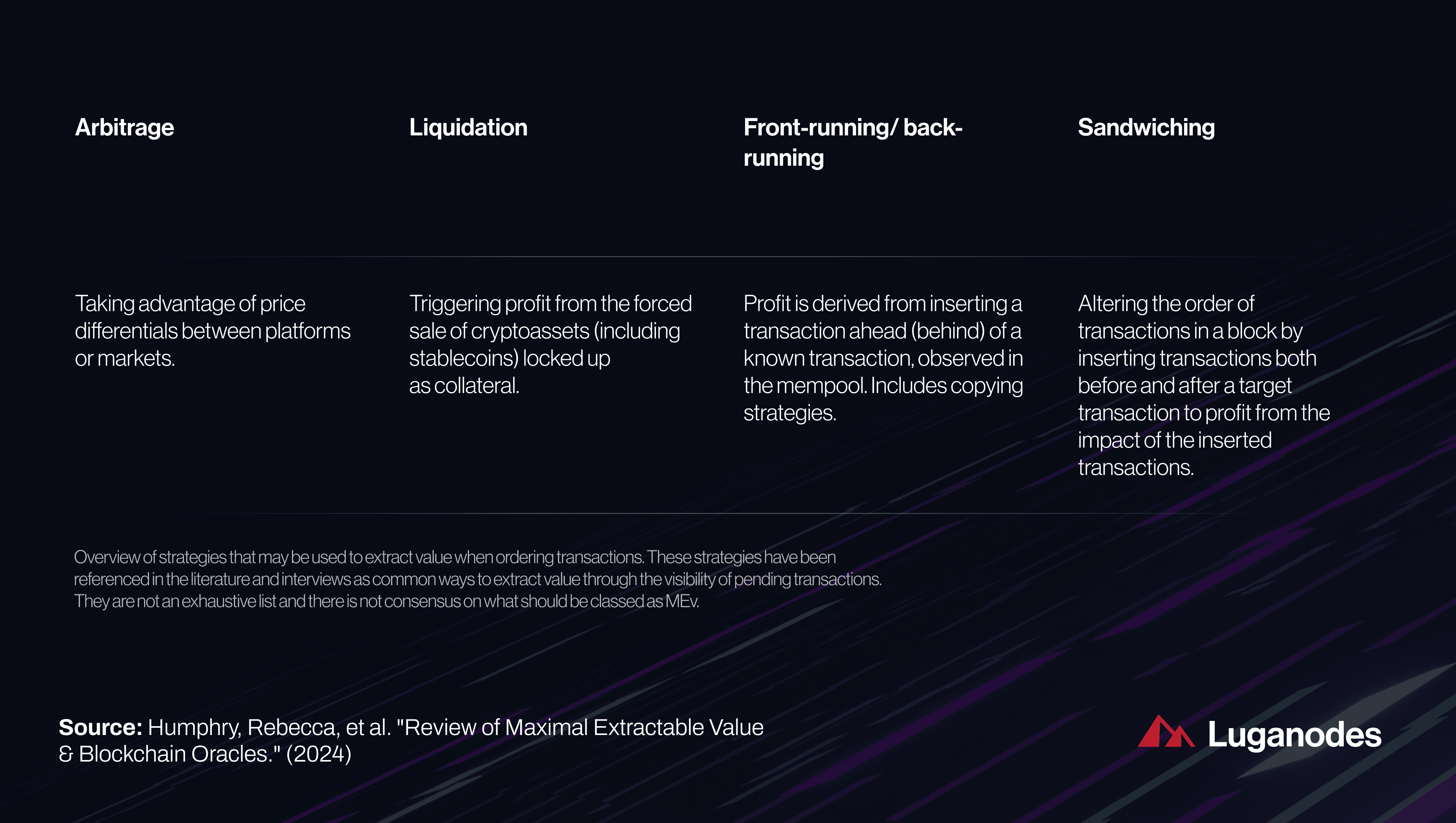

In the rapidly evolving landscape of decentralized finance (DeFi), transaction execution has become a battleground for efficiency, fairness, and value capture. Traditional MEV (Maximal Extractable Value) extraction methods have long exposed users to front-running, sandwich attacks, and unpredictable transaction costs. Enter modular MEV auctions: a paradigm shift that leverages real-time data and transparent competition to optimize every facet of blockchain transaction flow.

The Problem with Traditional Transaction Ordering in DeFi

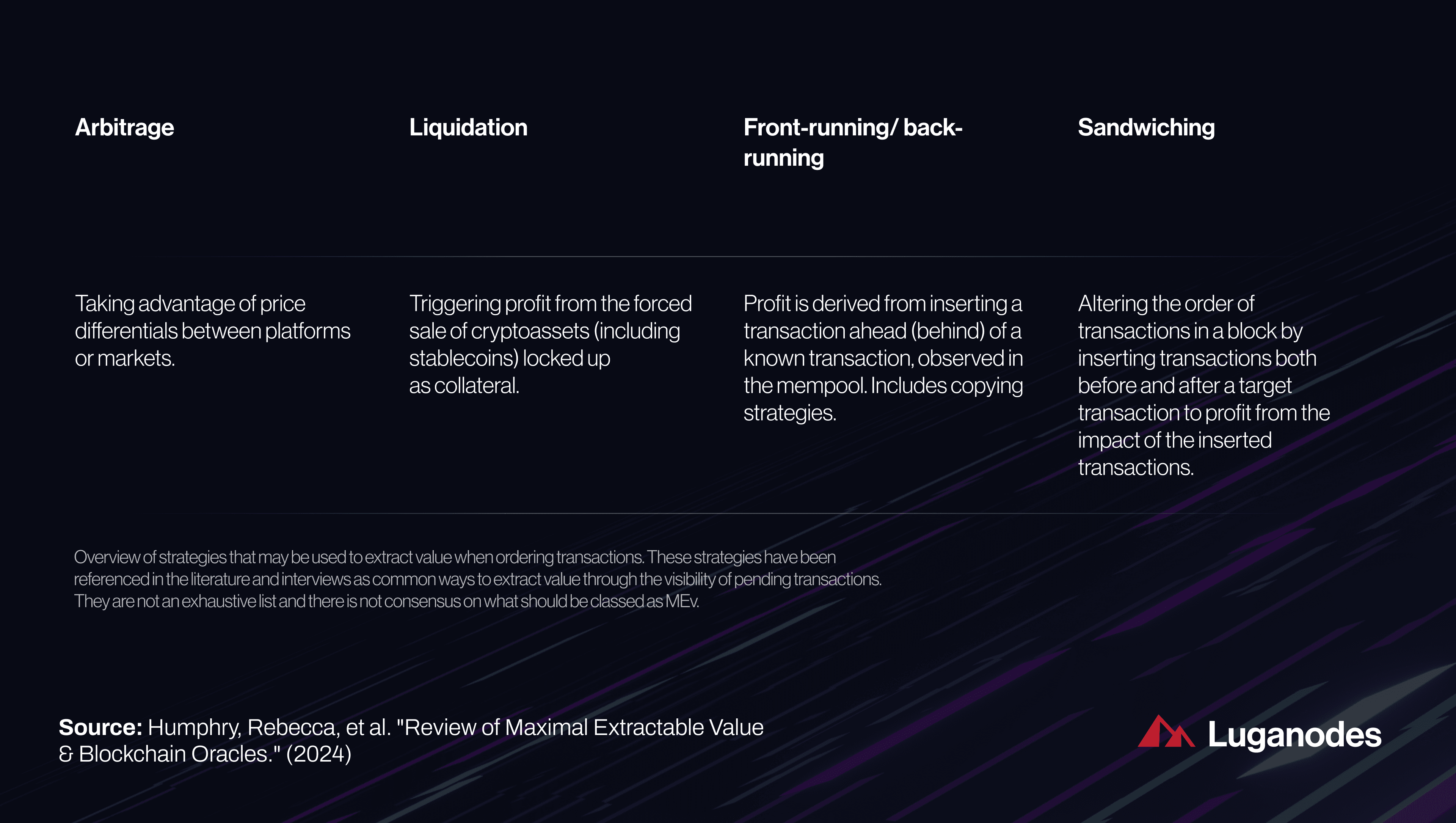

Legacy DeFi protocols rely on public mempools where anyone can observe, reorder, or insert transactions for profit. This environment rewards high-frequency bots and sophisticated searchers at the expense of ordinary users, often resulting in failed trades or inflated slippage. As DeFi volumes surge and blockspace becomes more contested, these inefficiencies have only intensified.

Recent research highlights that up to 10% of all Ethereum trades are negatively impacted by MEV-related interference. Users pay higher gas fees or see their trades front-run by actors exploiting information asymmetry. The need for a more equitable system is urgent.

How Modular MEV Auctions Restructure Transaction Execution

Modular MEV auctions fundamentally alter this dynamic by introducing competitive marketplaces for transaction ordering. Instead of leaving transaction inclusion to chance or predatory actors, these systems:

- Batch user transactions and auction them to specialized builders or solvers.

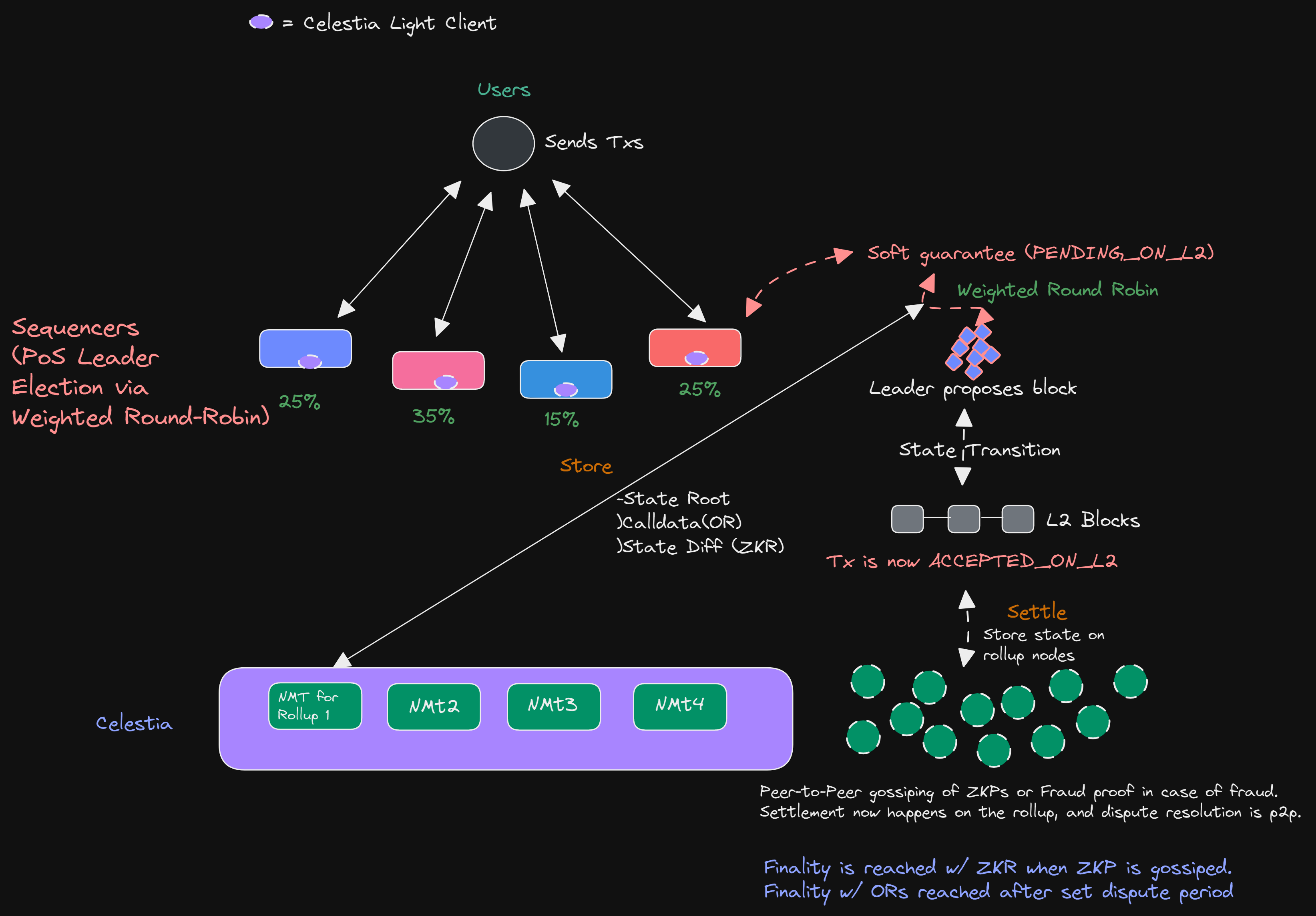

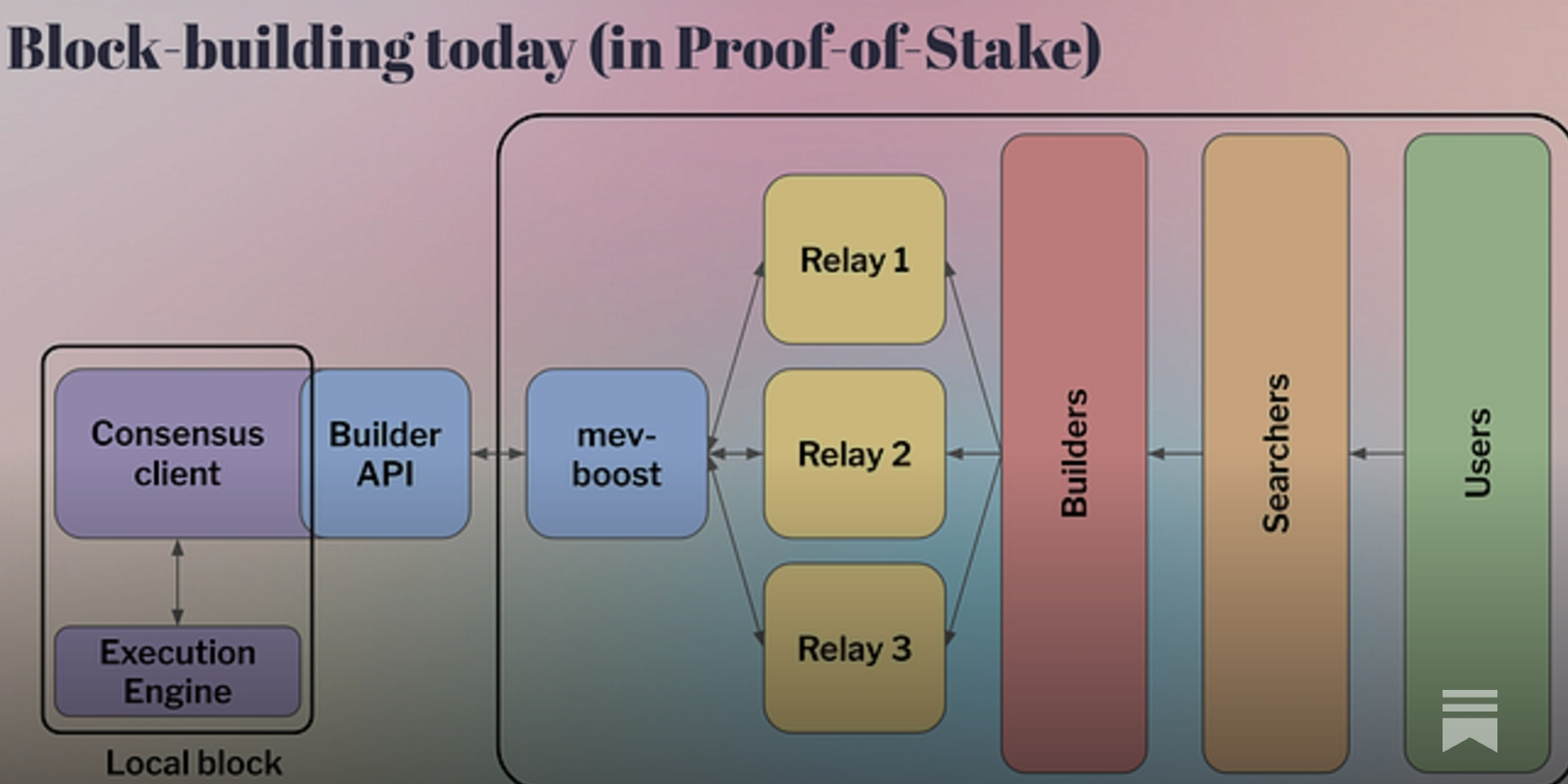

- Implement proposer-builder separation (PBS), decentralizing control over block construction and reducing single points of failure.

- Enforce failure cost penalties, filtering out malicious or unserious bidders who might otherwise disrupt orderflow.

This structure not only mitigates exploitative practices but also increases predictability for all participants. Builders compete transparently for orderflow, while proposers select blocks based on clear economic incentives rather than opaque relationships or off-chain deals.

The Role of Real-Time Auction Data in Optimized Trade Execution

The availability of real-time auction data is a game changer for both retail traders and institutional players. By accessing up-to-the-moment insights into auction outcomes, fee rates, and blockspace allocation:

- Traders can better time their orders, reducing the risk of failed execution or excessive slippage during volatile periods.

- Auction participants gain transparency into market demand, allowing them to calibrate bidding strategies dynamically.

- Protocols can adjust fee models on the fly, mitigating LVR (Loss Versus Rebalancing) and aligning incentives across stakeholders.

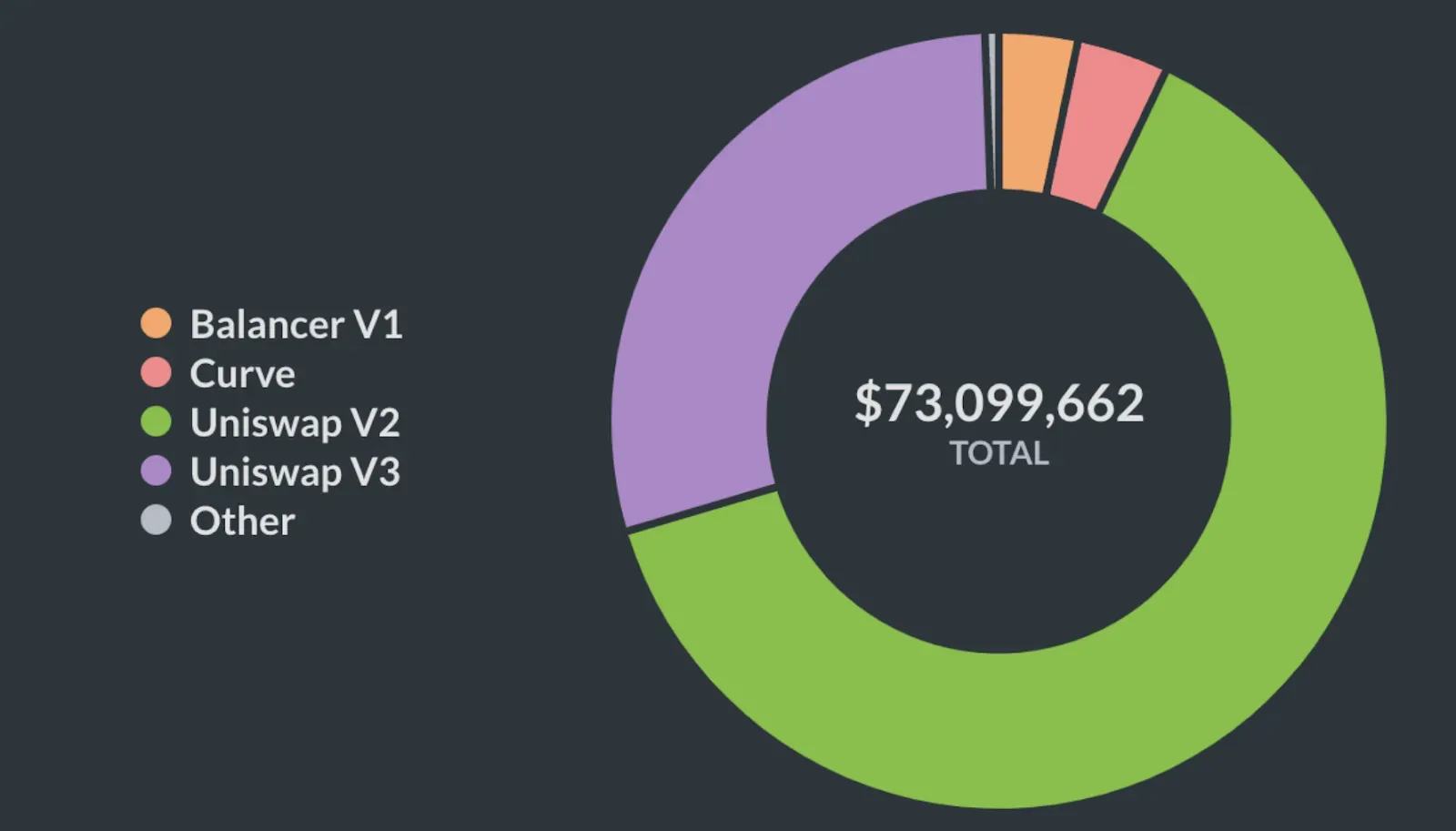

This feedback loop fosters a more liquid and efficient market where value flows back to end users instead of being siphoned off by shadowy arbitrageurs. Studies from platforms like Arrakis Finance confirm that dynamic auction-based models reduce predatory behavior while enhancing overall price discovery.

Integrating Blockspace Market Solutions for Next-Level Efficiency

The synergy between modular MEV auctions and advanced blockspace market solutions is reshaping how DeFi protocols operate at scale. By treating blockspace as a dynamically priced commodity allocated via transparent auctions:

- Batched orderflow reduces network congestion, optimizing gas usage across chains.

- Diverse participants access equal opportunities to compete for inclusion value.

- Ecosystem-wide transparency drives down costs while increasing throughput potential.

This approach aligns with findings from platforms like Solana’s Jito bundling system, where auction-based revenue redistribution benefits both infrastructure providers and token holders. As more rollups adopt similar architectures, the potential for cross-rollup composability grows – addressing long-standing issues around fragmented liquidity and shared MEV opportunities across chains.

As modular MEV auctions and blockspace markets continue to mature, the competitive landscape of DeFi is evolving toward greater efficiency and transparency. The ability to analyze real-time auction data not only empowers traders to optimize execution, but also enables protocols to fine-tune their mechanisms for fee collection, order routing, and risk management. This data-driven approach is instrumental in reducing the prevalence of failed trades and minimizing the extractive impact of traditional MEV strategies.

One notable outcome is the reduction in LVR (Loss Versus Rebalancing), a persistent issue in AMMs where arbitrageurs profit at the expense of liquidity providers. By incorporating dynamic fee models and auction-based transaction ordering, platforms can tax opportunistic actors more effectively and redistribute value back into the protocol. This not only curbs predatory behavior but also enhances capital efficiency for liquidity providers, ultimately increasing protocol stickiness and long-term sustainability.

Practical Benefits for Traders, Protocols, and Builders

The implementation of modular MEV auctions delivers tangible advantages across the DeFi stack:

Key Benefits of Modular MEV Auctions in DeFi

-

Enhanced Transaction Fairness: Modular MEV auctions standardize transaction inclusion, reducing advantages for high-frequency bots and minimizing frontrunning and sandwich attacks. This creates a more level playing field for all traders. (modularmev.com)

-

Improved Price Discovery: By enabling competitive bidding for block space, these auctions drive tighter spreads and more efficient price formation, benefiting both protocols and end users. (modularmev.com)

-

Lower Transaction Costs: Batch processing and optimized blockspace allocation through modular auctions reduce network congestion and gas fees, making DeFi more cost-effective for traders and protocols. (modularmev.com)

-

Incentive Alignment for Builders and Protocols: Mechanisms like proposer-builder separation (PBS) and failure cost penalties align incentives across infrastructure providers, builders, and protocols, ensuring higher quality execution and discouraging malicious behavior. (arxiv.org)

-

Real-Time Data for Optimized Execution: Access to real-time MEV auction data empowers traders to optimize order timing and routing, minimizing failed trades and maximizing execution quality. (modularmev.com)

-

Greater Transparency and Trust: Modular MEV auctions replace opaque transaction ordering with transparent, auditable processes, fostering trust among users, protocols, and builders. (modularmev.com)

For traders, predictable execution costs and reduced slippage mean more reliable trading outcomes, even during periods of high volatility. Protocols benefit from improved price discovery mechanisms and a fairer distribution of transaction fees. Builders gain access to transparent bidding environments that reward honest participation over opaque or manipulative tactics.

This shift toward open competition is supported by research on proposer-builder separation (PBS) models, now increasingly adopted by leading rollups, which decouple block construction from block proposal. This separation reduces centralization risks while allowing for more sophisticated optimization strategies tailored to user needs.

A Roadmap Toward Fairer DeFi Markets

The trajectory for modular MEV auctions points toward an ecosystem where transaction execution in DeFi is no longer a zero-sum game dominated by insiders. Instead, value flows transparently among users, infrastructure providers, and protocols, all incentivized to participate honestly within an open marketplace.

Emerging cross-rollup solutions further expand this vision by enabling composable orderflow across multiple chains, addressing challenges like fragmented liquidity pools and shared MEV extraction opportunities. As these innovations gain traction, expect a rapid convergence toward best practices that prioritize fairness, efficiency, and user empowerment across all layers of decentralized finance.

The bottom line: Modular MEV auctions are not just an incremental improvement, they represent a foundational upgrade for transaction execution in blockchain markets. By leveraging real-time data, transparent competition, and advanced blockspace allocation mechanisms, they set a new standard for what’s possible in DeFi trading efficiency.