In the fast-shifting world of decentralized finance (DeFi), transaction ordering is the invisible hand shaping user experience, security, and profitability. For years, this process has been a battleground for sophisticated actors seeking to extract Maximal Extractable Value (MEV), often at the expense of regular users. But a new paradigm is emerging: modular MEV auctions. By systematizing and democratizing transaction sequencing, these innovations are transforming how DeFi protocols process and prioritize transactions.

The Problem with Traditional Transaction Ordering in DeFi

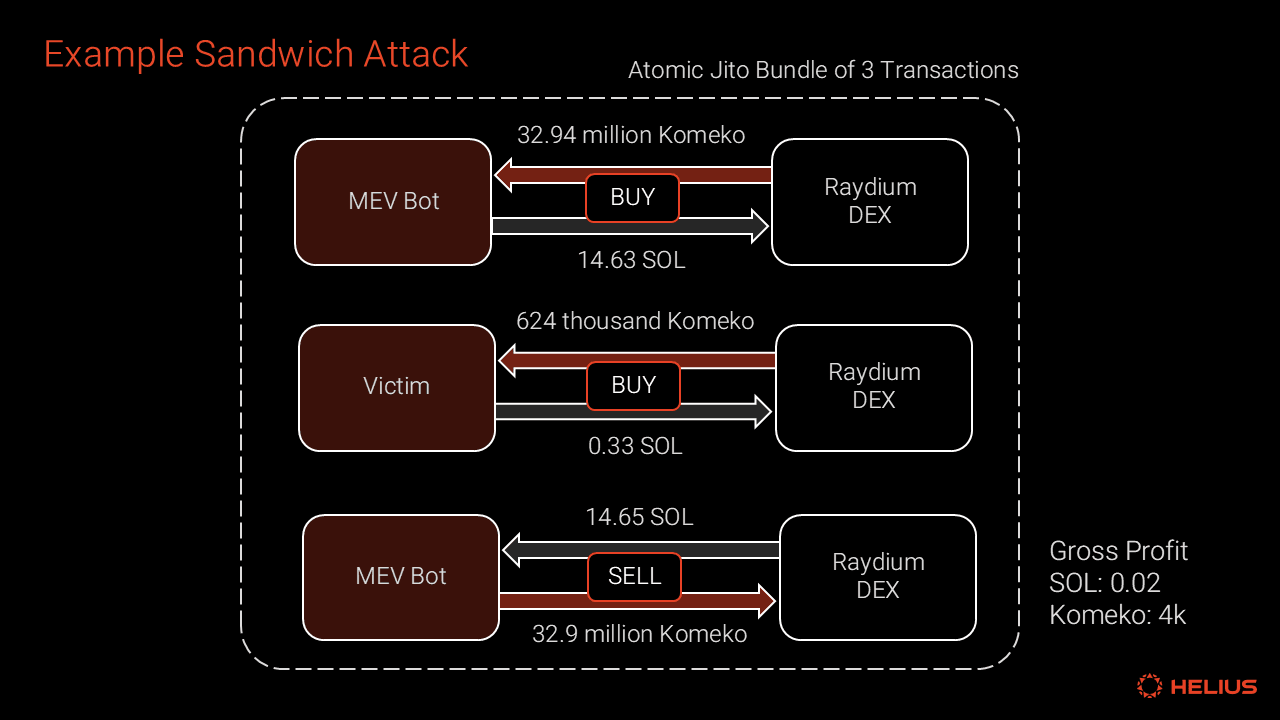

Before modular MEV auctions entered the scene, block producers wielded near-total control over transaction order. This lack of transparency enabled predatory tactics like front-running and sandwich attacks, where bots or miners could reorder pending transactions for personal profit. The result? Everyday users lost value, and the integrity of DeFi markets suffered.

The core issue was simple: whoever controlled block construction could manipulate transaction flow to their advantage. As highlighted in recent research (arXiv: Maximal Extractable Value Mitigation Approaches), this created an uneven playing field that discouraged fair participation.

What Are Modular MEV Auctions?

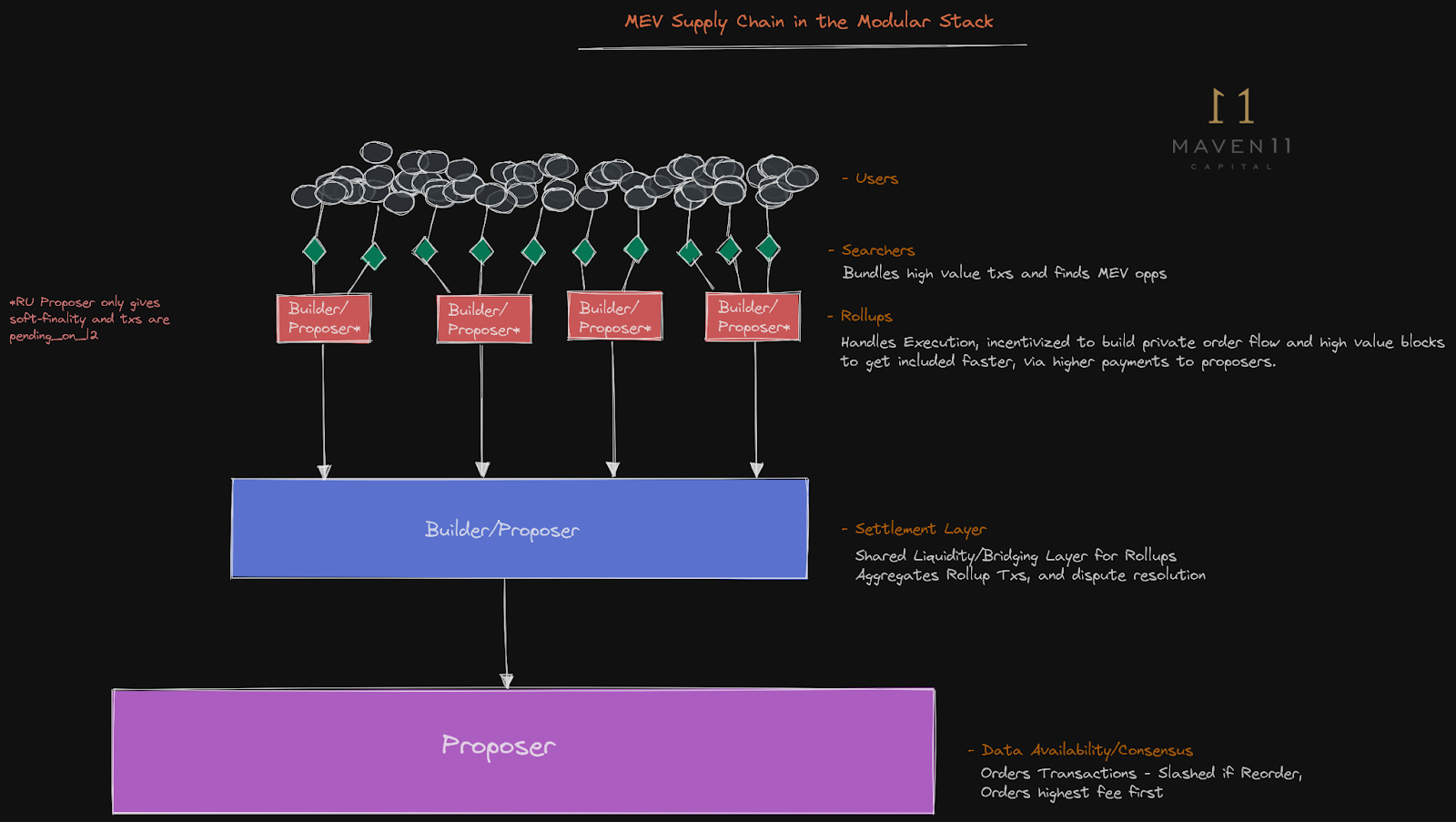

Modular MEV auctions introduce a radical shift by separating block construction into specialized roles, most notably, proposers and builders. This separation is at the heart of Ethereum’s push toward Proposer-Builder Separation (PBS), but it’s also being adopted across other blockchain ecosystems.

The key innovation is the Order Flow Auction (OFA). Here’s how it works:

- Users submit transactions to an open marketplace instead of directly to block producers.

- Bidders compete, offering payments for the right to order these transactions within the next block.

- The highest bidder wins, sequences the transactions to maximize value extraction, and often shares a portion of that value back with users or protocols.

This modular approach creates an open marketplace for transaction ordering, a vast improvement over opaque miner incentives. By inviting competition among builders and solvers, OFAs help ensure that no single entity can monopolize MEV opportunities.

The Impact on Transaction Ordering: Fairness Meets Efficiency

This new architecture delivers several game-changing benefits for DeFi participants:

- Enhanced Fairness: With multiple builders bidding transparently for order flow rights, manipulative practices like front-running are curbed. Users can trust that their transactions will not be unfairly exploited by insiders or bots.

- User Empowerment: Instead of losing value to hidden intermediaries, users can reclaim part of their transaction’s economic impact through rebates or lower fees, especially when using platforms built on transparent MEV auction principles.

- Greater Efficiency: Specialization allows blockspace market solutions to optimize for speed, efficiency, and user preference, driving down latency and slippage across major DeFi protocols.

This isn’t just theory; real-world implementations like those discussed in Maven 11’s analysis (Modular MEV Part 2: A Continued Systematization of. . . ) show measurable improvements in both market integrity and user outcomes when modular MEV auctions are deployed at scale.

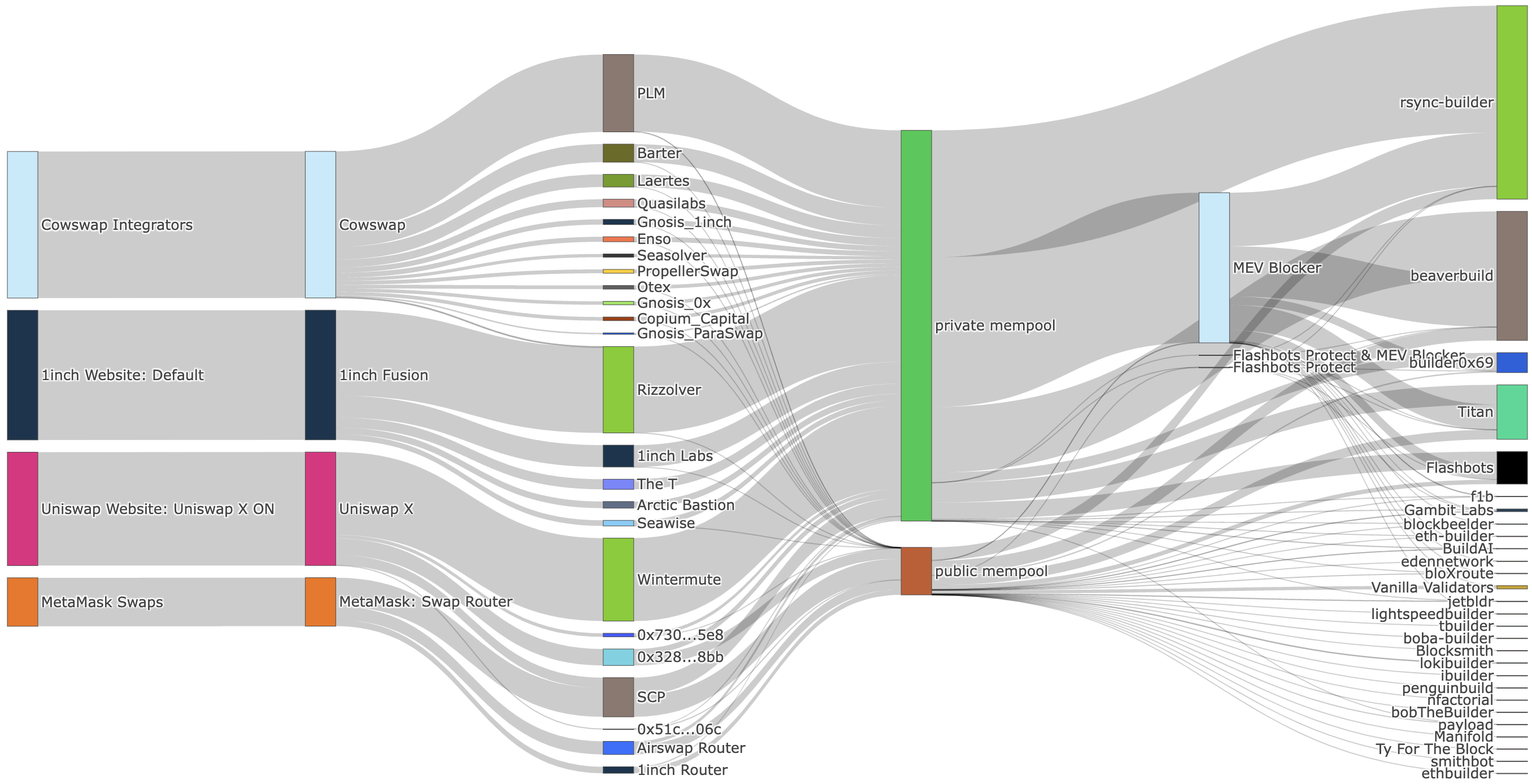

The Role of Orderflow Marketplaces and Blockspace Solutions

A vibrant ecosystem is emerging around these innovations. Dedicated orderflow marketplaces allow traders and protocols to monetize their own transaction streams directly, sidestepping traditional intermediaries entirely. Meanwhile, advanced blockspace solutions coordinate between multiple rollups or chains, addressing persistent challenges like cross-rollup MEV (Cross-rollup MEV: the unsolved problem. . . ). These tools are making it easier than ever for developers and traders alike to participate in, and benefit from, the evolving landscape of transparent MEV auctions.

As modular MEV auctions gain traction, the DeFi landscape is evolving into a more transparent and competitive environment. One of the most exciting developments is the rise of orderflow marketplaces, where protocols and users can auction their transaction flow to the highest bidder. This shift doesn’t just improve fairness; it also introduces new economic incentives that reward active network participants.

Key Benefits of Modular MEV Auctions in DeFi

-

Enhanced Fairness and Transparency: Modular MEV auctions, such as Flashbots and Order Flow Auctions (OFAs), decentralize transaction ordering and reduce front-running, creating a more equitable environment for traders and protocols.

-

Increased Efficiency in Transaction Processing: By separating block proposing and building, modular MEV frameworks allow specialized entities to optimize their roles, leading to faster and more reliable transaction inclusion for users and developers.

-

User Empowerment and Value Return: Mechanisms like OFAs enable users to receive a portion of the MEV generated from their transactions, directly rewarding them and improving the overall user experience.

-

Mitigation of Manipulative Practices: Modular MEV auctions help curb harmful behaviors such as sandwich attacks and transaction reordering, protecting both traders and protocols from value extraction exploits.

-

Greater Competition and Innovation: By enabling multiple builders to compete for transaction ordering rights, modular MEV systems encourage innovation and prevent monopolistic control within the DeFi ecosystem.

But there’s still work to be done. Cross-rollup MEV remains a major challenge, as opportunities for value extraction now span multiple blockchains and scaling solutions. Without robust coordination, fragmented transaction ordering across rollups can reintroduce inefficiencies and vulnerabilities. Forward-thinking projects are experimenting with shared sequencing layers and collaborative auction mechanisms to address these risks head-on.

Transparency and Analytics: The Next Frontier

Another core advantage of modular MEV auctions is real-time transparency. Platforms are rolling out powerful analytics dashboards, giving users deep insights into auction outcomes, builder performance, and blockspace utilization. With this data at their fingertips, traders can make more informed decisions while developers can design smarter protocols that minimize negative externalities from MEV extraction.

The shift toward transparent MEV auctions also means that value redistribution becomes measurable. Instead of opaque miner profits, we’re seeing tangible metrics on how much value is returned to users or protocols through rebates or fee reductions. This feedback loop incentivizes continuous improvement in auction design and user experience.

What’s Next for Modular MEV Auctions?

The modular approach isn’t just a technical upgrade; it’s a philosophical pivot toward open competition and user empowerment in DeFi markets. As more blockchains adopt proposer-builder separation or similar models, expect to see:

- More granular control over transaction privacy and sequencing preferences

- Integration with advanced blockspace market solutions supporting cross-chain liquidity and composability

- Evolving incentive structures that reward both searchers (who identify profitable opportunities) and end-users (who provide valuable orderflow)

The bottom line? Modular MEV auctions are not just mitigating old risks, they’re unlocking new possibilities for fair participation in decentralized finance. By combining open competition with sophisticated analytics and user-first incentives, these systems are laying the groundwork for a more resilient DeFi ecosystem where everyone has a stake in efficient transaction ordering.

If you’re building or trading in DeFi today, now is the time to get familiar with orderflow marketplaces and transparent MEV auction platforms. The future of transaction ordering is here, and it’s modular by design.