Orderflow data has become the linchpin of next-generation MEV auction strategies, especially as modular blockspace markets redefine the landscape for decentralized finance. By offering granular, real-time insight into pending user transactions, orderflow data enables builders and searchers to craft more precise and profitable block construction strategies. The result: higher efficiency in capturing Maximal Extractable Value (MEV) and an evolving market structure that rewards both technical prowess and fair competition.

Orderflow Data: The Engine Behind Modern MEV Auctions

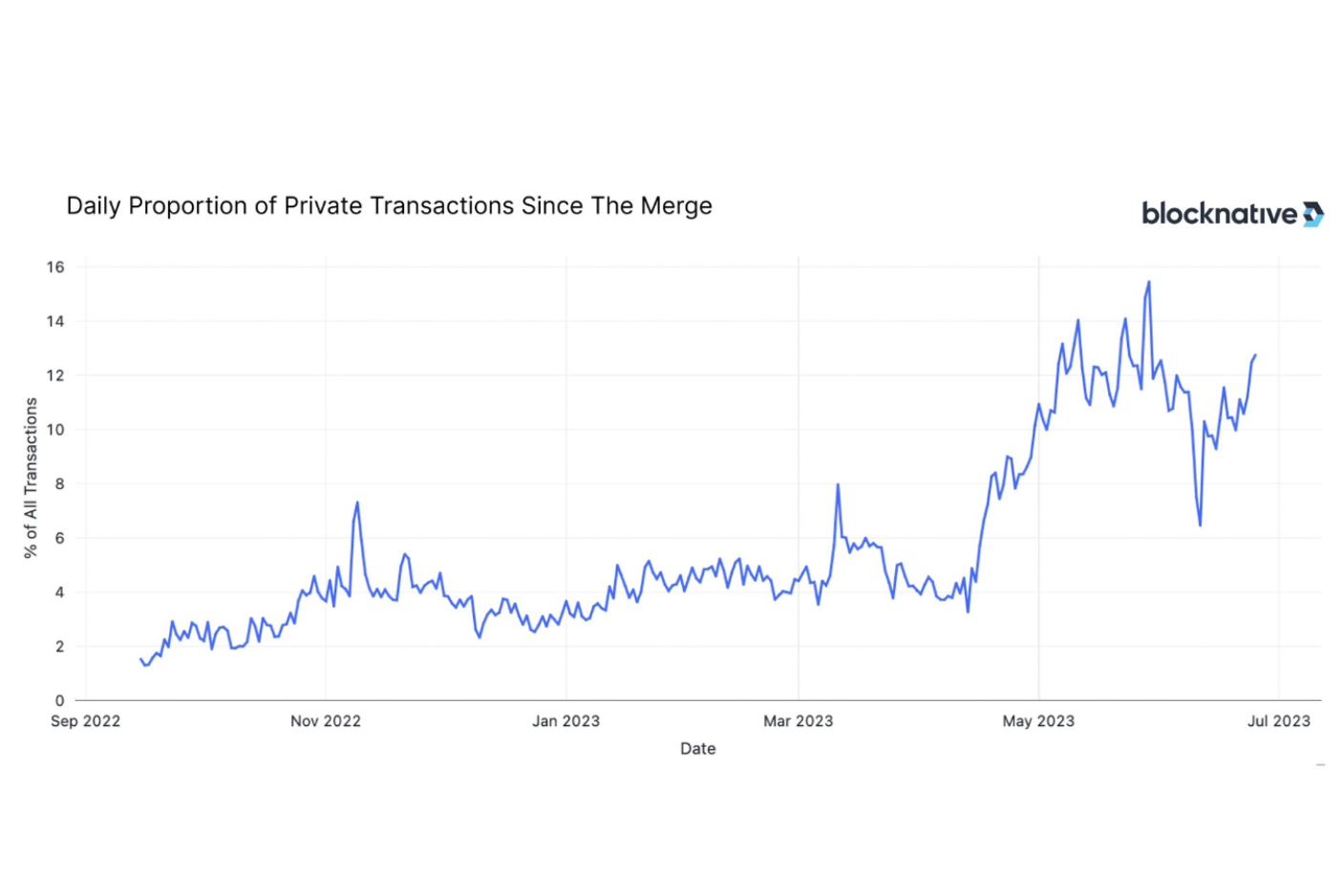

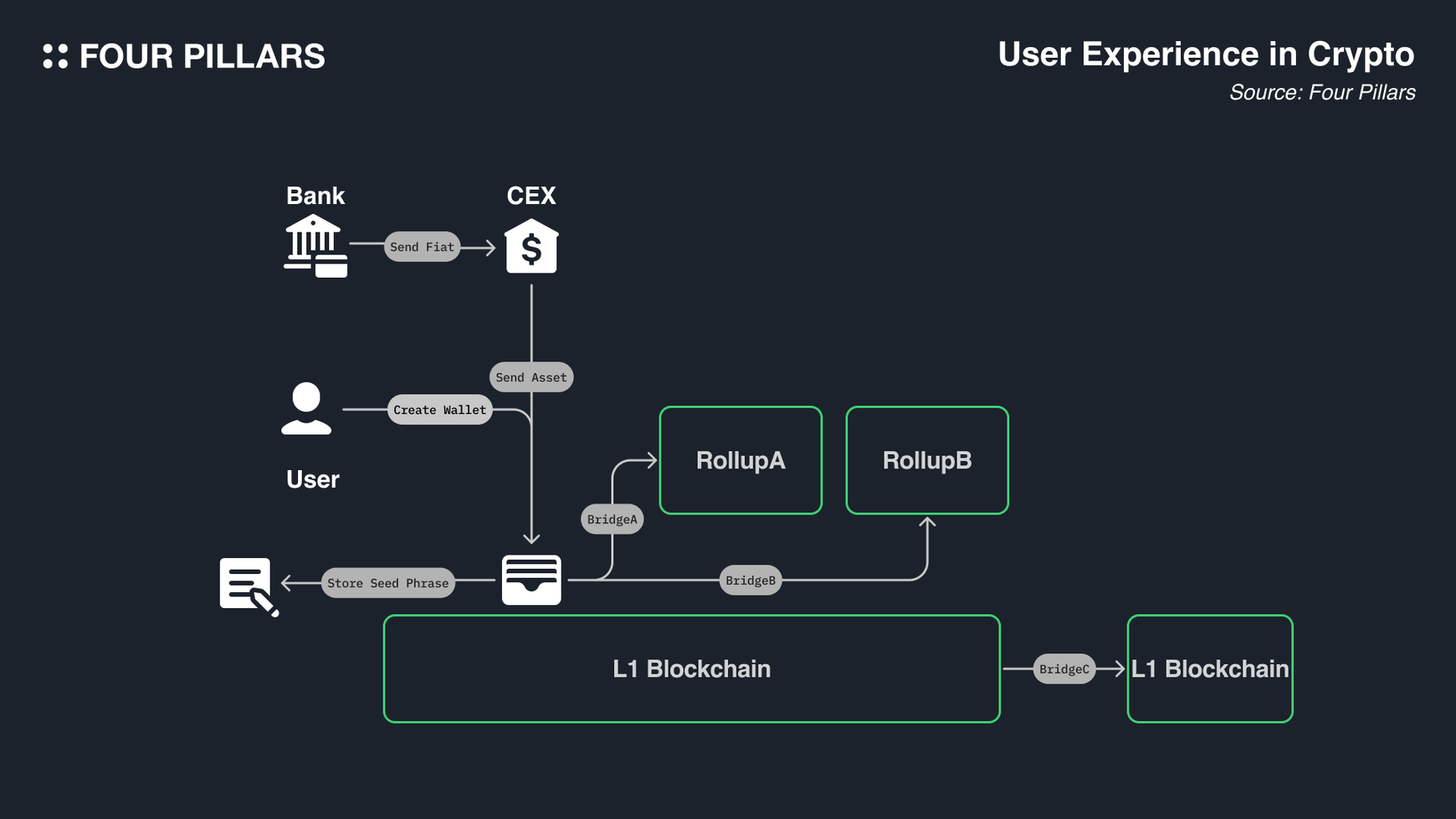

At its core, orderflow data MEV auctions rely on visibility into user-submitted transactions before they are finalized on-chain. This privileged access allows builders to simulate outcomes, anticipate arbitrage or sandwiching opportunities, and optimize transaction ordering for maximum profitability. In traditional monolithic blockchain architectures, this power was often concentrated among a handful of actors, leading to opaque practices and centralization risks.

The modular approach disrupts this paradigm. By decoupling orderflow from execution layers and introducing competitive Order Flow Auctions (OFAs), modular blockspace market strategies foster a transparent environment where builders bid for the right to execute user transactions. This not only democratizes access to MEV but also ensures that value is distributed more equitably among wallets, dApps, and end-users.

Competitive Dynamics: From Privilege to Auction

The shift from exclusive orderflow access to open auction mechanisms marks a pivotal evolution in blockchain transaction execution tools. Builders can no longer rely solely on their relationships with wallets or relays; instead, they must compete in real time against other sophisticated actors armed with advanced analytics and simulation engines.

This competitive bidding system brings several advantages:

- Transparency: All bids are visible, reducing information asymmetry.

- Efficiency: Builders are incentivized to maximize value extraction without resorting to manipulative tactics.

- User Alignment: Users can capture a share of the MEV their transactions generate via rebates or fee reductions.

Recent implementations like Flashbots’ MEV-Share illustrate how auctioning user orderflow can rebalance incentives across the ecosystem. By allowing wallets and dApps to participate directly in MEV revenue streams, these systems promote a healthier distribution of profits while minimizing monopolistic tendencies that threaten decentralization.

Real-Time Orderflow Analytics: Optimizing Auction Outcomes

The real breakthrough comes from integrating real-time orderflow analytics DeFi into auction processes. With access to streaming transaction data, builders can run advanced simulations, testing various block compositions against historical mempool patterns, to identify optimal ordering strategies under current network conditions. This dynamic feedback loop enables rapid adaptation as new opportunities arise or as competitive pressures intensify during peak activity windows.

This new paradigm is not without its challenges. The aggregation of orderflow by a few powerful builders still poses centralization risks if unchecked. However, OFAs introduce counterbalancing forces by making exclusivity contestable through open bidding rather than private deals, a critical safeguard for the future resilience of modular blockspace markets.

If you’re interested in how these mechanisms are transforming crypto trading at the infrastructure level, explore our deep dive on how modular MEV auctions are transforming orderflow in crypto trading.

For traders, developers, and protocol designers, the actionable edge comes from leveraging these analytics to fine-tune their own strategies. By analyzing historical bid data and real-time orderflow trends, participants can anticipate periods of heightened MEV extraction potential and adjust their auction tactics accordingly. This is particularly impactful in a modular blockspace market, where multiple execution environments compete for user orderflow and transaction sequencing rights.

In practice, builders deploy sophisticated bots that scan the mempool for high-value transactions, simulate various execution scenarios, and submit bids based on expected returns. The most successful actors integrate machine learning models that continuously adapt to evolving market patterns, optimizing for both speed and outcome quality. This arms race of intelligence not only increases the overall efficiency of MEV capture but also reinforces the need for robust transparency standards across all layers of the stack.

Risk Mitigation: Reducing Centralization in Modular Markets

Despite these advances, centralization remains a persistent concern. When a handful of builders control disproportionate orderflow access, they can influence block production outcomes to their advantage. OFAs directly address this by making access contestable, builders must outbid competitors in transparent auctions rather than rely on privileged relationships or opaque agreements.

Protocols like Flashbots’ MEV-Share have pioneered mechanisms where wallets and dApps can monetize their users’ orderflow by routing it through competitive auctions. As a result, end-users benefit from rebates or lower execution fees while searchers are incentivized to innovate more efficient extraction methods. This feedback loop pushes the ecosystem toward greater equilibrium between value creation and value capture.

Key Benefits of Order Flow Auctions in Modular Blockspace

-

Enhanced Fairness and Transparency: Order Flow Auctions (OFAs) create a competitive bidding process for transaction execution, ensuring a more open and transparent allocation of MEV opportunities among builders and searchers.

-

Redistribution of MEV Profits: By auctioning user orderflow, OFAs enable the redistribution of MEV revenue, allowing end users and wallets to capture a share of the value generated by their transactions. Platforms like Flashbots MEV-Share exemplify this approach.

-

Mitigation of Centralization Risks: OFAs reduce the risk of builder centralization by preventing exclusive access to orderflow, thereby promoting a more decentralized and competitive block production environment.

-

Optimized Transaction Settlement: OFAs aggregate and batch user orders, enabling more efficient and cost-effective settlement of transactions within modular blockspace markets.

-

Incentivization of Efficient Block Construction: Competitive bidding in OFAs motivates builders to optimize block construction strategies, leading to higher network performance and improved user outcomes.

Strategic Takeaways: Harnessing Orderflow Data for Competitive Advantage

To optimize MEV auction outcomes, market participants should focus on:

- Integrating real-time analytics: Use streaming data feeds to model expected value from different transaction bundles.

- Diversifying auction participation: Engage with multiple OFA platforms to avoid dependency on any single builder’s infrastructure.

- Pursuing user-aligned incentives: Design workflows that share MEV rewards with end-users or dApps supplying valuable orderflow.

The future of modular blockspace markets will be defined by how well these strategies scale with growing network activity and new DeFi primitives. As more protocols adopt OFA-based models, we can expect further innovation around privacy-preserving auctions, cross-domain settlement, and dynamic fee structures tailored to fluctuating demand.

The intersection of orderflow data MEV auctions, advanced analytics, and open auction design is catalyzing a new era in decentralized finance, one where transparency is foundational and efficiency is maximized at every layer. To stay ahead in this evolving landscape, continuous adaptation and technical rigor are essential.

Dive deeper into tactical approaches for optimizing your strategies with our resource on how orderflow analytics enhance MEV auction strategies in DeFi.