In the evolving landscape of decentralized finance (DeFi), orderflow analytics MEV is rapidly becoming a cornerstone for sophisticated trading and block-building strategies. As DeFi protocols mature and transaction volumes surge, the ability to extract and analyze real-time orderflow data is transforming how participants approach MEV auction strategies. By leveraging advanced analytics, traders, searchers, and builders gain actionable insights into transaction sequencing, market dynamics, and risk mitigation, ultimately leading to more efficient and transparent outcomes in the MEV ecosystem.

Orderflow Analytics: The Engine Behind Modern MEV Auction Strategies

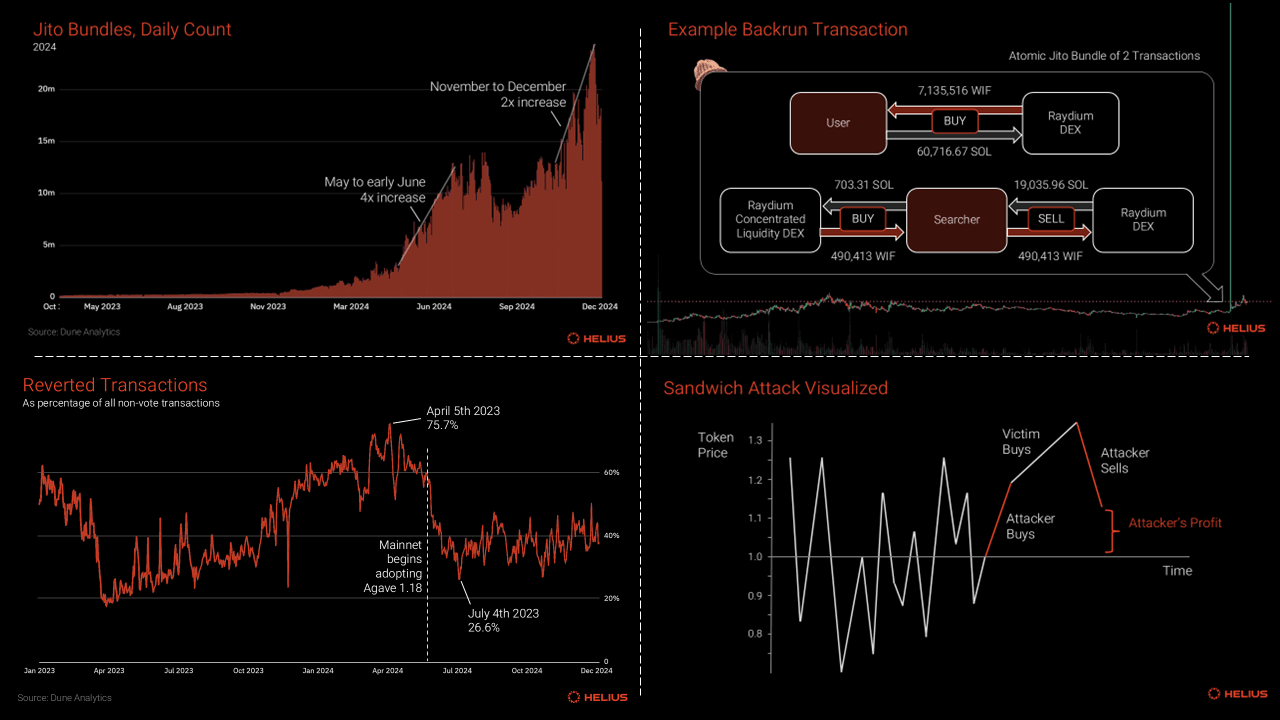

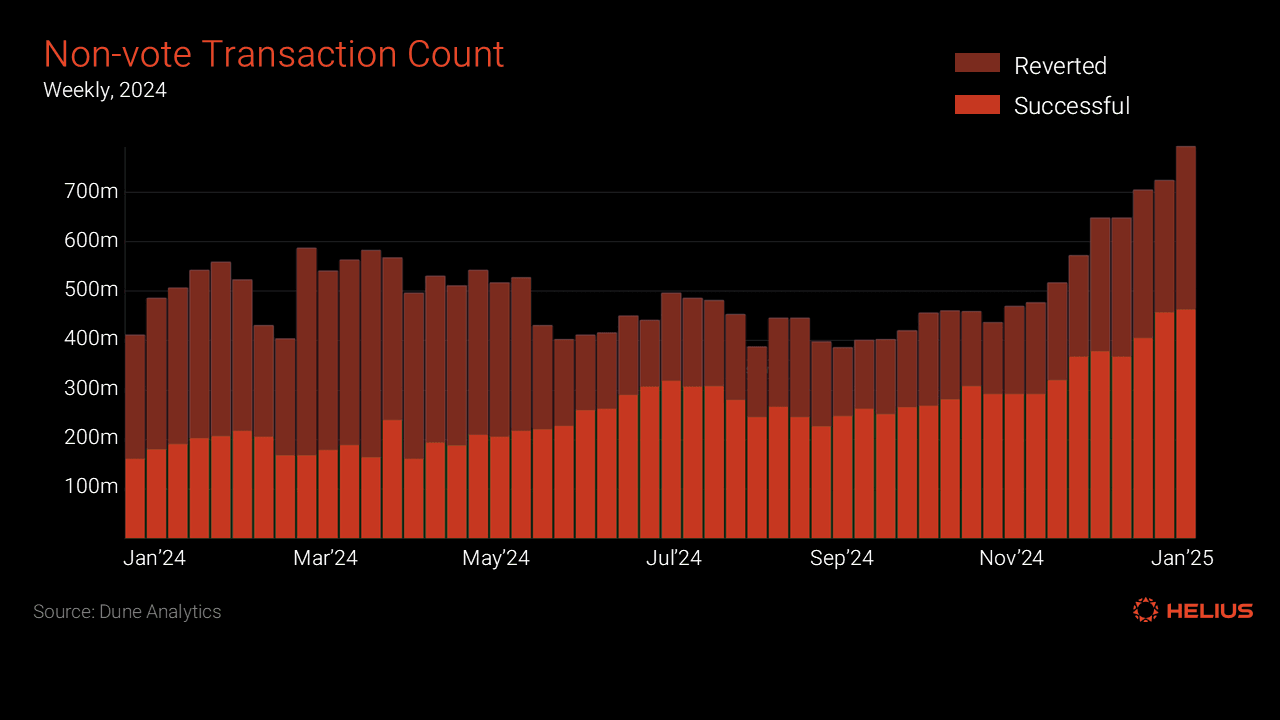

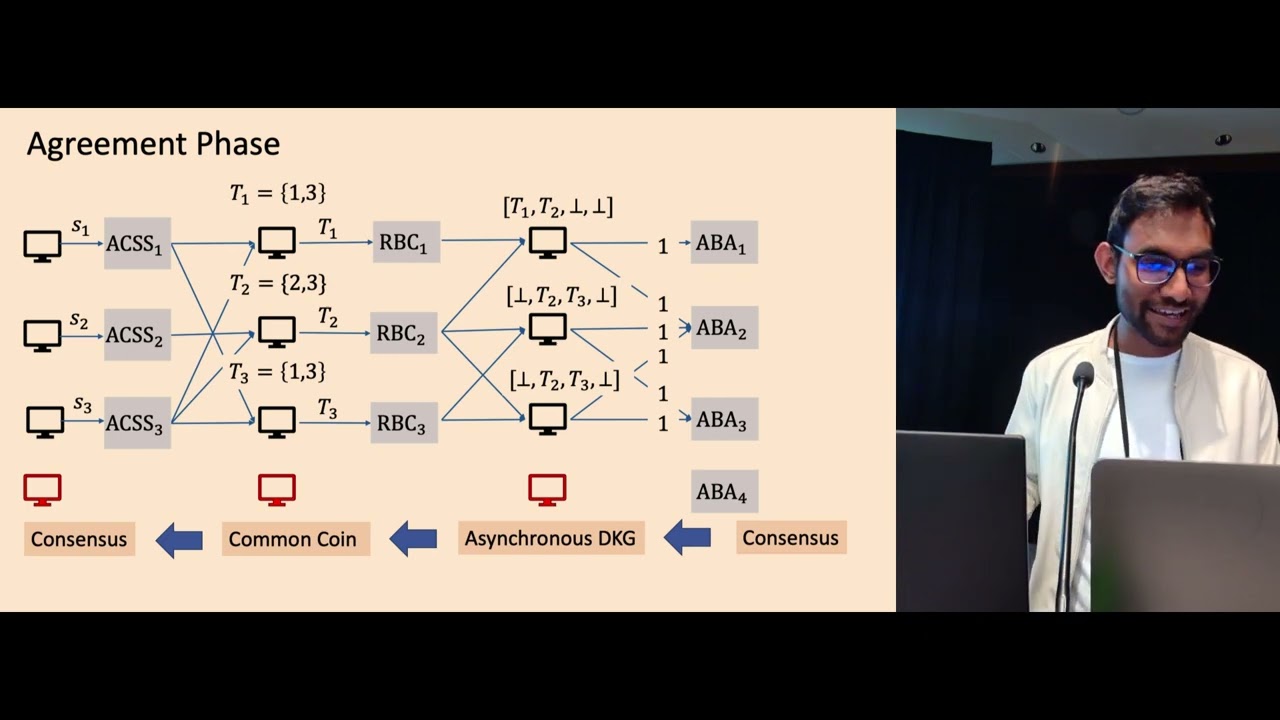

Orderflow analytics refers to the systematic examination of blockchain transaction data to uncover patterns, forecast price movements, and identify lucrative MEV opportunities. In the context of MEV auctions, this involves dissecting mempool activity, analyzing historical trading behaviors, and monitoring live order streams. The result is a granular understanding of how transactions propagate through the network, empowering searchers and builders to make informed decisions about which transactions to include or reorder for optimal value extraction.

This data-driven approach is especially relevant as protocols like Flashbots’ MEV-Share introduce new paradigms in orderflow auctions. Here, wallets and dApps can share transaction data with searchers in exchange for a share of extracted value. This transparency not only drives competition but also aligns incentives across stakeholders in the blockspace market.

“Order flow auctions rely on searcher competition to find more arbitrage opportunities and bid higher percentages of their profit towards users. “: Flashbots Writings

Key Benefits: Optimized Sequencing, Bid Precision and Risk Reduction

Key Advantages of Orderflow Analytics in DeFi MEV Auctions

-

Optimized Transaction Sequencing: Orderflow analytics enable participants to strategically position transactions, maximizing arbitrage opportunities and improving the efficiency of MEV extraction within DeFi auctions.

-

Enhanced Bid Pricing Precision: By accurately assessing transaction value, orderflow analytics allow for more competitive and precise bidding in MEV auctions, ensuring fairer compensation and improved market efficiency.

-

Risk Mitigation Against Adversarial Strategies: Deep analysis of transaction patterns helps identify and defend against frontrunning and sandwich attacks, reducing the risk of value loss for participants.

-

Increased Market Transparency: Protocols like Flashbots’ MEV-Share leverage orderflow analytics to share transaction data, promoting transparency and equitable value redistribution in MEV auctions.

-

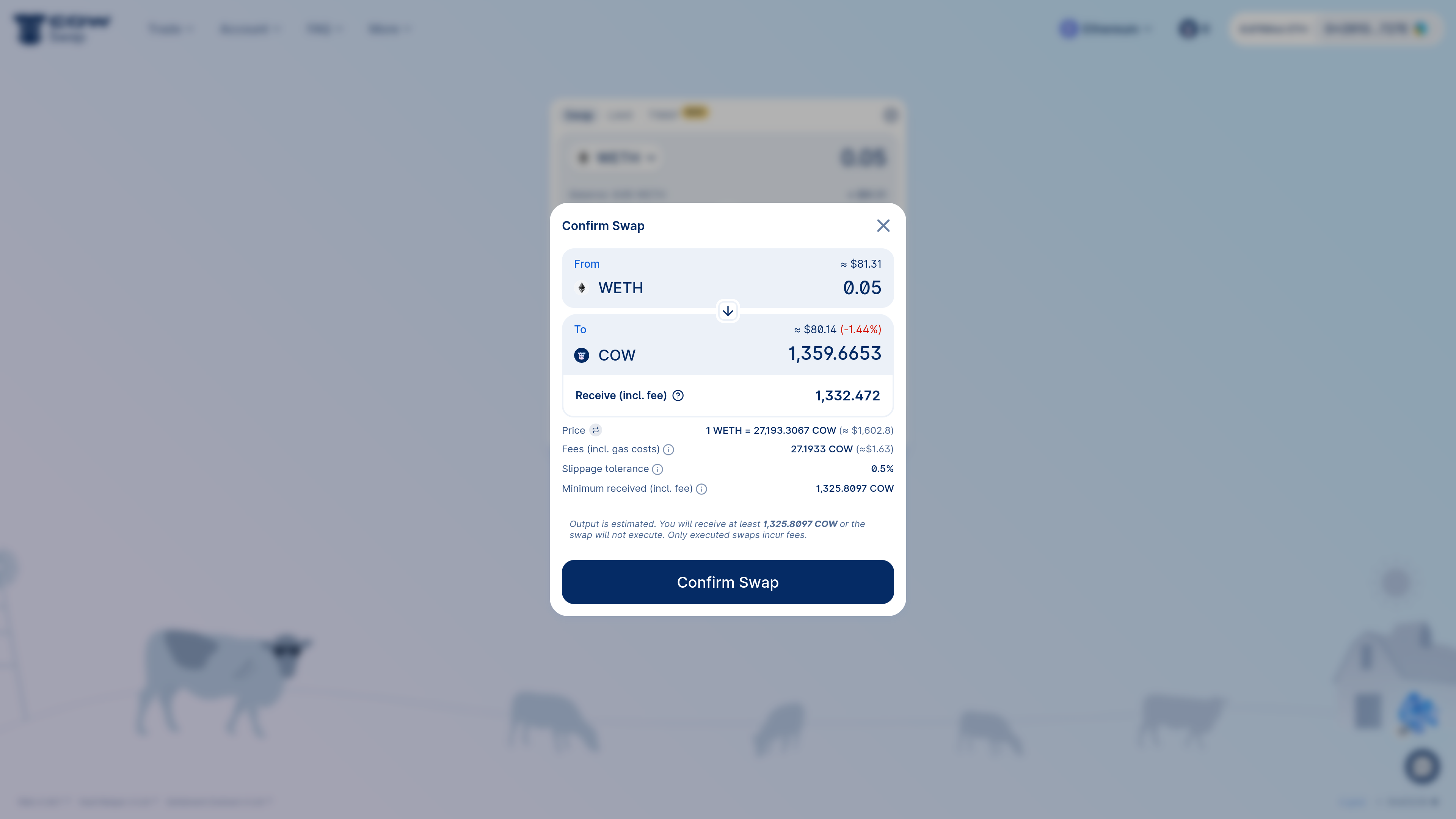

Fairer and More Efficient Trading Environments: Platforms such as CoW Swap use batch auctions and orderflow analytics to reduce the impact of high-speed traders, leading to fairer pricing and reduced MEV exploitation.

-

Advanced Liquidity and Market Fairness: Solutions like aPriori integrate AI-powered orderflow segmentation, bridging traditional HFT practices with DeFi to dynamically enhance liquidity and fairness.

The integration of orderflow tools DeFi into auction strategies yields several tangible benefits:

- Optimized Transaction Sequencing: Deep analysis allows participants to anticipate arbitrage windows, such as cross-DEX price discrepancies, and strategically sequence transactions for maximum profit.

- Improved Bid Pricing: Real-time insights enable more accurate valuation of individual transactions or bundles. This leads to competitive yet efficient bidding during block construction or orderflow auctions.

- Risk Mitigation: By identifying frontrunning patterns or sandwich attack attempts within mempool traffic, participants can proactively adjust tactics to safeguard against potential losses.

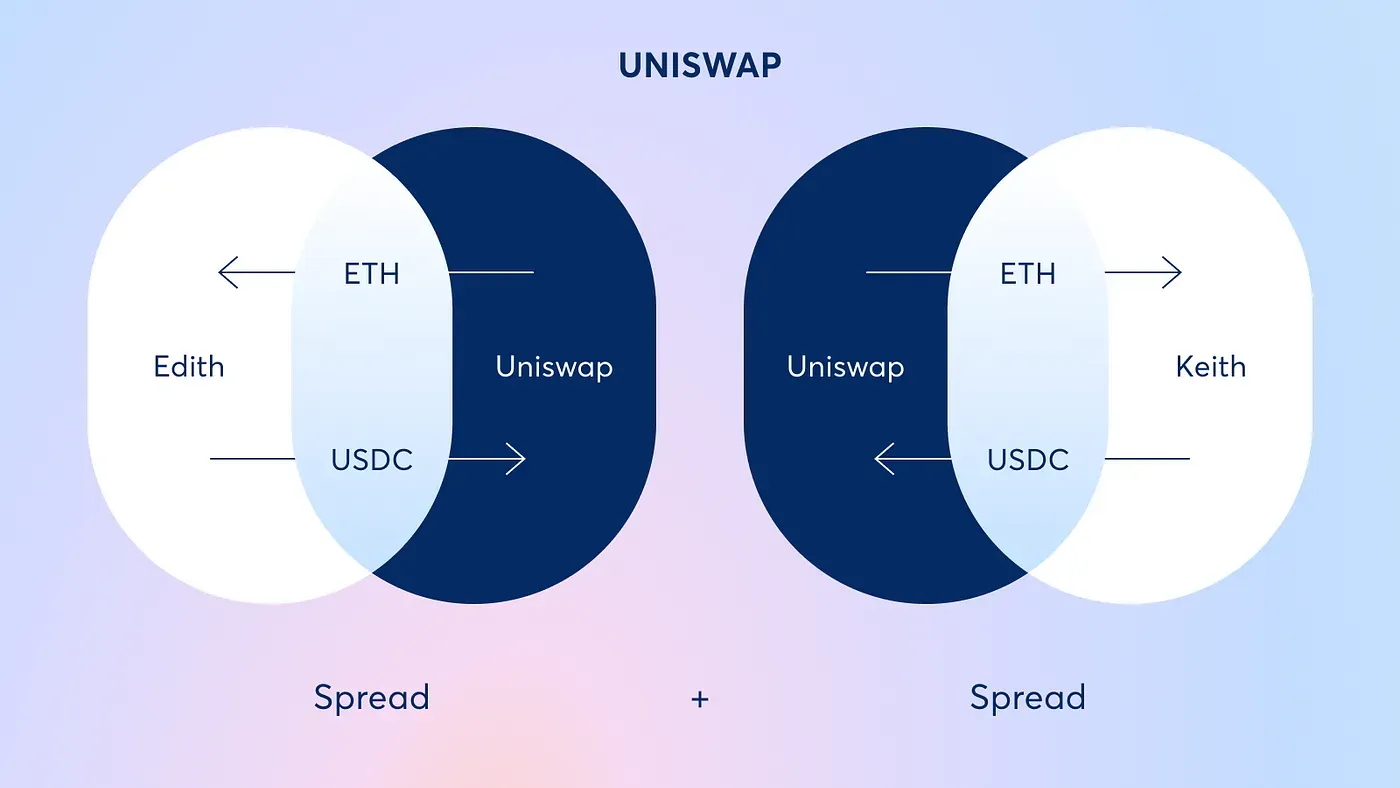

The competitive edge provided by these analytics is evident in platforms that aggregate orders into batches, like CoW Swap’s batch auction model, which helps neutralize latency advantages enjoyed by high-frequency traders. For further reading on batch-based mitigation techniques, see CoW Swap’s approach here.

Pioneering Protocols Leveraging Orderflow Insights

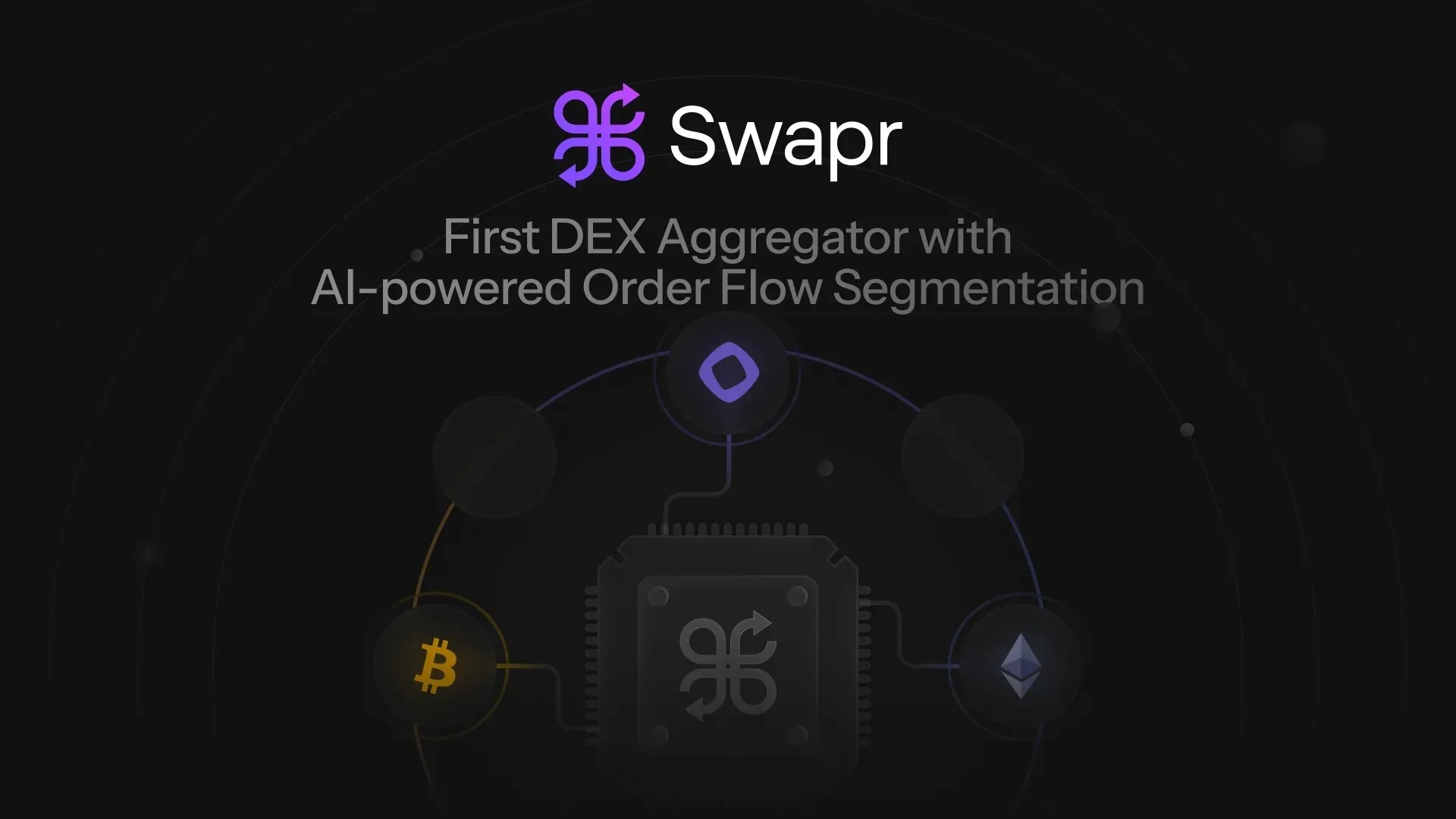

The design space for orderflow-powered MEV auctions has expanded significantly over the past year. Protocols such as aPriori are bridging traditional high-frequency trading (HFT) techniques with DeFi primitives by deploying AI-driven segmentation and dynamic routing frameworks. These systems analyze live order streams at scale, routing trades across venues based on optimal expected value while minimizing adverse selection risks (learn more about aPriori here). Such innovation underscores how modular analytics solutions are rewriting the rules for both liquidity providers and market makers operating in decentralized environments.

However, the adoption of sophisticated orderflow analytics MEV tools is not without its challenges. As DeFi matures, several critical considerations are shaping the trajectory of MEV auction strategies and the broader blockspace market.

Navigating Privacy, Centralization, and Market Integrity

Data privacy stands at the forefront of current debates. While comprehensive transaction analysis fuels better MEV extraction and fairer auctions, it also raises concerns about exposing sensitive user information. Protocols are experimenting with cryptographic solutions and privacy-preserving orderflow sharing to address these risks, balancing transparency against confidentiality remains a dynamic tension for protocol designers.

Market centralization is another emerging risk. As access to advanced analytics becomes a competitive differentiator, there is a real possibility that only well-capitalized participants with robust infrastructure can fully leverage these tools. This could inadvertently consolidate power among a handful of searchers or builders, undermining DeFi’s foundational ethos of openness and accessibility. Ensuring that modular MEV analytics solutions remain accessible to a broad spectrum of users is essential for preserving decentralization.

The credibility of orderflow auctions also hinges on mitigating manipulation and collusion among participants. Transparent reporting standards, open-source analytics frameworks, and community-led governance are being explored as ways to foster trust while enabling innovation in auction design (see: Dose of DeFi’s analysis on credible auctions).

The Future: Modular Orderflow Analytics in Action

The next wave of innovation will be driven by modular platforms like Modular Mev Auctions that integrate real-time dashboards, predictive analytics engines, and customizable risk management modules. These solutions empower both retail traders and institutional players to optimize their blockchain transaction optimization, extract more value from their orderflow, and minimize exposure to predatory tactics.

For example, live visualization dashboards allow users to monitor mempool congestion, front-running activity spikes, or batch auction performance in real time, enabling on-the-fly adjustment of strategies based on actionable intelligence. Predictive models further enhance decision-making by forecasting arbitrage windows or sandwich attack likelihoods across multiple DEXs simultaneously.

The convergence of AI-powered segmentation (as seen with aPriori), batch execution (CoW Swap), and transparent data-sharing protocols (Flashbots’ MEV-Share) signals an era where modularity and interoperability will define the competitive edge for DeFi participants. The ability to plug-and-play analytic modules tailored for distinct auction types or market conditions is rapidly becoming standard practice.

Key Takeaways for DeFi Participants

Actionable Steps for Adopting Modular MEV Auction Analytics

-

Integrate Real-Time Orderflow Data Feeds: Leverage platforms like Flashbots’ MEV-Share to access and analyze live transaction flows, enabling timely identification of MEV opportunities and improved auction participation.

-

Utilize Batch Auction Protocols: Implement solutions such as CoW Swap, which aggregates orders and executes them at a uniform price, reducing MEV risks and fostering fairer trade execution.

-

Adopt AI-Powered Orderflow Segmentation: Employ advanced analytics tools like aPriori to segment orderflow, predict transaction patterns, and dynamically route trades for optimal MEV extraction and liquidity.

-

Enhance Bid Pricing Models: Develop and refine bid strategies using empirical data from orderflow analytics to ensure competitive and precise participation in MEV auctions, maximizing value extraction while minimizing risk.

-

Implement Privacy-Preserving Analytics: Balance data utility and user privacy by integrating cryptographic techniques or privacy-focused protocols, ensuring sensitive transaction data remains secure during analysis.

-

Monitor and Mitigate Centralization Risks: Regularly assess the accessibility of analytics tools and promote open-source solutions to prevent market centralization and maintain DeFi ecosystem fairness.

The evolution toward more transparent, efficient MEV auctions will depend on how effectively protocols democratize access to cutting-edge orderflow tools while safeguarding user privacy. As these platforms mature, expect increased collaboration between researchers, developers, and end-users, driving the ecosystem toward greater fairness, resilience, and innovation.