Decentralized finance (DeFi) has always promised greater transparency and user empowerment compared to traditional markets. Yet, for years, the mechanics of transaction ordering and value extraction remained shrouded in complexity, with Maximal Extractable Value (MEV) often siphoned away from regular users by sophisticated actors. Modular MEV Auctions are now rewriting this narrative, introducing a new paradigm of orderflow transparency and equitable value distribution across the DeFi ecosystem.

Why Orderflow Transparency Matters in DeFi

Orderflow transparency is not just a buzzword – it’s the foundation for trust and efficiency in decentralized trading. In traditional MEV extraction models, miners or validators could reorder transactions to maximize their own profits, often at the expense of end-users who remained unaware of how their trades were manipulated. This lack of visibility led to hidden costs such as front-running or sandwich attacks, eroding user confidence and undermining the ethos of open finance.

With the advent of modular MEV auctions, DeFi platforms can now surface the true flow of value within each block. By routing user transactions into competitive auctions where searchers bid for execution rights, these systems ensure that users are no longer passive bystanders but active participants in capturing the economic potential their orders generate. As highlighted by research from Blocknative and Flashbots, this approach redirects profit that was once monopolized by validators back to users themselves.

How Modular MEV Auctions Work: The Mechanics Behind Transparency

The core innovation lies in disaggregating the transaction supply chain. In a typical modular MEV auction:

- User orders are submitted into an auction environment rather than directly to block builders.

- Searchers (or solvers) analyze these orders to identify potential MEV opportunities – such as arbitrage or liquidation – and submit competitive bids for execution.

- The highest bidder earns the right to include the transaction but must offer tangible benefits like price improvement or direct rebates back to the user.

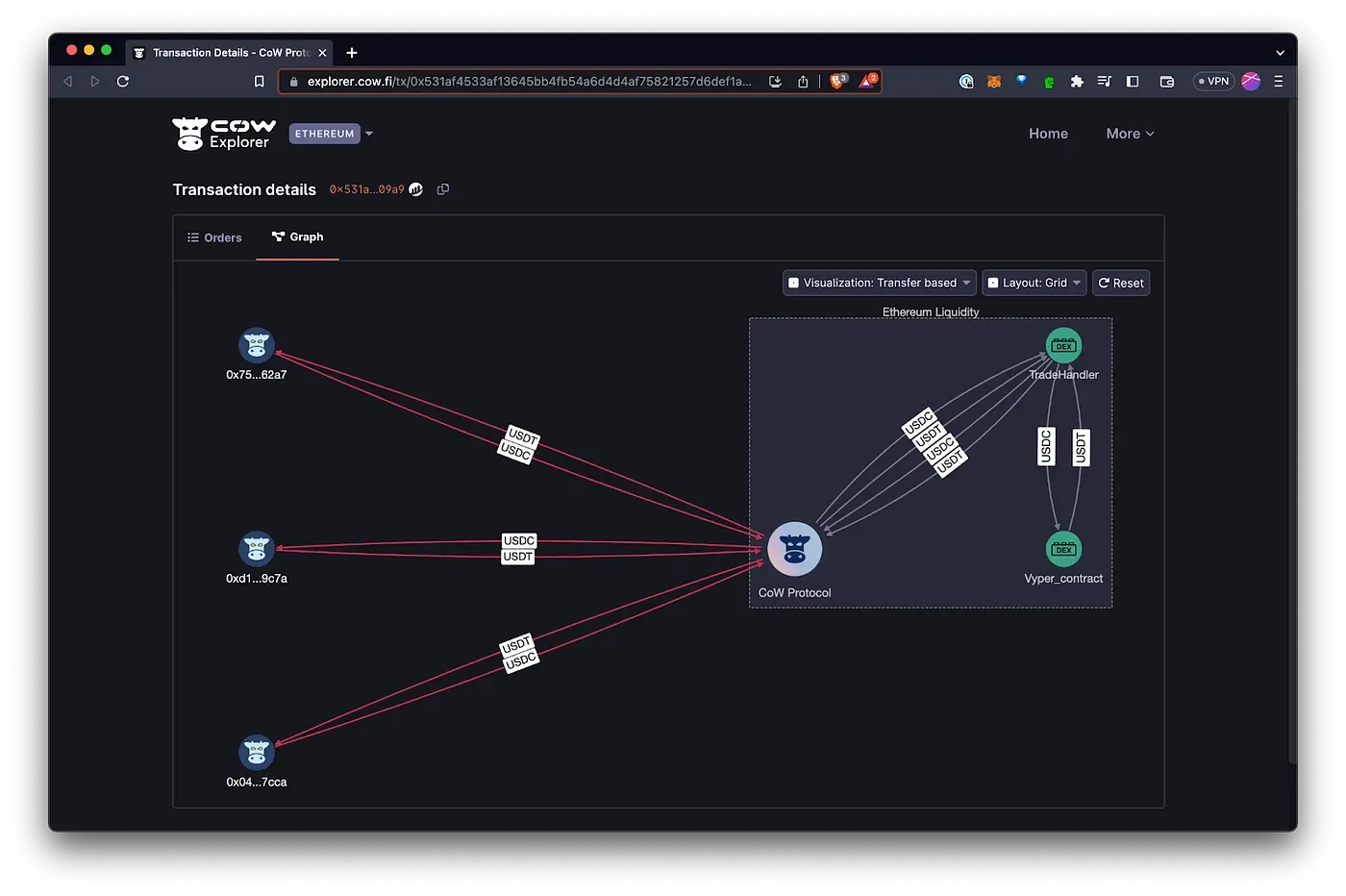

This market-driven mechanism not only increases competition among searchers but also creates an auditable trail for every transaction’s journey through the blockspace market. Users can see who bid on their orders, what value was extracted, and how much was returned as compensation – all in real time.

User-Centric Value Redistribution: From Hidden Costs to Tangible Rewards

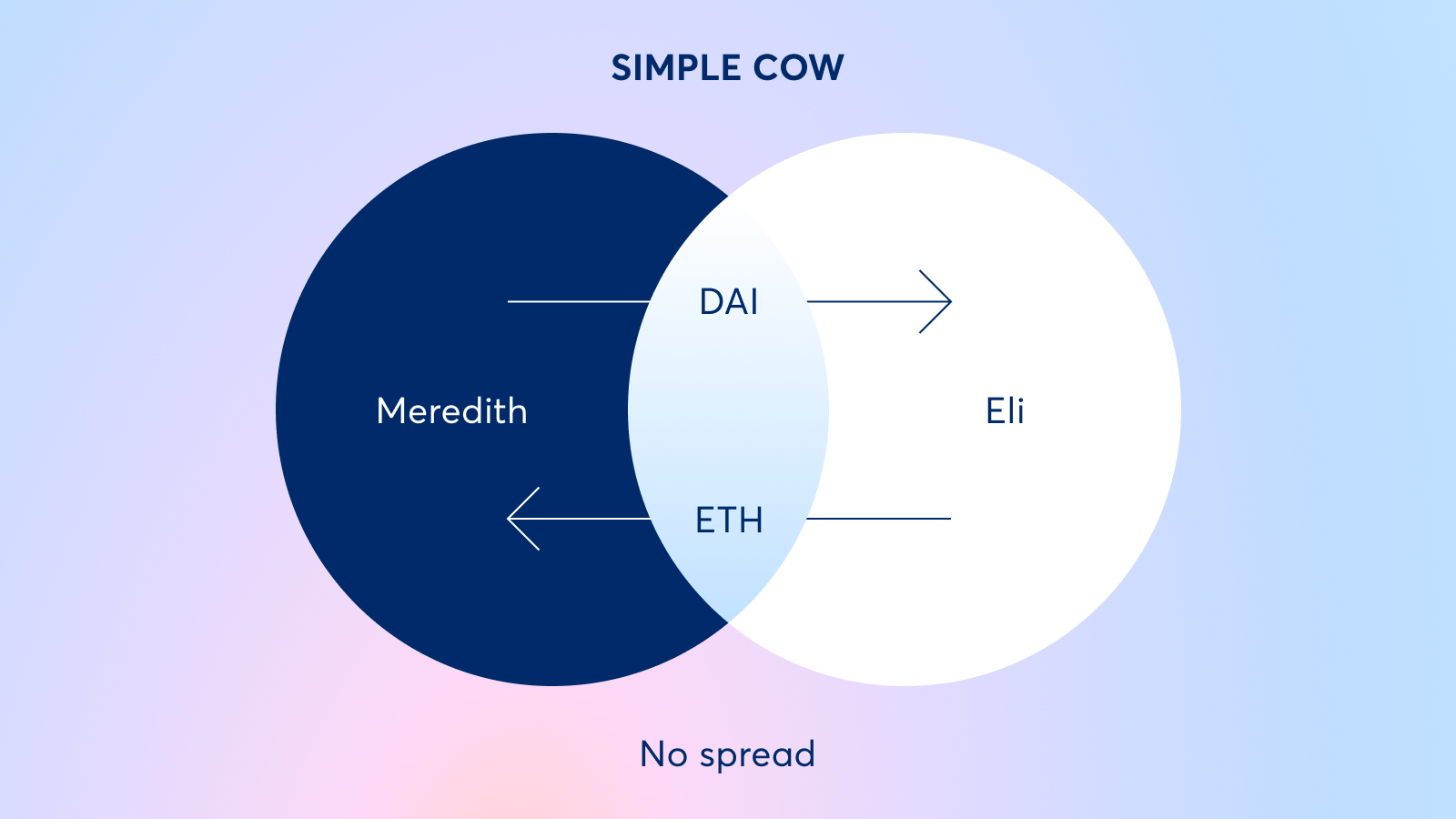

The most transformative aspect of modular MEV auctions is their ability to convert what was once a hidden tax on DeFi activity into a visible source of income for users. Instead of losing value through predatory strategies like front-running, traders can now receive direct rebates or enjoy better trade execution thanks to competitive bidding among searchers. Protocols like CoW Protocol and platforms leveraging Flashbots’ MEV-Share are already demonstrating this shift in practice.

This redistribution is not merely theoretical; it’s materializing in lower slippage, improved pricing, and even cash rewards credited back to user wallets. The process is further safeguarded by privacy-preserving mechanisms such as mixing real with decoy transactions (as seen with solutions like MEV Blocker), making it significantly harder for bad actors to exploit orderflow data for malicious gain.

The Broader Impact: Fairness, Efficiency, and Trust in DeFi Markets

By opening up the black box of transaction ordering, modular MEV auctions foster greater trust across all participants – from retail traders to institutional liquidity providers. Enhanced transparency means that every actor can verify how value is generated and shared within each blockspace market cycle. This openness not only deters exploitative practices but also drives continuous improvements in trading efficiency as searchers compete over increasingly granular opportunities.

The result? A more robust ecosystem where incentives align naturally between users, searchers, builders, and protocols themselves. As these systems mature, expect further innovations around real-time analytics and customizable auction parameters that will empower both individual traders and large-scale DeFi strategies alike.

Discover more about how modular MEV auctions are improving trading efficiency in DeFi

As the DeFi landscape evolves, the importance of orderflow transparency cannot be overstated. Modular MEV Auctions are setting a new standard by making every step of transaction processing visible and auditable. This level of clarity is not just a technical upgrade; it’s a strategic shift that directly impacts user confidence, platform credibility, and the efficiency of decentralized markets.

Top User Benefits of Modular MEV Auctions

-

Direct Rebates to Users: Modular MEV auctions like CoW Protocol and Flashbots MEV-Share enable users to receive rebates from the value their transactions generate, turning hidden MEV costs into tangible rewards.

-

Better Pricing Through Competitive Auctions: By routing orders through auction mechanisms, platforms ensure multiple searchers compete to offer the best execution, often resulting in improved pricing for users compared to traditional DEX trading.

-

Lower Slippage on Trades: Batch auctions and solver competition, as seen on CoW Protocol, help aggregate liquidity and match orders efficiently, leading to reduced slippage even for large trades.

-

Reduced Front-Running and Sandwich Attacks: Tools like MEV Blocker and Flashbots MEV-Share protect users by making it harder for malicious actors to exploit transaction ordering, minimizing harmful MEV extraction.

-

Greater Transparency and Fairness: Modular MEV auctions open up the MEV supply chain, allowing users to see how value is extracted and shared, fostering a more equitable DeFi ecosystem.

Transparency in the blockspace market also means that users and protocols can analyze auction outcomes to refine their MEV strategies. By studying real-time data on bids, rebates, and trade execution quality, traders gain actionable insights into how their orders perform under different market conditions. This feedback loop is essential for both individual optimization and broader protocol development.

Real-World Examples: Platforms Leading the Charge

Several leading protocols are already leveraging modular MEV auctions to great effect. For instance, CoW Protocol’s batch auctions let multiple solvers compete for orderflow, consistently delivering price improvements for users while keeping slippage minimal. Flashbots’ MEV-Share opens up previously closed information flows between wallets and searchers, enabling more equitable value distribution without sacrificing privacy or security.

This open auction model also counters the oligopolistic tendencies seen in traditional block building auctions. Rather than concentrating power among a few vertically integrated builders, modular approaches democratize access to MEV opportunities and foster healthier competition at each layer of the stack.

What’s Next? The Future of Orderflow Transparency in DeFi

The trajectory is clear: as more platforms adopt these transparent auction mechanisms, we’ll see increasingly sophisticated blockspace market solutions emerge, tailored not just for high-frequency traders but also for everyday DeFi participants seeking safer and more profitable trading experiences.

Looking forward, expect innovations around cross-chain modular MEV auctions and customizable privacy settings that allow users to control exactly how their orderflow data is shared or shielded. Real-time analytics dashboards will soon become standard tools for both retail traders and professional market makers aiming to optimize their MEV strategies.

Modular MEV Auctions are not just a technological fix, they’re an economic realignment that puts users at the center of value creation in decentralized finance. By lifting the veil on transaction ordering and empowering participants with new tools for optimization, these systems are paving the way toward a fairer, more efficient DeFi ecosystem where trust is earned through radical transparency.

Explore how orderflow efficiency is being redefined by modular MEV auctions