Gas anxiety has long been a defining pain point for DeFi users and traders, but the emergence of real-time blockspace marketplaces is rapidly changing the landscape. By enabling dynamic, transparent auctions for transaction ordering and inclusion, these platforms are making MEV (Maximal Extractable Value) strategies more accessible and efficient while reducing network congestion. The latest innovations from projects like ETHGas and Jito Block Engine are not just theoretical – they are actively reshaping how value flows through Ethereum, Solana, and other leading chains.

From Priority Gas Auctions to Real-Time Blockspace Trading

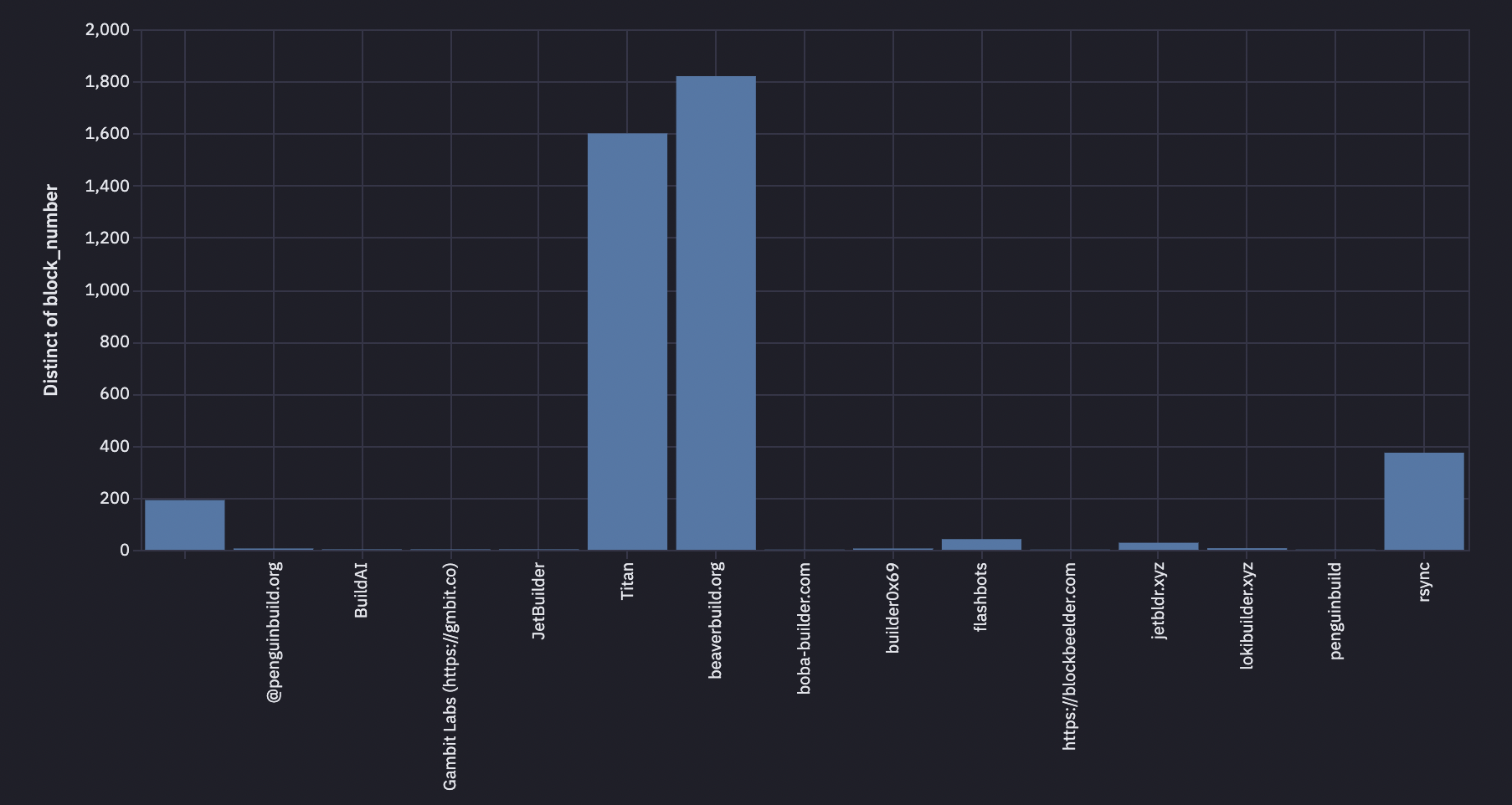

Historically, MEV extraction in DeFi revolved around Priority Gas Auctions (PGAs). Searchers would compete by bidding higher gas fees to get their transactions prioritized by validators. This approach led to a winner-takes-all dynamic: failed transactions soared, gas prices spiked, and regular users bore the brunt of inefficiency. According to recent research, MEV bots now consume over 40% of Solana’s blockspace and more than 50% of on-chain gas on Ethereum Layer 2s like Base and Optimism.

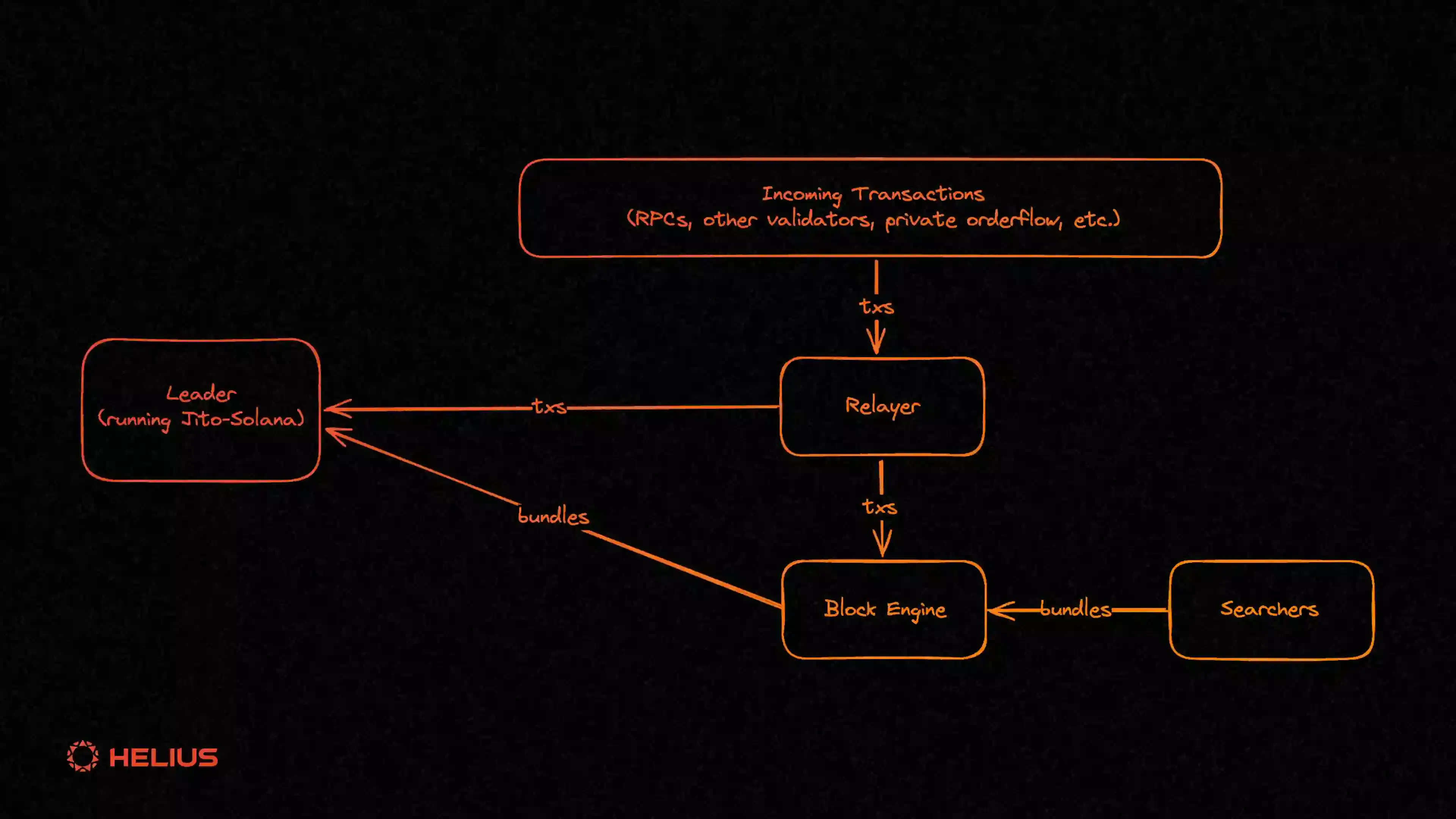

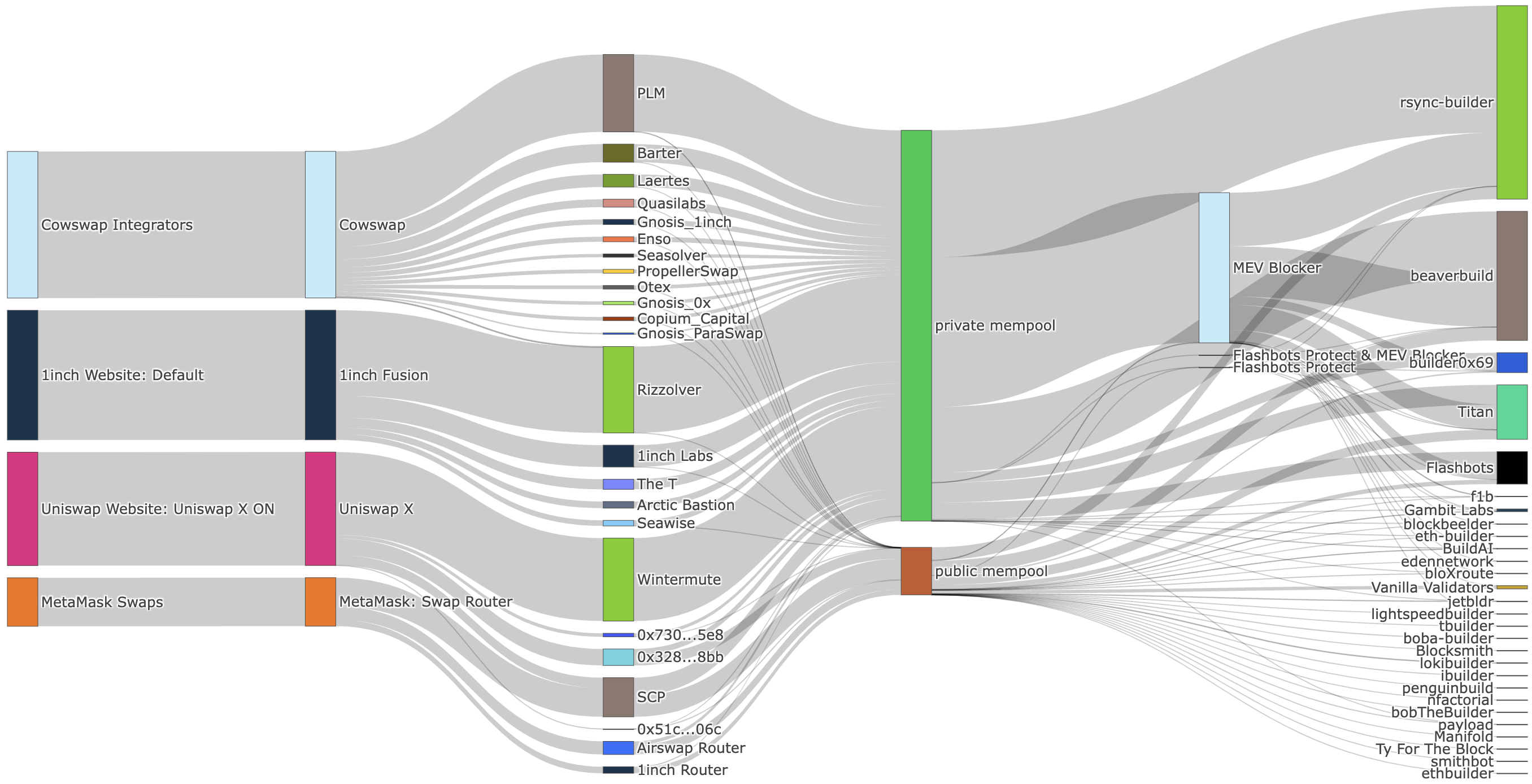

The shift toward real-time blockspace marketplaces, exemplified by solutions like Flashbots’ MEV-Boost or ETHGas’s invisible gas infrastructure, is fundamentally altering this equation. Instead of congesting the network with redundant bids, searchers participate in off-chain auctions where they can bid for transaction inclusion directly with validators or sequencers. This reduces failed transactions and stabilizes gas fees across the ecosystem.

The Mechanics Behind Real-Time MEV Auctions

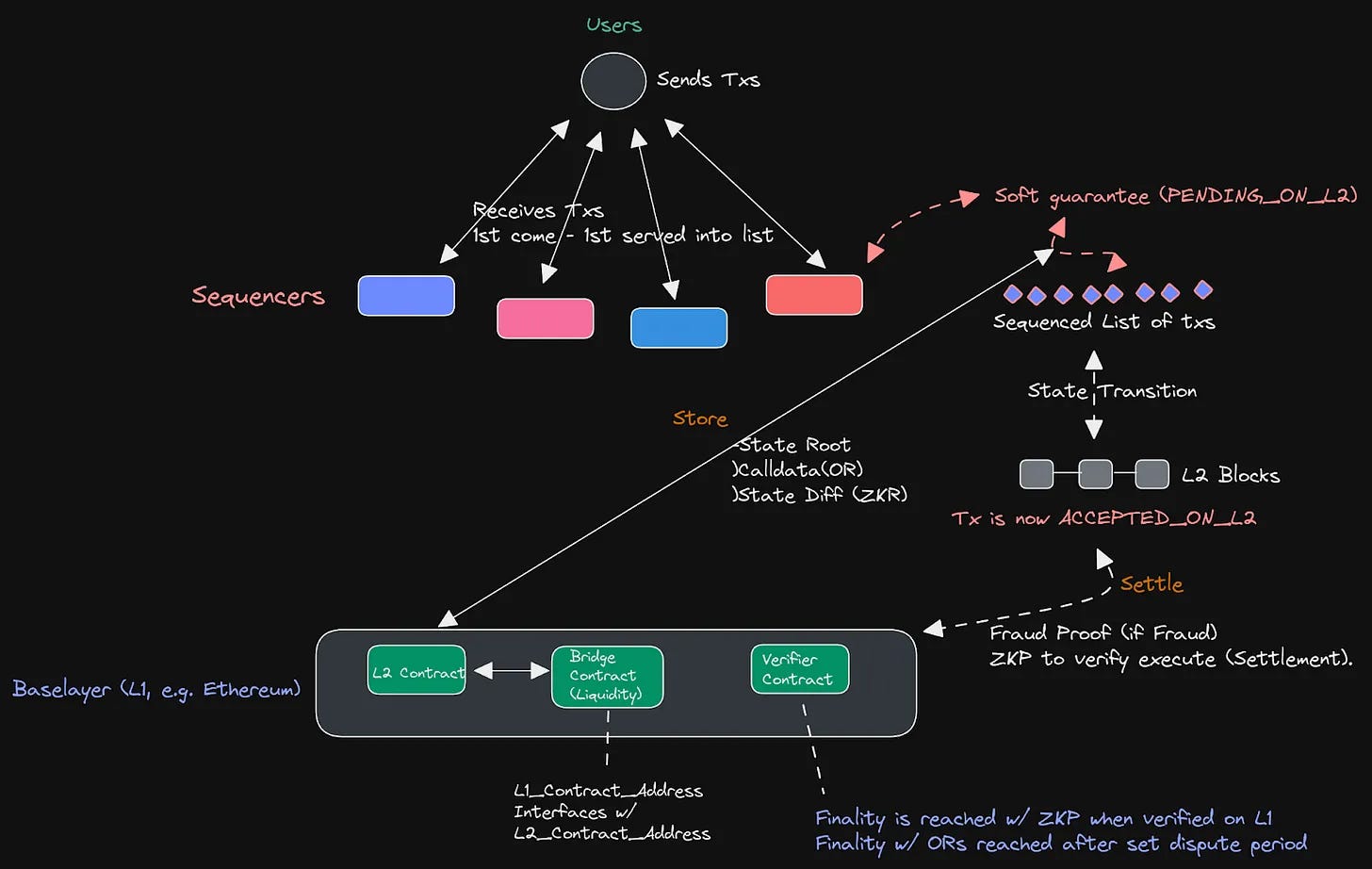

At its core, a real-time blockspace marketplace enables flexible trading of block inclusion rights as a commodity. Validators can sell future blockspace or guarantee preconfirmations – validator-signed commitments that ensure a transaction will be included before it even hits the chain. This model brings several advantages:

Key Benefits of Real-Time Blockspace Marketplaces for DeFi Traders

-

Reduced Gas Fee Volatility: Platforms like ETHGas and Flashbots MEV-Boost enable off-chain auctions, stabilizing gas fees and minimizing the unpredictable spikes that previously plagued DeFi traders.

-

Faster and More Reliable Transactions: Real-time blockspace allocation, as seen with ETHGas and Jito Block Engine, allows traders to secure transaction inclusion instantly, reducing failed transactions and wait times.

-

Enhanced Transparency and Fairness: By enabling explicit MEV auctions and pre-confirmations (e.g., Espresso Systems), these marketplaces offer clearer rules for transaction ordering, reducing the risk of manipulation and ensuring a level playing field.

-

Lower Network Congestion: Off-chain bidding and programmable privacy features—pioneered by Flashbots—help prevent network congestion caused by on-chain gas wars, benefiting all users with smoother DeFi experiences.

- Reduced Gas Volatility: Off-chain bidding removes the chaos of PGAs, smoothing out transaction costs.

- Higher Throughput: Efficient allocation means less wasted space and fewer failed transactions.

- User-Centric Design: Protocol-funded gas rebates (like those from ETHGas) return value directly to users, lowering effective costs.

- Programmable Privacy: New auction mechanisms allow searchers to bid while preserving sensitive strategy data.

This approach also opens the door for advanced products such as blockspace futures, allowing sophisticated traders to reserve capacity ahead of time or hedge against price spikes. As highlighted by recent developments on both Ethereum and Solana, these innovations are paving the way for more predictable execution environments, critical for both institutional desks and DeFi power users alike.

The Rise of Preconfirmations: Quiet Revolution in Transaction Ordering

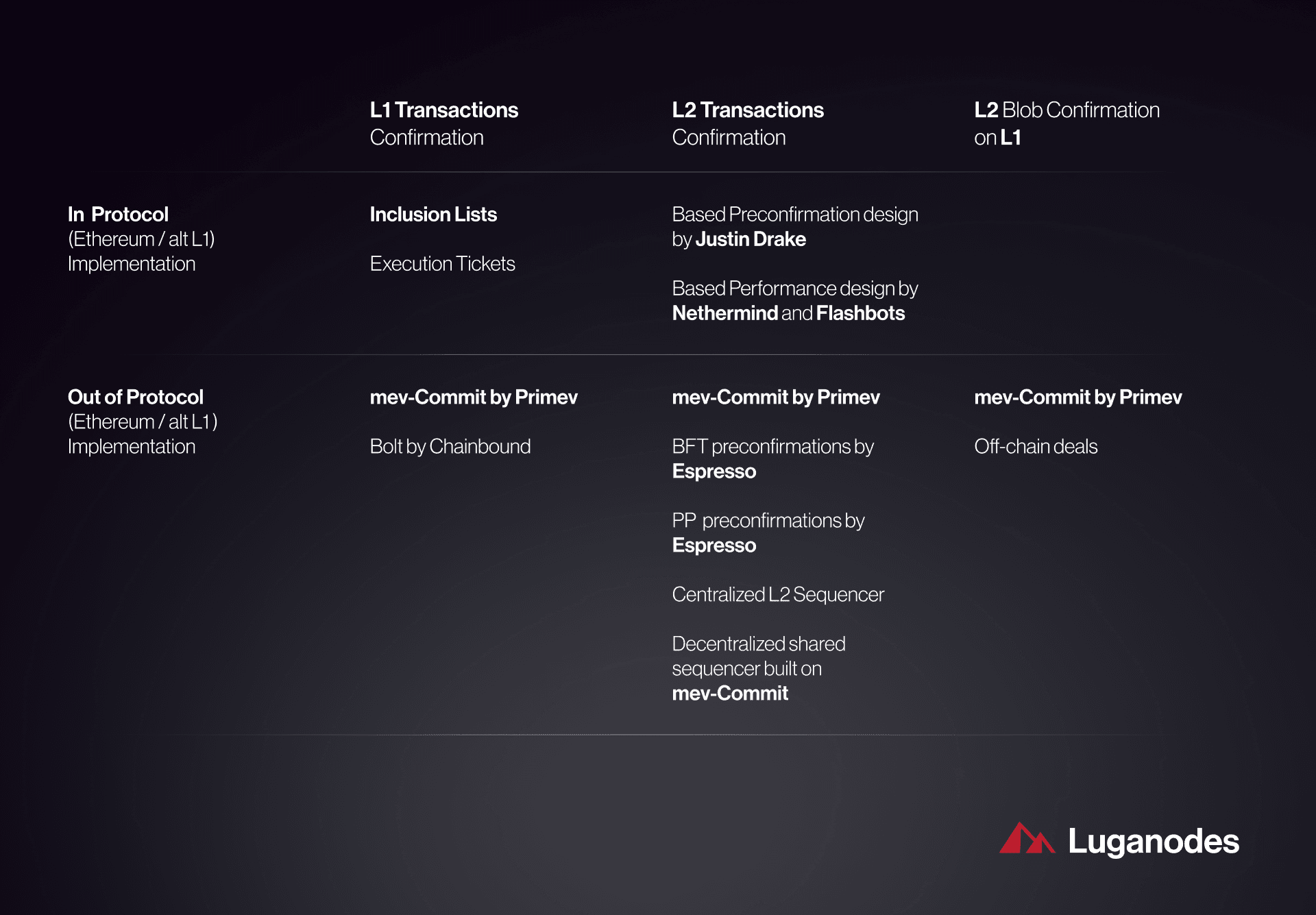

A particularly transformative trend is the rise of preconfirmations blockchain. By offering validator-signed guarantees before a transaction enters a block, preconfirmations provide certainty for both users and searchers, enabling new forms of orderflow optimization. Projects like Espresso Systems are pioneering inclusion pre-confirmation markets where participants can buy guaranteed slots within an upcoming block.

The result? Enhanced composability across protocols, reduced slippage for high-value trades, and a deeper alignment between user incentives and network health. For developers building next-generation DeFi primitives or modular MEV auctions platforms, this means access to more granular control over transaction execution timing, ushering in an era where precision meets performance.

Yet, as real-time blockspace marketplaces gain traction, new challenges emerge. The concentration of MEV activity, where bots and sophisticated searchers occupy a majority of blockspace, raises important questions about fairness, network sustainability, and user accessibility. While solutions like ETHGas and Jito Block Engine are mitigating gas volatility and failed transactions, the arms race for optimal orderflow remains intense, pushing networks to innovate continuously.

One promising direction is the integration of gas rebates DeFi mechanisms and programmable privacy. Protocols such as ETHGas are already distributing gas rebates to eligible users, directly reducing transaction costs and democratizing access to efficient execution. Meanwhile, privacy-preserving auctions enable searchers to participate without exposing sensitive trading strategies, fostering a more level playing field for all participants.

For developers and traders, the ability to interact with modular MEV auctions and blockspace trading protocols means more granular control over transaction execution. Products like blockspace futures and execution tickets let users schedule, reserve, or hedge their transaction inclusion, transforming blockspace into a tradable, programmable asset. This evolution is particularly relevant for institutions and high-frequency trading desks, who demand predictability and efficiency at scale.

Strategic Implications for DeFi and Beyond

The ripple effects of these innovations extend well beyond gas fees. As modular MEV auctions mature, DeFi protocols can offer richer, more customizable user experiences. Preconfirmations, programmable privacy, and dynamic orderflow optimization converge to create markets that are not only more efficient but also more equitable and transparent. This shift is critical for onboarding the next wave of users and capital into decentralized finance.

Strategic Advantages of Real-Time Blockspace Marketplaces

-

Reduced Gas Anxiety & Smoother UX: Platforms like ETHGas are pioneering real-time infrastructure for “Invisible Gas” transactions, minimizing user exposure to volatile gas fees and making DeFi interactions seamless.

-

Efficient MEV Extraction Without Network Congestion: Flashbots MEV-Boost enables off-chain MEV auctions, letting searchers bid for transaction inclusion without clogging the network, resulting in fewer failed transactions and more predictable fees.

-

Preconfirmations & Transaction Guarantees: Innovations like Espresso Systems and validator-signed preconfirmations offer users early assurances of transaction inclusion, reducing uncertainty and improving capital efficiency.

-

Programmable Privacy & Fair Ordering: Real-time blockspace marketplaces are exploring programmable privacy to allow searchers to bid for ordering rights while protecting sensitive user data, addressing fairness and transparency concerns in MEV auctions.

-

Blockspace Reservation & Scheduling: Solutions like Raiku on Solana let developers reserve blockspace ahead of time, enabling precise transaction scheduling and reducing competition for inclusion.

-

Gas Rebates & Incentivized Participation: Protocols such as ETHGas are rolling out gas rebate programs, rewarding eligible users and lowering the effective cost of DeFi activity.

-

Enhanced Efficiency for Rollups & L2s: Marketplaces like Espresso Market empower rollups and sequencers to sell their sequencing rights, optimizing blockspace allocation across Ethereum Layer 2s.

However, vigilance is still required. As MEV bots continue to consume significant portions of blockspace, over 40% on Solana and 50% on Ethereum Layer 2s, according to recent data, networks must balance innovation with robust safeguards to prevent centralization and protect ordinary users. Ongoing research into explicit MEV auctions, programmable privacy, and smarter blockspace allocation remains essential for sustainable growth.

Ultimately, the rise of real-time blockspace marketplaces signals a new era for MEV auctions in DeFi: one characterized by efficiency, transparency, and user empowerment. The platforms and protocols leading this transformation are not just solving for today’s congestion, they are architecting the infrastructure for tomorrow’s decentralized economy.

For those seeking deeper insights into how these developments are reshaping on-chain trading, explore our analysis on real-time MEV auction data and DeFi trading efficiency.