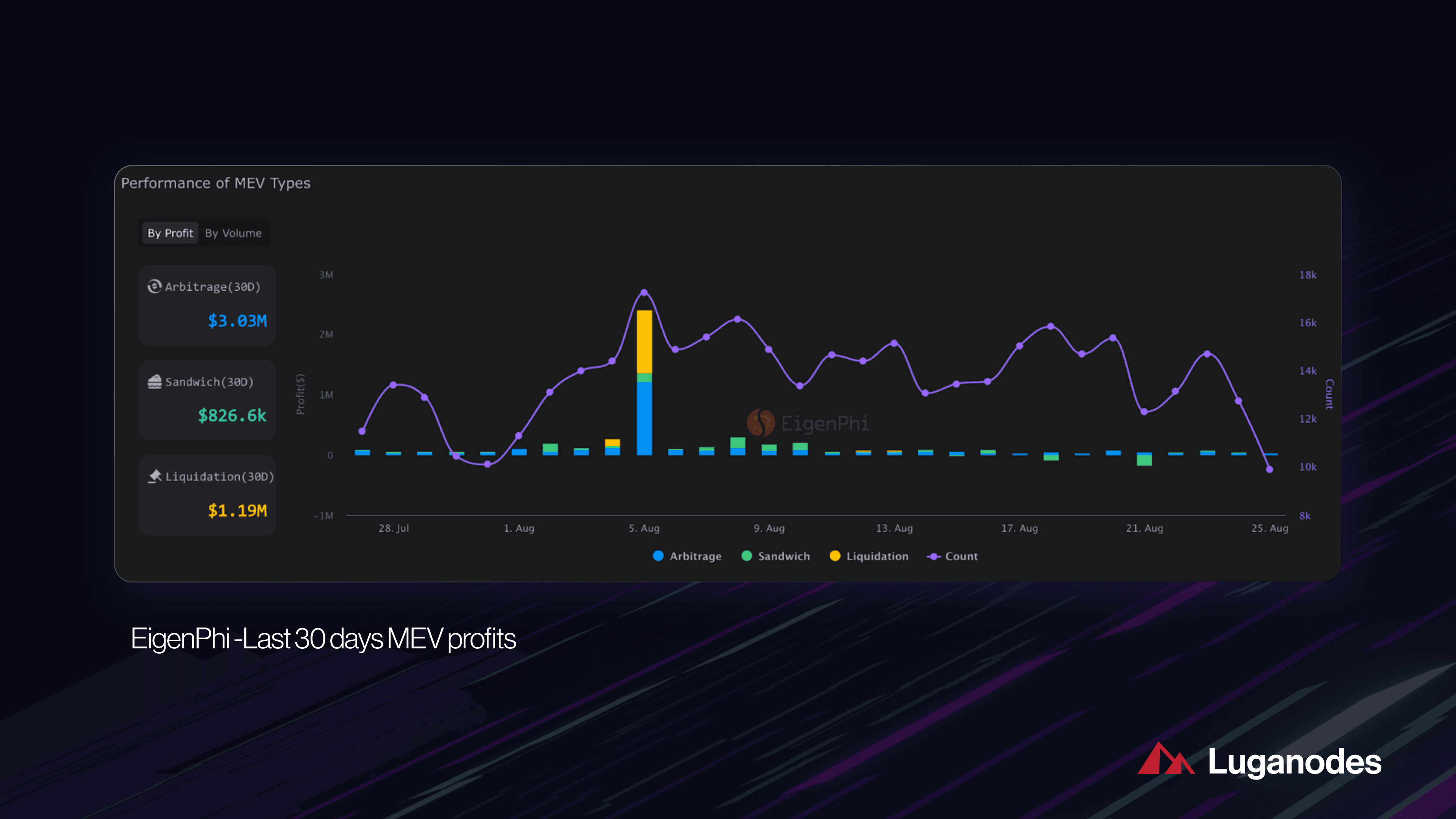

Blockspace marketplaces are rapidly redefining how Maximal Extractable Value (MEV) auctions operate, introducing a new era of efficiency and transparency in decentralized finance. As blockchain networks mature, the interplay between MEV, transaction fees, and blockspace allocation has become a critical area for both protocol designers and active participants. The latest data reveals that up to 60% of Ethereum Layer 2 blockspace is consumed by MEV bots, yet these entities contribute less than 10% to total transaction fees, a clear signal that legacy fee markets are struggling to align incentives and resource allocation.

Blockspace Marketplaces: The Engine Behind Transaction Fee Optimization

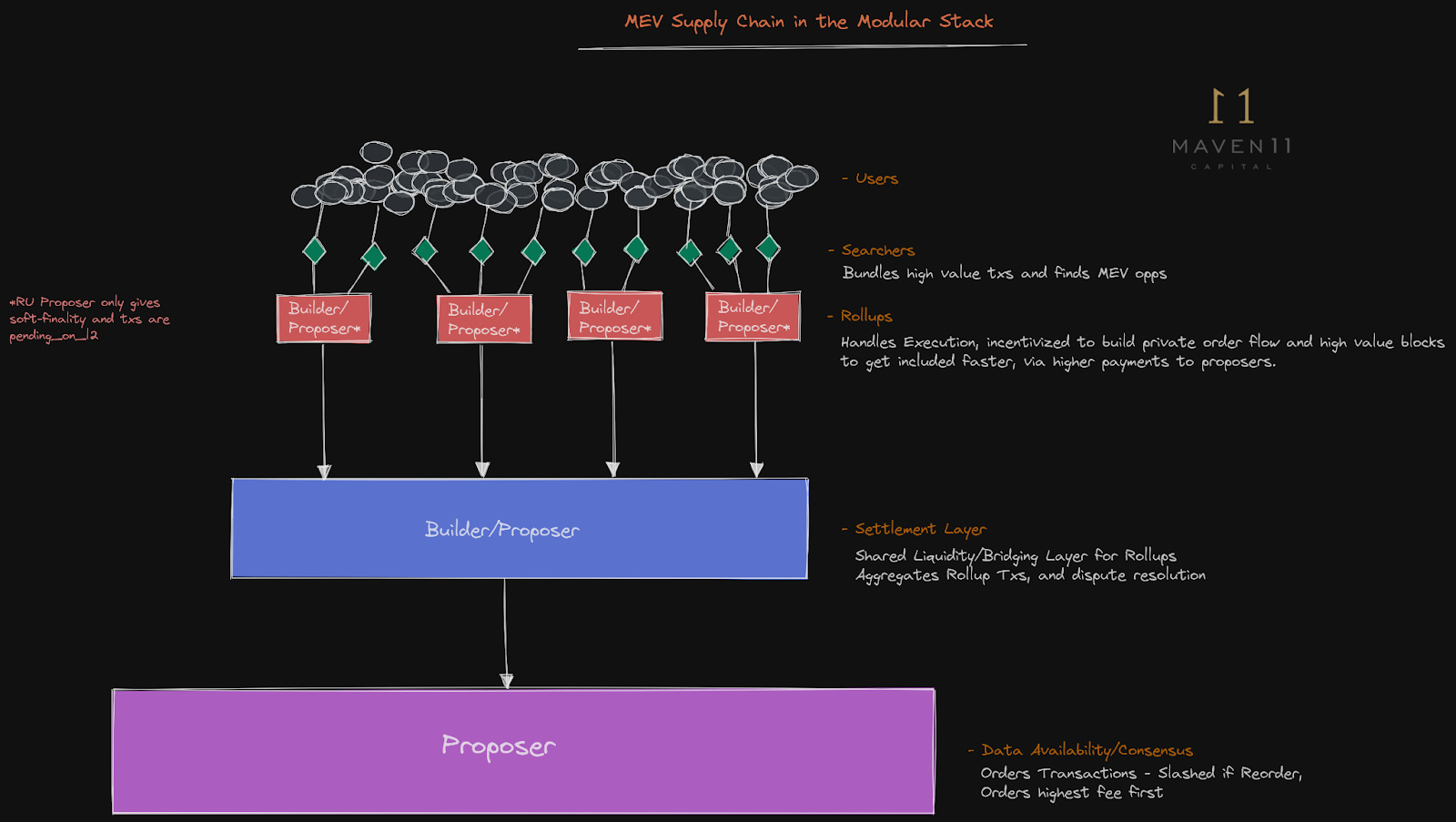

The traditional model for transaction inclusion is straightforward: users submit bids (gas fees) to compete for spots in the next block. This approach, while simple, has proven inadequate in the face of sophisticated MEV strategies and relentless spam transactions. Blockspace marketplaces such as MEV Auction have responded by pioneering structured auction mechanisms that segment blockspace into distinct tiers, priority-sensitive (α-blockspace) and non-priority-sensitive (β-blockspace).

This bifurcated structure allows for more granular pricing of block resources. Searchers with high-value strategies can bid aggressively for α-blockspace, securing fast execution for arbitrage or liquidations. Meanwhile, bulk or low-priority transactions are relegated to β-blockspace at reduced costs. The result? Congestion is alleviated, price discovery becomes more accurate, and overall transaction fee volatility decreases.

How Orderflow Marketplaces Reshape DeFi Transaction Execution

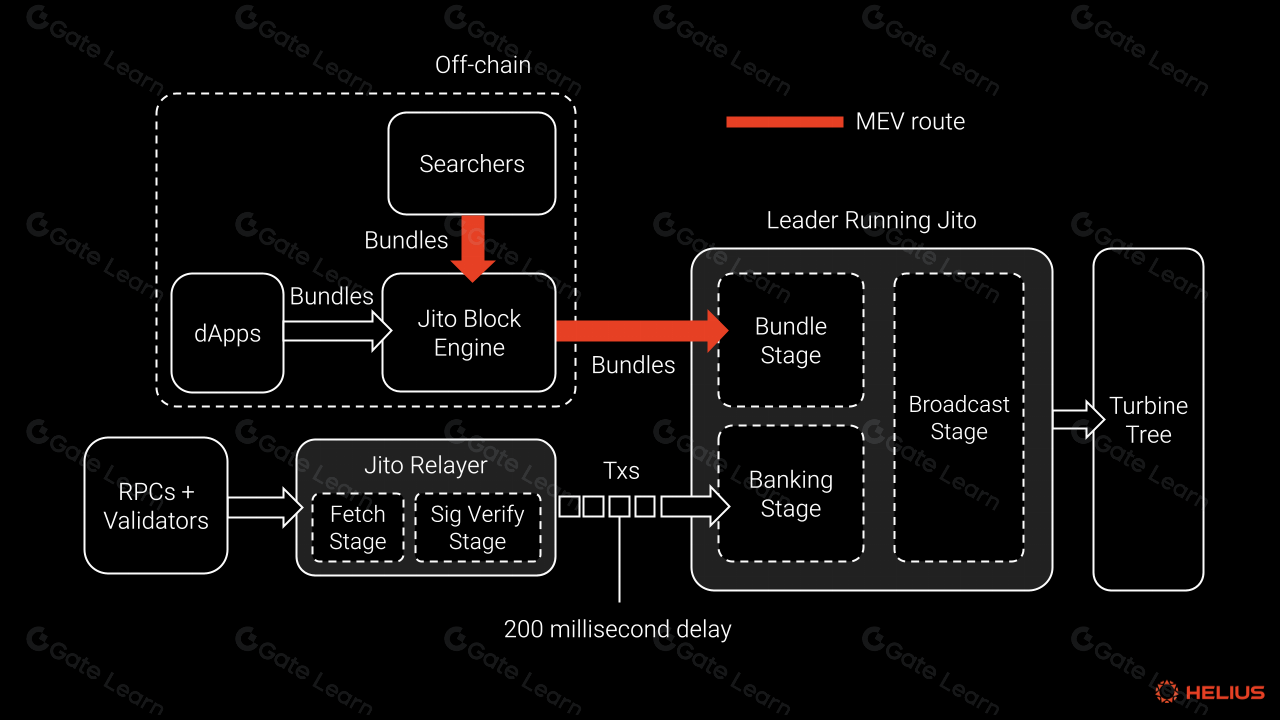

Orderflow marketplaces are at the heart of this transformation. By aggregating transaction intent from diverse sources, traders, searchers, protocols, they create a competitive environment where inclusion rights are auctioned transparently. This not only democratizes access but also curbs the rent-seeking behavior that previously allowed validators or miners to extract outsized profits through opaque reordering.

The strategic implications are profound: protocols can better forecast network demand, MEV searchers face less uncertainty when planning complex bundles, and end-users benefit from lower failure rates and more predictable costs. As outlined by recent research on cryptonews.net, these innovations directly address inefficiencies stemming from spam transactions and congested blocks on major L2s.

Key Advantages of Modern Blockspace Marketplaces

-

Efficient MEV Mitigation: Platforms like MEV Auction structure blockspace allocation through multi-unit auctions, reducing spam and curbing the dominance of MEV bots that can occupy up to 60% of blockspace while contributing less than 10% to total fees.

-

Optimized Fee Structures: By segmenting blocks into priority-sensitive (α-blockspace) and non-priority-sensitive (β-blockspace) areas, marketplaces enable more granular fee bidding, leading to lower transaction costs for regular users and better value extraction for searchers.

-

Transparent and Competitive Auctions: Modern marketplaces introduce transparent bidding processes for transaction inclusion, replacing opaque miner practices and enabling fairer competition among traders and developers.

-

Reduced Congestion and Delays: Structured blockspace allocation helps alleviate network congestion, resulting in fewer transaction failures and faster confirmations for both developers and traders.

-

Enhanced Scalability: By optimizing block resource usage and discouraging inefficient MEV activity, these marketplaces support higher throughput and improved scalability for blockchain networks like Ethereum and Solana.

The Economics of Blockspace Pricing in a Post-MEV World

At its core, the evolution of blockspace pricing is about aligning incentives between all stakeholders, searchers seeking profit opportunities, validators aiming for sustainable revenue streams, and regular users demanding affordable execution. Platforms like Modular Mev Auctions have emerged as pivotal players by offering real-time analytics and multi-unit auction formats that reflect true market demand.

Importantly, this shift does not eliminate MEV; rather it channels it into open competition where information asymmetries are minimized. As highlighted in recent industry updates, multi-unit auctions allow multiple winners per slot instead of a single highest bidder dominating the entire block. This fosters greater participation while reducing fee spikes during periods of intense network activity.

With these innovations, the relationship between MEV and transaction fees is evolving. While MEV extraction previously inflated costs for ordinary users, blockspace marketplaces now create an environment where transaction fee optimization is a shared objective. By leveraging segmented auctions and transparent orderflow, the gap between what searchers are willing to pay and what validators receive narrows. This leads to a more efficient allocation of resources and helps stabilize transaction fees even as network demand fluctuates.

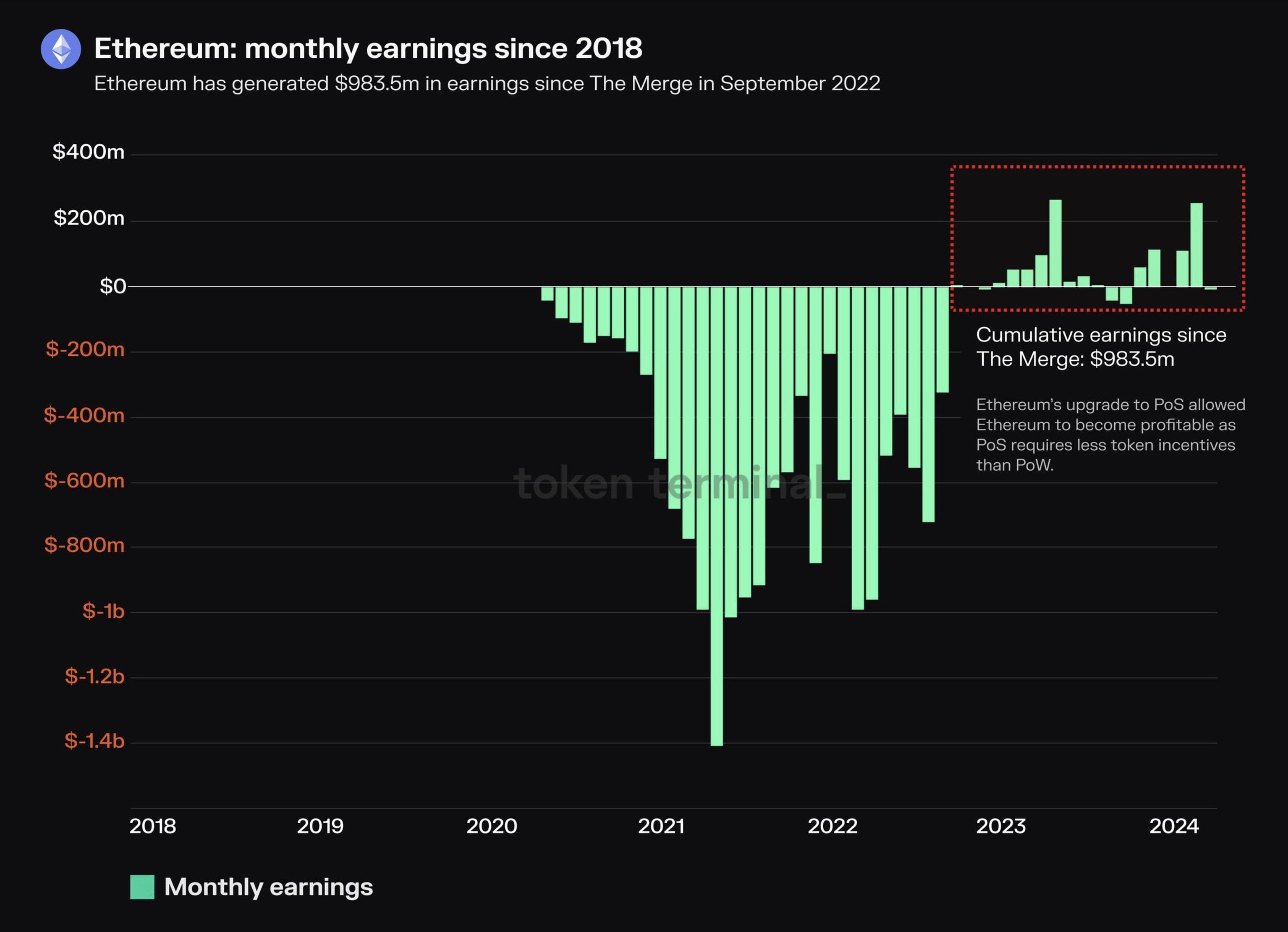

On networks like Solana and Ethereum, the impact of these changes is already visible. According to recent analysis from Galaxy, MEV as a percentage of transaction fees remains stable over time, suggesting that structured markets are successfully absorbing volatility and reducing the outsized influence of opportunistic actors. These marketplaces also help suppress spam by making it less profitable for bots to flood blocks with low-value transactions, especially when non-priority blockspace can be priced dynamically based on actual demand.

Looking Ahead: The Strategic Role of Modular Mev Auctions

The future of DeFi transaction execution will be defined by platforms that blend real-time analytics with robust auction infrastructure. Modular Mev Auctions stands at this intersection, offering tools that empower both traders and developers to make informed decisions in an increasingly complex landscape. With features like live auction data, customizable bidding strategies, and granular fee breakdowns, users gain unprecedented control over how their transactions are executed.

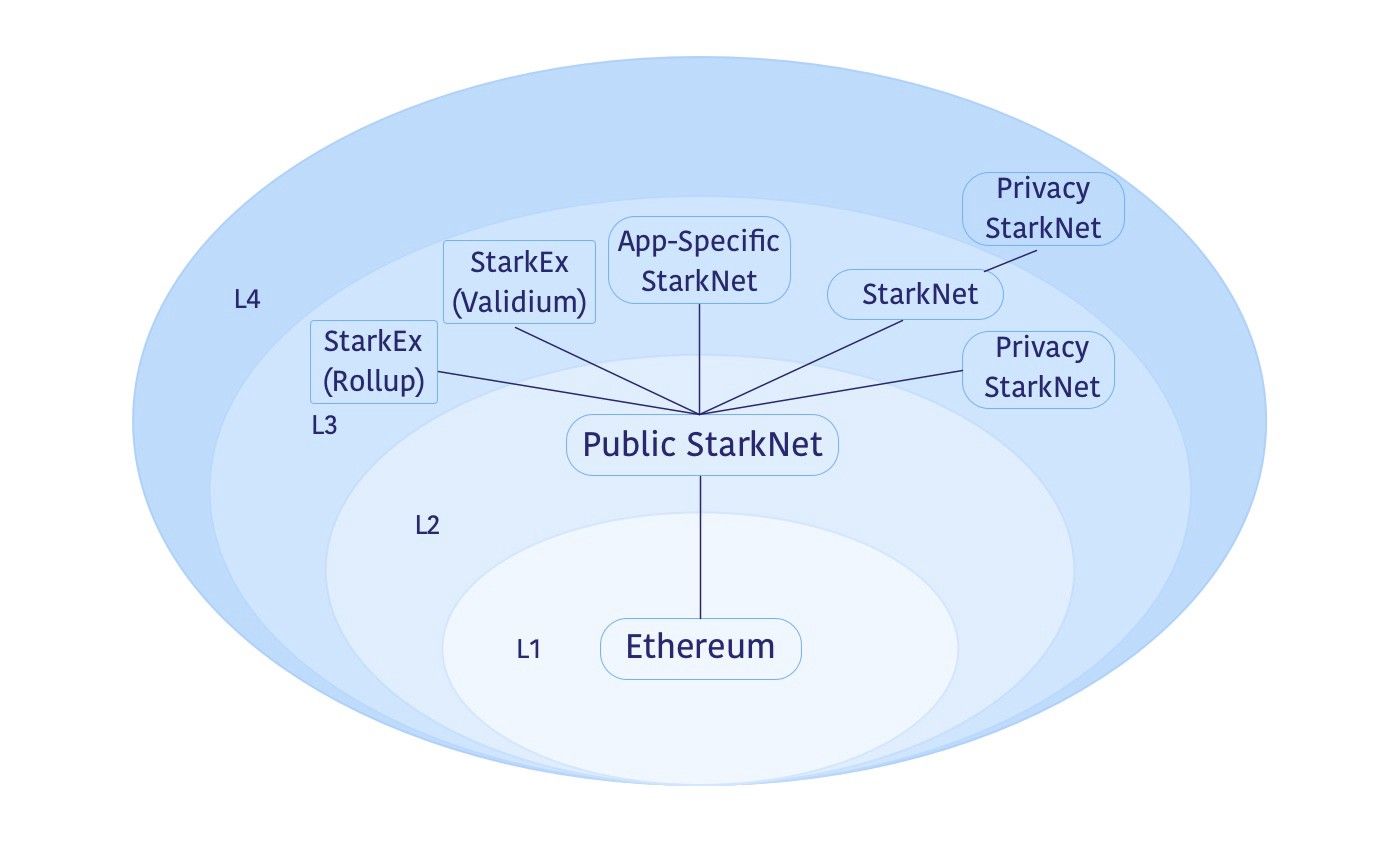

This shift toward modularity makes it easier for protocols to experiment with new fee models or integrate parallel execution environments, an area highlighted in recent research exploring alternatives for parallelized block production (source). As networks scale horizontally, efficient allocation of blockspace across multiple chains or shards will become even more critical.

Top Features of Modular MEV Auctions for DeFi Optimization

-

Multi-Unit Auction Mechanisms: Platforms like MEV Auction utilize multi-unit auctions, enabling multiple searchers to simultaneously bid for blockspace. This increases competition, drives efficient price discovery, and helps allocate blockspace to the highest-value transactions, directly supporting advanced DeFi strategies.

-

Bifurcated Block Structures: By dividing blocks into priority-sensitive (α-blockspace) and non-priority-sensitive (β-blockspace) segments, modular MEV auctions allow DeFi protocols to select the optimal blockspace tier for their transactions, balancing cost and execution speed.

-

Transparent and Competitive Bidding: Modular MEV auctions provide a transparent environment where all bids are visible, reducing information asymmetry and enabling DeFi users and protocols to optimize their strategies based on real-time market data.

-

Spam Mitigation and Lower Congestion: By organizing MEV activities through structured marketplaces, these auctions significantly reduce spam transactions and blockspace congestion—especially on Ethereum L2s—leading to more predictable transaction fees for DeFi users.

-

Enhanced Fee Optimization: The separation of blockspace types and competitive bidding mechanisms help DeFi protocols minimize costs by targeting the most cost-effective blockspace, improving capital efficiency and strategy execution.

The broader implication is clear: as orderflow marketplaces mature and blockspace pricing becomes more sophisticated, the barriers to entry for advanced MEV strategies fall while network health improves for everyone. Validators can rely on steady revenue streams without resorting to extractive tactics; searchers compete on a level playing field; end-users see fewer failed transactions and lower costs.

Ultimately, this transformation signals a new era where blockspace marketplace design is not just about maximizing profit but about orchestrating sustainable growth across the DeFi ecosystem. For those seeking an edge in transaction fee optimization or looking to build resilient protocols atop modern infrastructure, platforms like Modular Mev Auctions represent both a technological leap forward and a strategic imperative.