As DeFi matures, traders are demanding not just speed but also fairness, transparency, and efficiency in transaction execution. The rise of Modular MEV Auctions is answering this call, fundamentally changing how orderflow marketplaces operate and how value is distributed across the blockchain ecosystem. With Ethereum trading at $4,313.61 as of October 1,2025, the stakes for optimal transaction execution have never been higher.

Why Modular MEV Auctions Matter for DeFi Traders

In traditional DeFi markets, sending transactions to the public mempool exposes traders to predatory strategies like frontrunning and sandwich attacks – all symptoms of unchecked MEV (Maximal Extractable Value). This creates an uneven playing field where sophisticated actors extract value at the expense of regular users.

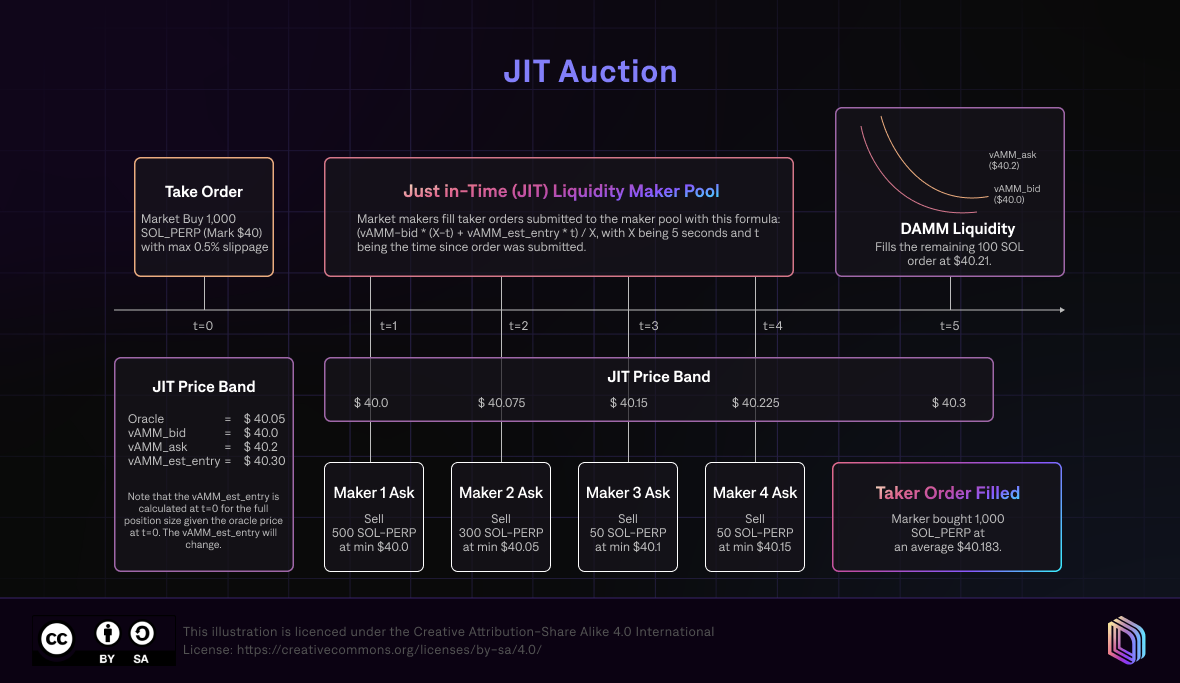

Orderflow auctions (OFAs) disrupt this paradigm by letting users send transactions directly to an auction instead of the public mempool. Here, specialized searchers compete to bid on user orderflow. The highest bidder wins the right to extract MEV from those transactions – but crucially, a portion of that value is now shared with the original user. This model doesn’t just redistribute profits: it actively incentivizes better execution quality and price discovery for everyone involved.

The modular approach enables a new era where traders are no longer passive participants in the MEV supply chain but active beneficiaries of their own transaction flow.

The Mechanics: Proposer-Builder Separation and Orderflow Auctions

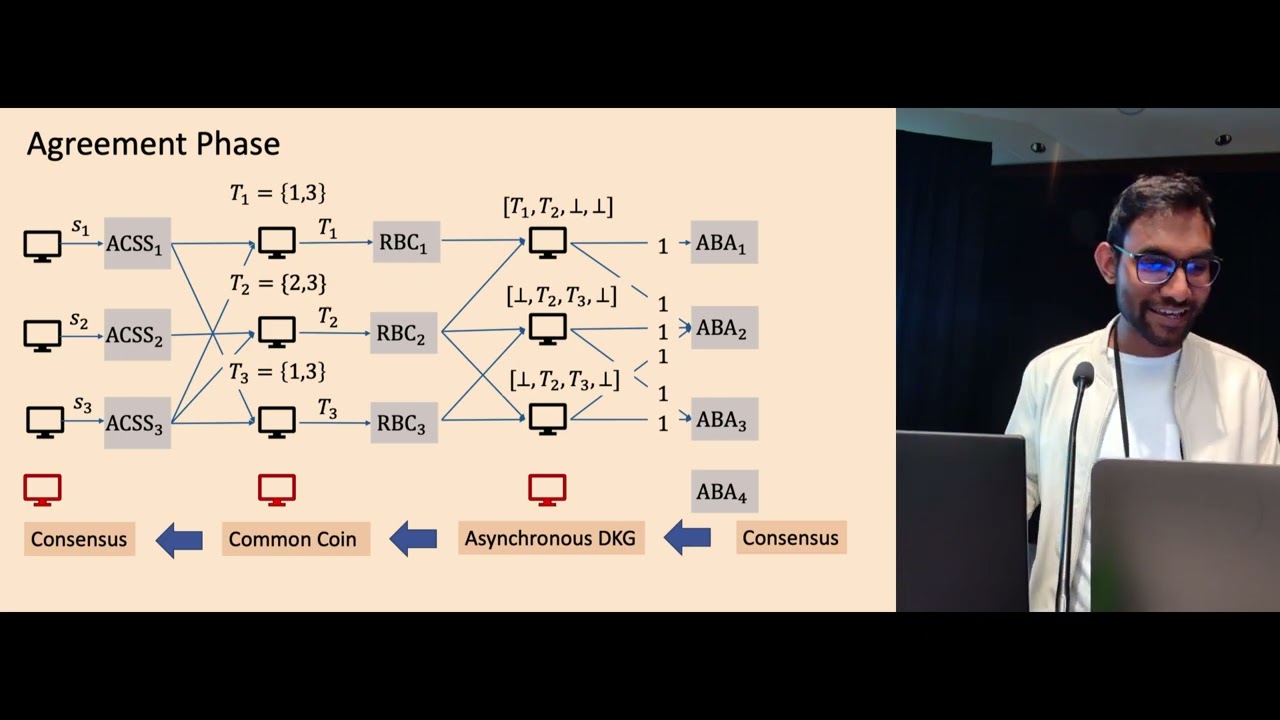

The heart of modular MEV lies in separating critical roles within block production:

- Proposer-Builder Separation (PBS): Builders construct blocks optimized for value extraction; proposers select which blocks get added to the chain based on fees or other criteria.

- Orderflow Auctions (OFA): Instead of broadcasting trades publicly, users submit orders privately to an auction where builders or solvers compete to offer best execution or rebates.

This structure increases competition among builders while reducing information asymmetry. For DeFi traders, it means tighter spreads, lower slippage, and more predictable outcomes – all while retaining sovereignty over their orderflow.

Current Innovations Shaping Orderflow Marketplaces

The landscape is rapidly evolving as leading protocols roll out modular auction-based solutions:

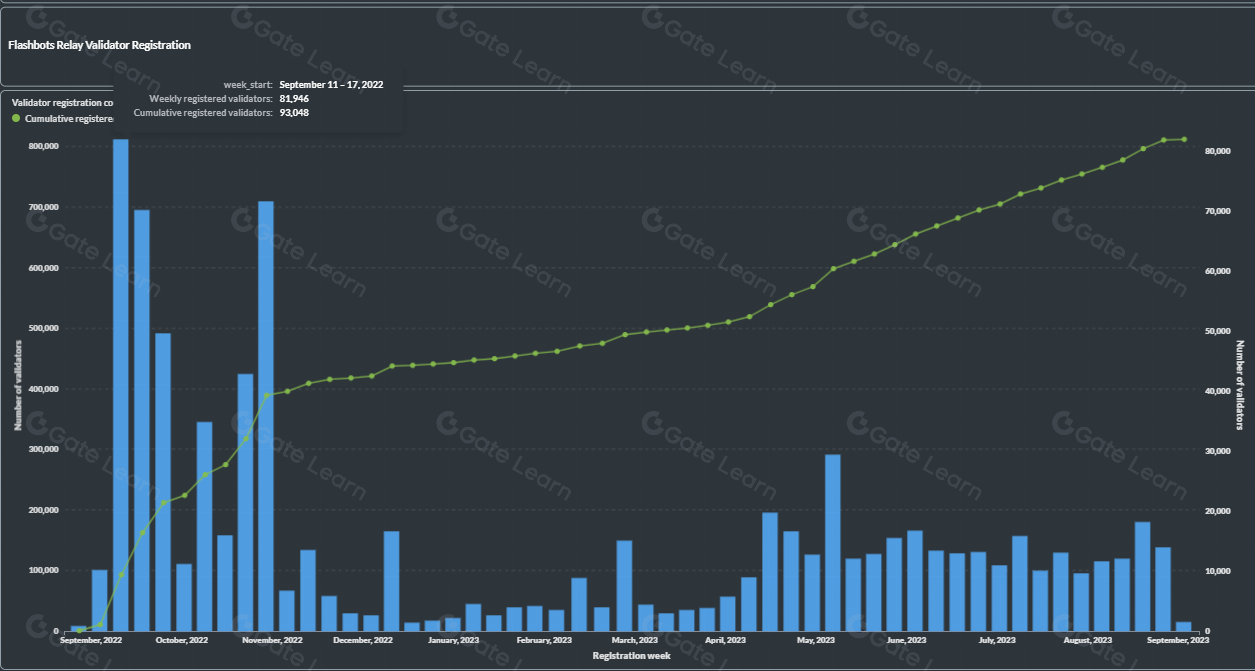

- Flashbots SUAVE: An Ethereum-native encrypted mempool designed to decentralize block building and maximize validator/user rewards by protecting orderflow privacy.

- Arrakis Finance DVMM: A decentralized market maker integrating MEV-aware mechanisms and orderflow auctions to return value directly to liquidity providers and traders.

- Maven 11’s Modular Marketplaces: Exploring integration of private orderflow auctions via modular design for increased efficiency and fairness.

This growing ecosystem is democratizing access to retail order flow and lowering barriers for both new entrants and established players. As a result, competition intensifies – which in turn benefits end users through improved pricing and reduced costs.

Ethereum (ETH) Price Prediction 2026-2031: Impact of Modular MEV Auctions

Forecasts based on advancements in modular MEV auctions, DeFi adoption, and evolving market structure

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,200 | $6,300 | +20.6% | Bullish DeFi innovation and MEV market efficiency drive growth; minor regulatory headwinds possible |

| 2027 | $4,200 | $6,000 | $7,400 | +15.4% | ETH benefits from increased institutional adoption; regulatory clarity improves market confidence |

| 2028 | $4,600 | $7,100 | $8,800 | +18.3% | Rollup and L2 adoption accelerates, modular MEV auctions widely implemented; competition from L2s and alt-L1s persists |

| 2029 | $5,000 | $8,250 | $10,500 | +16.2% | Global DeFi usage surges, ETH becomes core settlement layer; macro volatility introduces short-term risks |

| 2030 | $5,600 | $9,500 | $12,800 | +15.1% | Mature MEV marketplaces and interoperability with TradFi bolster value; regulatory harmonization underway |

| 2031 | $6,200 | $11,000 | $15,000 | +15.8% | ETH cements itself as a global financial layer; competition and new tech (AI/zk) influence growth |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 is strongly positive, supported by the rapid evolution and adoption of modular MEV auctions in DeFi. These innovations are expected to increase market fairness, liquidity, and user participation, driving ETH’s utility and value. While price appreciation is likely to be progressive and robust, the market will also face periods of consolidation, regulatory uncertainty, and competition from alternative protocols.

Key Factors Affecting Ethereum Price

- Widespread adoption and refinement of modular MEV auctions (e.g., Flashbots SUAVE, Arrakis DVMM)

- Increased DeFi activity and institutional adoption driven by fairer, more transparent marketplaces

- Regulatory developments globally, impacting investor confidence and market access

- Scalability solutions (L2s, rollups, sharding) enhancing Ethereum’s throughput and reducing fees

- Continued competition from alternative blockchains and Layer 2 solutions

- Macroeconomic conditions (interest rates, global risk sentiment) affecting crypto asset flows

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Tangible Benefits: Enhanced Fairness, Transparency and Execution Quality

The shift toward modularity isn’t just theoretical. Early data suggests that modular MEV auctions lead directly to:

- Fairer Distribution: Users capture more value from their own transactions as rebates or improved execution prices.

- Bigger Liquidity Pools: Lower fees attract more capital into DeFi protocols, boosting overall liquidity depth.

- Simplified Risk Management: Transparency around auction outcomes makes it easier for traders to assess risks before committing capital.

The result is a flywheel effect: increased participation fuels more competition among builders and solvers, which further improves outcomes for all market participants. As these systems mature alongside rising ETH prices – currently at $4,313.61, up $172.93 ( and 0.0418%) in 24 hours – DeFi traders are poised to benefit from a fundamentally fairer marketplace structure.

With the adoption of modular MEV auctions, the DeFi sector is witnessing a profound shift in how value circulates and who benefits from blockspace market solutions. The days when opaque practices dominated the transaction pipeline are rapidly fading. Instead, we see a new era where DeFi trader optimization is not just a buzzword but a lived reality for users interacting with modern protocols.

Practical Impacts: What DeFi Traders Experience Today

For everyday traders, the most immediate impact of modular MEV auctions is the tangible improvement in blockchain transaction execution. Instead of suffering unpredictable slippage or being sandwiched by bots, users now benefit from:

Key Advantages of Modular MEV Auctions for DeFi Traders

-

Enhanced Fairness and User Rebates: Modular MEV auctions, such as those enabled by Flashbots and Arrakis DVMM, introduce competitive bidding for orderflow. This ensures that a portion of the MEV is returned to traders through rebates, creating a more equitable environment and reducing the impact of predatory practices like frontrunning.

-

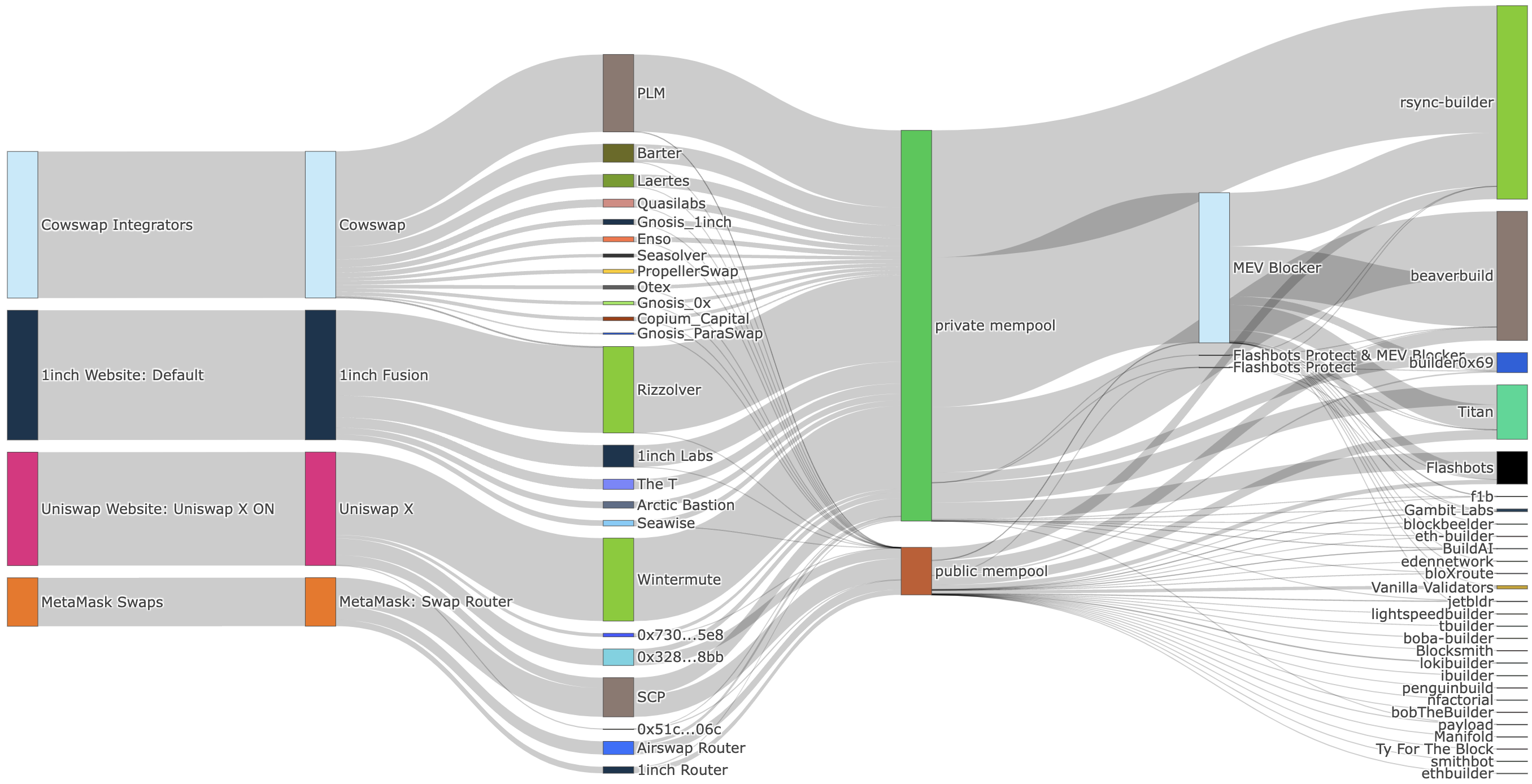

Improved Trade Execution and Price Discovery: By allowing specialized builders and solvers to compete in Order Flow Auctions (OFAs), traders benefit from better execution prices and reduced slippage. This competition drives optimal outcomes for users, as seen with platforms like CowSwap and leading DEXs.

-

Increased Transparency in Transaction Processing: The modular structure of modern MEV auctions, exemplified by Flashbots SUAVE, provides clearer insight into how transactions are handled and ordered. This transparency empowers traders to make more informed decisions and trust the execution process.

-

Greater Market Efficiency and Liquidity: Modular MEV auctions attract a wider range of participants by lowering barriers to entry and democratizing access to orderflow. This increased competition, highlighted by research from Gate.com and Blocknative, leads to deeper liquidity and more efficient markets for DeFi traders.

-

Protection Against Exploitative MEV Practices: Platforms like Arrakis Finance and Flashbots use MEV-aware mechanisms to shield traders from sandwich attacks and other forms of value extraction, fostering a safer trading environment.

This isn’t just about marginal gains. When every basis point counts, especially with Ethereum at $4,313.61: the ability to capture even small improvements in execution can have outsized effects on portfolio returns over time.

Transparency and Trust: Building Confidence in Orderflow Marketplaces

Transparency is no longer optional; it’s foundational. Modular MEV strategies make it possible for traders to inspect how their transactions are handled, what value is extracted, and how much is returned to them. This clarity encourages broader participation and helps level the playing field between retail users and sophisticated actors.

The feedback loop between user trust and protocol innovation cannot be overstated. As more traders see direct rewards from participating in these systems, protocols are incentivized to further refine their auction mechanisms, driving even greater efficiency and fairness.

What’s Next? The Future of Modular MEV Auctions

Looking ahead, the evolution of orderflow marketplaces will hinge on continued experimentation with auction formats, privacy-preserving technologies, and incentive structures that align all participants’ interests. As blockspace market solutions mature, expect to see:

- Greater user customization: Traders will be able to choose between different auction types based on their risk tolerance and desired outcomes.

- Cross-chain compatibility: Modular architectures are already inspiring similar designs across other L1s and L2s, promising broader access to efficient orderflow auctions.

- Expanded analytics: Real-time data tools will empower users with deeper insights into MEV strategies and historical auction performance.

The trajectory is clear: as competition among builders intensifies and as Ethereum maintains its position above $4,000, with ETH at $4,313.61 today, the incentives for both innovation and user-centric design have never been stronger.

The journey toward a more equitable DeFi landscape is well underway. For those seeking deeper dives into this transformation or actionable strategies for navigating the new orderflow marketplace paradigm, explore our dedicated resource at How Modular MEV Auctions Are Transforming Transaction Ordering in DeFi.