Decentralized exchanges (DEXs) have come a long way since the early days of simple constant-product pools. In 2025, the integration of internal MEV auctions within Automated Market Makers (AMMs) is not just a technical upgrade – it’s a full-scale transformation for DEX user experience. These innovations are rewriting the rules of on-chain trading, turning what used to be a battleground for bots and arbitrageurs into a more fair and efficient marketplace for everyday users.

Why Internal MEV Auctions Matter in 2025

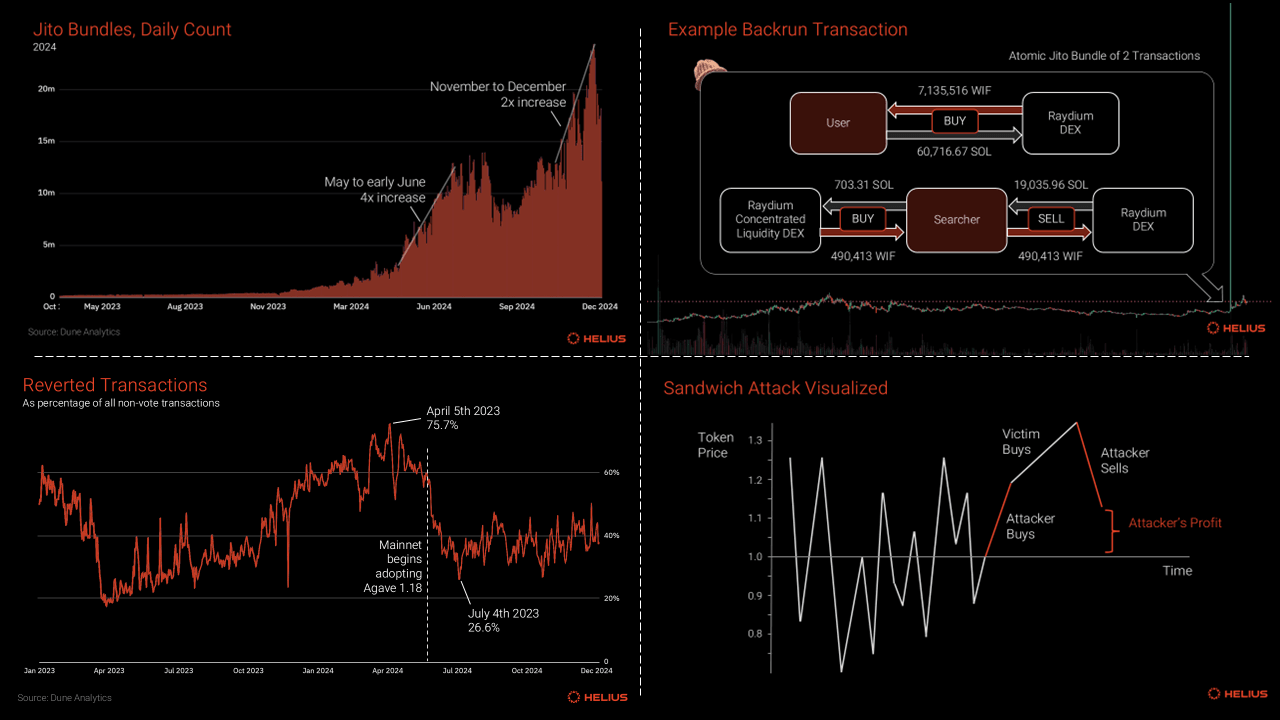

For years, MEV (Maximal Extractable Value) was synonymous with predatory practices like front-running and sandwich attacks. Traders would often find themselves paying more or receiving less than expected, as external actors manipulated transaction order for profit. According to recent studies, over $1 billion in MEV has been extracted since Ethereum’s transition to Proof-of-Stake, with 70% of new DEX tokens experiencing value erosion greater than 50% within their first week – much of it attributed to these exploitative tactics.

Internal MEV auctions flip this dynamic by allowing AMM protocols to capture value that would otherwise be siphoned off by third parties. Instead of losing out to external bots, users and liquidity providers now benefit directly from the protocol’s ability to internalize and redistribute this value. The result? A more equitable ecosystem where trust and transparency take center stage.

The Mechanics: How Internal AMM MEV Auctions Work

The key innovation is that these auctions operate inside the AMM itself, not as an external add-on. Here’s how leading protocols are making it work:

- Batch Auctions and Solver Networks: Platforms like CoW Swap aggregate user orders into batches and execute them at a single clearing price. This eliminates transaction ordering advantages, reducing opportunities for MEV extraction while solvers compete in real time to provide optimal trade execution.

- Dutch Auction Mechanisms: UniswapX has pioneered Dutch-style auctions where orders fill over time at decreasing prices. This dynamic approach enhances price discovery while minimizing external arbitrage opportunities – any captured value is returned directly to users via improved pricing.

- Dynamic Fee Structures: Some AMMs now adjust trading fees based on market volatility. Higher fees during turbulent periods deter predatory arbitrage, while lower fees during calm markets keep trading attractive for all participants. This balance helps mitigate Loss Versus Rebalancing (LVR), aligning interests between traders and liquidity providers.

If you want to dive deeper into how real-time auction data is reshaping DeFi efficiency, check out our guide on how real-time MEV auction data improves DeFi trading efficiency.

User Experience: Fairness Meets Efficiency

The most visible impact of internal AMM MEV auctions is felt by users themselves:

- No More “Invisible Tax”: By capturing and redistributing MEV internally, protocols eliminate the hidden costs that used to plague DEX trades.

- Smoother Execution and Lower Slippage: Batch processing and solver competition mean orders are filled closer to expected prices – even during volatile swings.

- Radical Transparency: Internal auctions offer clear frameworks for how value flows through the system, fostering greater user trust.

This paradigm shift doesn’t just protect traders from exploitation; it also unlocks new possibilities for protocol design and incentive alignment across the DeFi stack.

But the transformation goes even deeper. As more AMMs embrace internal MEV auctions, we’re witnessing a feedback loop of innovation: protocols are experimenting with intent-based orderflow, hybrid liquidity models, and even reinforcement learning to optimize value capture and distribution. The result is a DEX environment that’s not only safer but also fundamentally more competitive for both traders and liquidity providers.

Top Benefits of Internal MEV Auctions for DEX Users (2025)

-

Protection Against Front-Running & Sandwich Attacks: Internal MEV auctions in AMMs like CoW Swap and UniswapX prevent external actors from exploiting transaction ordering, shielding users from unfair price manipulation and value loss.

-

Better Trade Execution & Reduced Slippage: Batch auctions and solver networks aggregate user orders and execute them at uniform clearing prices, ensuring improved price outcomes and lower slippage for DEX traders.

-

Fair Value Redistribution: By capturing and redistributing MEV internally, protocols return value to users and liquidity providers, aligning incentives and increasing rewards for participation.

-

Dynamic Fee Structures for User Benefit: Platforms like Arrakis Finance implement dynamic fees that adjust to market volatility, deterring MEV-driven arbitrage and reducing Loss Versus Rebalancing (LVR) for users.

-

Enhanced Transparency & Trust: Internal MEV auctions establish clear, protocol-driven mechanisms for value flow, boosting user confidence and making DEX operations more transparent.

Protocol-level MEV management is now a core feature, not an afterthought. Unlike legacy systems where failed transactions and inflated fees were the norm (as highlighted in Flashbots’ reports), today’s leading AMMs use solver networks and batch clearing to reduce failed trades and keep costs predictable. This shift is especially important in high-frequency environments, where every microsecond counts and traditional optimization tools fall short.

Another key trend is the emergence of dynamic incentive structures. By adjusting fee schedules based on real-time volatility, AMMs can proactively defend against loss-versus-rebalancing (LVR) attacks while keeping trading friction low during stable periods. For users, this means less value leakage – and for liquidity providers, it translates to steadier returns even as market conditions fluctuate.

What Does This Mean for DeFi Traders?

The upshot: DEXs powered by internal MEV auctions are setting new standards for fairness and efficiency. Traders benefit from tighter spreads, fewer surprises at execution, and greater confidence that their interests are aligned with the protocol itself. Liquidity providers enjoy improved capital efficiency without constantly worrying about predatory bots eroding their yields.

Perhaps most importantly, this wave of innovation is making DeFi accessible to a broader audience. As user experience improves, barriers to entry fall away – bringing more retail traders into the fold and accelerating mainstream adoption of decentralized markets.

Looking Ahead: On-Chain MEV Solutions as the New Standard

The race isn’t over yet. As 2025 unfolds, expect continued competition among protocols to refine their internal auction mechanisms, experiment with new forms of orderflow routing, and further blur the lines between AMMs and order-book DEXs. Reinforcement learning agents may soon play a larger role in optimizing batch execution – pushing efficiency even higher.

If you’re eager to explore how these innovations are powering high-speed blockspace markets (and what it means for your trading strategies), don’t miss our feature on how MEV auctions are powering high-speed blockspace markets in 2025.

The bottom line? Internal MEV auctions have moved from theory to reality – transforming DEX user experience by making fairness programmable at the protocol level. The age of invisible tax is ending; transparency, efficiency, and user empowerment are taking center stage across on-chain finance.