Orderflow marketplaces and MEV are transforming the landscape of decentralized finance (DeFi), giving savvy traders new ways to optimize their strategies and capture value. With Ethereum trading at $4,463.24 as of today, understanding how orderflow and MEV intersect is more crucial than ever for anyone looking to stay ahead in blockchain trading.

What Is an Orderflow Marketplace?

An orderflow marketplace is a platform where transaction orders are aggregated and auctioned to participants like searchers and builders before being included on-chain. This process lets users, not just miners or validators, tap into the value their transactions generate. By participating in these marketplaces, DeFi traders can potentially reduce costs, improve execution quality, and even receive rebates or other incentives.

The rise of orderflow auctions has added a new layer of transparency and efficiency to the blockchain ecosystem. Platforms like Flashbots’ MEV-Share protocol empower users to control how their transaction data is shared within the MEV supply chain. This means you can decide who sees your orderflow, how it’s used, and even internalize some of the MEV your transactions create.

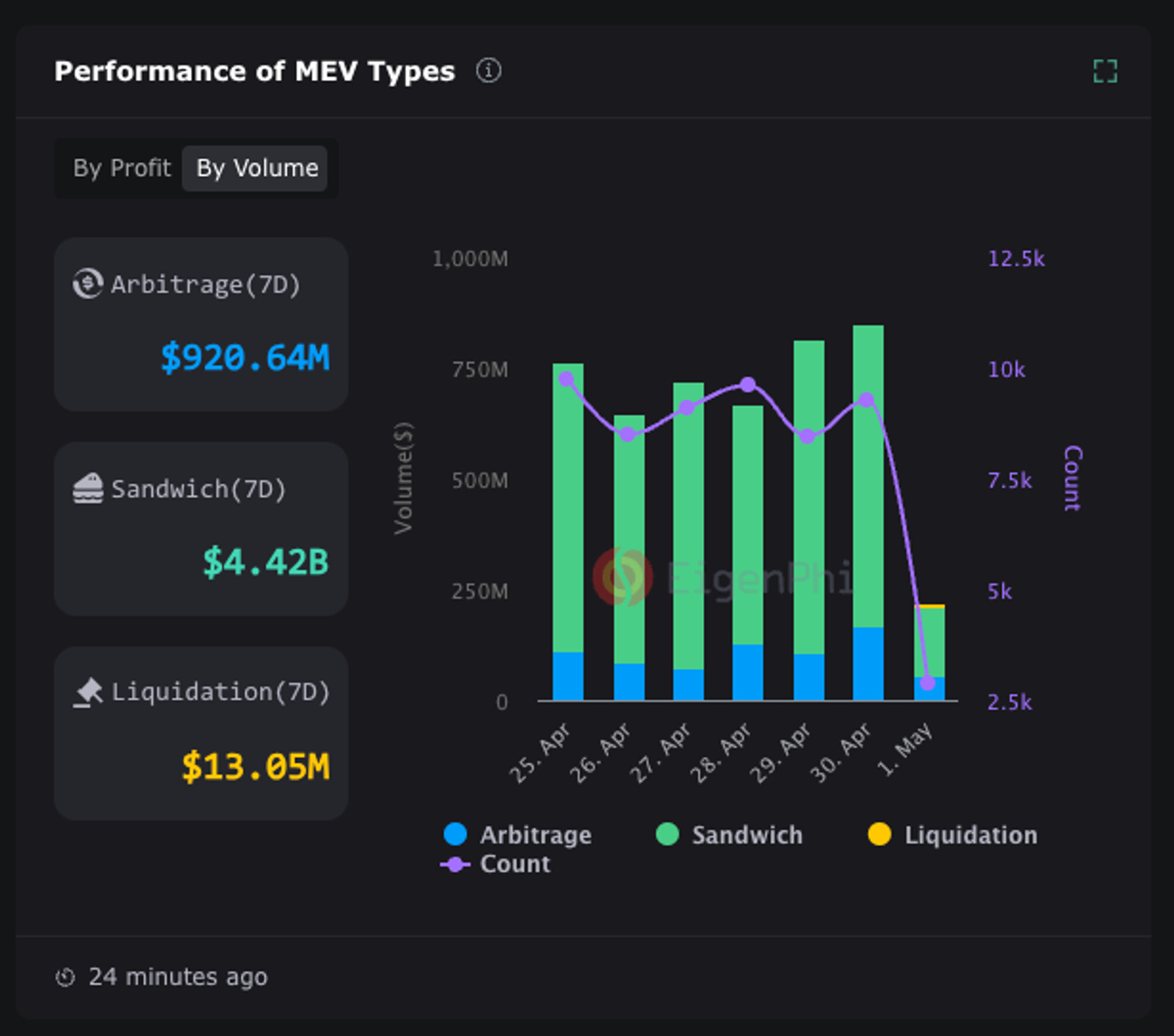

MEV: The Trader’s New Frontier

Maximum Extractable Value (MEV) refers to the extra value that can be captured by reordering or including/excluding transactions in a block. While this used to mostly benefit miners or validators, modern protocols are shifting that value back toward users and traders. Now, if you know how to leverage orderflow marketplaces and MEV-aware strategies, you can gain an edge that was previously out of reach.

A prime example is using private endpoints instead of public mempools. By sending your trades through private relays or encrypted channels, like those discussed on Cube Exchange: you can shield your intent from predatory bots looking to front-run or sandwich your orders. This privacy-first approach helps minimize risks while maximizing potential rewards.

Mechanisms That Give Traders the Edge

The mechanics behind these innovations are both fascinating and practical for active traders:

- Orderflow Auctions: Platforms like Blocknative’s OFAs allow end users to benefit directly from the economic opportunities created by their transaction flow (see more). Instead of leaking MEV to third parties, users can participate in auctions for better prices or rebates.

- Proposer-Builder Separation (PBS): By splitting up block proposing from block building, explained in depth on Cube Exchange, the system incentivizes fairer competition among builders while ensuring proposers receive fees without engaging in harmful extraction practices.

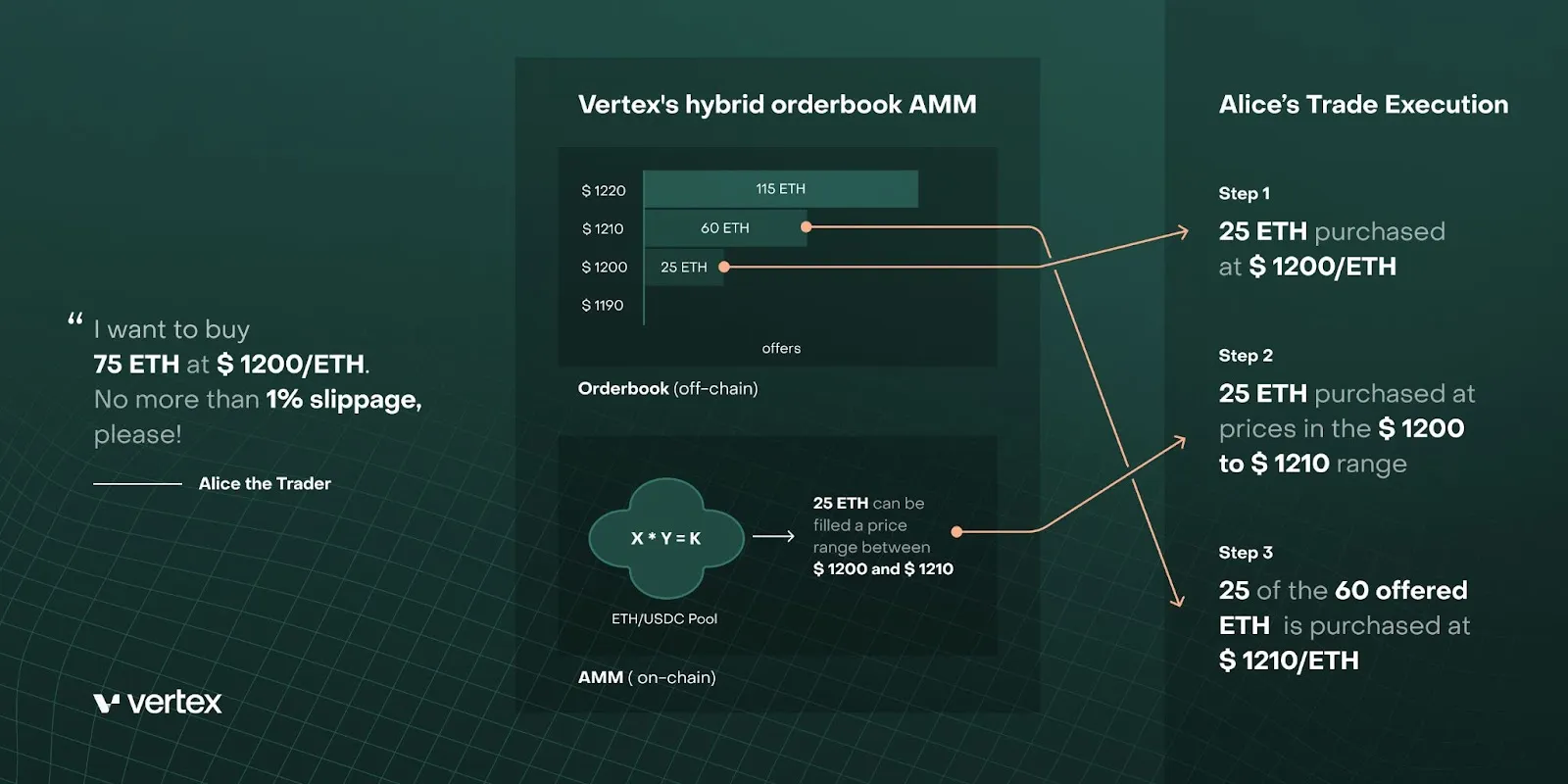

- Hybrid Orderbook Models: Projects like Orderly Network blend centralized speed with decentralized security. Their unique models batch trades quickly and concentrate liquidity so it’s harder for MEV extractors to exploit slow-moving orders (read more here).

Ethereum (ETH) Price Prediction 2026-2031

Based on Q4 2025 market data, orderflow marketplace innovations, and MEV mitigation trends

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg) vs. Prior Year | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,050 | $6,200 | +13% | Strong DeFi adoption, MEV mitigation boosts user confidence, moderate volatility |

| 2027 | $4,350 | $5,700 | $7,800 | +13% | Orderflow auctions widespread, improved scalability, ETH as leading smart contract platform |

| 2028 | $4,900 | $6,450 | $9,100 | +13% | Cross-chain MEV protocols mature, regulatory clarity increases institutional adoption |

| 2029 | $5,400 | $7,300 | $10,500 | +13% | Ethereum dominates Layer 1s, further DeFi and NFT growth, global expansion |

| 2030 | $5,900 | $8,200 | $12,300 | +12% | Rollups and hybrid orderbooks mainstream, ETH used in real-world assets, competition from new L1s |

| 2031 | $6,400 | $9,100 | $14,000 | +11% | Sustained ecosystem growth, ETH as digital asset reserve, possible new regulatory frameworks |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 is bullish, supported by advancements in orderflow marketplaces, MEV mitigation, and ongoing DeFi adoption. Average yearly growth is projected at 11-13%, with significant upside in bullish scenarios and robust floor prices even in bearish markets. Ongoing tech upgrades, regulatory clarity, and increasing real-world use cases could drive ETH toward new all-time highs.

Key Factors Affecting Ethereum Price

- Widespread adoption of orderflow marketplaces and MEV-resistant trading protocols

- Ongoing Ethereum network upgrades (scalability, rollups, hybrid orderbooks)

- Increasing institutional participation and regulatory clarity

- Growth in DeFi, NFTs, and real-world asset tokenization on Ethereum

- Competition from other Layer 1 blockchains and potential macroeconomic headwinds

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This evolving toolkit means DeFi traders no longer have to settle for being passive participants in the race for blockspace, they can actively shape outcomes through smart use of privacy tools, auction platforms, and hybrid exchange models.

The Real Impact: Price Discovery and Fairness

The impact goes beyond just profit potential. Orderflow marketplaces also improve price discovery, lower transaction costs for everyone involved, and help make markets fairer by redistributing value throughout the supply chain, not just at the validator level. As more platforms embrace these models, expect even greater efficiency across DeFi protocols.

For traders, this shift means their orderflow isn’t just a byproduct of trading activity, it’s a valuable resource. By understanding how to route transactions and which platforms to use, you can capture a slice of the MEV pie that was once reserved for insiders. This democratization of value is making DeFi markets more competitive and collaborative at the same time.

How to Capture Value in Orderflow Marketplaces

Ready to put these concepts into practice? Here are some actionable ways you can leverage orderflow marketplaces and MEV-aware strategies today:

Practical Steps for DeFi Traders: Orderflow Auctions & MEV Protection

-

Use Flashbots MEV-Share to Auction Your OrderflowLeverage Flashbots MEV-Share to submit transactions through their controlled auction system. This lets you internalize MEV your trades generate, potentially earning rebates and improving execution speed.

-

Route Transactions via Private Relays for Enhanced PrivacySend your trades to private endpoints (such as those offered by Cube Exchange) instead of the public mempool. This reduces exposure to front-running and sandwich attacks by concealing your trading intent.

-

Trade on MEV-Resistant Platforms Like Orderly NetworkChoose hybrid orderbook platforms such as Orderly Network, which combine centralized and decentralized features to minimize MEV risks and improve trade fairness.

-

Monitor Ethereum Gas Prices and Market DataStay updated on current Ethereum prices (e.g., ETH: $4,463.24 as of the latest data) and gas fees using tools like Etherscan Gas Tracker to optimize transaction timing and costs.

-

Stay Informed on MEV Research and Best PracticesFollow reputable sources such as Blocknative and Flashbots Collective for the latest developments, tools, and community guides on MEV protection and orderflow auctions.

1. Choose platforms with user-centric auction models: Look for protocols that let you control your transaction visibility, such as Flashbots’ MEV-Share or Blocknative’s OFA. These platforms help ensure that any value created by your trades comes back to you, either as rebates or improved execution.

2. Prioritize transaction privacy: Use private relays or hybrid orderbooks (like those at Orderly Network) to hide your intent from predatory bots. By reducing information leakage, you’re less likely to be front-run or sandwiched.

3. Stay informed on price action: With Ethereum currently trading at $4,463.24, small improvements in execution can mean significant gains over time, especially in volatile markets where every basis point counts.

“Orderflow auctions are leveling the playing field for everyday traders, no more losing out to invisible hands. ”

The Future of DeFi Orderflow: What’s Next?

The evolution is far from over. As cross-chain activity increases and new privacy tools emerge, expect even more sophisticated ways for traders and developers to collaborate, and compete, for MEV opportunities across multiple blockchains. Private orderflow channels are already disrupting traditional mempool dynamics, while innovative auction formats continue to push the boundaries of what’s possible in decentralized trading (learn more here).

The bottom line? As protocols mature and transparency increases, the edge will go to those who understand not just what they’re trading, but how, where, and when. Whether you’re routing trades through a private relay or participating in an open auction, mastering these new tools is quickly becoming essential for anyone serious about blockchain trading strategies.