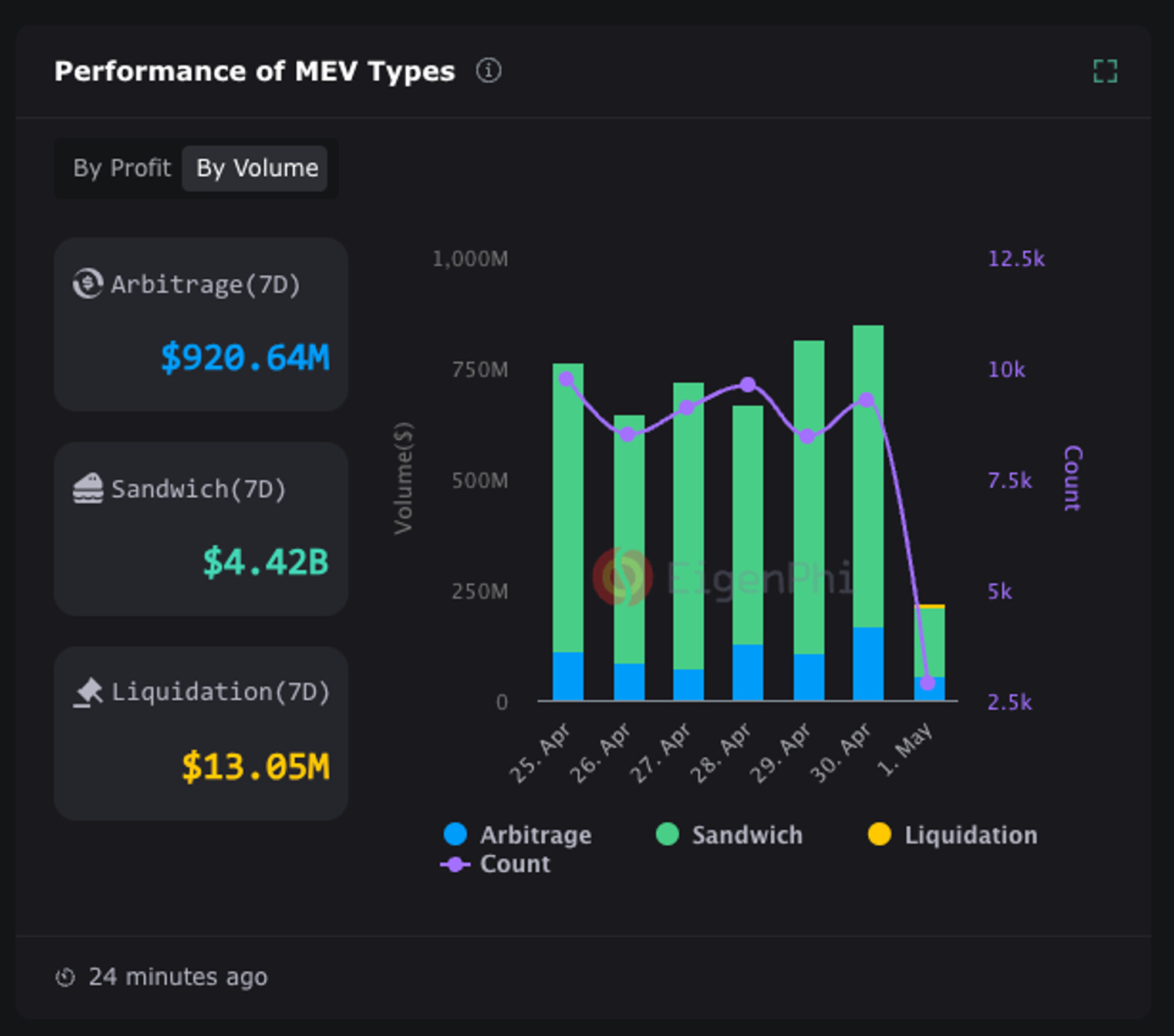

In 2025, on-chain perpetual trading has reached an inflection point. Monthly trading volumes for perpetual DEXs have soared past $1.5 trillion, a 52% year-over-year increase, reflecting both the sector’s maturation and intensifying competition among traders and liquidity providers. Yet, as the market grows more sophisticated, so do the challenges: persistent MEV (Maximal Extractable Value) extraction, latency arbitrage, and unpredictable execution costs continue to erode user trust and efficiency in decentralized finance (DeFi). Enter modular MEV auctions, a paradigm shift that is fundamentally reshaping the landscape of perpetual trading by introducing transparency, fairness, and capital efficiency at the protocol layer.

MEV: The Invisible Tax on On-Chain Perpetuals

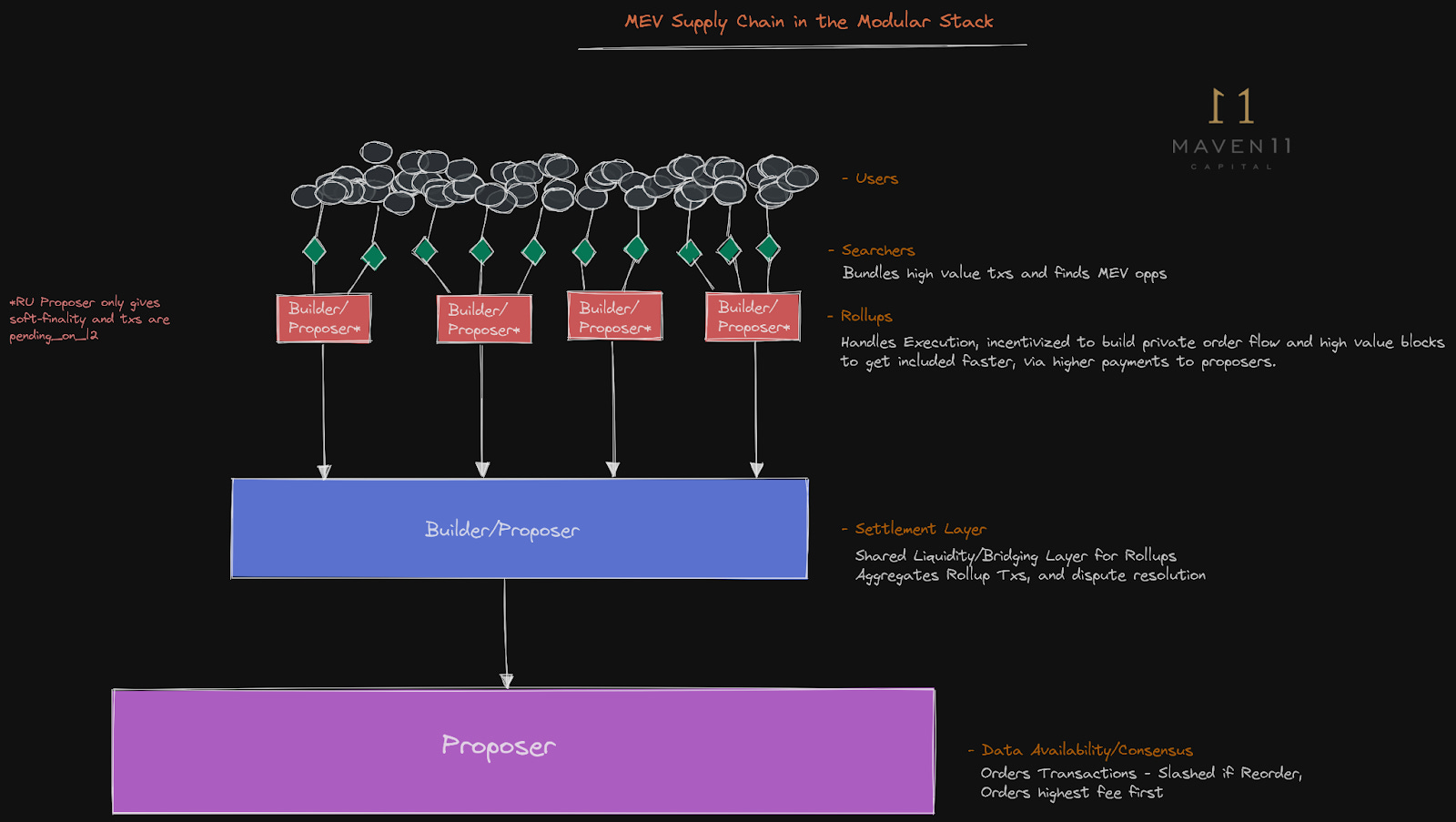

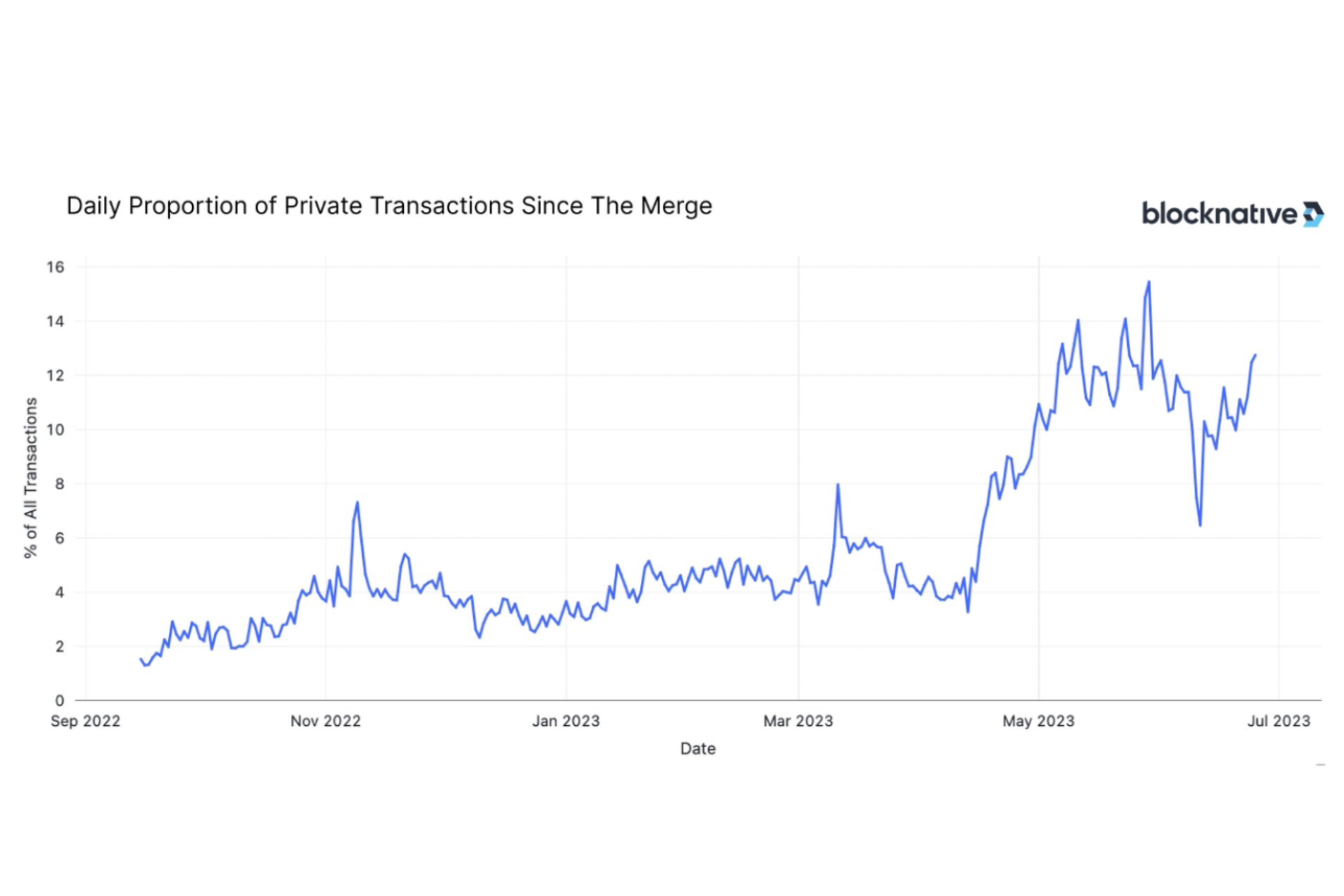

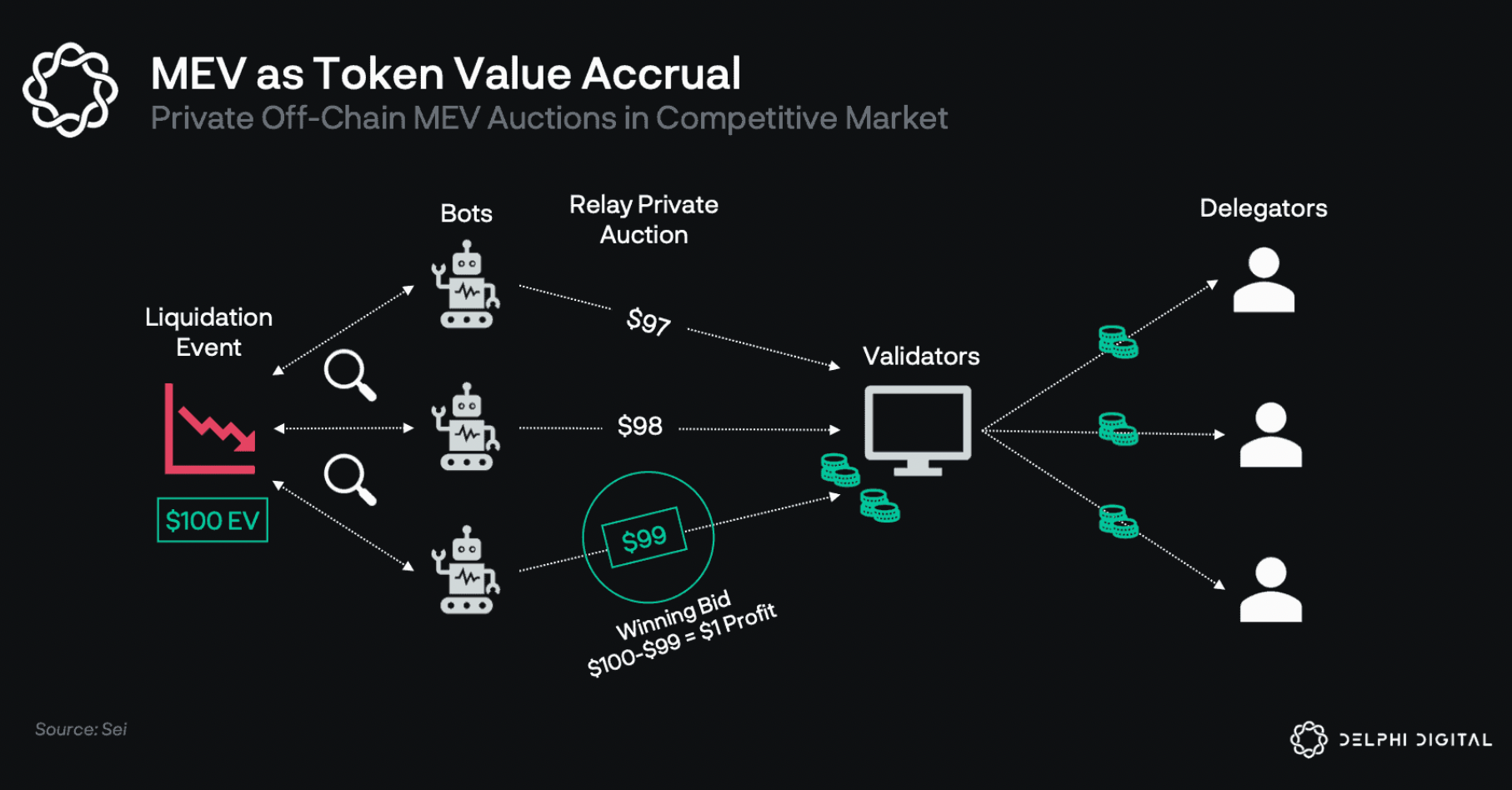

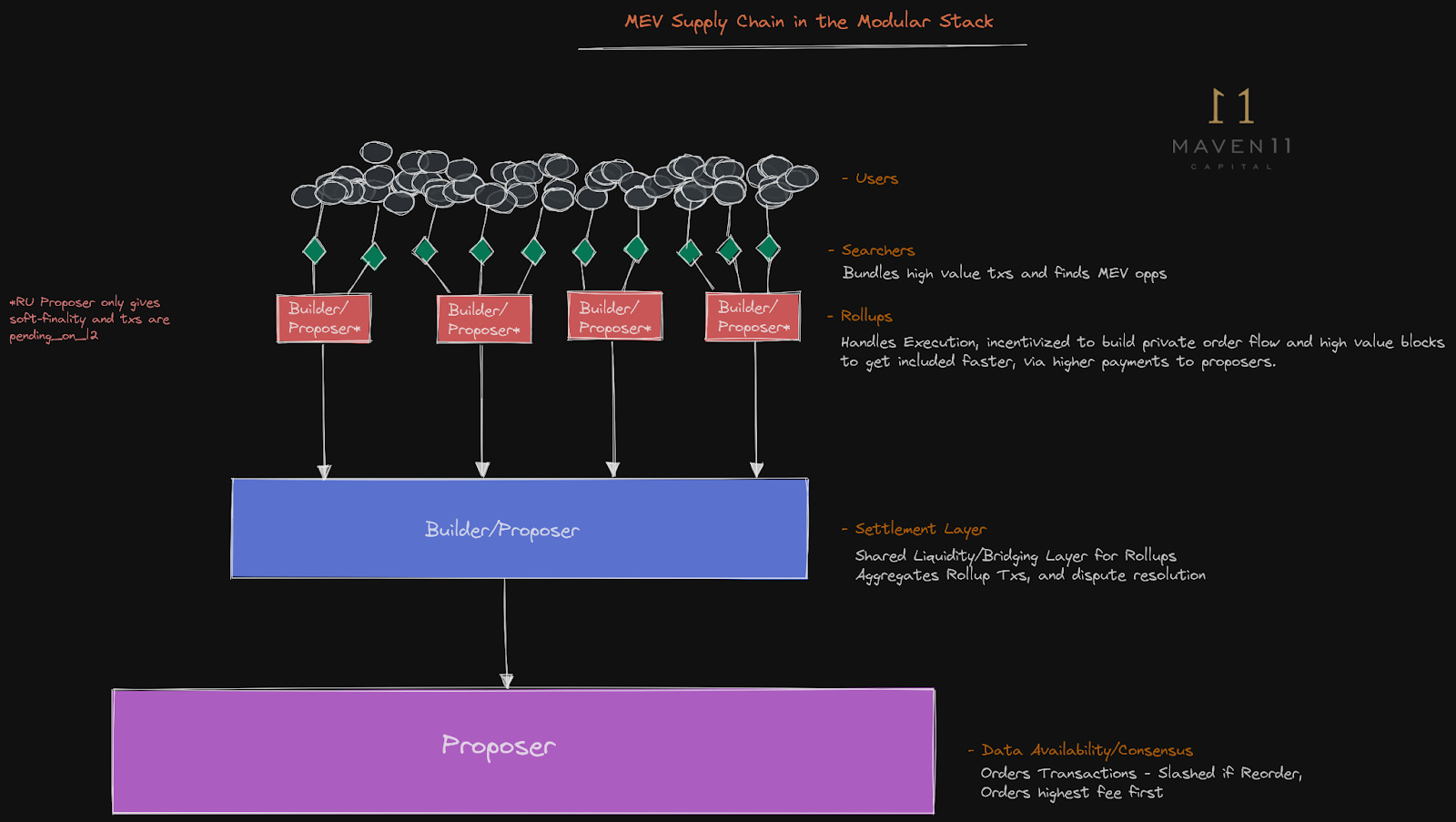

Historically, MEV has acted as an invisible tax on DeFi participants. In traditional architectures, miners or validators could reorder transactions within a block, often front-running or sandwiching large trades to siphon value from regular users. The impact was particularly acute in high-leverage environments like perpetual futures markets, where milliseconds matter and slippage can quickly spiral into significant losses.

With the rise of atomic multi-leg orders and increasingly complex DeFi strategies in 2025, these inefficiencies became glaring bottlenecks. Not only did they undermine price discovery but they also discouraged professional market makers from deploying deep liquidity on-chain. The result? Higher spreads, inconsistent execution quality, and a system ripe for exploitation by latency-sensitive actors.

The Modular MEV Auction Solution: Dual Flow Batch Auctions (DFBA)

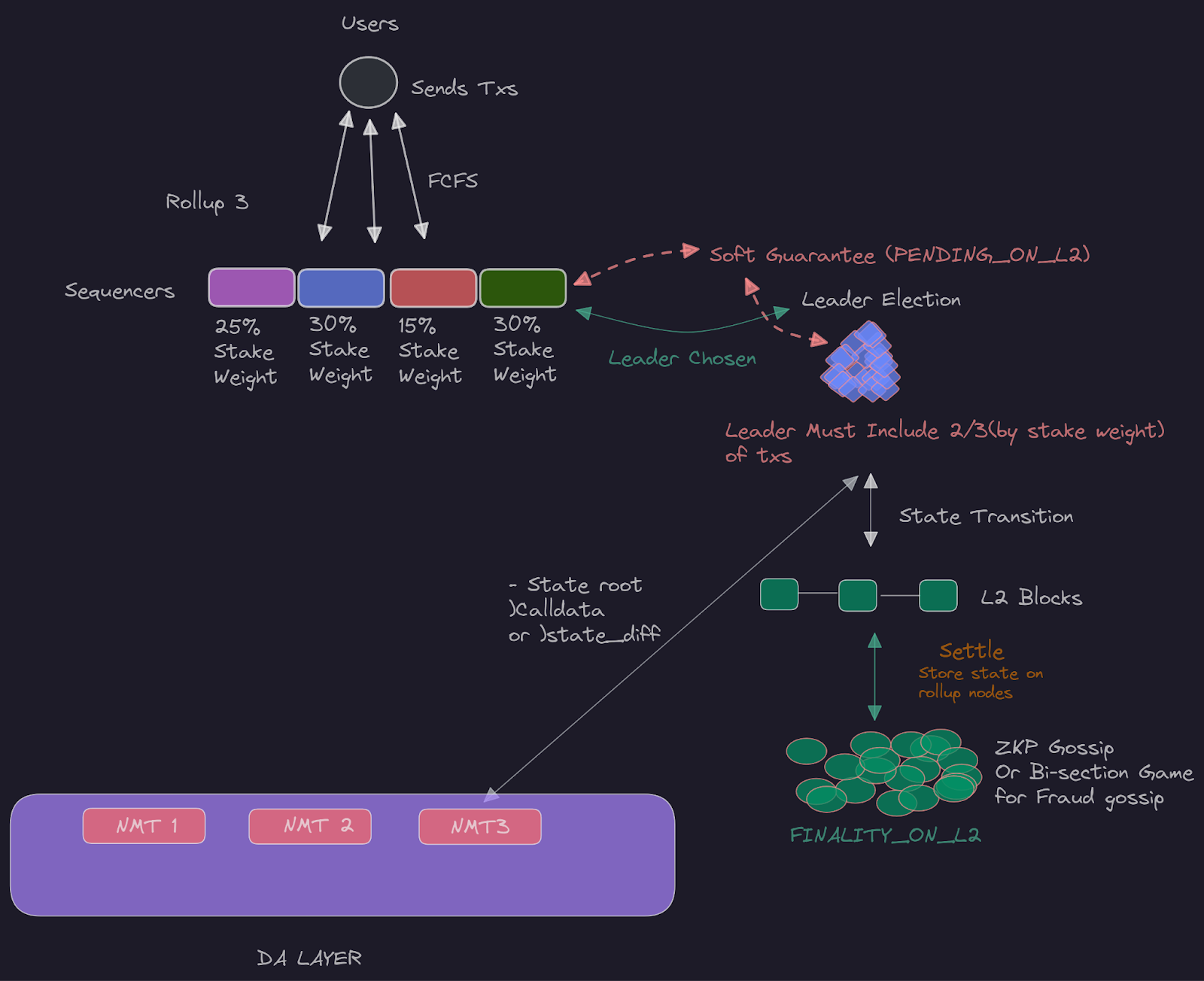

Modular MEV auctions directly address these pain points by restructuring how transactions are ordered and included in blocks. The flagship innovation, Dual Flow Batch Auctions (DFBA): batches user orders into discrete auctions where specialized builders compete to construct optimal blocks. This model introduces several key benefits:

- Elimination of Latency Arbitrage: By batching orders and revealing them simultaneously to competing builders, DFBA neutralizes advantages gained from speed alone.

- Fair Blockspace Allocation: Orderflow is routed through transparent auctions rather than opaque mempools, reducing information asymmetry between retail users and sophisticated searchers.

- Proposer-Builder Separation (PBS): Proposers select from multiple block candidates built by independent entities, decentralizing transaction ordering power and mitigating single-point manipulation risks.

This new architecture not only levels the playing field but also enables sub-second settlement speeds with minimal slippage, key features for institutional-grade perp trading infrastructure.

Real-Time Auction Data: Precision Tools for Modern Traders

The integration of modular MEV auctions has unlocked a new era of data-driven execution strategy. Real-time analytics allow traders to monitor auction dynamics, such as builder competition intensity or average batch settlement times, and route their orders when conditions are most favorable. This granular visibility empowers both manual traders and algorithmic bots to dynamically calibrate their tactics for optimal outcomes.

Liquidity providers, too, benefit from this transparency; predictable execution rules reduce systemic risk and encourage deeper order books across volatile regimes. Platforms leveraging modular MEV have reported measurable reductions in failed transactions and gas fee volatility, a direct boon for all participants seeking sustainable yield generation in DeFi’s most competitive arenas.

If you’re interested in a deeper dive into how modular MEV auctions are improving DeFi trading efficiency at every level, from protocol design to user experience, explore our detailed analysis here.

Looking ahead, the competitive edge in on-chain perpetual trading will increasingly hinge on access to robust auction data and the ability to adapt strategies in real time. Traders now have unprecedented visibility into blockspace demand, price impact forecasts, and evolving builder behaviors. This data-centric approach is rapidly becoming the norm for sophisticated participants seeking to minimize slippage and execution risk across volatile market cycles.

Key Advantages of Modular MEV Auctions for Perpetual Traders in 2025

-

Elimination of Front-Running and Sandwich Attacks: Modular MEV auctions, such as Dual Flow Batch Auctions (DFBA), batch user transactions and allocate blockspace competitively, drastically reducing opportunities for predatory tactics like front-running and sandwich attacks that previously increased costs and eroded trader trust.

-

Enhanced Transaction Fairness and Transparency: By introducing structured marketplaces and Order Flow Auctions (OFAs), modular MEV systems ensure that transaction ordering is transparent and fair, giving all traders equal access to blockspace and reducing information asymmetry.

-

Lower Transaction Costs and Reduced Gas Fee Volatility: Platforms utilizing modular MEV auctions report measurable reductions in failed transactions and gas fee volatility, leading to more predictable and efficient trading for perpetual traders.

-

Optimized Trade Execution and Price Discovery: Real-time analytics and dynamic auction mechanisms empower traders to route orders when market conditions are optimal, improving price discovery and execution quality on perpetual DEXs.

-

Attraction of Market Makers and Liquidity Providers: By offering predictable rules and minimizing systemic risk, modular MEV auctions create an environment that attracts professional market makers and liquidity providers, deepening order books and enhancing overall market liquidity.

-

Decentralized and Competitive Transaction Ordering: Mechanisms like Proposer-Builder Separation (PBS) decentralize transaction ordering, allowing multiple builders to compete and proposers to select the most optimal blocks, further enhancing execution quality and reducing centralization risks.

-

Dynamic Adaptation for Advanced Users: Advanced traders and liquidity providers can monitor real-time auction data to fine-tune trading bots or adjust liquidity strategies, enabling more sustainable returns across market cycles.

Another critical dimension is the democratization of orderflow. With Dual Flow Batch Auctions, retail and institutional users alike can participate in a unified auction mechanism, leveling the playing field that was previously tilted toward latency-sensitive actors. The transparent nature of these auctions also means that failed transactions, a persistent pain point in legacy DeFi protocols, have dropped to record lows, as confirmed by recent performance data from leading modular MEV platforms.

Beyond Perpetuals: The Broader Impact on DeFi Infrastructure

The implications of modular MEV auctions extend well beyond perpetual trading. By treating blockspace as a commoditized resource allocated via open competition, DeFi protocols can more efficiently match supply with demand across lending markets, spot exchanges, and cross-chain bridges. This architectural shift is fostering a new wave of protocol composability, enabling atomic multi-leg orders and complex trade routing with far greater reliability than ever before.

Security is another area seeing marked improvement. With proposer-builder separation and failure cost penalties embedded at the protocol level, networks are less vulnerable to manipulation or spam attacks that previously plagued high-volume DEXs. For developers building next-generation DeFi primitives, this translates to fewer edge-case failures and more predictable integration pathways for innovative products.

What’s Next: Evolving Standards and Industry Adoption

As adoption accelerates through 2025, expect modular MEV auctions to become an industry standard not only for decentralized perpetuals but also for any application requiring efficient blockspace allocation and fair transaction ordering. Open-source frameworks are lowering barriers for new entrants while established protocols race to integrate DFBA models into their core infrastructure.

The result is a positive feedback loop: deeper liquidity attracts more sophisticated traders; improved execution quality draws greater institutional capital; enhanced transparency rebuilds trust among retail users. For those looking to stay ahead of the curve in DeFi’s most competitive verticals, mastering these auction-based mechanisms will be essential.

For further insights into how modular MEV auctions are enhancing transaction efficiency across all facets of decentralized finance, see our comprehensive breakdown here.