As the digital economy surges and on-chain activity intensifies, the concept of a blockspace marketplace is rapidly transforming how decentralized networks approach transaction pricing. With Bitcoin trading at $115,864.00 as of today, the demand for efficient and predictable access to blockspace is more acute than ever. The evolution from monolithic protocols to modular architectures has catalyzed new approaches to DeFi execution, with marketplaces for blockspace emerging as a linchpin for scalability and fee stability.

Understanding Blockspace Marketplaces: Beyond Simple Fee Auctions

Blockspace refers to the finite capacity in each blockchain block that can be allocated to user transactions. Historically, users competed in a blind auction for this space, often leading to unpredictable spikes in blockchain transaction fees. The introduction of blockspace marketplaces marks a paradigm shift: instead of reactive bidding wars, users can now proactively secure future block inclusion at transparent rates.

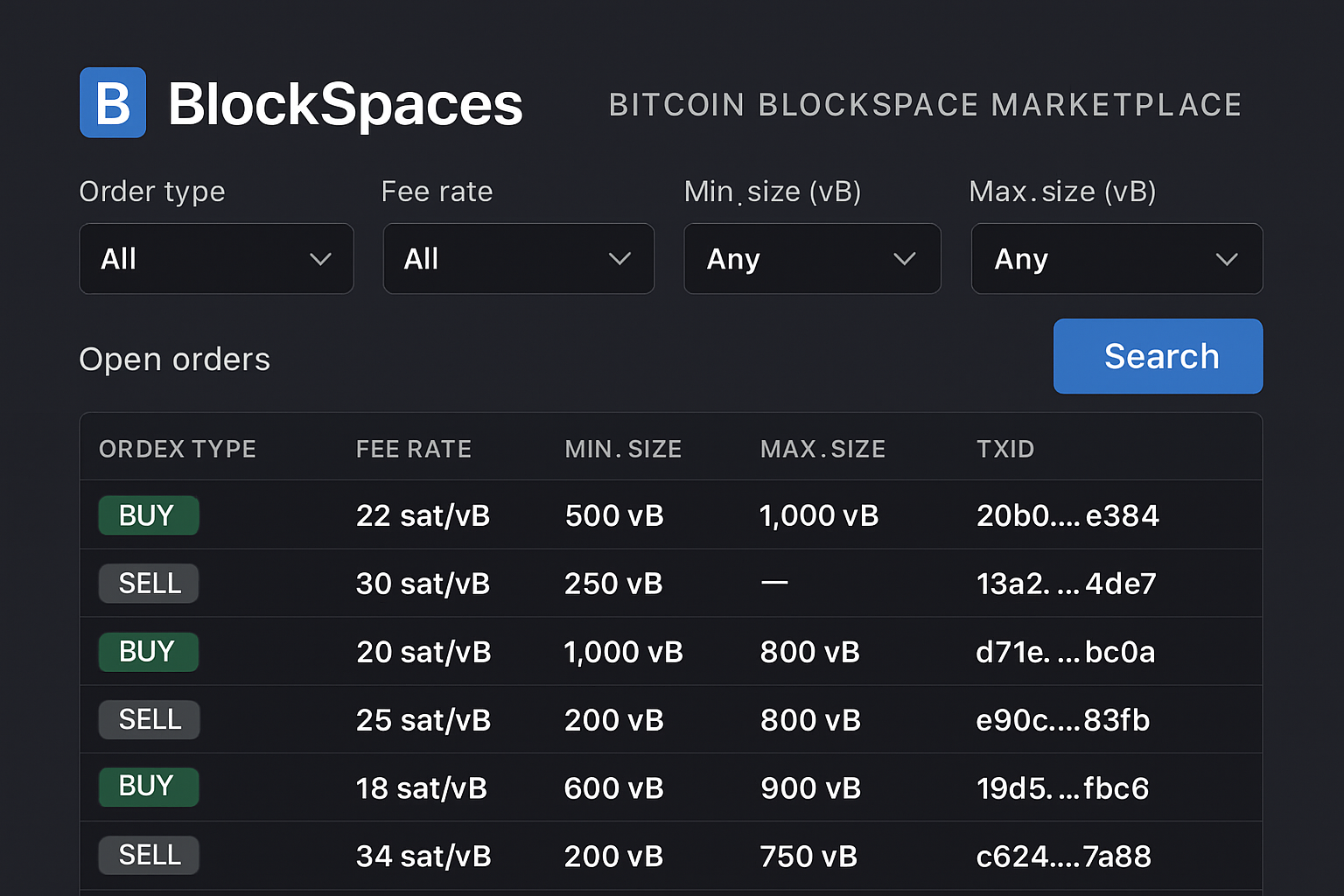

This model is gaining traction across both Layer 1 and Layer 2 ecosystems. For example, platforms like BlockSpaces are pioneering forward market infrastructure for Bitcoin’s blockspace, enabling institutions and miners to execute peer-to-peer contracts that lock in access and pricing for future blocks (source). This not only brings predictability but also introduces new financial primitives tailored for sophisticated on-chain actors.

The Rise of Modular Blockspace: Customization Meets Efficiency

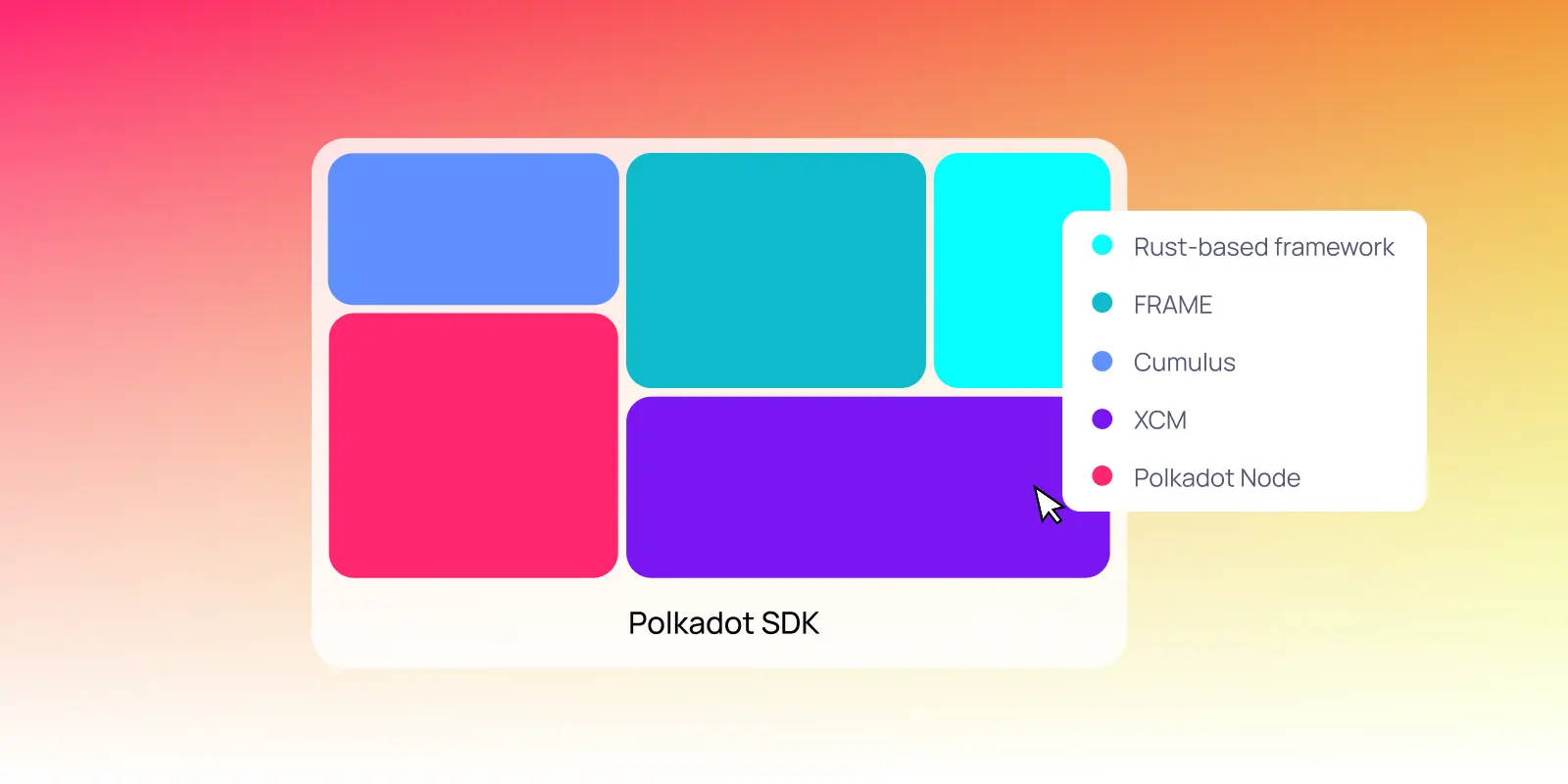

The shift from monolithic chains, where all functions are bundled together, to modular systems has opened up an expansive design space (source). In this new paradigm, projects can launch app-specific chains or leverage protocol-agnostic solutions like Lastic (source) to access tailored blockspace offerings without being constrained by shared network congestion.

On networks like Solana, innovations such as Jito’s Block Assembly Marketplace (BAM) have radically reimagined transaction processing. BAM introduces programmable, private, and verifiable auctions that allow users and searchers to bid directly for prioritized inclusion, ushering in a more transparent and competitive environment (source). This granular control over execution is particularly valuable for high-frequency DeFi strategies where latency and ordering are mission-critical.

Dynamic Pricing Mechanisms: Toward Predictable On-Chain Costs

The volatility of blockchain transaction fees has long been a pain point for users. Ethereum’s EIP-1559 was an early step toward addressing this by introducing dynamic base fees that adjust according to network demand. However, ongoing research into alternative mechanisms, such as posted-price models, suggests there is still room for improvement in achieving fee predictability (source).

The interplay between Layer 1 base layers and Layer 2 rollups further complicates the landscape. Recent studies have found that speculative MEV (Maximal Extractable Value) activities account for a significant share of gas usage on rollups (source). This persistent demand reinforces the need for robust blockspace marketplaces capable of absorbing shocks during periods of heightened activity.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook considering the emergence of blockspace marketplaces, modular blockchain trends, and current BTC price context ($115,864.00 as of September 2025)

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $86,000 | $120,000 | $147,000 | +3.6% | Blockspace marketplace adoption grows; moderate volatility |

| 2027 | $98,000 | $137,000 | $170,000 | +14.2% | Institutional adoption rises; regulatory clarity improves |

| 2028 | $112,000 | $155,000 | $195,000 | +13.1% | Wider use of modular blockchains; BTC as settlement layer |

| 2029 | $130,000 | $175,000 | $225,000 | +12.9% | Layer 2 and DeFi integration peak; fee markets stabilize |

| 2030 | $148,000 | $200,000 | $260,000 | +14.3% | Global financial platforms adopt BTC infrastructure |

| 2031 | $165,000 | $225,000 | $295,000 | +12.5% | BTC seen as digital gold; blockspace markets mature |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 remains bullish overall, but with significant volatility due to evolving blockspace economics, regulatory developments, and macro trends. The average price is projected to rise steadily, reflecting ongoing institutional adoption, the maturation of blockspace marketplaces, and the integration of modular blockchain solutions. Maximum price predictions account for bullish scenarios such as mass institutional adoption or rapid scaling of DeFi and payments. Minimums reflect potential bear cycles or adverse regulatory shocks, but remain progressively higher year over year, demonstrating Bitcoin’s growing role as a foundational digital asset.

Key Factors Affecting Bitcoin Price

- Adoption and efficiency of blockspace marketplaces, improving transaction fee predictability and network utility

- Institutional investment flows and the emergence of new financial products using BTC as collateral or settlement asset

- Global regulatory landscape, especially regarding crypto taxation, ETF approvals, and payments regulation

- Advances in modular blockchain infrastructure, Layer 2 scaling, and cross-chain interoperability

- Macroeconomic conditions: inflation, monetary policy, and global risk appetite for digital assets

- Competition from other blockspace ecosystems (e.g., Ethereum, Solana, Polkadot) driving innovation and demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Institutionalization of DeFi Execution via Blockspace Markets

As institutional players enter the DeFi arena en masse, their appetite for deterministic execution grows. By leveraging modular blockspace solutions and forward markets, these actors can hedge against fee spikes while ensuring timely settlement, a critical requirement in arbitrage-heavy or latency-sensitive strategies.

Blockspace marketplaces are not just technical innovations; they are fundamentally reshaping the incentives and risk profiles across the DeFi stack. By creating a liquid market for future block inclusion, these platforms enable sophisticated hedging, arbitrage, and even insurance products around on-chain transaction pricing. This financialization of blockspace is a natural evolution as DeFi matures, mirroring the way traditional finance developed robust derivatives and forward markets to manage volatility.

One of the most compelling effects of this institutionalization is the emergence of cross-chain and protocol-agnostic solutions. Projects like Lastic exemplify this trend by providing a single interface to access multiple blockspace ecosystems, allowing traders and developers to route transactions based on real-time liquidity, congestion, and pricing (source). This flexibility is particularly valuable as the modular blockchain thesis gains traction, with networks like Polkadot offering diverse fit-for-purpose blockspace options for Web3 builders.

Key Benefits for Traders and Protocols

Top 5 Benefits of Modular Blockspace Marketplaces for DeFi

-

Predictable Transaction Fees: Modular blockspace marketplaces, such as BlockSpaces for Bitcoin, enable DeFi participants to lock in transaction costs in advance, reducing exposure to fee volatility during periods of high network congestion.

-

Enhanced Transaction Efficiency: By allowing users to reserve blockspace ahead of time, platforms like Jito’s Block Assembly Marketplace (BAM) on Solana streamline transaction processing, resulting in faster and more reliable transaction inclusion for DeFi protocols.

-

Customizable Execution Environments: Modular ecosystems such as Polkadot and Celestia offer DeFi projects the ability to tailor blockspace to their specific needs, optimizing for throughput, security, and cost-efficiency.

-

Improved Transparency and Fairness: Solutions like Ethereum’s EIP-1559 and Jito’s BAM introduce transparent and programmable pricing mechanisms, ensuring that transaction ordering and inclusion are verifiable and less susceptible to manipulation.

-

Cross-Chain and Protocol-Agnostic Access: Platforms such as Lastic aggregate blockspace from multiple networks, enabling DeFi users to access the best blockspace solutions across chains without being locked into a single protocol.

For high-frequency trading firms, arbitrageurs, and protocol designers, access to predictable execution costs is more than a convenience, it’s a competitive advantage. Blockspace marketplaces reduce uncertainty around settlement timing and fee exposure. This fosters more sophisticated strategies such as batch auctions, MEV capture optimizations, or even just-in-time liquidity provision that would be infeasible in legacy fee auction systems.

The downstream effects extend beyond trading. Application-layer protocols can now offer users guaranteed transaction inclusion or subsidized fees by participating in forward blockspace markets. This unlocks new business models, think fixed-fee lending platforms or DEXes with predictable slippage guarantees, built atop modular blockspace primitives.

Challenges Ahead: Composability and Fairness

Yet challenges remain on the road to ubiquitous blockspace marketplace adoption. Ensuring composability between disparate chains and maintaining fairness in auction design are active areas of research. For example, while programmable auctions like Solana’s BAM offer improved transparency (source), they must also guard against new forms of collusion or information leakage that could undermine trust.

Moreover, as speculative MEV continues to drive gas usage especially on Layer 2s (source), there is an ongoing need for robust monitoring tools and governance frameworks that can adapt to rapidly changing market dynamics.

Looking Forward: The Modular Era of DeFi Execution

The proliferation of modular blockspace solutions signals a decisive shift away from one-size-fits-all blockchain architectures toward highly customizable execution environments. As Bitcoin maintains its position at $115,864.00, it’s clear that demand for scalable transaction processing will only intensify with mainstream adoption. Blockspace marketplaces stand at the nexus of this transformation, empowering users to optimize costs while unlocking new layers of composability across DeFi applications.

The next wave of innovation will likely see deeper integration between orderflow markets, real-time analytics platforms, and cross-chain routing engines, all built atop these emerging blockspace primitives. For traders, developers, and institutions alike, staying ahead means engaging proactively with these new market structures, and rethinking how value flows across decentralized financial systems.