In the fast-moving world of decentralized finance (DeFi), transaction efficiency can make or break a trading strategy. As DeFi protocols scale and competitive edge narrows, the way transactions are sequenced and executed on-chain has become a battleground for both traders and infrastructure providers. Modular MEV Auctions are emerging as a breakthrough solution, reshaping how value is captured and distributed across DeFi markets.

Why Traditional MEV Extraction Fails DeFi Traders

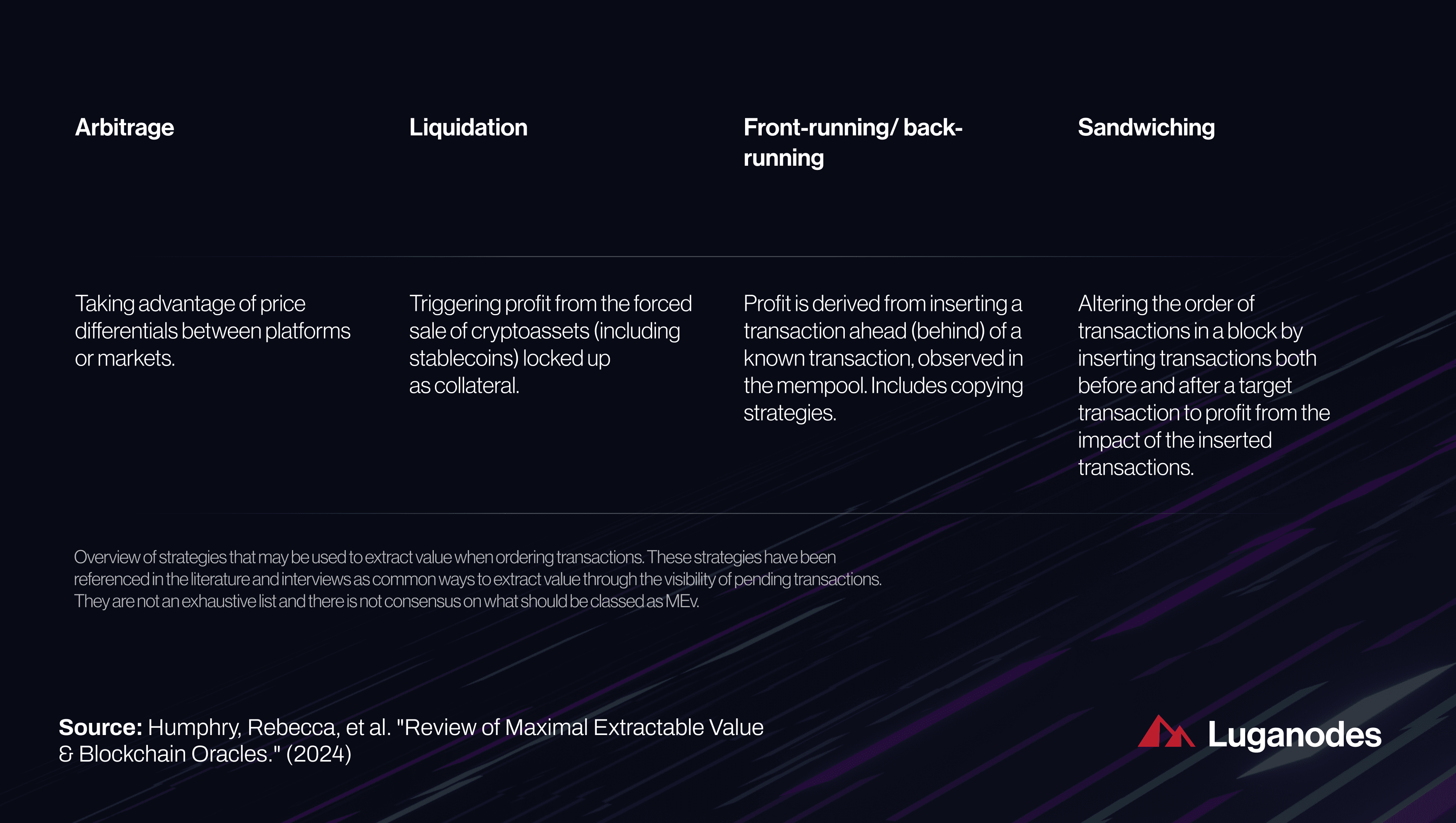

Historically, the public mempool has been a playground for sophisticated actors running bots that exploit transaction ordering through techniques like frontrunning and sandwich attacks. These strategies often lead to higher fees, failed trades, and an uneven playing field where ordinary users lose out. The result: network congestion spikes, unpredictable slippage, and eroding trust in DeFi platforms.

This problem is especially acute during periods of high volatility or when major protocols launch new features. In these moments, gas wars erupt as traders scramble to get their transactions included first – a process that can be both expensive and unreliable. The net effect is inefficiency: valuable blockspace gets wasted on spammy bids rather than productive transactions.

The Modular MEV Auction Advantage

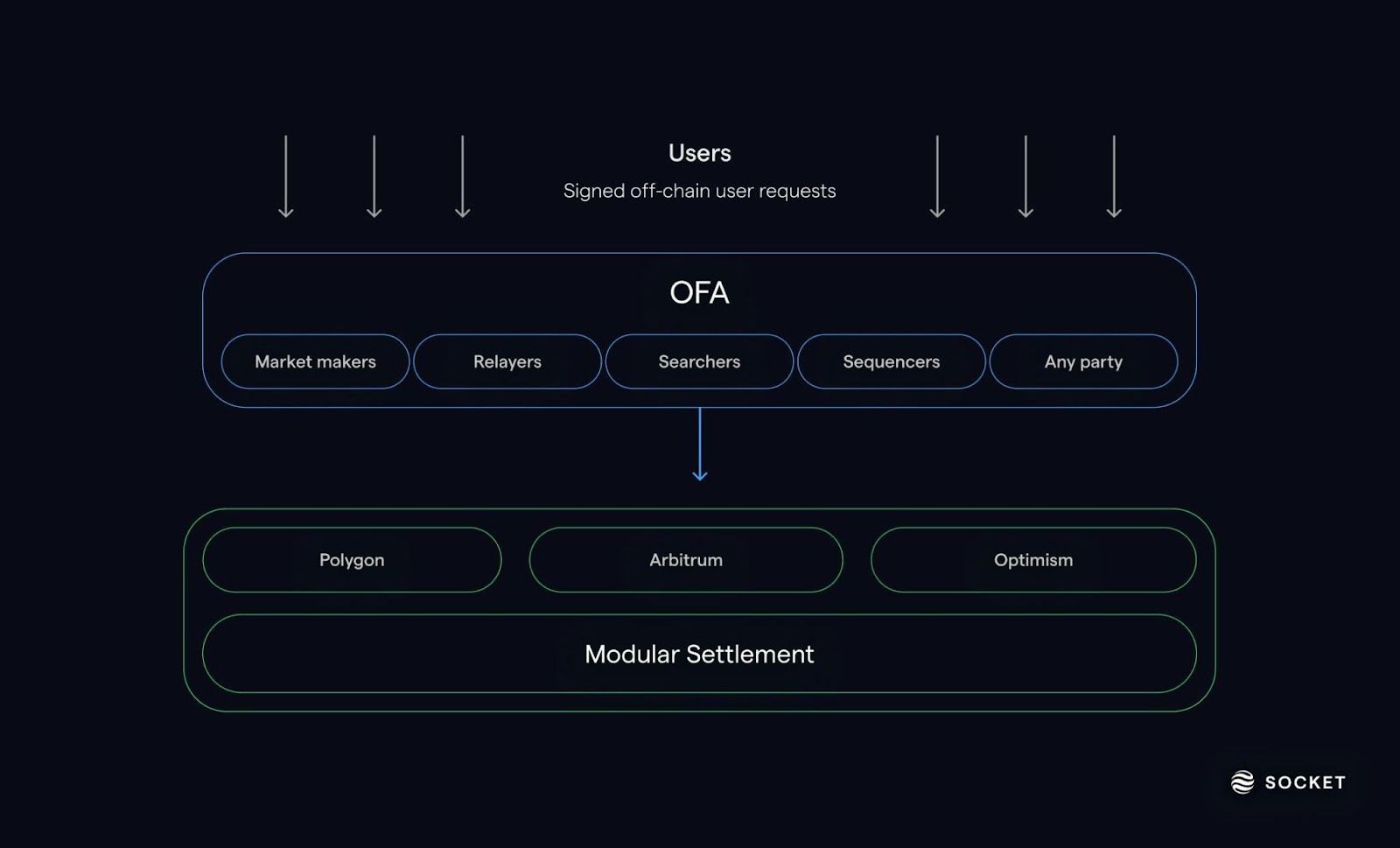

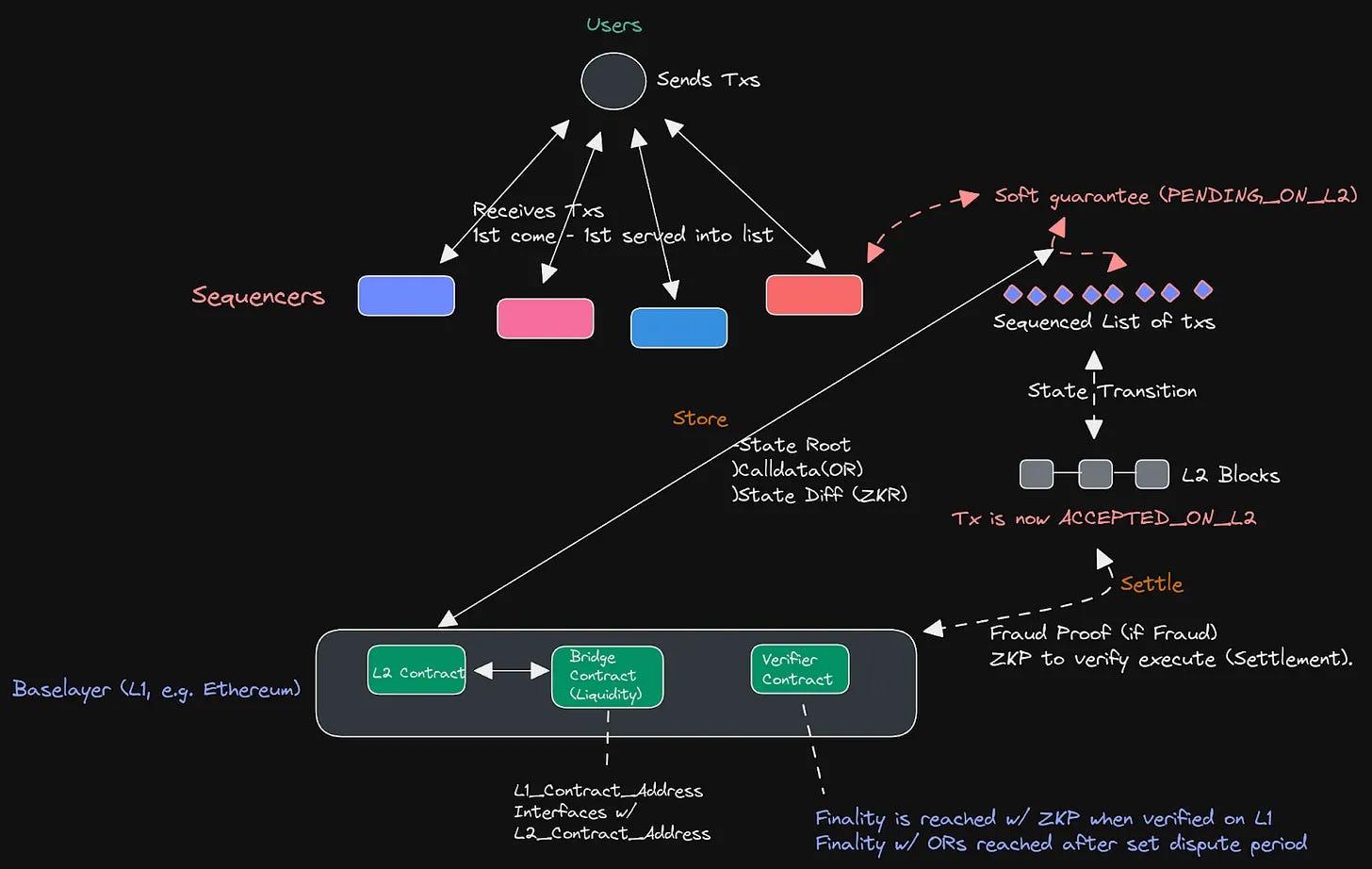

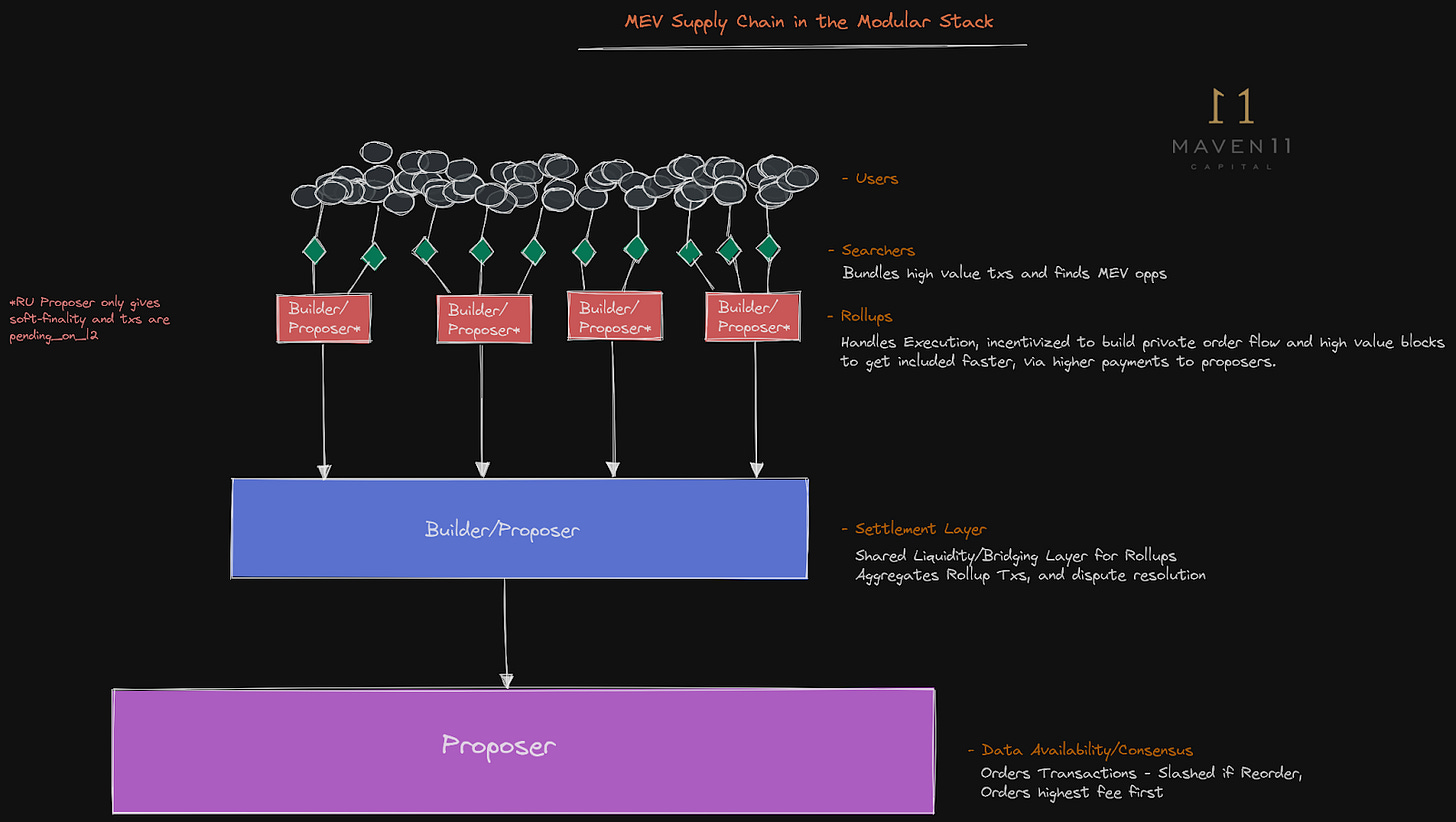

Modular MEV Auctions flip the script by introducing a structured orderflow marketplace. Instead of letting bots battle it out in public view, users submit their orders to an auction layer where builders and searchers compete for inclusion rights. This mechanism brings several key innovations:

- Order Flow Auctions (OFAs): Transactions are batched and auctioned off in sealed bids, ensuring fair competition among builders while reducing the impact of predatory tactics.

- Proposer-Builder Separation (PBS): By separating those who propose blocks from those who build them, power over transaction sequencing becomes decentralized – minimizing risks like censorship or manipulation.

- Failure Cost Penalties: Unfulfilled commitments are penalized financially, weeding out unserious bidders and guaranteeing more reliable execution for end users.

This design prioritizes transparency over speed hacks, aligning incentives so that everyone from retail traders to institutional market makers can participate on more equal terms. As protocols like Jito on Solana have shown with priority auctions, replacing spam with structured bidding leads to more efficient blockspace usage and improved network throughput.

Tangible Gains: Fairness, Lower Costs and Better Liquidity

The shift toward modular MEV auctions is already delivering significant benefits for DeFi traders:

- Enhanced Fairness: Standardized inclusion processes mean fewer advantages for high-frequency bots – everyday users see more equitable trade outcomes.

- Improved Price Discovery: Competitive bidding ensures blockspace goes to the highest-value transactions, tightening spreads across platforms.

- Lower Transaction Costs: Batch processing reduces congestion and gas usage – crucial during volatile periods when every basis point counts.

- Sustainable Liquidity Growth: Clear rules attract market makers who can reliably price risk without fear of being sandwiched or frontrun by hidden actors.

This new architecture does come with challenges – namely ensuring that auction infrastructure remains decentralized enough to prevent builder cartels from dominating outcomes. Still, the direction is clear: by lowering barriers for all participants and redistributing value more transparently, modular auctions are setting a new standard in DeFi market design.

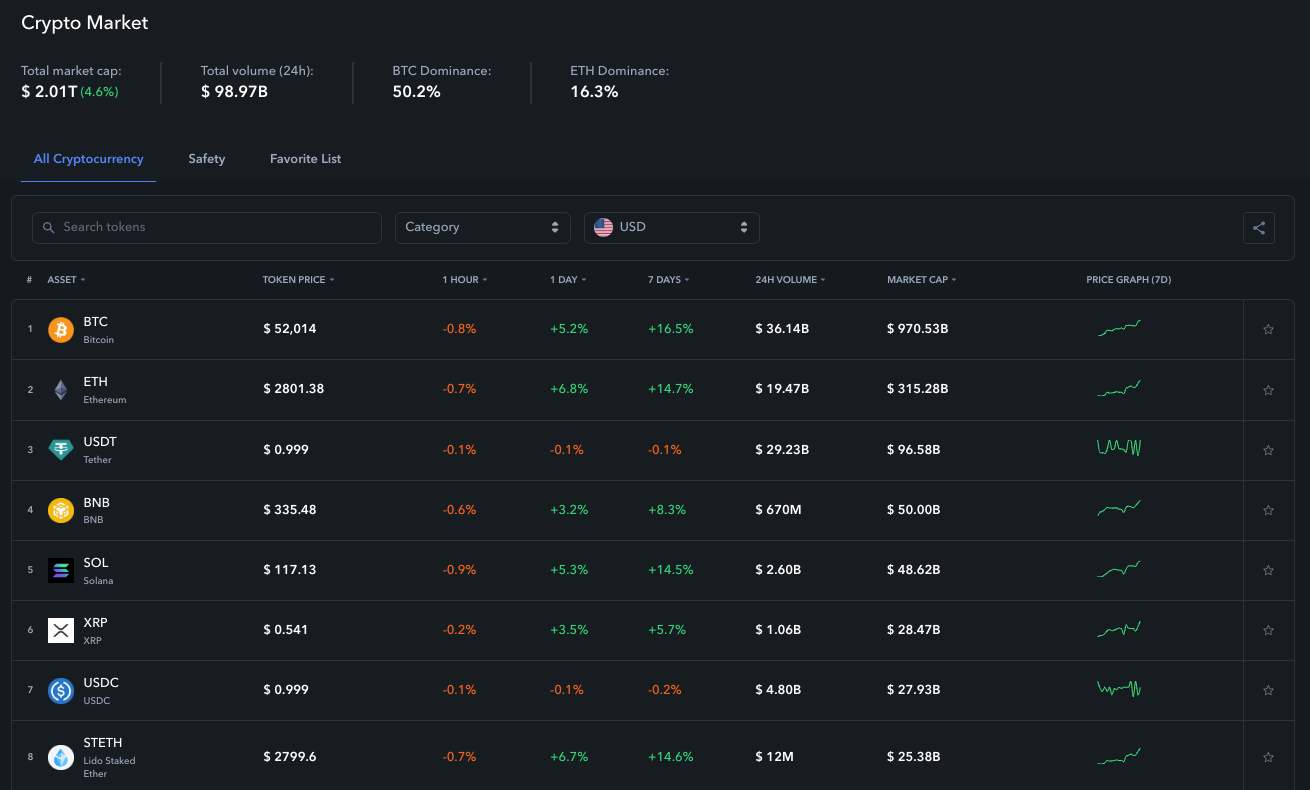

The Role of Real-Time Data and Blockspace Market Solutions

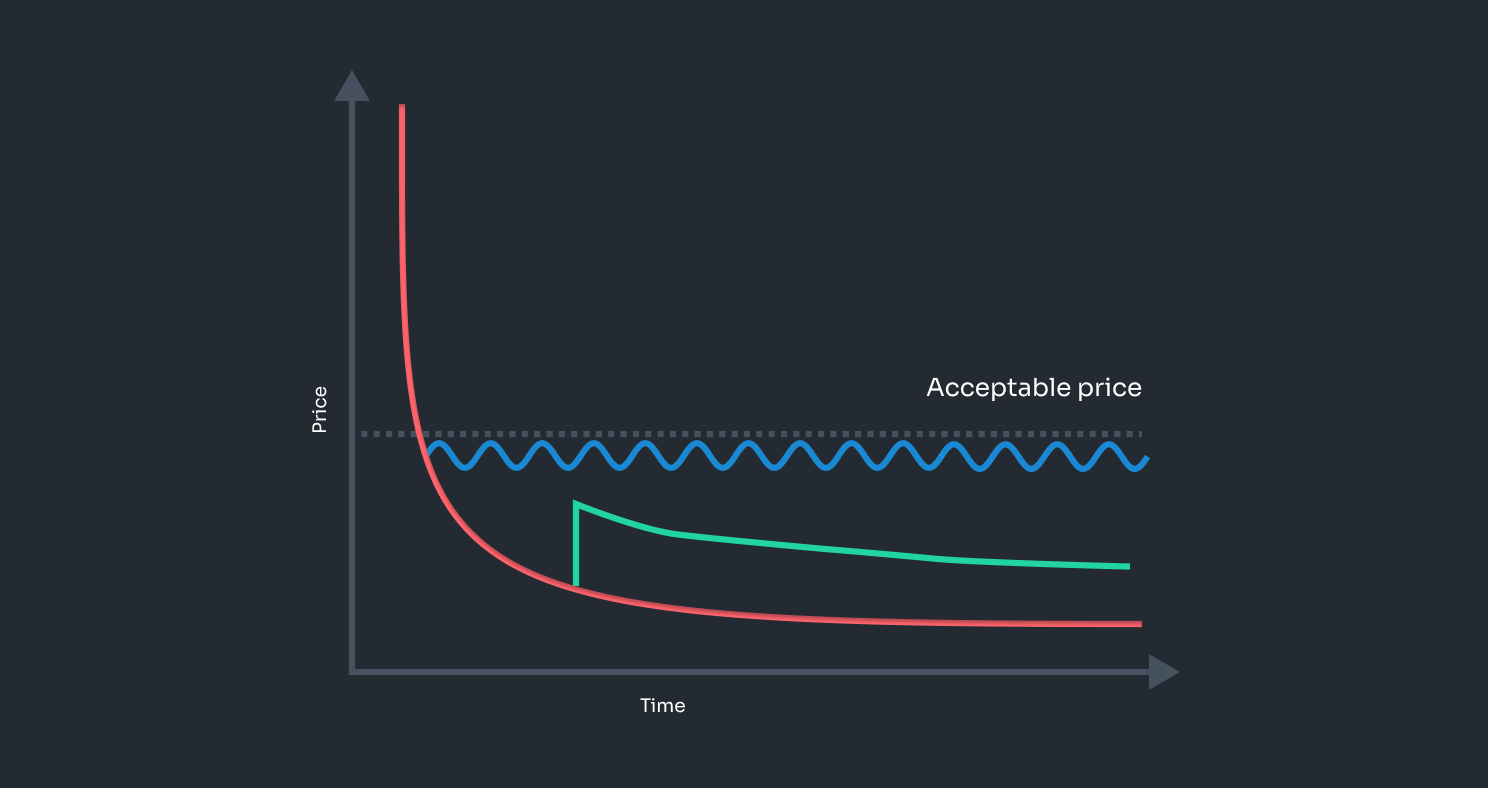

A defining feature of modern modular MEV platforms is their integration with real-time analytics tools. Traders now have access to up-to-the-moment auction data that informs exactly when to route orders for optimal execution. For developers building advanced strategies or liquidity provision algorithms, these insights are invaluable – turning raw transaction streams into actionable intelligence.

Access to real-time MEV auction data isn’t just a convenience for DeFi traders, it’s a game changer. By leveraging live analytics, users can anticipate periods of congestion, predict slippage risk, and fine-tune their order submission strategies. This proactive approach minimizes failed trades and helps traders consistently capture better pricing, even during volatile market swings.

Top Benefits of Modular MEV Auctions for DeFi Traders

-

Fairer Transaction Ordering: Modular MEV auctions replace chaotic gas wars with transparent, competitive bidding for transaction inclusion, reducing frontrunning and sandwich attacks for everyday traders.

-

Lower Transaction Costs: By batching transactions and optimizing blockspace allocation, modular auctions help reduce network congestion and gas fees, making DeFi trading more cost-effective.

-

Improved Price Discovery: Auctions ensure that blockspace goes to the highest-value transactions, leading to tighter spreads and more accurate market pricing across DeFi platforms.

-

Enhanced Market Transparency: Real-time auction data and analytics tools allow traders to track transaction flows and outcomes, empowering them to make smarter, data-driven decisions.

-

Sustainable Liquidity Growth: Clear rules and predictable execution attract more liquidity providers and market makers, supporting deeper and more stable DeFi markets.

-

Reduced Failed Trades: With up-to-the-moment MEV data and penalties for failed execution, traders experience fewer failed or reverted transactions, increasing reliability.

-

Democratized Access to Order Flow: Modular auctions lower barriers for both retail and institutional traders, leveling the playing field and distributing value more equitably.

The synergy between modular MEV auctions and modern blockspace market solutions is particularly noteworthy. Treating blockspace as a transparent, auctioned commodity, rather than an opaque resource subject to gas wars, enables more efficient allocation and fairer access for all participants. Platforms that embrace this model empower users to make informed decisions about when and how to route their transactions based on current network conditions.

For developers and quantitative traders, MEV optimization tools provide granular insights into auction outcomes, expected returns, and execution risks. Interactive dashboards transform auction data into strategy blueprints, allowing teams to iterate quickly as market dynamics shift. The result: smarter bots, tighter spreads, and a measurable edge in competitive DeFi environments.

What’s Next? The Road Ahead for Efficient DeFi Markets

The modular approach to MEV auctions is catalyzing a broader shift toward transparency and fairness in decentralized markets. As more protocols adopt orderflow marketplaces and proposer-builder separation models, the ecosystem will see:

- Greater democratization of access: Lower barriers mean both retail traders and professional liquidity providers can compete on execution quality, not just speed or capital.

- Resilience against manipulation: With robust penalty mechanisms and diversified builder participation, the risk of centralization or collusion is reduced.

- Sustainable growth in liquidity: Predictable rules attract long-term participants who help deepen markets without fear of predatory tactics eroding returns.

The challenges are not insignificant, particularly around maintaining true decentralization within auction infrastructure, but the momentum is undeniable. By aligning incentives across all stakeholders and providing actionable data at every step, modular MEV auctions are redefining what’s possible in DeFi transaction efficiency.

If you’re looking to stay ahead in this evolving landscape, now is the time to explore platforms that prioritize transparency and user empowerment through innovative auction design. For more on how these systems work under the hood or how you can integrate them into your own trading stack, check out our detailed guide on how Modular MEV Auctions enhance transaction efficiency for DeFi traders.