Blockchain scalability has always been a bottleneck for decentralized finance, particularly when it comes to extracting and auctioning Maximal Extractable Value (MEV). Traditionally, blockchains process transactions sequentially, meaning only one transaction is executed at a time per thread. This limitation constrains throughput, increases latency, and amplifies competition for blockspace during peak periods. As a result, traders and validators face higher costs and reduced efficiency in MEV auctions. The emergence of parallel transaction processing on modular blockchains is fundamentally reshaping this dynamic by enabling multiple non-conflicting transactions to be executed simultaneously.

Parallel Processing: The Engine of Next-Gen MEV Auctions

At its core, parallel transaction processing allows blockchains to break away from the constraints of sequential execution. Instead of lining up every transaction in a single queue, modern modular chains can identify independent operations and run them concurrently across multiple threads or cores. This innovation is especially transformative for MEV auctions, dynamic marketplaces where traders bid for optimal transaction ordering, because it directly addresses the issues of congestion and inefficiency that have long plagued these systems.

Recent advances highlight the pace of progress:

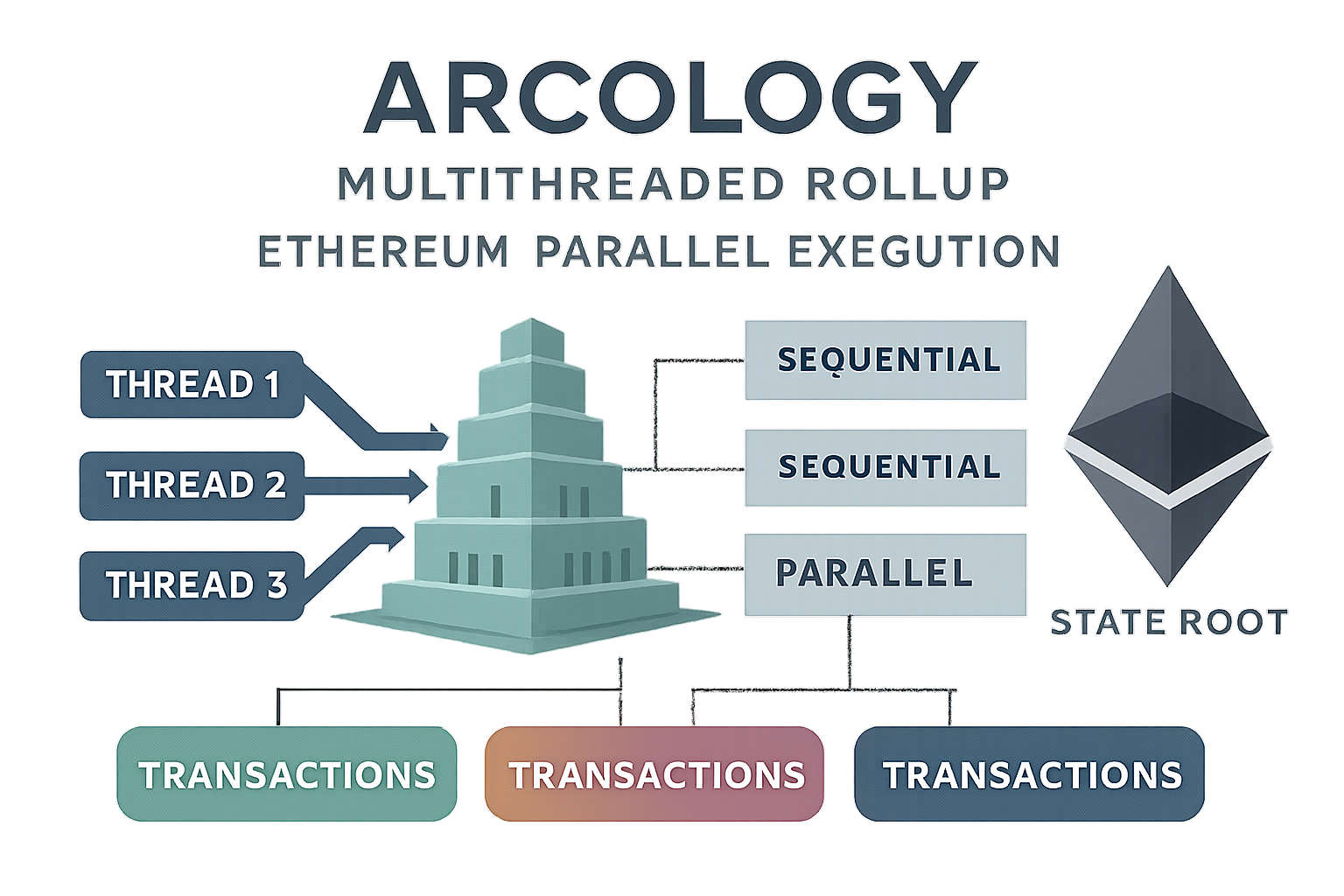

- Arcology’s multithreaded rollup on Ethereum demonstrates real-world throughput between 10,000 and 15,000 transactions per second by leveraging parallel execution (source). This leap vastly increases the capacity available for MEV strategies and orderflow optimization.

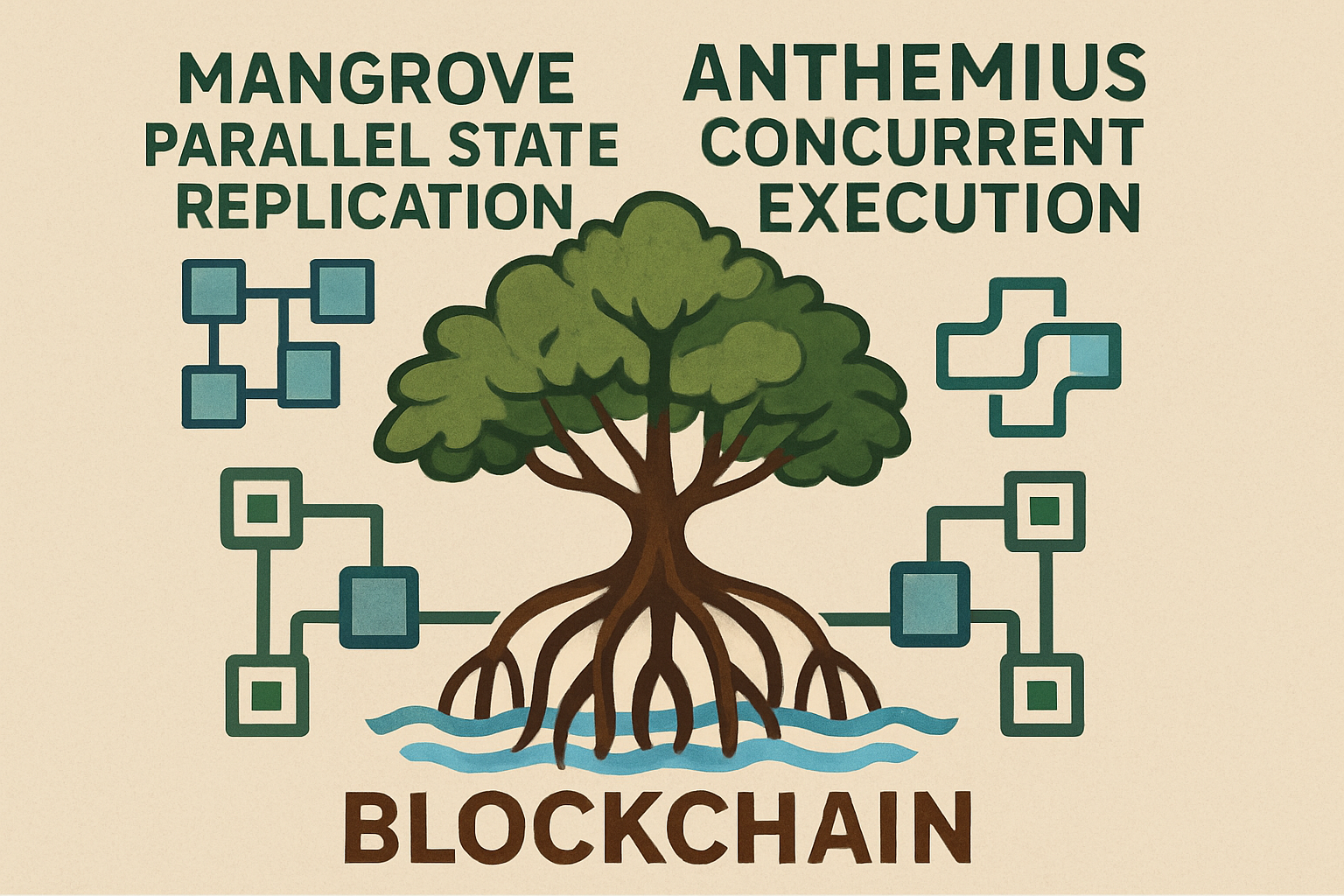

- Mangrove’s parallel state replication takes another approach: it splits consensus into separate instances per smart contract, allowing non-overlapping transactions to be processed at once (source). The result is reduced contention and faster block inclusion for MEV-sensitive trades.

- Anthemius’ concurrent block assembly algorithm systematically optimizes which transactions can safely be included together in the same block without conflicts (source). This maximizes the number of profitable opportunities captured by auction participants.

The Modular Blockchain Advantage: Decoupling Execution for Scale

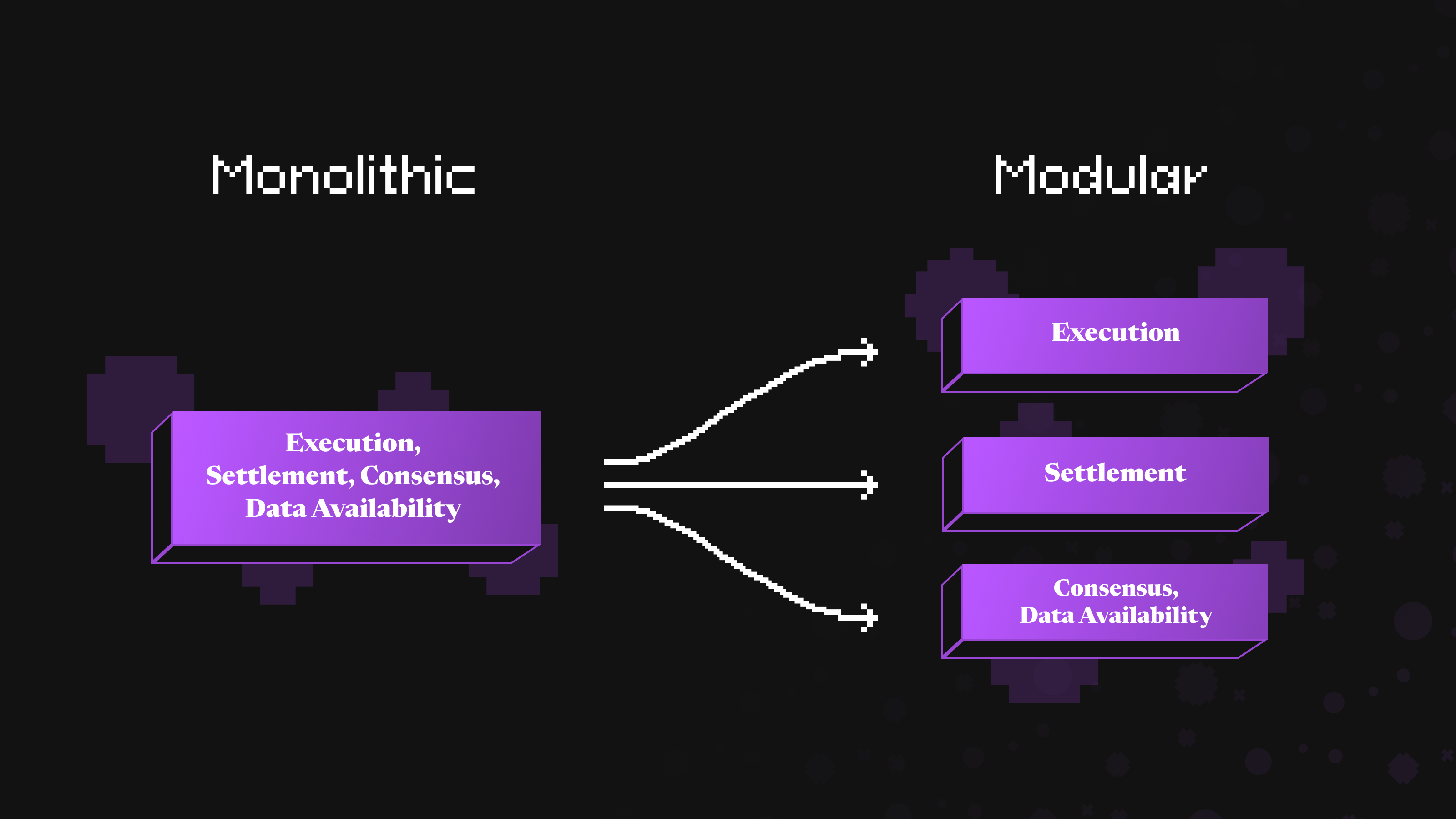

The rise of modular blockchains: where execution, consensus, and data availability are handled by distinct layers, makes parallel transaction processing even more potent. By separating concerns at the protocol level, modular architectures allow each component to specialize and scale independently. For MEV auctions specifically, this means:

- Dramatic Throughput Gains: Modular designs can dedicate entire execution shards or threads to high-value auction flows without impacting network-wide consensus or data propagation.

- Latency Reduction: Transactions targeting MEV opportunities can be identified and prioritized across multiple lanes simultaneously, minimizing delays that erode profit margins.

- Smoother Orderflow Optimization: Auction platforms like Modular Mev Auctions benefit from real-time analytics that reflect actual system capacity, not just theoretical maximums, enabling smarter bidding strategies for both searchers and validators.

This architectural flexibility ensures that as demand surges, for example during major DeFi liquidations or NFT mints, the underlying infrastructure doesn’t become a chokepoint. Instead, it adapts dynamically to process more transactions in parallel while maintaining fairness across participants.

The Impact on Fairness and Market Dynamics in DeFi

The implications extend beyond raw performance metrics. In traditional sequential systems, high-frequency traders with superior latency often dominate MEV opportunities by frontrunning slower participants. Parallel processing levels this playing field: with more transactions included per block, and fewer bottlenecks, the window for predatory tactics narrows considerably. Auction mechanisms become less about speed alone and more about genuine price discovery within the blockspace market.

This shift is already visible on platforms experimenting with concurrent execution models; empirical data shows measurable reductions in extractable value concentration among top actors. As modular chains continue to integrate advanced analytics with real-time auction data feeds, we expect further democratization of access to profitable orderflow optimization strategies.

For developers and protocol designers, the move to parallel transaction processing also unlocks a new design space for MEV mitigation and auction structure. Instead of relying solely on off-chain coordination or complex cryptographic commitments, protocols can enforce fairness and efficiency at the execution layer itself. By leveraging conflict detection algorithms and dynamic workload distribution, modular blockchains are now capable of minimizing cross-shard contention and ensuring that high-value transactions do not crowd out smaller, but essential, user activity.

Key Benefits of Parallel Transaction Processing for MEV Auctions

-

Massive Throughput Gains: Parallel execution enables modular blockchains to process thousands of transactions per second, dramatically increasing the capacity of MEV auctions. Arcology’s multithreaded rollup for Ethereum, for example, achieves 10,000–15,000 TPS—a significant leap over traditional sequential models.

-

Lower Latency for Faster MEV Strategies: By processing transactions simultaneously, parallelization reduces the time it takes for transactions to be included in blocks. This is crucial for MEV participants, as faster inclusion can mean the difference between profit and loss in competitive auctions.

-

Enhanced Fairness in Auctions: Parallel processing can level the playing field by reducing the advantages high-speed bots and traders have in sequential systems. This leads to a more equitable environment for all MEV auction participants.

-

Optimized Resource Utilization: Modular blockchains benefit from parallel execution by allowing different modules—such as execution, consensus, and data availability—to operate more efficiently and independently. This modularity boosts overall network performance and scalability.

-

Innovative Scaling Approaches: Solutions like Mangrove’s parallel state replication and Anthemius’ block assembly for concurrent execution enable non-conflicting transactions to be processed together, further optimizing MEV auction throughput and minimizing bottlenecks.

This technical evolution is especially relevant for decentralized finance efficiency. As more protocols adopt modular designs and integrate parallel execution engines, DeFi users benefit from lower fees, faster settlement times, and a more predictable trading environment. The cascading effects include tighter bid-ask spreads in AMMs, reduced slippage for large trades, and improved composability across protocols that previously competed for scarce blockspace.

Moreover, real-time auction data becomes significantly richer and more actionable in a parallelized system. Traders can analyze not only which transactions were included but also how different execution paths impacted final settlement order. This transparency allows sophisticated strategies to flourish while reducing information asymmetry between participants. For validators and searchers alike, access to granular analytics on block assembly provides a crucial edge in designing optimal bidding algorithms.

What’s Next for Modular MEV Auctions?

Looking ahead, the integration of reinforcement learning techniques with parallel execution environments will further accelerate the sophistication of MEV extraction strategies. Recent research on Polygon and other scalable networks demonstrates that machine learning agents can dynamically adapt to shifting network conditions, optimizing transaction placement not just for immediate profit but also for long-term systemic health (read more). As these tools mature within modular architectures, expect auction outcomes to reflect both market-driven incentives and protocol-level safeguards against manipulation.

Ultimately, the synergy between parallel transaction processing, modular blockchain architectures, and advanced analytics is setting a new standard for MEV auctions. Platforms like Modular Mev Auctions are at the forefront, offering traders real-time insights into auction dynamics while enabling developers to build resilient infrastructure that scales with demand. This paradigm shift is not just about throughput; it’s about creating an ecosystem where efficiency, transparency, and fairness reinforce one another as DeFi matures into its next phase.