Decentralized finance (DeFi) has unlocked new frontiers for traders, developers, and liquidity providers, but it has also exposed the ecosystem to the complex dynamics of Maximal Extractable Value (MEV). MEV arises when actors reorder, insert, or censor transactions within a block to capture additional profit. While some forms of MEV, such as arbitrage, can improve price discovery and market efficiency, others like front-running and sandwich attacks increase costs for everyday users and degrade overall trading experience. The challenge is clear: how do we preserve the benefits of MEV while minimizing its downsides?

Understanding the MEV Bottleneck in DeFi

MEV extraction is often a zero-sum game played at the expense of regular traders. When bots compete to exploit transaction ordering, users are forced to pay higher gas fees or suffer from unfavorable execution prices. This not only erodes user returns but also leads to network congestion and unpredictable slippage. According to recent research, unchecked MEV can drive up transaction costs across major blockchains and slow down networks.

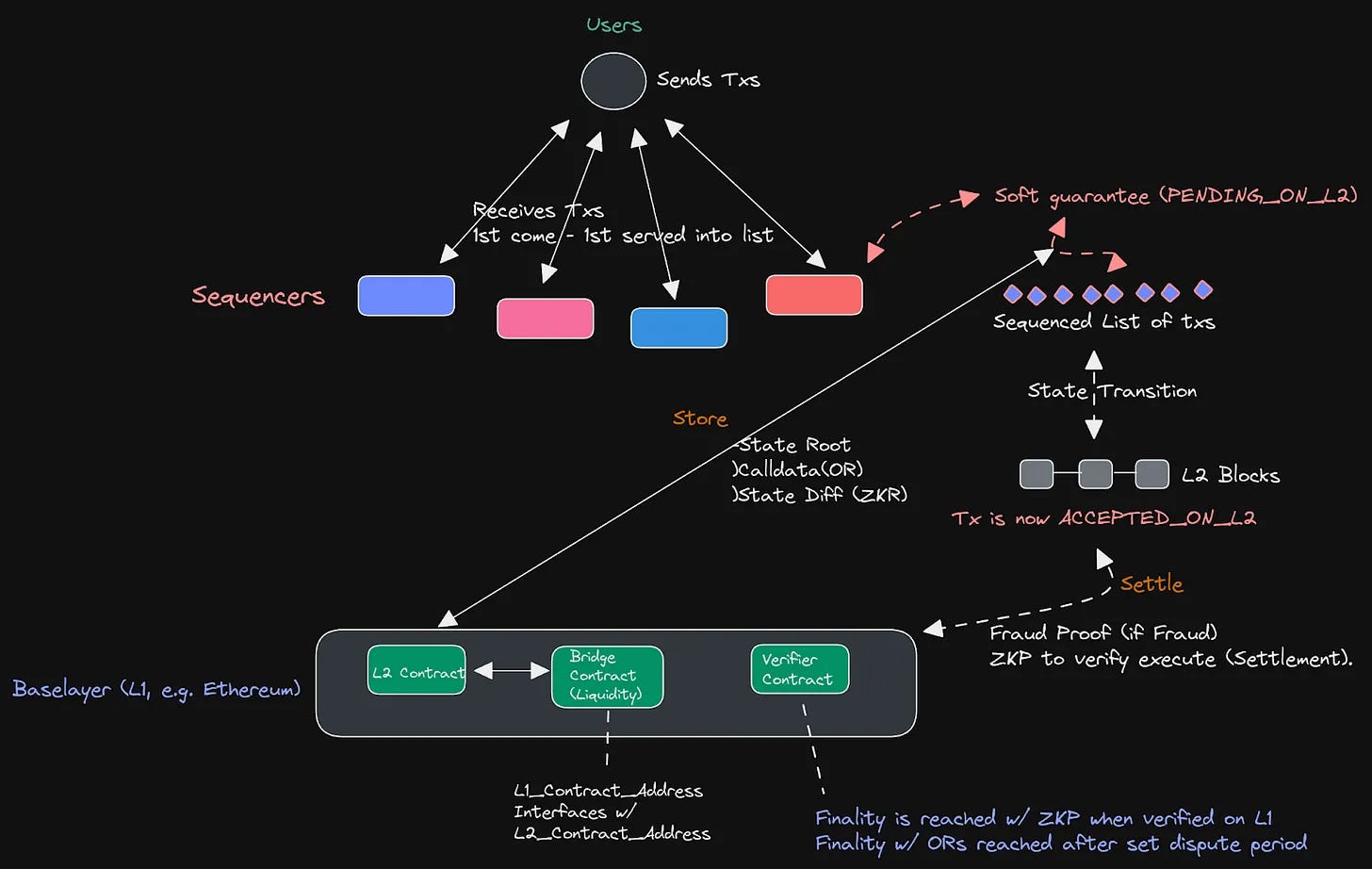

The core issue lies in transparency and fairness: traditional DeFi protocols broadcast transactions publicly before inclusion in a block, giving sophisticated actors time to exploit order flow for personal gain. This dynamic creates inefficiencies that ripple through every layer of decentralized markets.

How Modular MEV Auctions Reshape Transaction Optimization

Modular MEV auctions represent a paradigm shift in how DeFi protocols manage transaction sequencing and value extraction. By introducing structured auction mechanisms for transaction ordering, these systems aggregate user orders into batches and execute them at a uniform clearing price. This design reduces opportunities for predatory strategies like front-running because all participants receive the same execution price regardless of their position in the batch.

This approach delivers several measurable improvements:

Key Benefits of Modular MEV Auctions for DeFi Traders

-

Lower Transaction Costs: Modular MEV auctions reduce the need for users to overpay on gas fees by minimizing MEV-driven manipulations, resulting in more cost-effective trades.

-

Greater Market Fairness: By batching transactions and executing them at a uniform price, these auctions prevent front-running and sandwich attacks, ensuring equitable execution for all participants.

-

Improved Network Efficiency: Modular MEV auctions help alleviate network congestion by streamlining transaction ordering, leading to faster processing times and better block space utilization.

-

Protection Against Exploitative Practices: Structured auction mechanisms make it harder for malicious actors to exploit transaction sequencing, safeguarding traders from predatory MEV strategies.

-

Adoption by Leading Platforms: Major DeFi protocols like UniswapX have implemented auction-based routing to combat MEV extraction, demonstrating real-world effectiveness and industry acceptance.

- Reduced Transaction Costs: Users no longer need to overpay on gas fees simply to get favorable placement in the block.

- Slippage Reduction: Uniform pricing minimizes adverse price movement between order submission and execution.

- Enhanced Blockchain Transparency: Auction results are verifiable on-chain, making market manipulation harder to conceal.

Platforms such as UniswapX have already begun leveraging these mechanisms by routing trades through auction-based systems that dynamically discover prices, making it increasingly difficult for traditional MEV bots to extract value through reordering or insertion tactics. For an in-depth look at how batch auctions protect against centralization and bot-driven manipulation, see this detailed overview on batch auctions in DeFi.

The Data-Driven Case for Efficiency Gains

The impact of modular MEV auctions is best understood through analytics rather than anecdotes. By aggregating order flow into competitive auctions instead of first-come-first-served mempool races, networks experience less congestion and more predictable fee markets. As noted by industry analysts, this leads directly to improved blockspace utilization, a critical resource as DeFi scales globally.

This data-centric approach does more than just lower costs; it levels the playing field between sophisticated searchers and everyday users while increasing protocol revenue through fairer fee distribution mechanisms. The result is an ecosystem where incentives are better aligned with long-term network health rather than short-term extraction.

Another compelling advantage of modular MEV auctions is how they unlock new forms of liquidity and participation. By making transaction ordering more transparent and less exploitable, these systems encourage a broader range of actors, market makers, arbitrageurs, and retail traders alike, to engage with DeFi protocols. This influx of diverse order flow not only deepens liquidity but also tightens bid-ask spreads, resulting in more competitive pricing for all participants.

Recent market data underscores the magnitude of this shift. For instance, protocols implementing batch auctions have reported measurable reductions in average gas costs during periods of peak network activity. These savings are not merely anecdotal; they reflect a fundamental rebalancing of incentives away from extractive practices and toward sustainable transaction optimization. According to research from Coinmonks, batch-based execution models can reduce slippage by 30-50% compared to traditional mempool-based trading, a significant efficiency gain for high-frequency DeFi users.

Mitigating Centralization and Strengthening Protocol Security

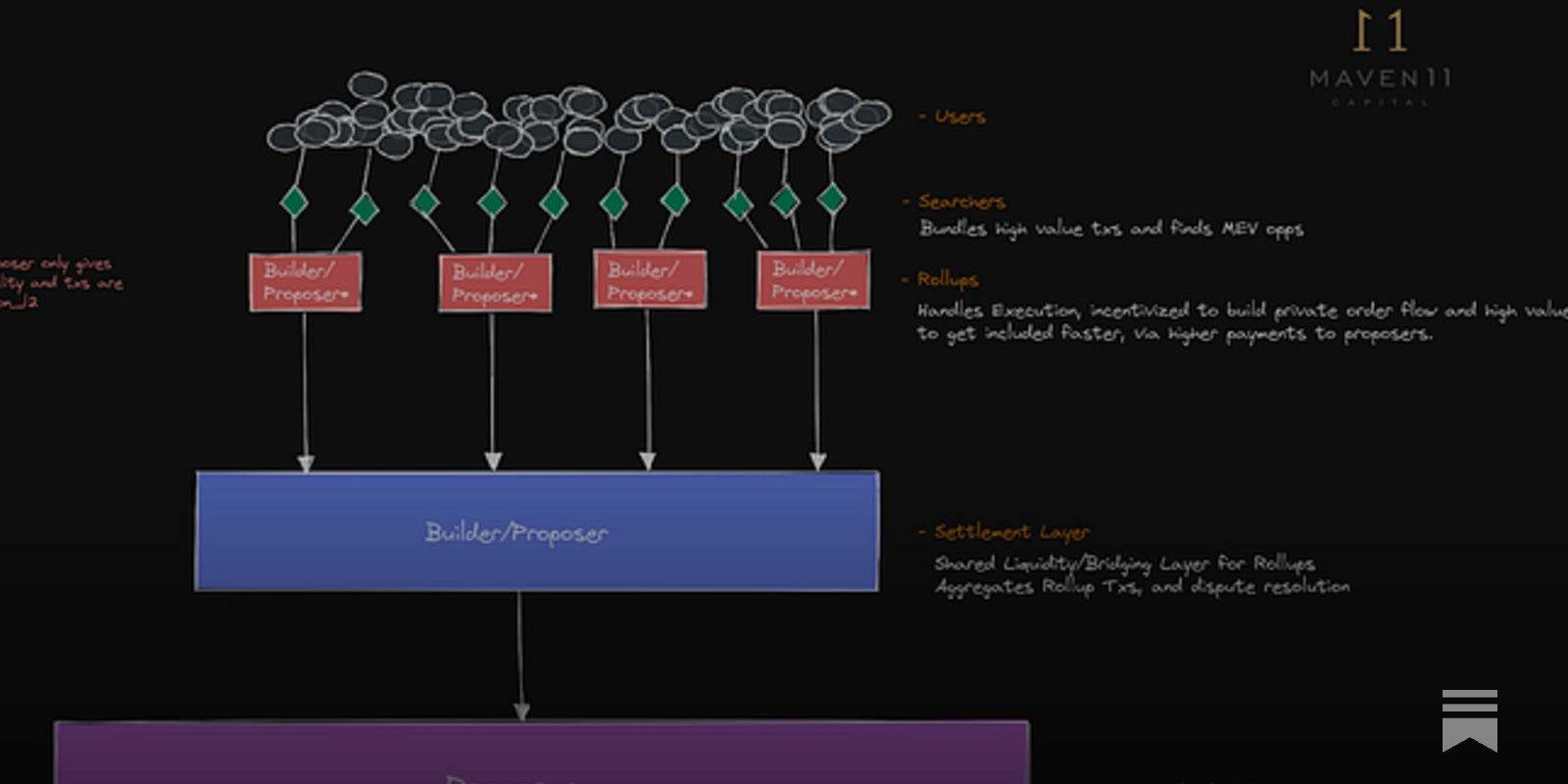

The modular approach also addresses deeper systemic risks associated with MEV extraction, namely, the threat of validator or miner centralization. When a small subset of actors consistently profit from privileged access to order flow, it can lead to concentration of power and influence over block production. Modular MEV auctions counteract this by democratizing access to blockspace markets; anyone can participate in the auction process on equal footing, thereby dispersing control and enhancing protocol resilience.

This decentralization is particularly vital as blockchains scale and composability between protocols increases. By obfuscating transaction contents until after auction settlement or leveraging cryptographic commitments, modular architectures further reduce the risk that validators or sequencers will collude with searchers to extract value at users’ expense. These innovations contribute directly to both security and fairness, core pillars for any robust DeFi ecosystem.

What’s Next: The Roadmap for DeFi Trading Efficiency

Looking forward, adoption of modular MEV auctions is likely to accelerate as more protocols recognize their role in driving transaction optimization, slippage reduction, and overall blockchain transparency. As open-source toolkits mature and cross-chain interoperability becomes standard, we can expect seamless integration across major DeFi venues, from DEXs to lending markets, further amplifying efficiency gains at scale.

Key Upcoming Developments in Modular MEV Auctions

-

UniswapX’s Auction-Based Routing Expansion: UniswapX is set to further develop its auction-based routing, making it increasingly difficult for MEV strategies like front-running and sandwich attacks to succeed by leveraging dynamic price discovery and batch execution mechanisms.

-

Widespread Adoption of Batch Auctions: More DeFi protocols are integrating batch auction mechanisms, where transactions are aggregated and executed at a uniform price, significantly reducing MEV-driven manipulation and enhancing market fairness.

-

Integration of Order Flow Auctions (OFAs) Across Rollups: Order Flow Auctions are being adopted by leading Ethereum rollups to separate transaction ordering from execution, mitigating MEV risks and supporting fairer, more efficient DeFi markets.

-

Development of MEV-Resistant Smart Contract Patterns: Projects are introducing advanced MEV-resistant smart contract patterns, using cryptographic techniques and obfuscation to limit the visibility of transaction details and reduce exploitability by MEV bots.

-

Collaborative Protocol-Level MEV Mitigation Initiatives: Major DeFi platforms are collaborating on shared infrastructure—such as Flashbots SUAVE—to create open, modular MEV auction layers that standardize fair transaction ordering and enhance cross-protocol efficiency.

The evolution is already underway; projects are experimenting with hybrid models combining batch auctions with dynamic fee adjustments or integrating off-chain order books for even greater capital efficiency. While challenges remain, such as ensuring liveness guarantees under extreme market conditions, the trajectory is clear: structured auction-based mechanisms are setting a new benchmark for equitable value extraction in decentralized finance.

The bottom line is that modular MEV auctions represent a data-driven solution to one of DeFi’s most persistent challenges. By aligning incentives across users, validators, and developers while curbing exploitative behaviors, they pave the way for a fairer, more efficient future where every participant benefits from transparent markets, and where the true potential of decentralized trading can be realized.