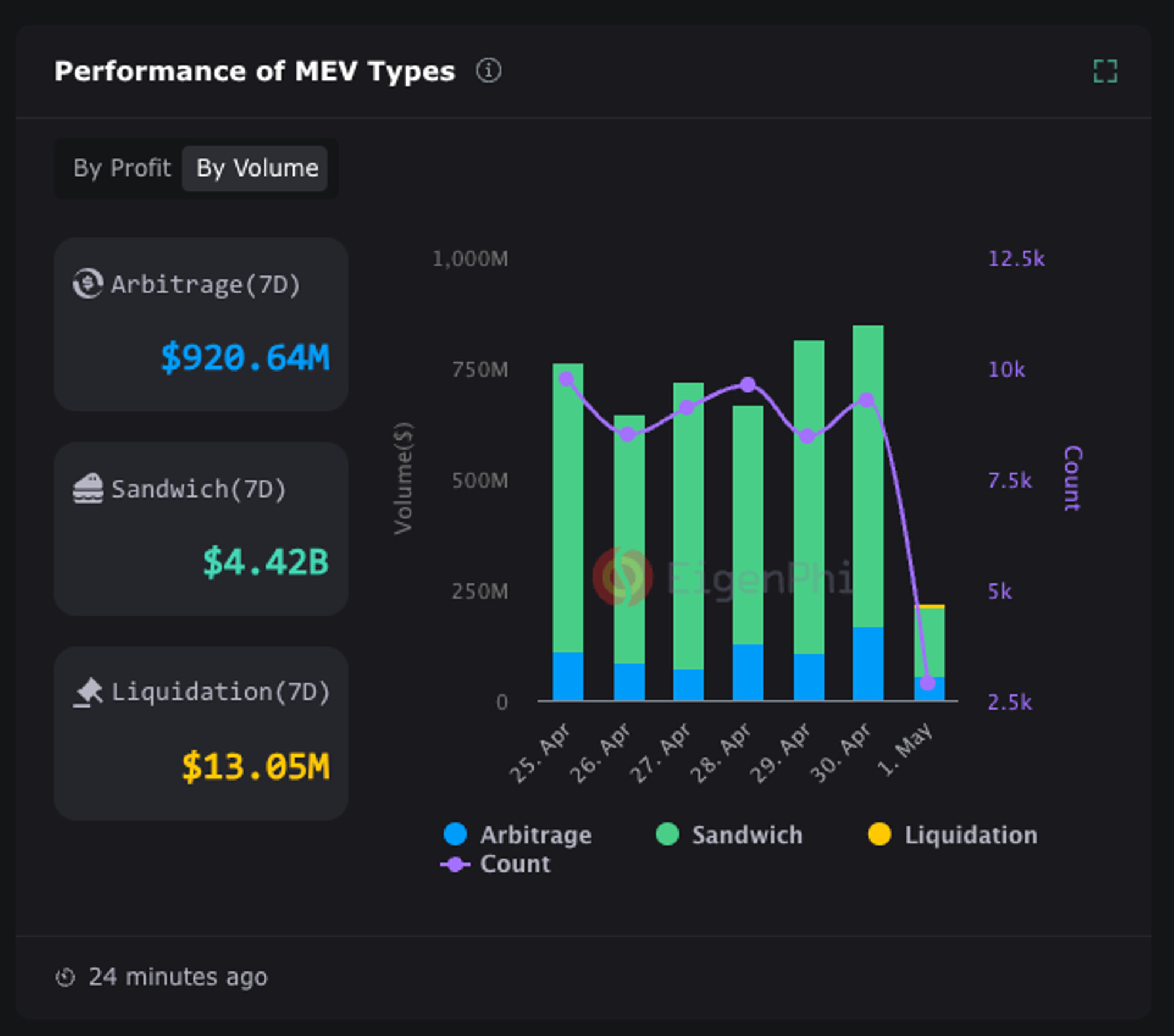

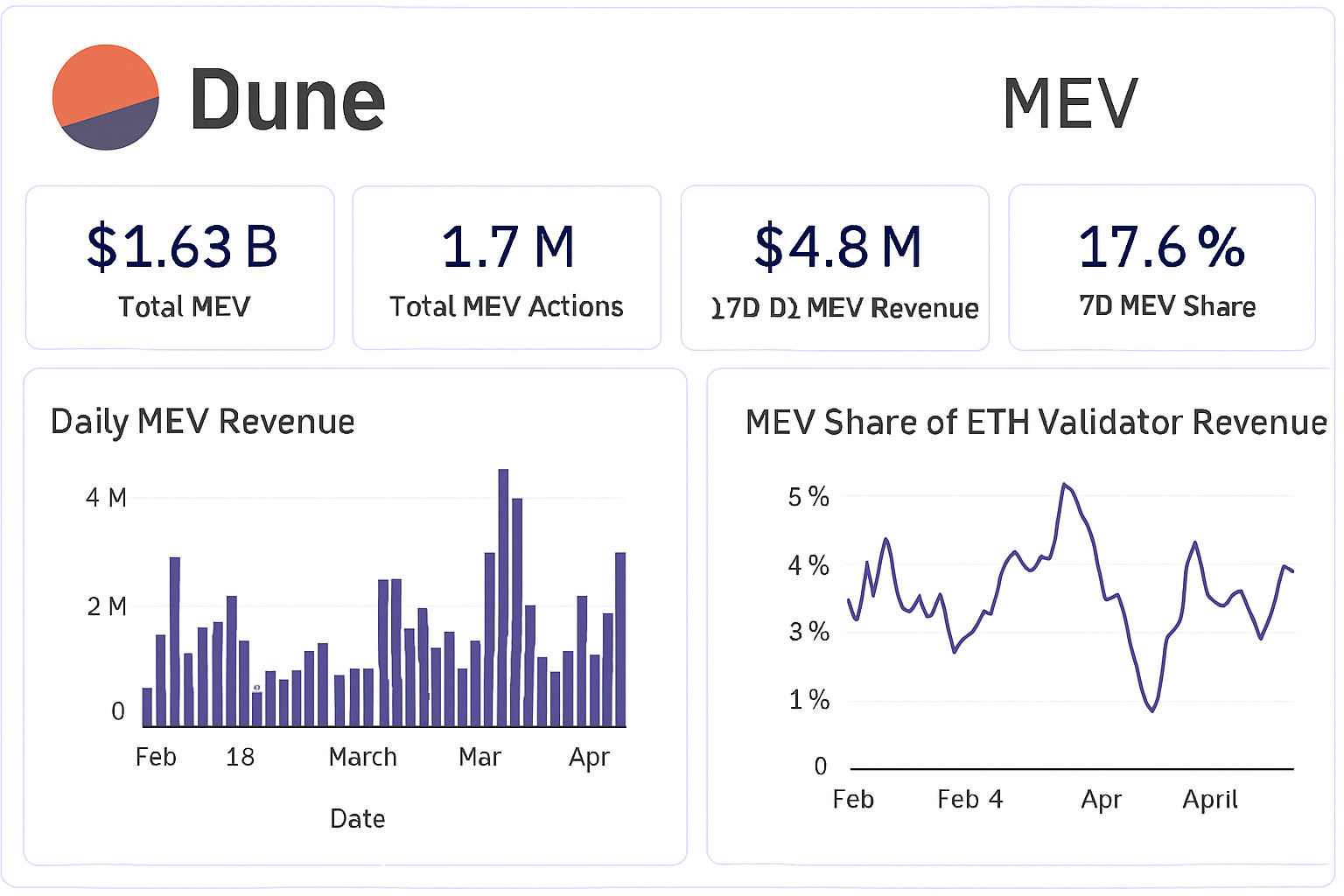

Maximal Extractable Value (MEV) auctions are rapidly redefining the blockspace market, introducing both lucrative opportunities and acute risks for DeFi traders. As blockchains like Ethereum and Solana evolve, MEV has become a central force in transaction optimization, price discovery, and network dynamics. The rise of modular MEV platforms and real-time auction data is reshaping how traders interact with on-chain liquidity, but not without profound consequences for cost, fairness, and market structure.

Understanding MEV Auctions: The Engine of Modern Blockspace Markets

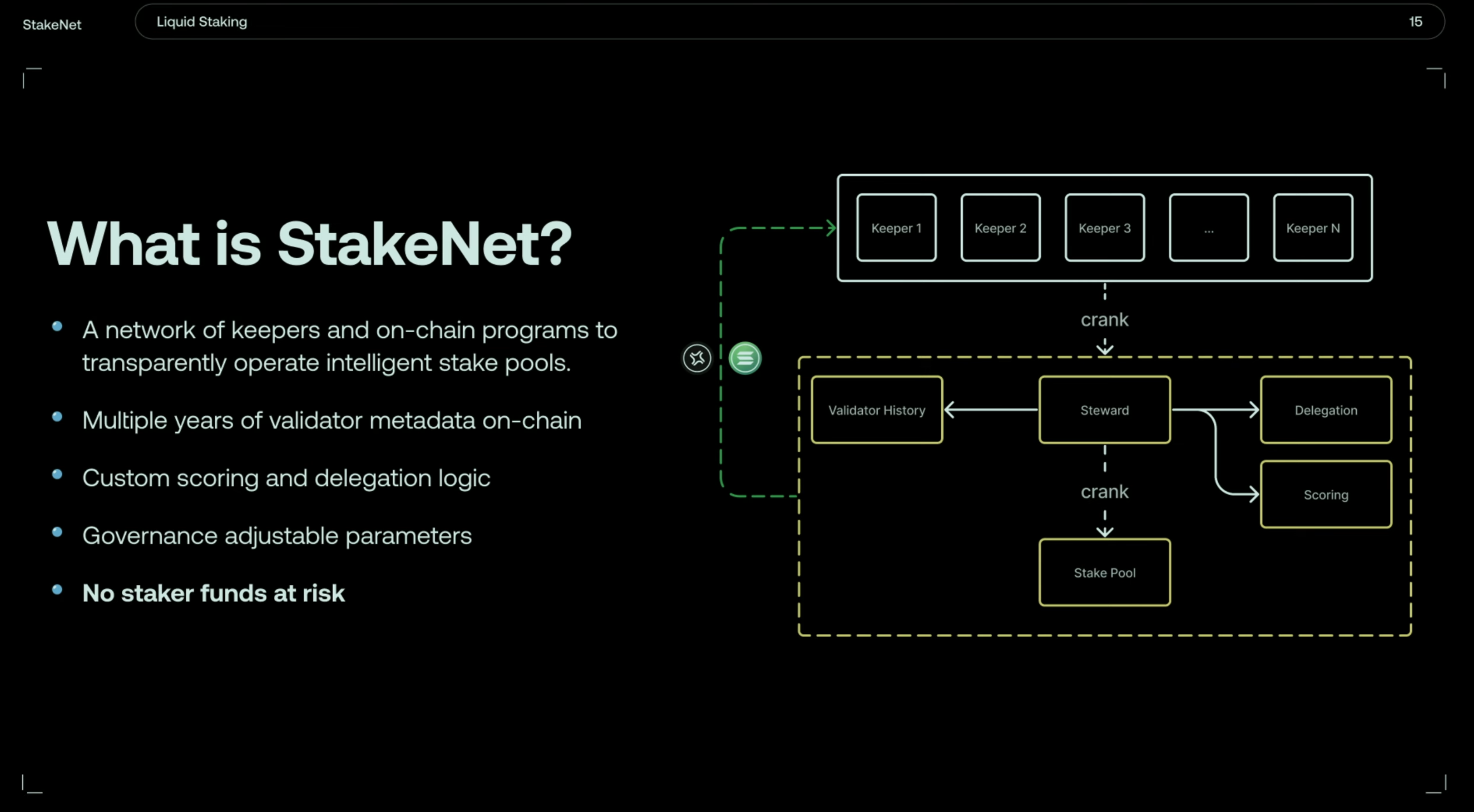

At its core, MEV refers to the extra profit that can be captured by validators or miners through reordering, inserting, or excluding transactions within a block. With the advent of MEV auctions, this process has become more transparent and competitive: searchers bid for priority in executing their strategies, such as arbitrage or liquidations, directly influencing how blockspace is allocated and priced.

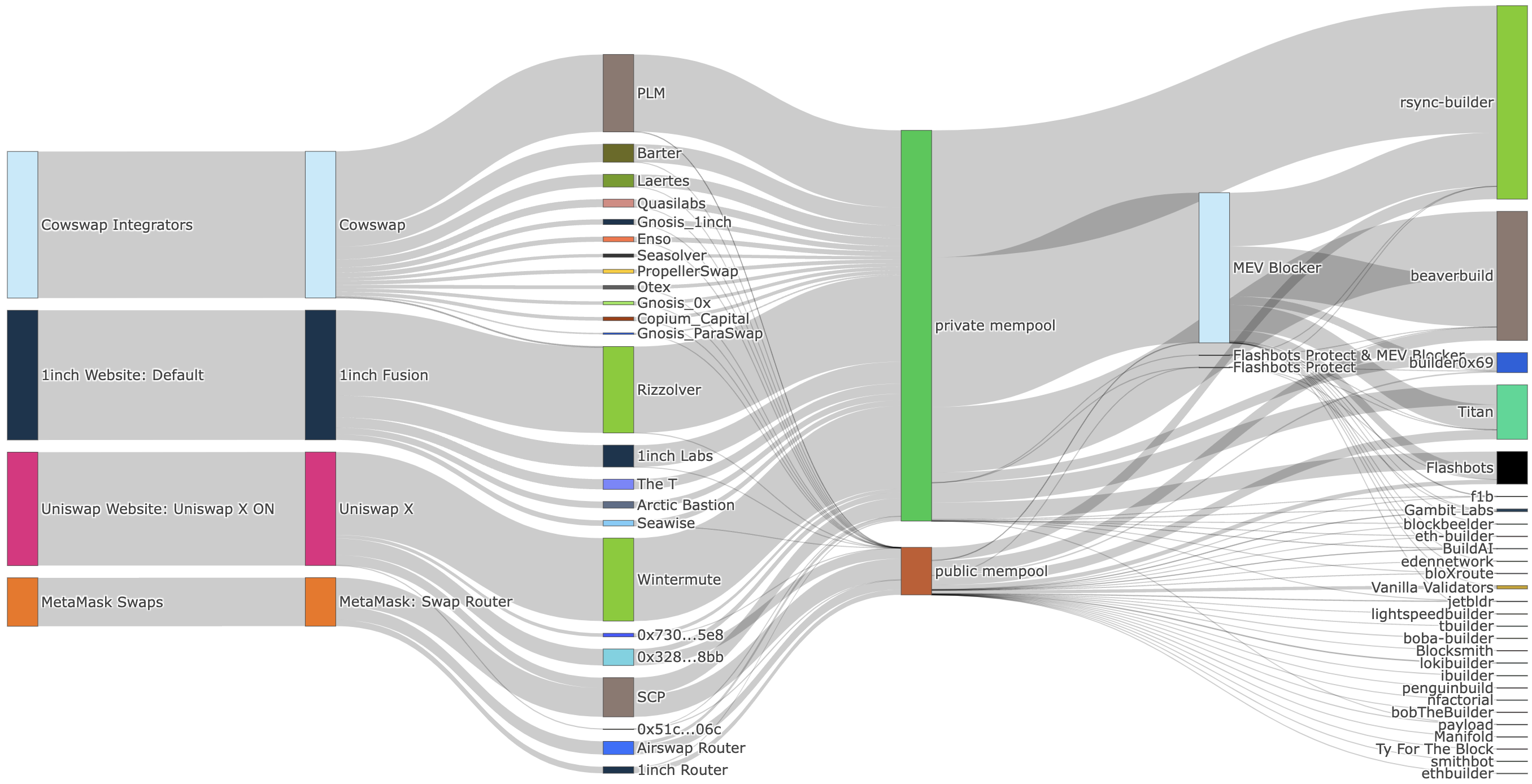

The result? A dynamic orderflow marketplace where the highest bidder can determine transaction order, creating a new paradigm for both traders and infrastructure providers. Platforms like MEV-Boost on Ethereum and Jito Bundling on Solana exemplify this shift, aligning incentives by redistributing MEV revenue throughout the ecosystem. For DeFi traders, this means access to new alpha sources, but also exposure to a rapidly shifting landscape where transaction costs and execution quality are anything but static.

Opportunities: Arbitrage, Market Efficiency, and Advanced Strategies

MEV auctions present several compelling opportunities for sophisticated DeFi participants:

Key Opportunities for DeFi Traders in MEV Auctions

-

Arbitrage Across DEXs: MEV auctions enable traders to exploit price discrepancies between decentralized exchanges, allowing for swift arbitrage trades that can yield profits before prices equalize.

-

Liquidation Participation: By monitoring MEV auctions, traders can identify and participate in liquidation opportunities, profiting from undercollateralized positions on platforms like Aave and Compound.

-

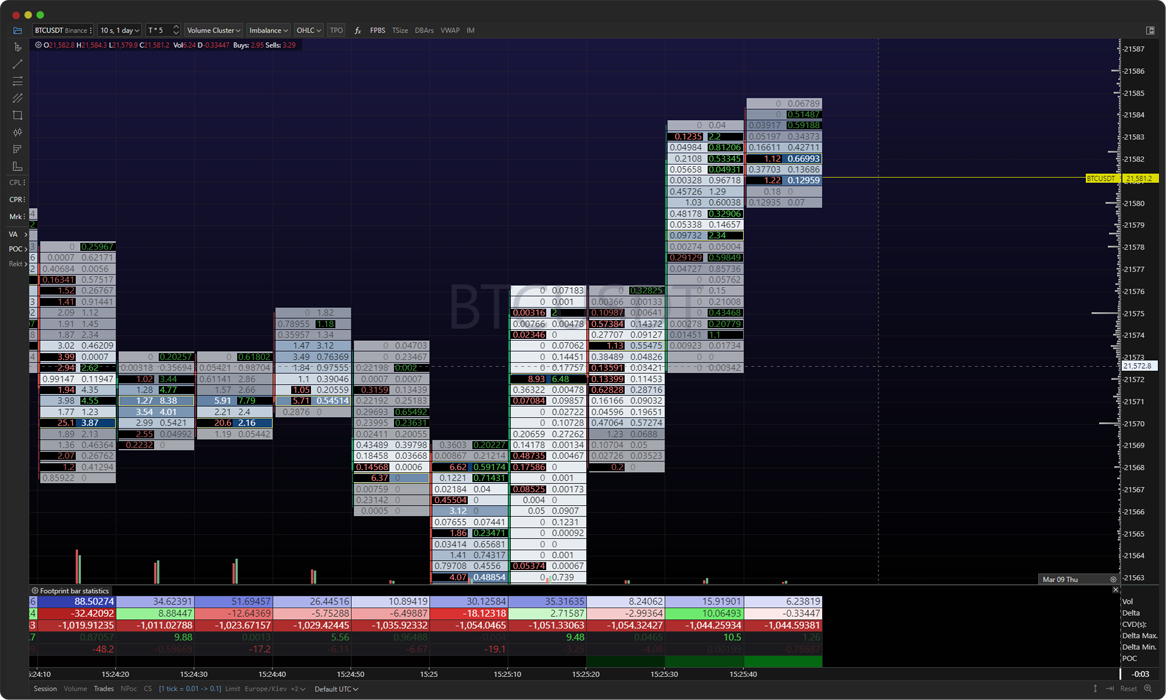

Advanced Orderflow Analysis: MEV data and auction outcomes provide insights into network-wide orderflow, helping traders anticipate large moves and optimize their strategies based on block-level transaction patterns.

-

Access to Priority Transaction Inclusion: Platforms like Flashbots and Jito allow traders to privately submit transaction bundles, reducing the risk of front-running and increasing the likelihood of favorable execution in MEV auctions.

-

Market Efficiency Gains: Active participation in MEV auctions can help correct price inefficiencies quickly, allowing informed traders to benefit from tighter spreads and more accurate asset pricing.

Arbitrage remains the most visible opportunity. By leveraging auction mechanisms, traders can exploit fleeting price discrepancies between decentralized exchanges (DEXs), often executing complex multi-hop trades within a single block. According to Arkham Research’s 2025 guide, MEV strategies in arbitrage and liquidation scenarios tend to deliver net benefits to individual traders who can move quickly enough to outpace competitors.

Beyond direct profit extraction, MEV activity can also improve market efficiency. When price gaps close rapidly due to competitive bidding in MEV auctions, overall slippage decreases for all participants. In theory, this should lead to tighter spreads and more robust DeFi markets, as long as the benefits outweigh the rising transaction costs from increased competition.

Yet the sophistication required to consistently capitalize on these opportunities is growing. Modular MEV platforms now offer real-time analytics and advanced tooling, enabling traders to monitor auction flows, analyze orderflow patterns, and adapt strategies on the fly. For those able to harness these resources, the blockspace market becomes a rich hunting ground for alpha generation.

Risks: Rising Costs, Execution Threats, and Network Congestion

However, the competitive nature of MEV auctions introduces significant risks, some of which threaten to erode the very efficiencies they create.

- Increased Transaction Costs: As MEV bots battle for priority, gas fees can spike dramatically. This impacts not just searchers but all users transacting during periods of intense auction activity. For example, sudden surges in MEV-driven bidding can render previously profitable strategies unviable due to prohibitive fees.

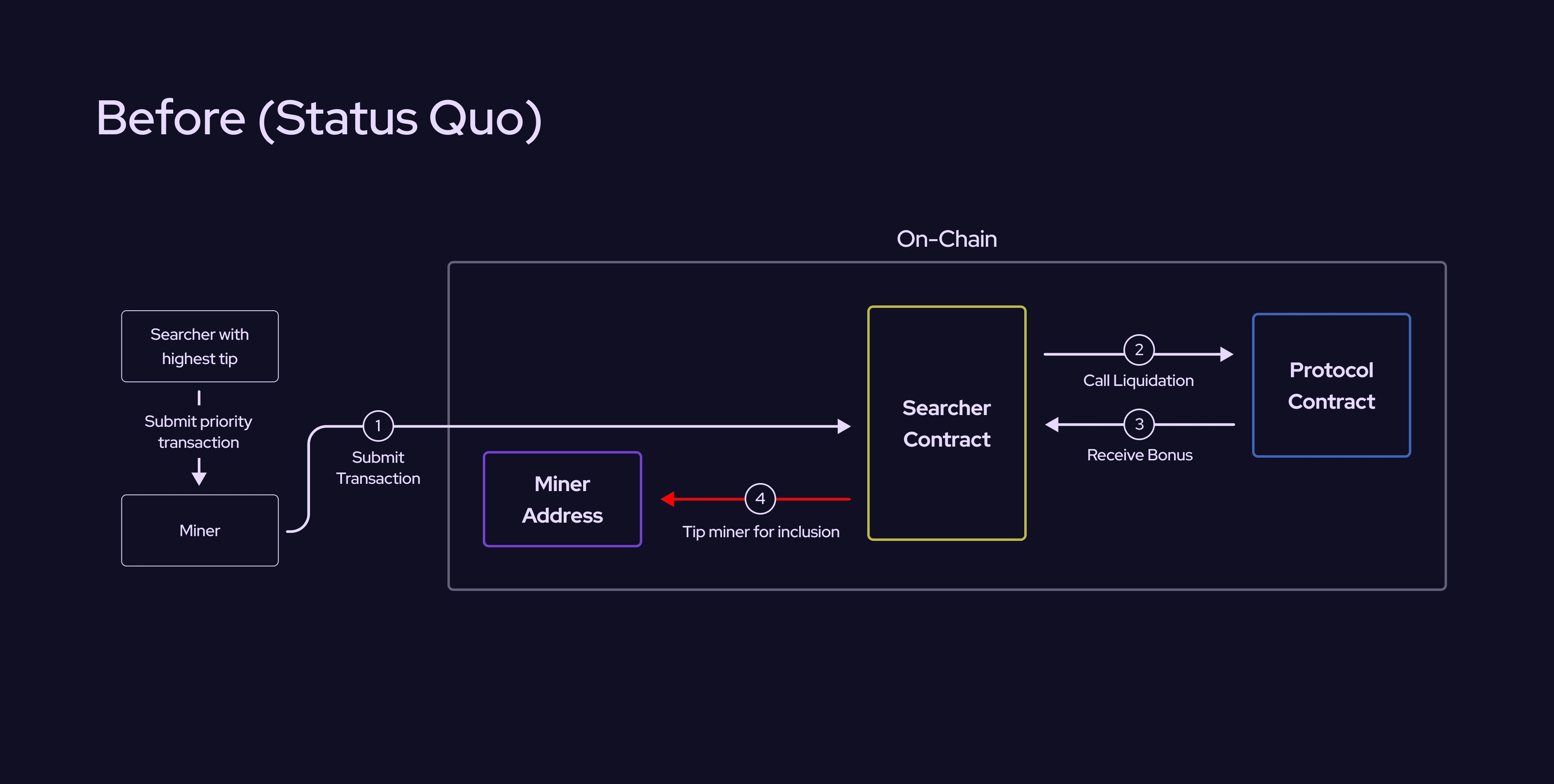

- Front-Running and Sandwich Attacks: Malicious actors exploit the visibility of public mempools by inserting their own trades ahead of or around target transactions. In a sandwich attack, for instance, a trader’s transaction is squeezed between two attacker transactions, resulting in unfavorable execution prices for the victim. These tactics remain a persistent threat despite ongoing innovation in private transaction pools and orderflow protection.

- Network Congestion: The scramble for MEV can clog blockchains, slowing confirmation times and increasing the likelihood of failed transactions. This not only frustrates traders seeking to optimize execution but also impacts the broader DeFi ecosystem by driving up costs and reducing reliability.

The paradox is clear: while MEV auctions can foster efficiency and innovation, they also introduce volatility and risk that must be managed with discipline and data-driven strategy.

Mitigation Tactics: Navigating the MEV Auction Landscape

To survive, and thrive, in the era of modular MEV auctions, DeFi traders must employ robust mitigation strategies:

- Private Transaction Pools: Leveraging services like Flashbots or custom private relays can shield trades from public mempool exposure, reducing vulnerability to front-running and sandwich attacks.

- Slippage Controls: Setting tight slippage tolerances ensures that trades only execute within predefined price bands, protecting against unexpected losses from sudden auction-driven price moves.

- Continuous Learning: Staying informed about evolving MEV trends, auction mechanics, and mitigation best practices is essential. Active engagement with research communities and analytics platforms can provide a critical edge.

This evolving toolkit reflects the broader reality that modular MEV platforms are not just shaping blockspace, they are redefining what it means to trade effectively in DeFi’s most competitive arenas.

As the blockspace market matures, the interplay between MEV auctions, transaction optimization, and network transparency becomes increasingly nuanced. Modular MEV platforms are at the forefront, offering granular analytics, real-time monitoring, and new frameworks for risk management that empower both institutional and retail traders. These innovations are not just technical upgrades, they represent a pivotal shift in how value is extracted and distributed across decentralized ecosystems.

Strategic Adaptation: How DeFi Traders Can Stay Ahead

Success in this environment demands a blend of agility, data literacy, and strategic foresight. Traders who thrive are those who:

Adaptive Strategies for DeFi Traders in MEV Auctions

-

Leverage Real-Time Analytics Platforms: Utilize advanced analytics tools like Dune Analytics and Nansen to monitor MEV activity, gas fees, and transaction patterns. These platforms provide actionable insights for identifying profitable opportunities and potential risks in evolving MEV auction environments.

-

Route Transactions via Private Pools: Use private transaction relays such as Flashbots Protect or Taichi Network to shield transactions from public mempools, reducing the risk of front-running and sandwich attacks.

-

Stay Informed with MEV-Focused Research and Alerts: Subscribe to MEV research updates from sources such as Galaxy Research and Finematics, and set up alerts for significant auction or blockspace events to adapt strategies promptly.

For example, integrating automated monitoring of real-time auction data can help traders identify favorable windows for execution, while scripting custom bots for orderflow analysis allows for rapid response to emerging arbitrage or liquidation opportunities. Meanwhile, robust risk controls, such as dynamic gas fee thresholds and fallback transaction logic, can reduce exposure to adverse auction outcomes.

It’s also crucial to recognize the broader market implications. As more value is funneled through competitive MEV auctions, transaction fees and blockspace pricing become increasingly volatile. This volatility can be both a source of alpha and a threat to capital preservation, underscoring the need for disciplined portfolio management and continuous strategy refinement. The most successful actors treat MEV not as a fixed opportunity, but as a moving target, one that demands constant vigilance and adaptation.

The Future of Blockspace: Transparency, Fairness, and Modular Innovation

The next phase of the blockspace market will be defined by transparency and modularity. Platforms that offer real-time auction analytics, privacy-preserving orderflow, and programmable execution environments are setting new standards for both efficiency and fairness. This evolution is already visible in initiatives like MEV-Boost, Jito Bundling, and the proliferation of orderflow marketplaces that prioritize user choice and execution quality.

For DeFi traders, the implications are profound. The ability to access granular auction data, simulate trade outcomes, and engage with modular MEV infrastructure is shifting the balance of power away from opaque, extractive practices and toward a more meritocratic landscape. However, this shift also requires a willingness to invest in education, tooling, and community engagement. As the saying goes, blockspace is the new oil, but only those who adapt to its complexities will consistently capture value.

For a deeper dive into how real-time auction analytics are transforming DeFi trading strategies, see this resource.

Key takeaway: The rise of MEV auctions is not just a technical phenomenon, it’s a catalyst for new forms of market structure, risk, and opportunity. Traders who combine data-driven strategy with adaptive risk management will be best positioned to navigate and profit from the evolving blockspace landscape.