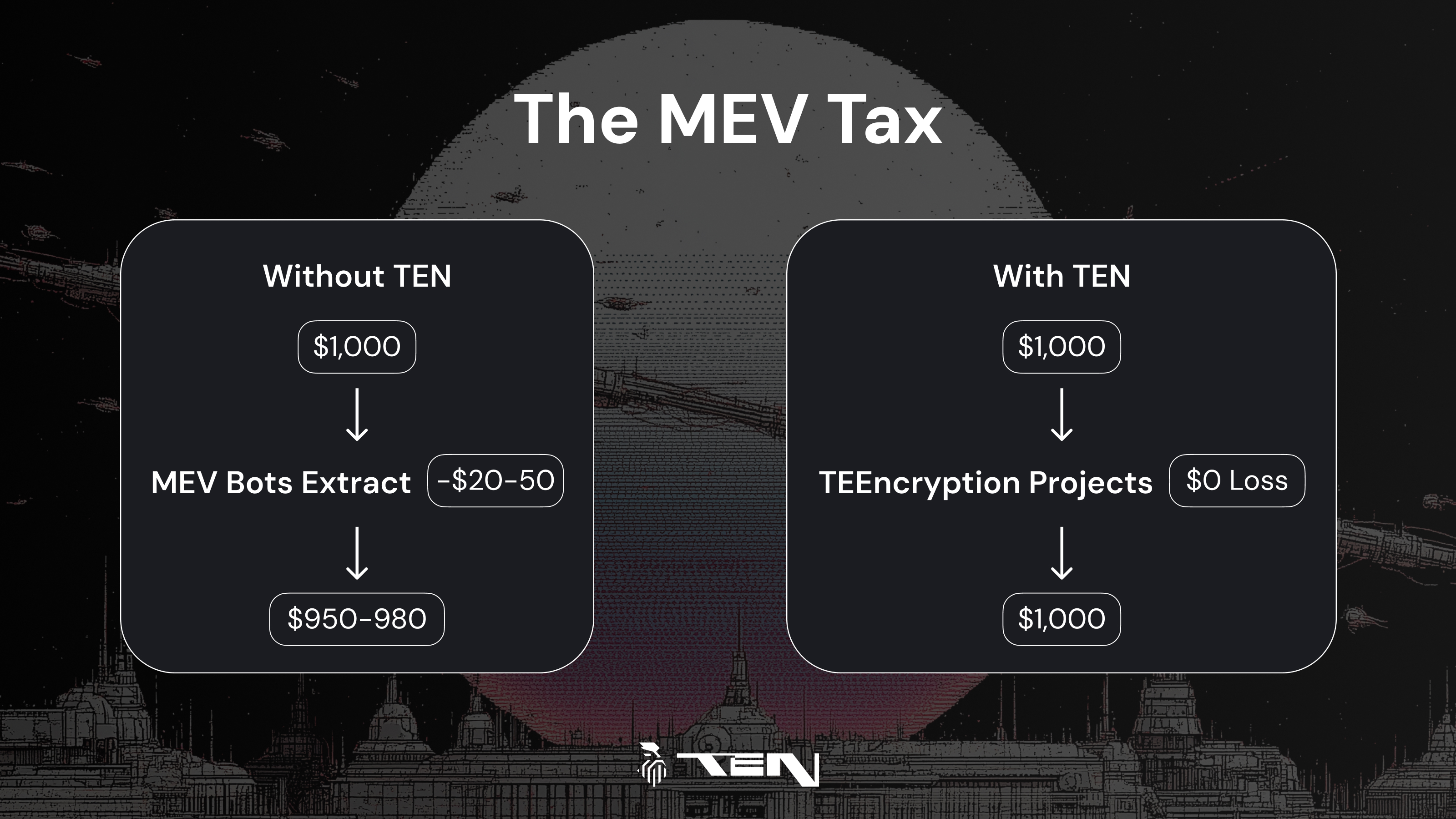

Decentralized finance (DeFi) faces a persistent challenge: frontrunning. This exploit, where adversaries observe pending transactions and insert their own trades ahead of others to extract value, undermines trust and efficiency in on-chain markets. As DeFi protocols and market participants seek robust MEV frontrunning solutions, sealed-bid MEV auctions have emerged as a leading mechanism to restore fairness and optimize MEV value capture.

The Mechanics of Sealed-Bid MEV Auctions

Unlike traditional open auctions where bids are visible in real time, sealed-bid MEV auctions require participants to submit their bids confidentially. All bids remain hidden until the auction closes, at which point they are revealed simultaneously. The highest bidder wins access to blockspace or orderflow, securing the right to reorder or include transactions for optimal execution.

This confidentiality is pivotal in fair MEV auction design. By preventing visibility into competing offers, sealed-bid auctions inhibit the predatory strategies that fuel frontrunning. Protocols such as Flashbots Protect leverage these mechanics to shield user transactions from manipulation, reinforcing equity across the DeFi landscape.

How Sealed-Bid Auctions Reduce Frontrunning Risk

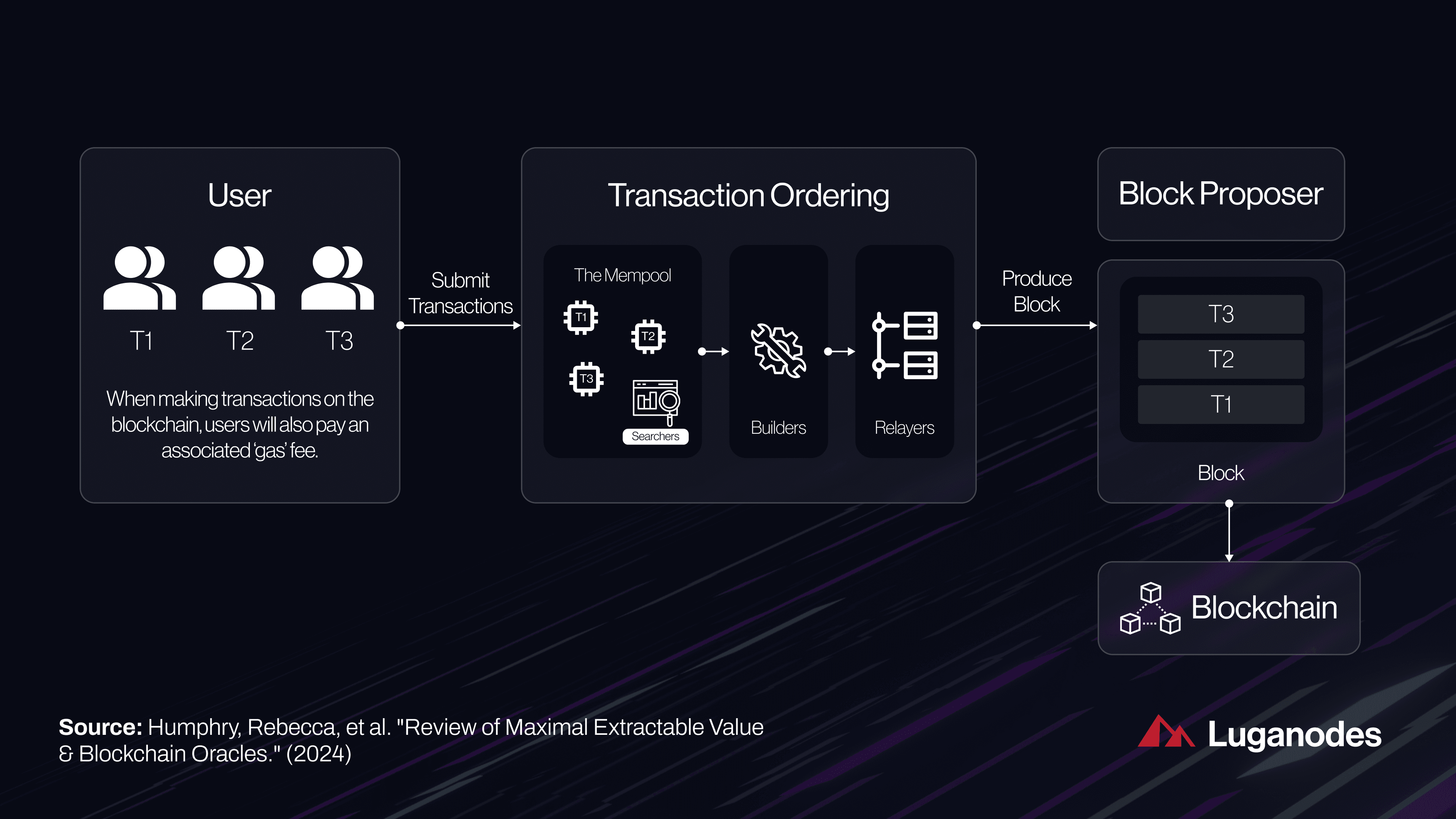

The transparency of blockchain networks is both a feature and a vulnerability. In conventional transaction ordering, malicious actors can scan the mempool for lucrative opportunities, then submit higher gas bids to jump ahead, extracting profits at the expense of regular users. Sealed-bid MEV auctions disrupt this dynamic by introducing temporal and informational opacity:

How Sealed-Bid MEV Auctions Mitigate Frontrunning

-

Bid Confidentiality Prevents Transaction Manipulation: In sealed-bid auctions, all bids are submitted privately and revealed simultaneously, making it impossible for frontrunners to observe and exploit pending transactions.

-

Equal Opportunity for All Participants: By concealing bids until the auction closes, sealed-bid mechanisms ensure that no participant has an informational advantage, fostering a fairer trading environment in DeFi.

-

Integration with MEV Protection Tools: Platforms like Flashbots Protect use sealed-bid auctions and private transaction relays to shield users from frontrunning, neutralizing MEV extraction.

-

Resistance to Real-Time Bid Adjustment: Unlike open auctions, sealed-bid formats prevent competitors from adjusting their bids in response to others, effectively blocking sandwich and backrunning attacks.

-

Advanced Cryptography Enhances Integrity: The use of techniques like zero-knowledge proofs and secure multi-party computation in sealed-bid auctions ensures bid privacy and process integrity, further reducing the risk of manipulation.

This approach ensures that no participant can reactively outbid another based on observed intent or price signals. Instead, each actor must independently assess value and risk before submitting their bid, driving more honest price discovery and reducing toxic orderflow.

Cryptographic Techniques for Auction Integrity

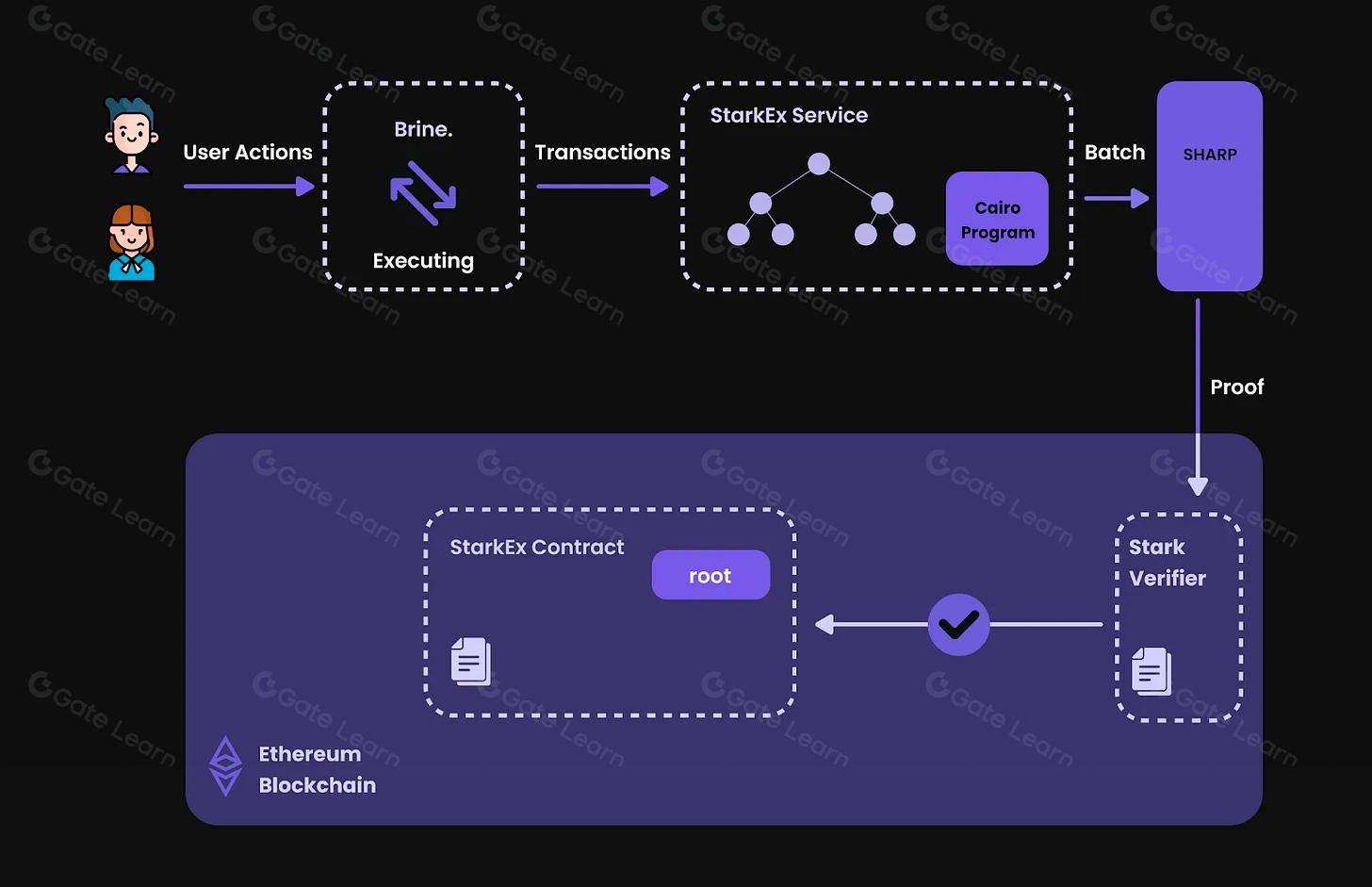

Implementing sealed-bid auctions on-chain is non-trivial. Maintaining bid privacy while ensuring verifiable outcomes requires advanced cryptographic primitives. State-of-the-art solutions employ zero-knowledge proofs (ZKPs), fully homomorphic encryption (FHE), or secure multi-party computation (MPC) to keep bids private until final reveal while guaranteeing correctness.

Despite these advances, challenges remain around scalability, collusion resistance, and minimizing latency, especially as DeFi adoption accelerates. Ongoing research is focused on optimizing these cryptographic protocols so that sealed-bid mechanisms can scale with demand without sacrificing security or fairness.

Real-World Adoption and Protocol Innovations

The shift toward fairer blockchain auction mechanisms is tangible across leading protocols. Flashbots’ relay architecture exemplifies how private orderflow channels paired with sealed-bid logic can neutralize frontrunning incentives in high-value environments like Ethereum’s blockspace market. Other emerging solutions are experimenting with hybrid models, combining batch processing with private bidding phases, to further enhance transaction equity.

For a deeper dive into how modular approaches are transforming fairness in transaction execution, explore our analysis at this dedicated resource.

As sealed-bid MEV auctions gain traction, their impact is being felt not just at the protocol level but across the entire DeFi user experience. By introducing true bid confidentiality, these mechanisms are reshaping how value is distributed and how risk is managed in on-chain trading. The result is a measurable reduction in transaction manipulation and a more predictable environment for both retail and institutional participants.

Emerging Standards and Ecosystem Collaboration

Industry-wide collaboration is accelerating the adoption of sealed-bid MEV auctions as a standard for fair execution. Key DeFi infrastructure providers are aligning on technical specifications to ensure interoperability, while open-source initiatives drive transparency and auditability of auction logic. This collective momentum is crucial for establishing trust in new auction formats and for scaling solutions that can handle the growing throughput of modern blockchains.

Protocols are also experimenting with dynamic auction parameters, such as variable bidding windows or adaptive reveal phases, to optimize for both efficiency and fairness. These innovations allow systems to respond to real-time network conditions, further reducing latency and minimizing the attack surface for would-be frontrunners.

User Experience: What Traders Should Expect

For traders, the transition to sealed-bid MEV auctions means more than just security, it fundamentally changes strategy. Without access to real-time bid data, participants must rely on robust analytics, historical auction outcomes, and predictive modeling to inform their submissions. This levels the playing field by reducing informational asymmetry, but it also rewards those with superior quantitative insight into market microstructure.

Key Benefits of Sealed-Bid MEV Auctions for DeFi Traders

-

Mitigation of Frontrunning Attacks: Sealed-bid auctions conceal bid information until the auction ends, preventing malicious actors from exploiting transaction order and reducing the risk of frontrunning in DeFi protocols.

-

Enhanced Trading Fairness: All participants submit bids privately, ensuring equal opportunity and eliminating information asymmetry commonly exploited in open auctions.

-

Improved Transaction Privacy: Solutions like Flashbots Protect use sealed-bid mechanisms and private relays to keep transaction details confidential, shielding users from MEV extraction.

-

Optimal Price Discovery: Competitive sealed-bid formats incentivize honest bidding, leading to more accurate and efficient price formation compared to open auctions.

-

Integration with Advanced Cryptography: Sealed-bid MEV auctions leverage technologies like zero-knowledge proofs and secure multi-party computation to ensure bid confidentiality and integrity.

The net effect is a marketplace where execution quality improves, slippage risk drops, and users can transact with greater confidence that their intent will not be subverted by adversarial actors. As more protocols integrate sealed-bid systems, expect competitive pressure to drive further enhancements in user-facing tools, ranging from privacy-preserving wallets to real-time auction analytics dashboards.

Looking Forward: The Road to Frictionless Fairness

Sealed-bid MEV auctions represent an inflection point in the evolution of blockchain auction mechanisms. Their adoption signals a shift away from zero-sum games dominated by predatory bots toward cooperative value creation that benefits all ecosystem stakeholders. However, sustained progress will depend on continued advancements in cryptography, rigorous economic modeling, and transparent governance frameworks.

For those building or participating in next-generation DeFi protocols, understanding the nuances of sealed-bid architecture, and its implications for MEV value capture, is now table stakes. As research matures and implementations proliferate, expect these auctions to become a cornerstone of fair MEV extraction strategies across diverse chains.

To explore how modular approaches enhance transaction efficiency while preserving fairness at scale, see our detailed discussion at this resource.