In the fast-evolving world of decentralized finance (DeFi), the battle for transaction priority is fierce, and nowhere is this more pronounced than in modular orderflow auctions. These auctions are designed to optimize transaction sequencing, aiming for fairness and efficiency. Yet, the rise of latency arbitrage and MEV (Maximal Extractable Value) bots is fundamentally reshaping how these auctions operate, introducing new complexities and opportunities for both traders and developers.

Latency Arbitrage: The Race for DeFi Execution Speed

Latency arbitrage is all about speed. MEV bots, often run by sophisticated searchers, set up ultra-low-latency connections to blockchain nodes such as Geth, Nethermind, and Erigon on Ethereum. Their goal? To spot profitable opportunities before anyone else and have their transactions included at just the right moment. This high-stakes game is not just about who has the best algorithm, but who can get their order in first, sometimes shaving off milliseconds can mean thousands of dollars in profit.

On platforms like Solana and Arbitrum, latency arbitrage has become a defining feature. Bots continuously monitor the mempool for arbitrage, liquidation, and sandwich attack opportunities, then compete to execute trades with the highest possible efficiency. This arms race for DeFi execution speed has led to tighter spreads and more dynamic real-time pricing, but it’s also increased transaction costs and network congestion for everyone else.

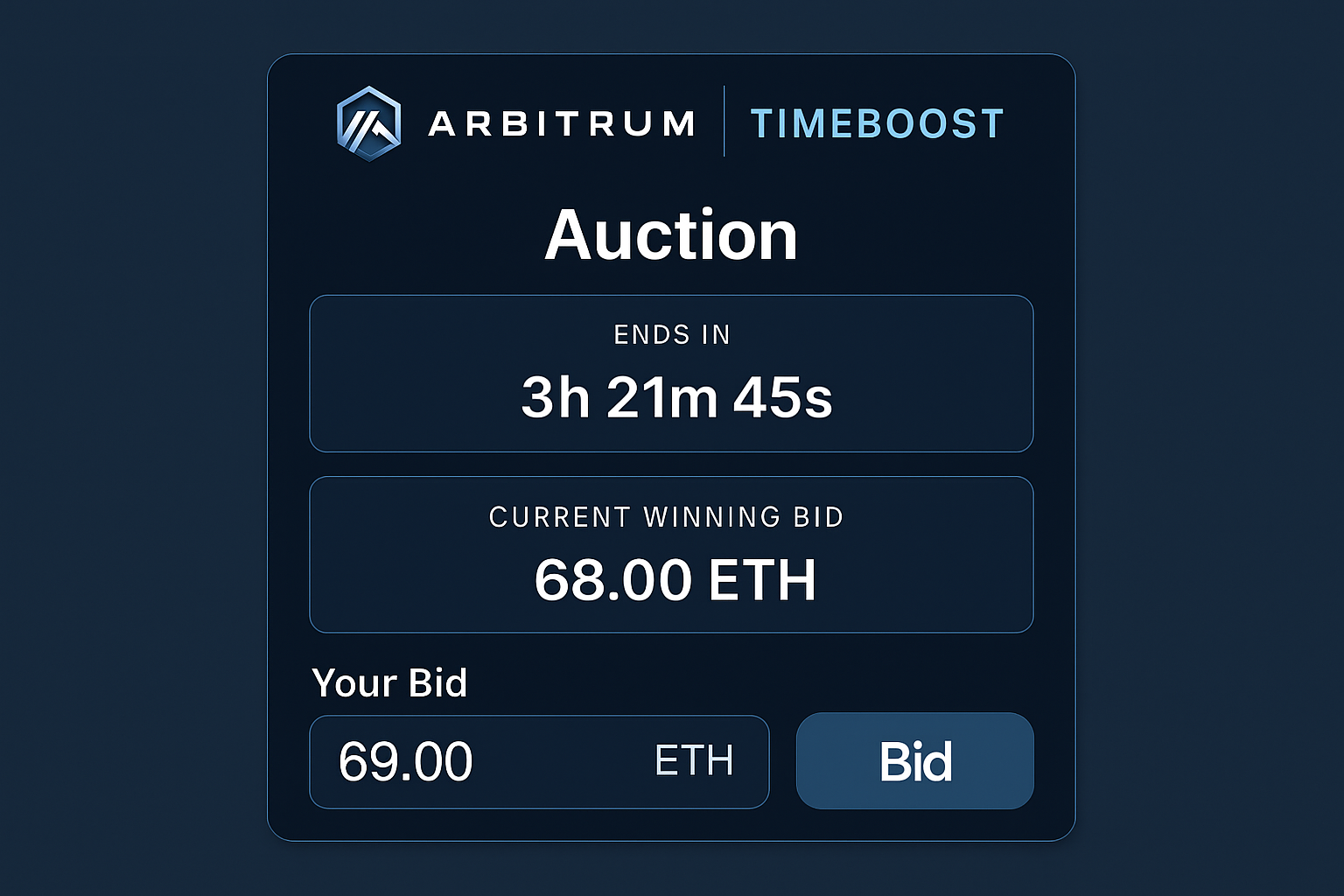

Did you know? On Arbitrum, a handful of entities win the majority of express lane auctions, highlighting just how centralized and competitive latency arbitrage has become. Many time-boosted transactions are reverted, showing that even with advanced mechanisms, spam and inefficiency persist.

MEV Bots: How They Work and Why They Matter

MEV bots are automated programs engineered to extract value from the way transactions are ordered within a block. They do this by:

- Monitoring the mempool for profitable opportunities (like arbitrage or liquidations)

- Submitting transactions with higher gas fees to gain priority

- Leveraging low-latency infrastructure to minimize delays

Some bots use strategies like sandwich attacks, placing their buy and sell orders around a target transaction to profit from price movement, or simple arbitrage between DEXs. Regardless of the method, the common thread is optimization: squeezing every last drop of value from transaction ordering.

But this isn’t just a technical curiosity. The influence of MEV bots has pushed DeFi protocols to innovate. Mechanisms like Arbitrum’s Timeboost introduce auction-based sequencing, letting users bid for express lane access. However, research shows that while these mechanisms can provide earlier inclusion, the most lucrative MEV opportunities often cluster at the end of blocks. This means express lane access doesn’t always guarantee bigger profits, sometimes it’s all about timing, not just speed.

Modular Orderflow Auctions: Adapting to a New Reality

With Ethereum trading at $3,878.88 as of October 18,2025, market participants are more aware than ever of the impact that latency arbitrage and MEV bots have on DeFi efficiency and fairness. Modular orderflow auctions are evolving in response to these pressures. Some protocols are experimenting with batch auctions and private transactions to reduce slippage and mitigate MEV attacks. Others are refining their auction logic to reward honest participation rather than just raw speed.

The rise of modular MEV auctions is also giving birth to a new breed of orderflow marketplaces. Here, traders can access advanced analytics, real-time auction data, and tools designed specifically for slippage reduction and tight spreads in DeFi. For a deeper dive into how modular auctions are transforming orderflow, check out our guide on how modular MEV auctions are revolutionizing orderflow marketplaces for DeFi traders.

Ethereum (ETH) Price Prediction 2026-2031

Professional Outlook Considering DeFi Orderflow, MEV Bots, and Modular Auction Dynamics

| Year | Minimum Price | Average Price | Maximum Price | % Change from 2025 (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,250 | $4,200 | $5,150 | +8.3% | Regulatory uncertainty and ongoing MEV-related inefficiencies may cause volatility; strong DeFi usage supports steady growth. |

| 2027 | $3,600 | $4,700 | $6,000 | +21.2% | Layer 2 scaling and anti-MEV tech adoption begin to reduce transaction cost spikes, attracting new institutional interest. |

| 2028 | $4,100 | $5,350 | $7,200 | +37.9% | Widespread use of modular auctions and fair sequencing protocols increase user and developer confidence; ETH use in RWAs grows. |

| 2029 | $4,650 | $6,200 | $8,800 | +59.9% | Global regulatory clarity and continued ETH burn from EIP-1559 drive supply reduction; DeFi TVL rebounds strongly. |

| 2030 | $5,100 | $7,100 | $10,500 | +83.1% | Ethereum cements role as leading DeFi and modular smart contract platform; potential for ETF approval in major economies. |

| 2031 | $5,600 | $8,200 | $12,800 | +111.5% | Matured ecosystem, high institutional adoption, and advanced MEV mitigation foster robust growth; ETH achieves blue-chip status. |

Price Prediction Summary

Ethereum is projected to experience steady appreciation from 2026 through 2031, with average prices rising from $4,200 in 2026 to $8,200 by 2031. The price trajectory reflects ongoing improvements in DeFi infrastructure, adoption of MEV mitigation solutions, and increasing institutional participation. While volatility from MEV dynamics and regulatory shifts may persist, the overall outlook remains bullish, particularly as Ethereum maintains its position as the backbone of DeFi innovation.

Key Factors Affecting Ethereum Price

- Adoption and effectiveness of MEV mitigation (e.g., orderflow auctions, private transactions)

- Global regulatory developments affecting DeFi and crypto assets

- Ethereum’s Layer 2 scaling and modular execution advancements

- Institutional adoption and integration with traditional finance (e.g., ETFs, RWAs)

- Competitive landscape from other smart contract platforms

- Macroeconomic conditions impacting risk assets and crypto markets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As this landscape continues to change, one thing is clear: understanding the mechanics of latency arbitrage and MEV bots is essential for anyone looking to optimize their DeFi strategies. In the next section, we’ll explore how modular orderflow auctions are adapting, and what it means for the future of transaction execution in DeFi.

Protocols are now actively integrating anti-MEV solutions, such as batch auctions and private orderflow, to level the playing field. These methods aim to obscure transaction details or group them together, making it much harder for bots to predict and exploit individual trades. The result is a measurable reduction in slippage and more predictable outcomes for everyday users and institutional players alike.

But adaptation isn’t just about defense. Some platforms are harnessing the competitive nature of MEV searchers by inviting them into structured, transparent auctions. Modular MEV auctions provide a framework where searchers bid openly for blockspace, helping to redistribute value more equitably across participants. Instead of shadowy backroom deals or exclusive access, the process becomes visible and auditable, an important step toward trust in DeFi infrastructure.

Orderflow Marketplaces: Tools for a New Era

The emergence of dedicated orderflow marketplaces marks another leap forward. These platforms offer real-time analytics, historical auction data, and actionable insights that empower traders and developers to adapt their strategies on the fly. By surfacing metrics like execution speed, fill rates, and slippage events, orderflow marketplaces help users identify patterns in MEV extraction, and avoid becoming victims themselves.

Key Features of Modern Modular MEV Auction Platforms

-

Express Lane Access via Auction Mechanisms: Platforms like Arbitrum implement systems such as Timeboost, where users can bid for priority inclusion of their transactions, enabling time-sensitive trades and MEV strategies.

-

Batch Transaction Processing: Many platforms employ batch auctions to group and sequence transactions together, reducing the risk of frontrunning and improving fairness for all participants.

-

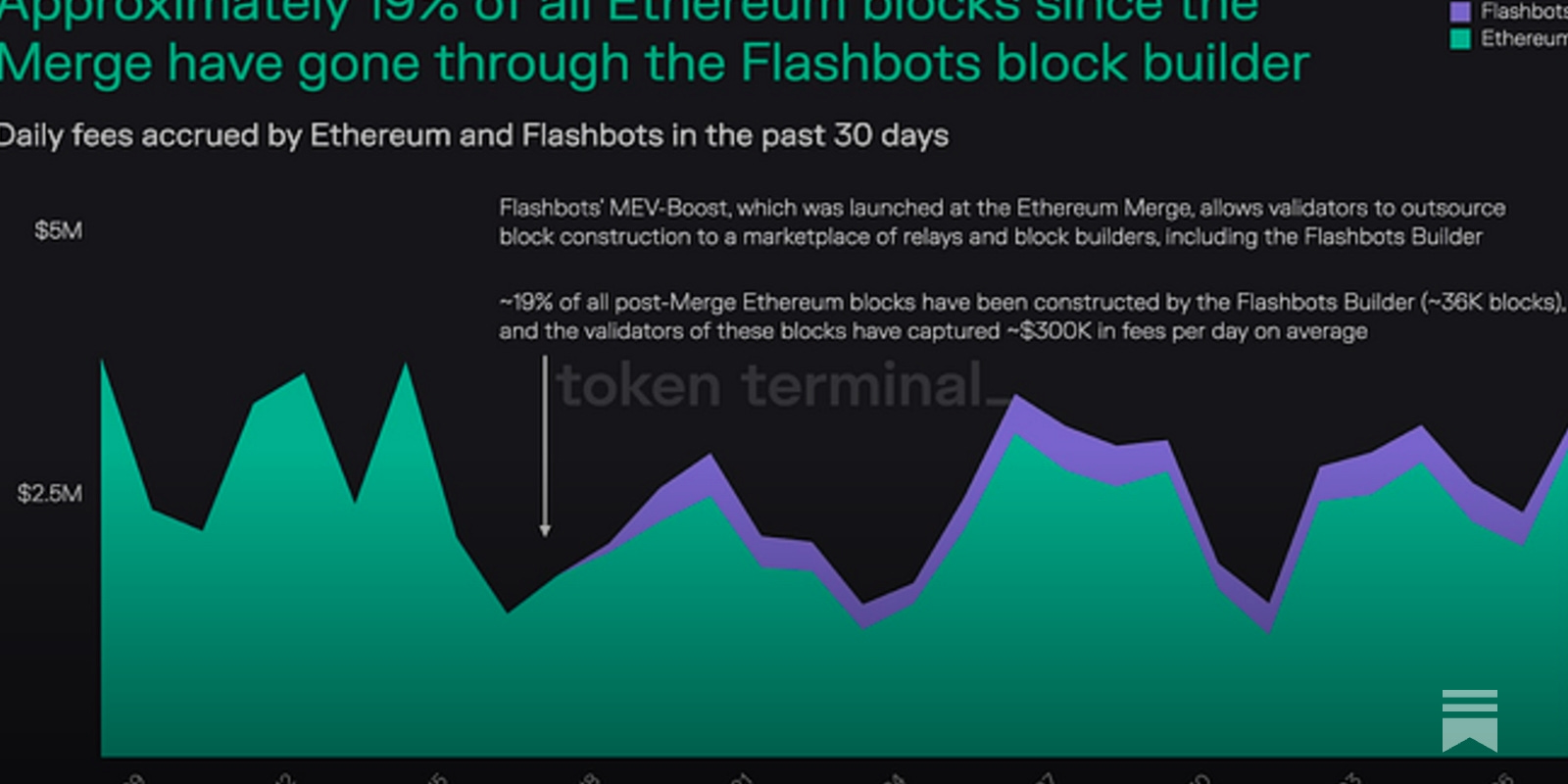

Private Transaction Pools: Solutions like Flashbots offer private mempools, allowing users to submit transactions directly to miners or validators, minimizing exposure to MEV bots and sandwich attacks.

-

Low-Latency Node Infrastructure: Leading platforms support integration with high-performance nodes (e.g., Geth, Nethermind, Erigon), enabling MEV bots and searchers to monitor and react to on-chain opportunities in real time.

-

Transparency and Open Data Access: Most modular MEV auction platforms provide open APIs and dashboards, allowing users to analyze auction outcomes, track MEV extraction, and monitor network health.

-

Multi-Chain and Modular Compatibility: Modern platforms increasingly support multiple blockchains and modular architectures, enabling cross-chain MEV extraction and auction participation.

This transparency also drives innovation in trading strategies. With access to granular data on auction outcomes and blockspace demand, market makers can fine-tune their participation for optimal returns while minimizing negative externalities like gas wars or failed transactions. If you’re curious about how these tools directly enhance DeFi execution efficiency, you’ll find a thorough breakdown in our article on how modular MEV auctions enhance transaction efficiency in decentralized finance.

Looking Ahead: The Future of Fairness and Efficiency

As Ethereum holds firm at $3,878.88, the DeFi community is at an inflection point. The interplay between latency arbitrageurs, MEV bots, and evolving auction mechanisms will define the next chapter of decentralized markets. We’re already seeing protocols experiment with reinforcement learning algorithms that dynamically adjust sequencing rules based on observed attack patterns, a promising sign that adaptability is built into the DNA of modern DeFi.

The bottom line? While latency arbitrage and MEV bots have introduced new challenges for modular orderflow auctions, they’ve also accelerated innovation across every layer of the stack, from consensus protocols to user-facing trading tools. Staying ahead means embracing transparency, adopting robust analytics, and participating in open marketplaces designed for this new era of programmable finance.

If you want to stay informed about future developments or optimize your own strategies for slippage reduction and tight spreads in DeFi trading, explore our resources on how modular MEV auctions improve DeFi trading efficiency.