MEV bots have become a defining force in on-chain trading, fundamentally altering the landscape for DeFi users, protocols, and liquidity providers. While their presence is often invisible to the untrained eye, their impact is anything but subtle. These automated actors operate with precision, exploiting transaction ordering and blockchain inefficiencies to extract profits, often at the expense of regular traders. Understanding how MEV bots function and the real-world consequences of their strategies is critical for anyone navigating decentralized finance today.

What Are MEV Bots and Why Should DeFi Users Care?

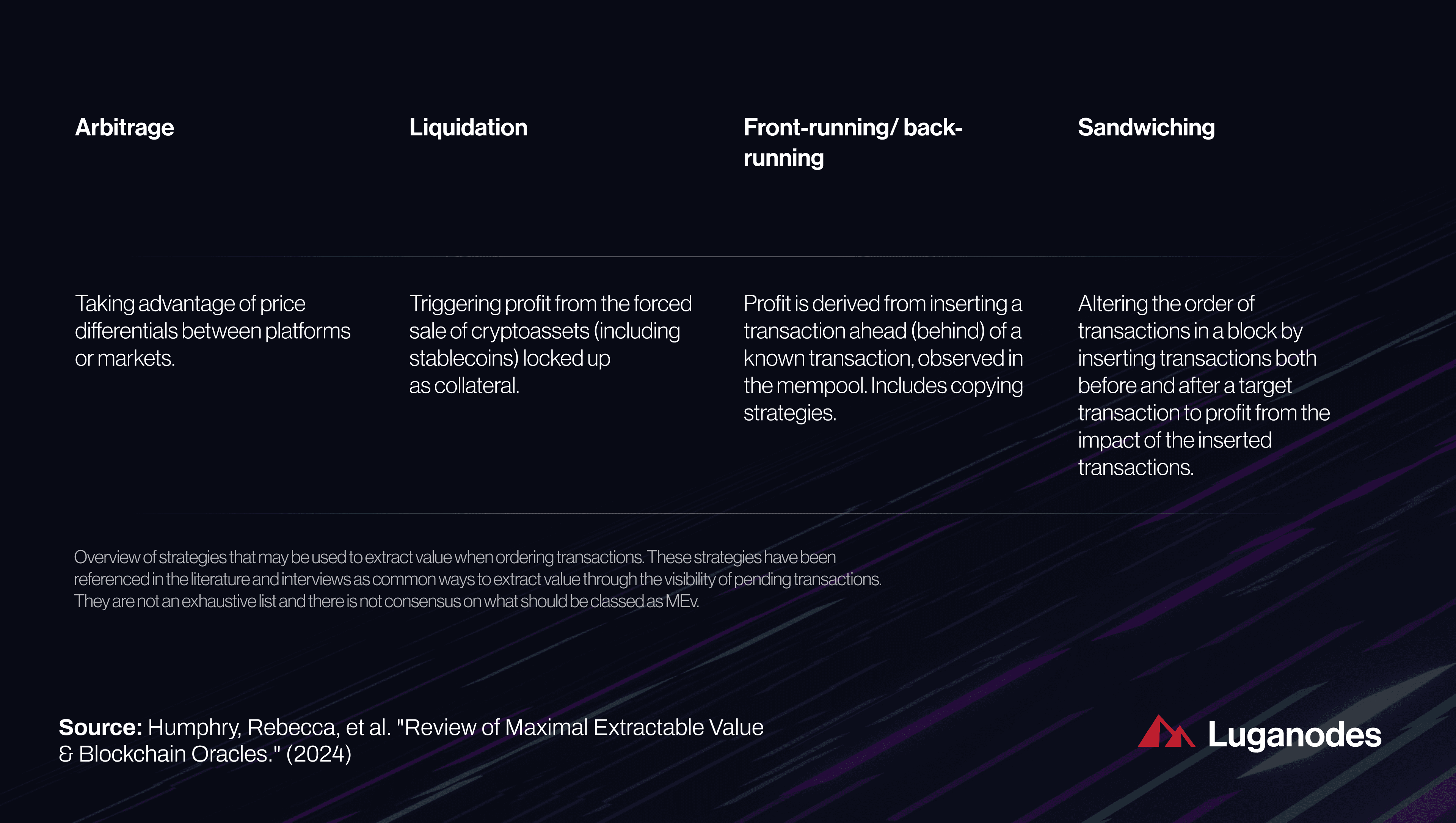

Maximal Extractable Value (MEV) refers to the maximum value that can be extracted from block production by including, excluding, or reordering transactions within a block. MEV bots are specialized programs designed to capture this value through advanced algorithms and rapid execution. By monitoring the public mempool, these bots identify profitable opportunities such as arbitrage, frontrunning, and sandwich attacks, each with unique implications for market efficiency and user experience.

For everyday DeFi participants, MEV activity can mean higher gas fees, increased slippage, or even failed transactions. On high-traffic chains like BNB Chain and Ethereum mainnet, malicious MEV strategies have drained millions from unsuspecting users, undermining trust in decentralized exchanges (DEXs) and discouraging new entrants into the ecosystem.

Real-World Examples: How MEV Bots Extract Profits

The sophistication of MEV bots is best illustrated by recent high-profile exploits:

- Arbitrage: In October 2023, an MEV bot on BNB Chain executed a flash loan attack targeting the BH/USDT pair on PancakeSwap. The bot netted $1.575 million in profit while incurring just $4.16 in transaction fees, a stark demonstration of capital efficiency at scale.

- Frontrunning: In another case from 2023, a bot detected a large Uniswap buy order for a low-liquidity token. By submitting its own buy order first (with a higher gas fee), it secured inventory ahead of the original trader and quickly sold at an inflated price, earning over $100,000 in profit.

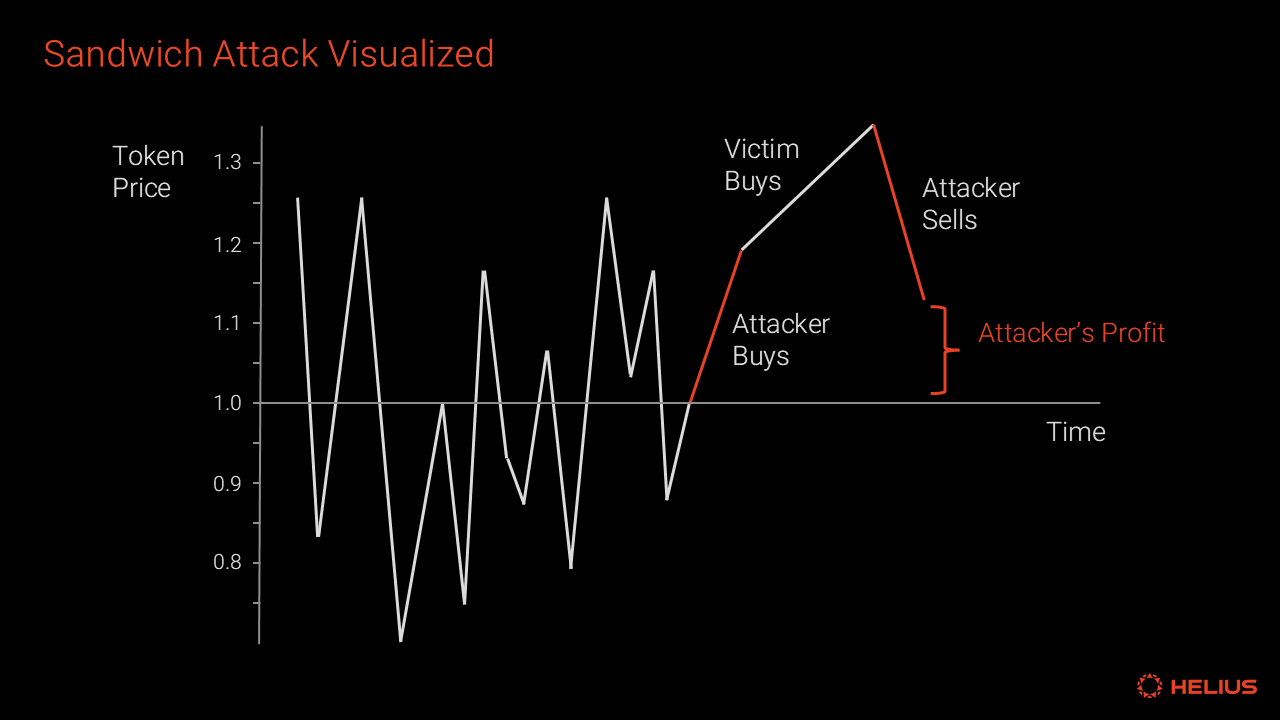

- Sandwich Attacks: Here, bots bookend a user’s trade with buy/sell orders to manipulate prices in real time. This tactic not only siphons value from the target but also distorts price discovery across DEXs.

Common MEV Attack Types in DeFi

-

Arbitrage Attacks: MEV bots exploit price discrepancies across decentralized exchanges (DEXs) by buying assets where prices are lower and selling where they are higher. For example, in October 2023, a bot on BNB Chain used a flash loan to profit $1,575,000 on the BH/USDT trading pair, incurring only $4.16 in transaction costs.

-

Frontrunning: Bots scan the mempool for large pending trades and submit their own buy orders with higher gas fees to execute first. This allows them to benefit from the subsequent price movement. In 2023, a bot front-ran a Uniswap trade and earned over $100,000 by buying a low-liquidity token before the user and selling it at a premium.

-

Sandwich Attacks: Here, MEV bots place a buy order just before, and a sell order just after, a user’s large transaction. This manipulates the price to the bot’s advantage and often results in significant losses for the user. Sandwich attacks are a well-documented threat on DEXs like Uniswap and PancakeSwap.

-

Backrunning: Some bots monitor for large liquidity events, such as liquidations or arbitrage opportunities, and quickly execute trades immediately after these events to capture residual value. This can further erode profits for regular users participating in the same pools.

-

Time-Bandit Attacks: In these sophisticated attacks, miners (or validators) may reorganize blockchain blocks to capture past MEV opportunities, undermining transaction finality and network security.

The cumulative effect? Increased costs for honest traders and heightened volatility across blockspace markets. For more detail on how these strategies play out in live markets, and what traders can do to respond, see this deep dive into real-time MEV auction data.

The Broader Impact: Efficiency vs Exploitation

The debate around MEV bots is nuanced. Some argue they serve as decentralized market makers or high-frequency traders, ensuring DEX prices remain synchronized across liquidity pools. Others see them as predatory actors who impose an “invisible tax” on every trade. Regardless of perspective, it’s clear that unchecked MEV extraction can erode user confidence and stifle innovation in DeFi protocols.

This paradox has led to an arms race between bot operators seeking ever-thinner margins and protocol developers working to minimize exploitability through smarter design choices, including batch auctions and private orderflow marketplaces like Modular Mev Auctions.

Towards Safer Trading: Emerging Solutions for DeFi Users

The industry response has been swift but fragmented:

Key Solutions for Mitigating MEV Risks in DeFi

-

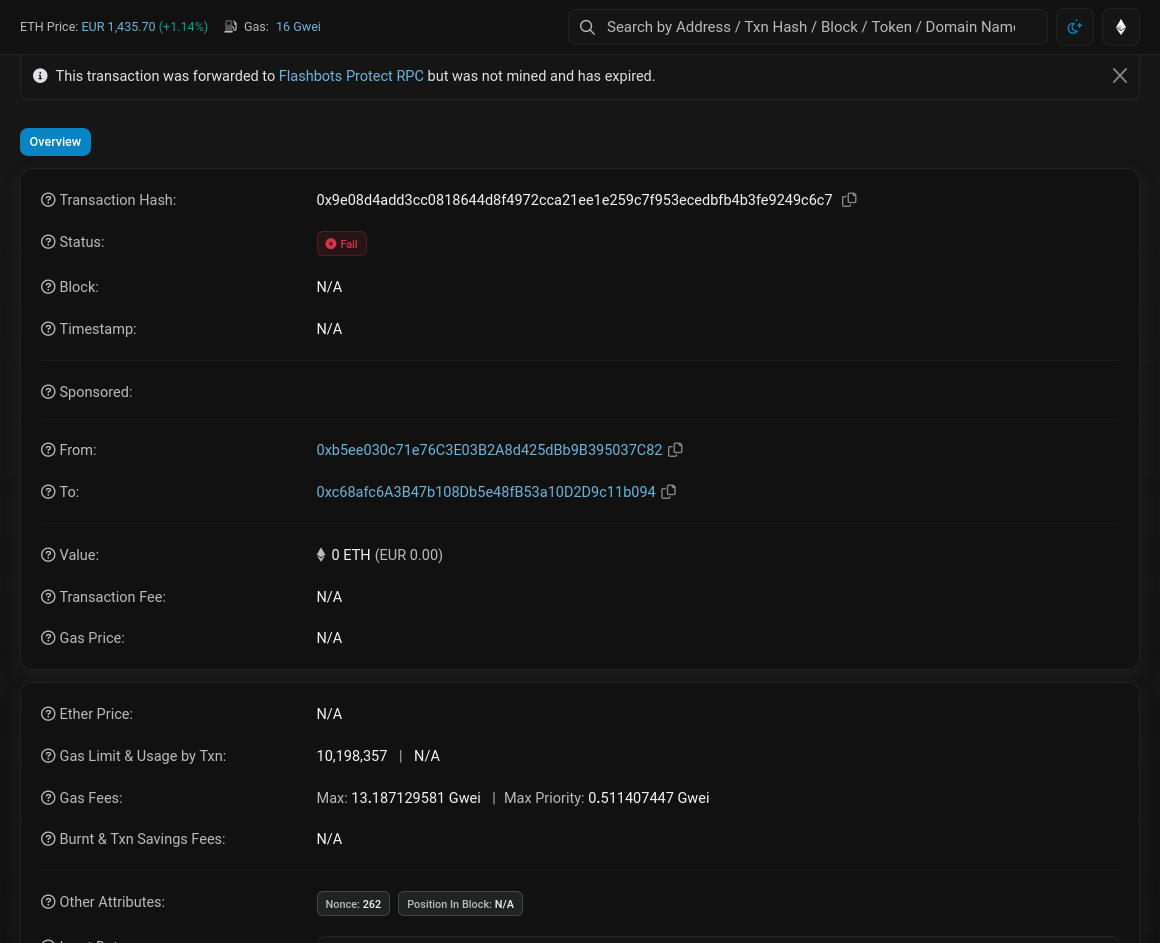

Flashbots Protect: Submit transactions privately to miners, bypassing the public mempool and reducing exposure to MEV exploits such as frontrunning and sandwich attacks. This tool is widely used to enhance user privacy and transaction security.

-

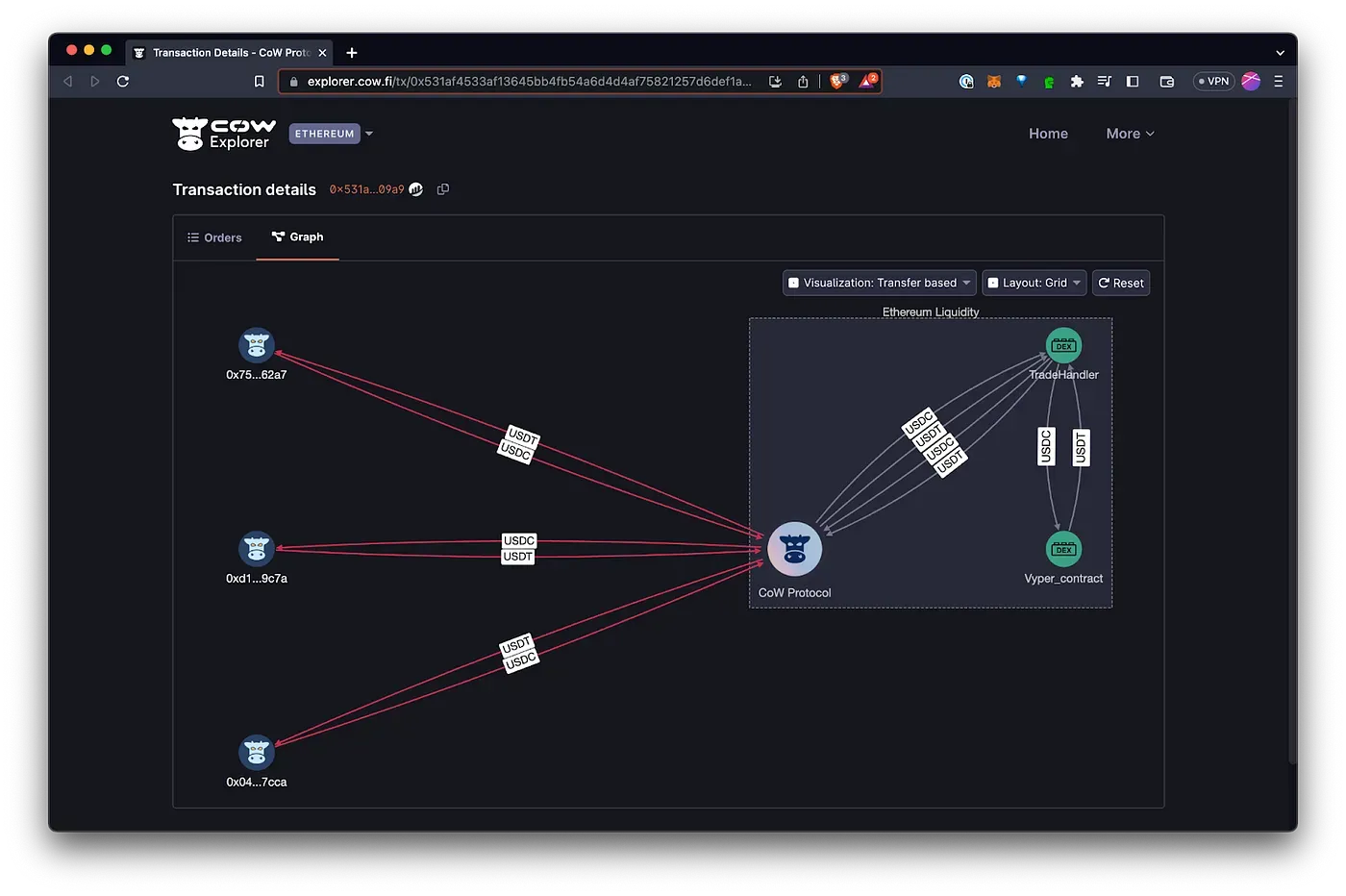

CoWSwap Batch Auctions: Execute trades collectively through batch auctions, making it difficult for MEV bots to target individual transactions. CoWSwap’s MEV-resistant protocol minimizes the risk of frontrunning and sandwich attacks for DeFi users.

-

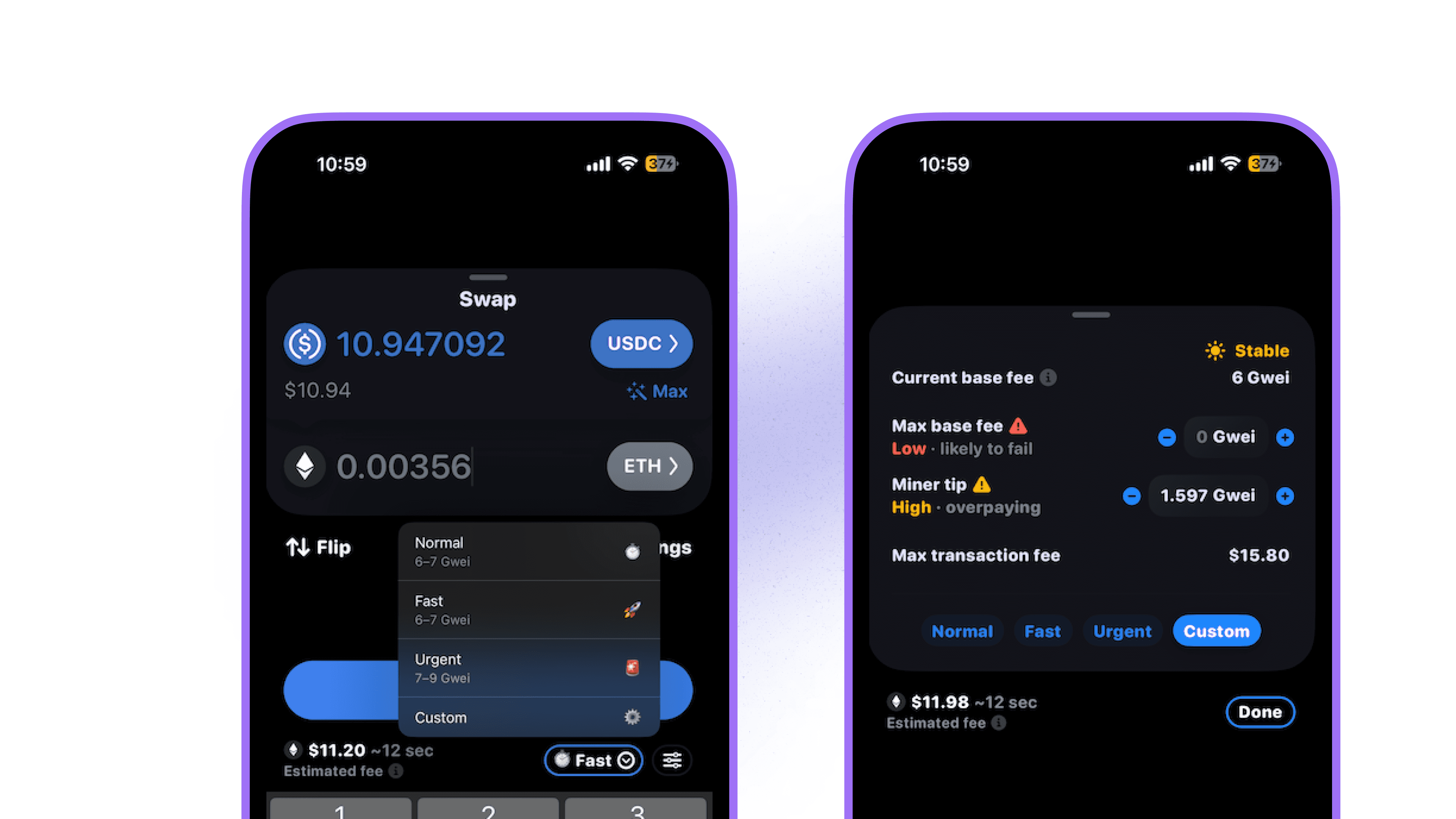

Optimized Gas Fees: Adjusting gas fees strategically can help users avoid having their transactions targeted by MEV bots. By setting competitive but not excessive gas prices, users can reduce the likelihood of being front-run or sandwiched.

-

On-Chain Monitoring Tools: Platforms offering real-time analytics and alerts help users detect suspicious MEV-related activities. Monitoring tools empower traders to respond quickly and protect their assets from potential exploitation.

Tools like Flashbots Protect allow traders to bypass the public mempool entirely by submitting transactions privately to miners or validators, reducing exposure to frontrunning and sandwiching attacks. Batch auction models pioneered by platforms such as CoWSwap aggregate orders before execution; this collective approach makes it much harder for bots to single out individual trades for exploitation.

Optimizing gas fees is another practical defense. By carefully calibrating transaction fees, users can make their trades less attractive targets for MEV bots. However, this requires a nuanced understanding of network conditions and mempool dynamics, skills that not all DeFi participants possess. For those seeking a more automated approach, on-chain analytics platforms are emerging as essential tools. These services monitor suspicious activity and provide real-time alerts, empowering users to identify and react to potential MEV threats before they impact their portfolios.

Protocols themselves are also evolving. MEV-resistant architectures are gaining traction, with some DEXs experimenting with encrypted mempools or randomized transaction ordering to disrupt the deterministic strategies employed by bots. Meanwhile, blockspace market innovations, such as Modular Mev Auctions, are introducing transparent auction mechanisms for orderflow, giving traders greater control over transaction execution while redistributing extracted value more equitably across the ecosystem.

The Role of Modular Mev Auctions in Shaping Fairer Markets

Platforms like Modular Mev Auctions are at the forefront of this shift. By offering an open orderflow marketplace and advanced analytics, these solutions empower both professional traders and everyday users to participate in MEV auctions directly. This not only democratizes access to blockspace but also increases transparency around who profits from transaction ordering, and how much value is being extracted from each trade.

The result is a more level playing field where sophisticated strategies can be countered by equally sophisticated defenses. For a deeper look at how real-time auction data is transforming DeFi trading efficiency, see this analysis.

Ultimately, combating predatory MEV extraction requires collective action from developers, traders, and protocol designers alike. The ongoing evolution of DeFi infrastructure, from private submission tools to modular blockspace markets, signals a future where fairer trading experiences are not just possible but expected.

Best Practices for DeFi Traders Navigating the MEV Landscape

Staying informed about current threats and available protection mechanisms is crucial. Here’s what every DeFi trader should keep in mind:

- Use private submission tools like Flashbots Protect whenever possible.

- Favor batch auction protocols that aggregate transactions (e. g. , CoWSwap).

- Monitor gas prices and adjust accordingly to avoid being singled out by bots.

- Leverage on-chain analytics for early detection of suspicious activity.

- Engage with platforms offering transparent MEV auctions, such as Modular Mev Auctions, to maximize returns while minimizing risk.

The landscape will continue to evolve as both attackers and defenders innovate, but with the right strategies, DeFi users can regain control over their trades and help shape a more resilient financial ecosystem.