In decentralized finance, transaction execution is the battleground where traders, protocols, and infrastructure providers all vie for optimal outcomes. The rise of MEV (Maximal Extractable Value) has transformed this landscape. While MEV once lurked in the shadows as a source of inefficiency and predatory behavior, today’s modular MEV auctions are rewriting the rules, offering a more transparent and competitive mechanism for prioritizing transactions.

The Problem: Traditional MEV and Transaction Execution Frictions

Historically, MEV has been synonymous with front-running, sandwich attacks, and other forms of value extraction that undermine user trust. When transactions are broadcast to the public mempool, malicious actors can reorder or insert their own trades to profit at others’ expense. This not only distorts pricing but also leads to unpredictable costs for everyday users.

The core issue is simple: whoever controls transaction ordering within a block can extract value from others by manipulating inclusion. This creates a zero-sum game where efficiency suffers and users pay more than necessary.

How Modular MEV Auctions Reshape Transaction Ordering

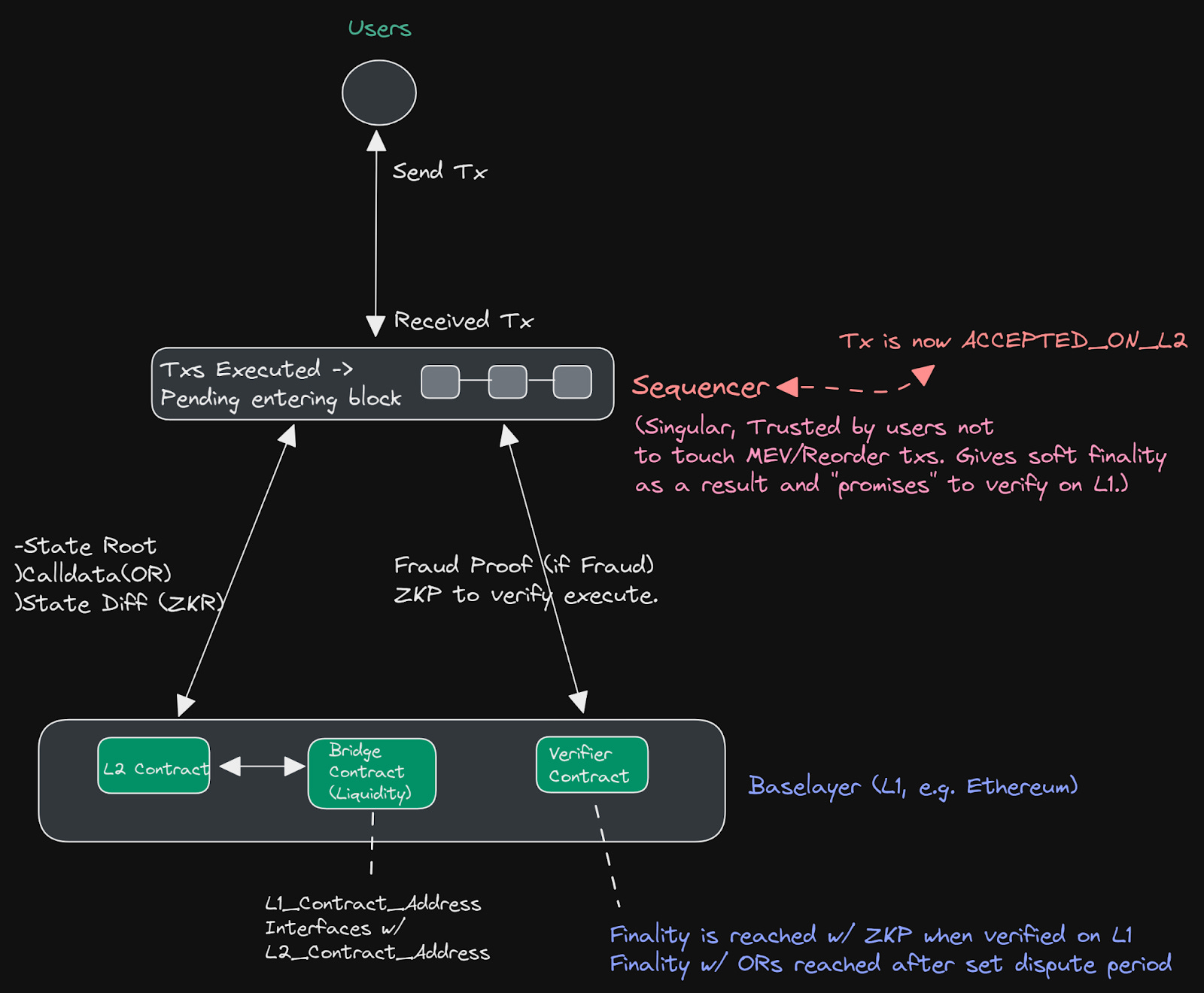

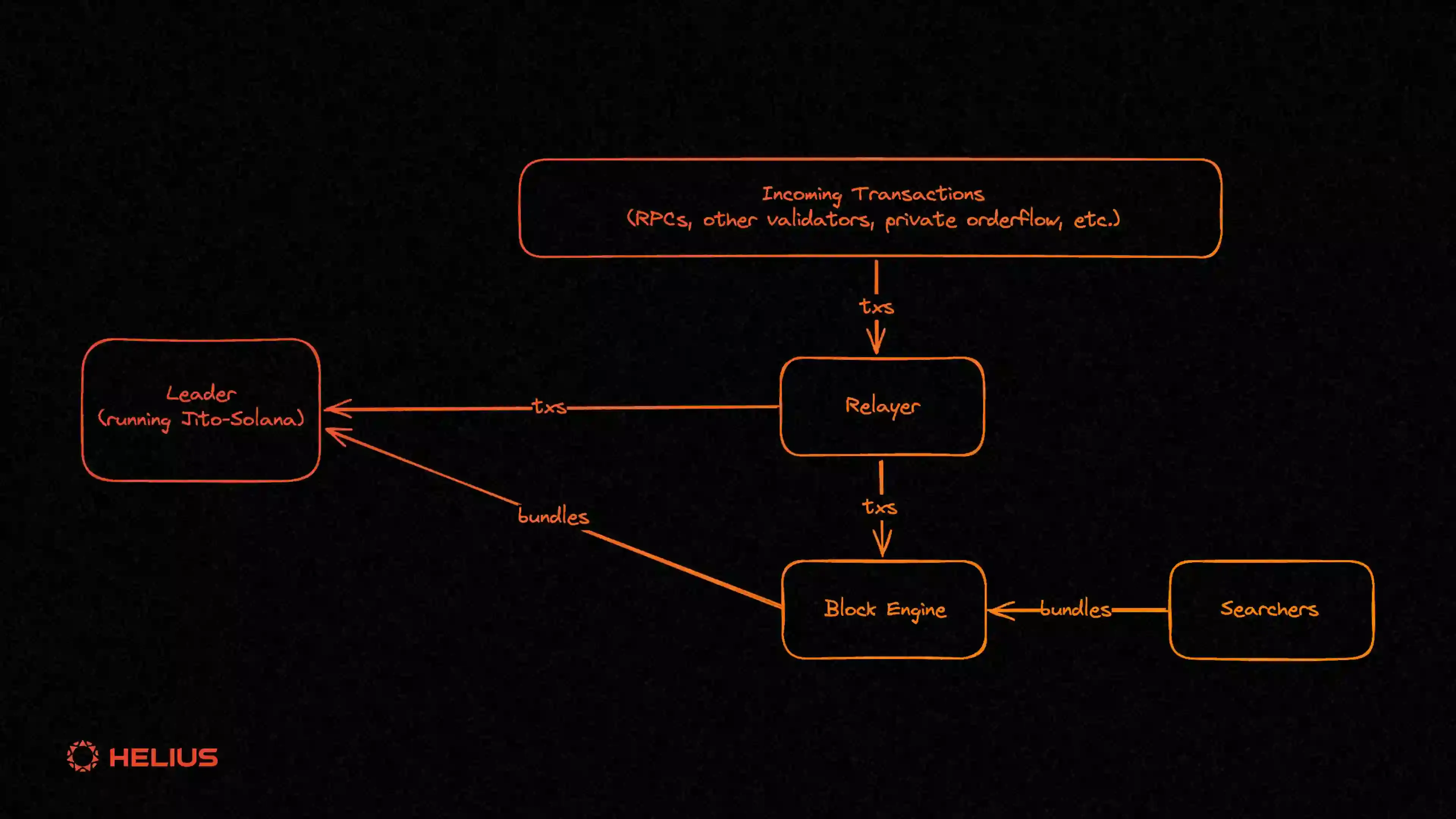

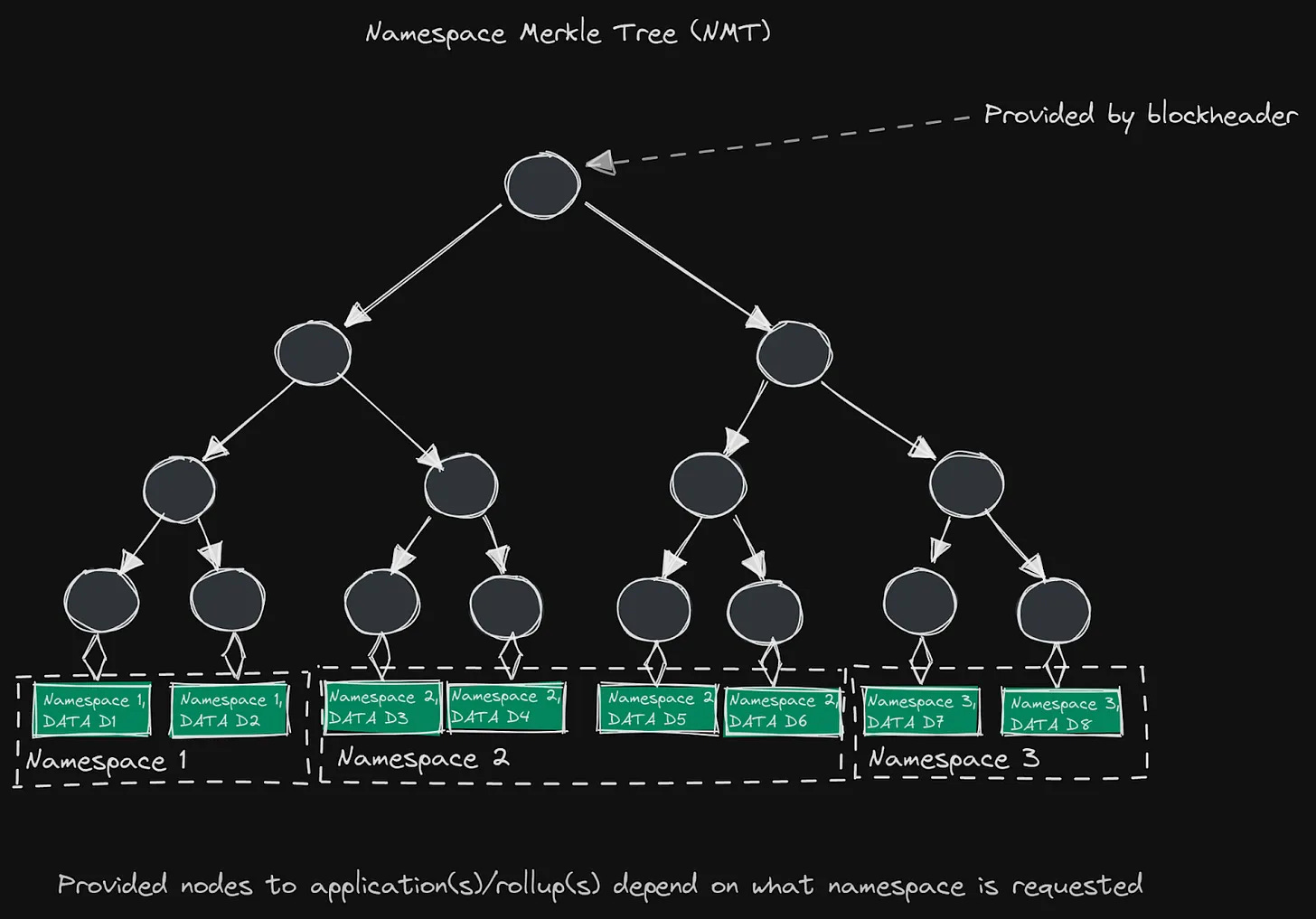

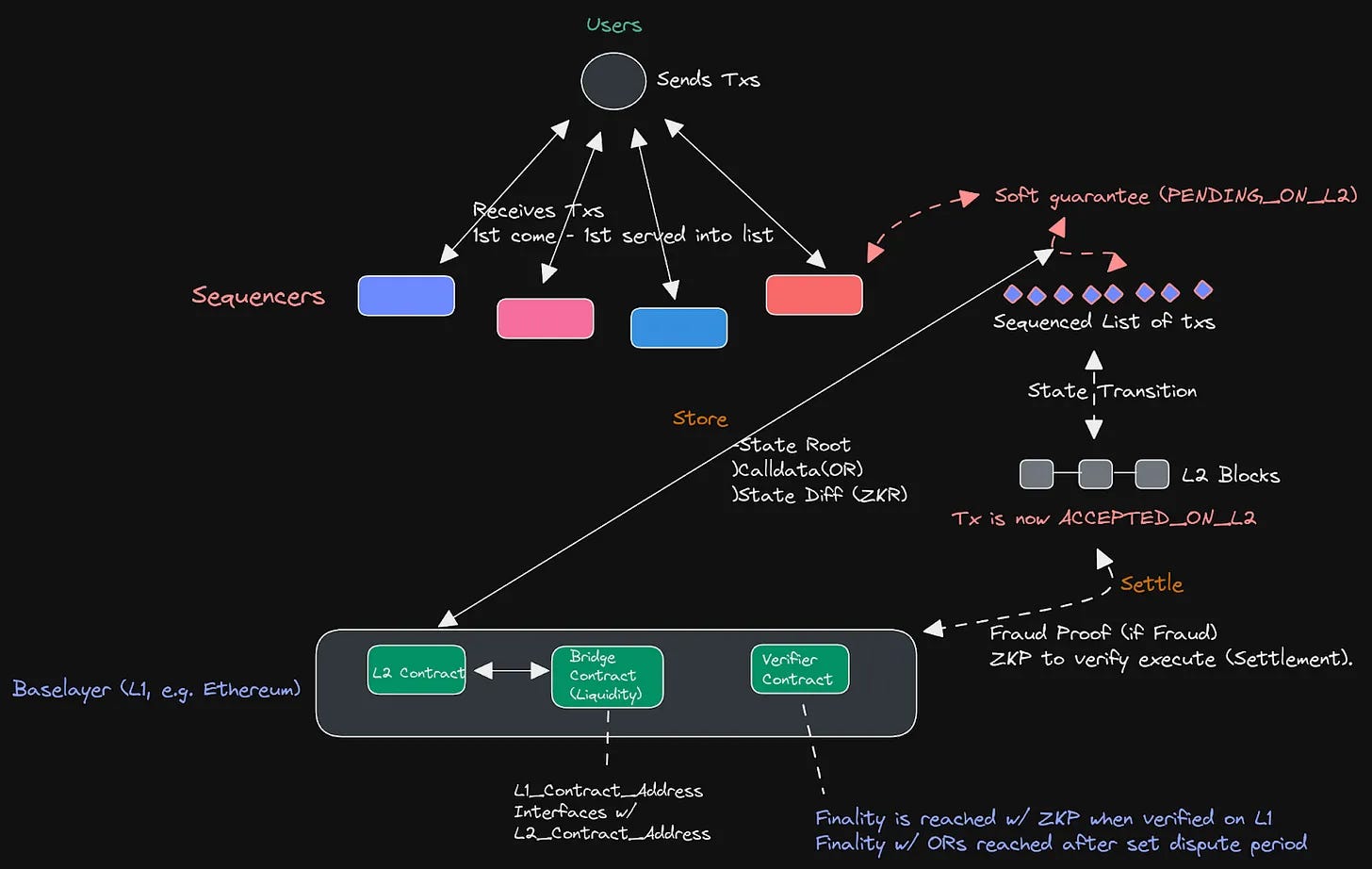

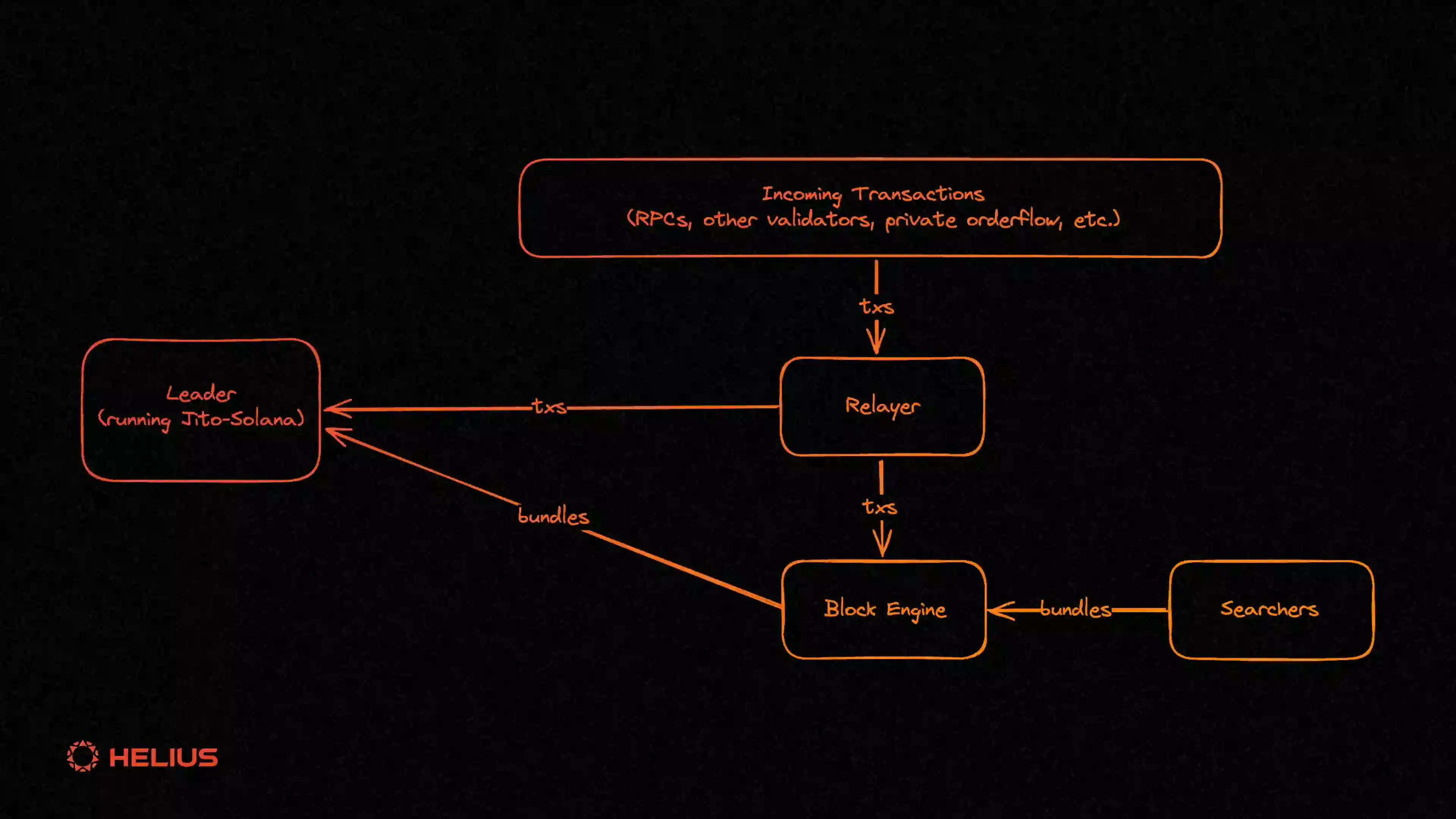

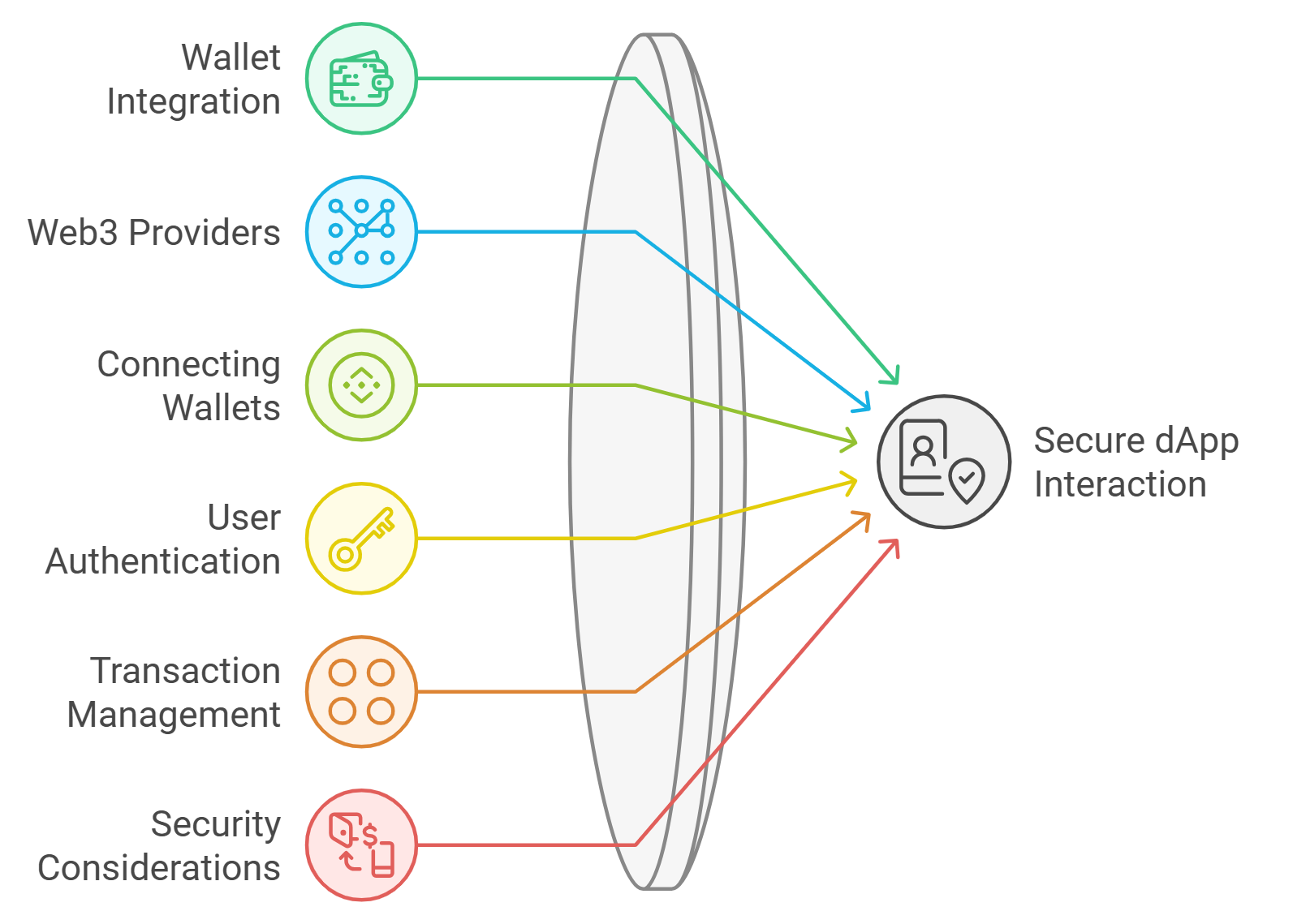

Modular MEV auctions introduce a new paradigm by separating block proposers from block builders, a concept known as Proposer-Builder Separation (PBS). In this system, specialized entities compete in real-time auctions for the right to construct blocks using user order flow. This competition fosters more efficient pricing of blockspace and reduces opportunities for manipulation.

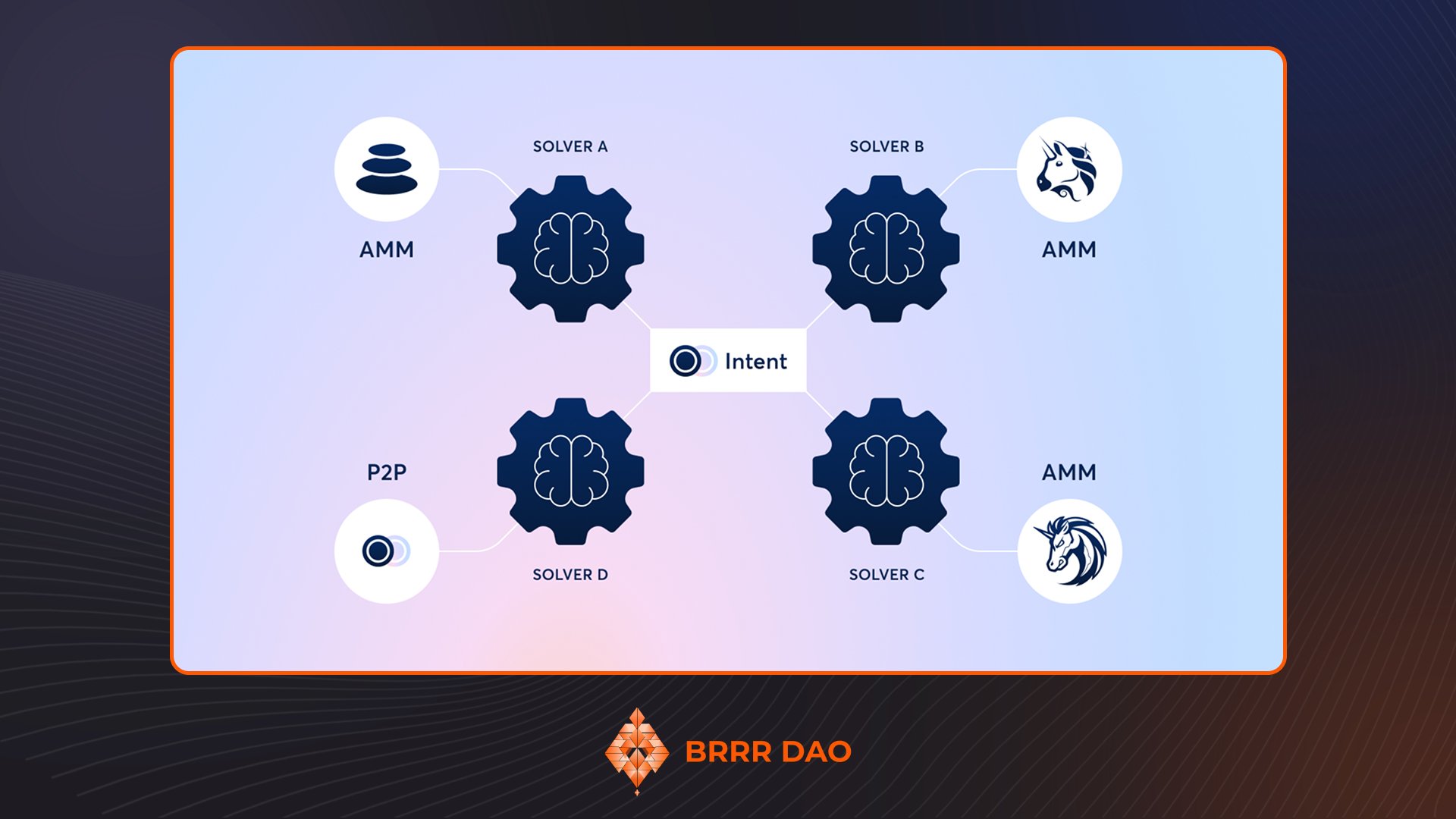

The result? A structured marketplace where transaction inclusion is determined by open bidding rather than opaque relationships or brute-force gas wars. By leveraging orderflow marketplace blockchain solutions, modular MEV auctions empower both users and protocols to optimize execution strategies while minimizing adverse selection risks.

Key Benefits of Modular MEV Auctions for DeFi Traders

-

Fairer Transaction Ordering: Modular MEV auctions leverage Proposer-Builder Separation (PBS) to reduce front-running and sandwich attacks, enabling more equitable transaction inclusion for all traders. This structured approach helps prevent manipulative practices that have historically disadvantaged regular DeFi users.

-

Lower Transaction Costs: By introducing competitive bidding for block space and processing transactions in batches, modular MEV auctions can reduce gas fees and slippage compared to traditional transaction ordering methods.

-

Enhanced Execution Reliability: Many modular MEV auction systems implement failure cost penalties, which incentivize block builders to fulfill their commitments. This mechanism improves execution quality and reliability for DeFi traders.

-

Greater Transparency and User Choice: Platforms like Arrakis Finance and Monoceros offer modular MEV solutions that increase transparency around transaction flows and allow users to participate in or opt out of auctions, aligning incentives and empowering traders.

-

Mitigation of MEV Extraction Risks: By restructuring how transactions are prioritized, modular MEV auctions reduce the risk of value extraction from users, helping to create a more secure and efficient DeFi environment.

Tackling New Challenges: Centralization and Reliability Risks

No innovation comes without trade-offs. As modular MEV auctions gain traction, concerns about centralization have surfaced. Execution auctions can favor dominant bidders, potentially leading to concentration among a few powerful builders who consistently win rights to assemble blocks.

This risk is not merely theoretical; recent research highlights how unchecked auction dynamics could erode decentralization over time. To counterbalance this trend, some platforms implement mechanisms like failure cost penalties, which penalize auction winners who fail to deliver on their commitments. These measures help ensure reliability while maintaining fairness in transaction execution.

A Glimpse Into Real-Time Auction Data and Analytics

The transparency offered by modular MEV solutions extends beyond just fairer execution. With access to real-time auction data and advanced analytics tools, traders can analyze orderflow trends, monitor builder performance, and adapt their strategies dynamically, a significant leap forward compared to legacy systems.

Access to granular, real-time auction data is a game changer for participants in the DeFi ecosystem. By surfacing live metrics on bid distribution, blockspace utilization, and auction outcomes, modular MEV platforms empower traders and protocols to make informed decisions. This visibility not only demystifies the block construction process but also brings a level of accountability that was previously missing in opaque mempool environments.

For active traders, the ability to monitor builder reliability and historical execution quality can mean the difference between capturing alpha and suffering slippage. Protocols can integrate these analytics to fine-tune their routing logic, allocating order flow where it’s most likely to receive optimal execution. This feedback loop between market data and strategy drives a more adaptive, and ultimately more efficient, DeFi marketplace.

Why Robust Blockspace Market Solutions Matter

The evolution from gas wars to structured blockspace markets marks a pivotal shift for DeFi. In traditional settings, users were forced into bidding wars with unpredictable costs and uncertain outcomes. Modular MEV auctions replace this chaos with predictable pricing mechanisms and clear rules of engagement.

By leveraging robust blockspace market solutions, protocols can guarantee transaction inclusion at agreed-upon prices or leverage batch processing to further reduce costs. This not only supports institutional-grade strategies but also democratizes access for smaller traders by lowering barriers to entry.

Key Features of Advanced Modular MEV Auction Solutions

-

Proposer-Builder Separation (PBS): Modular MEV auctions leverage PBS to decouple block proposing from block building, enabling specialized builders to compete for transaction inclusion and reducing single-party control.

-

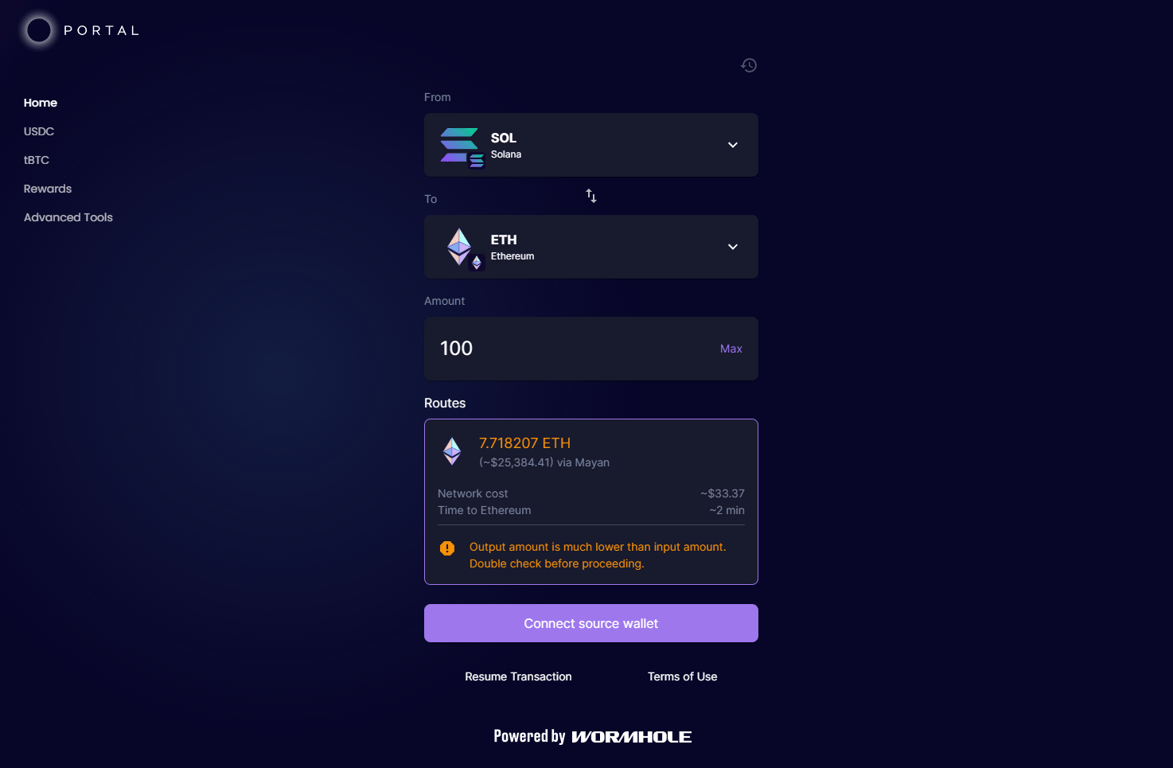

Private Transaction Pools: Platforms like MEV-Relay provide private mempools, protecting users from front-running and sandwich attacks by keeping transaction details confidential until block inclusion.

-

Sealed-Bid Blockspace Auctions: Solutions such as MEV-Geth implement sealed-bid auctions for blockspace, fostering fair competition among builders and minimizing manipulative practices.

-

Dynamic Fee Mechanisms: Protocols like Semantic Layer enable applications to set custom transaction execution policies and dynamic fees, helping to mitigate Loss Versus Rebalancing (LVR) and optimize user outcomes.

-

Failure Cost Penalties: Some modular MEV auction systems introduce penalties for entities that fail to fulfill their auction commitments, incentivizing reliable and high-quality transaction execution.

-

Order Flow Auctions (OFAs): Platforms such as Monoceros use OFAs to batch user orders and auction them, redistributing value back to users and lowering transaction costs.

-

Transparency and Open Participation: Leading solutions emphasize transparent auction processes and open access for builders and proposers, reducing the risk of centralization and fostering a fairer DeFi ecosystem.

Furthermore, these platforms are evolving rapidly, incorporating mechanisms like dynamic fee adjustments and semantic layers that allow applications to customize transaction execution according to their unique needs. The result is a flexible ecosystem where both users and protocols can avoid predatory MEV extraction while maximizing returns.

The Road Ahead: Continuous Innovation and Vigilance

While modular MEV auctions offer undeniable improvements over legacy models, continuous innovation remains essential. Developers must remain vigilant against the risks of centralization by experimenting with new incentive structures or rotating builder roles. Community-driven governance could play an outsized role here, ensuring that no single entity dominates block construction over time.

The future of transaction execution in DeFi will likely be defined by platforms that combine transparency, competition, and adaptability. As more protocols adopt these paradigms, and as analytics tools become increasingly sophisticated, the DeFi landscape will move closer to true efficiency without sacrificing fairness or decentralization.

If you’re looking to dig deeper into how modular MEV auctions are reshaping decentralized finance, explore our detailed analysis at How Modular MEV Auctions Enhance Transaction Efficiency in Decentralized Finance.