In the rapidly evolving world of decentralized finance (DeFi), the persistent threat of front-running and Maximal Extractable Value (MEV) continues to challenge the integrity and efficiency of blockchain markets. As DeFi matures, so too do the tactics used by sophisticated actors to extract value from unsuspecting users, often at their direct expense. This dynamic has spurred a wave of innovation in market design, with periodic auctions emerging as a promising solution to these systemic issues.

The Mechanics Behind MEV and Front-Running

To understand why periodic auctions are gaining traction, it’s essential to first grasp how MEV and front-running operate within current blockspace market architecture. MEV represents the additional value that miners, validators, or other privileged protocol actors can extract by reordering, including, or excluding transactions within a block. A particularly predatory form is front-running: when an attacker sees a pending transaction in the mempool and inserts their own transaction just before it, typically by paying a higher gas fee, to capitalize on predictable price movements.

This behavior is not theoretical; it is an everyday occurrence in DeFi markets, as highlighted in recent analyses such as this glossary entry on front-running. The result? Users face increased slippage, higher costs, and a loss of trust in on-chain trading mechanisms.

Periodic Auctions: Leveling the Playing Field

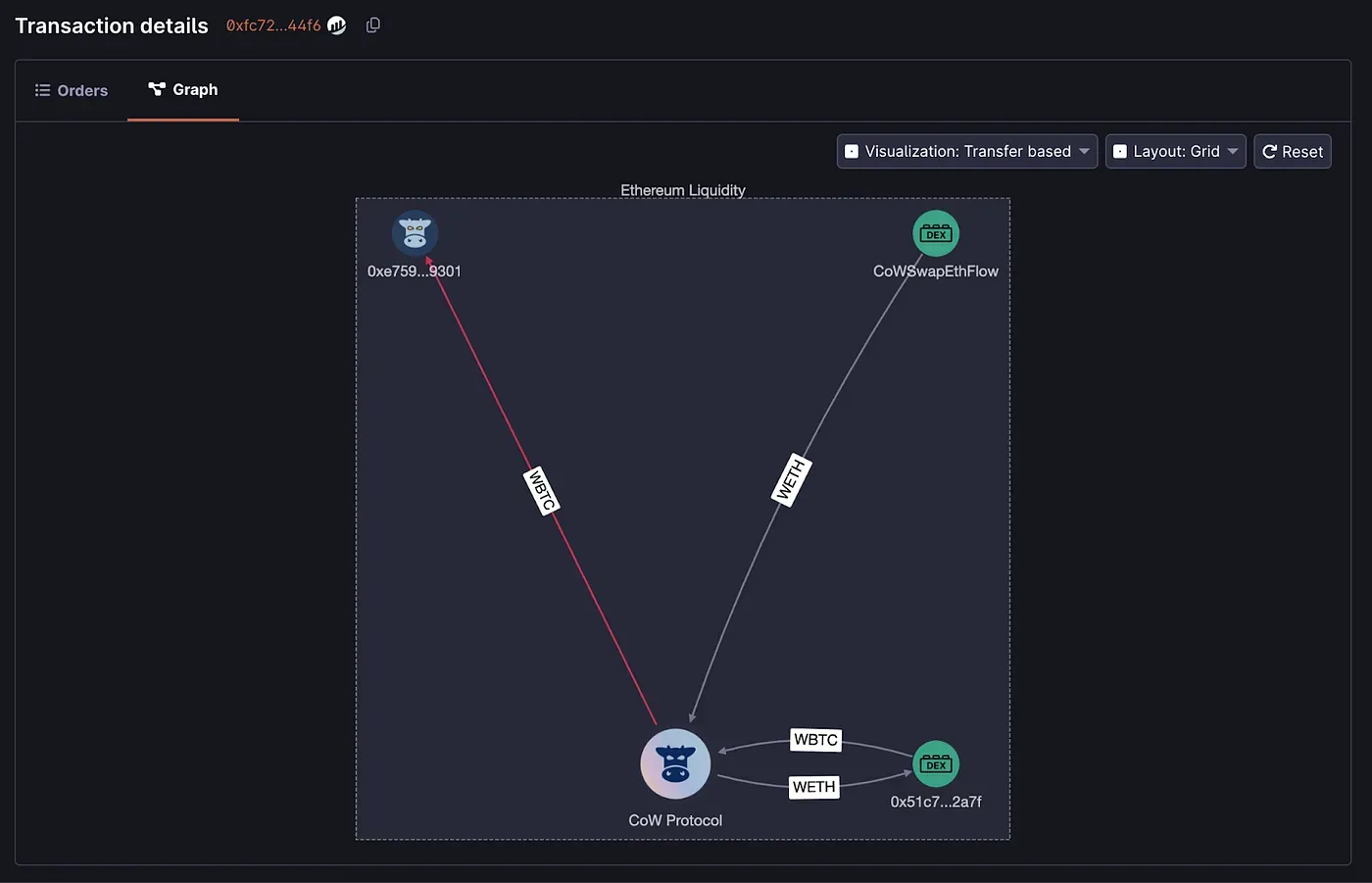

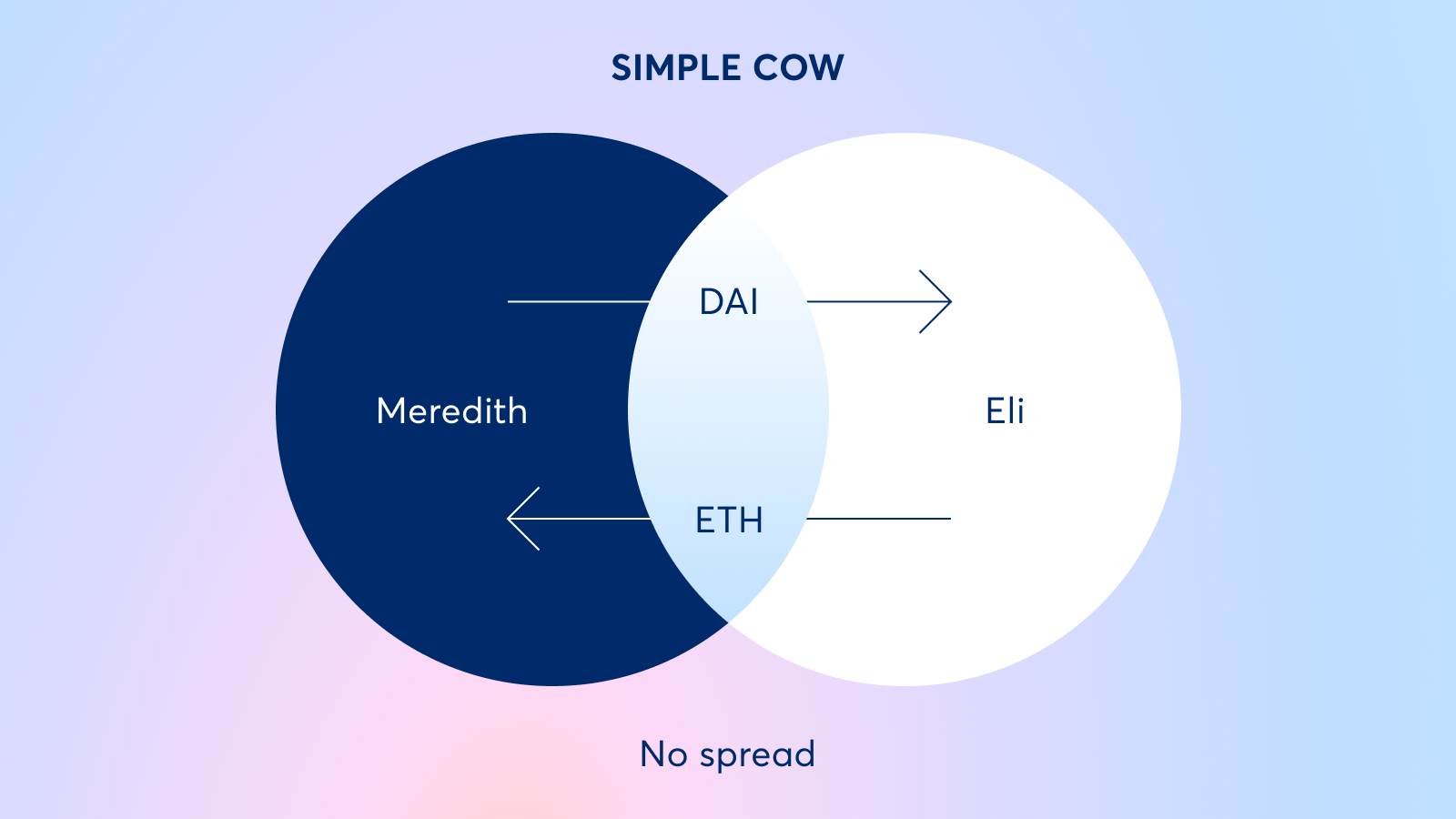

Periodic auctions, also known as batch auctions, fundamentally change how orders are processed on-chain. Rather than executing each transaction sequentially as it arrives, which exposes users to MEV attacks, batch auctions collect orders over a defined period and execute them all at once at a uniform clearing price. This approach dramatically reduces the predictability of transaction ordering and eliminates opportunities for attackers to insert or reorder trades for profit.

This method isn’t just theoretical; platforms like CoW Protocol have successfully implemented batch auctions to mitigate MEV risks. According to recent research from cryptodamus.io, batch execution ensures fairer pricing for all participants, regardless of when they submit their orders within the auction window.

Key Advantages of Periodic Auctions in DeFi

-

Elimination of Front-Running and Sandwich Attacks: By executing all trades in a batch at a uniform price, periodic auctions prevent malicious actors from inserting transactions before or after others, effectively neutralizing front-running and sandwich attacks. Example: CoW Protocol utilizes batch auctions to protect users from these exploitative strategies.

-

Fairer and More Transparent Pricing: Periodic auctions aggregate orders and match them at a single clearing price, ensuring that all participants receive the same rate. This reduces price manipulation and slippage, leading to a more equitable trading experience.

-

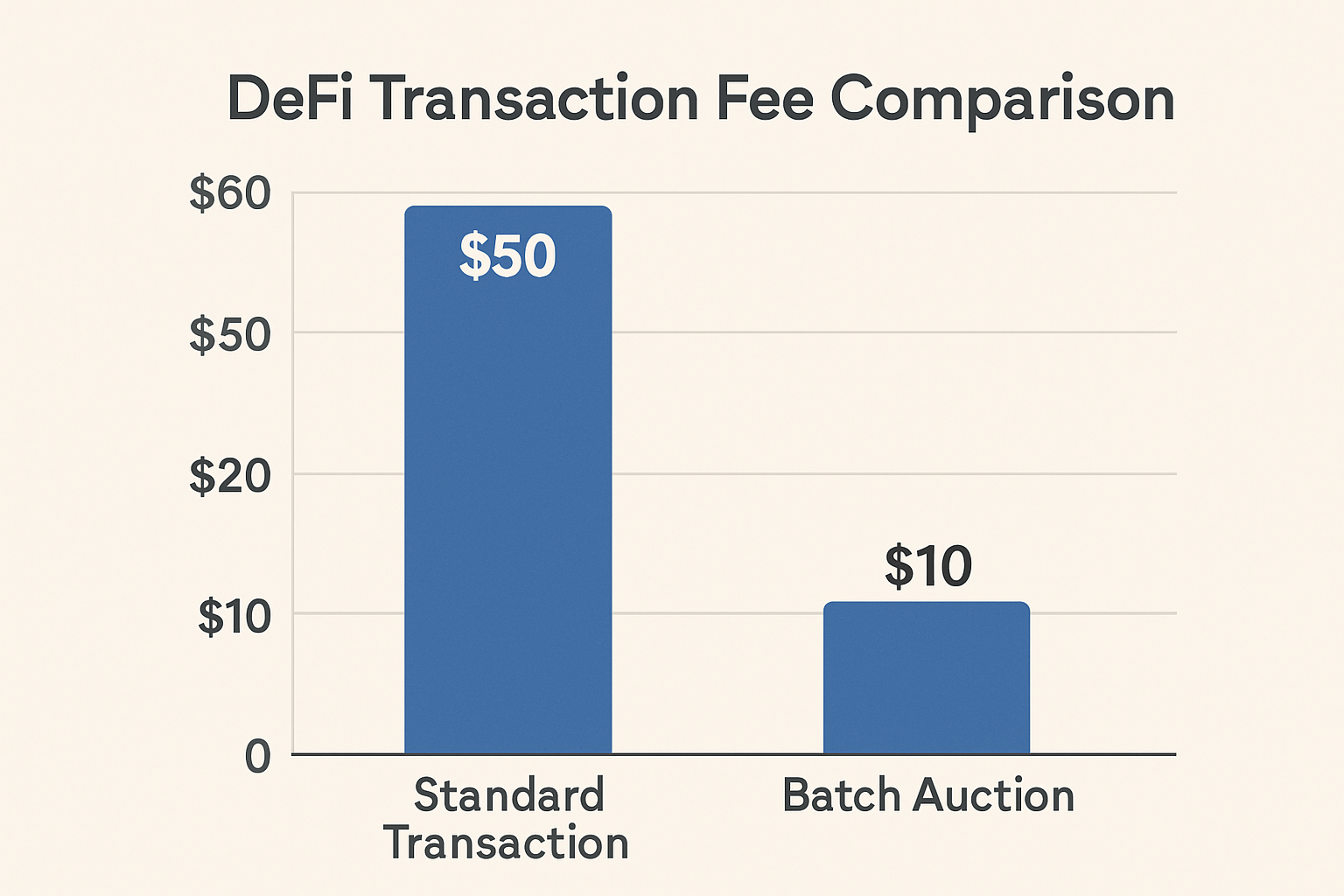

Reduced Transaction Fee Competition: Since transactions are grouped and ordered together, there is less incentive for users to overpay on gas fees to secure priority, which helps lower overall transaction costs across the protocol.

-

Enhanced Market Integrity and Security: By making transaction ordering unpredictable, periodic auctions make it much harder for attackers to exploit price movements, thereby strengthening the security and integrity of DeFi markets.

-

Scalability for Protocols and DEXs: Platforms implementing periodic auctions, such as CoW Protocol, demonstrate that batching can efficiently process a high volume of trades, supporting scalability as DeFi adoption grows.

The Role of Modular MEV Auctions in On-Chain Fairness

The rise of modular architectures has enabled platforms like Modular Mev Auctions to offer robust solutions tailored for efficient orderflow management and transparent blockspace allocation. By integrating periodic auction mechanisms directly into their infrastructure, these platforms empower both traders and developers with tools that minimize risk while maximizing execution quality.

Key features include:

- Real-time auction analytics: Providing transparency into orderflow dynamics and clearing prices.

- Advanced batch processing: Grouping user transactions for simultaneous settlement at market-clearing prices.

- User protection: Reducing exposure to sandwich attacks and slippage by obscuring individual order intent until execution.

This proactive approach aligns with recent findings from Volt Capital’s overview on blockspace markets: sealed-bid auction models not only optimize profitability but also enhance fairness across ecosystems. The modularity further allows for seamless integration with other DeFi protocols seeking more secure transaction environments.

As the DeFi landscape grows more competitive, the need for transparent and equitable trading environments has never been clearer. Periodic auctions, with their batch-based settlement, represent a tangible step forward in this direction. By obscuring the precise order of transactions until the auction closes, these mechanisms neutralize the information asymmetry that front-runners have historically exploited.

From a user perspective, this means less uncertainty and greater confidence in on-chain activity. For developers and protocol designers, integrating periodic auctions into their stack can reduce systemic risk and foster deeper liquidity. As more projects move toward modular MEV auctions, we’re witnessing a shift from adversarial to collaborative market structures, where value is distributed more evenly among participants rather than siphoned off by a privileged few.

Challenges and Considerations for Widespread Adoption

Despite their clear benefits, periodic auctions are not without trade-offs. One major consideration is latency: because orders are grouped over a period rather than executed instantly, traders must accept some delay between order submission and execution. In highly volatile markets, this can introduce new forms of risk or opportunity cost.

Additionally, implementing robust batch auction logic at scale requires careful engineering, both at the smart contract level and within off-chain infrastructure that manages orderflow. Security audits become paramount as the complexity of these systems increases. Still, as highlighted by recent developments in MEV mitigation, these challenges are surmountable with thoughtful design and community engagement.

Looking Ahead: The Future of DeFi Transaction Optimization

The adoption of periodic auctions across leading blockspace markets signals an industry-wide commitment to fairer trading practices. As modular MEV auction platforms continue to evolve, offering advanced analytics, customizable auction parameters, and seamless integrations, we can expect even greater protection against predatory tactics like front-running and sandwich attacks.

Ultimately, the success of on-chain auction mechanisms will hinge on their ability to balance efficiency with fairness. For institutional traders seeking optimal execution or individual users demanding transparency, batch auctions offer a compelling model for sustainable growth in decentralized finance.