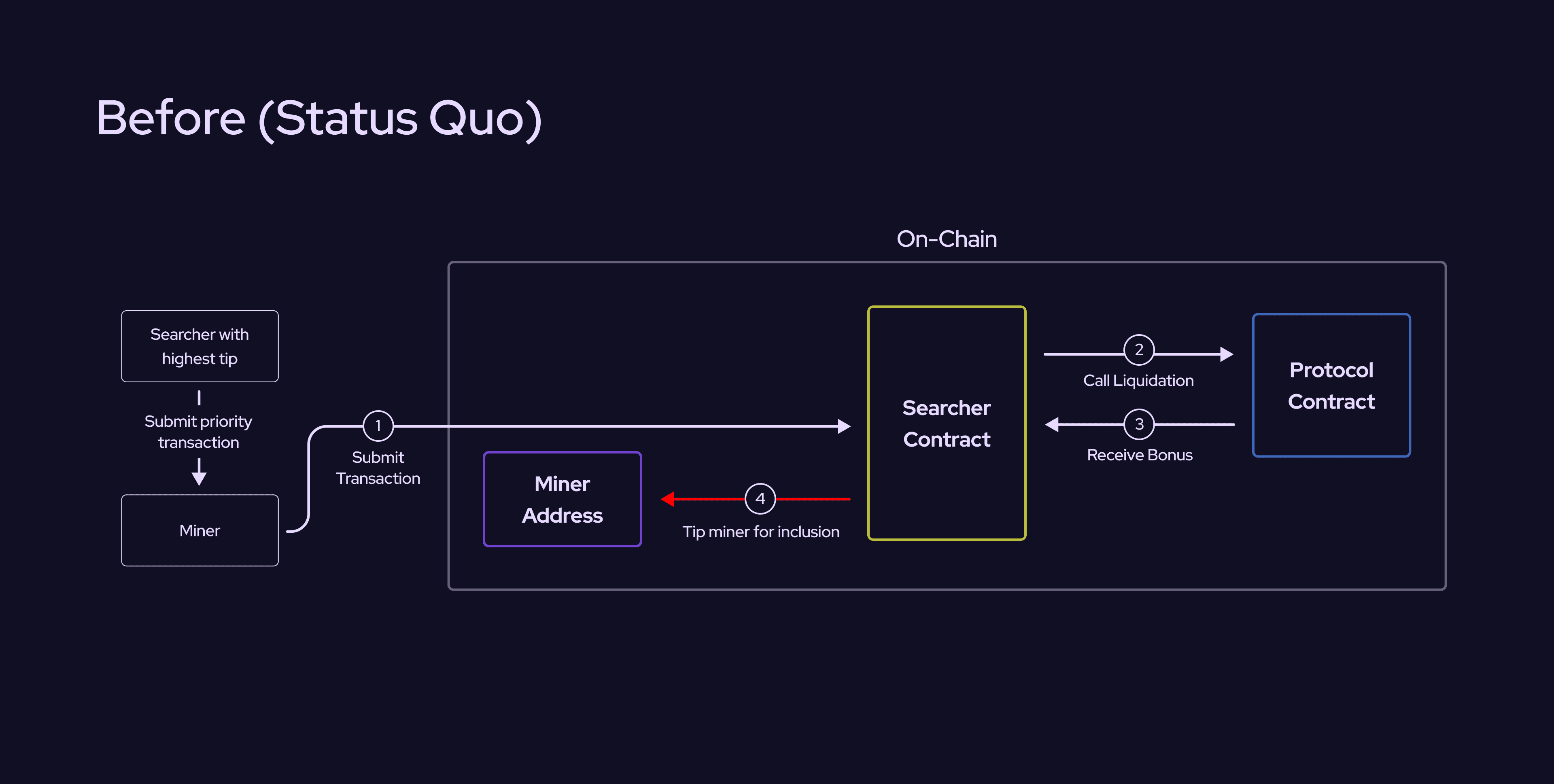

Decentralized finance (DeFi) has always promised open, permissionless markets, but the rise of Maximal Extractable Value (MEV) revealed cracks in that vision. Traditional DeFi transactions exposed users to MEV exploits: adversaries could manipulate transaction ordering, front-run trades, or sandwich users with predatory strategies. This resulted in higher costs and unpredictable execution for everyday traders. Enter intent-based MEV auctions: a new paradigm that’s rapidly transforming real-time orderflow and the economics of blockspace allocation.

From Raw Orderflow to Intent-Based Auctions: A Shift in DeFi Transaction Dynamics

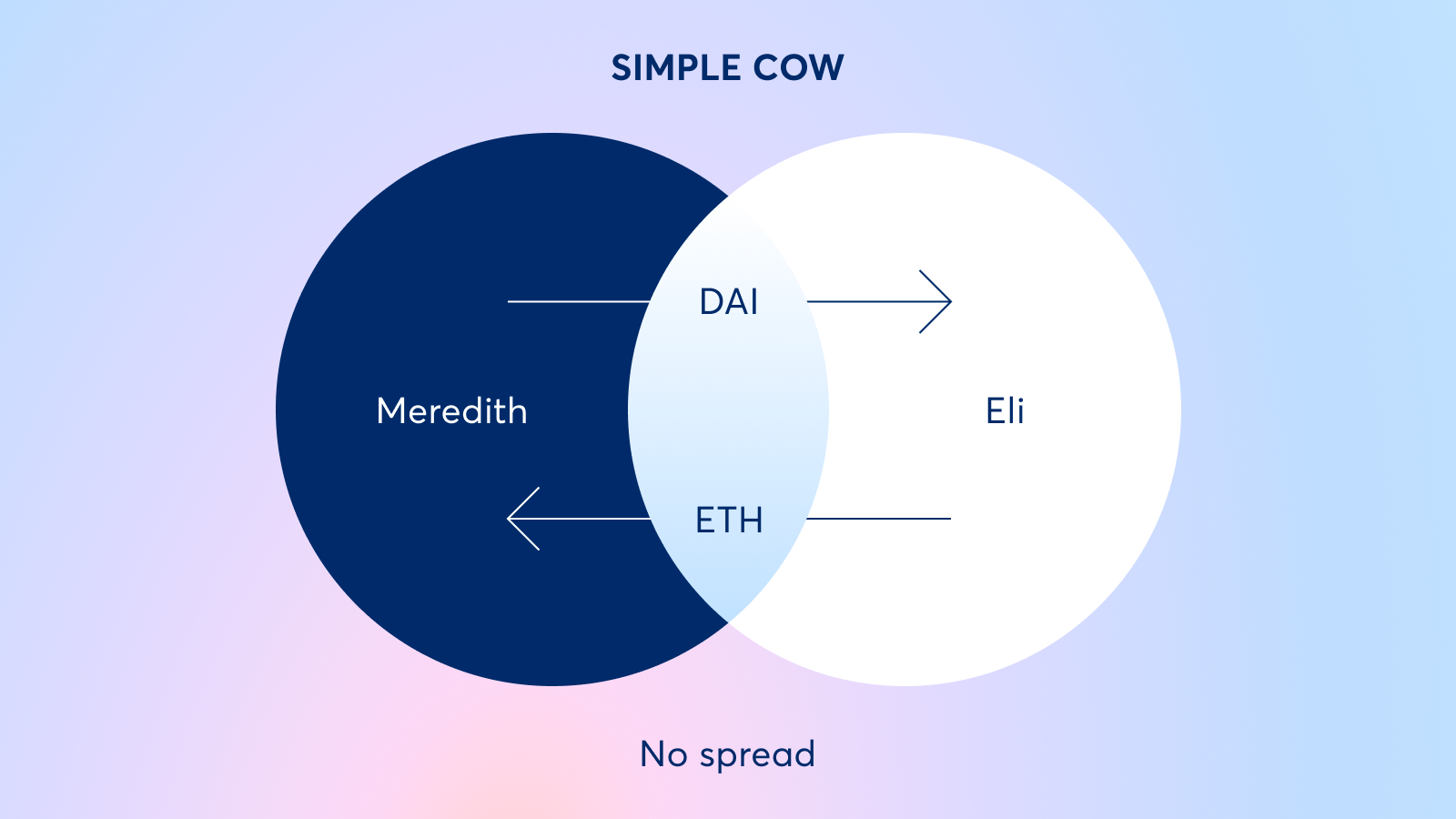

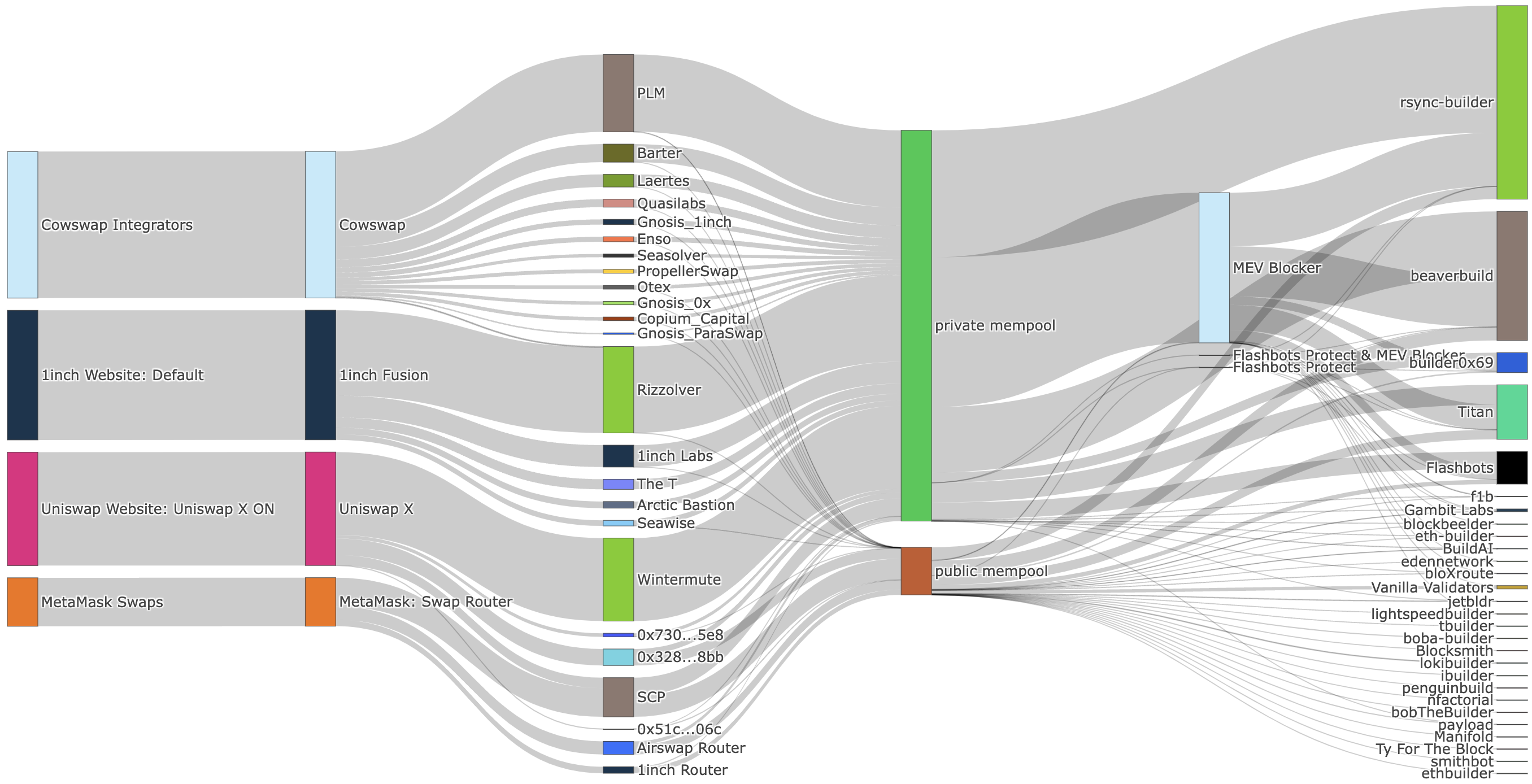

Historically, DeFi users submitted transactions directly to public mempools, where anyone could observe and exploit them. With order flow auctions, users instead send their orders (or “intents”) to a third-party auction. Specialized searchers then bid for exclusive rights to execute these intents, competing on price and efficiency. This approach is at the heart of platforms like CoW Protocol and UniswapX, which have reimagined how value is distributed in DeFi markets.

The innovation lies in abstracting away the granular details of execution from the user. Instead of specifying how a swap or trade should be routed or executed on-chain, users simply express what they want, for example, “Swap 5 ETH for as much USDC as possible. ” Solvers then compete to fulfill this intent with optimal pricing and minimal slippage. The result? Users enjoy better outcomes without worrying about gas wars or being front-run by bots.

Key Benefits: Efficiency, User Experience, and Robust MEV Protection

Top 5 Benefits of Intent-Based MEV Auctions in DeFi

-

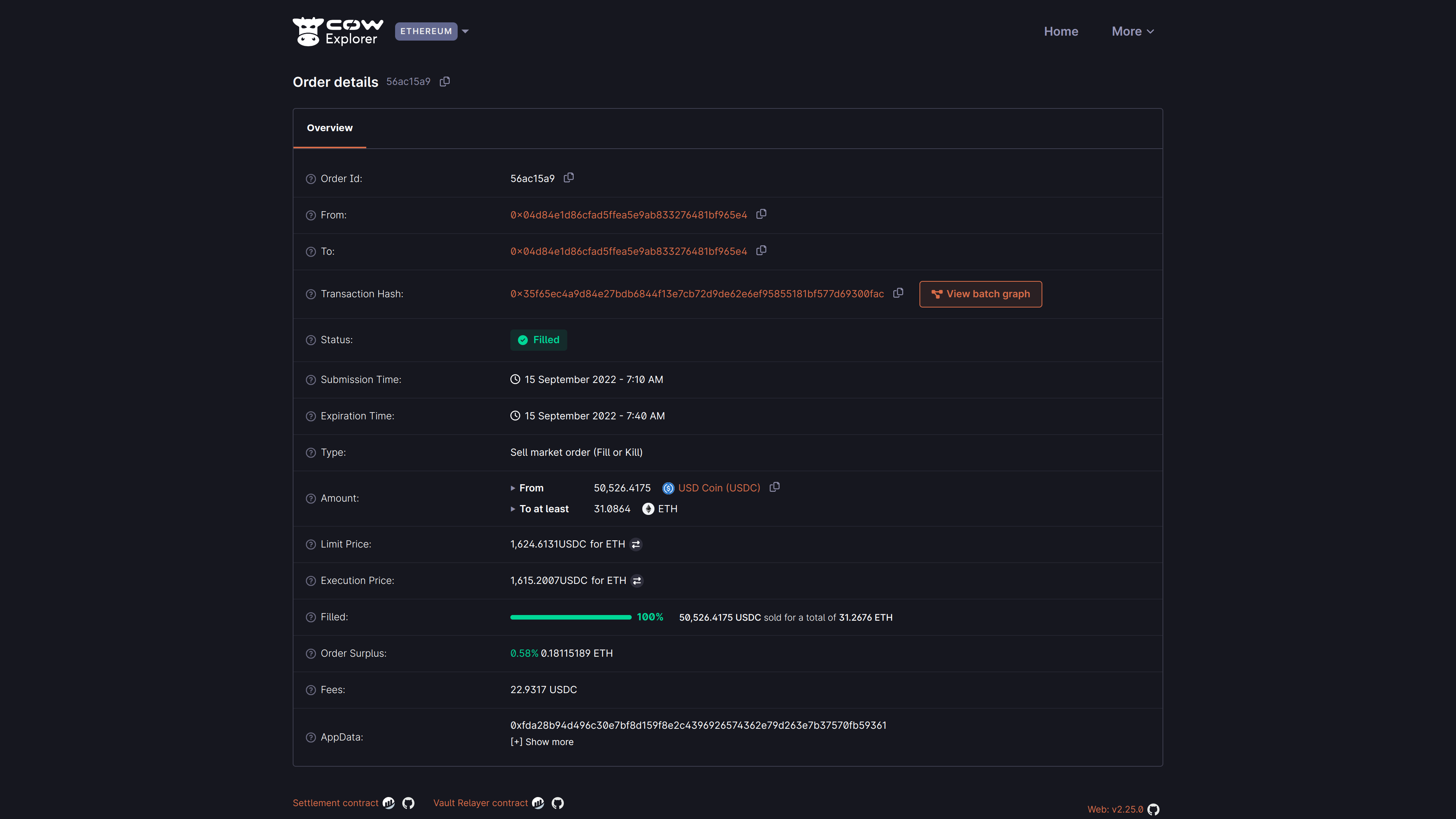

Superior Execution Quality: Intent-based MEV auctions allow solvers to compete for the right to fulfill user orders, often resulting in better pricing and reduced fees. Platforms like CoW Protocol use batch auctions and solver networks to aggregate liquidity and minimize MEV exploitation, directly benefiting traders.

-

Enhanced User Experience: By abstracting away complex elements such as gas fees and transaction routing, intent-based systems make DeFi more accessible and user-friendly. Users simply state their desired outcome, while the system handles the technical execution, as seen with UniswapX.

-

Effective MEV Protection: Intent-based auctions shield users from common MEV attacks like front-running and sandwich attacks by removing transactions from public mempools. This design, implemented by platforms such as 1inch Fusion, transfers MEV risk to solvers rather than users.

-

Optimized Gas Costs: Many intent-based platforms, including 1inch Fusion and UniswapX, offer gasless or gas-optimized transactions. This reduces trading costs for users and lowers the barrier to entry for new DeFi participants.

-

Greater Market Efficiency and Fairness: By enabling open competition among solvers and aggregating order flow, intent-based MEV auctions improve price discovery and market fairness. This mechanism ensures that value created by user orders is more equitably distributed, benefiting both traders and protocols.

This model delivers several transformative advantages:

- Improved Execution Quality: Solvers aggregate liquidity across sources and batch orders together, often resulting in better prices than single-venue trades.

- Simplified User Experience: By delegating execution logic to solver networks, platforms like CoW Protocol remove complexity around gas fees and routing decisions (source). Traders can focus on outcomes rather than mechanics.

- MEV Protection: Since intents are handled off-chain or within private pools before settlement, common attacks like front-running become far less effective (source). The risk shifts from user to solver, who must price it into their bids, creating fairer markets overall.

- Blockspace Market Optimization: By efficiently matching intents with solvers’ strategies in real time, these systems help allocate scarce blockspace where it’s most valuable (source). This is crucial as network congestion grows alongside adoption.

- Ecosystem Interoperability: Intent-based models can aggregate liquidity across multiple DEXs and chains without requiring users to navigate complex bridges or interfaces.

Pioneering Protocols Leading the Charge

The shift toward intent-based orderflow isn’t just theoretical, it’s already reshaping live markets. Here are three standout implementations making waves:

- CoW Protocol: Pioneers batch auctions with solver competition to minimize MEV attacks while maximizing user returns. Its solver network aggregates liquidity across DEXs for optimal execution (source).

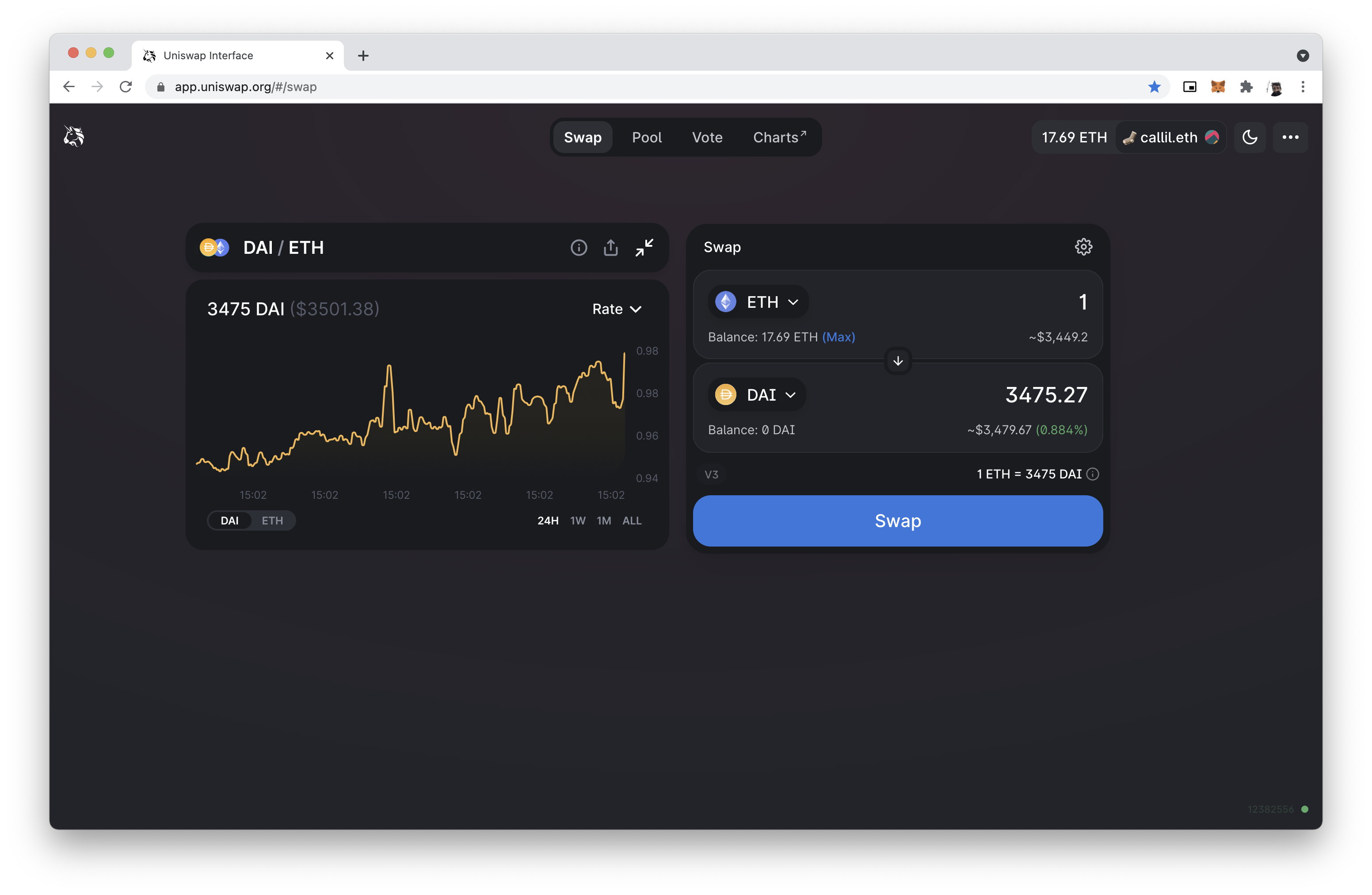

- UniswapX: An evolution of Uniswap that leverages Dutch auctions and solver networks for improved pricing and gas-free swaps (source). It abstracts away transaction complexity so users only care about results.

- 1inch Fusion: Introduces Dutch auctions with resolver competition for optimized gas costs and built-in MEV protection, enabling gasless trades without sacrificing price quality (source).

The Future of Real-Time Orderflow: What’s Next?

This new architecture doesn’t just protect traders, it also unlocks more efficient blockspace markets by routing orderflow through competitive auctions rather than static mempool queues. As more protocols adopt intent-driven models, we’ll likely see continued improvements in decentralized finance transaction efficiency, security against extraction attacks, and seamless cross-chain interoperability.

Real-time orderflow in DeFi is entering a new era, where the competition among solvers for user intents is driving both transparency and efficiency. Protocols are leveraging intent-based MEV auctions to create a more neutral playing field, one where users can finally recapture some of the value that was previously siphoned off by predatory actors lurking in public mempools.

But this transformation is not just about user protection. It’s about blockspace market optimization. As Ethereum and other blockchains continue to experience congestion, the ability to allocate scarce blockspace based on competitive bidding for execution rights becomes essential. Intent-based auctions are paving the way for dynamic, real-time allocation of transaction slots, ensuring that blockspace goes to its highest and best use.

How Intent-Based Auctions Empower Builders and Traders

For developers and protocols, intent-based models open up new design spaces. Solvers can be programmed with custom strategies, allowing protocols to experiment with different auction formats (batch vs. Dutch), privacy levels (private pools vs. encrypted mempools), and cross-chain execution mechanisms. This flexibility drives rapid innovation while maintaining robust MEV protection tools for end-users.

- Developers: Can plug into open orderflow marketplaces or build their own solver infrastructure, tapping into new revenue streams by capturing solver fees or offering premium execution.

- Traders: Gain access to improved pricing, lower slippage, and reduced gas costs, all without needing to understand complex routing algorithms or mempool dynamics.

- Protocols: Benefit from higher user trust and increased trading volumes as a result of transparent auction mechanics and minimized extraction risks.

Challenges Ahead: Privacy, Incentives, and Fairness

No system is perfect yet. As intent-based orderflow grows in popularity, several challenges remain at the forefront:

- Privacy leakages: Even with private pools or encrypted submissions, sophisticated adversaries could attempt inference attacks on batched transactions or solver behaviors (source).

- Solver centralization: If only a few solvers dominate auctions due to technical prowess or capital resources, decentralization could suffer, reintroducing single points of failure or rent extraction.

- Auction design complexity: Crafting mechanisms that balance fairness (for users), profitability (for solvers), and efficiency (for protocols) remains an ongoing research challenge (source).

The good news? The modular nature of these systems means they can iterate quickly. Protocols like CoW Protocol and UniswapX are already experimenting with layered privacy solutions, diverse solver incentives, and flexible auction parameters, all aimed at refining the ecosystem’s resilience against evolving threats.

Top Intent-Based MEV Protection Tools for 2025

-

CoW Protocol: A pioneer in intent-based trading, CoW Protocol leverages batch auctions and a decentralized solver network to aggregate liquidity and minimize MEV attacks. Its design removes user transactions from the public mempool, protecting traders from front-running and sandwich attacks while optimizing execution quality.

-

UniswapX: As the next evolution of Uniswap, UniswapX introduces Dutch auctions and solver competition to deliver improved pricing and gas-free trading. Its intent-based architecture ensures that users benefit from MEV protection and seamless order execution across multiple liquidity sources.

-

1inch Fusion: 1inch Fusion brings Dutch auction mechanics and resolver competition to the forefront, enabling gasless swaps and robust MEV protection. By allowing users to submit trade intents, Fusion ensures optimal pricing and shields traders from value extraction exploits.

-

MEV Blocker: Developed by a consortium including CoW Protocol, Gnosis, and Beaver Build, MEV Blocker is an RPC endpoint that routes user transactions through an order flow auction, providing privacy and minimizing MEV risks at the builder level.

-

Flashbots MEV-Share: Flashbots MEV-Share enables users to selectively submit transaction data to an order flow auction, allowing searchers to compete for execution while protecting sensitive transaction details and reducing exposure to MEV extraction.

Why This Matters Now: The Competitive Edge in DeFi

If you’re a trader looking for an edge, or a protocol builder seeking stickier liquidity, the rise of intent-based MEV auctions is impossible to ignore. These systems are not just theoretical upgrades; they’re live today on major platforms, quietly reshaping how value flows through decentralized markets.

The next wave will likely see even more granular customization options for expressing intents (think: conditional orders or multi-step workflows) as well as deeper integrations across L1s and L2s. The endgame? A composable DeFi stack where users express what they want, and the entire network competes to deliver it efficiently, securely, and fairly.

The age of raw mempool exposure is ending. As intent-based architectures become standard across DeFi’s most innovative protocols, expect real-time orderflow to become smarter, and far more user-centric, than ever before.