In decentralized finance, the pursuit of fair execution in MEV auctions is more than a technical challenge – it’s a fundamental question of value distribution and network sustainability. As Ethereum and other blockchains evolve, the mechanisms for extracting and distributing Maximal Extractable Value (MEV) have grown increasingly sophisticated. Yet, the core dilemma remains: how can we ensure that rewards are shared equitably among builders, node operators, and protocol treasuries, without undermining decentralization or efficiency?

Understanding MEV Auctions: The Modular Landscape

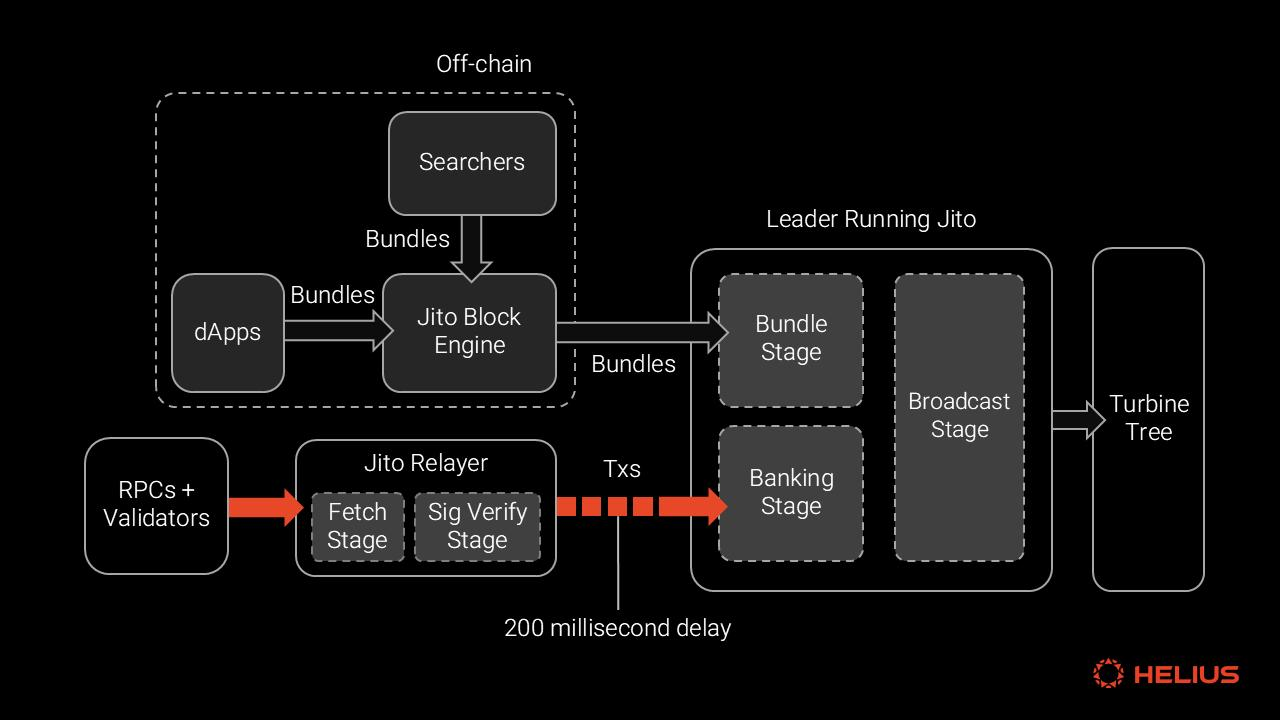

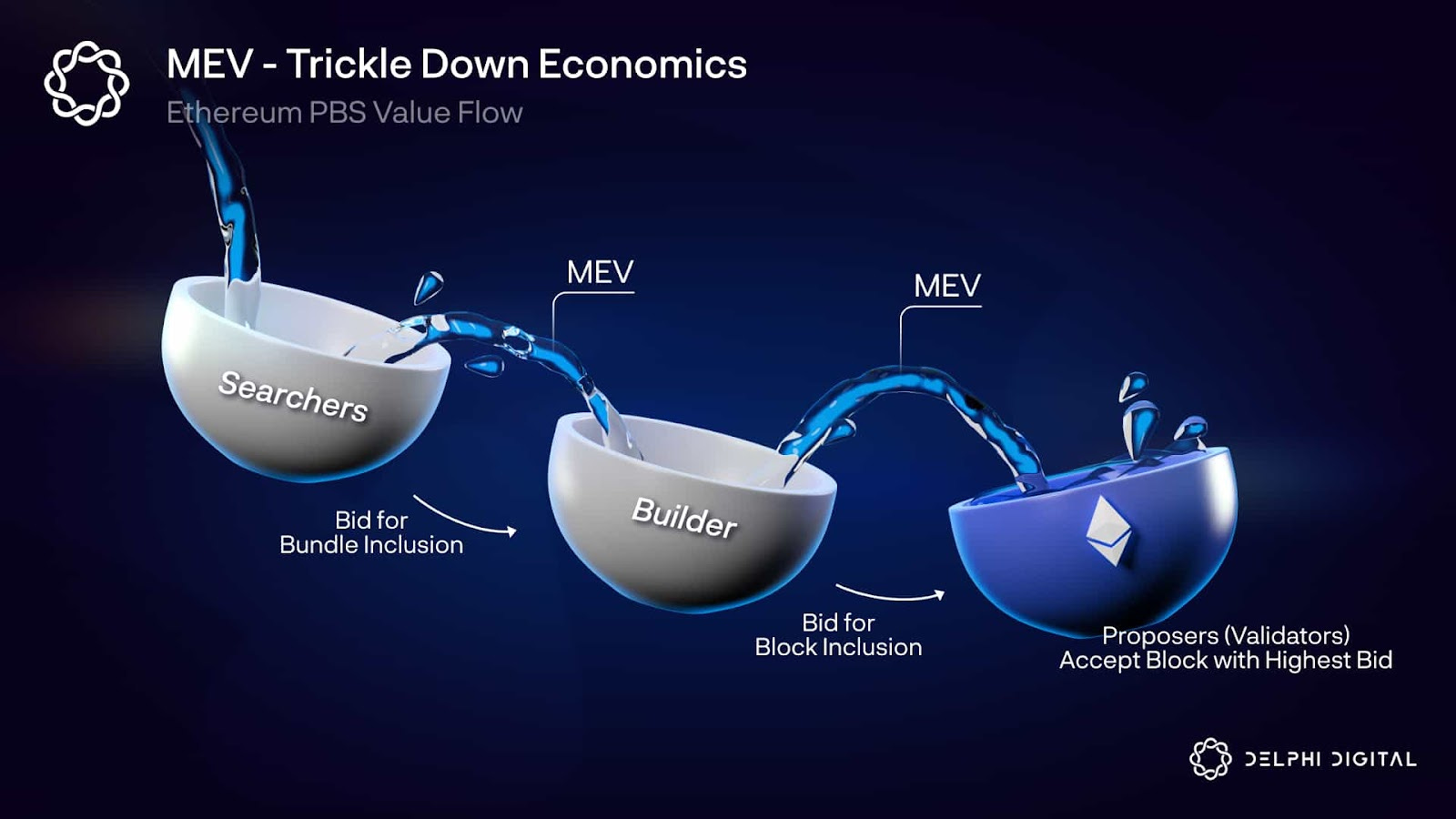

MEV auctions have become the backbone of modern blockspace markets. In these systems, specialized block builders aggregate transactions from searchers and public/private orderflow, constructing blocks optimized for maximum value extraction. Validators (node operators) then select from competing bids via mechanisms like MEV-Boost, outsourcing block production to the highest bidder.

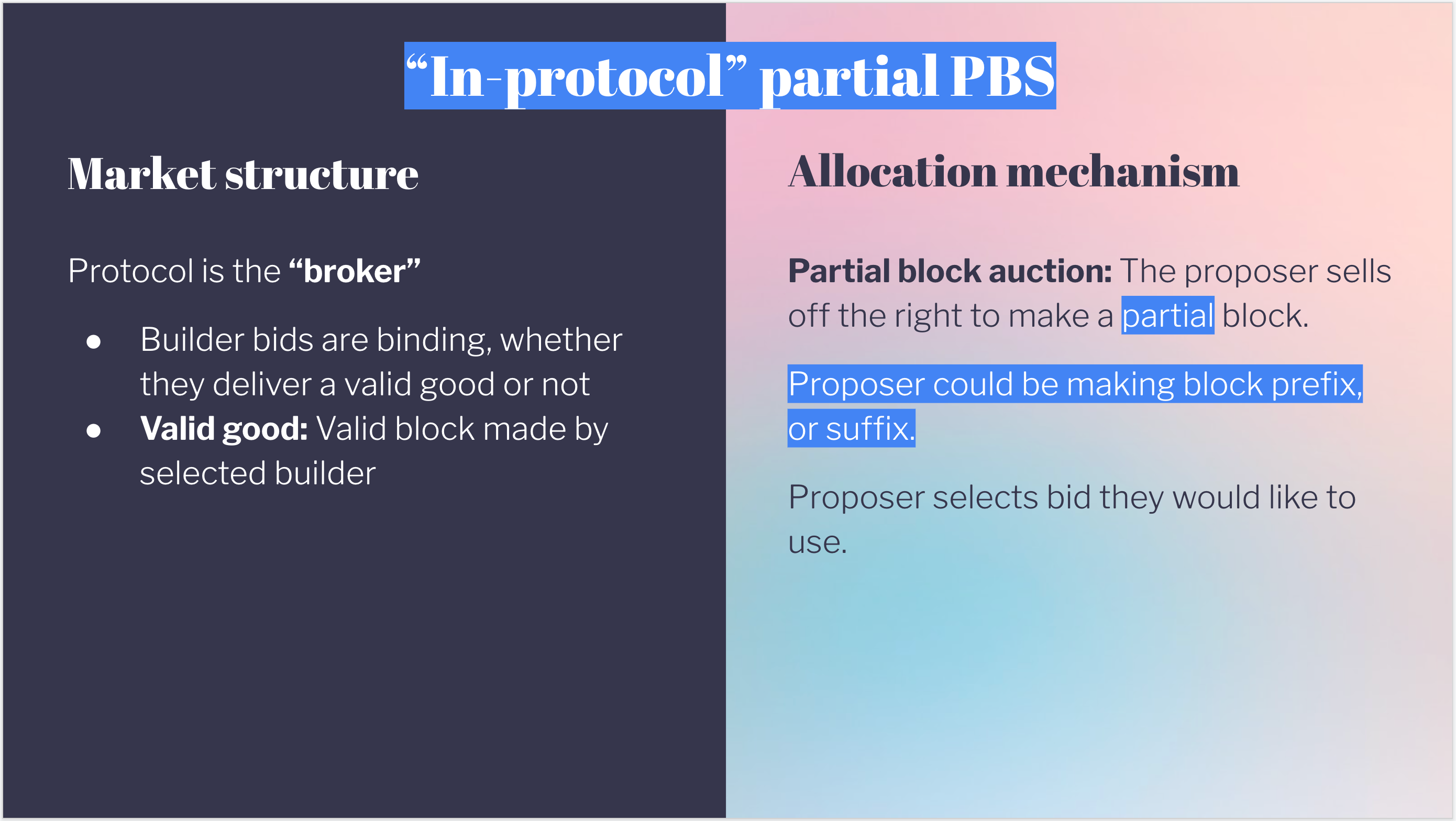

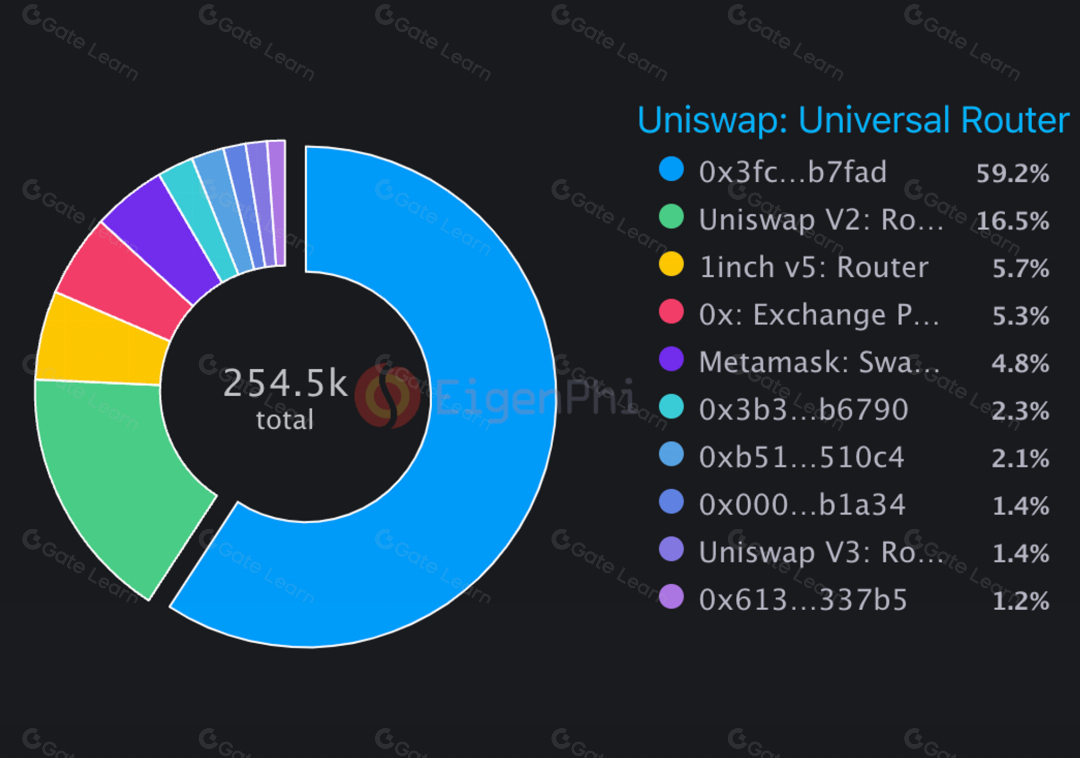

This separation – known as Proposer-Builder Separation (PBS) – was designed to decentralize power and reduce manipulation risk. However, real-world data shows that a handful of dominant builders now capture a disproportionate share of rewards. Meanwhile, staking pools like Lido concentrate validator power, raising concerns about both centralization and the fairness of reward allocation.

The Challenge: Centralization vs. Fairness in Reward Distribution

Current MEV distribution mechanisms create a value chain where:

- Builders earn execution rewards by optimizing transaction order for maximum profit.

- Validators receive both consensus rewards (issuance) and execution rewards (MEV and tips).

- Treasuries, if included at all, often receive only protocol-level fees.

This setup incentivizes technical prowess and low-latency infrastructure – but it also leads to oligopolistic dynamics. Builders with privileged access to private orderflow or superior network connectivity can outcompete others consistently. As noted in recent research (arxiv.org), this reduces auction efficiency and undermines the original intent of PBS.

Key Problems in Fair Execution for Modular MEV Auctions

-

Builder Centralization: A small number of specialized builders, such as those leveraging Flashbots infrastructure, dominate MEV-Boost auctions. This oligopoly reduces competition and undermines the intended decentralization of MEV extraction.

-

Validator Concentration: Large staking pools like Lido control significant portions of validator power, leading to disproportionate MEV reward distribution and raising concerns about network centralization.

-

Unequal Access to Private Order Flow: Builders with privileged access to private order flows can outcompete others, leading to unfair advantages and reduced auction efficiency.

-

Lack of Transparent and Fair Revenue Sharing: Current mechanisms do not guarantee equitable MEV distribution among builders, validators, and transaction originators, often sidelining smaller participants and users.

-

Latency and Network Advantage Exploitation: Builders with superior network connectivity can submit winning bids more efficiently, exacerbating centralization and undermining fair competition.

-

Insufficient Incentives for Protocol-Level Fairness: Without mechanisms like MEV burning or Shapley value redistribution, protocol-level incentives remain misaligned, failing to ensure fair value sharing across all stakeholders.

The result is a system where rational actors maximize their own returns but may not contribute to broader ecosystem health or user welfare. For DeFi protocols striving for longevity and trustless operation, this is an existential concern.

Toward Equitable Value Sharing: Emerging Models and Solutions

The industry is actively exploring models that rebalance incentives while preserving competitiveness:

- MEV Burning: Auctioning off block proposal rights with the winning proposer committing to burn part of their extracted MEV. This reduces centralization by making hoarding less profitable (notes.ethereum.org).

- Shapley Value Redistribution: Applying cooperative game theory to allocate MEV based on each participant’s marginal contribution (arxiv.org). This could mean splitting rewards not just between builders and validators but also with transaction creators themselves.

- Decentralized Builder Networks: Initiatives like Flashbots’ BuilderNet aim to democratize block building by lowering entry barriers for new participants (gate.com). This enhances both fairness and resilience against collusion.

The interplay between technical innovation and incentive design is crucial here. Protocols must strike a balance between rewarding those who add measurable value (builders/operators), supporting network maintenance (treasury), and ensuring end-users aren’t left behind in a zero-sum contest among insiders.

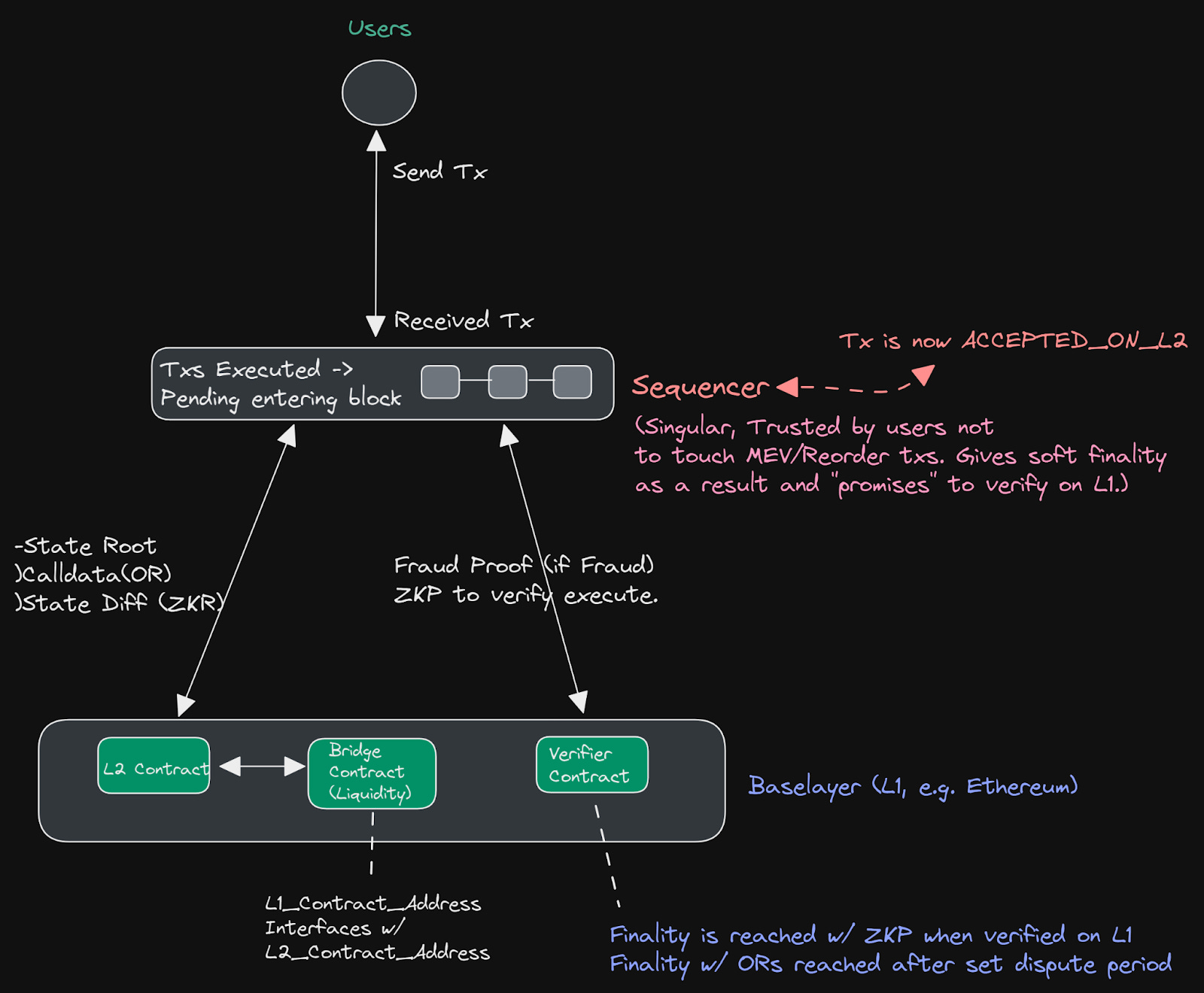

One of the most promising developments in fair execution MEV auctions is the integration of on-chain mechanisms that enforce transparent and verifiable reward allocation. For example, the use of Verifiable Random Functions (VRFs) in fair sequencing protocols can mitigate order manipulation by introducing cryptographic randomness to transaction ordering, thus leveling the playing field for all participants. These innovations are not just theoretical; they are actively shaping how blockspace markets operate and how value is shared across stakeholders.

The application of game-theoretic models, such as Shapley value-based redistribution, marks a significant shift from zero-sum competition to cooperative value sharing. By quantifying each actor’s marginal contribution to block profitability, protocols can automate reward splits that reflect actual economic input. This approach is particularly relevant for modular auction architectures, where orderflow providers, searchers, builders, and validators all play distinct yet interdependent roles.

Designing Incentive Structures: Balancing Builders, Treasury, and Node Operators

For modular MEV auctions to achieve sustainable growth and broad adoption, incentive structures must be both robust and adaptable. Protocol treasuries play a vital role here, receiving a portion of auction proceeds can fund ongoing research, security upgrades, and ecosystem grants. Node operators (validators) require predictable rewards to maintain infrastructure reliability. Builders need sufficient upside to justify investments in optimization and latency reduction.

Innovative Models for MEV Reward Distribution

-

MEV-Boost Auctions: Validators use MEV-Boost to outsource block production to specialized builders. Builders compete by submitting bids, and the highest bidder’s block is proposed, with rewards typically flowing to validators and, in some cases, shared with node operators. This model has increased validator rewards but faces centralization risks due to dominant builders.

-

Revenue Sharing via Proposer-Builder Separation (PBS): Under PBS, rewards from MEV extraction are split between block proposers (validators), builders, and, where implemented, node operators. This mechanism aims to decentralize block production and can be extended to allocate a portion of rewards to protocol treasuries for ecosystem funding.

-

MEV Burning: Proposed in Ethereum research, MEV Burning involves auctioning the right to propose a block, with the winning proposer required to burn a portion of the MEV. This reduces the concentration of profits, potentially benefits the protocol treasury, and discourages extractive behavior that harms network health.

-

Shapley Value Redistribution: Applying cooperative game theory, the Shapley value method redistributes MEV revenue among participants (builders, validators, node operators, and transaction originators) based on their marginal contribution to extracted value. This approach aims for mathematically fair allocation and has been explored in recent Ethereum research.

-

Decentralized Builder Networks (e.g., Flashbots BuilderNet): Flashbots BuilderNet and similar decentralized builder networks strive to distribute MEV rewards more equitably by reducing builder centralization and enabling a broader set of participants to earn rewards, including node operators and protocol treasuries.

Emerging proposals suggest dynamic fee splits that adjust based on network conditions or governance votes. For instance:

- Fixed percentage splits: Predefined ratios between builders, validators, and treasury ensure baseline funding but may lack flexibility.

- Performance-based allocation: Rewards scale with measurable contributions, such as block quality or inclusion of user orders, aligning incentives with network health.

- MEV burn mechanisms: Automatically reduce extractable profits by destroying a share of MEV at the protocol level; this directly benefits all token holders by reducing supply-side inflation (notes.ethereum.org).

The optimal design will likely combine elements from each model while incorporating feedback loops for community-driven adjustment, an approach already being piloted in several L2s and modular chains.

The Road Ahead: Building Trust Through Transparency

The next phase for reward distribution in modular auctions will hinge on radical transparency and open participation. On-chain analytics dashboards provide real-time insights into who captures value, and how much, enabling users to audit fairness claims independently. Open governance frameworks empower token holders to shape incentive policies directly rather than relying solely on protocol developers or insiders.

This paradigm shift is already influencing user behavior across DeFi ecosystems. As more protocols adopt fair execution principles and transparent reward flows, trust increases, not just among technical participants but also among end-users whose capital powers these networks. Ultimately, aligning incentives across builders, node operators, treasuries, and users is essential for unlocking the full potential of decentralized blockspace markets.