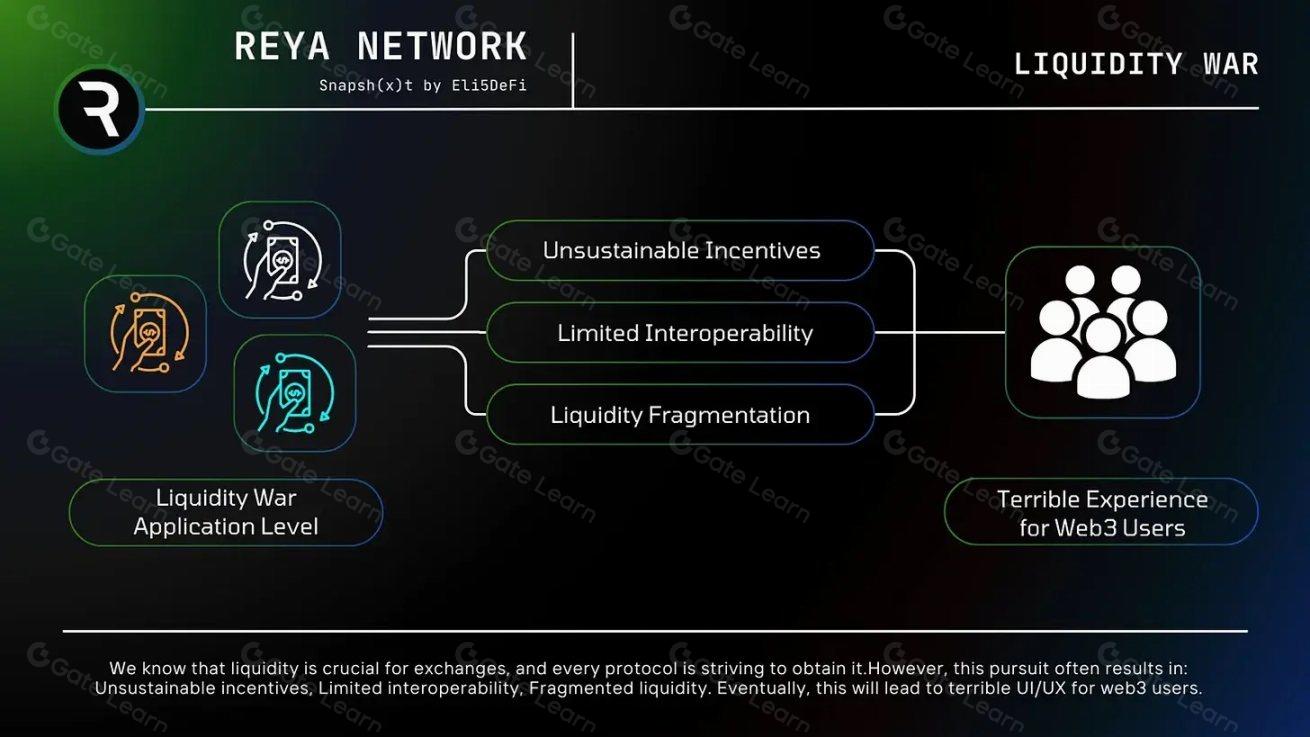

Liquidity fragmentation is one of the most persistent and misunderstood barriers to capital efficiency in decentralized finance (DeFi). As assets disperse across disparate blockchains, protocols, and liquidity pools, users and traders face higher slippage, increased transaction costs, and a fractured user experience. This phenomenon undermines DeFi’s promise of composability and seamless capital flow.

Why Liquidity Fragmentation Persists in DeFi

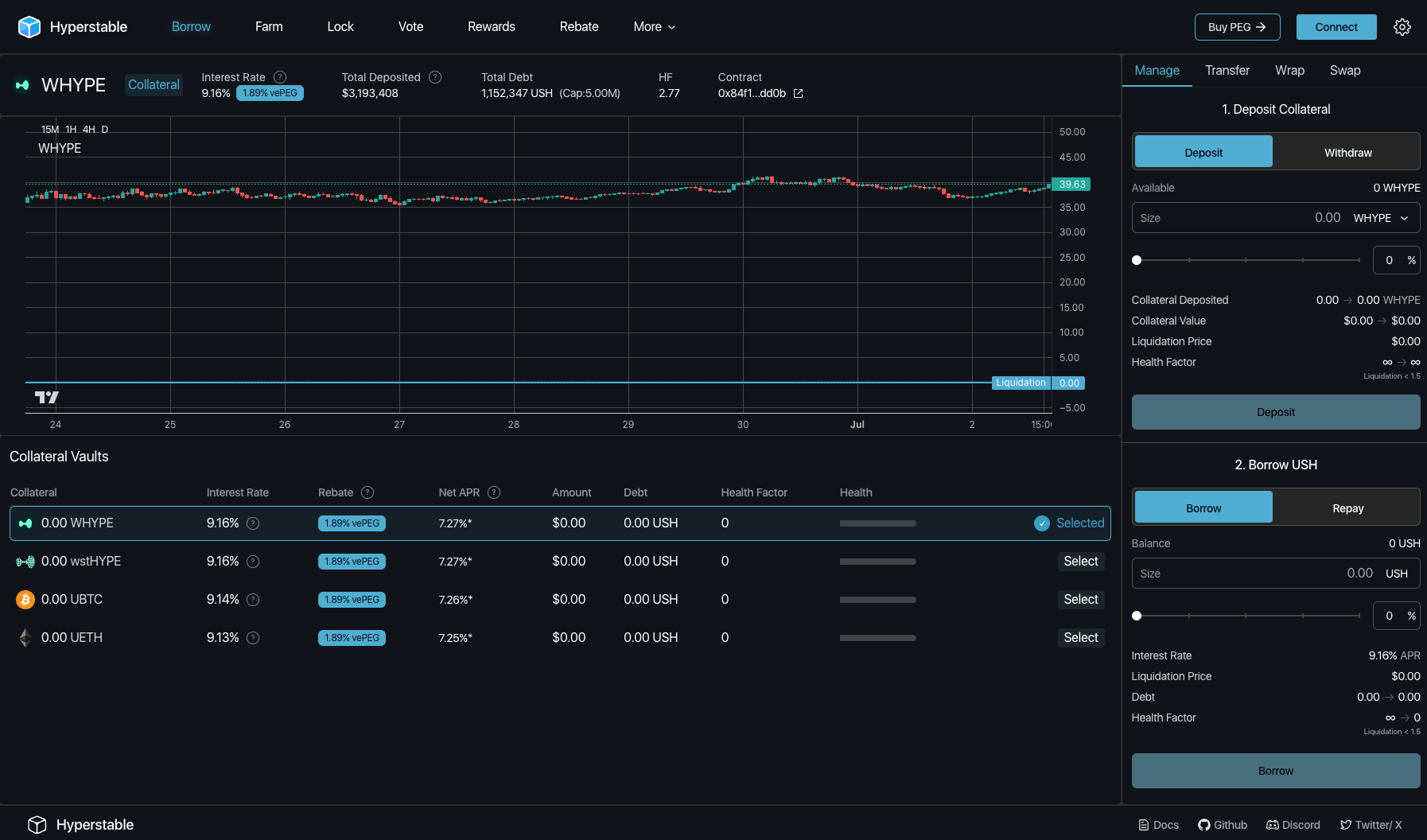

At its core, liquidity fragmentation DeFi is a structural byproduct of the multi-chain paradigm. Each blockchain operates as an isolated liquidity silo – Ethereum, Solana, Arbitrum, BNB Chain – with their own native pools and protocol-specific markets. Even within a single chain, competing protocols often split liquidity further. For example, lending protocols that restrict collateral types or AMMs that operate isolated pools for each asset pair exacerbate the issue (Mitosis University, Euler Finance).

This uneven distribution leads to inefficiencies:

- Poor price discovery: Thin orderbooks mean wider spreads and increased market impact for large trades.

- Higher slippage: Fragmented pools can’t absorb volume efficiently.

- User friction: Manual bridging or swapping across protocols is slow and costly.

- Capital inefficiency: Idle assets trapped in one protocol can’t be deployed elsewhere without overhead.

The result? Traders can’t reliably access best execution. Protocols struggle to attract deep liquidity. The entire ecosystem loses out on the network effects that drive sustainable growth.

The Rise of Modular Auction Solutions

Innovators are moving beyond patchwork bridges and basic aggregators to tackle fragmentation at its root: by building modular auction solutions designed for unified cross-chain liquidity management. These platforms aggregate orderflow across chains into a single auction or orderbook layer, letting users tap into deeper markets without manual intervention.

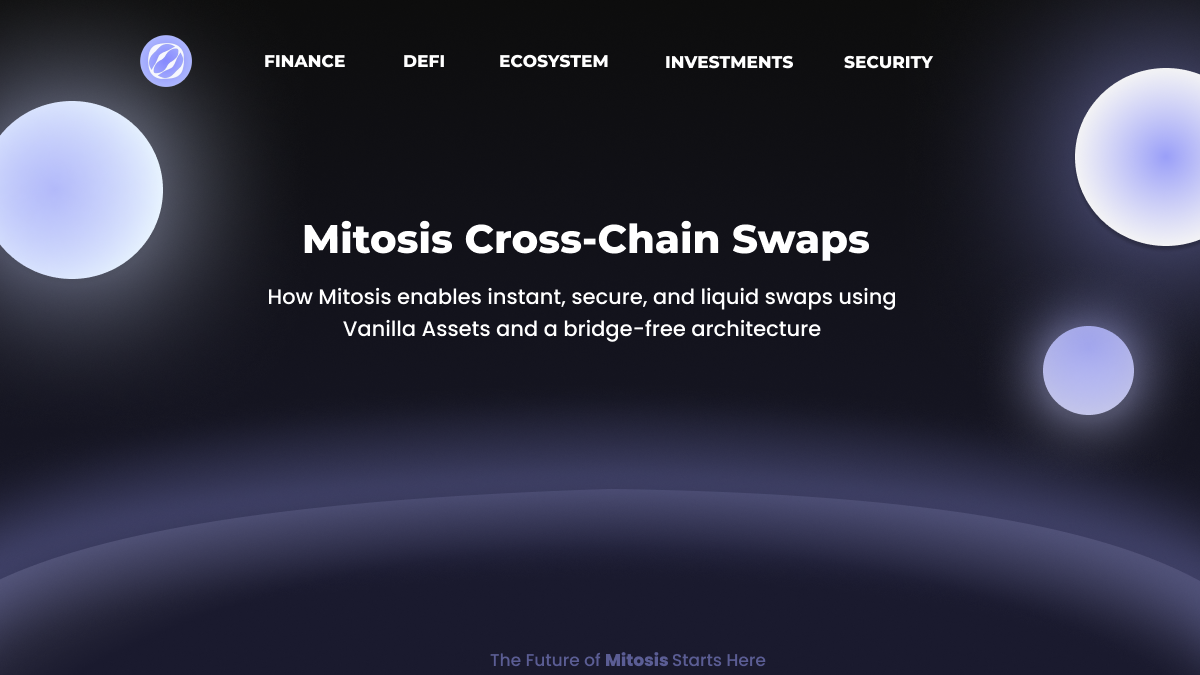

Mitosis exemplifies this new approach by introducing tokenized liquidity positions and programmable routing logic. Assets flow dynamically across chains based on real-time demand rather than static bridges or wrapped tokens (Mitosis University). Meanwhile, Orderly Network consolidates trading orders from multiple chains into a unified permissionless layer-2 orderbook – improving depth and execution quality for all participants (Orderly Network overview).

This architecture unlocks several advantages:

Key Benefits of Modular Auction Solutions in DeFi

-

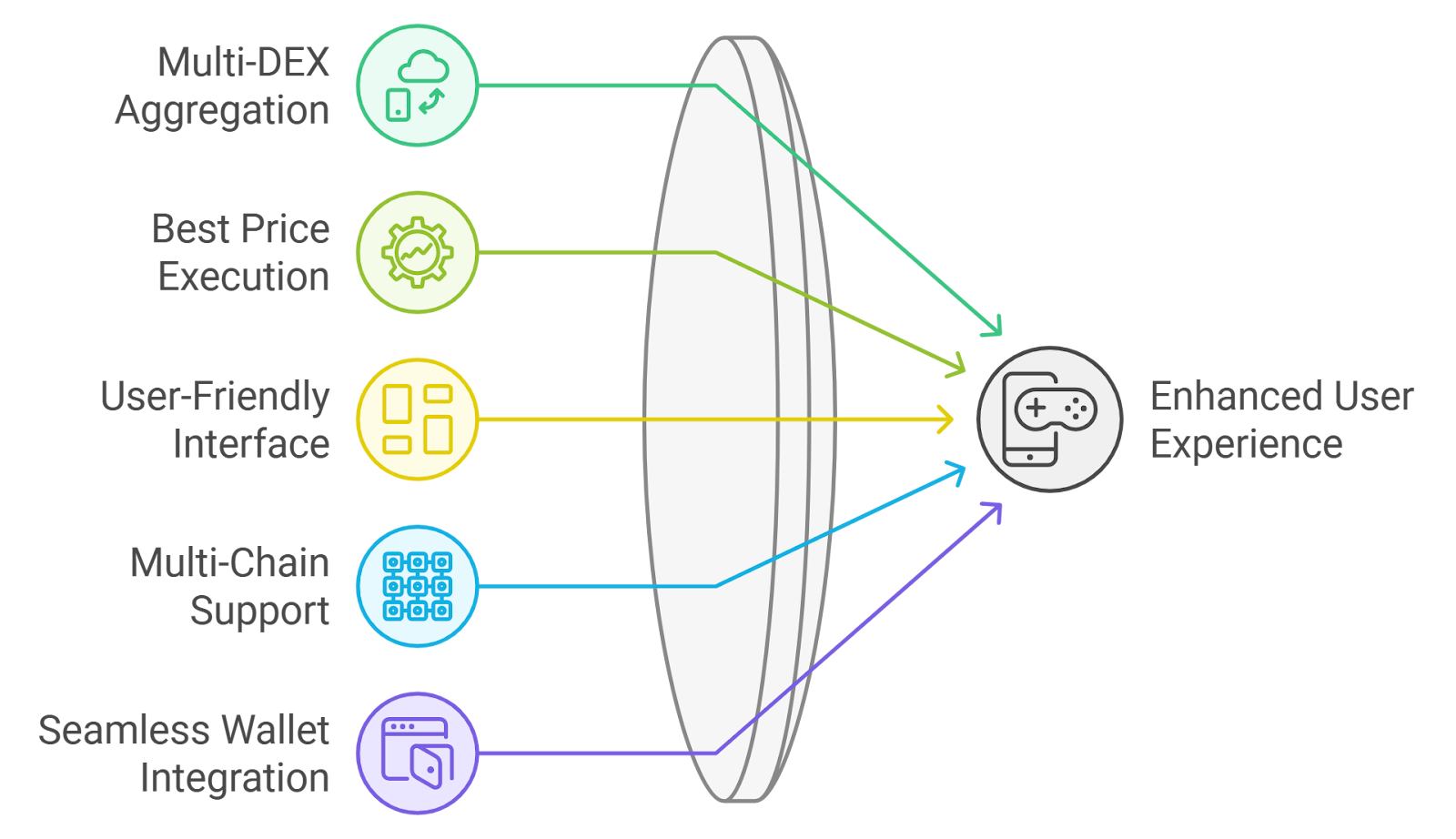

Unified Liquidity Pools: Modular auction solutions aggregate liquidity from multiple blockchains and protocols, reducing fragmentation and enabling users to access deeper liquidity for more efficient trading.

-

Enhanced Capital Efficiency: By consolidating fragmented assets, these solutions maximize capital utilization, reducing idle funds and improving yield opportunities for liquidity providers.

-

Lower Transaction Costs and Slippage: Aggregated liquidity leads to tighter spreads and less slippage, allowing users to execute trades at more favorable prices with reduced transaction fees.

-

Seamless Cross-Chain Asset Movement: Platforms like Mitosis enable tokenized and programmable liquidity, allowing assets to move dynamically across chains without manual bridging, streamlining user experience.

-

Improved Trading Efficiency: Solutions such as Orderly Network offer unified orderbooks across chains, enhancing order matching and liquidity depth for traders.

-

Strengthened DeFi Composability: By providing a modular architecture, these solutions foster interoperability between protocols, enabling more complex and innovative DeFi applications.

By abstracting away chain-specific complexity and focusing on unified auctions or orderbooks, modular solutions enable true cross-chain capital efficiency without sacrificing security or composability.

How Modular Auctions Transform DeFi Execution Quality

The practical impact of modular auctions is clear: reduced slippage due to deeper aggregated pools, lower transaction costs thanks to optimized routing logic, and improved price discovery as arbitrage opportunities shrink between chains. For high-frequency traders (HFTs) and sophisticated market makers seeking edge in MEV strategies, these platforms offer new venues for capturing value while minimizing operational risk.

A key differentiator is programmability: modular auctions allow developers to customize execution logic based on user intent or market conditions. This flexibility supports advanced strategies like batch auctions for large trades or dynamic fee models that reward early liquidity provision while deterring toxic flow.

Beyond the technical architecture, modular auction solutions are fundamentally shifting the incentives for both liquidity providers and traders. By aggregating cross-chain liquidity into a single, programmable layer, these platforms create a positive feedback loop: deeper liquidity attracts more order flow, which in turn incentivizes further liquidity provision. This virtuous cycle is critical for sustainable DeFi growth.

Moreover, unified auction layers reduce the reliance on manual bridging or fragmented routing protocols. Instead of users hunting for best execution across dozens of pools, capital can be deployed efficiently from a single interface. This streamlined experience is especially valuable for institutional market participants who demand low-latency, high-throughput execution without operational drag.

Challenges and Trade-Offs in Modular Liquidity Aggregation

While modular auction solutions present a compelling answer to liquidity fragmentation DeFi, they are not without trade-offs. Protocol designers must balance composability with security – aggregating assets across chains increases the attack surface for cross-chain exploits. Smart contract risk and governance complexity rise as more logic is abstracted into unified layers.

Another challenge lies in aligning incentives across heterogeneous chains and protocols. Fee models need to account for varying transaction costs and latency profiles. Governance frameworks must ensure fair participation and prevent centralization of routing logic or auction control.

- Security risks: Cross-chain messaging and asset movement introduce new vectors for smart contract exploits.

- Latency: Synchronizing state across chains can result in slower settlement or stale orderbooks if not engineered correctly.

- Complexity: Programmable auctions require robust testing to avoid unintended market behaviors or incentive misalignments.

The most successful modular auction platforms will be those that transparently address these risks while delivering clear benefits in terms of capital efficiency, composability, and user experience.

Key Differences: Fragmented Liquidity Pools vs. Modular Auction Solutions

-

Liquidity Distribution: Fragmented liquidity pools disperse assets across multiple blockchains and protocols, leading to isolated pockets of liquidity. In contrast, modular auction solutions aggregate liquidity from various sources into unified platforms, enabling deeper and more accessible liquidity.

-

Capital Efficiency: Fragmented pools often suffer from inefficient capital allocation, as assets are siloed and underutilized. Modular auction solutions optimize capital efficiency by allowing assets to move dynamically across chains, maximizing their utility and reducing idle capital.

-

User Experience: Fragmented pools require users to manually bridge assets and interact with multiple interfaces, increasing friction and complexity. Unified modular auctions streamline the process, offering a seamless trading experience through consolidated interfaces and cross-chain functionality.

-

Slippage and Transaction Costs: Liquidity fragmentation leads to higher slippage and increased transaction costs due to thin order books and limited depth. Modular auction solutions, such as those by Mitosis and Orderly Network, aggregate orders and liquidity, reducing slippage and costs for users.

-

Composability: Fragmented pools limit DeFi composability, making it difficult for protocols to interact and build on each other. Modular auction solutions enhance composability by providing unified liquidity layers that can be integrated across multiple protocols and chains.

What’s Next: The Future of Blockchain Liquidity Management

The trajectory is clear: as DeFi matures, the market will reward platforms that deliver seamless access to deep liquidity with minimal friction. Modular auctions are at the forefront of this evolution, enabling not just better prices but entirely new forms of programmable financial infrastructure.

Mitosis, Orderly Network, and similar projects are already demonstrating what’s possible when capital flows freely across chains. Expect continued innovation around permissionless orderflow aggregation, dynamic routing algorithms, and incentive structures tailored for high-frequency trading environments.

Which DeFi solution do you prefer for managing liquidity?

Liquidity fragmentation spreads assets across multiple blockchains, leading to higher costs and a fragmented user experience. Modular auction solutions aim to unify liquidity, offering better capital efficiency and seamless trading. Which approach do you think is best for DeFi?

The bottom line? Liquidity fragmentation may have been an unavoidable consequence of early DeFi architecture – but with modular auction solutions gaining traction, unified cross-chain markets are rapidly becoming the new standard for DeFi execution quality. For traders seeking edge and protocols striving for network effects, embracing these innovations will be essential in the next phase of decentralized finance.