In the high-stakes arena of blockchain transactions, low-priority fees often spell vulnerability. MEV bots and snipers thrive here, front-running trades and sandwiching orders to siphon value from unsuspecting users. These predatory tactics erode trust in DeFi, turning what should be fair execution into a battlefield. Yet, a new wave of MEV auctions is emerging as a strategic countermeasure, designed to neutralize these threats and restore balance to low-priority transactions.

Consider the mechanics at play. When traders opt for minimal gas fees to cut costs, their transactions languish in the mempool, ripe for exploitation. Snipers, armed with ultra-low latency infrastructure, detect these opportunities and insert their own orders ahead, capitalizing on price inefficiencies. MEV bots, meanwhile, orchestrate complex bundles to extract maximal value, often at the expense of retail participants. This dynamic not only inflates costs but distorts genuine market signals.

Dissecting the Sniper Threat in Token Launches

Token launches exemplify the sniper’s playground. Fresh liquidity pools draw instant attention, with bots bidding aggressively via priority fees to secure first-mover advantage. Ethereum Research highlights how snipers minimize exposure to volatility by flipping positions rapidly, preserving capital for the next hunt. But this efficiency comes at a cost to projects and early buyers, who face manipulated price discovery.

Enter specialized MEV auctions like ClankerSniperAuctionV0 on Base. This module auctions the right to execute the inaugural swap on new pools, capping at five auctions per pool over initial blocks. Bids leverage priority ordering, with proceeds split 80/20 between reward recipients and the factory. If no valid bids emerge, auctions cease, allowing organic flow. It’s a clever internalization of MEV, transforming predatory sniping into protocol revenue.

Arbitrum Timeboost: Promise Versus Reality

Arbitrum’s Timeboost aimed higher, offering an express lane via auctions to sidestep latency wars. Users bid for brief priority slots, theoretically democratizing access and curbing spam. In practice, however, centralization reigns: two entities dominate over 90% of wins, per recent arXiv analysis. Worse, 22% of boosted transactions revert, signaling persistent spam rather than mitigation.

This underscores a core tension in MEV transaction safeguards. Auctions can allocate blockspace, but without robust decentralization, they merely shift power to well-heeled players. Priority fee auctions on rollups exacerbate mis-ordering, as empirical data shows transactions landing out of sequence. For low-priority users, the result is unchanged: bots still prey on the slow lane.

Solana takes a different tack with Uniform Price Auctions for token launches. Bidders specify quantity and price; all pay the uniform clearing price at auction end, the lowest that exhausts supply. This nullifies priority fee races, as snipers gain no edge from jumping ahead. Blockworks notes it deters front-running outright, fostering equitable entry.

These models highlight evolving blockchain snipers protection. By auctioning sequencing rights or uniform outcomes, protocols claw back MEV from bots. Flashbots’ sealed-bid auctions pioneered this on Ethereum, evolving into bundle auctions where extracted value funds ‘shadow fees. ‘ Yet, for low-priority transactions, the paradox persists: bots must shield themselves from rivals, relying on private RPCs like MEV Blocker or Flashbots Protect.

CoW DAO’s intent-based solvers offer another layer, routing trades through protected endpoints to evade mempool predation. Traders setting low slippage tolerances add personal armor, limiting bot drainage. Still, as James Prestwich observes in his MEV retrospective, these patches treat symptoms, not the root: transaction ordering dependency.

Addressing this root requires rethinking blockspace allocation entirely. MEV auctions represent a pivot toward structured competition, where bots bid transparently rather than lurk in shadows. On Ethereum, Flashbots’ evolution from sealed-bid mechanisms to bundle auctions channels extracted value back as fees, softening the blow for low-fee users. But as Arkham Research illustrates with a bot netting 0.015 ETH after 0.0347 ETH priority fees, the spoils still favor the infrastructure-rich.

Modular MEV Auctions: Tailored Safeguards for Low-Priority Resilience

Platforms like Modular MEV Auctions step into this fray with precision-engineered orderflow marketplaces. By hosting real-time auctions for blockspace and sequencing rights, they empower traders to compete on merit, not just latency. Low-priority transactions gain protection through bundled safeguards: private mempools shield from snipers, while auction analytics reveal bot patterns in advance. This isn’t mere mitigation; it’s proactive value recapture, aligning incentives across the ecosystem.

For developers, modular components allow custom MEV modules, akin to ClankerSniperAuctionV0 but generalized. Imagine auctioning not just first swaps, but any vulnerable low-fee order. Traders benefit from dashboards tracking MEV bots low priority fee exploits, with tools to simulate outcomes. In a world where revert-based MEV plagues rollups, as arXiv studies confirm with mis-ordered placements, such modularity ensures efficient allocation without centralization pitfalls.

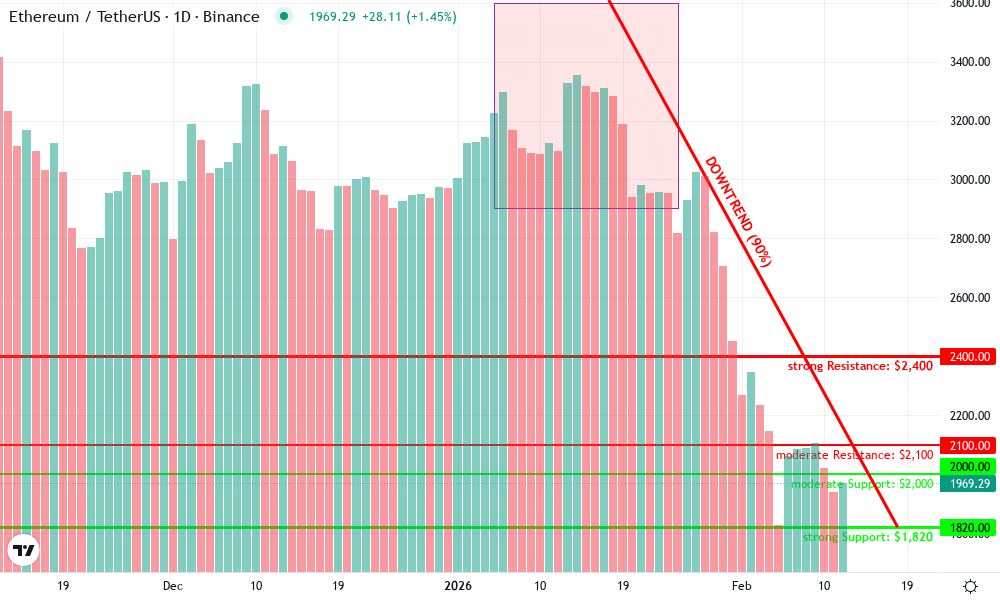

Ethereum Technical Analysis Chart

Analysis by Ava Stanton | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

To annotate this ETHUSDT chart in my balanced hybrid style, start by drawing a primary downtrend line connecting the January 2026 peak at approximately 2026-01-12 high of 3920 to the recent February low around 2026-02-18 at 1820, using ‘trend_line’ tool with red color for bearish bias. Add horizontal support at 1800-1820 (multiple touches) and resistance at 2400 (prior swing high). Overlay a Fibonacci retracement from the Jan peak to Feb low, highlighting 38.2% at ~2500 and 61.8% at ~2100 as potential reversal zones. Mark a consolidation rectangle from 2026-02-05 to present between 1820-1980. Use arrow_mark_down at MACD bearish divergence point around 2026-01-25, callout on volume spike during breakdown at 2026-02-01 noting ‘high volume confirmation’. Add text labels for key levels and a short_position marker near 1950 for medium-risk entry.

Risk Assessment: medium

Analysis: Clear downtrend with exhaustion signals; MEV fundamentals add downside bias but divs offer balanced opportunity—medium tolerance suits waiting for 1800 hold/break

Ava Stanton’s Recommendation: Hybrid stance: Scale short-term short from 1950, prepare long above 2000 confirmation; adaptability over aggression

Key Support & Resistance Levels

📈 Support Levels:

-

$1,820 – Strong multi-touch low with volume shelf

strong -

$2,000 – Psychological and prior consolidation base

moderate

📉 Resistance Levels:

-

$2,400 – Swing high from early Feb retest

strong -

$2,100 – Fib 61.8% retracement confluence

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1,850 – Bounce from strong support with MACD convergence, medium risk aligns with tolerance

medium risk -

$1,950 – Short entry on resistance rejection, MEV news pressure context

medium risk

🚪 Exit Zones:

-

$2,400 – Profit target at key resistance

💰 profit target -

$1,750 – Stop loss below structure break

🛡️ stop loss -

$1,700 – Trailing stop on further downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Climax volume on Jan-Feb breakdown, now fading on lows suggesting exhaustion

High red volume confirms distribution, green divergence at bottom

📈 MACD Analysis:

Signal: Bearish crossover mid-Jan, histogram contracting with price lows (bullish div)

Momentum weakening despite price, watch for bullish cross

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Ava Stanton is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Empirical edges emerge here. Solana’s uniform model proves snipers falter without priority leverage, clearing prices fairly. Ethereum could mirror this via intent solvers like CoW Swap, but auctions add teeth: bids fund network security, not bot profits. Dwellir’s bot guide underscores the irony; even predators need protection. Modular approaches flip this, letting retail users auction defenses collectively.

Practical Plays: Armoring Low-Priority Trades

Traders aren’t passive. Layer defenses strategically. First, route via MEV Blocker RPCs to bypass public mempools entirely. Second, embrace auctions: bid modestly for express slots on Arbitrum-style lanes, but diversify to Solana for uniform fairness. Third, monitor with analytics; Finematics decoding shows MEV’s network strain, yet auctions internalize it.

Consider token launches. Snipers demand capital efficiency, per Ethereum Research, but blockchain snipers protection via auctions caps their runs. Clanker’s 80/20 split rewards projects, stabilizing price discovery. MixBytes warns DeFi projects of ordering perils; auctions enforce it predictably. Set slippage low, as CoinSwitch advises, but pair with auction participation for offense.

James Prestwich’s five-year MEV chronicle reveals growth pains: from crisis to controlled extraction. Today’s auctions evolve this, converting shadow fees into sustainable yields. Yet balance tempers optimism. Timeboost’s 90% centralization warns against over-reliance; true resilience demands open, modular designs.

Ultimately, MEV transaction safeguards thrive when accessible. Modular MEV Auctions democratizes this, offering analytics, real-time data, and auction tools for all. Low-priority no longer means low protection. Traders optimize, bots recalibrate, and blockchains mature. In this recalibrated arena, adaptability secures returns, turning vulnerabilities into vetted opportunities.

Equip yourself with these insights. Monitor mempool dynamics, bid in auctions, and leverage platforms built for the MEV era. The battlefield evens; strategic players prevail.