In Solana’s high-throughput ecosystem, where blocks process thousands of transactions per second, Maximal Extractable Value (MEV) represents untapped potential for profit through transaction ordering. Yet, until recently, this value often flowed to a handful of insiders via private deals, sidelining everyday validators and stakers. Open-MEV Hubs are flipping the script with transparent MEV Solana auctions, creating permissionless markets for Solana blockspace auctions that redistribute gains more fairly. As Binance-Peg SOL trades at $84.35, down 4.29% over the last 24 hours, these hubs couldn’t arrive at a more critical moment for network optimization.

I’ve watched MEV evolve from Ethereum’s flashbots to Solana’s unique challenges, and what strikes me is how Solana’s speed amplifies both opportunities and risks. Traditional MEV extraction relied on off-chain signaling and validator favoritism, fostering sandwich attacks that inflate user costs. Open-MEV Hubs, like those from Toby Network, introduce MEV hub network infrastructure that screens transactions intelligently and auctions bundles openly.

Solana’s Shift from Opaque MEV to Auction-Driven Fairness

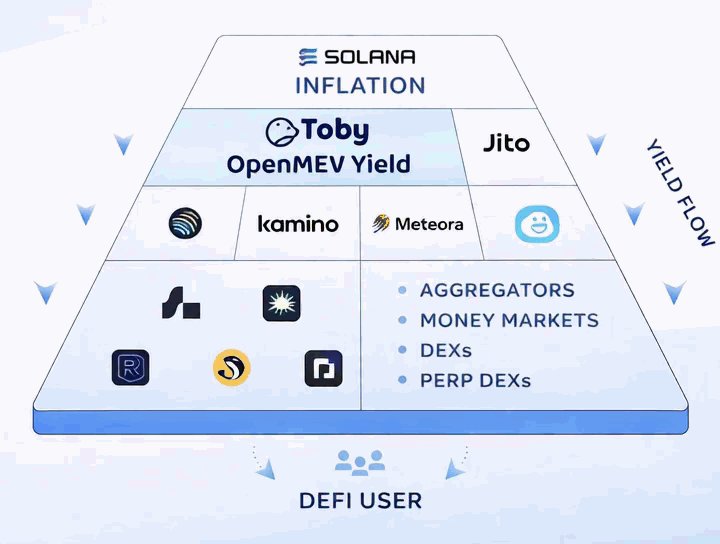

Solana MEV kicked off with Jito’s Bundle Auction Mechanism (BAM), transforming private backroom deals into a programmable marketplace. Validators now accept tips for priority inclusion, but this still left room for centralization. Data shows MEV capturing 90% market share in months, per recent reports, underscoring the need for broader access. Toby Network’s stack- MEV-Hub for filtering, Headchef for bundle auctions, and Validator Optimizer- exemplifies open MEV auctions. Searchers bid competitively for block positions, with proceeds flowing back to stakers via transparent ledgers.

This isn’t just technical plumbing; it’s a philosophical pivot. In my analysis of blockchain equities, centralized MEV echoes early mining pools- profitable but destabilizing. By enabling any searcher to participate, hubs enforce MEV value redistribution, boosting yields for Marinade Finance-style validator markets and curbing predatory bots.

Inside Open-MEV Hubs: From Transaction Screening to Bundle Auctions

Picture this: a user submits a trade. MEV-Hub ingests it, applying filters to detect toxic flows while preserving privacy. Valid bundles- atomic transaction sets- head to auction platforms like Headchef. Bidders compete with tips denominated in SOL, and the highest offer secures inclusion. Validators integrate these via optimizers, ensuring seamless block production. Unlike Ethereum’s proposer-builder separation, Solana’s model leverages leader schedules for rapid finality.

Technical breakdowns from Toby highlight auction initiation: leaders signal upcoming slots, searchers respond with sealed bids, and winners get cryptographic proofs for execution. This minimizes collusion, a plague in prior regimes. For blockspace optimization, it’s gold- priority fee MEV bots now compete on merit, packing blocks denser and slashing latency.

Solana (SOL) Price Prediction 2027-2032

Forecasts driven by Open-MEV Hubs, transparent MEV auctions, and Solana’s blockspace optimization amid bullish adoption trends

| Year | Minimum Price | Average Price | Maximum Price | Est. YoY % Change (Avg)* |

|---|---|---|---|---|

| 2027 | $110 | $140 | $180 | +47% |

| 2028 | $130 | $170 | $220 | +21% |

| 2029 | $150 | $200 | $270 | +18% |

| 2030 | $180 | $240 | $320 | +20% |

| 2031 | $210 | $280 | $370 | +17% |

| 2032 | $250 | $330 | $430 | +18% |

Price Prediction Summary

Solana (SOL) is projected to experience steady growth from 2027-2032, starting from a 2026 baseline of ~$95, fueled by Open-MEV innovations democratizing MEV profits, reducing centralization, and boosting network efficiency. Average prices could reach $330 by 2032 in bullish scenarios, with min/max reflecting bear markets and peak cycles.

Key Factors Affecting Solana Price

- Open-MEV Hubs enabling transparent, permissionless MEV auctions and equitable profit distribution

- Solana’s technological edge in throughput and MEV integration (e.g., Toby Network, Jito BAM)

- Market cycles aligned with BTC halvings and DeFi/NFT adoption surges

- Regulatory progress favoring efficient L1s like Solana

- Competition from Ethereum L2s and macro factors like interest rates influencing volatility

- Validator optimization and staking yield boosts from MEV revenue sharing

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Consider the numbers: with SOL at $84.35, even modest MEV uplift per block compounds massively across 50,000 and daily slots. Hubs like these could add basis points to staker APYs, drawing institutional capital weary of Ethereum’s fragmentation.

Real-World Impacts: Reducing Sandwich Attacks and Enhancing Efficiency

Predatory MEV, like sandwiching DEX trades, erodes trust and efficiency. Open auctions expose these tactics to competition; a searcher profiting from arbitrage bids higher than a sandwicher, naturally prioritizing value-add. Observers note Solana leaping ahead of Ethereum’s PBS, with Jito’s BAM as precursor. Yet Toby pushes further toward full decentralization.

Stakeholders win across the board. Validators access blockspace marketplaces automating rewards, searchers scale without gatekeepers, and users see lower effective fees. In a market where SOL dipped to $83.25 intraday, such innovations fortify resilience against volatility.

Marinade Finance’s open validator marketplace complements this by automating MEV value redistribution, ensuring stakers capture a slice without lifting a finger. As an analyst tracking digital assets for eight years, I’ve seen how such mechanisms stabilize yields during downturns, like today’s SOL at $84.35 after touching $83.25 low.

Participating in Open-MEV Auctions: A Validator’s Playbook

Getting started isn’t arcane. Validators plug into hubs via simple SDKs, routing bundles through screened pipelines. Searchers, meanwhile, craft bundles using off-the-shelf tools from Helius or RPC Fast providers. The beauty lies in permissionlessness: no KYC, no whitelists, just code and capital. This levels the field against priority fee MEV bots that once dominated via speed alone.

Once integrated, auctions run continuously. Toby’s MEV-Hub filters out spam, Headchef orchestrates bids, and optimizers fine-tune inclusion. Proceeds? Split transparently- often 90% to stakers, 10% infra fees. In a network churning 50,000 slots daily, this trickles up to meaningful APY lifts, especially as SOL hovers around $84.35 amid volatility.

Challenges Ahead: Balancing Speed, Security, and Fairness

No revolution lacks hurdles. Solana’s leader rotation demands sub-second auctions, testing hub latency. Collusion risks linger if bidder pools consolidate, echoing Ethereum’s builder centralization. Yet innovations like sealed bids and zero-knowledge proofs, hinted in Toby docs, counter this. Regulators eye MEV too, but on-chain transparency turns audits into public goods.

From my portfolio vantage, these hubs mitigate Solana’s MEV inevitability, as Sumanth Neppalli argues. They channel value productively- arbitrage smooths prices, liquidations stabilize lending- without the predation. Compare to Jito’s BAM, which jumpstarted 90% MEV adoption; open hubs scale that ethos globally.

Blockspace optimization shines here. Denser packing via competitive bundles means fewer dropped txs, vital at peak loads. Users benefit indirectly: sandwich attacks wane as positive-sum bids outpace them, per Medium analyses. With SOL’s 24-hour high at $88.35 now behind us, efficiency edges matter for reclaiming highs.

The Road to Institutional-Grade Solana MEV

Looking ahead, MEV auctions propel Solana toward Ethereum’s PBS maturity, but faster. Toby’s stack foreshadows multi-hub competition, eroding Jito’s lead. Institutional inflows follow: imagine BlackRock staking via Marinade, juiced by hub yields. At $84.35, SOL undervalues this trajectory; my models peg upside as MEV matures.

Developers thrive too. SDKs from these hubs spawn bots, dashboards, even DeFi primitives betting on auction outcomes. Gate. com reports underscore rapid evolution; expect 2026 integrations with Firedancer clients for ultra-low latency. Stakers, don’t sleep: opt into hub validators now, capture the transparent MEV Solana wave.

As blockspace becomes a traded asset, Open-MEV Hubs cement Solana’s edge in high-speed finance. They don’t eliminate MEV- wisely, since it’s baked in- but harness it for collective gain. With tools like MEV hub network components ready, the network inches toward optimal utilization, rewarding participants proportionally in this $84.35 SOL era.