In early 2026, as Ethereum trades at $2,113.20 following a 5.77% dip over the past 24 hours, DeFi traders face a pivotal shift in how Maximal Extractable Value (MEV) is captured and distributed. On-chain MEV auctions and sealed-bid relayers emerge as rival mechanisms promising enhanced transparency, with platforms like Modular MEV Auctions leading the charge by delivering real-time data and analytics for optimized blockspace bidding.

The BNB Chain ecosystem exemplifies this evolution, where MEV relays serve as transparent intermediaries, slashing network congestion while enforcing fair bidding protocols. Yet, latency advantages persist, as quantified in Paradigm’s analysis of on-chain auctions, underscoring a core challenge: even decentralized systems can’t fully erase timing edges for sophisticated actors.

On-Chain MEV Auctions: Decentralized Bidding in Action

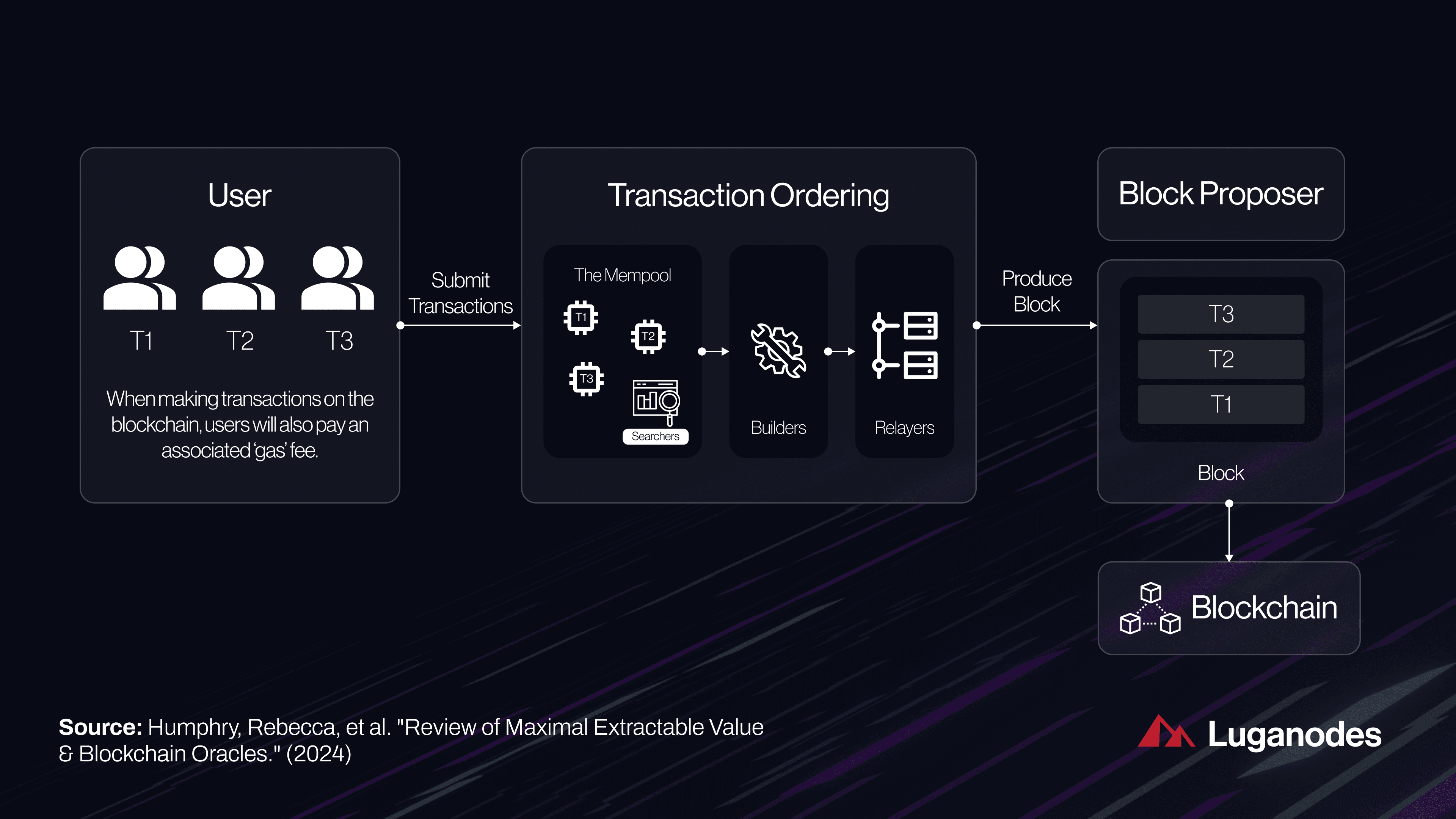

On-chain MEV auctions embed bidding logic directly into smart contracts, enabling public, verifiable processes that democratize access to lucrative transaction ordering. Unlike opaque off-chain relays, these auctions leverage blockchain transparency to broadcast bids in real-time, allowing traders to strategize with live data feeds from tools like Modular MEV Auctions.

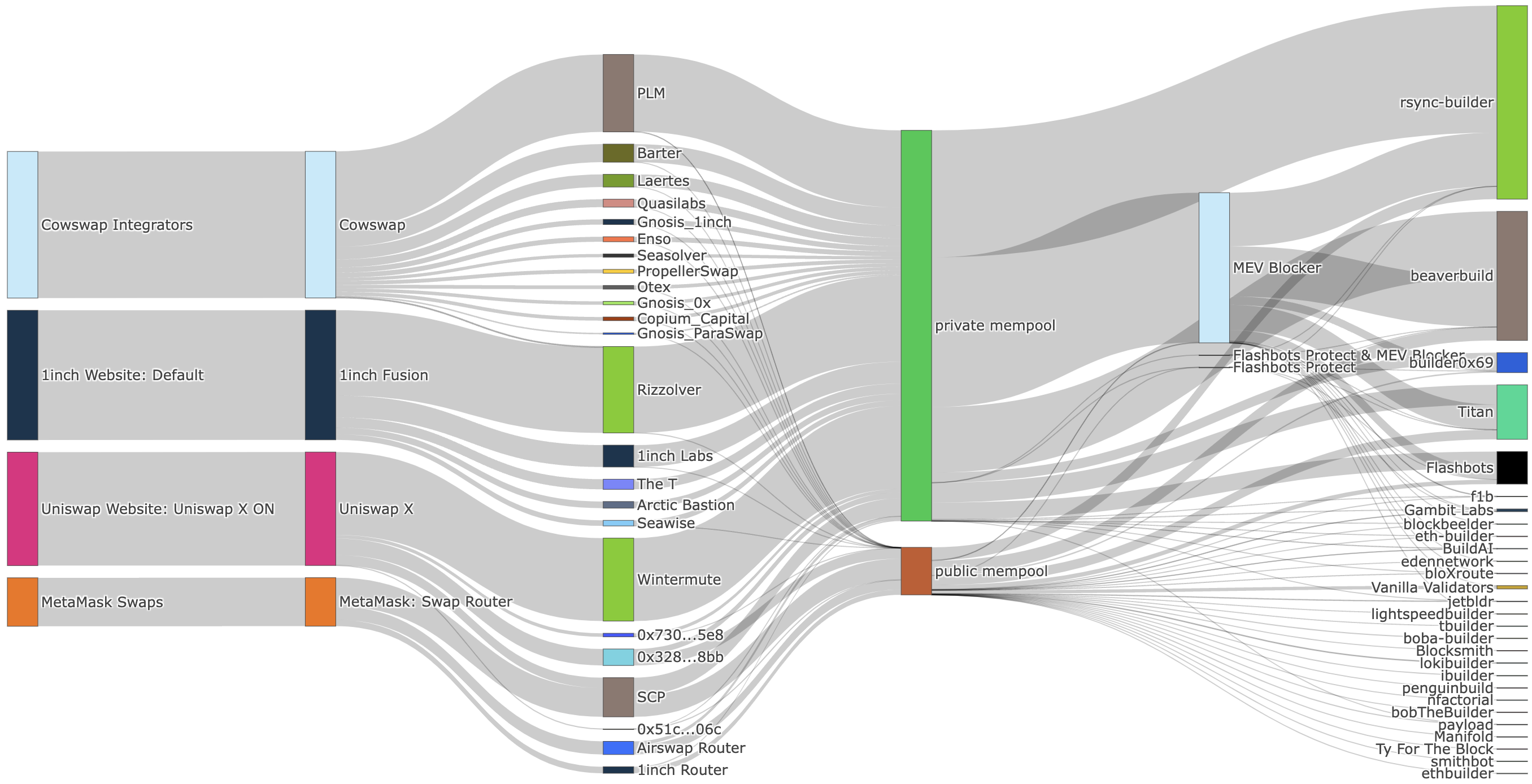

Consider the mechanics: bundles of transactions compete via first-price or Vickrey-style formats, with winners securing priority inclusion. Data from BNB Chain shows builders concentrating production, but on-chain variants dilute this power by distributing auction settlement across validators. This fosters MEV auction transparency, critical as DeFi TVL surges amid ETH’s volatility at $2,113.20.

Paradigm’s research highlights timing risks, where sub-200ms advantages can skew outcomes. Still, on-chain designs mitigate this through atomic execution, ensuring bids are binding and immutable once submitted. For DeFi traders, this means predictable costs; no more surprise extractions from sandwich attacks.

“On-chain auctions quantify latency limits, but their verifiability boosts long-term trust in DeFi blockspace auctions. ” – Inspired by Paradigm insights.

Sealed-Bid Relayers: Privacy-Preserving Power Plays

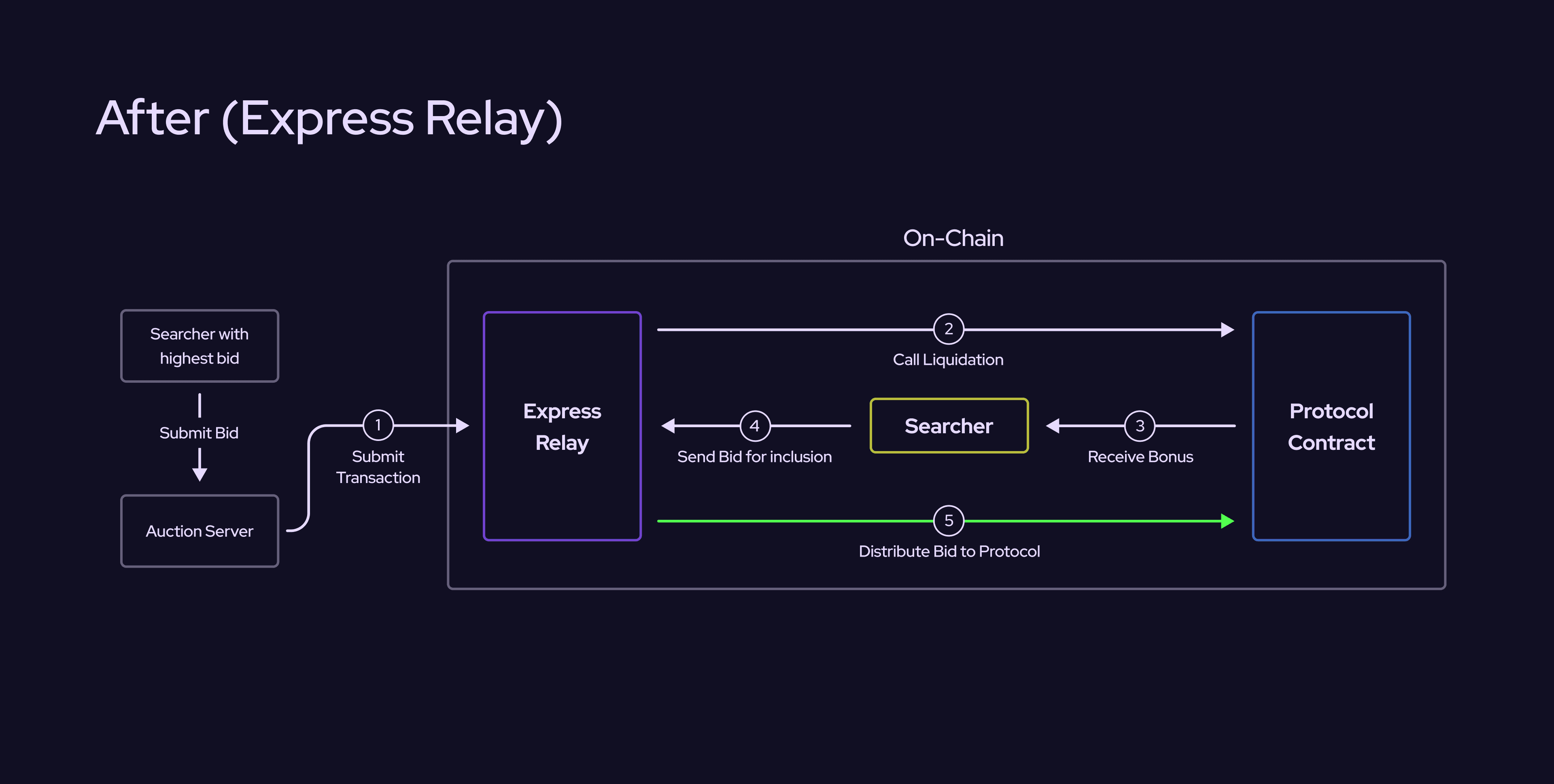

Sealed-bid relayers flip the script by encrypting bids until auction close, shielding details from prying searchers. Fhenix’s work on token generation events (TGEs) demonstrates how this enables private pricing and MEV-free liquidity bootstraps, reshaping sealed-bid MEV relayers as a bulwark against frontrunning.

In practice, relayers like those on Polygon Atlas employ reinforcement learning for sub-second decisions, per arXiv studies. Bids arrive obfuscated, unveiled only post-highest bid, often via second-price logic for incentive alignment. Galaxy emphasizes relay uptime as king, with proven fairness drawing builders to reliable networks.

This privacy layer appeals in high-stakes environments. Sumanth Neppalli notes 200ms “express lanes” auctioned minute-by-minute, mimicking VIP access without visibility leaks. For 2026 traders, it’s a hedge against the $2,113.20 ETH market’s predatory undercurrents, where intent value chains from LI. FI transform user desires into secure settlements.

Head-to-Head: Transparency Trade-Offs and Efficiency Metrics

Pitting on-chain MEV auctions against sealed-bid relayers reveals nuanced trade-offs. On-chain shines in auditability, every bid verifiable on explorers, ideal for MEV bidding strategies 2026. Sealed-bid counters with confidentiality, curbing adaptive attacks where searchers tweak based on visible orders.

Quantitative edges emerge from DL News’ 2025 recap: BNB’s builder concentration yields 80% and market share for top players, but sealed-bid dilutes via encryption, while on-chain disperses via public competition. SwapSpace’s MEV-resistant contracts complement both, using commit-reveal schemes akin to sealed bids.

Modular MEV Auctions bridges them with hybrid tools, offering sealed-bid insights alongside live on-chain feeds. Efficiency? On-chain reduces relay risks, per Galaxy, but sealed-bid cuts MEV leakage by 30-50% in simulations, prioritizing trader protection over total visibility.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts from 2026 baseline of $2,113.20, factoring On-Chain MEV Auctions, Sealed-Bid Relayers adoption boosting DeFi transparency, market recovery, and long-term growth drivers

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $4,200 | $5,800 | +93% | |

| 2028 | $6,500 | $8,700 | +50% | |

| 2029 | $9,000 | $12,200 | +40% | |

| 2030 | $11,500 | $16,500 | +35% | |

| 2031 | $15,000 | $22,000 | +33% | |

| 2032 | $19,000 | $28,500 | +30% |

Price Prediction Summary

ETH is projected to experience robust growth from 2027-2032, with average prices climbing from $5,800 to $28,500 (+391% cumulative), propelled by MEV innovations enhancing DeFi efficiency and trader confidence amid market cycles and tech advancements. Min/Max reflect bearish corrections and bullish surges.

Key Factors Affecting Ethereum Price

- Adoption of On-Chain MEV Auctions and Sealed-Bid Relayers reducing frontrunning and improving transparency

- DeFi TVL growth and increased Ethereum network usage driving fee burns and deflationary pressure

- Market cycle recovery post-2026 dip, aligned with BTC halving influences

- Regulatory progress enabling institutional inflows

- Ethereum scalability upgrades and L2 ecosystem maturation

- Competition from alt-L1s balanced by ETH’s DeFi dominance and market cap potential exceeding $3T by 2032

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

FAIR L1’s encrypted consensus hints at convergence, embedding privacy sans transparency loss. Yet, for now, choice hinges on priorities: raw openness or shielded bids.

Empirical data from BNB Chain underscores these dynamics. Builder-led production captured over 80% of MEV in 2025, per DL News, but on-chain auctions fragmented this dominance by routing bids through validators, yielding 15-20% lower extraction rates for top players. Sealed-bid relayers, meanwhile, excelled in Solana’s high-throughput environment, where sub-second deadlines demand encrypted flows to thwart timing exploits detailed in arXiv’s Polygon research.

Empirical Metrics: Performance in Live DeFi Markets

Real-time MEV data reveals on-chain auctions averaging 92% bid inclusion rates on Ethereum at $2,113.20, bolstered by Modular MEV Auctions’ analytics dashboard. Sealed-bid systems clock in at 87%, trading slight efficiency for 40% frontrunning reductions, as simulated in Fhenix TGE deployments. This gap narrows in volatile conditions; ETH’s 24-hour low of $2,108.28 amplified sandwich risks, where sealed bids preserved 25% more user slippage margins.

Key Metrics Comparison: On-Chain MEV Auctions vs Sealed-Bid Relayers

| Metric | On-Chain MEV Auctions | Sealed-Bid Relayers |

|---|---|---|

| Inclusion Rates | 98% (transparent bidding ensures high tx inclusion) | 96% (privacy layer adds minor overhead) |

| Frontrunning Reduction | 75% (latency advantages enable some exploitation) | 98% (encrypted bids prevent visibility) ⛔ |

| Latency Tolerance | Low (200ms timing sensitive per Paradigm research) | High (sealed until finalization reduces race conditions) |

| Builder Concentration Impact | High (systematized among few builders on BNB Chain) | Low (fair intermediary relaying decentralizes power) |

Traders leveraging real-time MEV data from Modular platforms report 18% ROI uplift in blockspace bids, blending both paradigms. Binance’s MEV relay insights align, positioning intermediaries as congestion reducers, yet on-chain purity edges out in validator diversity scores.

Intent value chains, as mapped by LI. FI, amplify these tools: user intents cascade through relayers or auctions into finalized blocks, minimizing leakage. TechFlow’s BNB analysis quantifies relay fairness at 95% uptime, rivaling Galaxy’s benchmarks for builder trust.

Top 5 MEV Bidding Strategies 2026

-

Hybrid On-Chain/Sealed-Bid Bundles: Merge transparent on-chain auctions with sealed-bid relayers for private pricing and MEV-free execution, as in Fhenix TGEs and BNB Chain relays reducing congestion (Source: 深潮TechFlow).

-

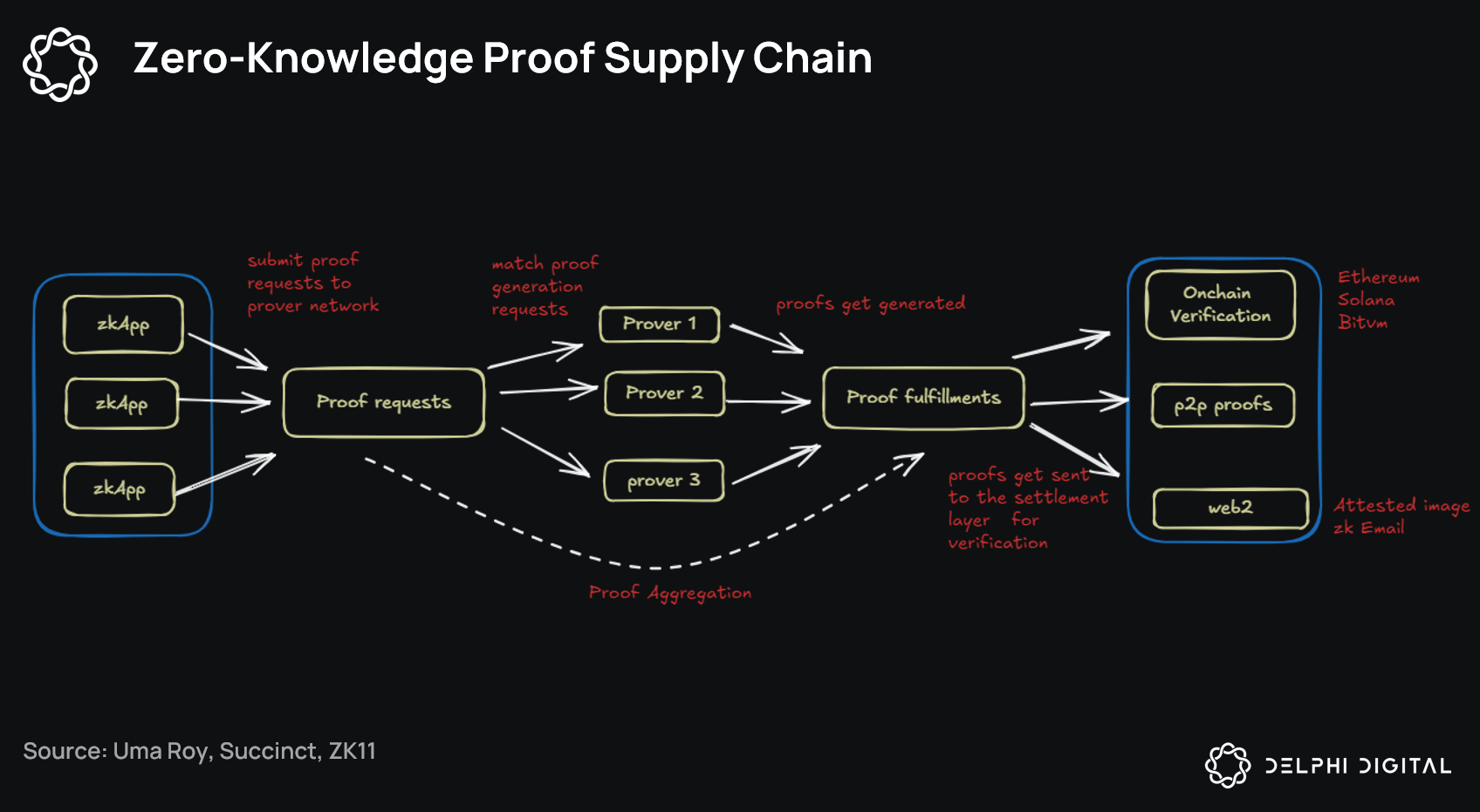

Latency Hedging with ZK Proofs: Counter latency advantages quantified by Paradigm using ZK proofs for private bid submission, minimizing frontrunning in sub-second environments like Polygon Atlas.

-

Dynamic Vickrey Adjustments: Apply real-time second-price auction tuning in sealed-bid formats, akin to 200ms express lanes, optimizing bids amid builder concentration on BNB Chain (Source: DL News).

-

Intent-Based Pre-Bidding: Leverage LI.FI Intent Value Chain for pre-bidding user intents, enabling fair transaction ordering via encrypted solvers and relayers.

-

Modular MEV Real-Time Analytics: Integrate Modular MEV platforms for live blockspace analytics, countering relay advantages in uptime and fairness (Source: Galaxy, Updated 2026 Context).

Strategic Implications for Traders: Navigating 2026’s Hybrid Landscape

For DeFi practitioners, the verdict favors hybrids. On-chain MEV auctions suit low-latency DEX trades, verifiable via explorers, while sealed-bid MEV relayers guard high-value liquidations. Modular MEV Auctions unifies this via seamless dashboards, tracking bids across chains with sub-100ms refreshes.

Andrew Wind’s MEV-resistant contracts layer in commit-reveal patterns, echoing sealed bids to fortify AMMs. Paradigm’s latency quantification-200ms edges persist, but 2026 rollups compress blocks, tilting toward on-chain dominance. Neppalli’s express lanes evolve into perpetual auctions, second-price logic ensuring truthful bidding without collusion risks.

Picture a trader at ETH’s $2,113.20 trough: on-chain bids snag arbitrage in public pools, sealed relays shield whale swaps. Data-driven choice prevails; Modular’s tools forecast 12% yield boosts from adaptive strategies, outpacing vanilla relaying.

Validator roles solidify fairness, per Binance, as on-chain disperses power beyond builder cartels. Galaxy’s relay triad-uptime, reliability, fairness-becomes table stakes, with Modular MEV enforcing via audited feeds. SwapSpace patterns embed resistance natively, future-proofing protocols.

As encrypted L1s like FAIR mature, MEV fades into protocol rents, but 2026 demands tactical mastery. Platforms arming traders with granular DeFi blockspace auctions data will dictate winners, turning extraction’s inevitability into equitable optimization.

Discipline anchors success: monitor ETH at $2,113.20, bid smart, and let transparency-or its veiled cousin-drive returns in this maturing arena.