In the pulsating world of decentralized finance, where Ethereum trades at $2,975.82, blockspace auctions in MEV have emerged as a battleground for traders chasing superior execution and fatter arbitrage margins. As we navigate 2026, these auctions are no longer fringe experiments but core infrastructure reshaping how orderflow is captured, bundled, and monetized across chains. Modular MEV Auctions stands at the forefront, turning raw transaction intent into auctionable assets that savvy searchers bid on fiercely.

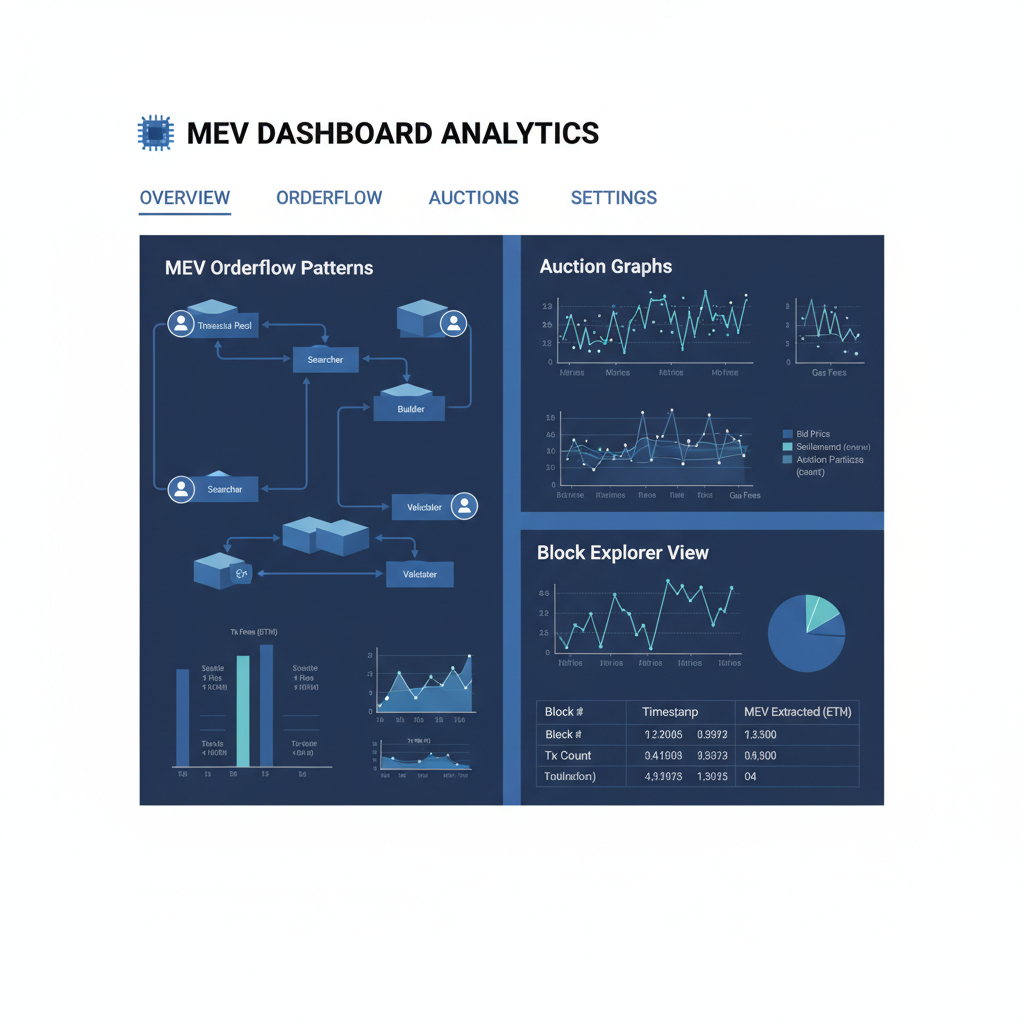

Orderflow data, once a scattered byproduct of user activity, now fuels MEV orderflow optimization. Platforms like Modular MEV’s marketplace provide granular analytics, revealing patterns in swap sizes, slippage tolerances, and timing preferences that predict arbitrage potential. This visibility shifts the game from reactive bot-hunting to proactive strategy design, especially in modular blockspace markets where L2s and appchains fragment liquidity pools.

Decoding Timeboost and Auction Centralization Risks

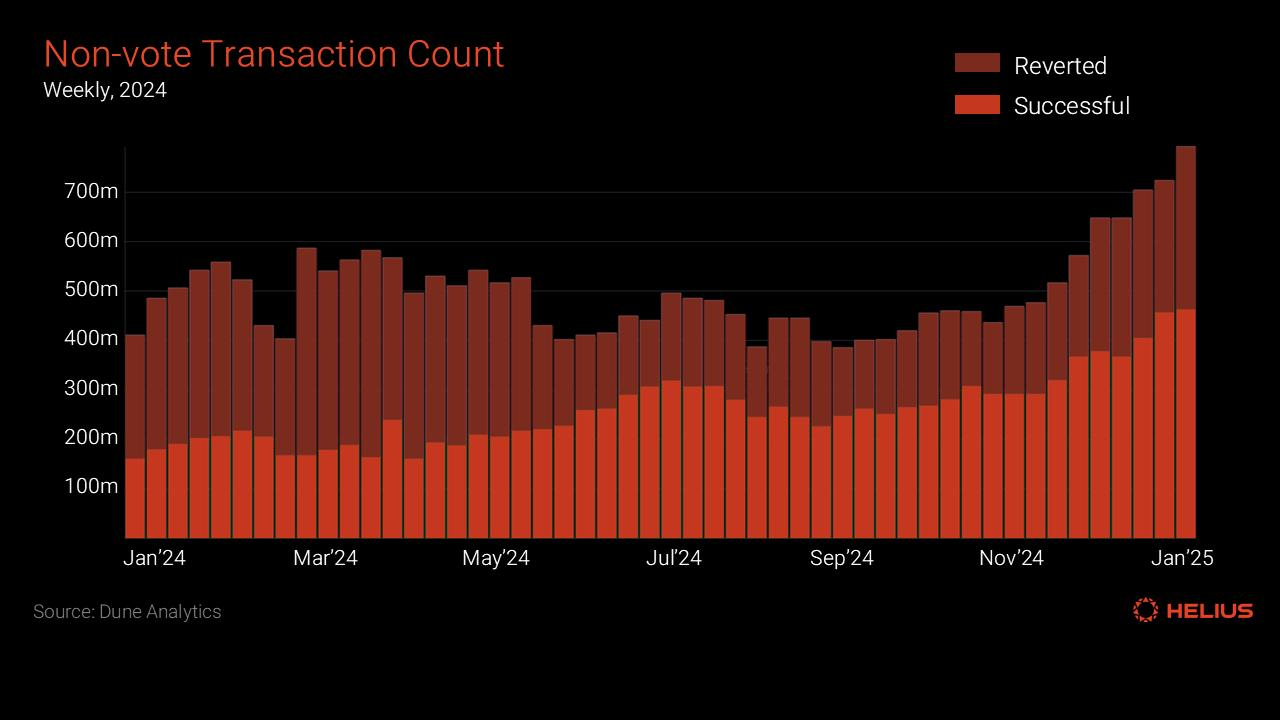

Arbitrum’s Timeboost mechanism exemplifies the double-edged sword of priority auctions. By auctioning slots in an express lane, it promised faster inclusion for high-value transactions. Yet, analysis of 11.5 million transactions from mid-2025 paints a sobering picture: two dominant players snagged over 90% of auctions, entrenching centralization. Profitable MEV clustered block-end, diluting priority’s edge, while 22% of boosted txs reverted as spam. Competition waned, starving the DAO of revenue. This underscores a harsh reality in blockchain transaction auctions: without robust design, auctions amplify winner-take-all dynamics rather than democratizing access.

Builders and validators, incentivized by sealed bids, often consolidate power. For DeFi traders, this means monitoring auction winners via tools like Modular MEV to anticipate frontrunning risks. The lesson? Prioritize chains with inclusion lists or proposer-builder separation (PBS) to hedge against such imbalances.

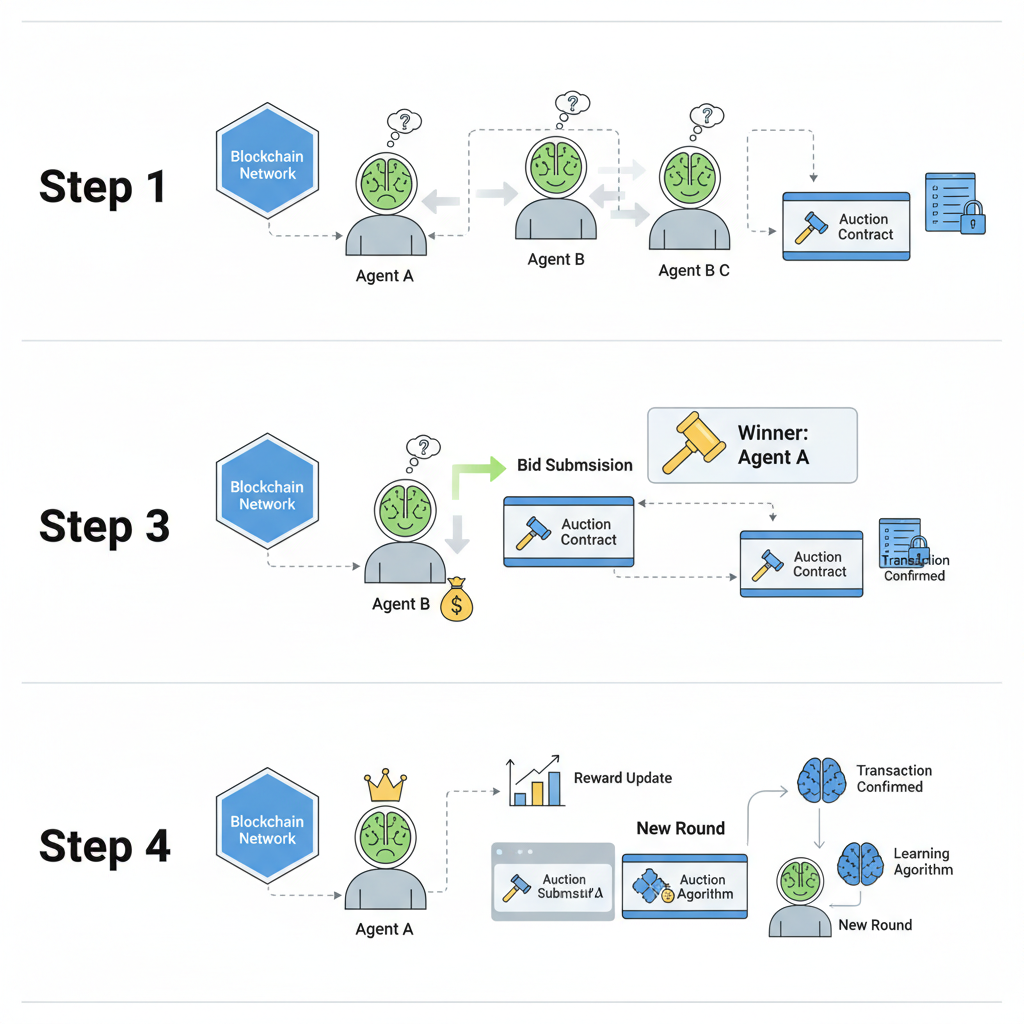

Reinforcement Learning Revolutionizes MEV Bidding on Polygon

Polygon’s Atlas auctions mark a leap from chaotic gas wars to disciplined sealed-bid arenas, but the speed demands machine smarts. Traditional game theory buckles under stochastic arbitrage arrivals and rival bids. Enter reinforcement learning: a PPO agent, trained in simulated environments mirroring real Atlas dynamics, seizes 49% of profits alongside incumbents and 81% solo. It adapts bids in continuous spaces, history-conditioned for context, all at production speeds.

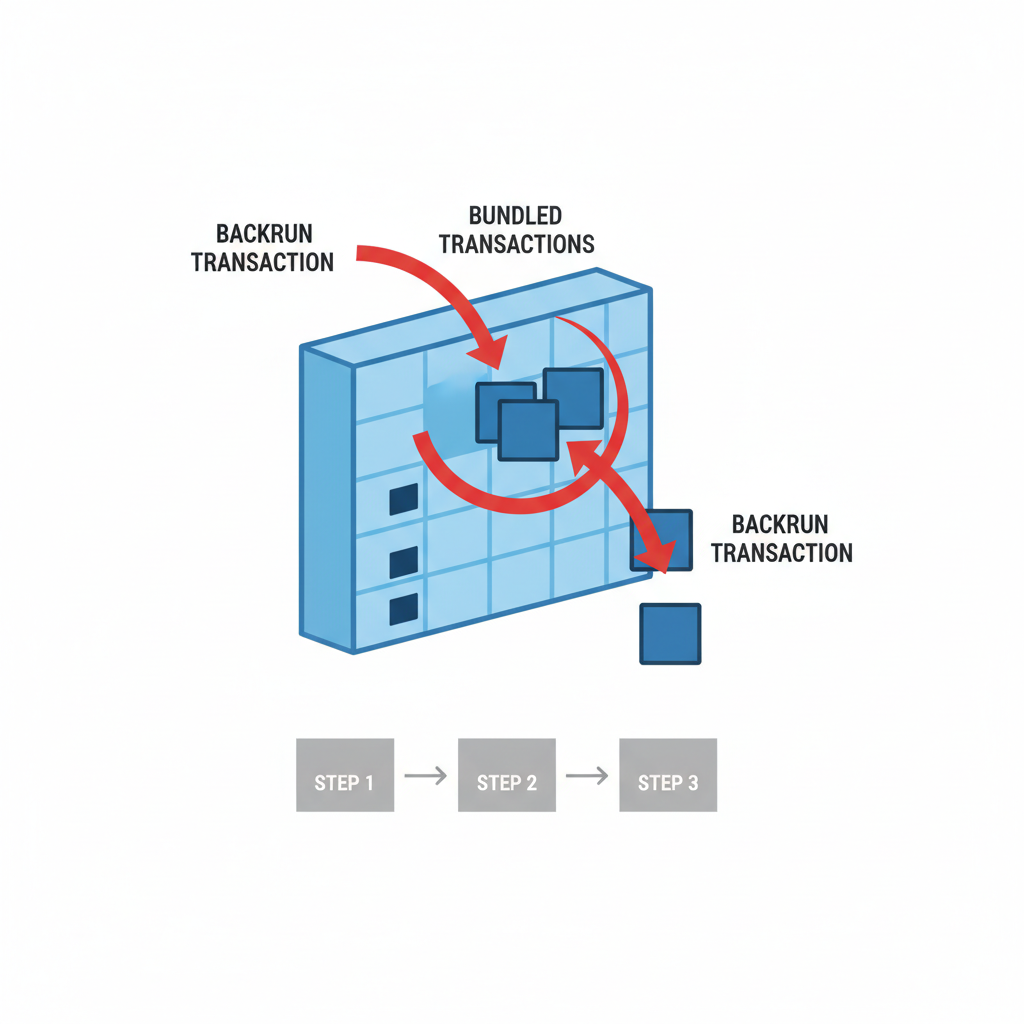

This isn’t hype; it’s empirical proof that AI edges out static heuristics in high-frequency DeFi arbitrage strategies 2026. Searchers deploying such agents on Polygon report consistent outperformance, bundling user orders with backruns for compounded yields. Modular MEV users can integrate similar analytics to simulate their own bids, optimizing entry into these auctions.

Leveraging Proposer-Builder Separation for Fairer Orderflow

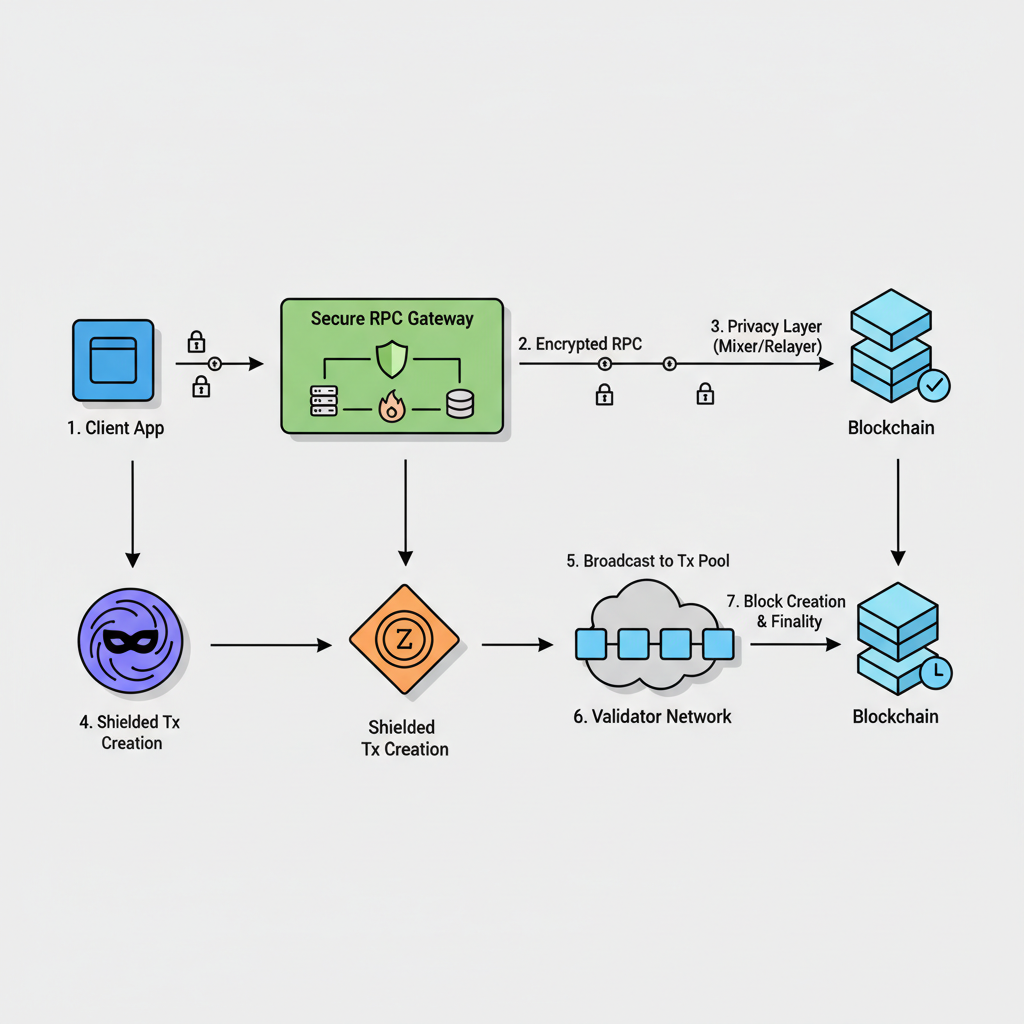

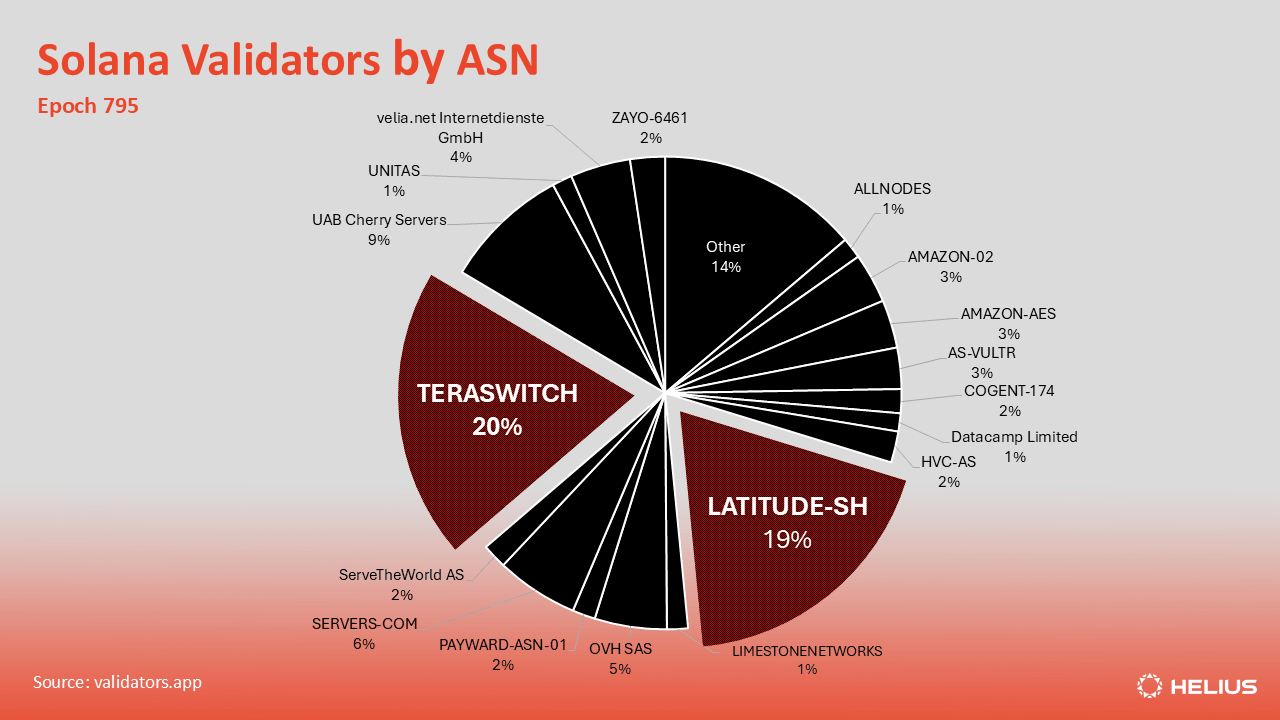

PBS, via relays like MEV-Boost, divorces block proposal from construction, letting specialized builders craft value-maximizing bundles. Orderflow auctions (OFAs) extend this: users auction intents to solvers promising rebates or execution guarantees. Cross-chain OFAs, as explored by Variant Fund, bridge domains for unified liquidity capture, vital as Solana’s Jito bundling redistributes MEV to stakers.

Yet, bots still congest networks, inflating fees. Flashbots proposes off-chain bids with privacy, freeing on-chain space. For arbitrageurs, tactics include routing via MEV-protected RPCs (MEV-Blocker) and targeting batch auctions to neutralize sandwiches. Modular MEV auctions shine here, mitigating spam through structured markets.

Ethereum (ETH) Price Prediction 2027-2032

Amid MEV Auction Growth and Blockspace Optimization Strategies

| Year | Minimum Price (Bearish Scenario) | Average Price (Baseline) | Maximum Price (Bullish Scenario) |

|---|---|---|---|

| 2027 | $3,200 | $4,500 | $6,500 |

| 2028 | $4,000 | $6,200 | $9,200 |

| 2029 | $5,200 | $8,300 | $13,000 |

| 2030 | $6,800 | $11,000 | $17,500 |

| 2031 | $8,500 | $14,000 | $22,000 |

| 2032 | $10,500 | $17,500 | $26,000 |

Price Prediction Summary

Ethereum (ETH) is forecasted to experience robust growth from 2027 to 2032, driven by MEV auction innovations like Timeboost, PBS, and orderflow optimizations, lifting average prices from $4,500 to $17,500. Bullish scenarios could see peaks above $26,000 by 2032 with enhanced DeFi adoption and efficiency gains, while bearish cases account for regulatory hurdles and market corrections.

Key Factors Affecting Ethereum Price

- MEV auction advancements (e.g., Timeboost on Arbitrum, Polygon Atlas RL bidding) reducing spam and centralization risks

- Proposer-Builder Separation (PBS) and orderflow auctions improving transaction fairness and profitability

- Modular blockspace markets and cross-chain OFAs boosting network efficiency and arbitrage opportunities

- Ethereum L2 scaling and upgrades enhancing throughput amid rising DeFi demand

- Crypto market cycles, including 2028 Bitcoin halving spillover effects

- Regulatory progress on DeFi and blockchain infrastructure

- Institutional adoption and competition dynamics with Solana/Jito ecosystems

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

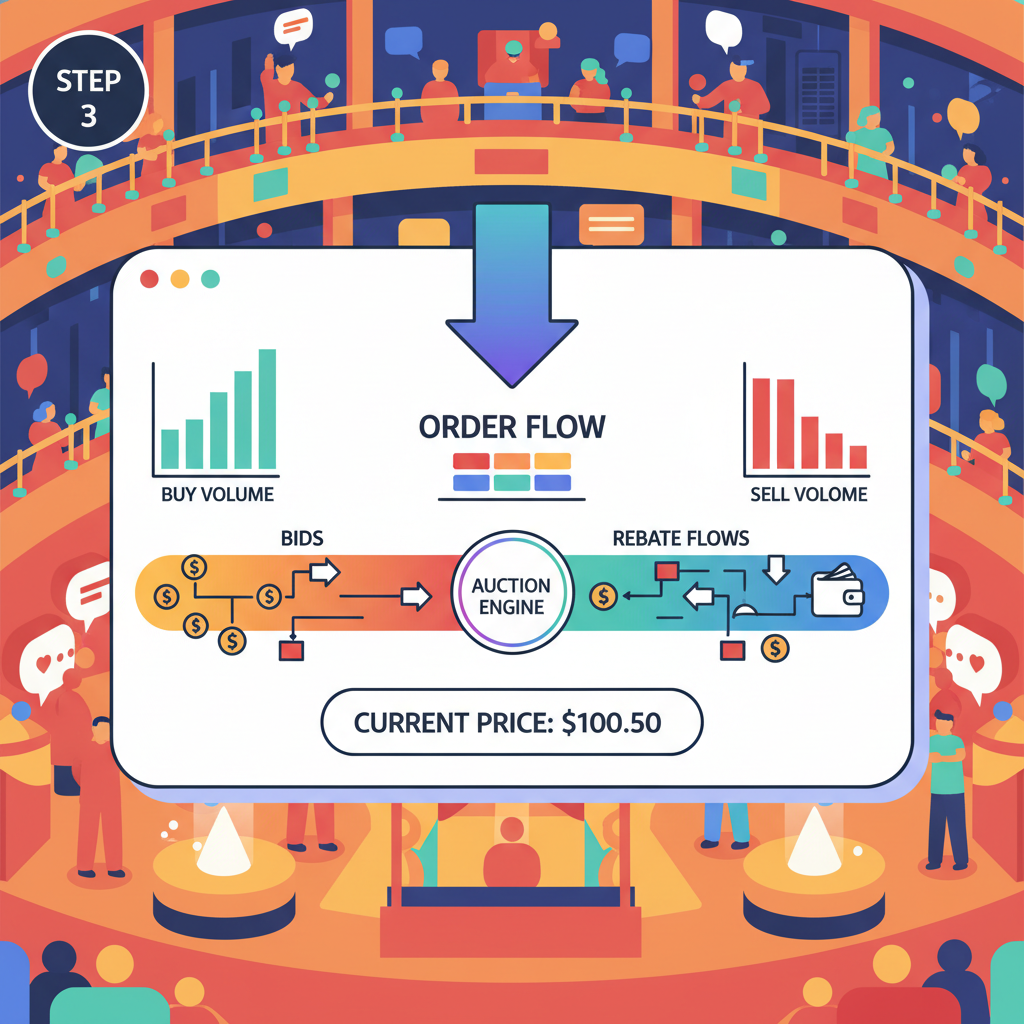

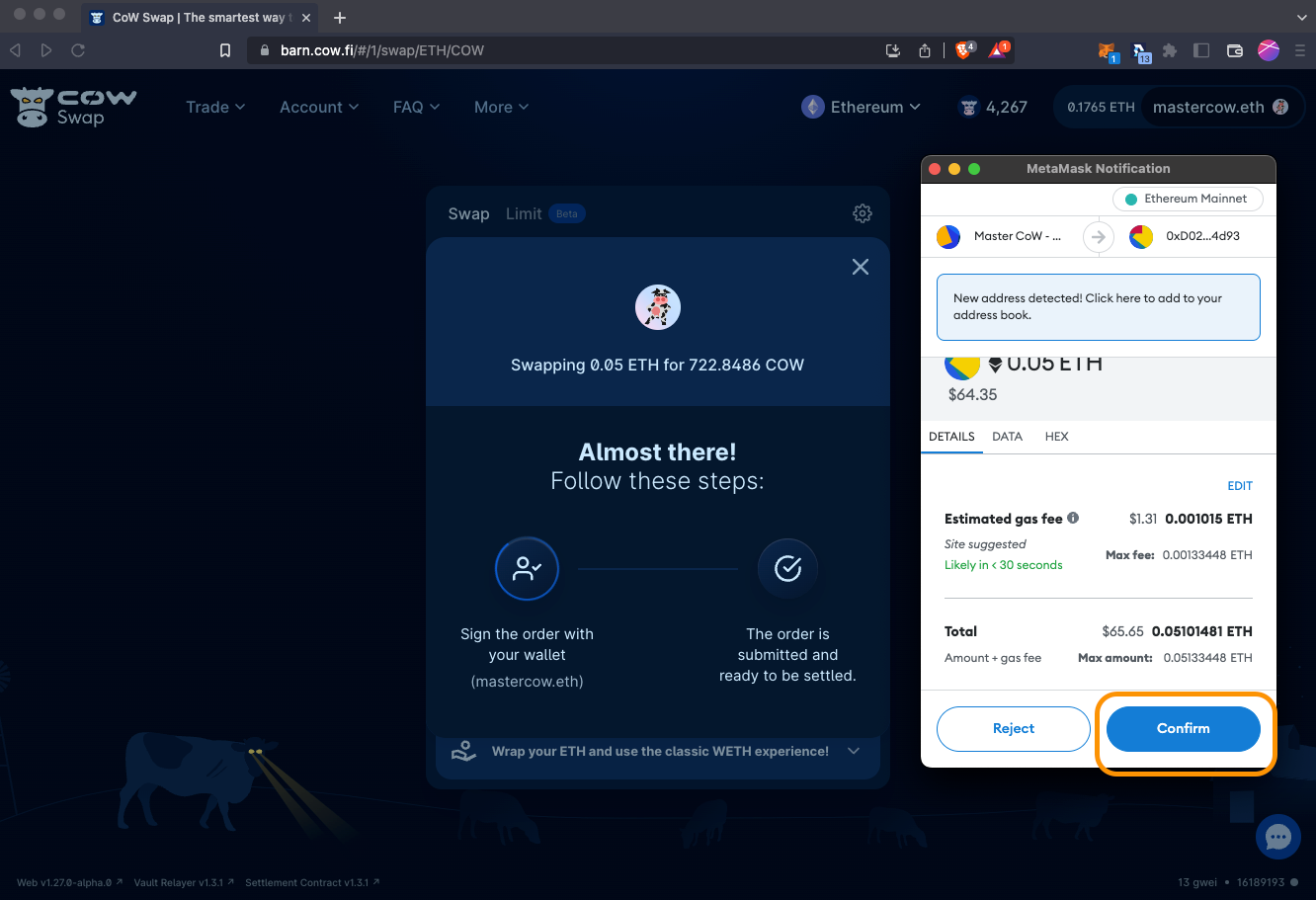

Frontier Research’s survey of 12 OFA designs highlights tradeoffs: uniform-price vs. discriminatory auctions, with rebates balancing user-builder incentives. In practice, blend these: use CoW-style aggregators for rebates, Atlas for speed, Timeboost warily on L2s.

Traders blending these mechanisms report up to 30% better execution in fragmented liquidity environments, underscoring why modular MEV auctions are indispensable for 2026 portfolios. With Ethereum holding steady at $2,975.82, even modest arbitrage edges compound amid rising TVL.

Practical Tactics for MEV Orderflow Optimization

Armed with these insights, how do you actually deploy MEV orderflow optimization in live markets? Start by dissecting orderflow marketplaces. Modular MEV’s platform aggregates intents from DEXs and aggregators, surfacing high-slippage swaps ripe for capture. Pair this with Jito-style bundling on Solana, where auctions redistribute MEV to validators, creating symbiotic opportunities for searchers.

Consider a real-world arbitrage: a Uniswap v3 pool imbalance spotted via orderflow analytics. Instead of mempool chaos, submit to an OFA where solvers compete on execution quality. Winners deliver post-trade rebates, often 10-20 basis points, directly to your wallet. This flips toxic extraction into user-aligned value, especially as cross-chain OFAs from Variant Fund unify Ethereum-Solana flows.

| Mechanism | Strengths | Risks | Best For |

|---|---|---|---|

| Timeboost (Arbitrum) | Priority lane access | Centralization, spam | L2 high-value txs |

| Atlas (Polygon) | Sealed-bid fairness, RL adaptable | Time constraints | High-freq arb |

| PBS and OFAs | Builder competition, rebates | Bot congestion | Cross-chain bundles |

| Jito Bundling (Solana) | Stakeholder revenue share | Chain-specific | Fast L1 execution |

This matrix reveals no silver bullet; success lies in hybrid routing. For instance, use Polygon Atlas for intra-chain arb, then PBS relays for Ethereum settlement. MEV-protected endpoints from Shoal. gg or Blocknative shield your flow, plugging into private mempools that sidestep public frontrunning.

5 Key DeFi Arbitrage Tactics 2026

-

Leverage orderflow data for predictive bidding: Analyze orderflow from Modular MEV to forecast demand and refine bids in blockspace auctions.

-

Deploy RL agents on Atlas-like systems: Use PPO-based reinforcement learning on Polygon Atlas for adaptive, high-frequency bidding outperforming static strategies.

-

Prioritize rebate-focused OFAs: Select auctions like CoW.fi for post-trade rebates, optimizing execution value over direct pricing.

-

Monitor centralization via auction dashboards: Track winners and metrics in Arbitrum Timeboost auctions to mitigate risks of dominance by few entities.

-

Integrate modular marketplaces for spam-free execution: Adopt MEV-Share and modular systems to filter spam and secure reliable orderflow.

Yet, pitfalls loom. MEV bots, as Flashbots notes, devour capacity faster than scaling solutions emerge. Their gas guzzling elevates baseline fees, squeezing retail users. The antidote? Programmable privacy auctions with off-chain bids, reserving on-chain for essentials. Modular MEV pioneers this, structuring blockspace into spam-resistant tiers that favor quality over noise.

In Solana’s ecosystem, Jito’s findings align incentives beautifully: auction proceeds bolster infrastructure, drawing more stakers and liquidity. Traders tapping this via cross-domain OFAs capture alpha across chains, turning Ethereum’s $2,975.82 stability into multi-network yields. Frontier’s design space audit warns of discriminatory auction pitfalls, like discriminatory pricing favoring whales, so favor uniform-price formats for equitable entry.

Looking ahead, 2026’s DeFi arbitrage strategies 2026 will hinge on analytics depth. Modular MEV’s real-time dashboards forecast auction dynamics, from bid densities to reversion risks, empowering nuanced positioning. Whether you’re a solo searcher or institutional desk, these tools democratize what was once elite bot territory.

Ultimately, blockspace auctions evolve MEV from predatory zero-sum to collaborative markets. By prioritizing orderflow auctions with robust safeguards, traders not only maximize profits but fortify the ecosystem against its own excesses. With Ethereum at $2,975.82 and modular innovations accelerating, the edge goes to those who master this auction arena today.