MegaETH’s public token sale from October 27 to 30,2025, shattered expectations, pulling in over $1.3 billion in bids-27.8 times its $50 million cap. This English auction started at a mere $0.0001 per MEGA token, pegging the fully diluted valuation at $1 million, and climbed to a $0.0999 cap for a $999 million FDV. Yet premarket signals on platforms like Hyperliquid hinted at a $5 billion valuation. With Ethereum trading at $3,004.74 today, up $36.99 or 0.0125% in the last 24 hours, MegaETH’s move underscores a bold play in high-speed Layer-2 innovation, where MEV strategies MegaETH enthusiasts see untapped potential for blockspace mastery.

What sets this apart? MegaETH, aiming for 10-millisecond latency and 20,000 and transactions per second, didn’t just sell tokens. It engineered a mechanism blending transparency with incentives, prioritizing ecosystem builders via a novel U-Shaped allocation. Non-insiders emerged as the largest stakeholder group, dwarfing VCs and the team-a deliberate nod to decentralized ethos. As we eye 2026 blockspace auctions, this setup offers blueprints for MegaETH auction mechanism tactics that savvy traders can adapt.

The English Auction Edge in Token Distribution

Bidders chose their price between $0.0001 and $0.0999, with higher bids filling first until the cap hit. But oversubscription forced innovation: 14,491 participants, 819 maxing at $186,000 each. MegaETH rolled out a priority formula rewarding Ethereum and MegaETH community engagement. This isn’t your standard first-come frenzy; it’s a calibrated system echoing English auction dynamics that mirror upcoming blockspace auctions 2026.

Think of it as MEV in action for fundraising. Just as searchers bid for transaction ordering, here bidders vied for allocation slices. The result? Broad distribution without whale dominance. With 819 wallets at the ceiling, yet thousands more getting slices, it democratized access. For traders, this highlights public sale bidding tactics: bid high early, but layer in community signals for priority boosts.

U-Shaped Allocation: Fairness Meets Incentives

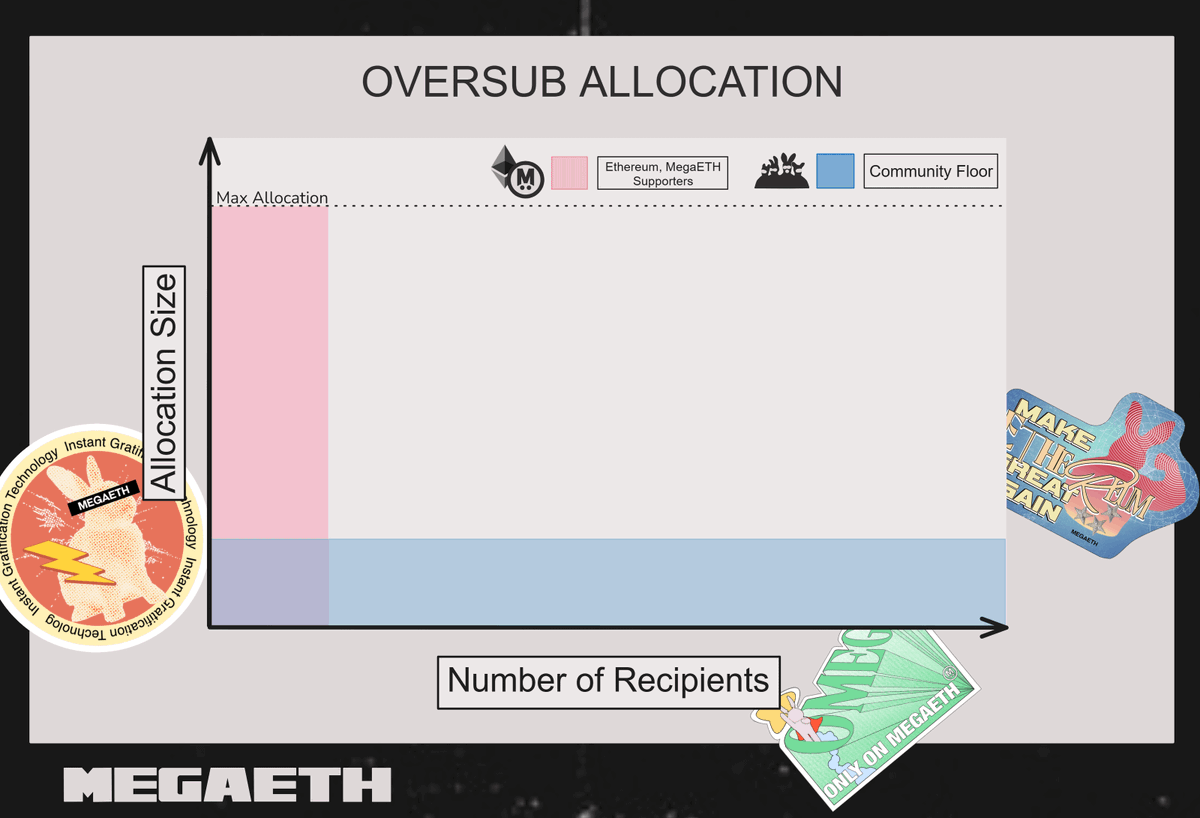

MegaETH’s U-Shaped model is the star. It funnels bigger shares to top bidders and key contributors at the curve’s peaks, while the base ensures minimums for the masses. This counters oversubscription pitfalls, like excluding small players. Per their blog, it makes public buyers the dominant holder bloc-a rarity in VC-heavy L2s.

Why does this matter for MEV? MegaETH targets real-time Ethereum, tackling mempool toxicity head-on. Their auction previews blockspace markets where validators auction slots via similar curves. Imagine bidding MEGA for priority execution in 100k TPS environments. Early data shows $450 million bids in hours; full commitments hit $1.3 billion. As MEGA eyes January 2026 trading, this allocation cements long-term alignment.

In practice, contributors with testnet activity or Ethereum commits scored higher. It’s opinionated design: reward builders, not just capital. For modular MEV auctions, this scales-traders can front-run with engagement metrics alongside bids.

MEV Strategies Tailored for MegaETH Blockspace

MegaETH isn’t just fast; it’s MEV-native. Their public sale tested waters for MEV strategies MegaETH in high-throughput chains. Traditional Ethereum MEV relies on bundles; MegaETH’s sub-10ms latency demands auctioned blockspace to curb spam and extraction.

Post-sale, expect MEGA to power governance over auction params. Traders: position via perpetuals now, as Hyperliquid priced $5B FDV pre-sale. Pair with ETH at $3,004.74-a stable anchor amid L2 hype. The auction’s transparency formula? It paves for blockspace auctions 2026, where repeated sealed bids or English formats optimize fees.

MegaETH (MEGA) Price Prediction 2027-2032

Post-launch forecasts (2026 baseline avg: $0.40) based on auction success, real-time L2 tech, ETH at $3,004.74, and market cycles

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg from Prior) |

|---|---|---|---|---|

| 2027 | $0.30 | $0.60 | $1.80 | +50% |

| 2028 | $0.50 | $1.20 | $3.60 | +100% |

| 2029 | $0.90 | $2.40 | $7.20 | +100% |

| 2030 | $1.40 | $4.00 | $12.00 | +67% |

| 2031 | $2.00 | $6.50 | $19.50 | +63% |

| 2032 | $3.00 | $10.00 | $30.00 | +54% |

Price Prediction Summary

MegaETH (MEGA) is positioned for strong growth post its oversubscribed 2025 public sale and 2026 launch, leveraging real-time Ethereum L2 capabilities for 10ms latency and 20k+ TPS. Predictions reflect bullish adoption in DeFi/gaming amid ETH ecosystem expansion, with avg prices climbing from $0.60 (2027) to $10 (2032); min/max capture bear/bull scenarios tied to cycles and competition.

Key Factors Affecting MegaETH Price

- Strong auction demand ($1.3B bids, 27x oversubscribed, $50M cap)

- Real-time blockspace optimization and MEV strategies

- Ethereum price correlation and L2 scaling adoption

- Market cycles (2028 halving bull potential)

- Regulatory clarity for L2s and token distributions

- Tech upgrades enabling 100k TPS targets

- Competition from Monad/other high-perf L2s; broad token distribution via U-Shaped model

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Optimizing here means blending bids with proofs-of-contribution. MegaETH’s 27x oversubscription proves demand; now, strategies shift to post-launch MEV harvesting on their chain.

Arbitrageurs and liquidators stand to gain most in MegaETH’s ecosystem. With sub-10ms block times, MEV strategies MegaETH evolve from Ethereum’s slower bundles to real-time priority auctions. Picture flash loans executing across DeFi protocols without the mempool sandwich attacks plaguing ETH at $3,004.74. Builders bid MEGA for sequencer slots, ensuring fair ordering while extractors pay premiums for front-running edges.

Ethereum Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

To annotate this ETHUSDT chart effectively in my balanced technical style, start by drawing a prominent downtrend line connecting the swing high around 2026-10-10 at $4,850 to the recent swing high near 2026-12-15 at $3,200, extending it forward as dynamic resistance. Add horizontal support at $2,873 (24h low) and resistance at $3,055 (24h high). Mark a recent consolidation rectangle from 2026-12-10 to 2026-01-20 between $2,900-$3,050. Use fib retracement from the major high to low for potential bounce levels at 23.6% ($3,100). Place callouts on volume spikes during the December decline noting fading momentum, and an arrow up on recent MACD histogram shortening for bullish divergence. Vertical line at 2026-01-22 for MegaETH token launch context impact. Entry zone long above $2,950 with stop below $2,850 and target $3,200.

Risk Assessment: medium

Analysis: Downtrend intact but signs of exhaustion with support test and positive divergences; external L2 news adds upside skew but volatility high around current $3,004 price

Market Analyst’s Recommendation: Cautious long on breakout above $3,055 with tight stops, medium position size per my risk tolerance

Key Support & Resistance Levels

📈 Support Levels:

-

$2,873.38 – Strong support at 24h low, aligning with prior swing low and psychological 2900 area

strong -

$2,950 – Intermediate support from recent consolidation lows

moderate

📉 Resistance Levels:

-

$3,004.74 – Current price level acting as pivot/resistance post bounce

moderate -

$3,055.6 – 24h high resistance, key breakout level

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$2,990 – Bounce from support zone with volume confirmation, aligned to medium risk long setup

medium risk

🚪 Exit Zones:

-

$3,200 – Initial profit target at 61.8% fib retrace of recent decline

💰 profit target -

$2,850 – Stop loss below key support to limit downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: fading on decline, spike on recent bounce

Declining volume during downtrend indicates weakening selling pressure; recent uptick supports reversal potential

📈 MACD Analysis:

Signal: bullish divergence

MACD histogram contracting with price lows higher relative to prior, signaling momentum shift

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Critics might call it gimmicky, but the numbers don’t lie: 27.8x oversubscription with 14,491 wallets signals genuine hype. Compare to Monad’s parallel push; MegaETH prioritizes latency over raw TPS, suiting MEV where microseconds count. Traders ignoring this risk missing the next EigenLayer moment, but adapted public sale bidding tactics translate directly: stack contributions pre-launch for allocation edges.

Key MegaETH Auction Metrics

| Metric | Value |

|---|---|

| Total Bids | $1.3B |

| Oversubscription | 27.8x |

| Participants | 14,491 |

| Max Bid | $186K |

| FDV Cap | $999M |

| Premarket FDV | $5B |

Zooming out, MegaETH spotlights Ethereum L1 alternatives MEV. ETH’s mempool chokes at scale; L2s like this reclaim value through auctions. Post-January 2026, MEGA holders vote on fee splits, potentially directing 20-50% of MEV to stakers. Savvy plays? Long perps on Hyperliquid now, hedge with spot ETH at $3,004.74, and farm testnet badges for airdrop multipliers.

Building Your Edge in Modular Blockspace Markets

For platforms like Modular MEV Auctions, MegaETH sets the bar. Their English format, fused with contribution proofs, inspires repeated sealed-bid MEV auctions for dynamic blockspace. Traders: simulate U-Shaped bids in backtests, targeting 10-20% allocation premiums via engagement. Risks? Centralization if whales game contributions, but transparency logs mitigate that.

2026 forecasts point to hybrid auctions dominating, blending MegaETH’s model with instant MEV formats. As Ethereum holds steady at $3,004.74, L2 tokens like MEGA could 10x on mainnet velocity. Position early: monitor sequencer auctions, bundle with AI-driven searchers, and diversify across high-speed chains. MegaETH’s sale proves community firepower trumps VC allocations; the future favors those who bid smart and build alongside.

With over $450 million pouring in hours and full bids eclipsing $1.3 billion, MegaETH didn’t just fundraise-it redefined modular MEV auctions. As MEGA trades come online, expect blockspace wars where strategy reigns supreme, turning latency into liquidity for those ready to adapt.