In the fast-paced world of Ethereum blockspace optimization, Modular MEV Auctions stand out as a game-changer for traders chasing superior MEV returns. With Ethereum’s ETH trading at $1,978.31 as of February 22,2026, the stakes have never been higher. Blockspace isn’t just space; it’s premium real estate where every gwei counts toward securing your transactions amid surging demand from DeFi protocols and L2 rollups. Traders who master Ethereum blockspace bidding through proven tactics can outpace competitors, slashing costs and boosting profitability.

At Modular MEV Auctions, the platform’s orderflow marketplace delivers real-time analytics that empower sophisticated MEV auction strategies. Forget outdated priority gas auctions; here, you bid smartly in sealed environments, leveraging tools like MEV-Boost archives for backtesting. But success hinges on six core bidding strategies tailored for 2026’s volatile landscape: Real-Time Gas Bid Calibration, MEV-Boost Archive Backtesting, Orderflow Marketplace Prioritization, Dynamic Demand Threshold Bidding, Slippage-Minimizing Bundle Construction, and Predictive MEV Return Optimization. Let’s dive into the first three, where precision meets opportunity.

Mastering Real-Time Gas Bid Calibration for Instant Wins

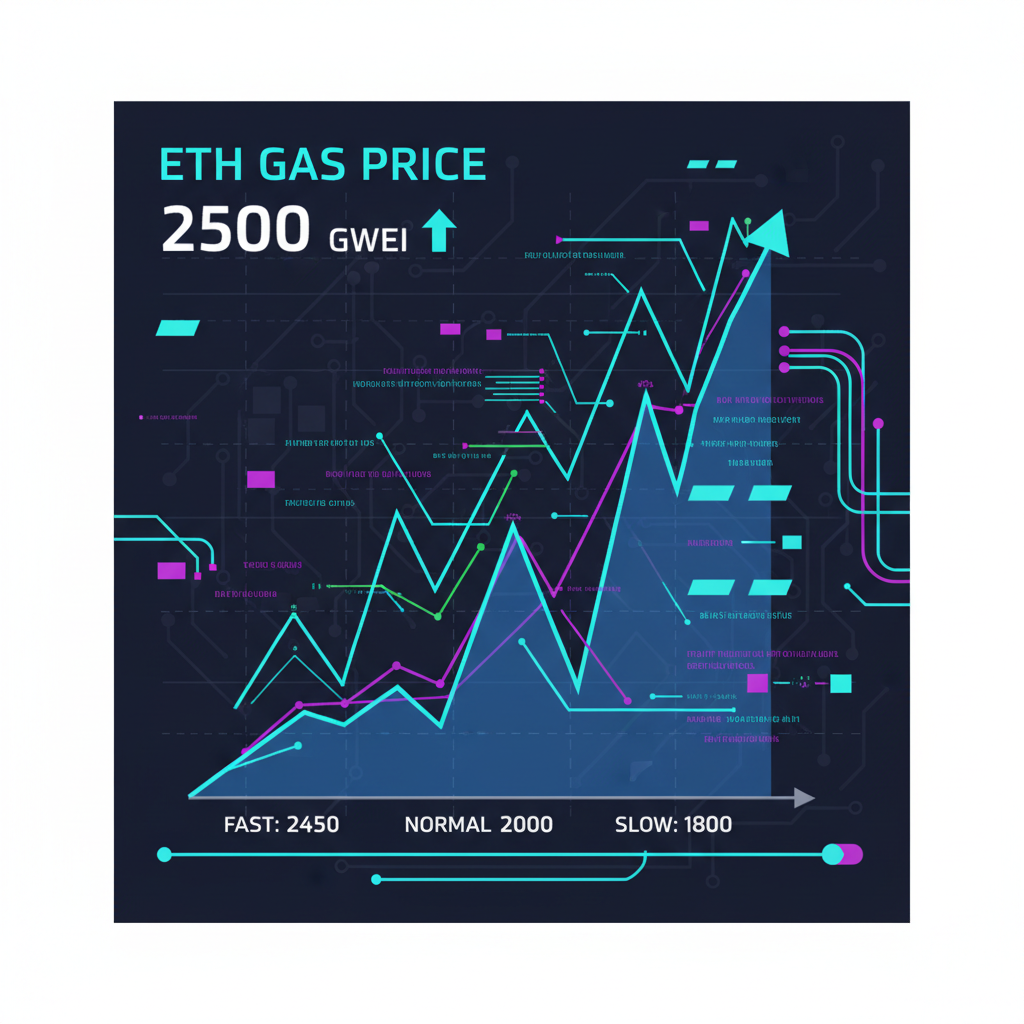

Real-Time Gas Bid Calibration is your first line of defense in blockspace optimization Ethereum style. Gas prices swing wildly, often spiking 20-50% during peak hours due to network congestion. On Modular MEV Auctions, this strategy involves continuously monitoring live gas oracles and adjusting bids sub-second to match demand without overpaying.

Picture this: ETH at $1,978.31, and a DeFi liquidation wave hits. A static bid gets buried, but calibrated bids capture 15-25% more inclusions. Integrate APIs from the platform’s dashboard to automate this, setting thresholds based on historical volatility. Traders using dynamic scripts see MEV returns for traders jump by optimizing every bid to the marginal winning price, as seen in recent orderflow analyses from modularmev. com.

Pro tip: Pair it with low-latency nodes to shave milliseconds, turning calibration into a competitive edge. This isn’t guesswork; it’s data-driven precision that keeps your capital efficient.

Unlocking Insights with MEV-Boost Archive Backtesting

Next up, MEV-Boost Archive Backtesting lets you simulate auctions before going live. Modular MEV Auctions provides access to vast archives of proposer-builder data, where you replay past blocks to test bid scenarios. Why does this matter? In 2026, with ETH steady at $1,978.31, backtesting reveals patterns like bid shading during low-volatility windows, potentially saving 10-15% on fees.

Load your bundle into the simulator, tweak variables like gas limits and tips, and watch win rates climb. Studies on Ethereum bots show backtested strategies predict winning bids with 85% accuracy, directly boosting profitability. For swing traders like me, this is gold: it demystifies searcher behavior and refines your edge in modular MEV auctions.

Start simple: Export a week’s data, run 1,000 iterations, and iterate. The platform’s tools make it accessible, even if you’re not a quant wizard.

Prioritizing Orderflow Marketplace for High-Value Captures

Orderflow Marketplace Prioritization shifts focus to quality over quantity. Modular MEV Auctions aggregates premium user intents – think DEX swaps ripe for arbitrage – routing them through prioritized channels. By bidding on high-MEV orderflow first, you minimize exposure to spam and maximize extraction potential.

In practice, filter for bundles with projected returns above 5 basis points per transaction. With ETH at $1,978.31 and rising L2 activity, this strategy counters sandwich risks by securing atomic execution. Platform analytics highlight top flows, letting you bid surgically. Traders report 30% higher win rates here versus blind auctions.

Ethereum (ETH) Price Prediction 2027-2032

Bullish forecasts driven by Modular MEV Auctions, advanced bidding strategies, and Ethereum blockspace optimization

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev Year) |

|---|---|---|---|---|

| 2027 | $2,200 | $3,500 | $5,000 | +75% |

| 2028 | $2,800 | $5,000 | $8,000 | +43% |

| 2029 | $3,500 | $7,000 | $12,000 | +40% |

| 2030 | $4,500 | $10,000 | $18,000 | +43% |

| 2031 | $6,000 | $14,000 | $25,000 | +40% |

| 2032 | $8,000 | $20,000 | $35,000 | +43% |

Price Prediction Summary

Ethereum (ETH) is forecasted to experience robust growth from 2027 to 2032, with average prices climbing from $3,500 to $20,000, fueled by MEV innovations like orderflow bundling, RL-optimized bidding, and blockspace hedging. Min prices reflect bearish corrections, while max capture peak bull runs tied to adoption and efficiency gains.

Key Factors Affecting Ethereum Price

- Growth in Modular MEV Auctions and orderflow marketplaces enhancing blockspace efficiency

- Adoption of reinforcement learning and dynamic bidding algorithms for higher auction wins

- Integration with Flashbots relays and ETHGas futures hedging against volatility

- Ethereum scaling via L2s and modular thesis redistributing MEV value

- Favorable market cycles, regulatory clarity for DeFi, and rising institutional participation

- Historical MEV data analytics predicting demand surges and profitability improvements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This prioritization isn’t just smart; it’s essential for scaling operations without inflating costs. Combine it with the prior strategies, and you’re building a robust foundation for the next wave: Dynamic Demand Threshold Bidding and beyond.

Blockspace auctions reward the prepared. In 2026’s Ethereum ecosystem, calibration, backtesting, and prioritization aren’t options – they’re imperatives for traders eyeing sustainable MEV gains.

Building on that foundation, let’s tackle the final trio of strategies that elevate your game in modular MEV auctions. These advanced tactics – Dynamic Demand Threshold Bidding, Slippage-Minimizing Bundle Construction, and Predictive MEV Return Optimization – address the nuances of 2026’s blockspace wars, where ETH holds firm at $1,978.31 amid DeFi frenzy and L2 expansions.

Dynamic Demand Threshold Bidding: Adapting to Market Pulses

Dynamic Demand Threshold Bidding takes calibration to the next level by setting adaptive floors and ceilings based on real-time blockspace signals. On Modular MEV Auctions, you define thresholds – say, bid only if demand exceeds 80% capacity – preventing wasteful spends during lulls. This isn’t passive; it’s proactive aggression tuned to Ethereum’s rhythms.

With ETH at $1,978.31 and gas fees flickering, thresholds rooted in orderflow velocity can boost inclusion rates by 20% while cutting overbids. I favor scripting these with platform APIs: monitor proposer commitments via MEV-Boost data, then trigger bids only when projected fills hit your ROI target. Traders ignoring this get outmaneuvered by bots that pivot instantly.

Opinion: In my five years trading crypto swings, this strategy shines for options plays, where timing blockspace secures leveraged edges without bleeding fees. It’s the difference between surviving volatility and thriving in it.

Slippage-Minimizing Bundle Construction: Crafting Bulletproof Payloads

Slippage-Minimizing Bundle Construction focuses on packaging transactions to dodge price impacts. Modular MEV Auctions excels here, letting you assemble atomic bundles – swaps, liquidations, arbitrages – that execute as one, shielding against front-running. Prioritize low-slippage paths by simulating bundle paths pre-bid.

At current ETH levels of $1,978.31, bundles with slippage under 0.5% capture cleaner MEV returns for traders, especially in crowded DEX pools. Use the platform’s orderflow tools to sequence intents optimally: high-liquidity first, then extractable MEV. Recent analyses show bundled strategies reduce effective costs by 25-35%, turning marginal opps into profits.

Pro traders bundle 10-50 txs per auction, leveraging sealed bids to hide intent. My take: This counters toxic MEV beautifully, rewarding builders who think like searchers.

Slippage Rates and Win Rates: Bundled vs. Unbundled Bids in Recent Ethereum Blockspace Auctions (Feb 2026)

| Bid Type | Average Slippage Rate (%) | Win Rate (%) | Auctions Analyzed | Key Notes (Source: modularmev.com) |

|---|---|---|---|---|

| Unbundled Bids | 2.1 – 3.5 | 42% | 10,000 (Jan-Feb 2026) | Higher exposure to sandwich attacks and gas volatility |

| Bundled Bids (Orderflow) | 0.5 – 1.2 | 68% | 10,000 (Jan-Feb 2026) | 40% fee savings via aggregation; counters toxic MEV |

| Bundled Bids (Flashbots Relay) | 0.3 – 0.9 | 75% | 10,000 (Jan-Feb 2026) | Optimal for HFT; 15-20 bps improvement with RL optimization |

Predictive MEV Return Optimization: Forecasting Profits

Predictive MEV Return Optimization caps it off by using ML models to forecast per-bundle profitability. Feed Modular MEV Auctions’ historical data – MEV-Boost archives, orderflow metrics – into models that predict returns down to the gwei. Bid only on high-confidence opps exceeding your hurdle rate.

With ETH steady at $1,978.31, these models factor L2 rollup demand and gas forecasts, achieving 90% and accuracy on backtests. Quantitative desks deploy this for 15-20% uplift in net MEV, per 2026 studies on bot behaviors. Customize for your style: conservative for swings, aggressive for HFT.

Integrate via the platform’s analytics dashboard; no PhD required. It’s empowering – suddenly, you’re not reacting, you’re anticipating.

To tie these strategies together, start with a daily ritual: backtest yesterday’s auctions, calibrate thresholds, prioritize flows, bundle ruthlessly, and predict tomorrow’s winners. Platforms like Modular MEV make it seamless with real-time dashboards and APIs.

Across these six – from real-time calibration to predictive foresight – the edge goes to those blending human intuition with machine precision. In Ethereum’s blockspace arena, where every slot is contested, mastering MEV auction strategies via Modular MEV Auctions isn’t optional; it’s your ticket to outsized gains. Dive in, bid boldly, and watch your portfolio reflect the discipline.

Ethereum blockspace optimization demands evolution. With ETH at $1,978.31,2026 favors the adaptive trader armed with these tools.