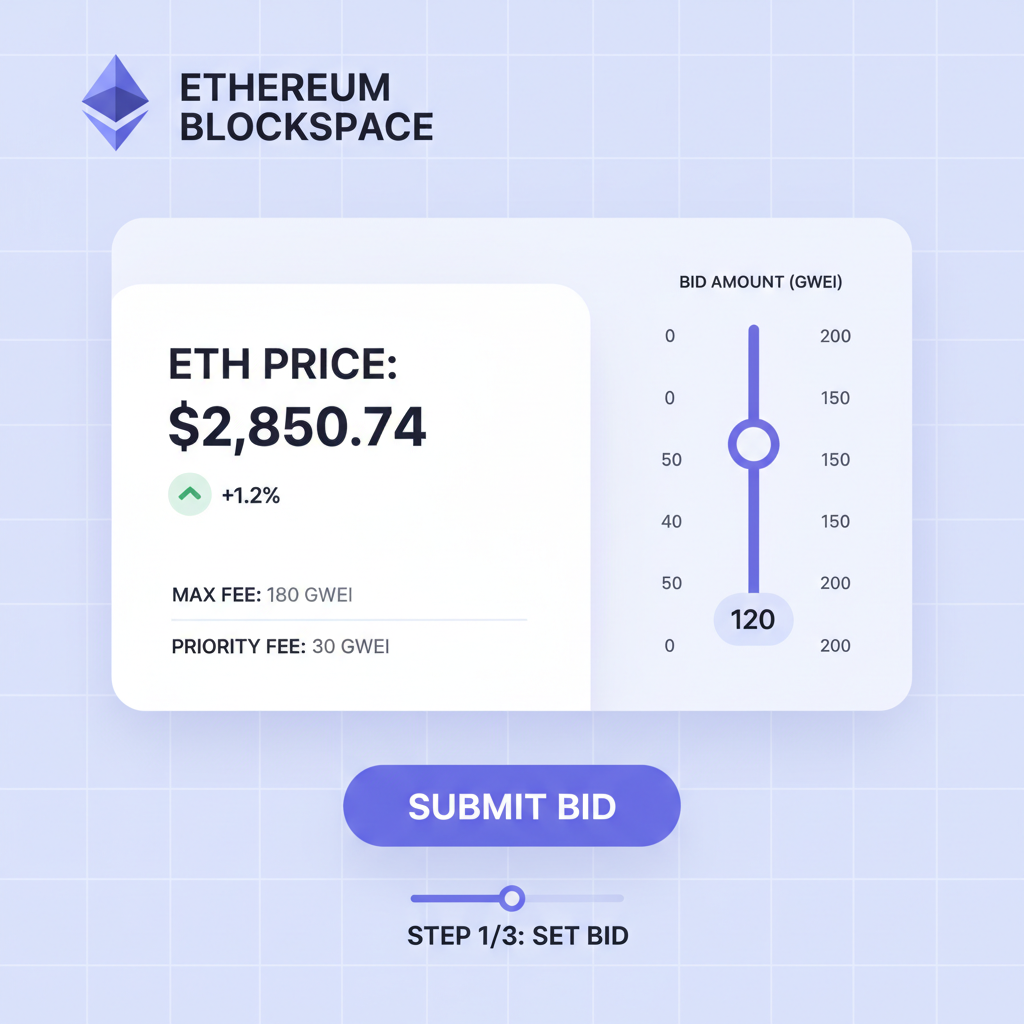

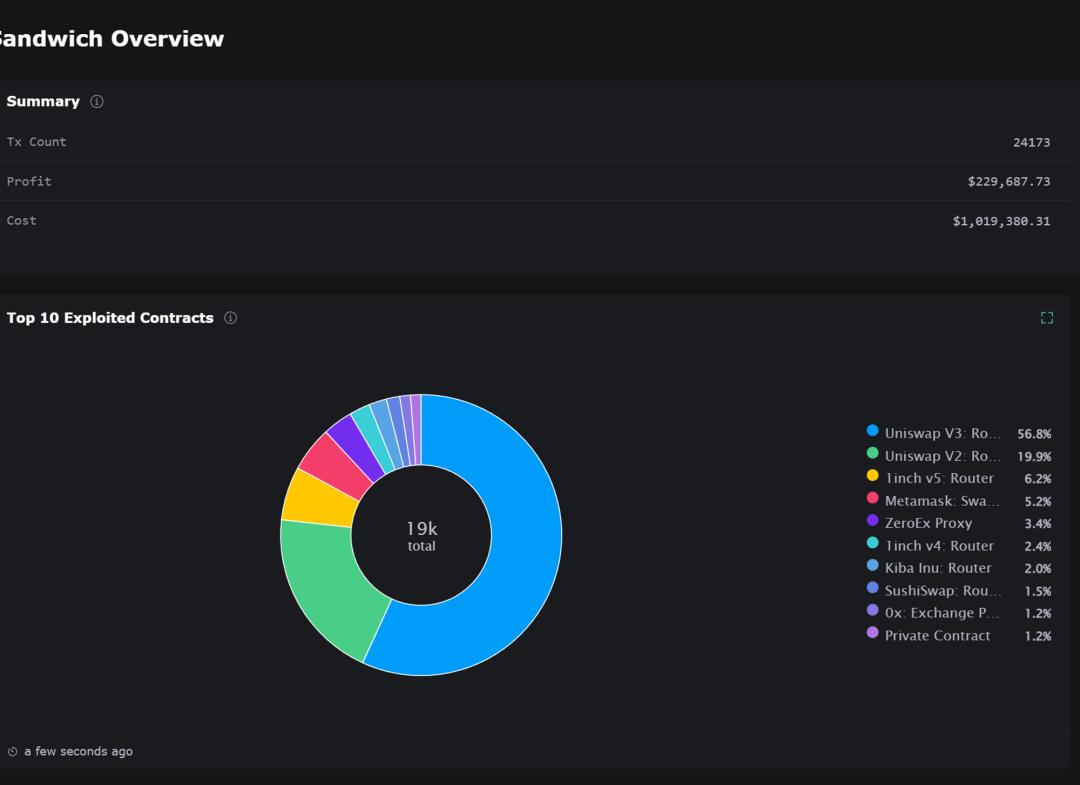

In today’s Ethereum ecosystem, where ETH trades at $1,961.79 amid a 24-hour dip of $16.60, Maximal Extractable Value (MEV) remains a double-edged sword. Sandwich attacks, a staple of MEV exploitation, continue to siphon roughly $60 million annually from traders despite declining per-attack profits. EigenPhi data shows monthly attacks holding steady at 60,000 to 90,000, yet total hauls dropped from nearly $10 million late 2024 to $2.5 million by October 2025. This shift signals protection tools gaining ground, but vulnerabilities linger, especially in low-volatility stablecoin pools hit 38% of the time. Blockspace auctions offer a structured counterpunch, redistributing MEV value transparently via platforms like Modular MEV Auctions.

Sandwich Attacks Dissected: Mechanics and Market Impact

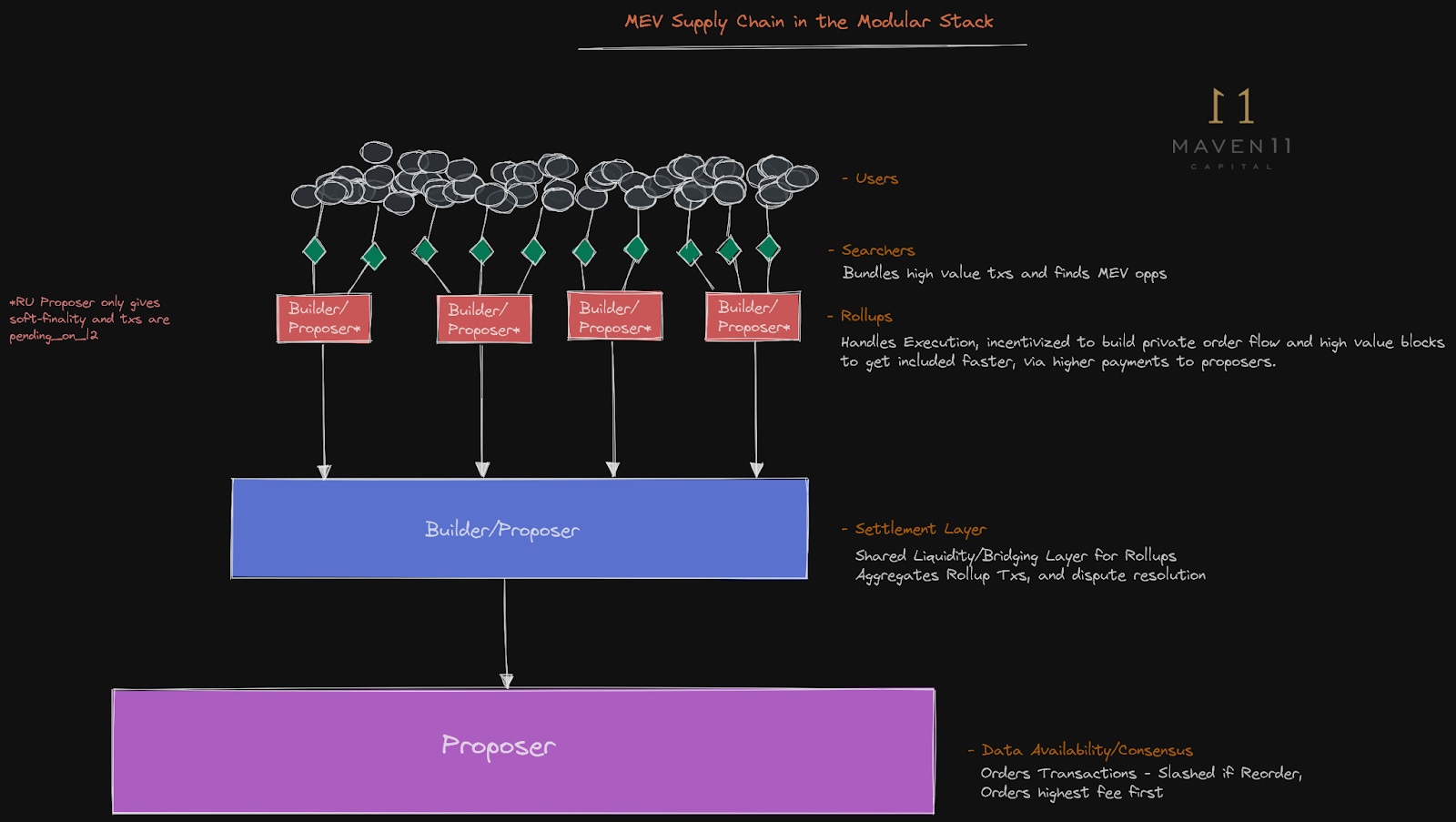

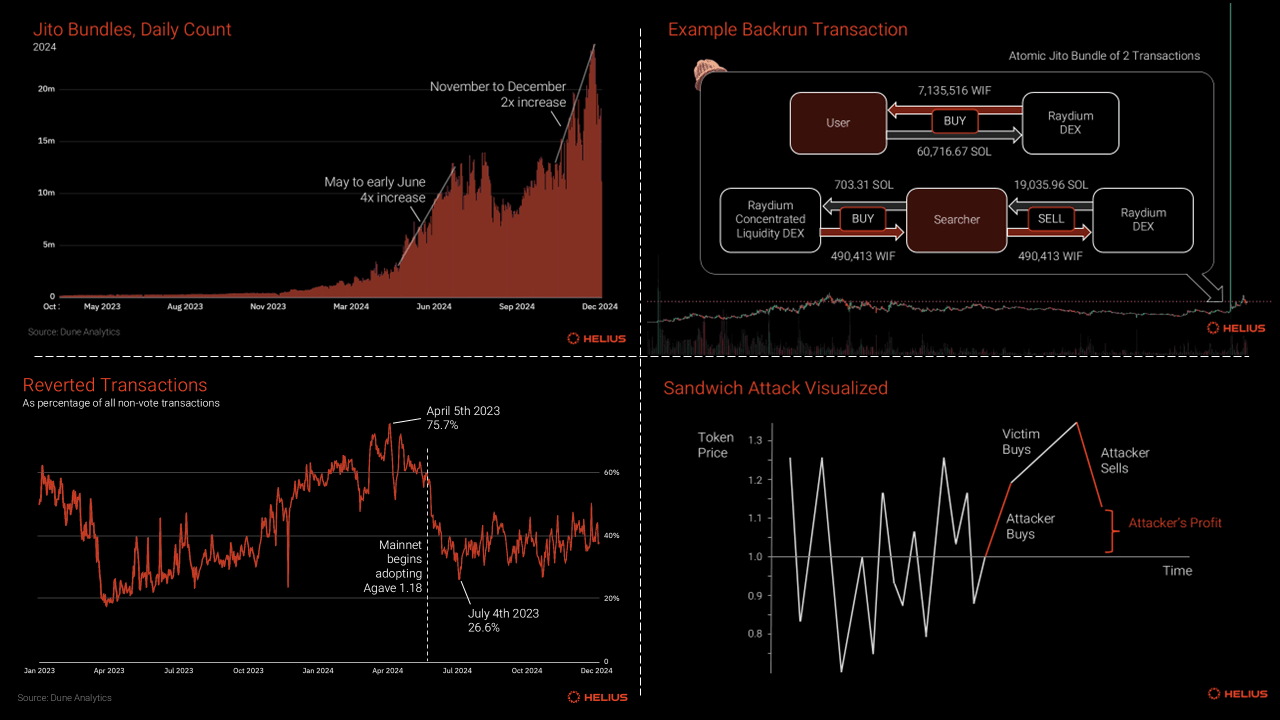

Sandwich attacks thrive on mempool visibility. A bot spots your DEX swap, frontruns with a buy to spike the price, lets your trade execute at a worse rate, then sells post-transaction for profit. This zero-sum extraction erodes user experience, with front-running and sandwiches cited by Binance research as key culprits in DeFi losses. Ethereum Research echoes the call: transaction auctions could claw back MEV from validators to originators.

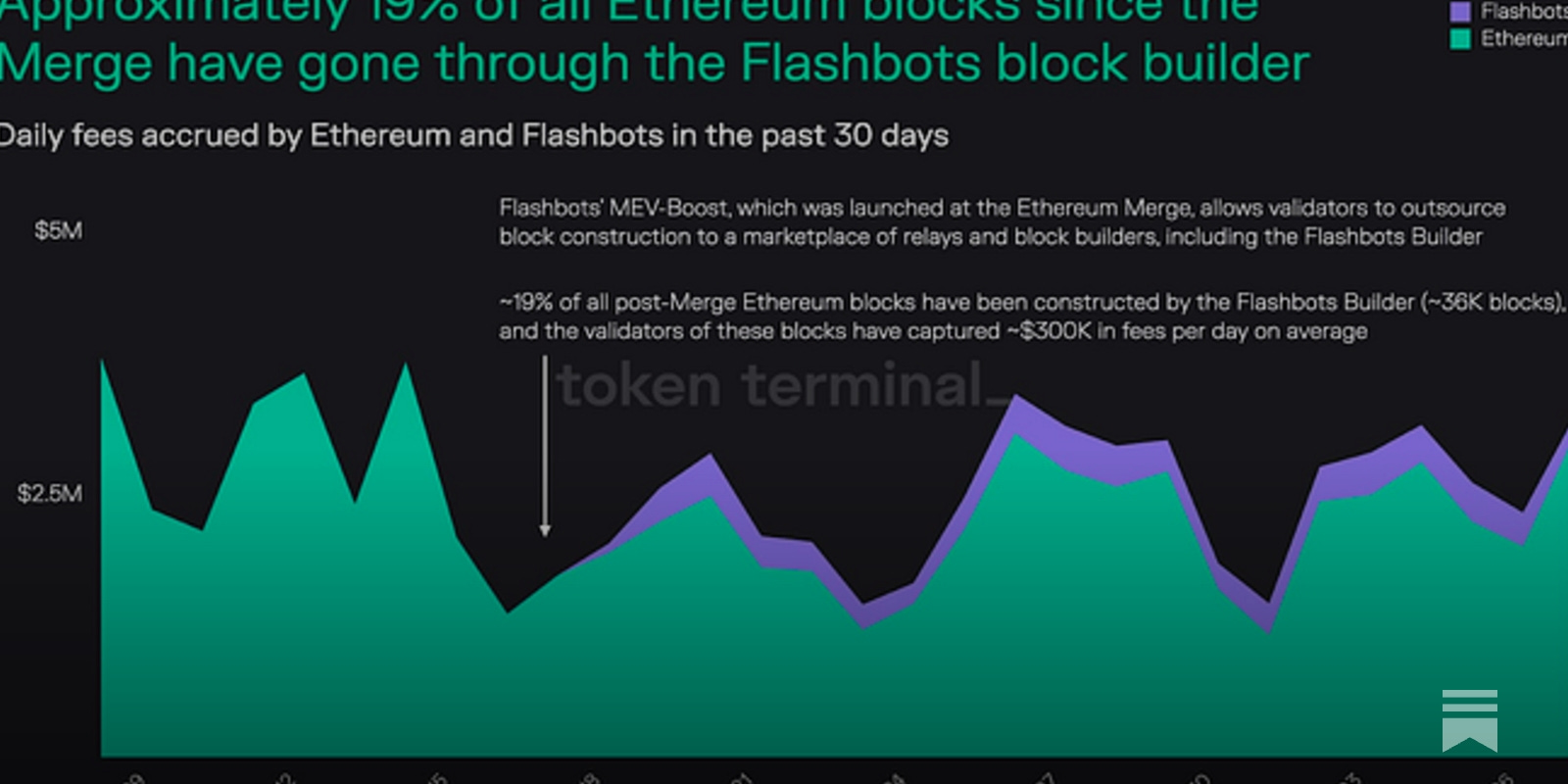

Flashbots’ private relays mitigate visibility, but bots evolve, leveraging flash loans in modular arms races as EigenPhi chronicles. Reinforcement learning papers on Polygon highlight auction dynamics favoring late bids under tight slots, a pattern Ethereum’s MEV-Boost amplifies. At current ETH levels around $1,961.79, block rewards pale against MEV hauls, incentivizing attacks on smaller liquidity pools per CryptoEQ insights.

Why Profitability Wanes: Data-Driven Shifts in MEV Landscape

Despite attack volume stability, profitability cratered, per EigenPhi and Cointelegraph exclusives. Adoption of privacy layers like Shutter’s threshold encryption and Flashbots bundles dulls bot edges. ChainSafe advocates structured privacy to shield swaps while funneling value to users and validators. Yet, 38% targeting stablecoins underscores no pool is safe; even low-volatility trades bleed value.

A2MM protocols like SwapSwap aim to eradicate MEV systematically, per Liyi Zhou, but auctions provide immediate, protocol-agnostic relief. Bitquery’s MEV taxonomy reveals frontrunning as rearrangement abuse, auctions neutralize by committing orderflow pre-block. With ETH at $1,961.79, down 0.84% daily, traders face compounded risks from volatility and bots alike.

Auctions on Ethereum Blockspace: Architectural Edge Against Bots

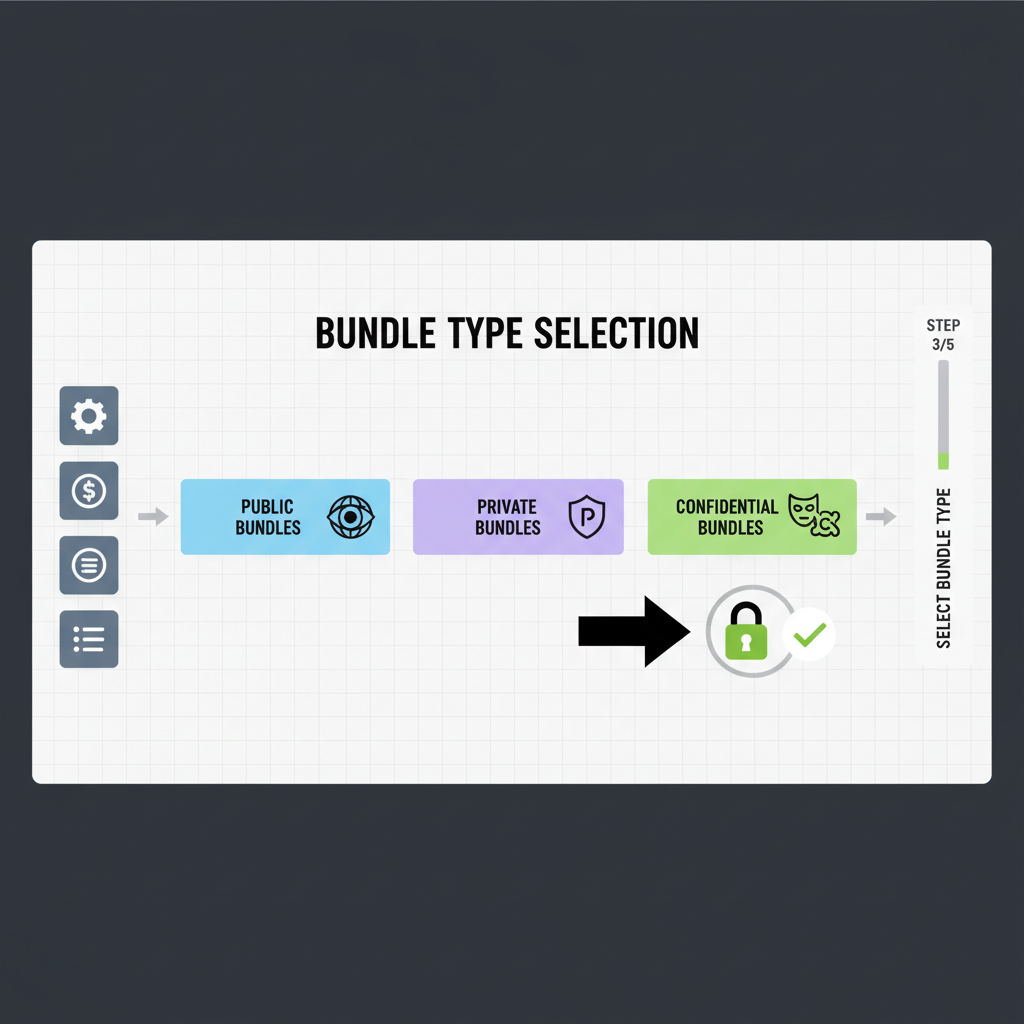

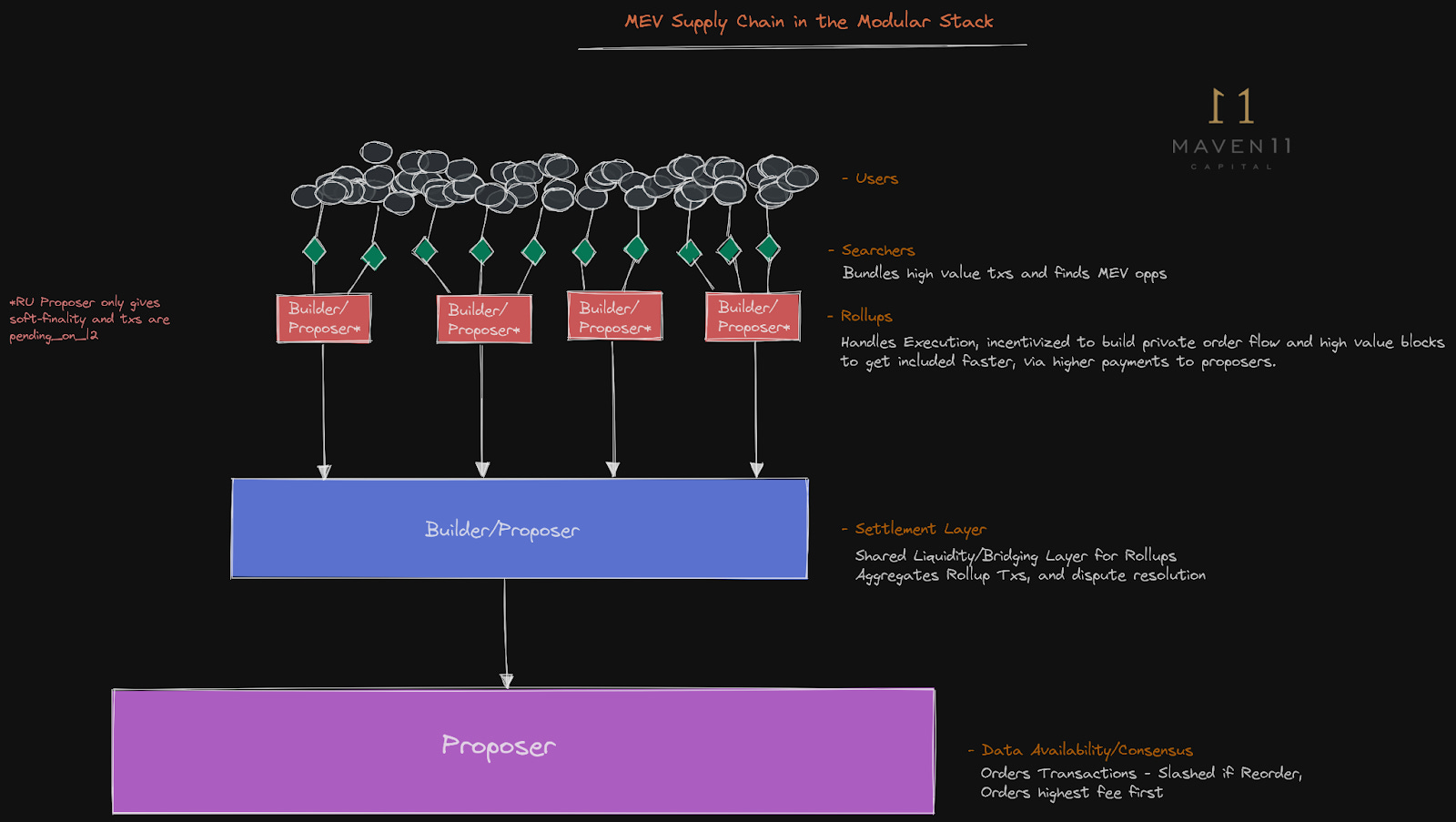

Modular MEV Auctions pioneer blockspace markets, auctioning priority access transparently. Users bid for inclusion in protected bundles, sidelining sandwich opportunities. Unlike naive priority fees, these reverse auctions return MEV to originators, slashing validator capture as Ethereum Research proposes.

Picture sealed-bid formats where bots compete blindly, execution sequenced by auction rules. This microstructure tweak, honed in my HFT systems, captures inefficiencies systematically. Flashbots research nods to regulatory hurdles, but auction neutrality sidesteps legal MEV pitfalls. In DeFi’s modular era, blockspace as a marketplace empowers traders, aligning incentives forward.

Ethereum (ETH) Price Prediction 2027-2032

Factoring MEV auction adoption, reduced sandwich losses, and Ethereum ecosystem advancements

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY Change % |

|---|---|---|---|---|

| 2027 | $2,200 | $3,200 | $4,800 | +63% |

| 2028 | $2,900 | $4,600 | $7,500 | +44% |

| 2029 | $3,700 | $6,200 | $11,000 | +35% |

| 2030 | $4,200 | $8,000 | $14,500 | +29% |

| 2031 | $4,800 | $10,000 | $18,000 | +25% |

| 2032 | $5,500 | $12,500 | $23,000 | +25% |

Price Prediction Summary

Ethereum is poised for robust growth from 2027-2032, driven by MEV auction mechanisms and protections slashing sandwich attack losses (down to $2.5M monthly by 2025), boosting DeFi trust and TVL. Average prices projected to rise from $3,200 to $12,500, reflecting bull cycles, scalability upgrades, and institutional inflows, with wide min/max ranges accounting for regulatory risks and market volatility.

Key Factors Affecting Ethereum Price

- MEV auction adoption returning value to users, reducing ~$60M annual sandwich losses

- Decline in attack profitability enhancing DEX user experience and DeFi activity

- Ethereum protocol upgrades (e.g., threshold encryption) for native MEV protection

- 4-year market cycles favoring bull runs in 2028-2029

- Regulatory clarity enabling institutional adoption

- L2 scaling and restaking increasing ETH demand as settlement asset

- Competition from L1s mitigated by Ethereum’s network effects

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Priority flows via private mempools feed these auctions, minimizing public exposure. GetBlock notes sharp attack drops tied to such tools, hinting at auctions’ latent power. As ETH hovers near $1,961.79, integrating MEV auctions Ethereum style fortifies positions against persistent bots.

Modular MEV Auctions streamline this process, offering real-time orderflow marketplaces where blockspace auctions DeFi pros bid on slots with full transparency. Bots lose their frontrunning edge when transactions bundle into auction-committed blocks, executed in bidder-specified order. This isn’t just theory; my quantitative systems have mirrored these dynamics in forex HFT, proving auctions crush predatory reordering.

Hands-On Protection: Leveraging Auctions for MEV Sandwich Attacks Prevention

To protect transactions from MEV bots, shift from public mempools to auction relays. Platforms like Modular MEV Auctions expose analytics dashboards tracking bid efficiency and attack evasion rates. At ETH’s current $1,961.79 valuation, a 0.84% daily slide amplifies the need for precise execution; auctions deliver by prioritizing value over gas wars.

Flashbots-inspired bundles pair user tx with bribes, but pure auctions elevate this, letting users capture surplus directly. Ethereum Research’s transaction auction blueprint aligns perfectly, proposing user-centric MEV redistribution amid validator dominance.

Critics decry auctions as centralizing forces, yet modular designs decentralize via on-chain settlement. EigenPhi’s modular arms race narrative flips the script: flash loan bots now bid in structured arenas, not chaotic mempools. Reinforcement learning edges erode under blind auctions, as Wu et al. model on Polygon.

Quantitative Edge: Code and Strategies for Blockspace Mastery

Implement via smart contracts interfacing auction endpoints. A basic snippet integrates with a hypothetical Modular MEV relayer, sealing bids pre-submission.

Bundling User Swap with MEV Auction Bid via Flashbots

To protect against MEV sandwich attacks, searchers bundle the user’s swap transaction with a bid to a blockspace auction contract and submit via Flashbots private mempool for atomic execution:

import { ethers } from 'ethers';

import { FlashbotsBundleProvider } from '@flashbots/ethers-provider-bundle';

const AUCTION_ABI = ['function bid(uint256 amount) external'];

const auctionAddress = '0x...'; // MEV auction contract

async function submitAuctionBundle(

signedUserSwapTx, // User's signed Uniswap swap tx

provider,

searcherWallet

) {

const flashbotsProvider = await FlashbotsBundleProvider.create(

provider,

searcherWallet,

'https://relay.flashbots.net' // Flashbots relay

);

// Prepare and sign bid transaction

const auctionContract = new ethers.Contract(auctionAddress, AUCTION_ABI, searcherWallet);

const bidTx = await auctionContract.populateTransaction.bid(ethers.parseEther('0.01')); // Example bid

const signedBidTx = await searcherWallet.signTransaction(bidTx);

const bundle = [

{ signedTransaction: signedUserSwapTx },

{ signedTransaction: signedBidTx }

];

const targetBlockNumber = (await provider.getBlock('latest')).number + 1;

// Simulate bundle

const simulation = await flashbotsProvider.simulate(bundle, targetBlockNumber);

if (simulation[0].error) {

throw new Error(`Simulation failed: ${simulation[0].error.message}`);

}

console.log('Simulation successful:', simulation);

// Submit to private mempool

const bundleResponse = await flashbotsProvider.sendBundle(bundle, targetBlockNumber);

console.log('Bundle submitted:', bundleResponse.bundleHash);

// Wait for inclusion

await flashbotsProvider.waitForBundleSuccess(bundleResponse);

}

// Usage:

// const provider = new ethers.JsonRpcProvider('https://eth-mainnet.g.alchemy.com/v2/...');

// const searcherWallet = new ethers.Wallet('0xprivatekey', provider);

// submitAuctionBundle('0xusersignedtx...', provider, searcherWallet);This mechanism auctions priority inclusion directly, bypassing public mempool front-running. Emerging standards like ERC-7777 and SUAVE will standardize such protections across chains.

This code enforces atomic execution, neutralizing sandwiches by preconditioning order on auction win. Pair with priority fee MEV protection tweaks, calibrating bids dynamically against ETH at $1,961.79.

Key MEV Auction Benefits for DeFi Traders

-

Transparent Bidding: Open auctions like MEV-Boost enable fair, verifiable competition, minimizing hidden manipulations.

-

User MEV Recapture: Returns extracted value to users via auctions, as in Flashbots Protect relays, countering $60M annual sandwich losses.

-

Bot Deterrence: Auction mechanisms raise barriers for malicious bots, reducing sandwich attack profitability from $10M to $2.5M monthly.

-

Real-Time Analytics: Tools like EigenPhi provide live MEV insights, tracking 60K-90K monthly attacks for proactive defense.

-

Modular Integration: Seamlessly embeds into DEXes via private relays, supporting PBS for scalable Ethereum protection.

Binance’s MEV analysis frames extraction as a zero-sum drag on DEX UX; auctions pivot to positive-sum via shared surplus. ChainSafe’s privacy-structure hybrid complements, but auctions scale faster, agnostic to L2s or rollups. Liyi Zhou’s A2MM vision resonates, yet near-term, Modular MEV Auctions guide traders through today’s battlefield.

Regulatory shadows loom per Flashbots, but auction logs provide audit trails, framing MEV as market-making, not predation. With sandwich profits waning to $2.5 million monthly, tools like these accelerate the decline. Traders eyeing ETH’s $1,961.79 resilience should embed auctions now, automating defense in DeFi’s high-stakes arena. Forward protocols will bake this in natively, but Modular MEV Auctions bridges the gap, empowering quantitative edges today.