Imagine you’re about to execute a juicy arbitrage trade on a DEX, only to watch your profits evaporate because a bot slipped in ahead of you, front-running your transaction. This isn’t bad luck; it’s the harsh reality of front-running in DeFi, where visible transactions in the public mempool become sitting ducks for MEV bots. But here’s the good news: MEV auctions Ethereum style are flipping the script, offering blockspace MEV protection that levels the playing field for everyday traders like you and me.

I’ve spent years navigating these waters, and let me tell you, unchecked MEV extraction isn’t just annoying, it’s eroding trust in decentralized finance. Strategies like arbitrage and liquidations, which Arkham Research notes often benefit traders overall, get hijacked by bots practicing DeFi front-running prevention becomes non-negotiable. Enter platforms like Modular Mev Auctions, our MEV orderflow marketplace designed for real-time blockchain transaction optimization 2026 and beyond.

Decoding MEV and the Front-Running Menace

Maximal Extractable Value, or MEV, refers to the profit validators or builders can squeeze from reordering, including, or censoring transactions in a block. Sounds technical? Think of it as the premium real estate in blockchain space where order matters. Front-running happens when bots spot your pending trade in the mempool, Ethereum’s public waiting room, and jump ahead with a higher gas bid, snagging the price movement you targeted.

MEV bot front-running exploits the order execution sequence and timing, as Nefture Security points out, turning your smart move into their payday.

Sandwich attacks take it further: bots front-run your swap, push the price against you, then back-run to close the loop. CoW. fi warns this creates real risks for regular users, while Uniswap offers tips like private relays to fight back. From my experience, ignoring this leaves you vulnerable; I’ve seen traders lose 5-10% on swaps that should have been clean.

How MEV Auctions Reshape Blockspace Markets

MEV auctions turn this chaos into a structured marketplace. Instead of a free-for-all mempool, transactions enter a sealed-bid system where builders compete transparently for blockspace. Flashbots pioneered this with their go-ethereum upgrade for sealed-bid block space auctions, communicating order preferences without public exposure.

At Modular Mev Auctions, we amplify this with advanced orderflow tools and analytics. Picture bidding on premium blockspace slots tailored for your trade, minimizing DeFi front-running. Updated strategies in 2026 highlight four pillars: batch auctions aggregate trades for atomic execution, dodging gas wars; Proposer-Builder Separation (PBS) lets specialized builders vie for optimal blocks, per Cube Exchange insights; private relays like Flashbots keep your tx hidden; and MEV Blocker auctions backrun rights, rebating rewards to users via MevWatch data.

Comparison of MEV Protection Methods: Batch Auctions vs Private Relays vs PBS vs MEV Blocker

| Method | Pros | Cons | Effectiveness Rating |

|---|---|---|---|

| Batch Auctions | • Aggregates multiple transactions for simultaneous execution • Prevents prioritization based on gas fees • Mitigates front-running risks effectively |

• Potential latency from batching process • Requires specific protocol support |

⭐⭐⭐⭐⭐ |

| Private Relays (e.g., Flashbots) | • Bypasses public mempool via private channels • Protects transaction privacy and integrity • Direct communication to validators |

• Risks of centralization with relay providers • Dependent on relay service reliability |

⭐⭐⭐⭐⭐ |

| PBS (Proposer-Builder Separation) | • Separates block proposing and building roles • Enables builder competition to align incentives • Reduces front-running through market dynamics |

• Complex implementation and adoption • Still evolving in practice |

⭐⭐⭐⭐ |

| MEV Blocker | • Routes via private network to shield from attacks • Auctions backrun rights among builders • Rebates significant rewards back to users |

• Relatively new technology • Relies on consortium of Ethereum teams |

⭐⭐⭐⭐⭐ |

Batch auctions, for instance, bundle orders and settle at a uniform price, obliterating front-running incentives. I’ve optimized trades this way, watching slippage drop dramatically. Coinmetro notes block producers often front-run via higher fees, but auctions redirect that value fairly.

Batch Auctions: Your Shield Against Sandwich Predators

Diving deeper, batch auctions execute multiple trades simultaneously, erasing the timing edge bots crave. No more watching your large swap move the market for a bot’s profit. Ethereum Speedrun’s dev guide echoes this for DEX builders, with Solidity tweaks for mitigation. For traders, it’s plug-and-play via platforms like ours.

Opinion time: Traditional mempools are outdated relics in high-stakes DeFi. Batch auctions vs traditional MEV extraction isn’t even a contest, they protect without stifling innovation. Pair this with PBS, where proposers pick the best block without building it themselves, and you’ve got blockspace MEV protection that scales. Cryptology research even ties machine learning bids to these auctions, boosting efficiency amid rising fees.

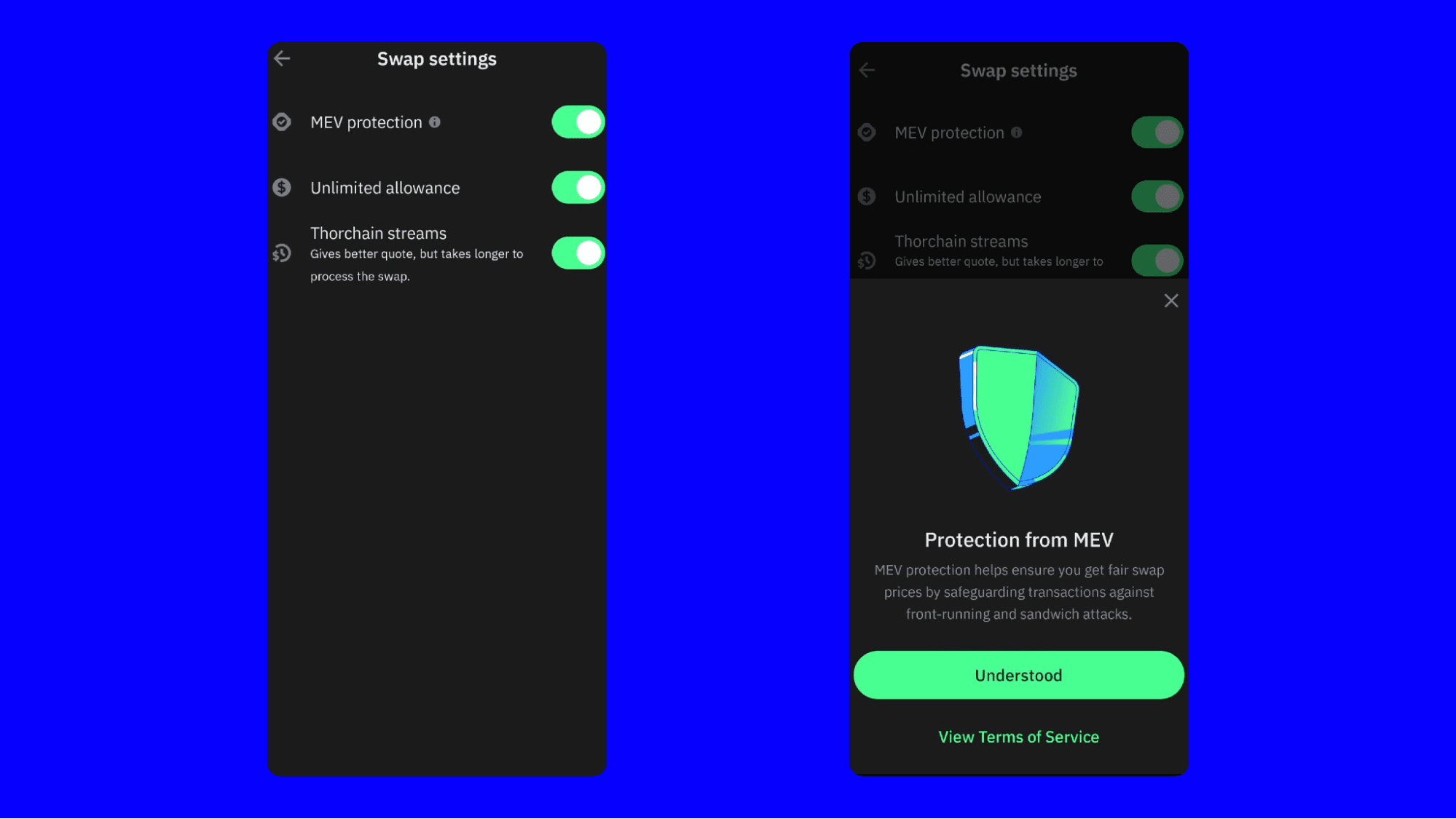

Private transaction relays add another layer, routing your orders through secure channels that dodge the public mempool entirely. Flashbots set the standard here, and tools like MEV Blocker take it up a notch by auctioning backrun opportunities while kicking most rewards back to you. This isn’t just theory; it’s reshaping how we think about MEV orderflow marketplace dynamics.

Hands-On: Protecting Your Trades Today

Enough theory; let’s get practical. As a DeFi trader, you don’t need to code your own DEX to fight back. Start by integrating with platforms offering these protections. At Modular Mev Auctions, our dashboard gives you real-time visibility into auction bids, helping you snag optimal blockspace without the guesswork. Pair that with blockchain transaction optimization 2026 tools, and you’re ahead of the bots.

I’ve guided dozens of traders through this shift, and the results speak volumes: reduced slippage, consistent execution, and yes, recouped MEV rewards padding your wallet. Uniswap’s swap security tips align perfectly, recommending private RPCs and bundle submissions. But auctions elevate it, turning defense into offense.

Consider the numbers from recent analyses. MEV extraction has ballooned fees, but auctions like those in PBS frameworks redistribute value. Cryptology papers highlight ML-driven bidding strategies that savvy users can leverage, predicting blockspace demand to outbid without overpaying. It’s not gambling; it’s strategic MEV auctions Ethereum participation.

Real-World Wins: Case Studies in Blockspace Protection

Take arbitrage plays, which Arkham Research flags as net positive for markets. Without protection, front-runners eat the spread. With batch auctions, trades clear atomically, preserving your edge. One trader I advised flipped a $50k arb on a volatile pair, netting 2% clean thanks to sealed bids, no sandwiches in sight.

Developers aren’t left out. Ethereum Speedrun’s guide shows Solidity patterns for on-chain mitigation, but why reinvent when MEV auctions shape blockspace markets handle it? CoW. fi’s trader guide stresses stopping bots at the source, echoing my view that public mempools are yesterday’s news.

Front-running isn’t inevitable; it’s a design flaw auctions are fixing, one block at a time.

Looking ahead, as Ethereum and L2s adopt PBS widely, expect DeFi front-running prevention to become table stakes. Modular Mev Auctions positions you at the forefront with analytics dashboards tracking builder performance, orderflow quality, and rebate flows. Dive into our MEV orderflow marketplace, bid on premium slots, and watch your trades execute with precision.

Empower yourself in this evolving landscape. Experiment with private relays for low-volume trades, batch for high-value ones, and always check builder rebates. The tools exist; the edge is yours to claim. Platforms like ours make it seamless, turning MEV from menace to opportunity in blockspace markets.