In the high-stakes world of blockchain trading, where every millisecond counts, mempool spam and failed transactions are silently eroding user trust and network efficiency. Picture this: you’re a trader eyeing a juicy arbitrage opportunity on Solana, but your tx gets drowned out by a flood of bot-submitted junk. By early 2025, Solana’s mempool was choking under memecoin frenzy, with delays hitting 40 seconds and failure rates soaring, all thanks to aggressive MEV bots spamming low-fee txs to snag toxic MEV.

MEV’s Hidden Toll: Spam and Failures in Today’s Blockchains

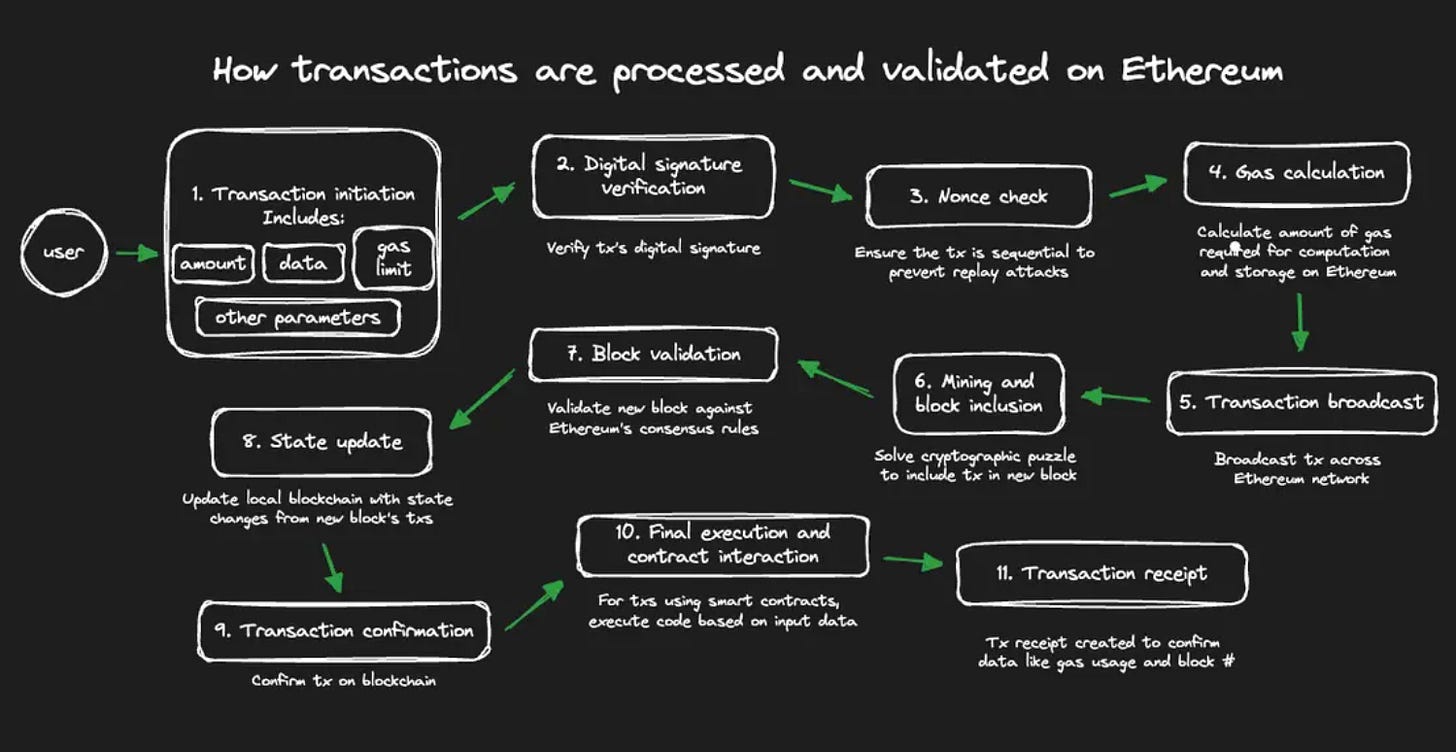

Maximal Extractable Value, or MEV, started as a clever side effect of decentralized ordering-no central clock means searchers compete fiercely to reorder txs for profit. But this freedom breeds chaos. On Ethereum L2s, Flashbots data reveals up to 80% of gas wasted on spam txs that pay minimally yet clog the pipes. Public mempools expose pending txs to all, inviting sandwich attacks where bots front-run your trade, executing at worse prices. It’s toxic MEV at its worst, labeled so because victims suffer slippage or outright failures.

Solana amplifies this nightmare with its low fees and Gulf Stream scheduling. Bots flood the network with bundles via Jito, but without better safeguards, congestion spikes. Ethereum fares no better post-PoS; Flashbots’ mev-boost separates proposers and builders, yet two builders snag 90% of block auctions, hinting at oligopoly risks.

Instant MEV Auctions: Speedy Relief or Centralization Trap?

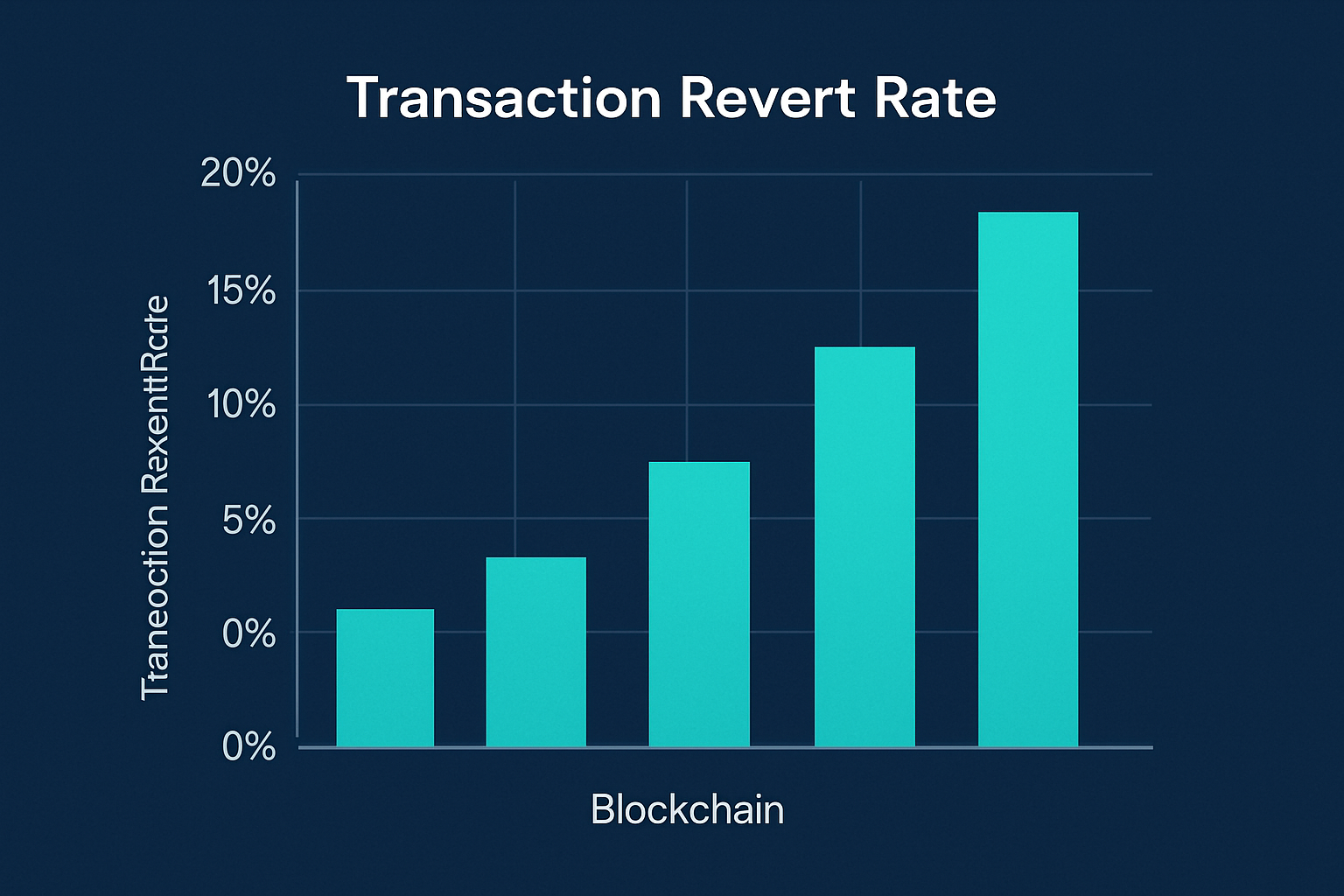

Instant MEV auctions promise a fix by letting the highest bidder claim immediate tx priority via sealed-bid, second-price formats. Arbitrum’s Timeboost exemplifies this: an express lane where top bids secure short-term boosts, slashing the need for spamming multiples. Theory says it curbs mempool spam by ending latency races among searchers. Yet reality bites-Arbitrum data shows two entities dominating 90% of wins, and 22% of boosted txs reverted anyway. Centralization creeps in, echoing Ethereum builder trends.

Instant MEV Auctions: Pros & Cons

-

Reduces Mempool Spam: Eliminates latency races among MEV searchers, cutting spam transactions and failed attempts. (Inspired by Arbitrum Timeboost)

-

Fast Prioritization: Grants immediate express lane access to highest bidder via sealed-bid auctions for quick tx inclusion.

-

Centralization Risk: Two entities won 90%+ of auctions, leading to oligopolistic control. (Ethereum & Timeboost data)

-

High Revert Rates: ~22% of boosted transactions revert, failing to fully curb spam. (Empirical Timeboost study)

Still, for high-frequency plays like Polygon MEV extraction, reinforcement learning edges out traditional methods in these auctions, per arXiv studies. Traders get reliable inclusion without blasting the mempool, preserving blockspace for real users. Platforms like Modular Mev Auctions could refine this into a true MEV orderflow marketplace, channeling bids transparently.

Slow Auctions Emerge: Fairer Bids, But at What Cost?

Enter slow MEV auctions, with extended bidding windows for cooler heads and broader participation. No frantic spam; bids deliberate over minutes, potentially evening the field against RL-powered bots. This suits baselayer neutrality, as Paradigm notes-MEV thrives sans gatekeepers, but slow formats distribute spoils without instant riches favoring the fastest infrastructure.

Yet speed is blockchain’s lifeblood. Solana traders can’t wait; delays compound in volatile 2025 markets. Slow auctions might cut failed transactions blockchain woes by design, fostering equitable blockspace auctions 2025, but empirical tests lag. Eclipse Labs pushes multidimensional fees at 1M TPS, hinting slow bids could pair with dynamic pricing to tame spam without instant winner-takes-all.

Check out how instant MEV auctions target these pains head-on, blending speed with spam defense.

Modular Mev Auctions steps in here, offering a refined MEV orderflow marketplace that traders can tap for both auction types, optimizing bids without the pitfalls.

Head-to-Head Battle: Instant vs Slow in Curbing Toxic MEV

Let’s pit them against each other. Instant auctions shine in high-speed environments like Solana, where Jito bundling demands split-second decisions. Bidders pay a premium for priority, slashing spam by design-no need to shotgun dozens of txs when one sealed bid wins the slot. But that 90% dominance by two players? It’s a red flag for anyone valuing decentralization. Slow auctions counter with inclusivity, letting smaller searchers join without supercomputers. Reinforcement learning bots still prowl, as ResearchGate papers show their edge in prolonged games, yet the extended timeline weeds out pure speed demons.

Ethereum Technical Analysis Chart

Analysis by Owen Gallagher | Symbol: BINANCE:ETHUSDT | Interval: 1W | Drawings: 8

Technical Analysis Summary

To illustrate this ETHUSDT chart in my conservative style, begin with a prominent uptrend line from the January 2025 low at $2,800 connecting to the July peak at $4,500, using ‘trend_line’ in green for the macro bull story. Overlay a short-term downtrend line from July $4,500 to November $3,200 low in red. Mark horizontal lines at key support $3,200 (strong, thick red) and $3,500 (moderate, dashed blue), resistance at $4,000 and $4,500 similarly. Add a rectangle for the late-2025 consolidation zone from Oct 1 ($3,800) to Dec 8 ($3,200). Place fib_retracement from July high to Nov low for pullback levels. Use callouts for volume bearish divergence and MACD bearish signal with arrow_mark_down. Vertical line at 2025-12-08 for MEV news impact. Long position marker near $3,550 entry, stop_loss at $3,400, profit_target $4,100. Text box: ‘MEV shadows the rally—wait for macro clarity.’

Risk Assessment: medium

Analysis: Technical rebound tentative against MEV-induced fundamental headwinds like spam and centralization; low conviction volume confirms caution

Owen Gallagher’s Recommendation: Remain sidelined—scale in only above $4,000 with macro improvement; preserve capital in this story’s uncertain chapter

Key Support & Resistance Levels

📈 Support Levels:

-

$3,200 – November 2025 low with volume spike, macro floor

strong -

$3,500 – October swing low, 50% fib retrace

moderate

📉 Resistance Levels:

-

$4,000 – Recent December high, psychological barrier

moderate -

$4,500 – July peak, prior all-time zone

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$3,550 – Bounce from moderate support with MACD stabilization, aligns low-risk fundamental wait

low risk

🚪 Exit Zones:

-

$4,100 – Near-term resistance test

💰 profit target -

$3,400 – Invalidation below key support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Bearish divergence on rebound

Volume dries up as price lifts from $3,200, signaling weak hands

📈 MACD Analysis:

Signal: Bearish crossover persisting

Histogram contracting, line below signal amid MEV macro drag

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Owen Gallagher is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

On Polygon and EVM L2s, slow formats could mesh with multidimensional fees, per Eclipse Labs, dynamically pricing blockspace to starve spam at 1M TPS scales. Toxic MEV prevention thrives here-sandwiching drops when ordering rights aren’t first-come frenzy. Failed transactions blockchain-wide plummet too; no more reverted bundles clogging queues. Arkham’s 2025 guide notes most searchers stick to public mempools, but auctions privatize that intel, shielding retail trades.

Flashbots’ PoS setup proves auctions work, yet policy analyses from the International Center for Law and Economics warn of unintended centralization. Instant risks oligopolies; slow risks irrelevance in memecoin pumps. The sweet spot? Hybrid models, where instant handles arbitrage flashes and slow governs builder-proposer splits.

Trader Tactics: Navigating Auctions in 2025

As a swing trader knee-deep in crypto options, I’ve seen bots feast on mempool chaos firsthand. Instant MEV auctions suit my high-conviction plays-buy priority for that DEX swap before volatility flips. But for patient positions, slow auctions level the field, letting me bid strategically sans infrastructure arms race. Platforms like Modular Mev Auctions aggregate these, providing real-time analytics to gauge bid viability. Imagine dashboards tracking oligopoly shares or revert rates-live tools turning MEV from foe to ally.

Discover deeper strategies in our 2025 guide to instant MEV auctions, tailored for battling toxic mempool extraction.

Solana’s low-fee lure amplifies needs for these mechanisms. WunderTrading details how MEV bots squeeze every tx, but explicit auctions flip the script-bots bid openly, not spam covertly. Paradigm’s take on baselayer neutrality holds: economic incentives order txs sans dictators, auctions just formalize the game.

By late 2025, expect blockspace auctions 2025 to dominate, with slow variants gaining on L2s for spam-proof scalability. Failed transactions fade as networks prioritize quality bids over quantity blasts. Traders win reliable execution; validators snag fair MEV shares. Modular Mev Auctions positions you ahead, blending auction types into seamless orderflow. Dive in, bid smart, and reclaim your edge from the bot hordes.