In the high-stakes arena of Ethereum blockspace, where every gas unit counts, instant MEV auctions are quietly reshaping the battlefield. As Ethereum trades at $3,031.50 today, with a 24-hour high of $3,062.83 and low of $3,026.15, toxic mempool extraction and spam drain resources that could fuel genuine innovation. Validators face a deluge of manipulative transactions, from sandwich attacks to outright spam, consuming up to 40% of blockspace on rival chains like Solana. This isn’t just inefficiency; it’s a systemic vulnerability that inflates fees and erodes user trust. Enter instant MEV auctions: a strategic pivot that channels MEV searchers Ethereum activities into structured, private marketplaces, slashing toxic mempool MEV while unlocking sustainable value.

The Anatomy of Toxic MEV and Blockspace Spam

Maximal Extractable Value, or MEV, isn’t inherently villainous. Policy analyses neatly classify it into toxic and nontoxic camps. Nontoxic forms, like atomic arbitrage, keep liquidity flowing without harming users. Toxic variants, however, thrive in the public mempool’s glare: front-running slips ahead of your trade to profit from slippage, sandwiching crushes it from both sides, and spam floods blocks with junk to manipulate outcomes. MEV bots, those relentless searchers, scan pending transactions, turning transparency into a weapon. On Ethereum, this congestion spikes gas fees during peaks, sidelining retail traders while enriching a few sophisticated players.

Consider the ethical divide highlighted in reinforcement learning studies on Polygon: while arbitrage stabilizes markets, front-running extracts value at users’ expense. Ethereum Research forums buzz with radical fixes, like DEX poison pills to thwart multi-swap exploits in one block. Yet these band-aids ignore the root: an open mempool invites predation. CoW DAO warns users to shield against these bots, but protection demands rerouting order flow. Order flow toxicity worsens it; informed traders withhold data, starving public liquidity. Flashbots recognized this early, pioneering systems to democratize MEV and curb harm, but spam persists, gobbling blockspace and inflating costs.

MEV bots are harmful to individual users, viewing pending transactions in the mempool to exploit them.

How Instant MEV Auctions Neutralize the Threats

Instant MEV auctions flip the script by severing toxic exposure at the source. Validators outsource block construction to specialized builders via real-time, sealed-bid auctions. Transaction bundles zip directly to builders, evading the public mempool entirely. This proposer-builder separation (PBS), crystallized in MEV-Boost post-Merge, lets validators bid for premium blocks without running complex infrastructure. Searchers compete transparently, but privately, ensuring only high-value bundles win inclusion.

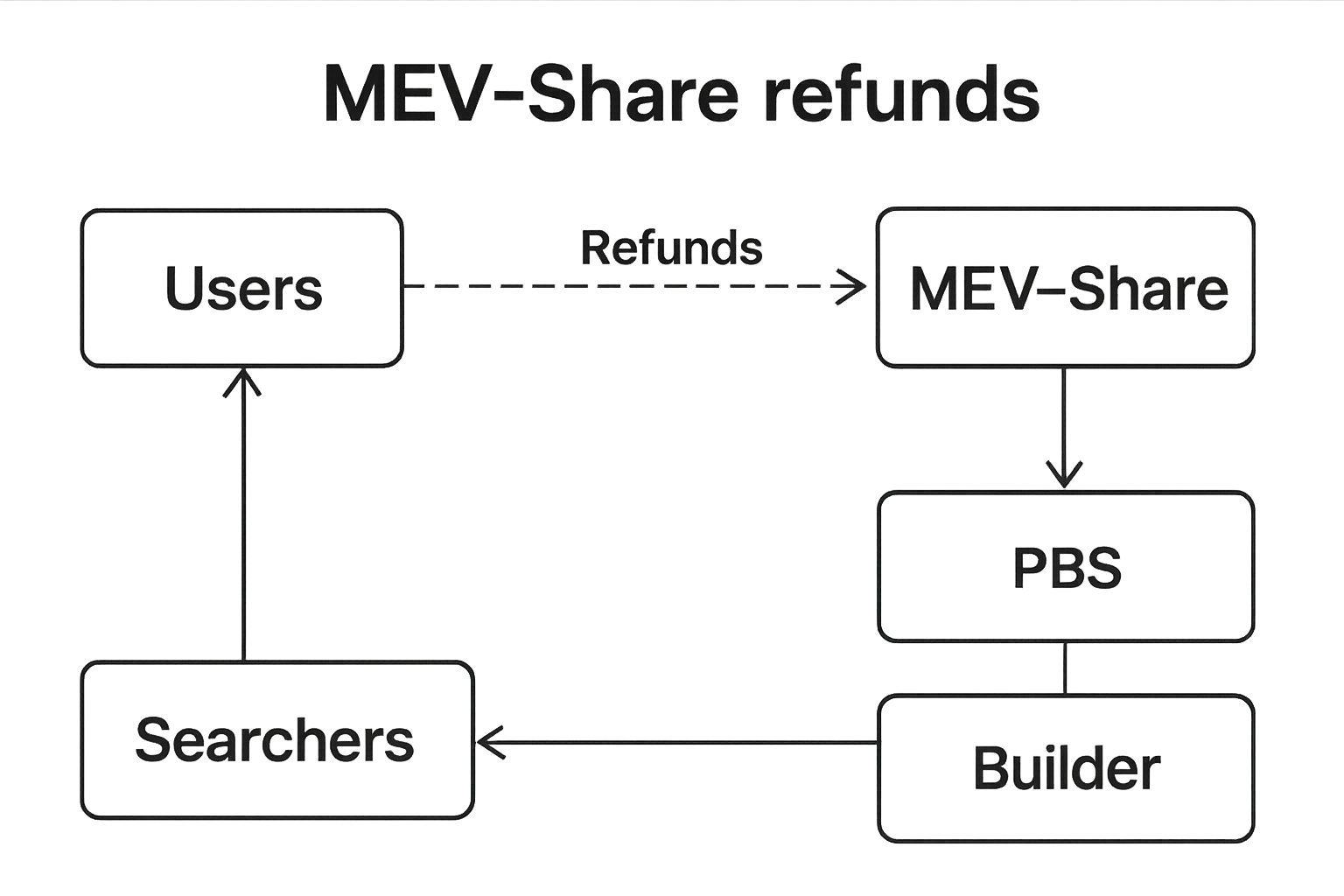

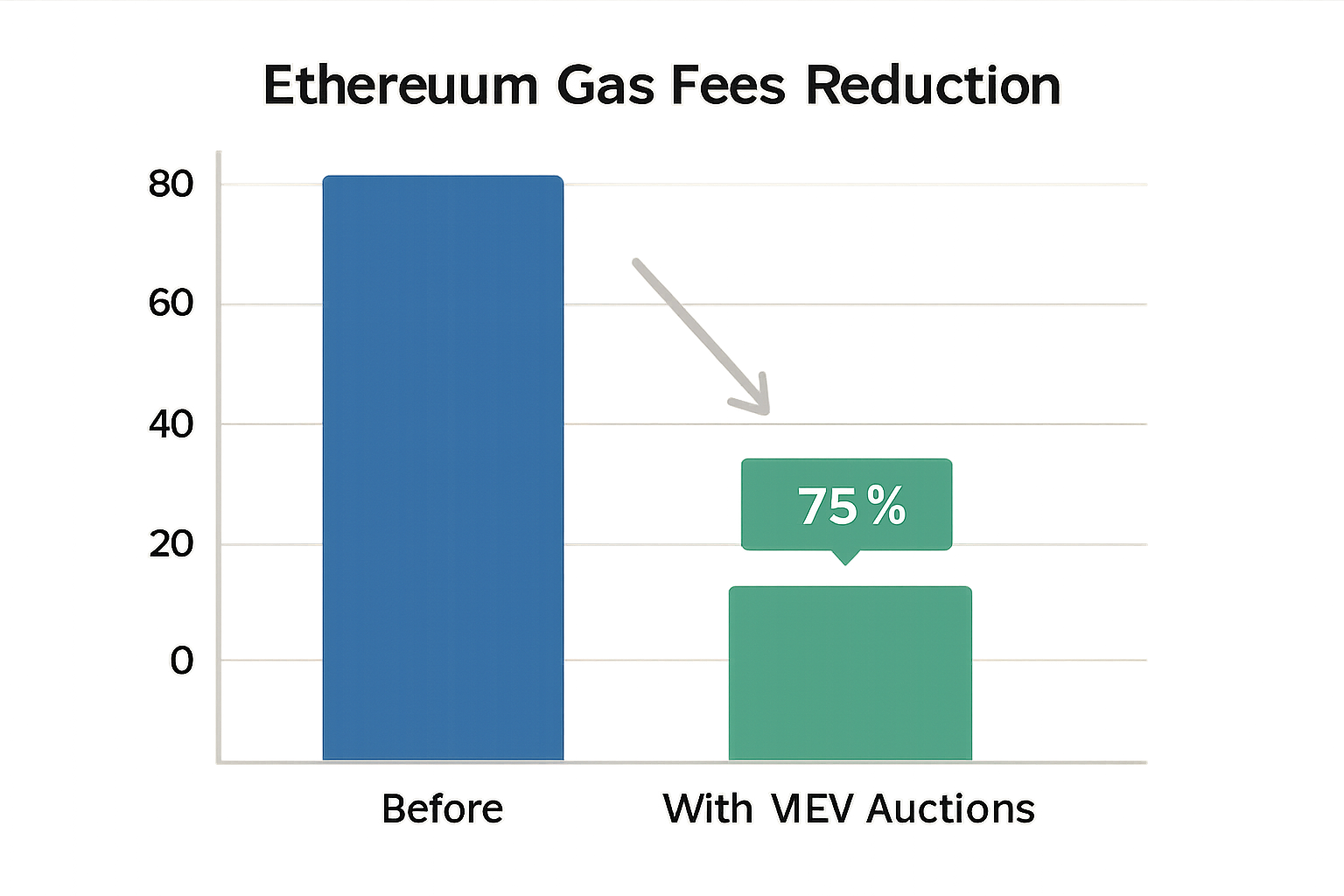

The mechanics are elegantly simple yet profoundly effective for blockspace spam prevention. Sealed bids prevent gaming; builders assemble optimal blocks, proposers select the highest bidder. No more mempool broadcasts mean no front-running fodder. Flashbots Auction, launched in 2020, set the template with MEV-Geth and relays, evolving into MEV-Share for user refunds on generated MEV. MEV-Share, from April 2023, shares selective transaction data, turning users into beneficiaries. Radius further balances rollup revenue against harms like sandwiching. These tools transform MEV from mempool menace to network boon.

Strategic Advantages in a Maturing Ecosystem

Beyond evasion, instant MEV auctions optimize Ethereum’s core. Network congestion plummets as MEV shifts off-chain; gas fees stabilize, welcoming more dApps. Privacy surges: bundles stay sealed until inclusion, foiling exploits. This democratizes access too; solo stakers tap MEV via MEV-Boost, diluting pool dominance and bolstering decentralization. In DeFi, backrunning could even supplant front-running as a gentler outlet, per EtherWorld insights.

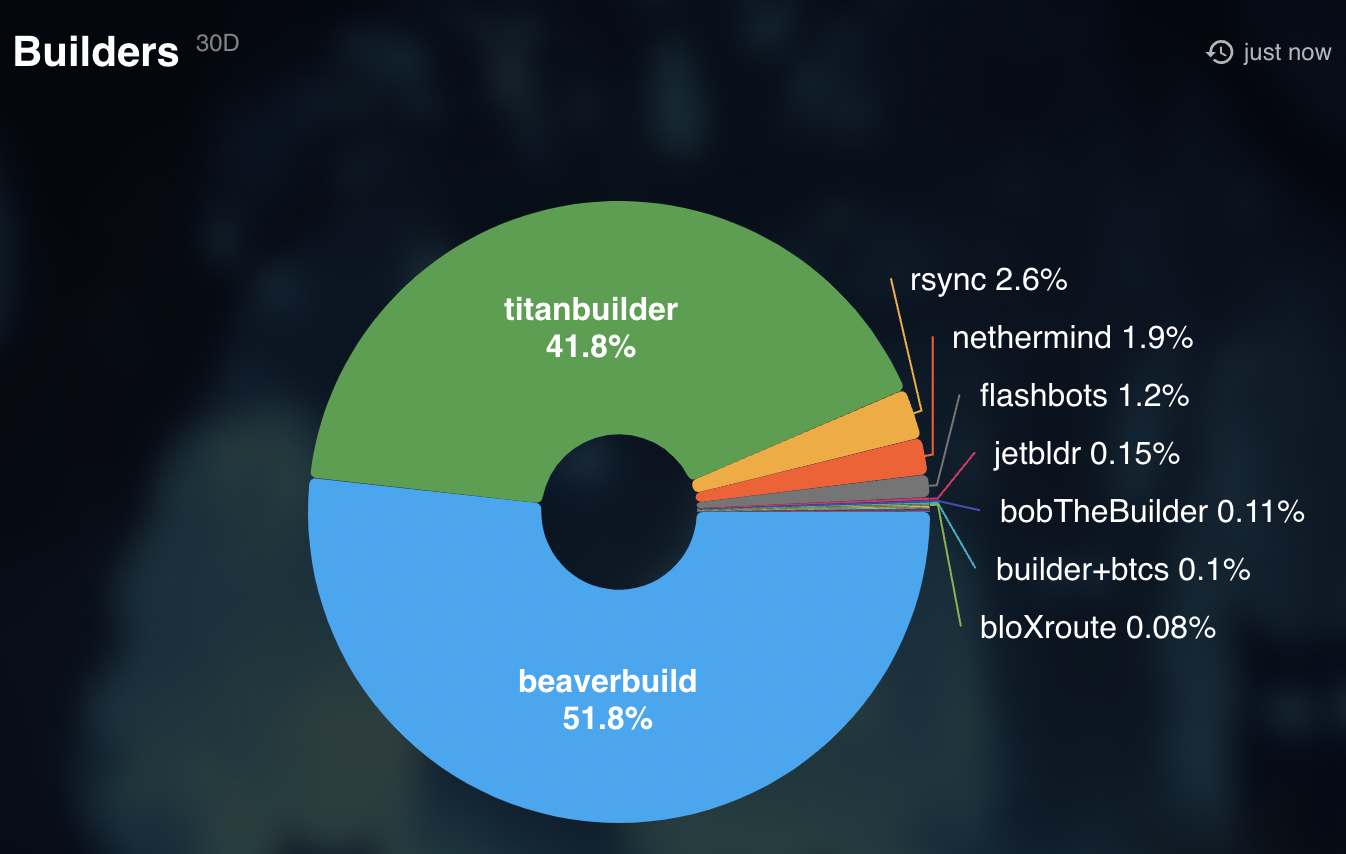

For Modular MEV orderflow, this means tailored marketplaces where traders auction bundles proactively. Platforms like Modular Mev Auctions thrive here, offering analytics and real-time data to navigate bids. As protocol designers curb harms without fracturing openness, per 2025 analyses, Ethereum edges toward resilience. Yet challenges linger: builder centralization risks, though relays mitigate them. The payoff? A blockspace market where value accrues to the network, not just extractors.

Ethereum (ETH) Price Prediction 2026-2031

Forecasts amid Instant MEV Auction adoption, reducing toxic mempool extraction and spam. Baseline: $3,031.50 (Dec 2025)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $4,000 | $5,500 | $8,000 |

| 2027 | $5,200 | $7,200 | $11,000 |

| 2028 | $6,500 | $9,500 | $15,000 |

| 2029 | $8,000 | $12,000 | $19,000 |

| 2030 | $10,000 | $15,000 | $24,000 |

| 2031 | $13,000 | $20,000 | $32,000 |

Price Prediction Summary

Ethereum’s price is projected to experience robust growth from 2026-2031, driven by MEV auction efficiencies improving network performance and adoption. Average prices could rise from $5,500 in 2026 to $20,000 by 2031, with min/max reflecting bearish (regulatory hurdles, market corrections) and bullish (widespread adoption, scalability breakthroughs) scenarios. Yearly avg growth ~27%, aligning with historical cycles and tech upgrades.

Key Factors Affecting Ethereum Price

- Instant MEV Auctions (Flashbots, MEV-Boost) mitigating toxic MEV, spam, and congestion

- Proposer-Builder Separation (PBS) enhancing decentralization and validator revenue

- Reduced gas fees and improved tx privacy boosting DeFi/NFT adoption

- Market cycles, institutional inflows, and ETH ETF approvals

- Regulatory developments favoring Ethereum’s compliance

- Scalability via L2s and competition from Solana/Polygon influencing upside potential

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Flashbots’ innovations underscore this shift, making MEV less extractive, more equitable. With Ethereum at $3,031.50, these auctions aren’t just technical tweaks; they’re economic realignments positioning the chain for scale.

Traders navigating this landscape gain a decisive edge by routing orders through Modular MEV orderflow platforms, where auctions turn potential losses into shared revenue. Picture a DEX swap: instead of mempool exposure inviting sandwich bots, bundles auctioned privately yield refunds via MEV-Share, sometimes slashing effective fees by 20%. This isn’t theoretical; Flashbots data shows over 90% of blocks now built via auctions, curbing spam that once devoured resources.

Navigating Orderflow Toxicity in Practice

Order flow toxicity, that subtle poison where informed traders shun public pools, finds its antidote in sealed auctions. Monoceros research boils it down: more trader info means adversarial pricing. Instant MEV auctions invert this, letting users control data sharing. CoW DAO-style protections evolve here, blending batch auctions with private relays to shield retail from MEV searchers Ethereum predation. Yet balance matters; fully private paths risk liquidity fragmentation. The sweet spot? Hybrid models like Radius, funneling rollup revenue while nixing harmful MEV forms.

Solana’s plight offers a stark mirror: MEV spam claiming 40% of blockspace underscores Ethereum’s foresight. AInvest notes innovations targeting “toxic” extraction could flip the script network-wide. Ethereum’s edge lies in its maturity; as ETH holds steady at $3,031.50 amid volatility, auctions stabilize fees, drawing dApps back from L2 exodus fears.

Key Trader Benefits

-

Reduced Sandwich Attacks: Instant MEV auctions bypass the public mempool via private bundles to builders, shielding trades from predatory front-running and sandwiching by MEV bots, as seen in Flashbots implementations.

-

MEV Refunds: Systems like MEV-Share return extracted value directly to traders, turning potential losses into refunds and promoting fairer value distribution in Ethereum’s ecosystem.

-

Lower Gas Fees: Off-chain auctions cut mempool spam and congestion, enabling efficient blockspace use and reducing overall transaction costs for traders during peak activity.

-

Enhanced Privacy: Sealed-bid private channels between users and builders protect transaction intent from scanners, minimizing exposure to toxic extraction strategies.

Future-Proofing Against Evolving Threats

Critics on Ethereum Research warn auctions might ossify into oligopolies, echoing old mining pools. Valid concern, but relays and open-source builders counter it, with MEV-Boost empowering 50,000 and validators. Protocol tweaks, like converting backrunning to front-running per EtherWorld, channel MEV into less disruptive paths. For 2025, expect refined PBS in Dencun upgrades, amplifying blockspace spam prevention. Digitap’s outlook is pragmatic: designers tame harms without sealing the blockchain shut.

Modular Mev Auctions positions itself at this nexus, blending real-time analytics with auction tools for pros. Developers build custom bundles; institutions hedge via orderflow marketplaces. The result? Ethereum not just surviving MEV, but monetizing it sustainably. As arXiv ethics papers urge, distinguishing arbitrage from malice guides this evolution.

Stakeholders must stay vigilant. Builder collusion remains a specter, though economic incentives align against it; highest bids win, fostering competition. Users benefit most by adopting RPCs like Flashbots Protect, blending public speed with private safeguards. In this calibrated ecosystem, Ethereum’s $3,031.50 price reflects resilience, buoyed by auctions that convert friction into fuel.

Ultimately, instant MEV auctions forge a blockspace economy where value flows equitably. Validators earn more, traders pay less, networks scale smarter. With tools like MEV-Boost and Share now mainstream, Ethereum sidesteps Solana’s spam pitfalls, charting a path where toxic mempool MEV becomes relic. Traders, integrate now; the marketplace rewards the adaptive.