Orderflow transparency is quickly becoming the linchpin for fairness in MEV auctions within modular blockspace markets. As DeFi matures, the need for open, auditable transaction flows has never been clearer. By shining a light on how orders move through the auction process, platforms like Modular Mev Auctions are not only deterring predatory behavior but also creating new opportunities for everyday traders and institutional participants alike.

Why Orderflow Transparency Matters in DeFi Auctions

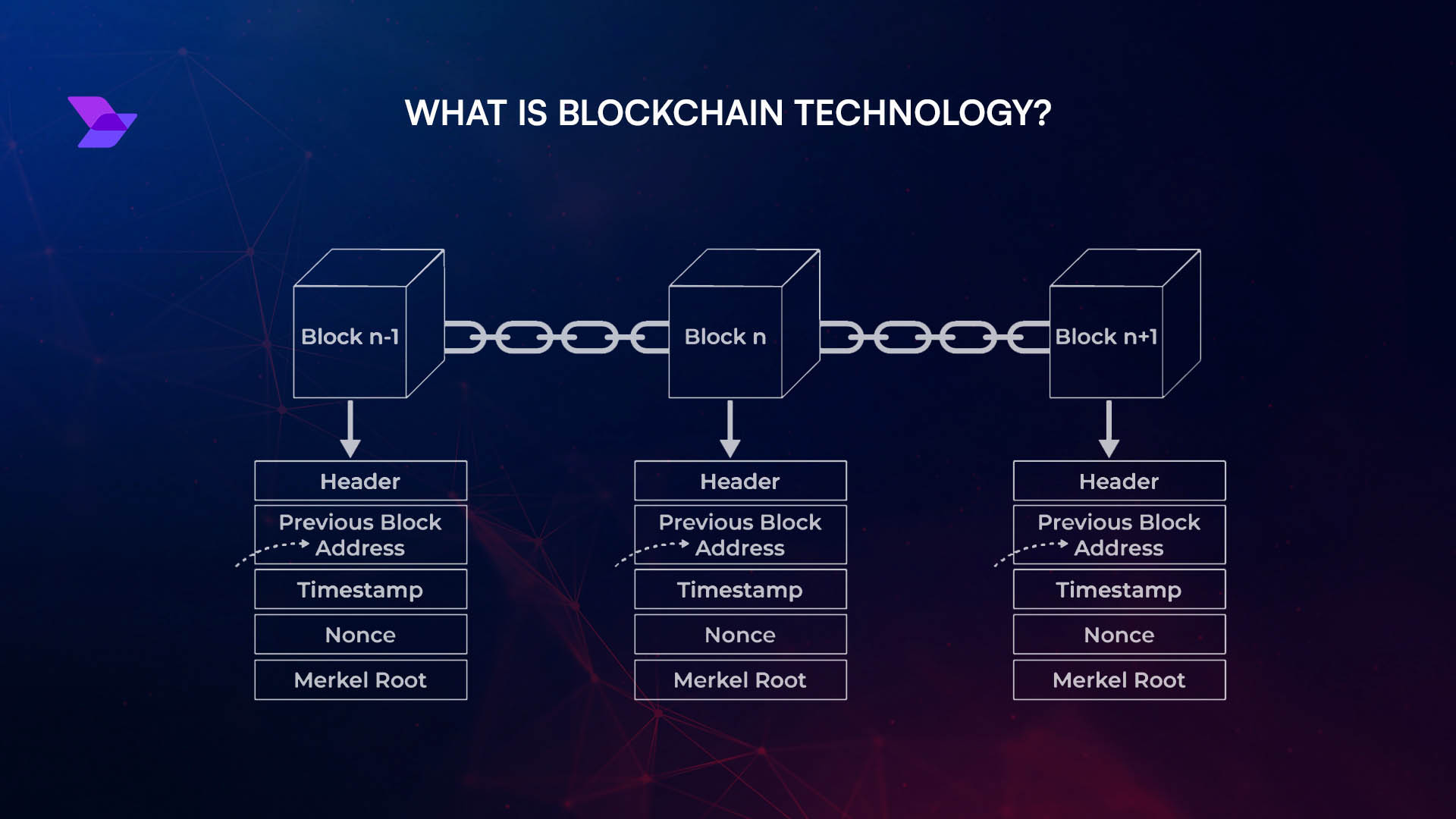

In traditional blockchain networks, the lack of visibility into transaction sequencing has allowed validators and miners to prioritize their own gains over user interests. This opacity paves the way for front-running and sandwich attacks, which siphon value from users without their consent or awareness. Orderflow transparency flips this narrative by making it possible to track exactly who bids on transactions, what value is extracted, and what compensation returns to users.

This level of clarity is especially critical in modular blockspace markets, where multiple actors compete over granular slices of blockspace. By exposing the full lifecycle of each order, from submission to execution, transparency ensures that all players operate on a level informational playing field. The result? More equitable value distribution and a significant reduction in exploitative practices.

The Mechanics Behind Transparent Orderflow Auctions

Let’s break down how transparent orderflow auctions work within a modular architecture:

- Transaction Submission: Users send their orders not directly to block builders but into a competitive auction environment.

- Bidding Process: Specialized searchers analyze these orders for MEV opportunities and place sealed bids for execution rights.

- User Compensation: The winning searcher must deliver tangible benefits, like price improvements or direct rebates, back to the user as part of their bid.

This structure creates an auditable record for every transaction, making it easy to verify who participated in each auction round and what outcomes resulted. For more technical readers interested in deeper mechanics, see our detailed breakdown on how orderflow data enhances MEV auction strategies.

User-Centric Value Redistribution: From Hidden Costs to Tangible Rewards

The real revolution lies in shifting value back toward users. Instead of quietly losing out to hidden extraction strategies, traders now find themselves at the center of the MEV value chain. Thanks to transparent auctions and competitive bidding among searchers, users can receive direct rebates or enjoy improved trade execution as part of each transaction’s outcome.

This isn’t just theoretical, platforms like CoW Protocol and Flashbots’ MEV-Share have already begun redistributing profits that were once monopolized by validators directly back to end-users. Modular Mev Auctions builds on this momentum by providing real-time analytics and open access to orderflow data, further empowering both retail traders and institutional participants.

The impacts ripple outward: as transparency grows, so does trust, setting the stage for broader institutional DeFi adoption and more robust market efficiency. In our next section, we’ll explore how these dynamics are transforming incentives across the entire ecosystem and why modular blockspace markets are uniquely positioned to lead this shift.

Aligning Incentives: How Transparency Shapes the Future of Modular Blockspace

Orderflow transparency does more than just level the playing field for individual traders; it fundamentally reshapes the incentive structures that drive DeFi markets. By making every step of the transaction process visible and auditable, modular MEV auctions force searchers, builders, and protocols to compete on fairer terms. This competition drives down hidden costs and ensures that value flows back to those who generate it, users and liquidity providers.

For institutional players, this transparency is a game-changer. Reliable orderflow analytics and predictable blockspace allocation mean they can deploy capital with greater confidence, knowing their strategies won’t be quietly undermined by opaque validator practices. As a result, we’re seeing a surge in institutional DeFi adoption, with larger funds entering markets that once seemed too risky due to information asymmetry.

This shift also benefits protocols themselves. With open access to inclusion signals and auction results, protocol designers can iterate faster on new features, like dynamic fee models or user-centric rebate programs, without fear of hidden value leakage. Ultimately, transparent orderflow auctions create a positive feedback loop: more data leads to better strategies, which attracts deeper liquidity and drives further innovation.

Challenges Ahead, and the Path Forward

No system is perfect. While modular MEV auctions have made huge strides in MEV auction fairness, challenges remain, especially around privacy for sensitive order types and maintaining performance at scale. Some critics argue that too much transparency could expose users to new attack vectors if not paired with robust privacy-preserving mechanisms.

Leading platforms are already experimenting with hybrid models that balance transparency with selective disclosure. For example, sealed-bid auctions and encrypted intent-sharing let users benefit from competitive bidding without publicly revealing every detail of their strategies until settlement. These innovations are paving the way for even more resilient decentralized finance auctions as the space matures.

If you’re looking to dive deeper into how these solutions work in practice, or want actionable tips for optimizing your own transactions, check out our latest insights on improving orderflow efficiency in DeFi trading.

What’s Next for Orderflow Transparency?

The story of modular blockspace markets is just beginning. As more projects adopt transparent auction frameworks and open up their orderflows to scrutiny, we’ll see continued improvements in market integrity and efficiency. The next wave will likely include even finer-grained analytics tools, automated user profit-sharing mechanisms, and new forms of programmable blockspace allocation, all designed to maximize fairness without sacrificing speed or privacy.

Top 5 User Benefits of Orderflow Transparency in Modular MEV Auctions

-

1. Fairer Transaction ExecutionOrderflow transparency ensures that all participants have equal access to transaction data, minimizing front-running and sandwich attacks. This levels the playing field for regular users and deters exploitative practices.

-

2. Direct User RewardsWith transparent orderflow, users can receive rebates or price improvements from searchers competing in MEV auctions—turning what was once hidden extraction into tangible benefits. Platforms like CoW Protocol and Flashbots MEV-Share exemplify this shift.

-

3. Enhanced Trust and AuditabilityEvery transaction in a modular MEV auction leaves an auditable trail, showing who bid, what value was extracted, and how users were compensated. This transparency builds trust across the DeFi ecosystem.

-

4. Improved Market EfficiencyOpen orderflow data drives competition among searchers, leading to better trade execution and tighter spreads for users. This results in a more robust and efficient DeFi market.

-

5. User Empowerment in Value DistributionOrderflow transparency shifts power from validators and block builders to users, allowing them to actively participate in capturing the value their transactions generate—a key step toward a fairer DeFi ecosystem.

Whether you’re an active trader seeking better execution or a protocol builder aiming for sustainable growth, one thing is clear: orderflow transparency isn’t just a technical upgrade, it’s a cultural shift toward accountability and shared value in decentralized finance. As modular MEV auctions continue to evolve, expect them to set new standards for what fairness looks like on-chain.