In the rapidly evolving landscape of decentralized finance, the emergence of modular MEV auctions has fundamentally changed how liquidations are handled onchain. Traditional DeFi liquidation mechanisms have long been criticized for their susceptibility to front-running, inefficiency, and a lack of transparency. By introducing real-time, sealed-bid liquidation flows, Modular MEV Auctions are addressing these pain points and setting a new standard for fairness and efficiency in blockchain transaction settlement.

Why Sealed-Bid Auctions Matter in DeFi Liquidations

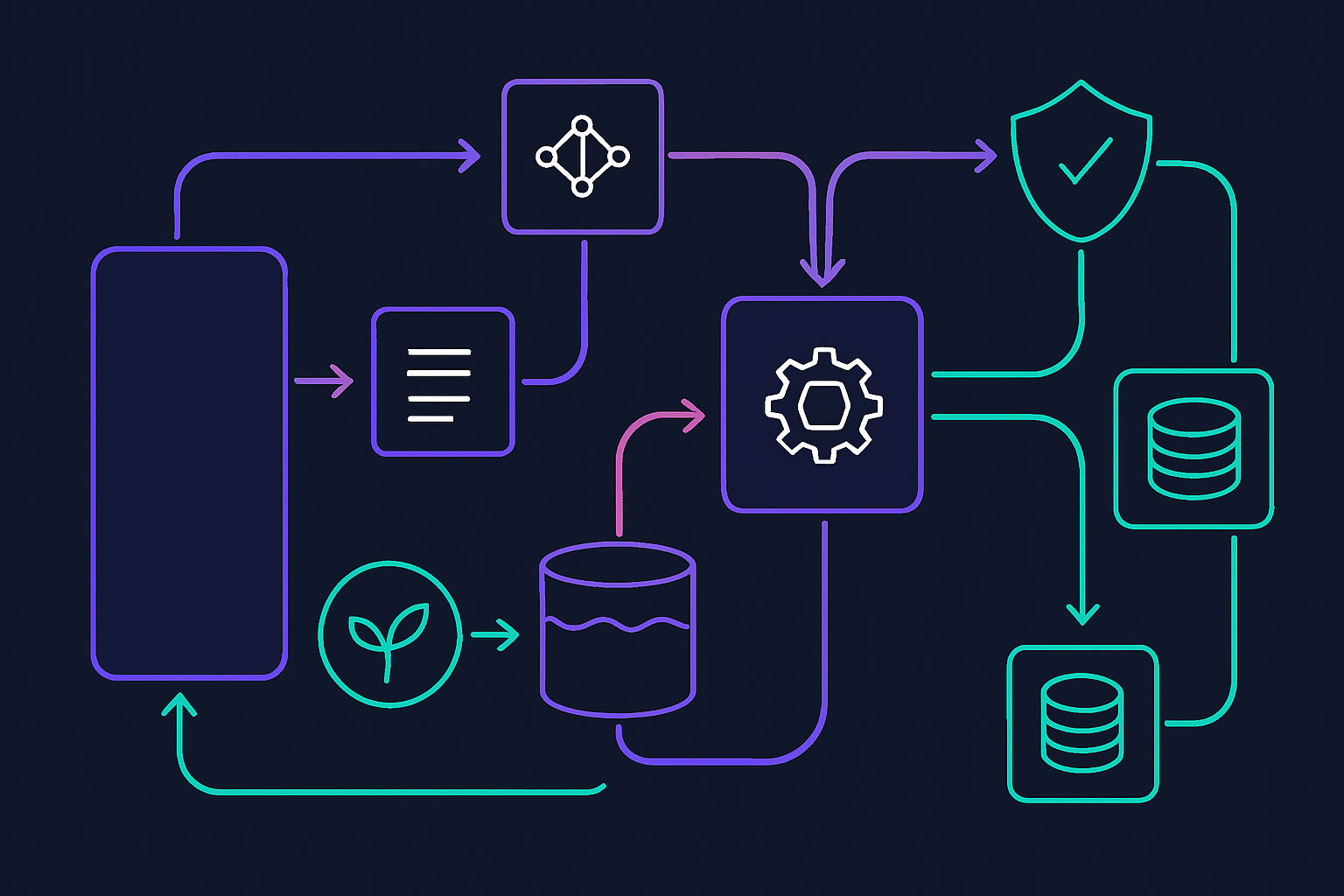

At the core of this innovation is the sealed-bid auction model. When a borrower’s collateral falls below protocol thresholds and triggers a liquidation event, interested parties can submit confidential bids to win the right to execute that liquidation. Unlike open or first-price auctions where participants can observe and react to others’ bids, sealed-bid formats ensure each participant submits their best offer without knowledge of competing bids. This mechanism is crucial for several reasons:

- Prevents Front-Running: By keeping bids hidden until auction closure, it eliminates the ability for sophisticated actors or bots to outmaneuver honest participants at the last second.

- Promotes Honest Price Discovery: Participants are incentivized to bid their true valuation for the right to liquidate, leading to more competitive pricing and less value leakage from protocols.

- Enhances Market Efficiency: The process reduces latency and operational risk during volatile market conditions where seconds can mean millions in losses or gains.

The Real-Time Advantage: Instantaneous Onchain Settlement

The integration of real-time functionality into onchain sealed-bid auctions is not just a technical upgrade; it is a strategic leap forward for DeFi risk management. With liquidations often occurring during periods of extreme volatility, any delay between price movement and auction execution can result in unnecessary protocol losses or missed opportunities for bidders. Modular MEV Auctions address this by enabling instantaneous settlement as soon as an off-chain price exposes a position to liquidation risk.

This rapid response window, sometimes measured in milliseconds, ensures that liquidations occur at prices that most accurately reflect current market conditions. The highest bidder wins not only the right to execute but also does so at an optimal moment, minimizing slippage and maximizing recovery for lending protocols.

Practical Implementations: RedStone Atom and Modus on Monad

The theory behind modular MEV auction design is already being put into practice by leading DeFi innovators:

- RedStone’s Atom: Leveraging FastLane’s Atlas engine, RedStone Atom opens a sealed-bid window lasting less than 300 milliseconds when an off-chain price signals liquidation eligibility. Liquidators compete for bonuses with atomic data feed updates ensuring both transparency and security.

- Modus on Monad: By integrating lending services with delta-neutral vaults and onchain sealed-bid auctions, Modus internalizes value traditionally captured by external liquidators, redistributing it among liquidity providers and active protocol users instead.

This modular approach provides flexibility across various blockchain environments, from rollups to mainnet, while maintaining robust orderflow management and transparent settlement processes. For deeper technical dives into how these models enhance transaction efficiency across decentralized finance platforms, see our related coverage: How Modular MEV Auctions Enhance Transaction Efficiency in Decentralized Finance.

The Competitive Edge: Fairness Meets Performance

The adoption of real-time sealed-bid modular MEV auctions represents more than just an incremental improvement; it signals a paradigm shift toward fairer access and optimized outcomes within DeFi’s most critical workflows. As platforms like Modular Mev Auctions continue refining these systems with advanced analytics, robust orderflow marketplaces, and seamless integration across protocols, we are witnessing a new era where transparency no longer comes at the cost of performance, or vice versa.

For traders, developers, and protocol designers, the implications are profound. Real-time, onchain sealed-bid liquidation auctions level the playing field by removing the information asymmetry that previously favored a handful of sophisticated actors. Instead, value is distributed more equitably among those who contribute liquidity or participate in risk management. This democratization of access not only aligns incentives across the ecosystem but also strengthens DeFi’s resilience against systemic shocks.

Another key advantage is the modular architecture underpinning these auctions. By decoupling auction logic from core protocol operations, platforms can upgrade or customize their liquidation flows without introducing breaking changes to their underlying smart contracts. This flexibility is especially important as new rollup-centric architectures and cross-chain strategies proliferate, demanding adaptable solutions for orderflow and settlement.

Future-Proofing DeFi Liquidations

The rapid evolution of MEV auction design is not happening in isolation. As research from Flashbots and others highlights, sealed-bid mechanisms are already influencing broader trends in blockspace markets and transaction ordering across Ethereum and emerging L2s. With innovations like SUAVE on the horizon, promising even more privacy-preserving and efficient auction protocols, the foundation laid by modular MEV auctions will likely serve as a blueprint for future developments.

Moreover, as regulatory scrutiny increases and institutional capital moves into DeFi, transparent onchain settlement becomes non-negotiable. Real-time sealed-bid auctions provide auditable trails for every liquidation event while minimizing opportunities for market manipulation, a critical requirement for mainstream adoption.

Key Takeaways for Stakeholders

- Traders: Gain fairer access to lucrative liquidation events without competing against predatory bots or insiders.

- Developers: Integrate modular MEV auction primitives into existing protocols to boost efficiency and user trust.

- Lending Protocols: Optimize recovery rates during liquidations while providing transparent auditability for all stakeholders.

The shift toward real-time, sealed-bid modular MEV auctions is setting new standards for fairness, efficiency, and transparency in decentralized finance. As platforms iterate on these designs, incorporating insights from live deployments like RedStone Atom and Modus on Monad, DeFi’s critical infrastructure grows more robust against both technical exploits and economic inefficiencies.

This evolution isn’t just theoretical; it’s already being felt across lending markets, DEXs, and rollup environments where optimized liquidation flows can mean the difference between protocol solvency and cascading failures. To explore how these innovations impact transaction execution across DeFi platforms, and what’s next as blockspace markets mature, see our deep dive: How Modular MEV Auctions Improve Transaction Execution in Decentralized Finance.