For anyone actively trading or building in DeFi, the rise of modular MEV auctions marks a decisive shift in how transaction efficiency is achieved. The days of unpredictable gas wars and opaque transaction ordering are being replaced by transparent, market-driven mechanisms that optimize for both fairness and performance. This evolution is not just about squeezing out inefficiencies; it’s about fundamentally re-architecting the way value flows through decentralized protocols.

From Gas Wars to Transparent Auctions: Why Efficiency Matters

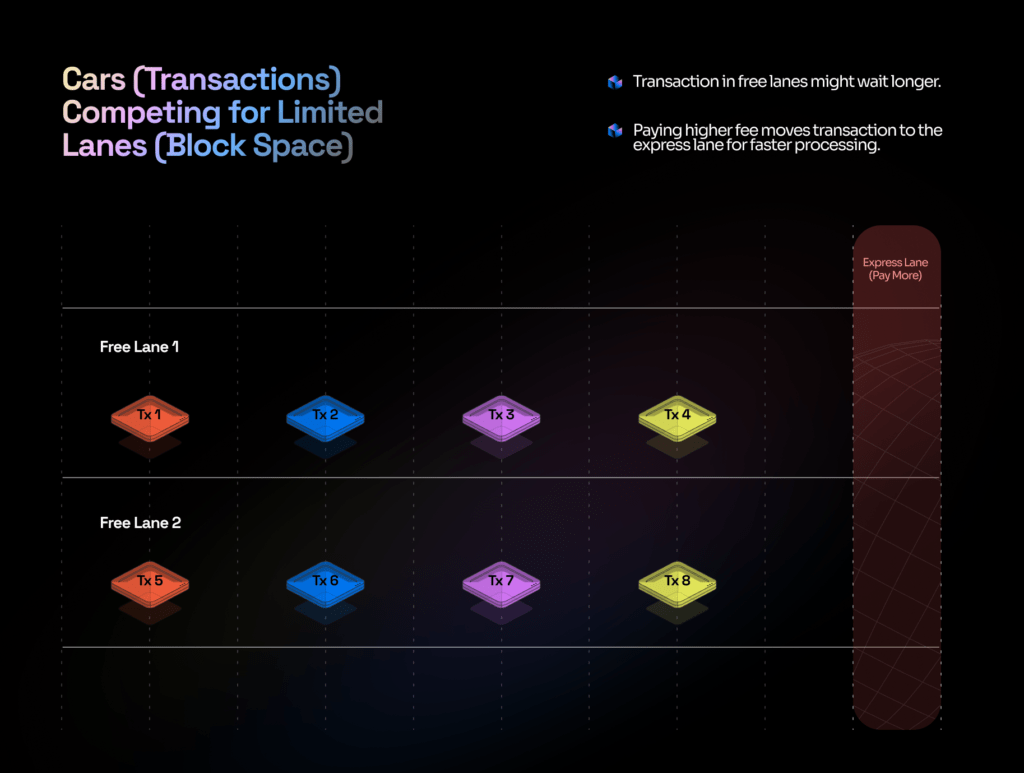

Historically, DeFi users have been at the mercy of gas price volatility and MEV extraction tactics like frontrunning and sandwich attacks. These behaviors led to network congestion, unpredictable costs, and a zero-sum environment where only the fastest or best-connected actors won out. The crux of the problem lies in transaction ordering: when inclusion in the next block is determined by who pays most, users are incentivized to overbid or spam transactions, wasting blockspace and driving up fees for everyone.

Modular MEV auctions disrupt this dynamic by introducing structured marketplaces for orderflow. Instead of a chaotic race, transactions are batched and auctioned off to builders or solvers who compete transparently for blockspace. This replaces public bidding wars with private valuation games where strategic bids reflect true economic value rather than brute-force spending on gas. As a result, protocols like CoW Protocol, UniswapX, and 1inch Fusion are seeing more efficient price discovery and lower average execution costs.

Orderflow Marketplaces: The Engine Behind Improved DeFi Transaction Efficiency

The real innovation isn’t just in auctioning off blockspace, it’s in how these platforms customize solutions for different segments of the DeFi ecosystem. Modular Mev Auctions exemplifies this trend by providing an orderflow marketplace that allows traders, protocols, and even L2s to tailor their participation based on risk tolerance and desired outcomes. By batching user transactions into orderflow auctions (OFAs), these systems ensure competitive bidding while minimizing exploitative practices that previously plagued DeFi markets.

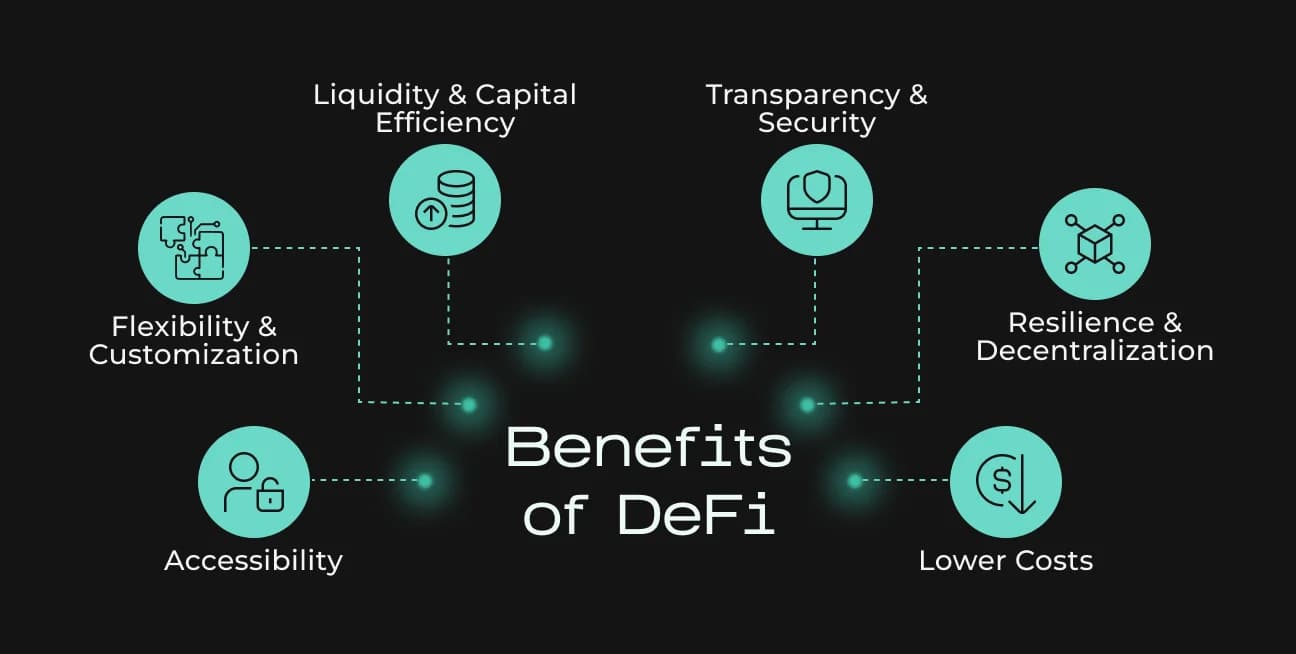

This approach has several key benefits:

- Fairer Transaction Ordering: Transparent bidding ensures everyone competes on equal footing.

- Reduced Congestion: Batching eliminates spammy tactics that clog networks.

- Lower Costs: Efficient use of blockspace means lower average fees for end users.

- User Value Redistribution: Instead of value leaking to extractors, more is returned directly to traders and liquidity providers.

The upshot? Not only do modular MEV auctions enhance efficiency, they also foster trust by making every step auditable and competitive. For a deeper dive into specific mechanisms powering this transformation, see our analysis on blockspace market solutions.

The Role of Proposer-Builder Separation (PBS) in Market Fairness

An equally critical pillar is Proposer-Builder Separation (PBS). By decoupling block proposers from builders, those who assemble transactions, PBS decentralizes control over transaction ordering. This separation reduces single points of failure or collusion risk while allowing specialized builders to focus on optimizing execution strategies within clear market rules. Combined with OFAs, PBS creates a robust framework where both efficiency and fairness can thrive even as DeFi volumes scale.

This dual-layered approach is already yielding results across major protocols adopting modular architectures. Not only does it improve execution quality for sophisticated traders employing advanced MEV optimization strategies, but it also levels the playing field for retail participants who previously struggled against bots or insiders exploiting information asymmetry.

As these modular MEV auction frameworks mature, the measurable impact on DeFi transaction efficiency is hard to ignore. Recent data from platforms pioneering this model shows tangible reductions in average execution costs and notable improvements in slippage for both retail and institutional users. By shifting transaction prioritization from a public arms race to a private market for orderflow, protocols are not only optimizing network throughput but also unlocking new forms of value creation for users.

Key Benefits of Modular MEV Auctions in DeFi

-

Fairer Transaction Ordering: Modular MEV auctions, such as those used in CoW Protocol and UniswapX, replace chaotic gas wars with transparent, competitive bidding, ensuring equitable access to block space for all users.

-

Reduced Transaction Costs: By batching transactions and eliminating inefficient gas bidding, platforms like 1inch Fusion help minimize fees, making DeFi trading more cost-effective for participants.

-

Enhanced Market Efficiency: Structured auctions and mechanisms like Proposer-Builder Separation (PBS) improve price discovery and reduce arbitrage inefficiencies, fostering a more stable and liquid DeFi market.

-

Mitigation of Exploitative Tactics: Modular MEV auctions limit the impact of frontrunning and sandwich attacks by decentralizing transaction ordering and increasing transparency.

-

Customizable Solutions for Protocols: Platforms such as Modular MEV Auctions offer adaptable frameworks, allowing DeFi protocols to tailor auction mechanisms to their specific needs and user bases.

It’s worth spotlighting how this change ripples through the ecosystem:

- Protocols gain more predictable fee structures and can pass efficiency gains directly to their users.

- Traders experience fewer failed transactions and enjoy better price execution, especially during volatile market conditions.

- Liquidity providers benefit from reduced impermanent loss as arbitrageurs compete transparently rather than extract value covertly.

- Builders and solvers can specialize, innovate, and compete on execution quality rather than privileged access or brute-force tactics.

The introduction of orderflow marketplaces has also catalyzed the development of new optimization strategies. For example, Jito bundling on Solana demonstrates how priority auctions can reduce wasted blockspace and improve network throughput, outcomes that are now being mirrored across EVM-compatible chains via modular MEV solutions. The common thread: structured competition leads to smarter resource allocation and a healthier market structure overall.

Looking Ahead: Modular MEV Auctions as the New Standard

The trajectory is clear. As more DeFi protocols adopt modular MEV auctions, the industry moves closer to a future where transaction ordering is not just fairer but fundamentally more efficient. This shift doesn’t eliminate competition, it refines it, channeling incentives toward maximizing user value rather than exploiting systemic weaknesses.

The next wave of innovation will likely focus on cross-chain compatibility, deeper integration with Layer 2s, and further decentralization of both proposers and builders. Ultimately, these advancements set the stage for DeFi markets that are not only more robust against manipulation but also capable of supporting mainstream-scale adoption without sacrificing transparency or performance.

If you’re navigating today’s rapidly evolving crypto landscape, whether as a trader seeking edge or a protocol architect designing for scale, understanding modular MEV auctions isn’t optional. It’s essential context for anyone serious about staying ahead as DeFi matures into its next phase of growth. For further exploration of practical use cases and advanced strategies, check out our related coverage on how modular MEV auctions benefit active traders.