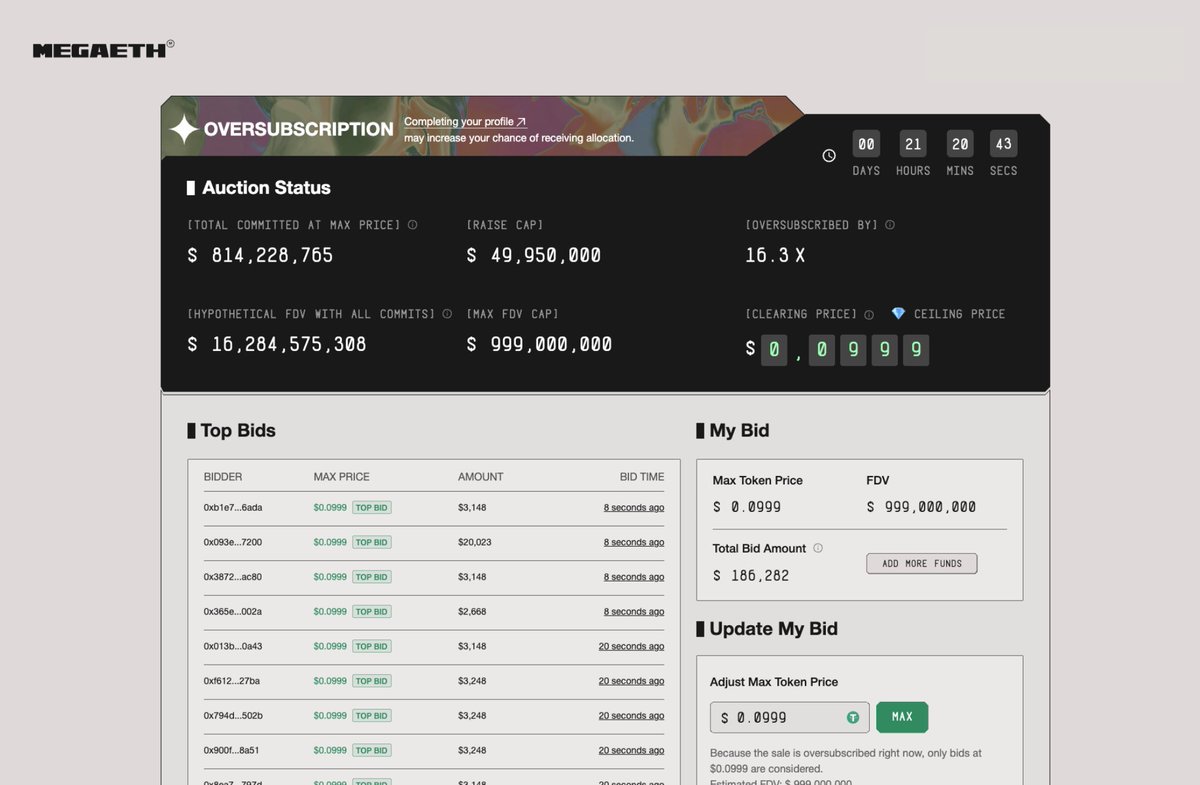

This week, the MegaETH $MEGA token sale has lit up the DeFi world, showcasing how English auctions can transform MEV token launches. With $450 million in commitments for just $49.95 million in available tokens, the offering was oversubscribed by 8.9x, and every serious trader is dissecting what made this event so compelling. The lessons from MegaETH’s auction mechanism are already shaping best practices for future MEV token sales.

How English Auctions Create Transparent Price Discovery

The English auction format is all about transparency and real-time competition. In this model, participants place incrementally higher bids until no one is willing to go further. The highest bid at close sets the final price for everyone. For MEV (Maximal Extractable Value) token sales, this method offers a market-driven approach to price discovery, eliminating backroom deals and giving everyone a fair shot at allocation.

In MegaETH’s case, the auction opened with a floor fully diluted valuation (FDV) of $1 million and a ceiling of $999 million, capped at $0.0999 per MEGA token. Bidders could participate with as little as $2,650 or as much as $186,282 in USDT on Ethereum mainnet, making it accessible yet competitive. Within minutes, bids soared to the cap and locked in the maximum price allowed by the rules.

What Made MegaETH’s Auction Stand Out?

Several features set MegaETH’s sale apart from typical crypto launches:

- Accessible yet controlled bidding: Wide bid ranges invited both retail participants and whales while preventing outlier bids from dominating.

- Lock-up incentives: A 10% discount was offered for those agreeing to a one-year lock-up, a move that not only rewarded long-term commitment but also stabilized early trading dynamics.

- Special allocation mechanism: With oversubscription inevitable, MegaETH announced an allocation system weighing both bid size and on-chain engagement/social reputation, an evolution beyond pure capital-based auctions.

The result? Over 5,000 unique wallets participated in one of DeFi’s most hotly contested public offerings of 2025. The process was auditable on-chain, fostering trust among both small investors and institutional players.

Lessons for Future MEV Token Auctions

MegaETH’s launch demonstrates several key takeaways for projects considering an English auction format:

- Market-driven pricing works: Letting demand set the clearing price ensures fairness, and signals true market interest.

- Diverse participation is possible: By lowering minimum bids but capping maximums per wallet, projects can attract broad community engagement without ceding control to whales.

- Incentives matter: Lock-up discounts not only reward conviction but also help build a committed user base post-launch.

If you want a deeper dive into how these mechanisms optimize distribution for DeFi traders specifically, check out our detailed breakdown at /how-megaeth-s-english-auction-mechanism-optimizes-mev-distribution-for-defi-traders.

6-Month Price Performance: MegaETH vs. Major DeFi and Crypto Assets

Comparison of MegaETH’s post-auction performance with leading DeFi tokens and major cryptocurrencies using real-time market data.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| MegaETH (MEGA) | $0.000001 | $0.000000 | +27.9% |

| Ethereum (ETH) | $3,856.51 | $3,200.00 | +20.5% |

| Bitcoin (BTC) | $108,242.00 | $95,000.00 | +13.9% |

| Uniswap (UNI) | $5.98 | $5.50 | +8.7% |

| Aave (AAVE) | $221.80 | $200.00 | +10.9% |

| Lido DAO (LDO) | $0.8876 | $0.8000 | +10.9% |

| dYdX (DYDX) | $0.3315 | $0.3000 | +10.5% |

| Blur (BLUR) | $0.0484 | $0.0450 | +7.5% |

Analysis Summary

MegaETH (MEGA) has outperformed both major cryptocurrencies and leading DeFi tokens over the past six months, with a 27.9% price increase following its English auction token sale. In comparison, Ethereum and Bitcoin posted gains of 20.5% and 13.9%, respectively, while top DeFi tokens saw more modest growth between 7.5% and 10.9%.

Key Insights

- MegaETH (MEGA) led the group with a 27.9% price increase, highlighting strong post-auction demand and market confidence.

- Ethereum (+20.5%) and Bitcoin (+13.9%) both outperformed most DeFi tokens but lagged behind MEGA’s growth.

- DeFi tokens such as Uniswap, Aave, Lido DAO, dYdX, and Blur posted steady but lower gains (7.5%–10.9%) compared to MEGA.

- The English auction format used by MegaETH may have contributed to its robust price appreciation and broad investor participation.

All prices and percentage changes are sourced directly from the provided real-time market data as of October 2025. The comparison uses exact figures for current and 6-month historical prices, ensuring accuracy and consistency.

Data Sources:

- Main Asset: https://www.coinbase.com/price-prediction/base-megaeth-9832

- Ethereum: https://www.coingecko.com/en/coins/ethereum

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Uniswap: https://www.coingecko.com/en/coins/uniswap

- Aave: https://www.coingecko.com/en/coins/aave

- Lido DAO: https://www.coingecko.com/en/coins/lido-dao

- dYdX: https://www.coingecko.com/en/coins/dydx

- Blur: https://www.coingecko.com/en/coins/blur

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

MegaETH (MEGA) Price Prediction 2026-2031

Comprehensive analyst forecast based on English auction outcomes, current market data, and projected adoption trends.

| Year | Minimum Price | Average Price | Maximum Price | Potential Annual Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.085 | $0.13 | $0.19 | -15% to +90% | Post-auction volatility likely; price discovery phase as tokens unlock; potential for sharp corrections if initial hype fades |

| 2027 | $0.11 | $0.18 | $0.27 | +30% to +42% | Ecosystem development and initial DApp launches; possible listing on major exchanges; regulatory clarity in key markets |

| 2028 | $0.15 | $0.23 | $0.34 | +28% to +26% | Increased adoption from DeFi and MEV applications; growing competition; potential for new use cases to boost demand |

| 2029 | $0.13 | $0.21 | $0.39 | -13% to +15% | Possible market correction or consolidation; macroeconomic headwinds; technological upgrades could drive renewed interest |

| 2030 | $0.18 | $0.27 | $0.48 | +38% to +23% | Broader crypto bull cycle; mainstream MEV adoption; institutional participation increases liquidity and price stability |

| 2031 | $0.16 | $0.30 | $0.57 | -11% to +19% | Market maturity phase; competition from similar protocols; sustained adoption and network effects critical for further growth |

Price Prediction Summary

MEGA’s price outlook is cautiously optimistic, reflecting both the strong initial demand and the risks of post-sale volatility. The token benefits from its innovative auction mechanism and MEV-focused use case, but faces challenges from competition, regulatory shifts, and broader market cycles. Prices are expected to fluctuate significantly, with higher potential in bullish scenarios if adoption and ecosystem growth materialize.

Key Factors Affecting MegaETH Price

- Strong initial demand and oversubscription in token sale signal investor interest and liquidity.

- MEV sector growth and MegaETH’s ability to capture market share.

- Regulatory developments, especially in major jurisdictions (US, EU, Asia).

- Technological improvements and successful DApp launches on MegaETH.

- Potential for competition from other MEV or Ethereum scaling solutions.

- General crypto market cycles, including potential bull and bear phases.

- Unlock schedules and vesting impacting circulating supply and price pressure.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

But the MegaETH auction didn’t just set a new fundraising record, it also raised the bar for transparency and fairness in MEV token sales. The special allocation mechanism, triggered by the 8.9x oversubscription, brought a new layer of sophistication to the English auction model. Instead of simply pro-rating allocations based on bid size alone, MegaETH factored in on-chain reputation, previous engagement with the protocol, and social signals. This approach rewarded loyal community members and active contributors, an innovation that many believe will become standard in future high-demand launches.

For participants, this meant that even smaller bidders with strong on-chain engagement stood a real chance at allocation. It’s a subtle but fundamental shift: MEV token sales are no longer just about capital, they’re about contribution. This aligns incentives between protocols and their communities, fostering long-term growth over short-term speculation.

Navigating Oversubscription: What Happens When Demand Outpaces Supply?

With $450 million committed for only $49.95 million worth of tokens at $0.0999 per MEGA, many participants faced partial or zero allocations. Here’s how MegaETH handled it:

How MegaETH Resolved Oversubscription in Its English Auction

-

1. Auction Cap Reached Rapidly: The English auction for MegaETH’s $MEGA tokens hit its $49.95 million cap within minutes, with bids quickly pushing the token price to its ceiling of $0.0999 per token. This resulted in a massive oversubscription, with over $450 million in total commitments—8.9x the intended raise.

-

2. Special Allocation Mechanism Triggered: As outlined in MegaETH’s official sale terms, the oversubscription activated a special allocation mechanism. This process was designed to fairly distribute tokens among all qualified bidders, rather than simply awarding allocations to the largest bids.

-

3. Pro-Rata Distribution Based on Final Price: Each eligible participant’s allocation was calculated pro-rata—meaning in proportion to their bid amount—at the final auction price of $0.0999 per token. This ensured all participants received a share of tokens relative to their commitment, rather than an all-or-nothing outcome.

-

4. Community Engagement Considered: In addition to bid size, MegaETH’s allocation process factored in community engagement metrics such as social media activity and project involvement, rewarding active supporters with higher allocations where possible.

-

5. 14-Day Withdrawal Window Offered: After allocations were finalized, all purchasers were given a 14-day window to withdraw from their token purchase if desired, adding a layer of flexibility and transparency to the process.

This transparent process was further enhanced by an auditable on-chain record and a 14-day withdrawal window post-auction, a rare but welcome protection for contributors who change their minds after allocations are finalized.

Implications for MEV Strategies and DeFi Traders

The lessons from MegaETH ripple far beyond this single sale:

- On-chain activity is now a core part of allocation strategy. Expect more protocols to reward loyal users and active governance participants in future auctions.

- Transparency is non-negotiable. Every bid, every rule, every allocation step was visible on-chain, setting a new industry expectation for trustless fundraising.

- Efficient price discovery attracts serious capital. The rapid move to the price ceiling showed that sophisticated traders value clear rules and open competition over backroom deals or opaque whitelists.

If you’re planning to participate in future English auction MEV token sales, or designing your own, take note: Your on-chain reputation may soon be as important as your wallet balance.

The $MEGA sale has shown what’s possible when you blend transparent price discovery with community-first allocation strategies. As protocols continue to experiment with auction formats and distribution mechanisms, watch closely: the next breakthrough in fair launch mechanics may already be underway.