In the rapidly evolving world of Ethereum Layer 2 solutions, MegaETH’s English auction mechanism has captured the attention of DeFi traders, token allocators, and protocol designers alike. The upcoming public sale of 5% of the total MEGA token supply, scheduled for October 27 to 30,2025, is not just another fundraising event. Instead, it is a strategic experiment in community building and transparent price discovery, one that could reshape how initial token distributions are approached across the sector.

How MegaETH’s English Auction Works: Transparent Price Discovery at Scale

MegaETH’s public sale leverages a classic English auction format, hosted on Echo’s Sonar platform. Unlike sealed-bid or Dutch auctions where price can be opaque or manipulated by insiders, the English auction unfolds in full view. Bidders compete openly by incrementally raising their offers within a range of $2,650 to $186,282 in USDT. The process starts at a baseline valuation of $1 million fully diluted, with an upper cap set at $999 million, ensuring no runaway pricing or speculative blow-off tops. For those with longer time horizons and greater conviction, a one-year lockup option comes with a 10% discount on final allocation.

This structure is designed to reward genuine commitment over short-term speculation. By requiring capital to be locked for discounted tokens, MegaETH aims to cultivate an engaged user base rather than transient airdrop hunters, a clear departure from prior L2 launches.

Auction Mechanisms vs. MEV Auctions: Untangling Token Distribution from Transaction Ordering

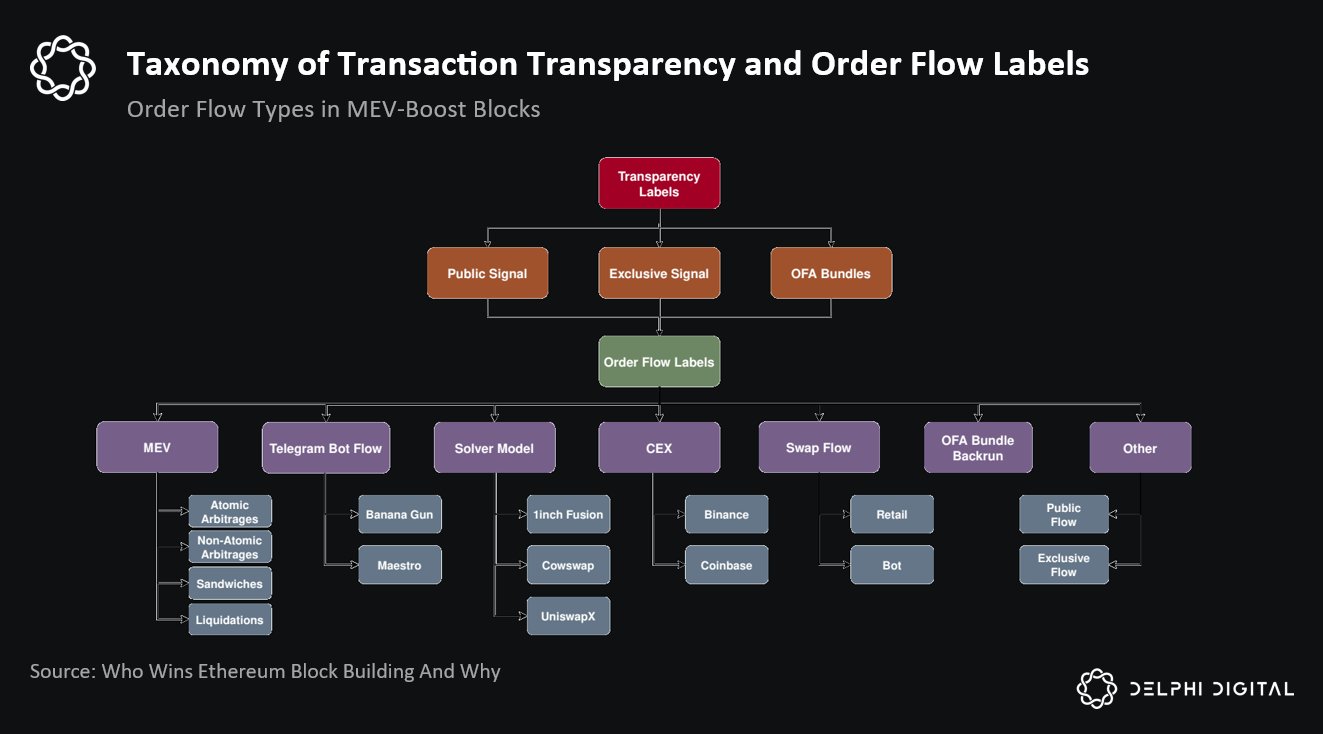

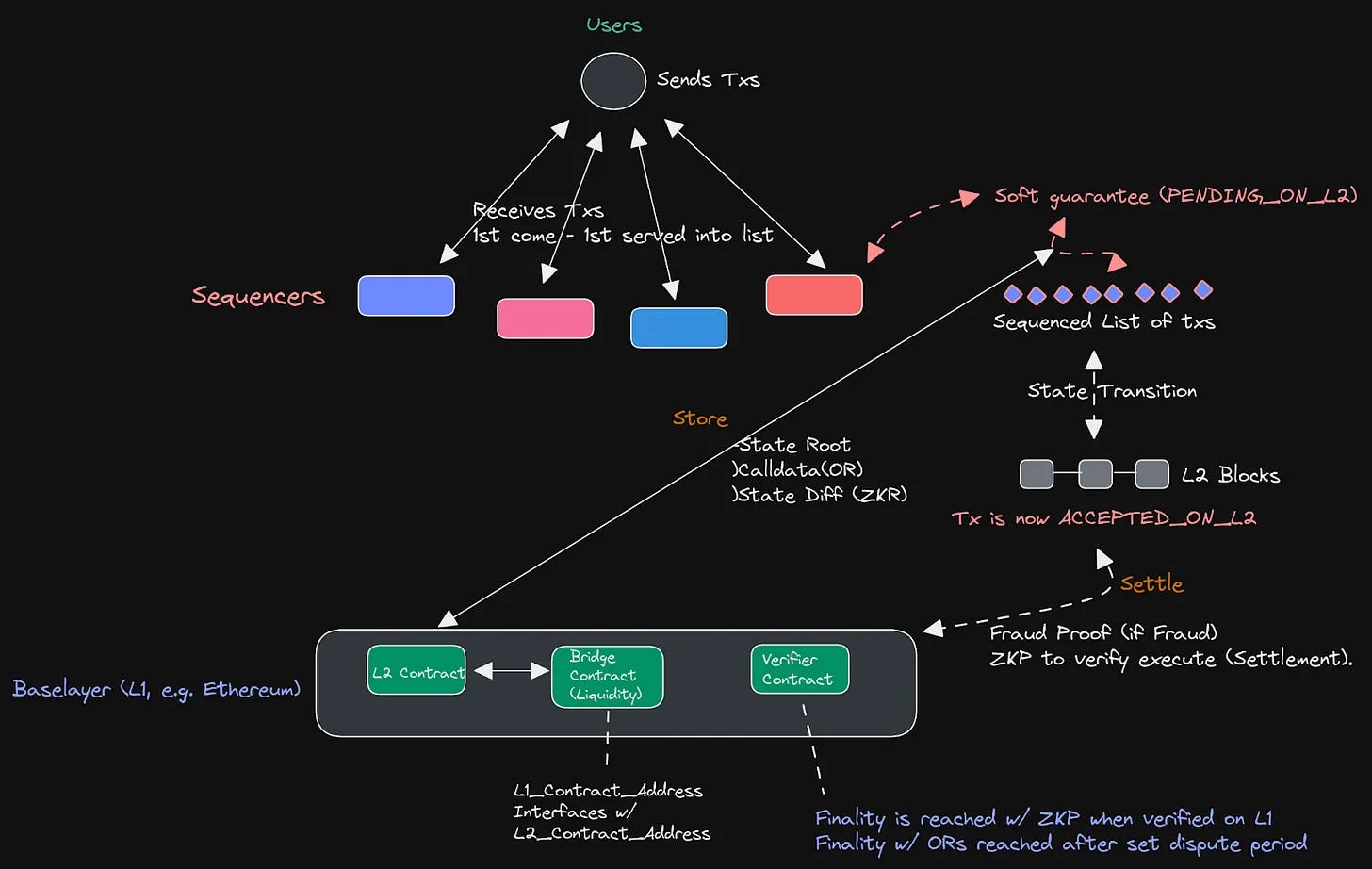

It is crucial to distinguish between MegaETH’s English auction for token distribution and the ongoing MEV (Maximal Extractable Value) auctions that underpin transaction ordering on Ethereum and its rollups. In traditional MEV auctions, like those enabled by Proposer-Builder Separation (PBS): builders compete for the right to order transactions within a block. The winner can reorder submitted trades or insert their own, extracting value from arbitrage opportunities or liquidations.

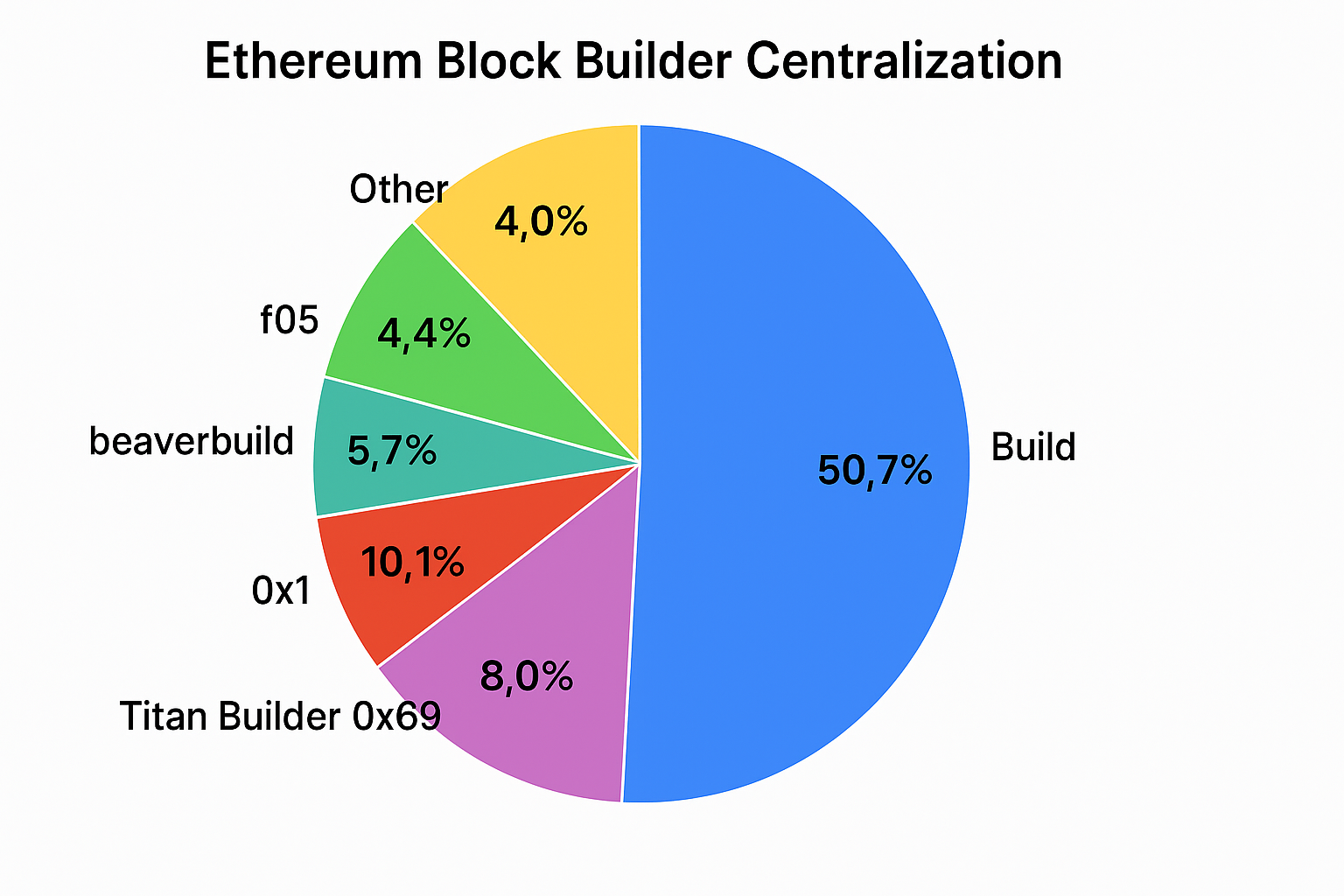

However, recent research highlights that this system has bred oligopolistic dynamics: dominant builders exploit latency advantages and privileged MEV access to reinforce their market power. This centralization undermines both auction efficiency and fairness for everyday DeFi traders seeking optimal execution (arXiv.org study).

MegaETH’s Approach: Building Community Commitment Before Optimizing MEV Distribution

While MegaETH’s upcoming public sale uses an open auction format to foster transparency and broad participation in its initial allocation phase, it is important not to conflate this mechanism with ongoing Layer 2 MEV distribution strategies. The current English auction does not directly optimize MEV distribution for DeFi traders; rather, it sets the stage for a committed user base that could later influence governance around sequencer fees and transaction ordering rights.

The inclusion of yield-generating stablecoins aimed at subsidizing Ethereum sequencer fees signals an intent to address long-term network costs, a major factor in Layer 2 economics, but again, this is distinct from real-time orderflow marketplace auctions where builders compete to maximize returns from block construction.

For DeFi traders, the distinction matters. MegaETH’s English auction for token distribution is about fair initial access and community alignment, not the granular mechanics of MEV capture during block production. The auction format prevents price manipulation and rewards conviction, but it does not provide new tools for traders seeking to optimize their transaction execution or minimize slippage from MEV extraction.

What MegaETH does offer is a potential foundation for future innovation in Layer 2 MEV auctions. By prioritizing a committed user base through its public sale mechanism, MegaETH may lay the groundwork for more democratic governance over sequencer roles, fee models, and possibly even orderflow marketplace participation down the line. Such a community-centric approach could eventually help shape how MEV staking rewards and transaction ordering rights are distributed in a way that benefits both traders and protocol maintainers.

Key Differences: MegaETH English Auction vs. L2 MEV Auctions

-

Purpose of Auction: MegaETH’s English auction is designed for initial token distribution, allocating 5% of MEGA supply to committed users. In contrast, Layer 2 MEV auctions (like MEV-Boost) focus on auctioning transaction ordering rights to maximize value extraction for validators and builders.

-

Participant Incentives: The MegaETH auction incentivizes long-term commitment by offering a 10% discount for a one-year token lockup. Layer 2 MEV auctions reward builders and validators who extract MEV, often favoring those with network advantages rather than community engagement.

-

Impact on Network Decentralization: MegaETH’s approach aims to broaden token ownership and build a diverse community. In contrast, research shows MEV auctions on Layer 2s can increase centralization, as a few dominant builders gain market power through network latency and MEV access.

-

Role in MEV Distribution: The MegaETH auction does not directly optimize MEV distribution for DeFi traders—it focuses on token allocation. Layer 2 MEV auctions, however, directly determine how MEV rewards are distributed among builders and validators, impacting DeFi transaction outcomes.

-

Auction Format & Transparency: MegaETH uses a public English auction format, with transparent bidding between $2,650 and $186,282 in USDT and a clear FDV range ($1 million to $999 million). Layer 2 MEV auctions typically use sealed-bid or real-time auctions among builders, with less public transparency for end users.

Community sentiment around this approach is already sparking debate among DeFi veterans and newcomers alike. Some applaud the transparent, anti-airdrop stance as a step toward healthier token economies. Others question whether initial distribution mechanisms can meaningfully impact long-term MEV dynamics without deeper changes to block production or sequencer incentives.

Looking Ahead: The Interplay of Auction Design and On-Chain Incentives

The real test will come after the public sale concludes. As MegaETH matures, its approach to sequencer auctions, yield-backed fee subsidies, and orderflow marketplace design will determine whether it can truly optimize MEV distribution for DeFi traders, or if it simply offers a fairer starting point with business as usual underneath.

For now, the MegaETH English auction stands out as an experiment in aligning early stakeholders with protocol health rather than short-term hype. It’s an open question whether this model will inspire broader adoption among Layer 2s or prompt further innovation in how on-chain value is allocated, especially as research continues to highlight centralization risks in current PBS-based MEV systems (arXiv.org study). Traders should watch closely how these auction strategies evolve alongside advances in real-time blockspace markets.

Summary Table: MegaETH Public Sale Details

Summary of MegaETH’s English Auction Parameters

| Parameter | Details |

|---|---|

| Supply Percentage | 5% of total MEGA supply |

| Auction Dates | October 27–30, 2025 |

| Price Range | $2,650 – $186,282 (USDT) |

| FDV Start | $1,000,000 |

| FDV Cap | $999,000,000 |

| Lockup Discount | 10% discount for one-year lockup |

Ultimately, while MegaETH’s public sale mechanism doesn’t directly optimize ongoing MEV distribution for DeFi participants, it does set an important precedent for transparency and community engagement at launch, a necessary first step if Layer 2s are to address deeper market structure issues facing on-chain traders today.