Decentralized exchanges are at a pivotal crossroads, with parallel execution and native orderflow rapidly redefining the landscape for both traders and protocol designers. These innovations are not merely incremental upgrades – they represent a strategic overhaul of how DEXs process transactions, manage liquidity, and mitigate MEV (Maximal Extractable Value) risks. As modular MEV auction platforms mature, the interplay between execution speed, fairness, and user protection is becoming the new competitive frontier.

Parallel Execution: Unlocking Scale in Blockchain Trading

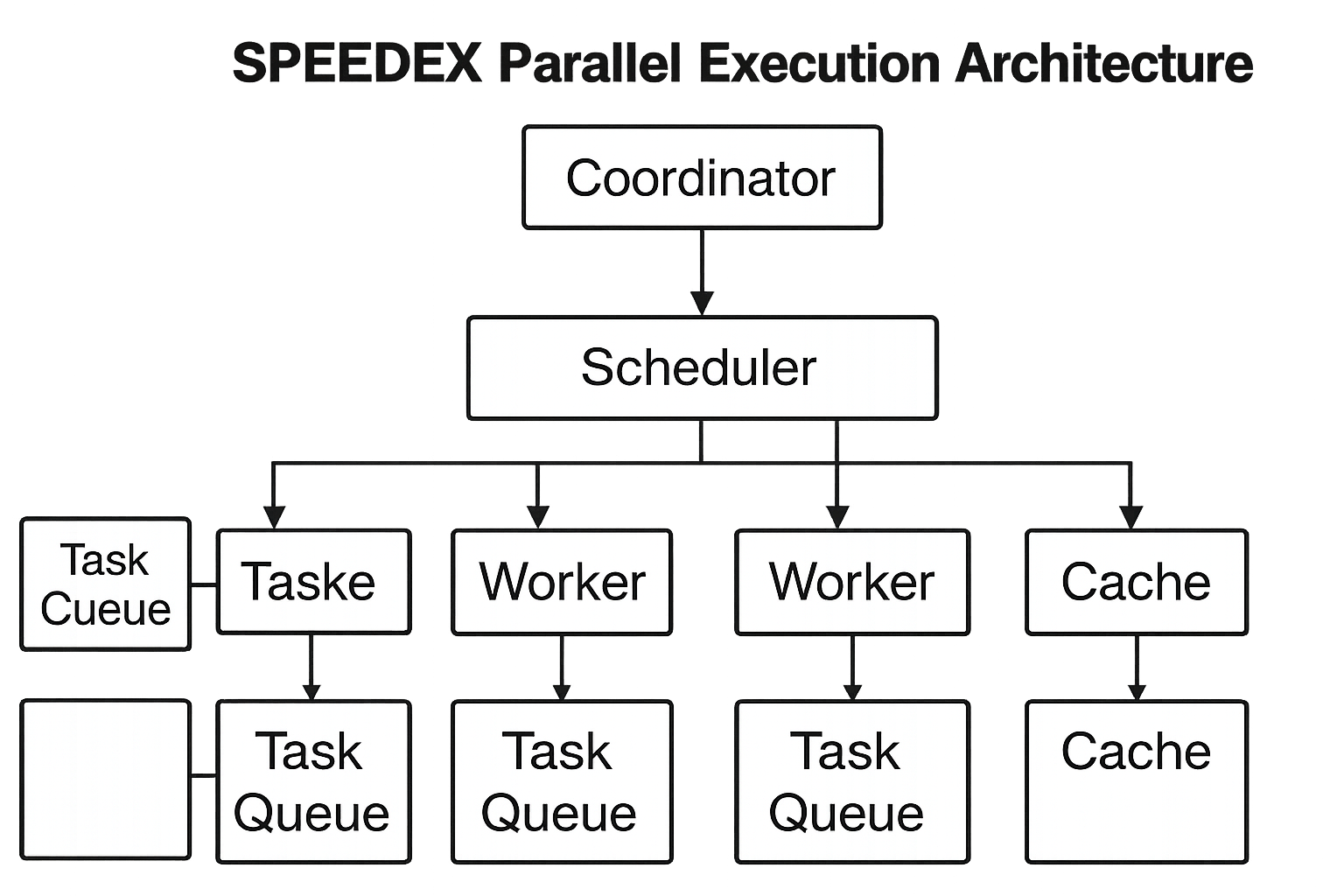

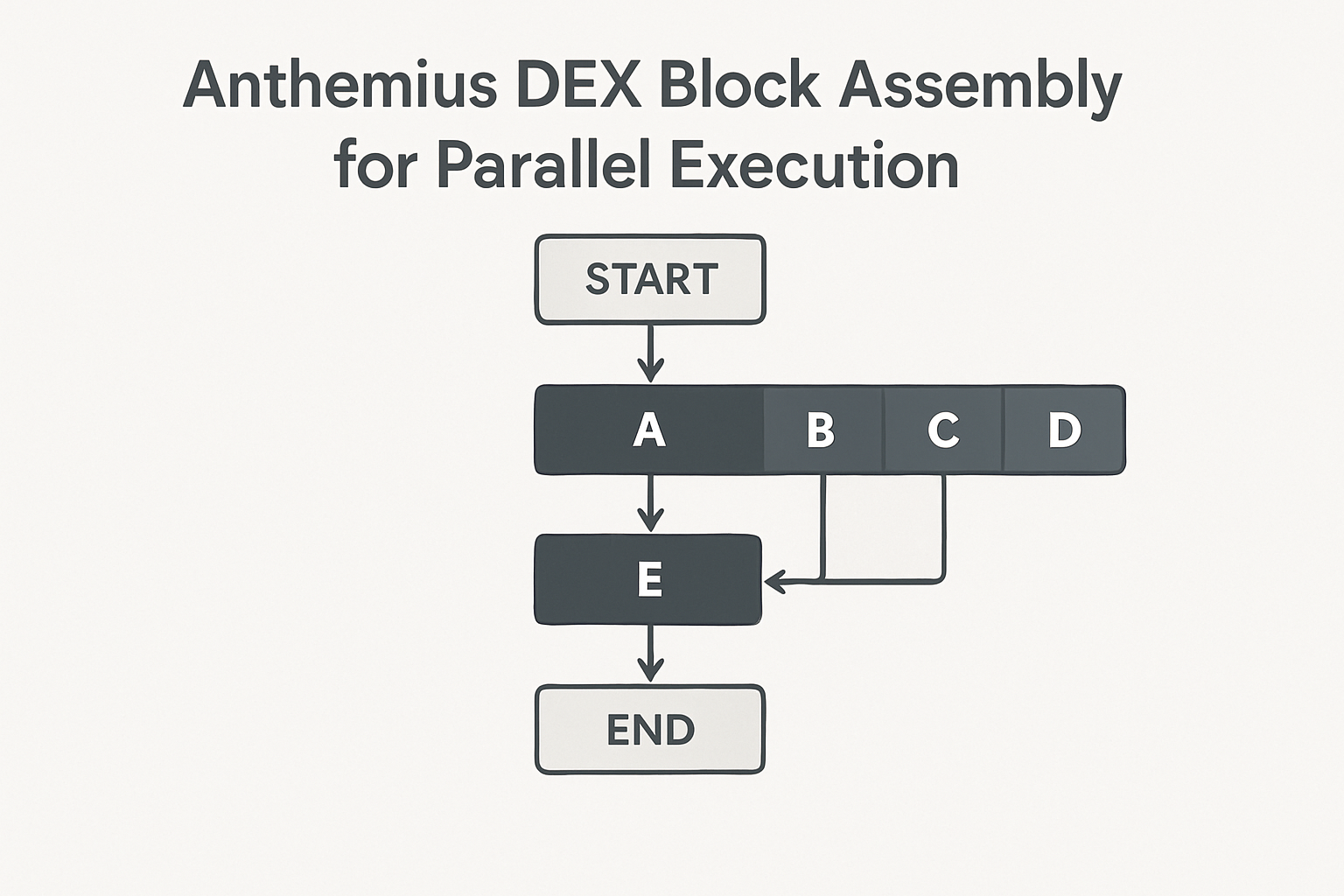

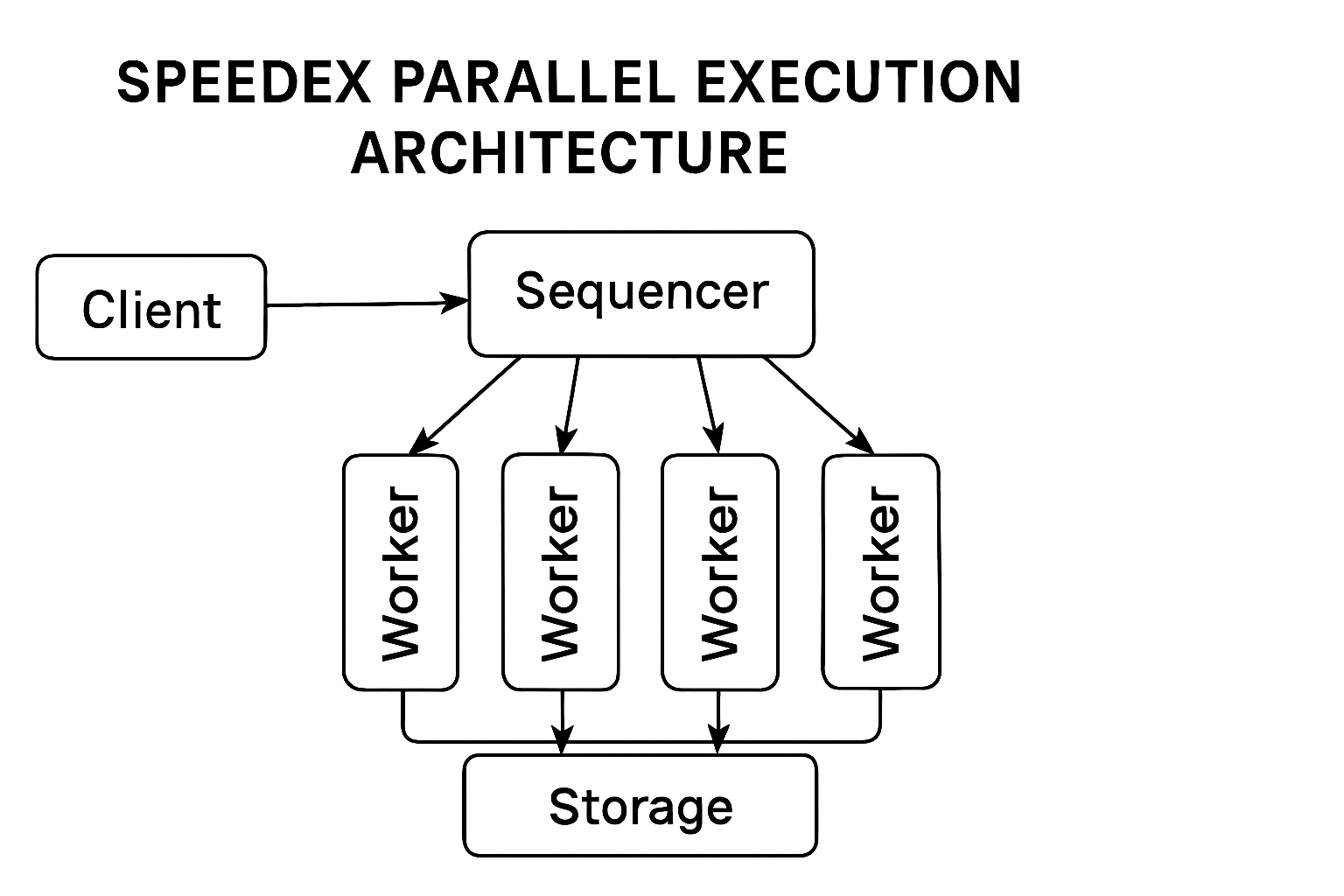

Historically, most DEXs relied on sequential transaction processing. This architecture bottlenecked throughput and exposed users to latency-driven risks such as front-running and slippage. Enter parallel execution blockchain designs: solutions like SPEEDEX have demonstrated that concurrent transaction processing is not only possible but can achieve over 200,000 TPS by leveraging commutative trade operations within Arrow-Debreu market structures. Similarly, Anthemius optimizes block assembly to maximize concurrency, effectively doubling transaction rates by intelligently organizing trades for simultaneous settlement.

The implications for market participants are profound. Higher throughput means more orders filled at intended prices and less congestion during volatile periods. For developers building on modular MEV auction platforms, this translates to a new paradigm where blockspace is more efficiently allocated and latency-sensitive strategies can be executed without compromise.

Native Orderflow: Redefining Fairness and MEV Mitigation

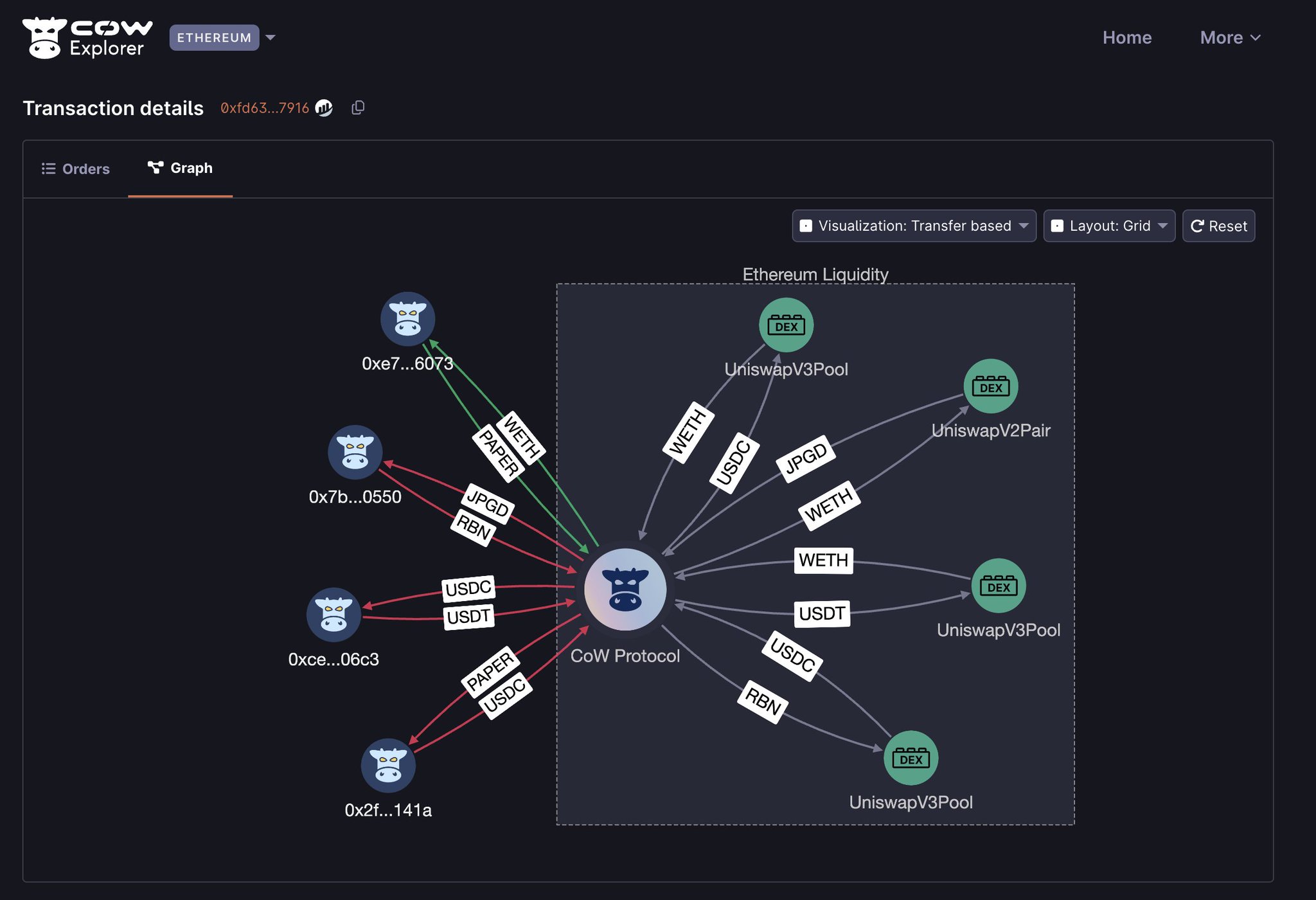

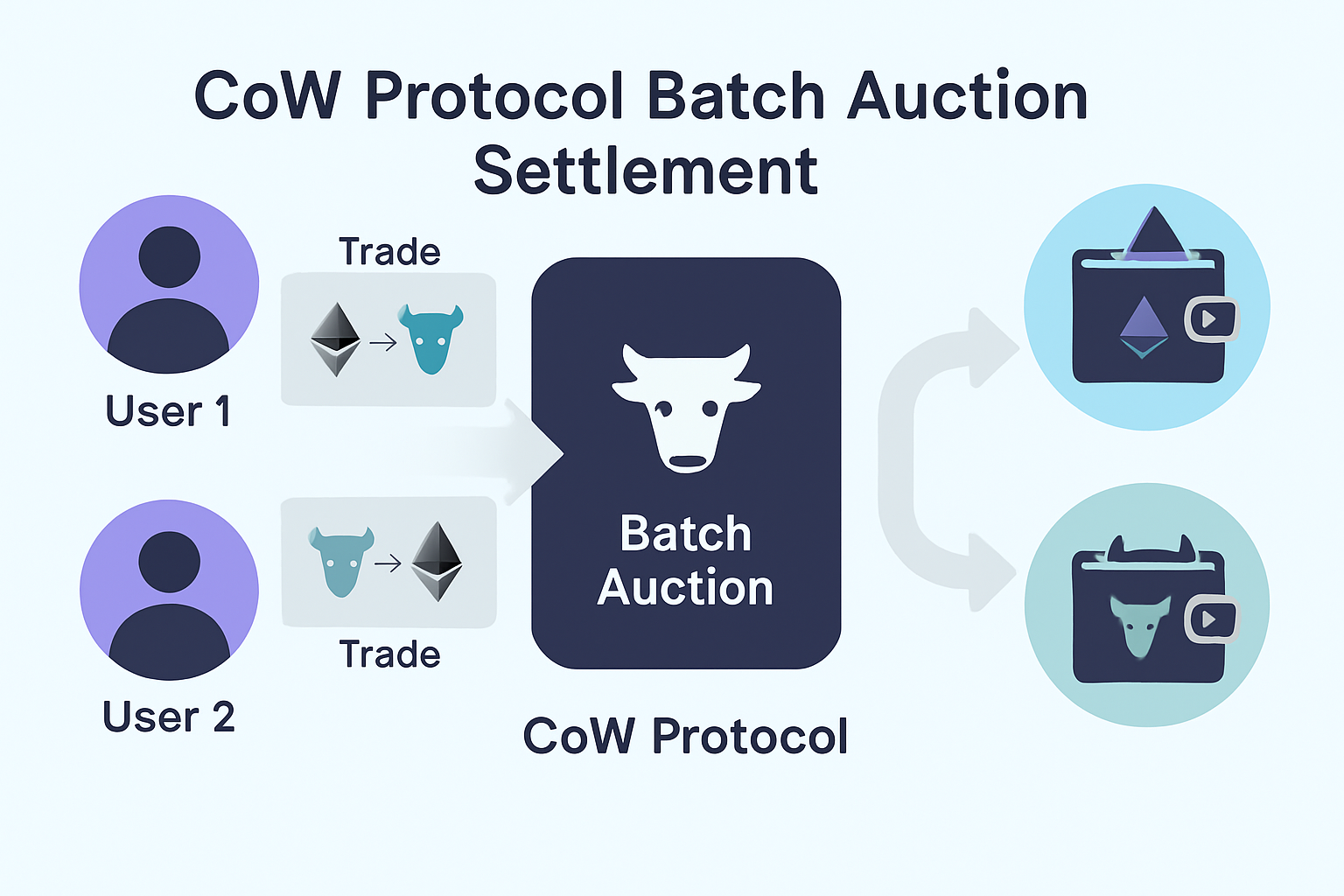

While speed is crucial, it cannot come at the expense of fairness or user protection. Native orderflow DEX mechanisms are emerging as critical tools for neutralizing toxic MEV practices such as sandwich attacks or predatory front-running. Platforms like CoW Protocol exemplify this shift by batching orders into uniform clearing price auctions – a move that dramatically reduces exploitable arbitrage opportunities while promoting price integrity.

The evolution does not stop with public batch auctions. The adoption of private orderflow solutions – including MEV Blocker and Flashbots Protect – enables users to route their transactions through secure relays that shield order details from the public mempool until execution. This approach not only deters opportunistic actors but also introduces new incentive models where recovered MEV can be rebated back to users or apps.

Performance Benchmarks: Throughput, Latency and User Experience

The integration of parallel execution with native orderflow is already producing measurable gains across several vectors:

Key Benefits of Parallel Execution & Native Orderflow

-

Massive Throughput Gains: Parallel execution architectures, such as SPEEDEX, enable decentralized exchanges to process over 200,000 transactions per second, vastly outpacing traditional sequential models and supporting high-volume trading environments.

-

Reduced Transaction Latency: Platforms like Anthemius optimize block assembly for concurrent execution, effectively halving confirmation times and delivering a faster, more responsive trading experience.

-

Enhanced MEV Protection: Native orderflow mechanisms, exemplified by CoW Protocol (CoW Swap), use batch auction settlements and uniform clearing prices to minimize front-running and sandwich attacks, ensuring fairer trade execution.

-

User Security via Private Orderflow: Solutions like MEV Blocker and Flashbots Protect route trades through private relays, shielding users from public mempool MEV threats and offering rebates from recovered MEV.

-

Greater Market Fairness: The combination of parallel execution and native orderflow levels the playing field for all traders, reducing the influence of predatory actors and promoting equitable pricing across DEX platforms.

- Increased Throughput: Modular architectures now handle trading volumes previously reserved for centralized exchanges.

- Reduced Latency: Transaction confirmation times have dropped significantly thanks to concurrent settlement models.

- User-Centric Fairness: With mitigated MEV extraction, traders experience fewer adverse outcomes and greater price transparency.

This new reality is especially relevant in blockspace market solutions where efficiency determines both user satisfaction and protocol profitability. By combining scalable execution layers with sophisticated orderflow controls, modular MEV auctions are setting the standard for next-generation decentralized trading infrastructure.

Looking ahead, the impact of these architectural changes extends beyond just performance metrics. As modular MEV auction platforms continue to evolve, they are fostering a more inclusive and resilient trading ecosystem, one where both sophisticated and retail participants benefit from transparent, efficient, and equitable market access. The interplay between parallel execution and native orderflow is also catalyzing further innovation in related domains such as intent-based trading, cross-chain liquidity aggregation, and programmable privacy for orderflow.

Strategic Implications: How Modular MEV Auctions Are Shaping the Future

For protocol architects and DeFi strategists, the message is clear: embracing modularity in both execution and orderflow design is no longer optional. The ability to dynamically allocate blockspace based on real-time demand, coupled with robust MEV mitigation mechanisms, positions modular MEV auctions as foundational infrastructure for the next wave of decentralized finance innovation. Projects on networks like Sei have already demonstrated how application-specific ordering and batch clearing can redistribute MEV more equitably across stakeholders, an approach that will likely become standard as competition intensifies.

Moreover, the integration of AI-driven reinforcement learning agents in MEV extraction (as evidenced by recent research on Polygon) points toward a future where auction dynamics become even more adaptive and complex. This raises new questions around governance, incentive alignment, and long-term sustainability for both protocols and their communities.

Navigating the Next Frontier: Opportunities and Challenges

The transition to parallel execution blockchain models with native orderflow DEX features is not without its hurdles. Developers must grapple with increased system complexity, rigorous security requirements for private relays, and the need for continuous monitoring against emerging MEV attack vectors. However, these challenges are balanced by substantial opportunities:

Key Opportunities Unlocked by Parallel Execution & Native Orderflow

-

Massive Throughput Gains with Parallel Execution: Platforms like SPEEDEX have demonstrated the ability to process over 200,000 transactions per second by leveraging parallelizable market structures, enabling DEXs to handle institutional-scale trading volumes without congestion.

-

Lower Latency and Faster Settlement: Solutions such as Anthemius optimize block assembly for concurrent execution, effectively reducing transaction confirmation times and improving user experience during periods of high demand.

-

MEV Mitigation via Batch Auctions: CoW Protocol (CoW Swap) utilizes batch auction settlements with uniform clearing prices, significantly reducing front-running and sandwich attacks, and promoting fairer trade execution.

-

Private Orderflow for User Protection: Services like MEV Blocker and Flashbots Protect route transactions through private relays, shielding users from public mempool vulnerabilities and enabling MEV rebates directly to traders.

-

Enhanced Fairness and Equitable Pricing: Native orderflow mechanisms ensure that all participants receive fair pricing and execution, helping DEXs compete with centralized exchanges on transparency and user trust.

From a trader’s perspective, these advancements mean tighter spreads during volatile markets, faster settlement even at peak times, and greater confidence that their strategies won’t be undermined by hidden adversarial actors. For liquidity providers and protocol DAOs, improved capital efficiency translates into higher utilization rates, and ultimately better returns across volatile market cycles.

As we enter this new era of decentralized trading infrastructure, it’s clear that platforms prioritizing modularity in both execution layers and orderflow management will define best practices for years to come. Those seeking deeper insights into how modular MEV auctions drive transaction efficiency should explore our comprehensive analysis at How Modular MEV Auctions Enhance Transaction Efficiency in Decentralized Finance.