Sealed-bid MEV auctions are rapidly emerging as a cornerstone for improving DeFi transaction fairness. In a landscape where transparency can often be weaponized by sophisticated actors, the confidentiality of sealed-bid formats offers a compelling solution to long-standing problems like frontrunning, sandwich attacks, and bidding wars that inflate gas costs. As DeFi matures, the demand for equitable and efficient transaction ordering has never been higher.

Why Sealed-Bid Auctions Matter in the Blockspace Marketplace

Traditional open-bid blockchain auctions expose every participant’s intent and pricing in real time. While transparent, this approach inadvertently enables predatory strategies. Malicious actors can monitor mempool activity, insert or reorder transactions, and extract MEV (Maximal Extractable Value) at the expense of regular users. Sealed-bid auctions, by contrast, keep all bids hidden until the auction closes. This subtle but profound change ensures that no participant can react to others’ bids in real time, leveling the playing field for all involved.

In practice, this means that searchers and traders submit their optimal bids without worrying about being undercut or gamed by rivals. The result is reduced gas fee volatility and less incentive for bots to spam or manipulate orderflow. The move toward sealed-bid mechanisms directly addresses issues outlined in recent research from both academia and industry watchdogs – notably the European Securities and Markets Authority’s ongoing analysis of MEV’s impact on crypto markets.

Real-World Implementations: From Flashbots to Algoryte

Several pioneering projects have already integrated sealed-bid MEV auction models into their protocols. These implementations are not theoretical; they are live systems tackling fairness challenges head-on:

Key DeFi Projects Using Sealed-Bid MEV Auctions

-

Flashbots Auction: A pioneering MEV marketplace on Ethereum, Flashbots introduced sealed-bid blockspace auctions to reduce bidding wars and front-running, enabling users to submit confidential transaction bundles for inclusion in blocks. Learn more.

-

Algoryte: Algoryte leverages encrypted mempools to keep transaction details hidden from miners and bots, using sealed-bid auctions to prevent front-running and sandwich attacks across multiple blockchains. Learn more.

-

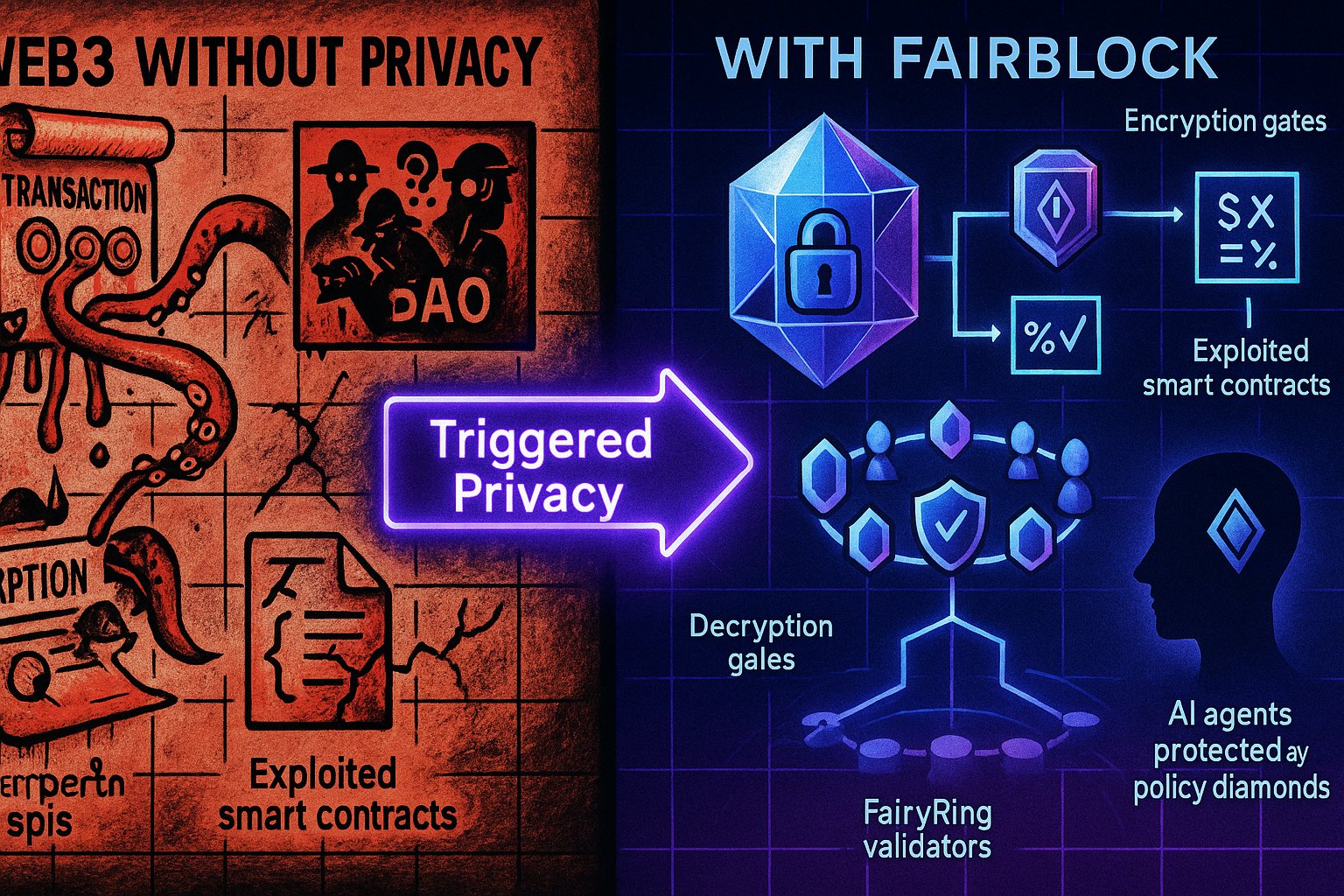

Fairblock: Fairblock implements on-chain sealed-bid auctions using threshold encryption, ensuring all bids remain private until the reveal phase, which enhances fairness and privacy in DeFi transactions. Learn more.

Flashbots Auction, for example, uses a private transaction pool where users submit bundles specifying desired transaction order within a block. By leveraging sealed-bid blockspace auctions, Flashbots minimizes bidding wars and network congestion – making gas prices more predictable for everyone.

Algoryte takes an even more privacy-centric approach with encrypted mempools. Here, transactions remain hidden from validators and bots until block confirmation. This method virtually eliminates front-running and sandwich attacks by keeping sensitive data confidential until it’s too late for adversaries to react.

Fairblock, meanwhile, employs threshold encryption so that all bids remain encrypted on-chain until revealed simultaneously at auction end. This design not only removes the need for collateral but also reduces censorship risk based on bid size or sender identity.

The Ongoing Challenge: Balancing Fairness with Efficiency

The promise of sealed-bid MEV auctions is clear – but so are their limitations. Recent studies into platforms like Arbitrum’s Timeboost reveal potential centralization risks: express lane control often ends up concentrated among a handful of entities. This undermines some of the fairness these mechanisms are intended to foster.

Moreover, auction-based ordering does not automatically solve spam or reverted transaction issues; empirical data shows that many time-boosted transactions never settle successfully. Implementing robust cryptographic protocols adds further complexity to both user experience and system security.

Despite these hurdles, the direction is unmistakable: as more DeFi protocols adopt sealed-bid models, the ecosystem moves closer to true orderflow transparency, reduced MEV extraction by bad actors, and ultimately a fairer blockspace marketplace.

Market participants are already noting the shift. As sealed-bid MEV auctions gain traction, there’s a visible reduction in gas fee volatility and fewer opportunities for predatory bots to manipulate transaction order. The impact is especially pronounced during periods of heightened network activity, when traditional open-bid systems would historically see gas wars spiral and ordinary users priced out of timely execution.

Importantly, sealed-bid models don’t just benefit sophisticated searchers or institutional traders. Everyday DeFi users stand to gain from improved predictability and lower transaction costs. When frontrunning is minimized, token swaps, NFT mints, and lending activities become less risky and more accessible, opening the door for broader participation in decentralized finance.

What’s Next for Sealed-Bid Auctions in DeFi?

Looking ahead, the adoption curve for sealed-bid MEV auctions is likely to accelerate as both technical standards and user tooling mature. Ongoing research into advanced cryptographic primitives, such as threshold encryption and zero-knowledge proofs, promises to make these systems even more robust against collusion and censorship.

However, vigilance remains essential. As with any innovation, new attack vectors may emerge, and centralization risks must be monitored closely. Community governance, transparent reporting, and open-source audits will be crucial in ensuring that sealed-bid mechanisms deliver on their promise of fairness without inadvertently introducing fresh vulnerabilities.

Key Benefits of Sealed-Bid MEV Auctions for DeFi Users

-

Mitigates Front-Running and Sandwich Attacks: By keeping bids confidential until the auction ends, sealed-bid MEV auctions prevent malicious actors from exploiting transaction order, significantly reducing front-running and sandwich attacks.

-

Promotes Transaction Fairness: Sealed-bid formats ensure that no participant has an informational advantage, fostering a more equitable environment for all DeFi users.

-

Reduces Gas Fee Volatility: Projects like Flashbots Auction use sealed-bid mechanisms to minimize bidding wars, resulting in more predictable and stable gas fees for users.

-

Enhances Privacy and Security: Platforms such as Algoryte and Fairblock leverage encryption to keep transaction and bid details private, protecting user data and strategies from public exposure.

-

Encourages Broader Participation: With a fairer and more private bidding process, sealed-bid auctions lower the barriers for new and smaller participants to engage in DeFi activities.

For those seeking a deeper technical dive or practical guidance on integrating sealed-bid auctions into their own protocols, resources like this in-depth guide offer step-by-step breakdowns and best practices.

As the modular blockspace marketplace continues to evolve, sealed-bid MEV auctions are poised to become a foundational pillar for DeFi transaction fairness. Whether you’re a protocol developer, trader, or everyday user, understanding these innovations, and their implications, will be key to navigating the next era of decentralized finance.