Sealed-bid auctions are rapidly becoming the backbone of modern MEV (Maximal Extractable Value) mitigation strategies in decentralized finance. As the battle for fair transaction ordering intensifies, these auction formats introduce a new paradigm of privacy and equitability that is fundamentally reshaping how value is extracted and distributed across blockchains. In a sector where orderflow fairness and blockspace market transparency are paramount, sealed-bid MEV auctions are emerging as a sophisticated solution to longstanding inefficiencies and risks.

The Mechanics of Sealed-Bid MEV Auctions

Unlike traditional open-bid systems, sealed-bid auctions require participants to submit confidential bids without knowledge of their competitors’ offers. This format can take the form of either first-price or second-price mechanisms, but in both cases, all bids remain private until the bidding window closes. The highest bidder wins the right to order transactions or secure blockspace, paying either their own bid (first-price) or the next highest bid (second-price). This confidentiality is crucial in minimizing front-running and strategic manipulation, problems that have plagued DeFi protocols since their inception.

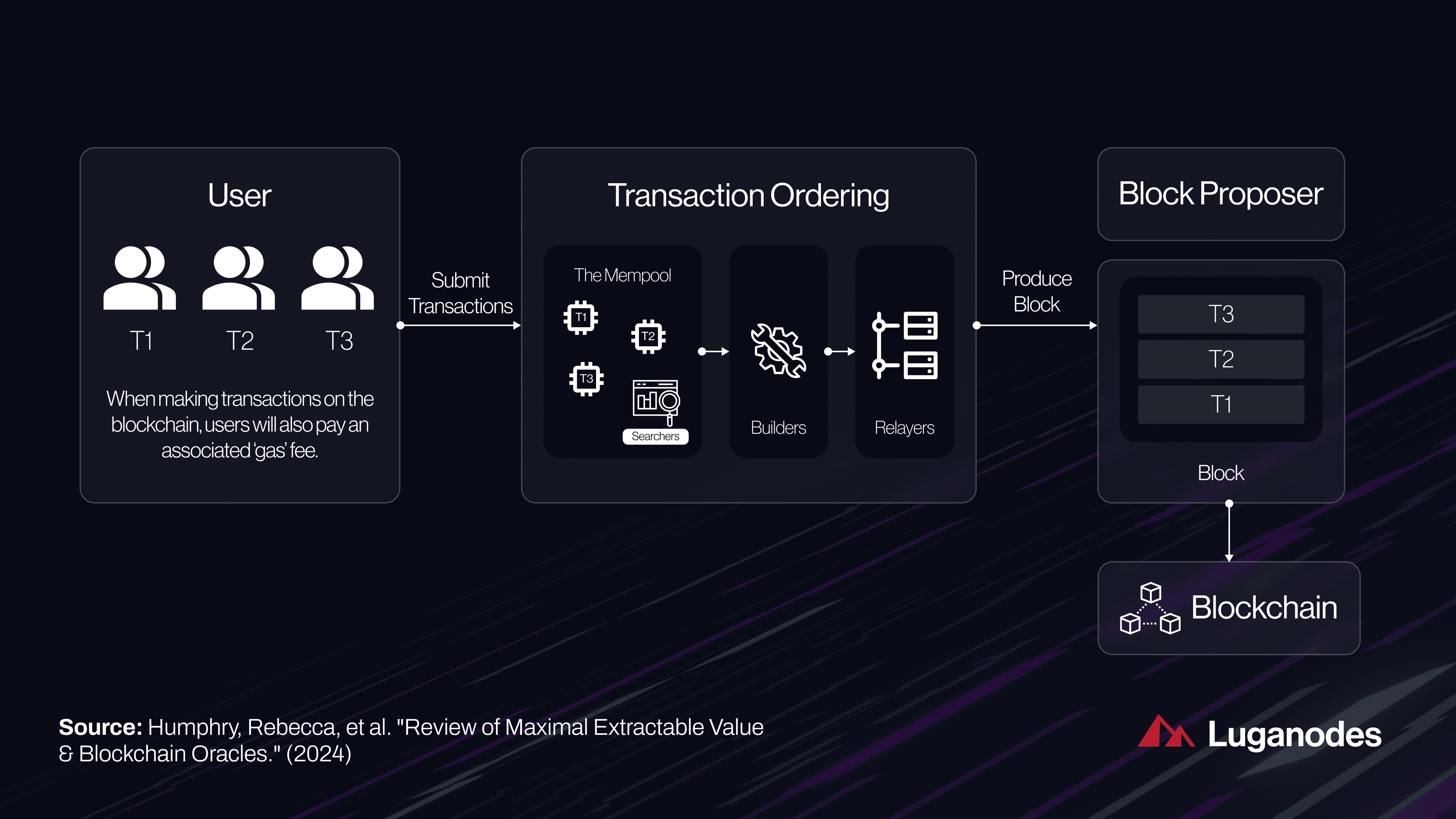

MEV is any additional profit that can be captured through the reordering, insertion, or censorship of transactions once they have been publicly broadcast.

This definition from Jake Rubin on Medium underscores why sealed-bid auctions are so transformative: by delaying bid revelation until after commitment, they prevent opportunistic actors from gaming the system at users’ expense.

Pioneering Implementations Driving Change

The shift toward sealed-bid MEV auctions is not just theoretical, it’s playing out across leading blockchain protocols:

- Manifold Finance’s MEV Protocol: Launched in October 2023, this protocol introduced an innovative auction system allowing multiple winners per slot. By enabling priority-sensitive transactions and multi-slot bidding for block builders, Manifold’s design enhances value creation for validators while decentralizing MEV extraction (cryptodaily.co.uk).

- Arbitrum’s TimeBoost: Arbitrum has implemented a 200-millisecond “fast lane” for transaction prioritization. Access to this lane is determined by a sealed-bid second-price auction held every minute, turning what was once an implicit tax into a transparent public good with revenue flowing back to the ARB DAO treasury (panewslab.com).

- Axis Finance’s Modular Auction Protocol: Axis Finance leverages encrypted bids within its modular protocol to ensure confidentiality and robust price discovery for ERC20 tokens (axis.finance).

Key Benefits of Sealed-Bid MEV Auctions for DeFi Users

-

Enhanced Privacy and Front-Running Protection: Sealed-bid auctions keep all bids confidential until the auction concludes, significantly reducing the risk of front-running and strategic manipulation that often plague open-bid systems.

-

Fairer Transaction Ordering: By revealing all bids simultaneously only after the auction ends, sealed-bid mechanisms ensure that no participant can adjust their bid in reaction to others, promoting a more equitable allocation of transaction ordering rights.

-

Lower User Costs and Reduced MEV Extraction: Competitive sealed-bid processes, such as those used by Arbitrum’s TimeBoost, transform MEV from an implicit tax into a public good, reducing the wealth drain from users to MEV extractors and often channeling auction proceeds back to the community or protocol treasury.

-

Improved Price Discovery: Protocols like Axis Finance leverage sealed-bid auctions to foster more accurate and transparent pricing, especially for assets like ERC20 tokens, by preventing information leakage and collusion.

-

Decentralized and Equitable MEV Distribution: Sealed-bid auctions decentralize the process of MEV extraction, as seen in Manifold Finance’s MEV Protocol, which allows multiple winners and advanced bidding strategies, broadening access and distributing value more fairly among participants.

-

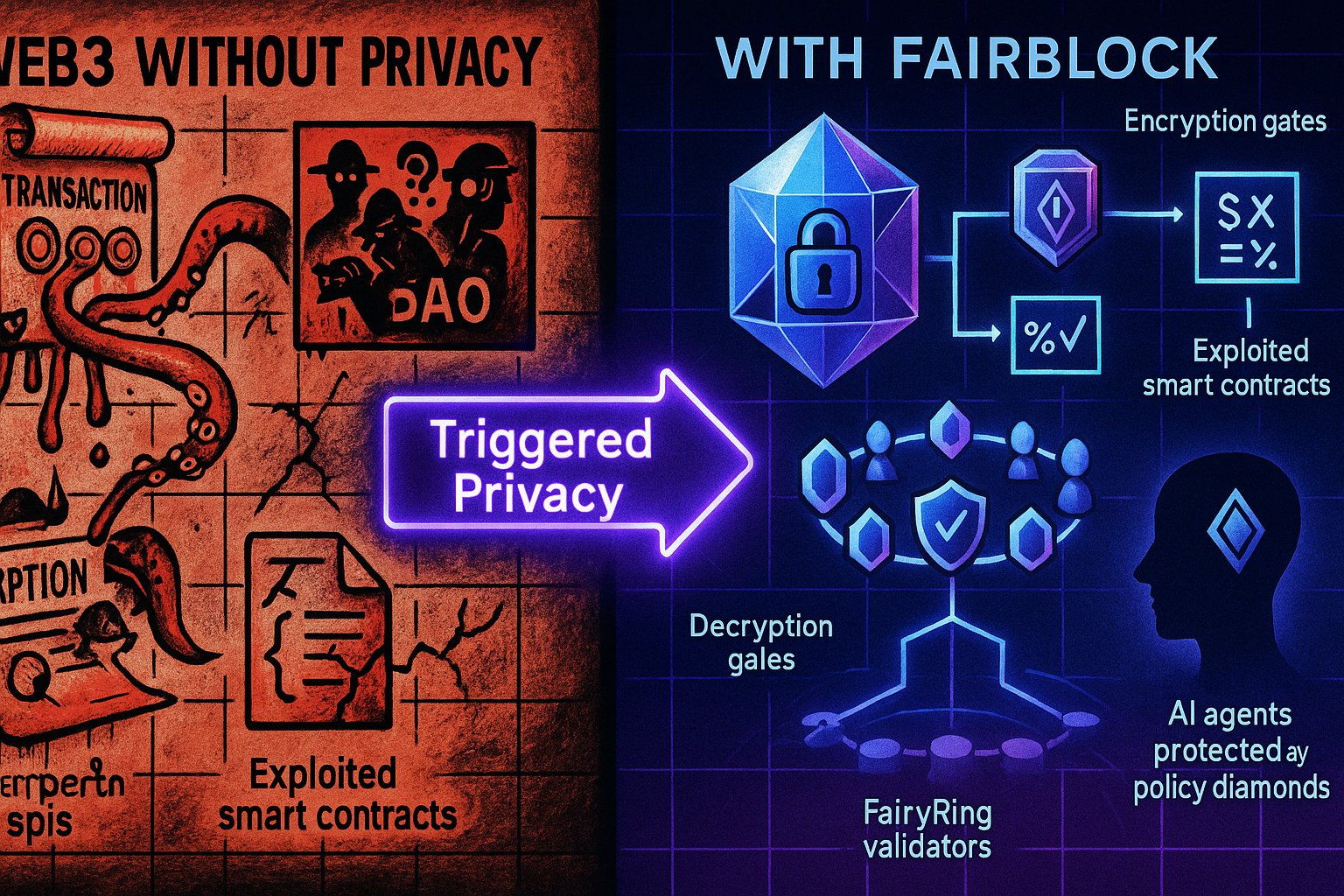

Technical Innovations for On-Chain Privacy: The adoption of cryptographic techniques like Fully Homomorphic Encryption (FHE) and Zero-Knowledge Proofs (ZKP)—as explored by projects such as Fairblock—enables sealed-bid auctions to maintain confidentiality even on transparent blockchains, bolstering trust and security.

The adoption of these models signals a decisive move away from latency-driven gas wars and towards mechanisms that reward true price discovery and user-centric outcomes.

Tackling Technical Challenges with Advanced Cryptography

The promise of sealed-bid auctions hinges on keeping bids confidential until settlement, a nontrivial task on transparent blockchains like Ethereum. To overcome this, projects are turning to advanced cryptographic techniques such as Fully Homomorphic Encryption (FHE), Zero-Knowledge Proofs (ZKP), and Multi-Party Computation (MPC). For example, Fairblock’s integration of programmable privacy technologies aims to further bolster auction integrity and decentralization (medium.com). These innovations are critical not just for security but also for scaling modular MEV auction solutions across diverse DeFi ecosystems.

Ecosystem Impact: From Exploitation to Equitable Value Distribution

The implications extend far beyond technical efficiency. By reducing information asymmetry and minimizing exploitative practices like sandwich attacks or time-bandit strategies, sealed-bid MEV auctions realign incentives between searchers, validators, and end users. As noted by research from Blocknative and L2IV Research, batch-based order flow auctions not only improve price discovery but also lower overall transaction fees, directly benefiting retail participants who previously bore the brunt of predatory extraction tactics.

Furthermore, the modularity of these auction protocols allows for rapid adaptation as new MEV strategies emerge. DeFi platforms can fine-tune auction parameters, integrate additional privacy layers, or expand to multi-asset orderflow marketplaces without overhauling their core infrastructure. This flexibility is essential in a landscape where the tactics and sophistication of MEV extraction evolve almost daily.

Realigning Incentives and Market Structure

Sealed-bid MEV auctions are not just technical upgrades; they represent a realignment of incentives across the entire DeFi stack. By making transaction ordering rights accessible through fair, confidential bidding, these systems democratize access to blockspace and reduce the concentration of power among a handful of sophisticated actors. This shift is especially relevant as DeFi matures and institutional capital seeks market structures that emphasize transparency and risk mitigation.

Notably, sealed-bid formats help ensure that a greater share of MEV is returned to protocol users or DAOs rather than being siphoned off by extractors. For example, Arbitrum’s TimeBoost channels significant auction proceeds directly into the ARB DAO treasury, enhancing community-driven development and governance capacity (panewslab.com). This creates a feedback loop where protocol health improves as value accrues to the ecosystem’s stakeholders, not just private searchers or validators.

Challenges Ahead: Latency Races and Scaling

While sealed-bid MEV auctions have mitigated many issues associated with open-bid systems, such as latency-driven races and information leakage, they are not a panacea. As highlighted in research from Frontier Research, teams continue to optimize for latency even within sealed-bid paradigms, seeking marginal advantages in bid timing or reveal phases. Maintaining true fairness will require ongoing improvements in cryptographic primitives and consensus mechanisms.

Additionally, scaling these auctions across chains with varying throughput and finality guarantees remains an open challenge. Protocols must balance confidentiality with computational efficiency to avoid introducing bottlenecks or excessive overhead that could undermine user experience.

The Future of Modular MEV Auction Solutions

The trajectory for modular MEV auction solutions is clear: increased adoption will likely drive greater orderflow fairness blockchain-wide, while further innovations in privacy technology will make sealed-bid mechanisms more robust and accessible. As DeFi protocols race to differentiate themselves on user protection and transparency, integrating advanced auction formats will become not just best practice but table stakes for serious platforms.

Top Emerging Trends in Sealed-Bid MEV Auctions for 2025

-

Multi-Winner Auction Models: Platforms like Manifold Finance are pioneering sealed-bid protocols that allow multiple winners per auction slot, enabling advanced use cases such as priority-sensitive transactions and multi-slot bidding. This approach increases value creation for validators and diversifies MEV extraction methods.

-

Priority Access via Sealed-Bid Time-Lanes: Arbitrum’s TimeBoost introduces a 200-millisecond fast lane for transactions, auctioned through sealed-bid, second-price auctions. This system transforms MEV into a public good, with significant revenue directed to the ARB DAO treasury, and reduces gas bidding wars.

-

Modular and Confidential Auction Protocols: Axis Finance has developed a modular auction protocol supporting encrypted sealed-bid submissions, promoting fair price discovery for ERC20 tokens and enhancing confidentiality in DeFi trading.

-

Advancements in On-Chain Privacy Technologies: Projects like Fairblock are integrating Fully Homomorphic Encryption (FHE), Zero-Knowledge Proofs (ZKP), and Multi-Party Computation (MPC) to maintain bid confidentiality on public blockchains, addressing a core challenge for sealed-bid auctions in DeFi.

-

Equitable MEV Distribution and Ecosystem Health: The adoption of sealed-bid auctions is shifting MEV extraction towards more equitable and transparent practices, reducing front-running and manipulation, and fostering greater trust and sustainability across the DeFi ecosystem.

The endgame is a more resilient DeFi ecosystem, one where value flows transparently according to merit rather than manipulation, and where all participants can trust that the rules are applied evenly. Sealed-bid auctions stand at the center of this transformation, offering both technical rigor and economic alignment in an industry defined by relentless innovation.