On-chain trading has always promised transparency and open access, but the reality is often far more chaotic. Maximal Extractable Value (MEV) – the profit that can be captured by reordering, inserting, or censoring transactions within a block – introduces an undercurrent of exploitation in decentralized finance. When miners or validators shuffle transaction order for their own gain, regular users are left vulnerable to front-running, sandwich attacks, and slippage. This hidden battle for blockspace creates noise and uncertainty across DeFi protocols.

Understanding MEV: The Source of On-Chain Chaos

The root of MEV-driven chaos lies in the open mempool. Once a transaction is broadcast to the network, anyone can observe it before inclusion in a block. This transparency enables predatory actors to manipulate transaction sequencing for profit, often at the expense of unsuspecting users. As highlighted by cube.exchange, these practices distort price discovery and degrade trust in DeFi markets.

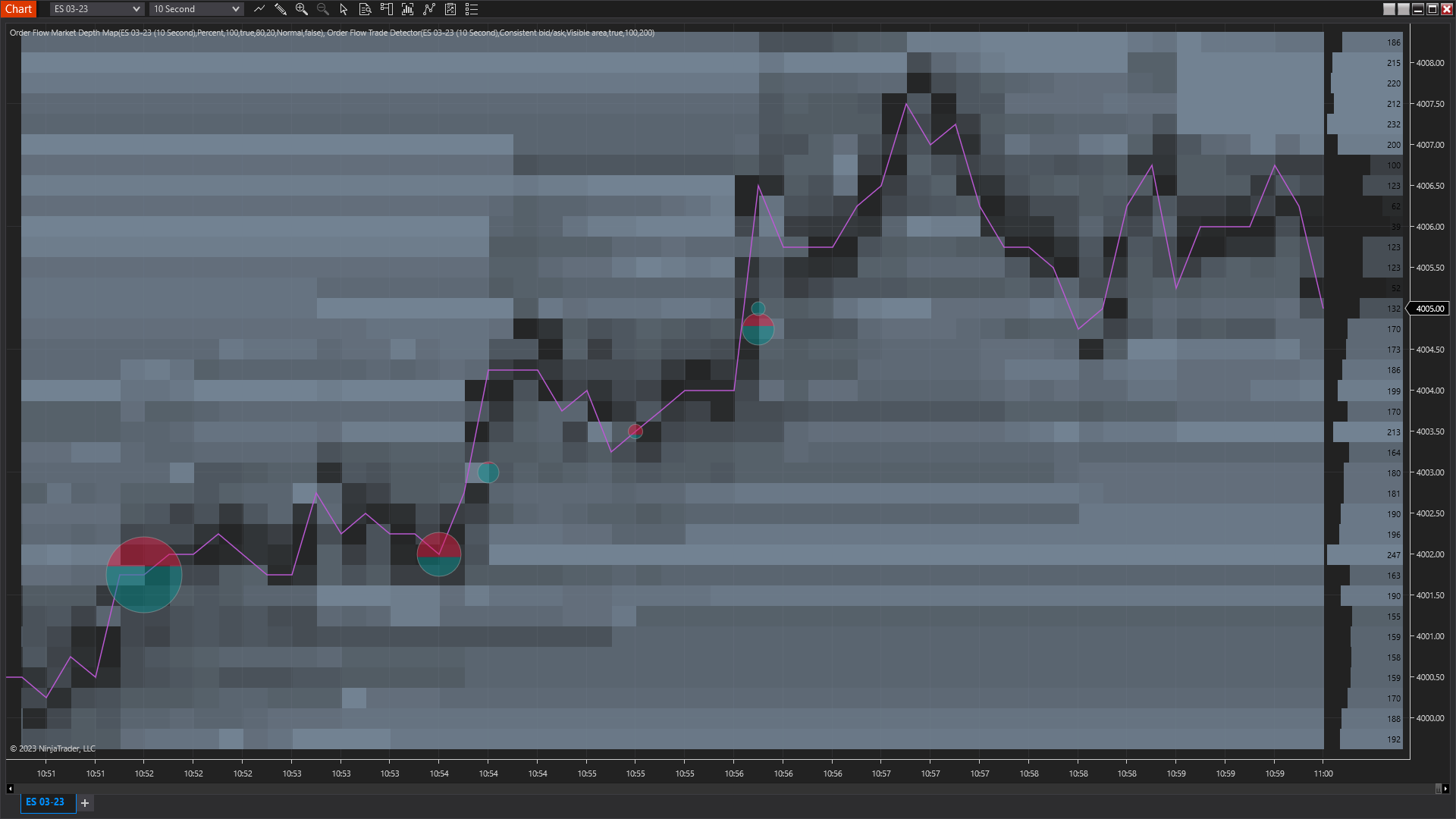

Traditional on-chain execution models lack robust mechanisms to prioritize user interests or ensure fair sequencing. The result is a race condition where bots spam transactions, gas fees spike unpredictably, and regular traders find themselves constantly outmaneuvered by sophisticated MEV strategies.

How MEV Auctions Bring Order to Blockspace Markets

MEV auctions introduce structure and competition into what was previously an opaque free-for-all. By formalizing how transaction order is determined and who profits from it, these systems reduce chaos and create a more level playing field for all participants.

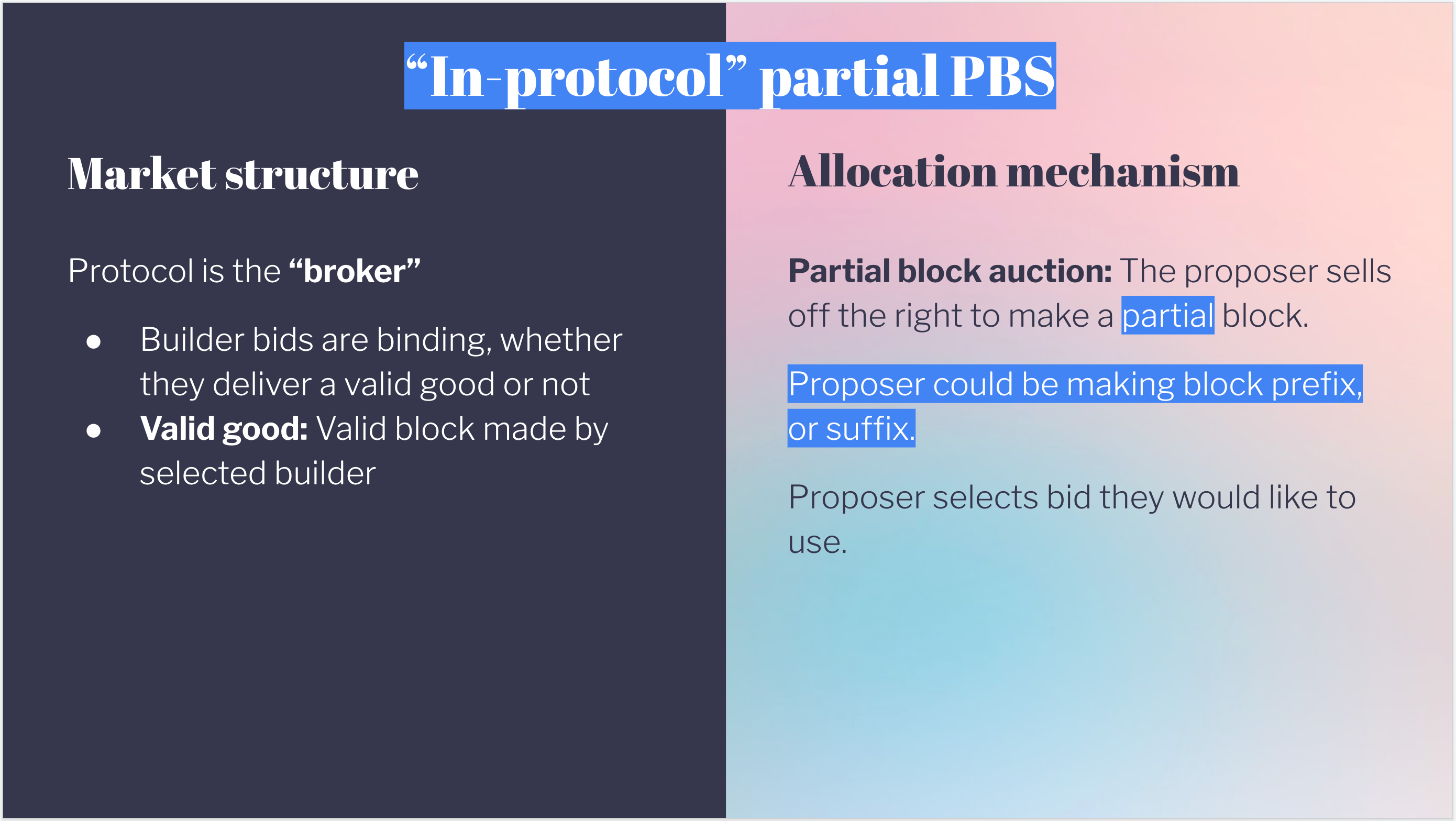

Proposer-Builder Separation (PBS) is one leading approach: specialized builders compete to assemble the most valuable block possible by bidding for orderflow or offering rebates directly to users. Block proposers then select from these candidate blocks based on transparent fee structures rather than private deals or backroom arrangements.

This separation of roles aligns incentives across the stack – proposers maximize their revenue while builders are forced to innovate on execution quality rather than exploit latency advantages. The net effect is a significant reduction in extractive behaviors like front-running and sandwiching.

Key Benefits of MEV Auctions for On-Chain Fairness

-

Reduces Transaction Reordering and Exploitation: MEV auctions, especially through Proposer-Builder Separation (PBS), minimize the ability of miners or validators to unfairly reorder, include, or exclude transactions for personal gain, directly addressing issues like front-running and sandwich attacks.

-

Promotes Fair User Outcomes via Order Flow Auctions: Order Flow Auctions (OFAs) allow users to benefit from the economic value their transactions generate by letting builders or solvers compete to offer the best execution or rebates, leading to more equitable transaction processing.

-

Enhances Transaction Privacy and Security: Protocols like FairFlow introduce components such as Privacy Keepers and randomized transaction ordering, which help protect sensitive transaction details and reduce information leakage that can be exploited for MEV extraction.

-

Improves Network Efficiency and Throughput: By replacing inefficient transaction spamming with structured auctions (e.g., Jito bundling on Solana), MEV auctions reduce wasted block space and increase the overall throughput of the blockchain network.

-

Aligns Incentives for Builders and Validators: Structured auction mechanisms ensure that builders and validators are incentivized to act in the best interests of the network and its users, rather than exploiting transaction order for personal profit.

-

Mitigates Chaos and Unpredictability in Trading: By introducing transparent and competitive processes for transaction inclusion, MEV auctions reduce the randomness and chaos that previously characterized on-chain trading environments.

The Rise of Order Flow Auctions (OFA) and Privacy Protocols

Order Flow Auctions take this concept further by allowing user transactions themselves to be auctioned among competing builders or solvers. Instead of being passively exposed to MEV risk, users become active participants in determining how their trades are executed and who captures any associated value.

Innovative protocols like FairFlow add additional layers of security through specialized nodes such as Auction Managers, Order Guardians, and Privacy Keepers. These components randomize transaction ordering and enhance privacy while ensuring that blockspace allocation remains equitable (source). As OFAs gain traction across major L1s and L2s, they promise not just better pricing but also real user empowerment in DeFi markets.

The Impact: From Transaction Spamming to Efficient Blockspace Allocation

The move from chaotic mempool competition toward structured auctions has tangible impacts:

- Reduced wasted blockspace: No more flooding the network with redundant transactions just to win priority.

- Smoother fee markets: Gas spikes become less frequent as competition shifts from speed to quality of execution.

- User-centric outcomes: End-users can receive rebates or improved execution instead of being perpetual victims of predatory trading bots.

Do you trust the fairness of current on-chain settlement processes?

With MEV (Maximal Extractable Value) allowing some insiders to profit by reordering or censoring transactions, new mechanisms like MEV auctions and Order Flow Auctions are being introduced to improve fairness. How much trust do you have in the fairness of on-chain settlements today?

Blockspace market solutions like MEV auctions are not just technical upgrades – they are a paradigm shift in how value and risk are distributed within decentralized systems. By introducing transparency and competition, these mechanisms create more predictable, user-friendly environments for both retail and institutional traders.

MEV Auctions as a Foundation for Transparent DeFi

Transparent MEV auctions fundamentally change the incentives for all network participants. Instead of relying on speed, secrecy, or privileged access to extract value, builders must compete in open markets where their strategies and outcomes are publicly auditable. This shift is critical for restoring trust in DeFi, especially as new users and capital continue to flow into blockchain ecosystems.

Protocols that implement Order Flow Auctions (OFA) or Proposer-Builder Separation (PBS) provide direct benefits to users:

- Fairer pricing: Users can receive rebates or improved execution quality as builders compete for their orderflow.

- Lower risk of predatory attacks: Randomized ordering and privacy enhancements reduce the effectiveness of front-running and sandwiching.

- Greater visibility: Auction data is available in real time, allowing everyone to observe how value is created and distributed.

The integration of privacy-focused protocols such as FairFlow further strengthens these outcomes. By randomizing transaction sequencing and introducing roles like Order Guardians, the system blunts the edge of latency arbitrageurs while keeping user data secure (source). These advances collectively push DeFi closer to its original vision: open, fair, and efficient markets accessible to all.

The move toward structured MEV auctions is not a cure-all for on-chain chaos – but it is a decisive step forward. By aligning incentives around transparency and competition rather than secrecy and speed, these innovations lay the groundwork for a more equitable financial future on public blockchains.