In the fast-evolving landscape of decentralized finance, the concept of Maximal Extractable Value (MEV) has shifted from a niche technical concern to a central force shaping transaction efficiency, cost, and user experience. As DeFi protocols and traders compete for optimal execution, the availability of real-time MEV auction data is transforming how transactions are prioritized and managed on-chain.

Why Real-Time MEV Auction Data Matters for DeFi Optimization

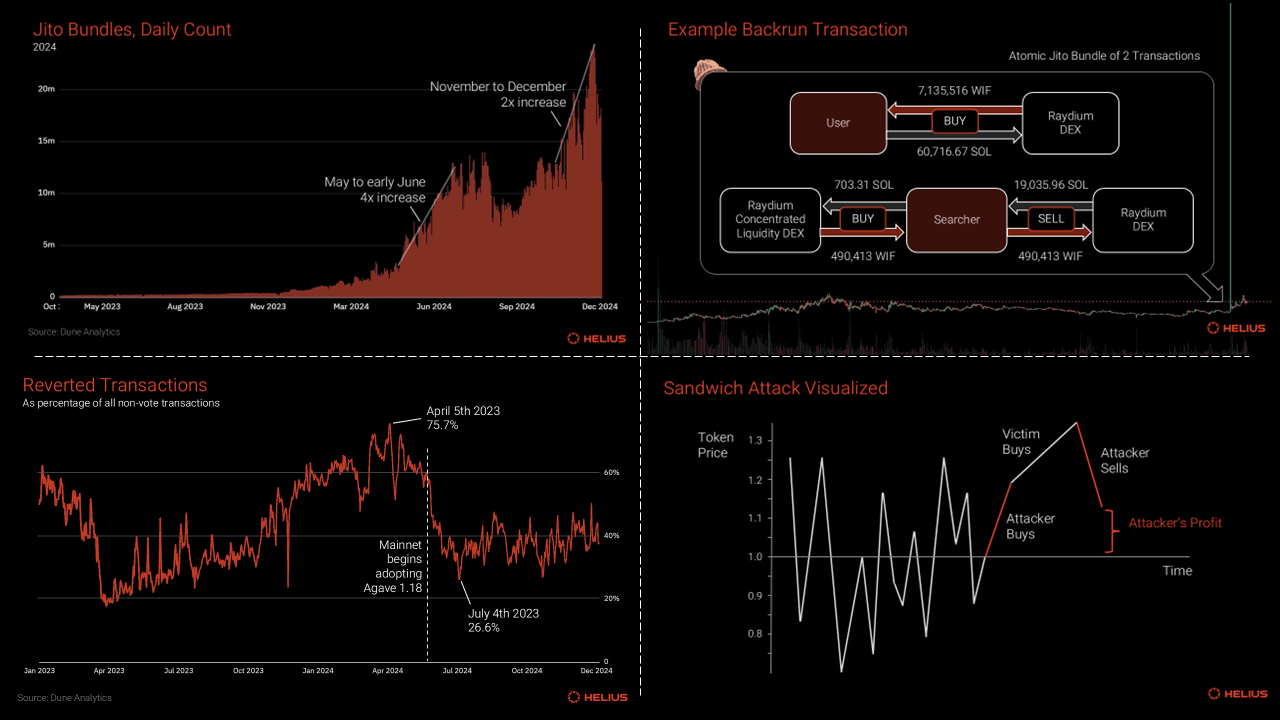

At its core, MEV represents the additional value that can be captured by reordering, inserting, or censoring transactions within a block. While this has long been exploited by sophisticated actors and MEV bots, the democratization of real-time MEV auction data is now empowering a broader range of users and protocols to optimize their strategies.

By integrating MEV-focused APIs and analytics, DeFi platforms can:

Key Benefits of Real-Time MEV Auction Data for DeFi

-

Enhances Transaction Efficiency: Real-time MEV auction data enables DeFi protocols to monitor transaction ordering and implement mechanisms like auction-based sequencing, ensuring faster and more reliable transaction execution.

-

Reduces Transaction Costs: By analyzing real-time MEV dynamics, platforms can design batch auctions and fairer pricing models, minimizing gas wars and lowering user fees.

-

Improves User Experience: Integrating MEV data increases transparency and predictability, allowing users to make informed decisions and fostering trust within DeFi ecosystems.

-

Enables Fair Value Redistribution: Solutions like Chainlink’s Smart Value Recapture (SVR) allow protocols to recapture and redistribute non-toxic MEV profits back to users, aligning incentives across the ecosystem.

-

Supports Innovative Protocol Mechanisms: Projects such as Arbitrum’s Timeboost leverage MEV auction data to introduce express lanes and priority access, mitigating latency races and internalizing MEV revenue for protocol sustainability.

This data-driven approach allows protocols to move beyond reactive measures. Instead, they can proactively design mechanisms that minimize friction, reduce gas wars, and create a more predictable transaction environment for users.

Enhancing Transaction Sequencing and Efficiency

One of the most immediate impacts of real-time MEV auction data is the ability to monitor and adjust transaction sequencing. By analyzing the live orderflow and auction outcomes, protocols can implement auction-based sequencing that prioritizes transactions based on explicit bids rather than pure gas price competition. This shift reduces the likelihood of failed or delayed transactions and ensures that high-priority trades are executed when they matter most.

For example, Arbitrum’s Timeboost mechanism leverages auction data to grant short-term priority access to an express lane, mitigating latency races and internalizing MEV revenue. This not only boosts protocol efficiency but also aligns incentives between users and validators. (arxiv. org)

Reducing Costs Through Batch Auctions and Fair Pricing

MEV-induced competition often leads to costly gas wars, where users overpay to ensure their transactions are mined quickly. Real-time auction data enables the deployment of batch auctions, where multiple transactions are grouped and cleared at a uniform price. This approach not only lowers individual transaction costs but also promotes a more equitable pricing model across the network.

Protocols leveraging this strategy can minimize unnecessary competition for block space, ensuring that users pay only what is necessary to have their transactions included. This reduction in cost is especially meaningful for high-frequency traders and liquidity providers, who are most sensitive to fluctuating gas fees. (blog. switcheo. com)

Case Studies: Real-World Implementations

Several leading DeFi protocols are already harnessing the power of real-time MEV auction data:

DeFi Protocols Leveraging Real-Time MEV Auction Data

-

Arbitrum’s Timeboost: Arbitrum introduced Timeboost, an auction-based transaction sequencing mechanism that grants short-term priority access to an express lane. This system leverages real-time MEV auction data to mitigate latency races and internalize MEV revenue, optimizing transaction flow for users and protocols.

-

Chainlink Smart Value Recapture (SVR): Chainlink has developed the Smart Value Recapture (SVR) oracle solution, which enables DeFi applications to recapture non-toxic MEV from Chainlink Price Feeds. This approach uses real-time MEV auction data to return value to protocols and their users, enhancing fairness and efficiency.

-

Pyth Network Express Relay: The Pyth Network offers Express Relay, a priority auction service designed to combat MEV in DeFi. By utilizing real-time MEV data, Express Relay speeds up protocol launches and provides equitable access to trading opportunities.

-

Cow Protocol (CowSwap): Cow Protocol integrates real-time MEV auction data by analyzing mempool transactions and executing batch auctions. This reduces gas wars and MEV exploitation, leading to lower transaction costs and improved execution for users.

-

Flashbots MEV-Boost: Flashbots provides MEV-Boost, a middleware that connects validators and block builders to real-time MEV auction data. This enables more efficient block construction and helps protocols optimize transaction sequencing while reducing harmful MEV extraction.

These implementations highlight the growing maturity of the DeFi ecosystem, where transparency and efficiency are no longer afterthoughts but foundational design principles.

Access to real-time MEV auction data is not just about cost savings or speed – it’s about fundamentally reshaping the incentives and power dynamics within decentralized finance. As protocols internalize MEV and redistribute its benefits, users experience fewer failed transactions, less slippage, and a more transparent relationship with the underlying infrastructure. The result is an ecosystem where trust is built not on blind faith, but on auditable, data-driven processes.

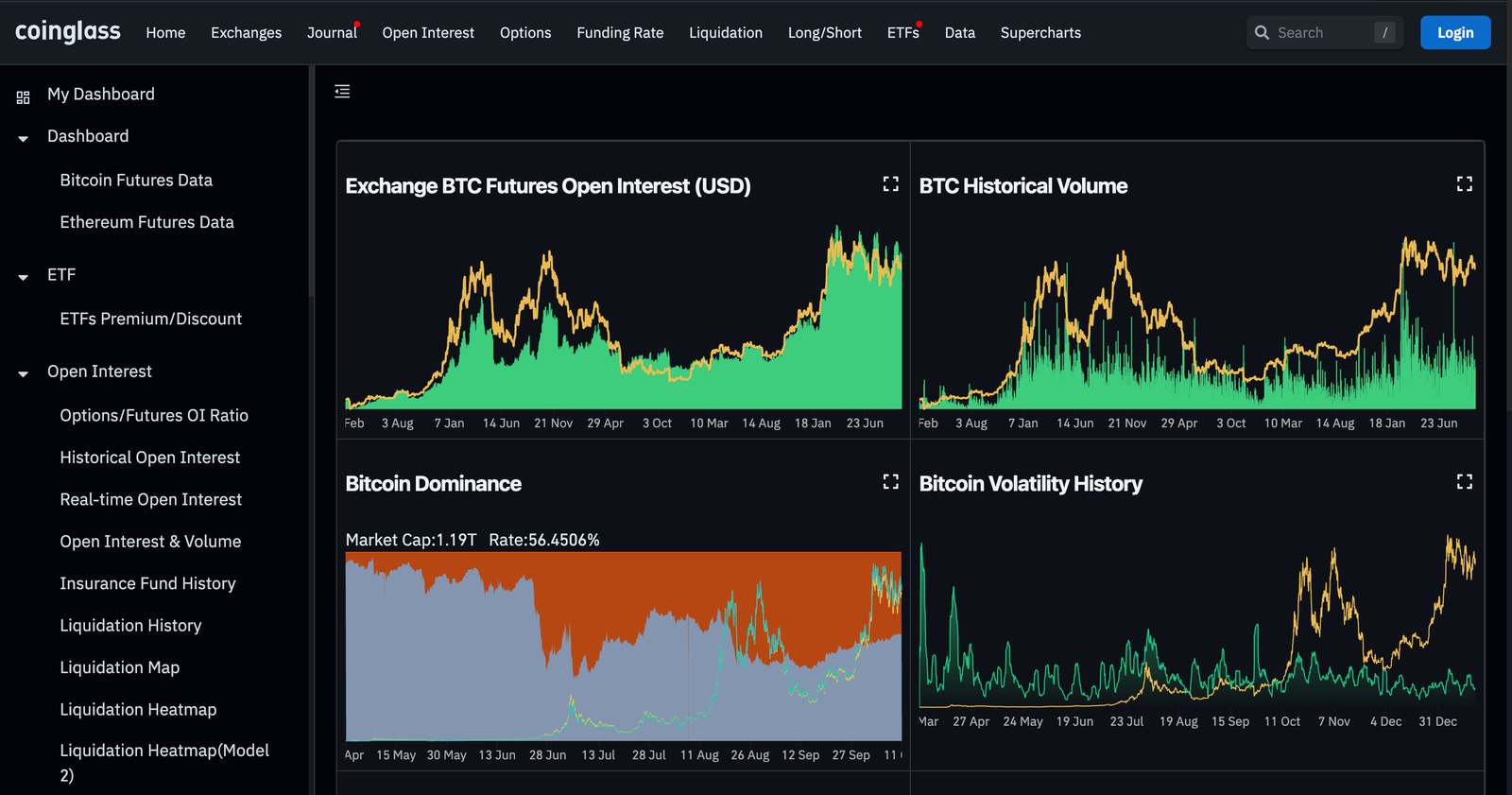

For traders, the advantage is clear. With actionable analytics from platforms like Modular Mev Auctions, market participants can track orderflow in real time, identify arbitrage opportunities, and adjust their strategies on the fly. This granular visibility into transaction sequencing and mempool activity allows for smarter routing and preemptive risk management. Developers, meanwhile, can build applications that dynamically respond to MEV opportunities and threats, rather than relying on static assumptions or historical data.

Building a Transparent and Equitable Blockspace Market

Perhaps the most profound impact of real-time MEV auction data is in fostering a fairer blockspace marketplace. By surfacing live auction data and orderflow analytics, platforms can expose previously hidden value flows, making it possible for protocols to design mechanisms that redistribute MEV gains back to their communities. Chainlink’s Smart Value Recapture (SVR) is a prime example – it enables protocols to capture non-toxic MEV and return value to users, aligning incentives and reducing extractive behaviors (blog. chain. link).

This transparency also helps protocols detect and deter predatory MEV strategies, such as sandwich attacks or front-running. By leveraging predictive models and real-time data feeds, suspicious transaction patterns can be flagged and mitigated before they impact users. The result is a more robust, resilient DeFi environment where the interests of builders, traders, and liquidity providers are more closely aligned.

How Real-Time MEV Auction Data Boosts DeFi Fairness

-

Enables Transparent Transaction Ordering: Real-time MEV auction data reveals how transactions are sequenced, allowing users and protocols to verify that ordering is based on clear, auditable criteria rather than opaque miner decisions.

-

Facilitates Fair Access Through Auction Mechanisms: Protocols like Arbitrum’s Timeboost use real-time MEV auctions to grant priority access in a transparent manner, reducing latency races and ensuring equal opportunity for all participants.

-

Reduces Information Asymmetry: By providing up-to-the-second data on MEV opportunities, real-time feeds help level the playing field between sophisticated MEV bots and regular users, minimizing unfair advantages.

-

Supports Community-Aligned Value Redistribution: Projects such as Chainlink’s Smart Value Recapture (SVR) leverage real-time MEV data to recapture and redistribute MEV profits back to users and protocols, fostering a more equitable ecosystem.

-

Enables Proactive MEV Risk Detection: Integrating MEV-focused APIs lets protocols and users detect suspicious or harmful transaction patterns in real time, increasing the system’s resilience against exploitative behaviors.

Looking Ahead: Modular Mev Auctions and the Future of DeFi Optimization

The evolution of MEV strategies is far from over. As blockchains scale and new protocols emerge, the demand for sophisticated, real-time analytics will only intensify. Platforms like Modular Mev Auctions are at the forefront of this transformation, offering advanced tools that empower users to optimize every aspect of their DeFi experience. From actionable dashboards to developer-focused APIs, these solutions are driving a new standard for efficiency and transparency in decentralized markets.

Ultimately, the integration of real-time MEV auction data into DeFi protocols is not just a technical upgrade – it’s a paradigm shift. By equipping both individuals and institutions with the insights they need to navigate the complex world of on-chain trading, the industry is paving the way for a more open, efficient, and equitable financial system.