In the ever-evolving world of decentralized finance, the concept of orderflow in crypto trading is being reimagined by modular MEV auctions. For years, traders and protocols have grappled with the challenges of Maximal Extractable Value (MEV) – the hidden profits that miners or validators could extract by reordering, including, or excluding transactions within a block. Traditionally, this dynamic placed everyday users at a disadvantage, as they often bore the cost of MEV extraction through higher fees or suboptimal execution. Today, innovative solutions like modular MEV auctions are flipping this paradigm on its head by introducing transparency, efficiency, and fairer value distribution.

Redefining Orderflow: From Centralized Control to Open Competition

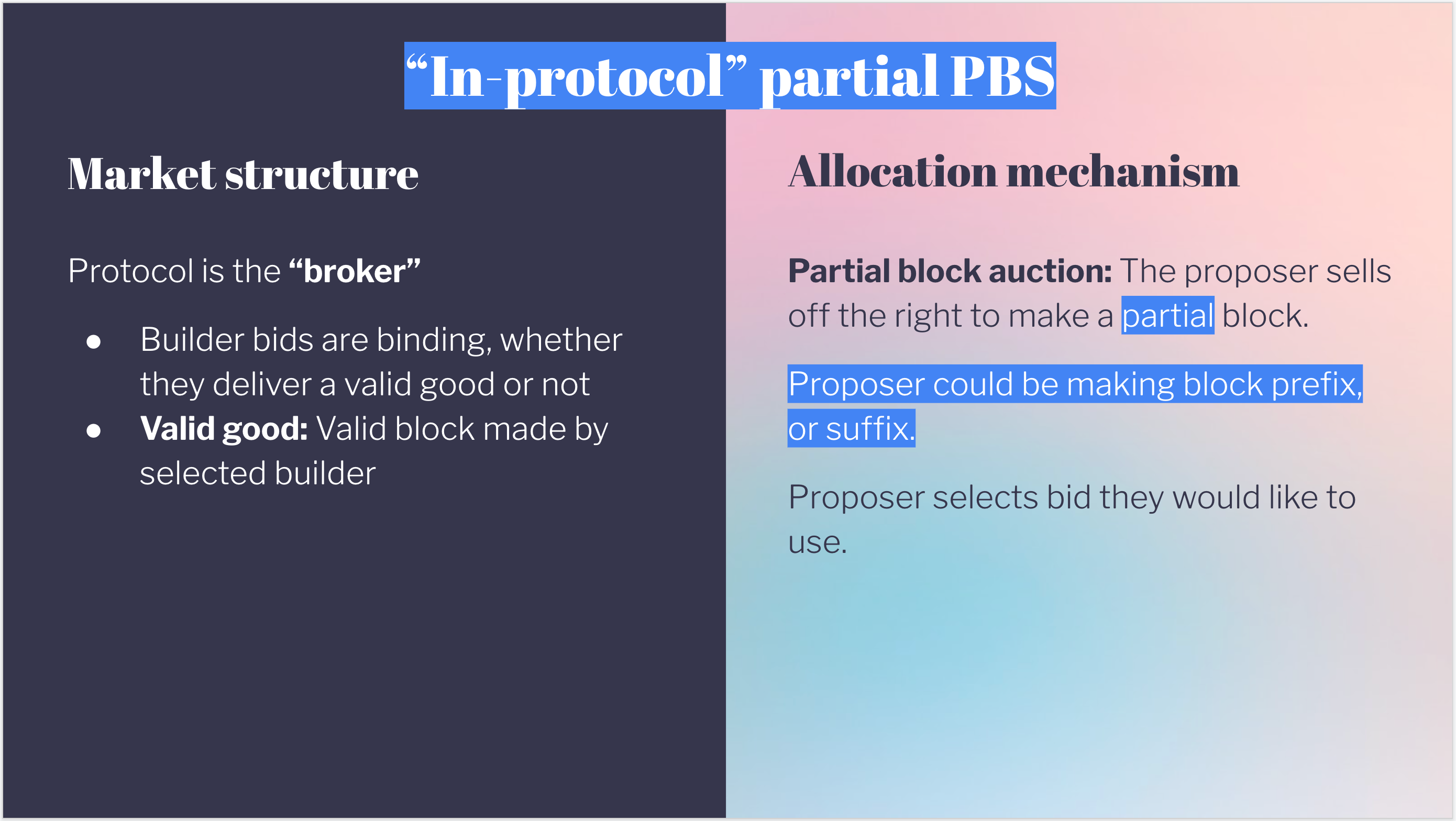

The old model was simple but problematic: block proposers had near-total control over transaction selection and sequencing. This allowed them to directly capture MEV – sometimes at the expense of both retail traders and DeFi protocols. The introduction of Proposer-Builder Separation (PBS) marked a pivotal shift. By decoupling block proposal from block construction, PBS opened the door for specialized builders to compete in constructing blocks packed with valuable transactions.

This competition is supercharged by MEV auctions, where builders bid for the right to include specific orderflows into blocks. Instead of a single actor extracting all value, MEV profits are now redistributed through open market mechanisms. The result is a more decentralized and competitive ecosystem – one where power is less concentrated and outcomes are more predictable for users.

The Rise of Order Flow Auctions (OFAs) and User Empowerment

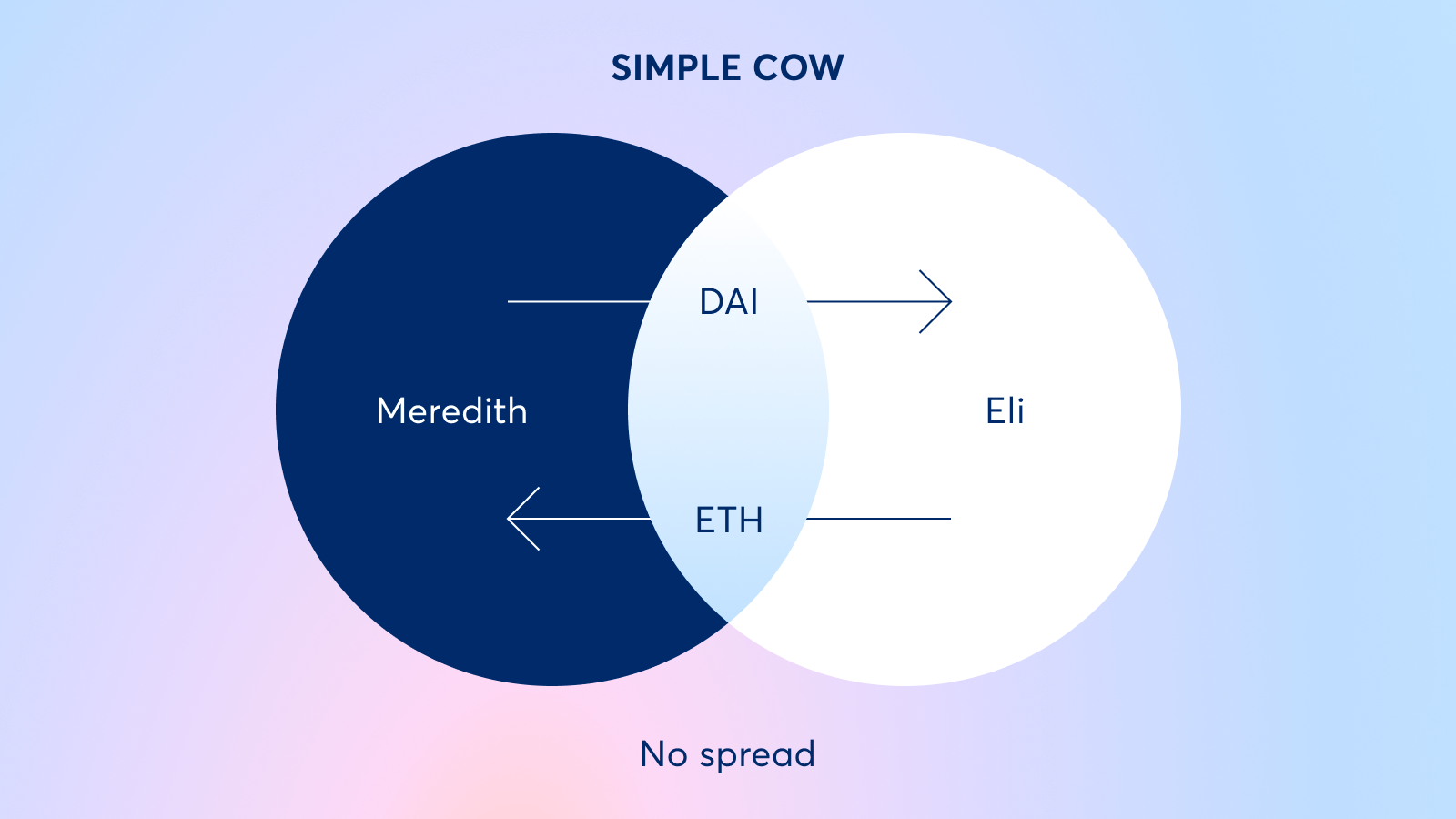

Order Flow Auctions (OFAs) represent another leap forward in aligning incentives across the crypto stack. In an OFA model, users can auction off their own transaction orderflow directly to builders or solvers. This means that instead of being passive participants – whose trades might be sandwiched or front-run – users now have agency over how their transactions are included in blocks.

The impact? A portion of previously extracted MEV gets redirected back to users themselves. According to recent analysis from CoW DAO and other industry leaders, this approach not only enhances price discovery but also reduces transaction costs and increases available liquidity across DeFi markets (source). As OFAs become more prevalent on Ethereum and beyond, they’re setting new standards for fairness and transparency in crypto trading.

Top Benefits of Modular MEV Auctions for DeFi Traders

-

Fairer Value Distribution: Modular MEV auctions, such as those enabled by Flashbots and CoW Protocol, allow users to capture a portion of the MEV that would otherwise be extracted by block proposers or builders. This means DeFi traders receive more equitable rewards from their transactions, aligning incentives across the ecosystem.

-

Reduced Centralization Risks: By decoupling block building from block proposing through mechanisms like Proposer-Builder Separation (PBS), modular MEV auctions foster competition among specialized builders. This decentralizes power, minimizes the risk of exclusive order flow, and protects the network from monopolistic control.

-

Enhanced Transparency & Lower Costs: Platforms such as Arrakis Finance and CoW Protocol leverage Order Flow Auctions to provide clear pricing and reduce transaction costs for users. Batch auctions and transparent bidding processes improve price discovery and can significantly lower slippage and fees for DeFi traders.

Modular Architecture: Flexibility Meets Security

The future of crypto transaction optimization lies in modularity. Projects like Flashbots’ SUAVE are pioneering an architecture where components like mempools, auction mechanisms, and privacy layers can be independently upgraded or replaced (see details here). This enables rapid innovation while minimizing central points of failure.

SUAVE’s Ethereum-native encrypted mempool illustrates this trend perfectly: it protects orderflow privacy while still allowing value expression through open auctions. Such advances help prevent any single builder or aggregator from monopolizing MEV opportunities – keeping markets open and competitive for all participants.

What’s Next for Orderflow Crypto Trading?

The momentum behind modular MEV auctions is unmistakable. As builders embrace these new tools and protocols integrate OFA models into their workflows, we’re witnessing a fundamental transformation in how value flows through decentralized markets. With more transparency comes greater trust – not just between traders but across the entire DeFi ecosystem.

Looking ahead, the continued evolution of blockspace market solutions promises to unlock even more sophisticated MEV strategies in DeFi. As modular MEV auctions mature, we can expect a wave of new protocols and products designed to give both retail and institutional participants finer control over their orderflow. This will likely include customizable auction parameters, advanced privacy settings, and seamless integration with cross-chain liquidity sources.

Perhaps most importantly, these innovations are forcing a rethink of what it means to compete in crypto markets. Rather than relying on opaque relationships or privileged access to mempools, traders can now leverage open auction mechanisms that reward transparency and efficiency. The days when block builders wielded unchecked power over transaction sequencing are fading fast – replaced by a landscape where competition drives better outcomes for everyone.

Navigating New Risks and Opportunities

Of course, no system is without tradeoffs. As orderflow becomes a tradable asset in its own right, both users and protocols must remain vigilant against new forms of centralization or collusion. The rise of private orderflow channels and cross-chain MEV opportunities introduces fresh vectors for risk – but also for creative arbitrage and yield generation.

The key takeaway? Staying informed is critical. Traders who understand how modular MEV auctions work will be best positioned to capture emerging opportunities while avoiding pitfalls. Protocol designers should prioritize interoperability and modularity to future-proof their platforms against rapid market shifts.

Why Transparency Matters More Than Ever

Transparency isn’t just a buzzword – it’s the foundation for sustainable growth in decentralized finance. By surfacing real-time auction data and analytics, platforms like Modular Mev Auctions empower users to make data-driven decisions about their trades. This visibility helps level the playing field between sophisticated trading firms and everyday DeFi users.

The open-source ethos driving these changes also encourages collaboration across the industry. Shared research on MEV extraction techniques, auction design, and privacy-preserving infrastructure accelerates progress for everyone involved.

Getting Started with Modular MEV Auctions

If you’re ready to take advantage of this new paradigm in orderflow crypto trading, start by exploring platforms that offer robust analytics, customizable OFA participation options, and strong privacy guarantees. Look for solutions that prioritize user empowerment through transparent pricing models and clear value distribution mechanisms.

Whether you’re an active trader seeking tighter execution or a protocol developer aiming to minimize user costs, the tools are now at your fingertips. The era of modular MEV auctions is here – bringing more opportunity, less risk, and a fairer deal to all corners of decentralized finance.