Real-time MEV auction data is rapidly transforming the landscape of decentralized finance (DeFi) trading. As Ethereum trades at $4,534.12, with a 24-hour increase of and $94.60, traders and protocol designers are seeking new ways to optimize transaction execution and minimize risks associated with Maximal Extractable Value (MEV). Understanding how to leverage real-time MEV analytics tools is now a prerequisite for anyone serious about DeFi trading efficiency.

Demystifying MEV: From Paradox to Opportunity

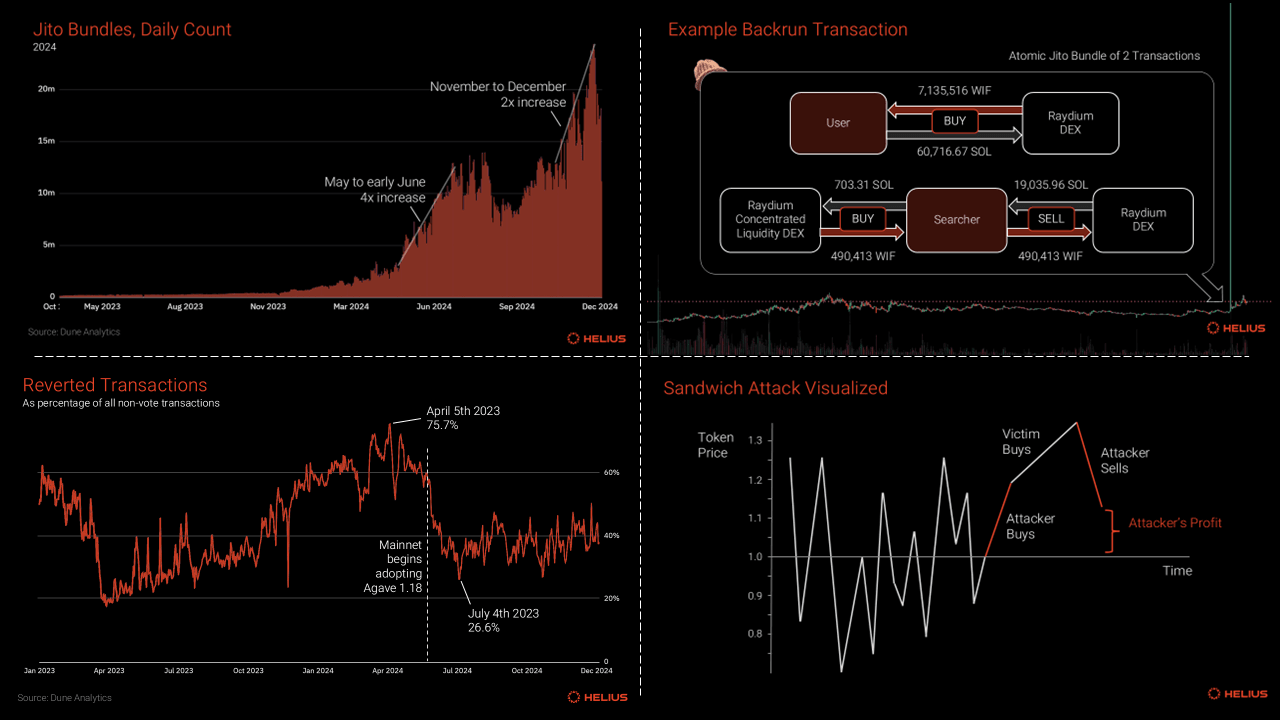

At its core, MEV represents the maximum value that can be extracted from reordering, inserting, or censoring transactions within a block. This concept, once the exclusive domain of validators and sophisticated MEV bots, is now accessible to all market participants thanks to platforms like Modular Mev Auctions. The paradox of MEV lies in its dual nature: while it can enhance market efficiency through arbitrage and liquidity provision, it also exposes traders to higher fees and predatory tactics such as sandwich attacks.

Recent research highlights that real-time access to MEV auction data enables traders to identify price discrepancies across decentralized exchanges instantly. By capitalizing on these opportunities, they help align asset prices across platforms, improving overall market efficiency and accelerating price discovery. For example, when ETH’s price diverges between two DEXs, automated strategies can exploit the gap within seconds, ensuring consistent valuation across the ecosystem.

MEV Analytics Tools: Precision Execution in Volatile Markets

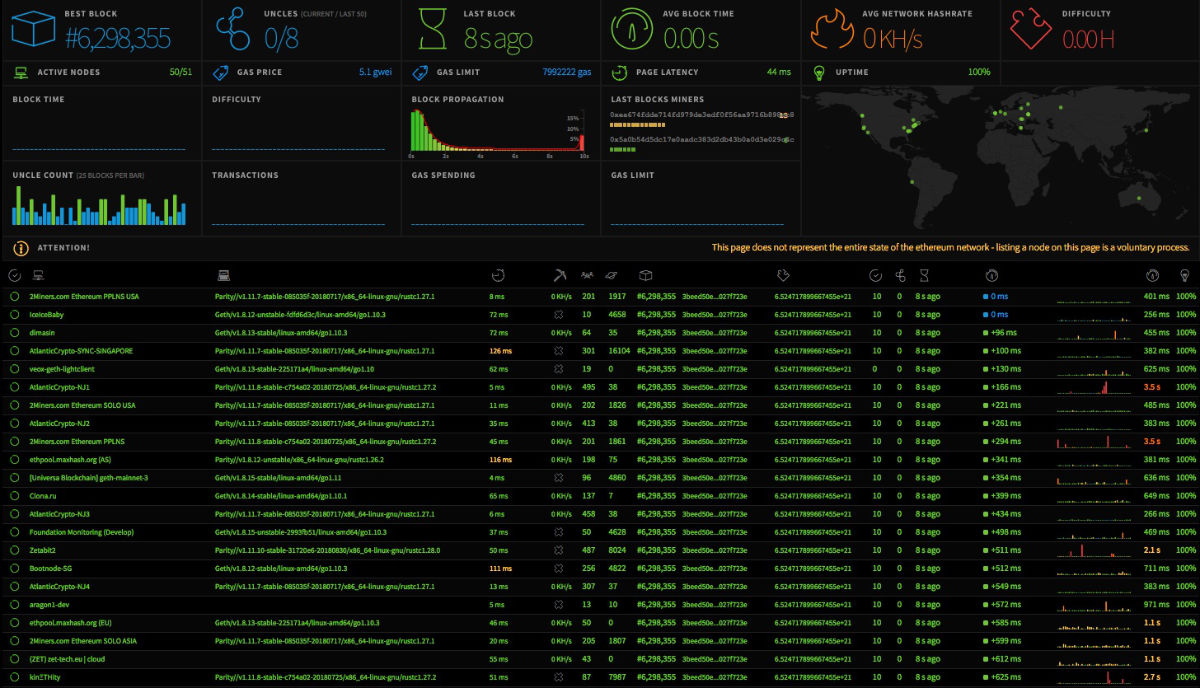

The surge in advanced MEV analytics tools has fundamentally changed how traders approach execution risk. On-chain data feeds now deliver granular insight into live auction dynamics, revealing the latest bids for blockspace, current frontrunning risks, and evolving transaction order flows. This transparency allows for dynamic strategy adjustment: traders can avoid peak periods of adverse MEV activity or tailor their orders to minimize slippage and failed transactions.

The impact is tangible. With real-time visibility into MEV auctions:

- Arbitrageurs can synchronize trades across venues with millisecond precision.

- Lending protocol users can anticipate liquidation cascades triggered by sudden price moves at $4,534.12 ETH levels.

- Market makers adjust spreads based on imminent blockspace congestion signals.

This level of operational awareness was previously unattainable, and it fundamentally reduces inefficiencies that have long plagued DeFi markets.

Ethereum (ETH) Price Prediction 2026-2031: Impact of Real-Time MEV Auction Data

Short-term and mid-term ETH price outlook based on enhanced DeFi trading efficiency and MEV trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $4,000 | $5,100 | $6,200 | +12.5% | Market stabilizes as MEV data drives more efficient price discovery; regulatory clarity improves sentiment. |

| 2027 | $4,300 | $5,700 | $7,400 | +11.8% | DeFi adoption accelerates; integration of MEV protection in protocols reduces volatility, but competition from L2s and alt-L1s increases. |

| 2028 | $4,800 | $6,300 | $8,200 | +10.5% | Ethereum upgrades (e.g., Danksharding) boost scalability; MEV auctions become standard, supporting higher on-chain volumes. |

| 2029 | $5,300 | $7,100 | $9,100 | +12.7% | Global institutions increase ETH allocation; regulatory frameworks in US/EU drive broader adoption despite rising competition. |

| 2030 | $5,900 | $8,200 | $10,600 | +15.5% | Cross-chain interoperability and advanced MEV mitigation attract new capital; ETH solidifies position as DeFi backbone. |

| 2031 | $6,700 | $9,300 | $12,200 | +13.4% | Sustained DeFi growth and mainstream financial integration; potential for ETH ETF approval and further institutional inflows. |

Price Prediction Summary

Ethereum is poised for steady price appreciation from 2026 through 2031, with average annual growth driven by real-time MEV auction data improving DeFi efficiency, adoption of new protocol upgrades, and increasing institutional interest. Minimum price predictions reflect possible bearish scenarios during market corrections or regulatory headwinds, while maximum prices account for bullish cycles and technological breakthroughs. The integration of MEV insights into trading and protocol design is expected to reduce volatility and enable more efficient price discovery, supporting ETH’s growth as the core DeFi asset.

Key Factors Affecting Ethereum Price

- Adoption of real-time MEV auction data enhancing DeFi market efficiency.

- Ethereum protocol upgrades improving scalability and security (e.g., Danksharding, EIP-4844).

- Global regulatory developments and potential for ETH ETF approvals.

- Competition from alternative L1s and Layer 2 scaling solutions.

- Institutional adoption and integration with traditional finance.

- MEV mitigation measures reducing risks associated with value extraction.

- Broader DeFi and NFT ecosystem growth on Ethereum.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Role of Modular Mev Auctions in Modern Blockspace Markets

Recent studies underscore that integrating modular blockspace market solutions is key for both traders and developers aiming to stay competitive. Platforms like Modular Mev Auctions aggregate orderflow from diverse sources and provide transparent access to ongoing auction metrics, empowering users with actionable intelligence instead of opaque mempool guesswork.

This paradigm shift not only benefits sophisticated quant traders but also democratizes access for retail users seeking improved execution quality in volatile environments like today’s $4,534.12 ETH market. As a result, we’re seeing:

- Tighter bid-ask spreads

- Smoother cross-platform arbitrage cycles

- A measurable drop in failed transaction rates during periods of high volatility

The ability to monitor live orderflow auctions directly translates into better-informed trading decisions, whether you’re optimizing gas usage or designing resilient DeFi protocols that minimize user exposure to harmful extraction techniques.

As the ecosystem evolves, the sophistication of blockspace market solutions continues to rise. Modular Mev Auctions, for example, offers a real-time lens into the current state of blockspace demand and supply. This empowers participants to not only react but also anticipate shifts in MEV dynamics as Ethereum maintains its position at $4,534.12. The transparency and granularity of this data are game-changers for both institutional and individual traders.

Strategic Advantages: From Risk Mitigation to Alpha Generation

Accessing real-time MEV auction data is no longer just about avoiding pitfalls. It’s about actively generating alpha in an environment where every millisecond counts. Here’s how:

Key Benefits of Real-Time MEV Auction Data in DeFi

-

Enhanced Arbitrage and Price Discovery: Real-time MEV auction data enables traders to identify and exploit arbitrage opportunities instantly, leading to more efficient price discovery and reduced price discrepancies across decentralized exchanges.

-

Mitigation of MEV-Related Risks: By monitoring live MEV activity, traders can adjust their strategies to avoid periods of high MEV extraction, reducing exposure to sandwich attacks and excessive slippage.

-

Optimized Trade Execution: Access to up-to-the-moment MEV data allows for better timing and ordering of transactions, minimizing failed trades and unnecessary transaction fees, especially on major blockchains like Ethereum (ETH: $4,534.12).

-

Data-Driven Protocol Design: Protocol designers can use real-time MEV insights to implement protective features such as slippage controls and time-weighted average pricing, enhancing user safety and protocol robustness.

-

Increased Transparency and Market Fairness: Public access to MEV auction data promotes transparency, allowing both traders and developers to make informed decisions and fostering a more equitable DeFi ecosystem.

For example, a trader monitoring MEV auctions can identify when gas prices are artificially inflated due to sandwich attack attempts or liquidation races. With this knowledge, they can either delay execution or reroute transactions through less congested paths, directly improving trade outcomes and reducing costs.

Moreover, protocol designers armed with live auction intelligence can implement adaptive features that dynamically adjust slippage tolerances or transaction batching logic based on current MEV risk levels. This level of responsiveness was previously impossible without up-to-the-second auction insights.

Data-Driven Decision Making: The New Standard in DeFi

The integration of real-time MEV analytics tools into trading workflows marks a shift toward data-driven decision making as the default mode in DeFi markets. Gone are the days when intuition or delayed mempool snapshots dictated strategy. Today, every participant, from arbitrageur to liquidity provider, can leverage live auction feeds to:

- Predict block congestion before it occurs

- Avoid adverse selection by tracking evolving orderflow trends

- Dynamically rebalance portfolios in response to emerging MEV patterns

This approach not only boosts efficiency but also levels the playing field by democratizing access to high-quality market intelligence.

Looking Ahead: MEV Data as Core Market Infrastructure

The trajectory is clear: real-time MEV auction data is rapidly becoming core infrastructure for modern DeFi markets. As platforms like Modular Mev Auctions continue to innovate, we can expect even greater precision in execution, tighter spreads, and more resilient protocols, especially during periods when Ethereum remains volatile around the $4,534.12 mark.

The future belongs to those who can interpret and act upon live market signals faster than their competitors. Whether you’re building next-generation trading bots or designing robust DeFi primitives, integrating modular blockspace analytics will be essential for sustained success.