Decentralized finance (DeFi) trading is evolving at breakneck speed, driven by the relentless pursuit of alpha and the ever-present challenge of adversarial on-chain environments. In this landscape, real-time MEV auction analytics have emerged as a game-changer. By providing granular visibility into blockspace markets and transaction flows, these analytics empower traders to refine execution, mitigate risks, and capitalize on fleeting opportunities that were previously invisible.

The Mechanics of MEV: Why Analytics Matter

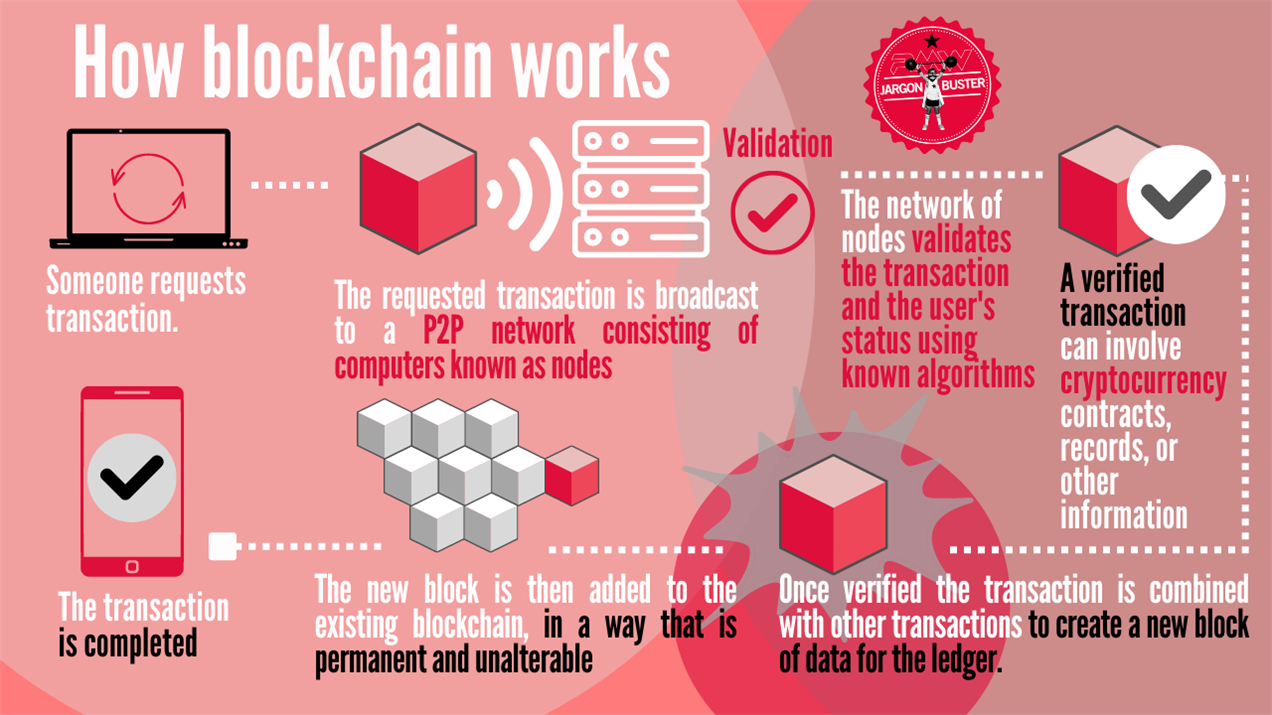

Maximal Extractable Value (MEV) represents the profit that can be captured by reordering, inserting, or censoring transactions within a block. This phenomenon is not just academic – it directly impacts slippage, gas fees, and the ultimate profitability of DeFi strategies. Techniques like front-running, back-running, and sandwich attacks have become common tools for sophisticated actors seeking edge on Ethereum and other EVM chains. Understanding how these strategies play out in real time is essential for anyone serious about DeFi trading optimization.

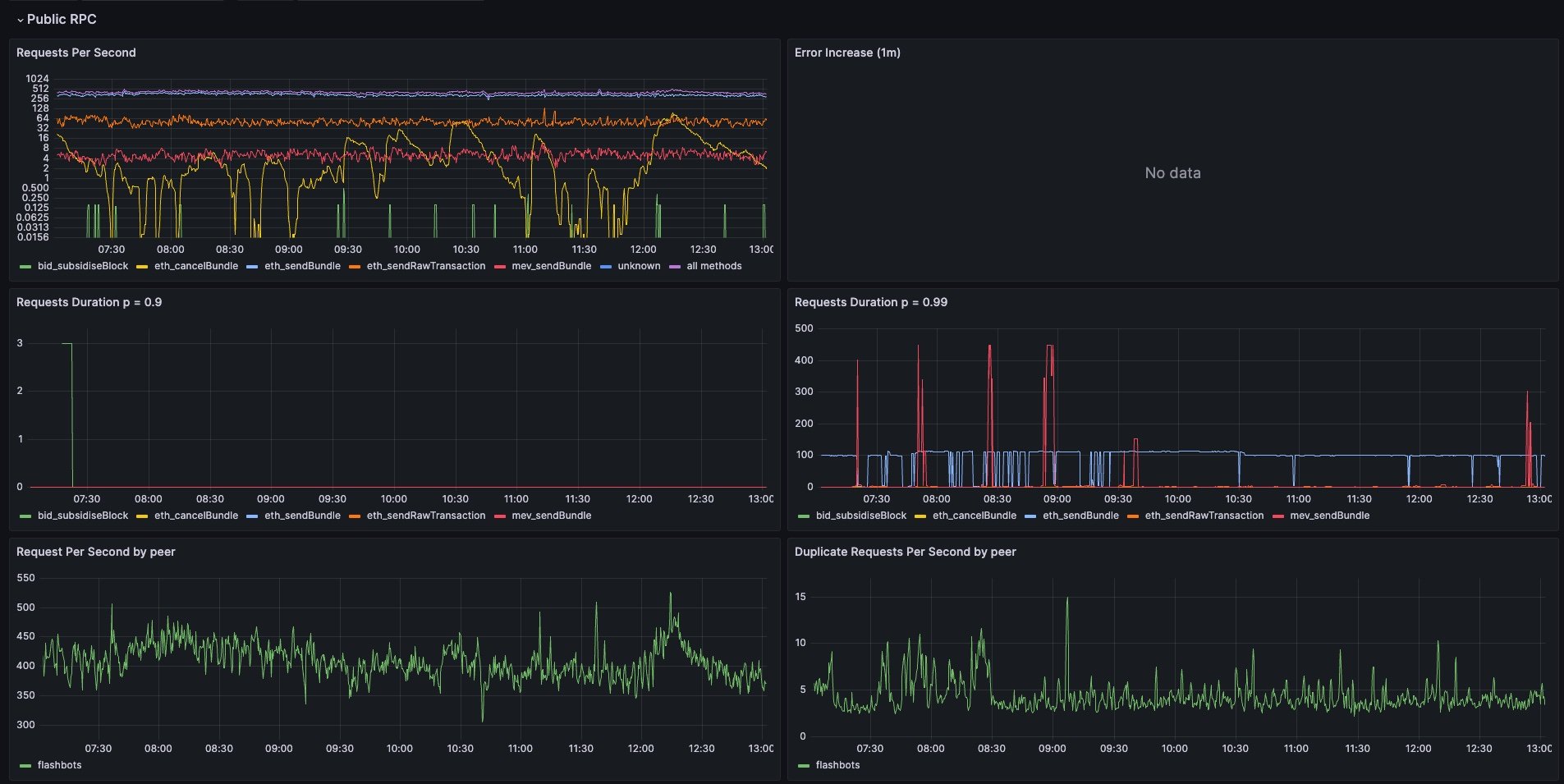

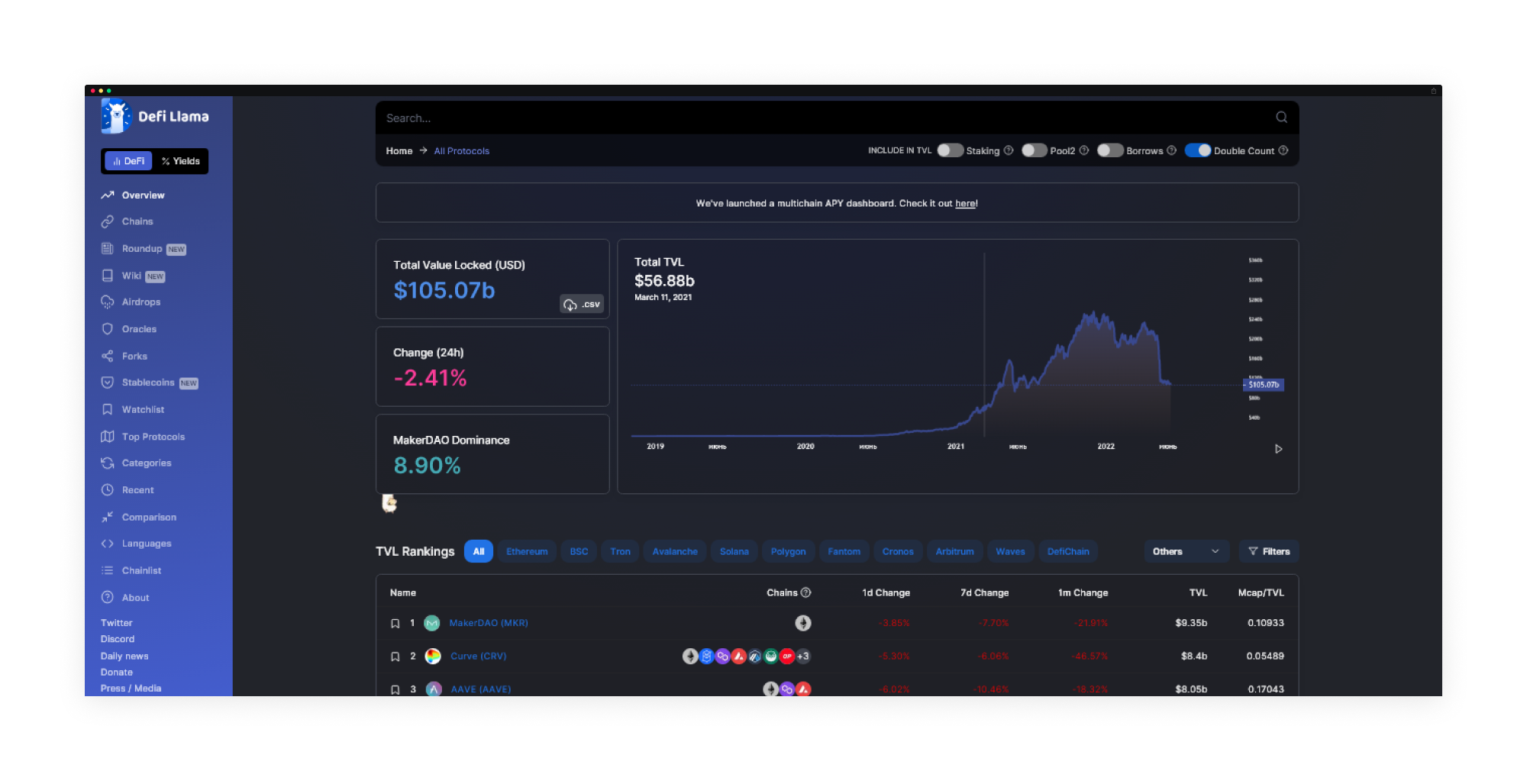

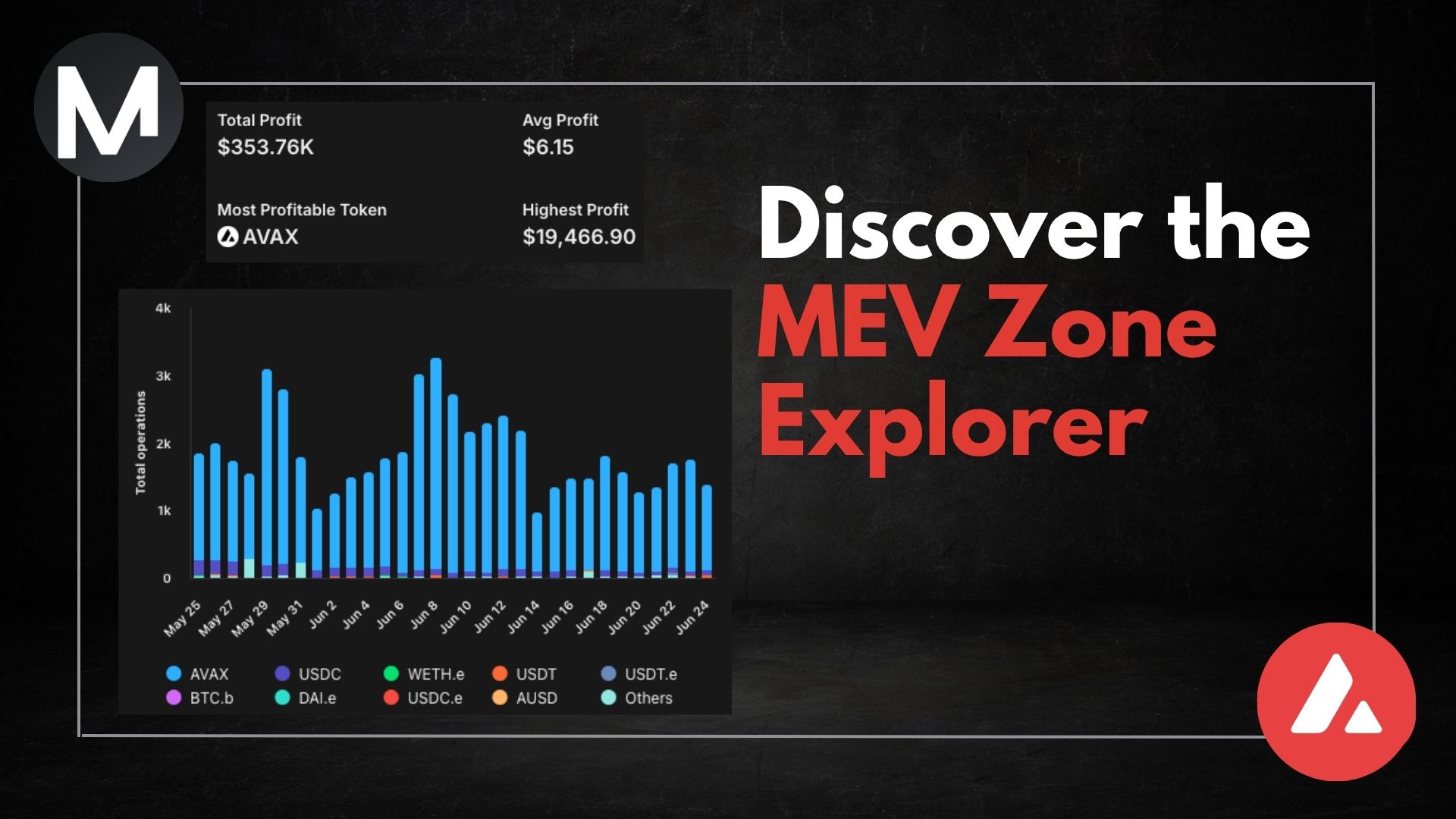

Traditional trading relied on historical data or post-mortem analysis. In contrast, modern MEV analytics platforms such as Modular Mev Auctions provide actionable insights as events unfold. This means traders can see pending arbitrage opportunities across DEXs, monitor mempool congestion, and even predict when their trades are most likely to be targeted by bots or validators.

Actionable Insights: Real-Time Data in Practice

The value proposition of real-time MEV auction analytics comes down to three core benefits:

Key Benefits of Real-Time MEV Analytics for DeFi Traders

-

Instant Arbitrage Detection: Real-time MEV analytics empower traders to spot and act on price discrepancies across multiple DEXs, enabling swift execution of profitable arbitrage opportunities.

-

Proactive MEV Risk Mitigation: By monitoring live mempool data, traders can identify potential front-running and sandwich attacks, allowing them to adjust gas fees and slippage settings to reduce losses.

-

Optimized Transaction Timing: Analytics platforms provide insights into optimal trade execution windows, helping traders avoid periods of high MEV activity and minimize transaction costs.

-

Enhanced Transparency with Transaction Path Dashboards: Visualization tools like transaction path dashboards reveal how trades move through the network, making it easier to detect suspicious patterns and MEV-related risks.

-

Smart Contract Vulnerability Analysis: Advanced analytics can identify exploitable contract logic, enabling traders and developers to implement safeguards against MEV exploits before they occur.

- Arbitrage Detection: By monitoring price discrepancies between DEXs in real time, traders can deploy capital with confidence before spreads close.

- Risk Mitigation: Identifying potential front-running or sandwich attacks allows users to adjust slippage tolerances or gas parameters proactively (source).

- Mempool Intelligence: Analyzing transaction queues helps optimize timing and sequencing of trades to avoid adverse selection (source).

The Toolset: Bots, Dashboards and Smart Contract Analysis

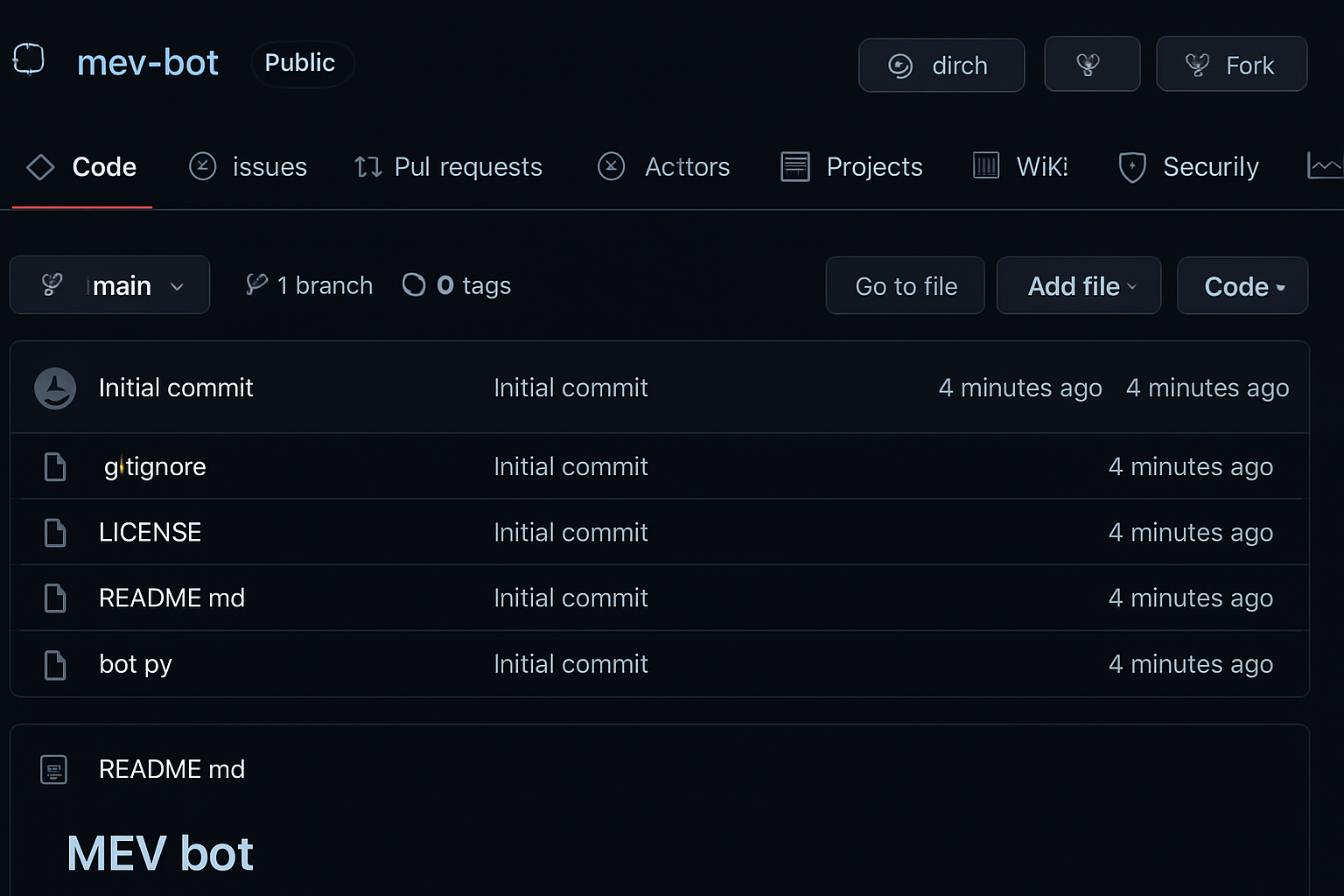

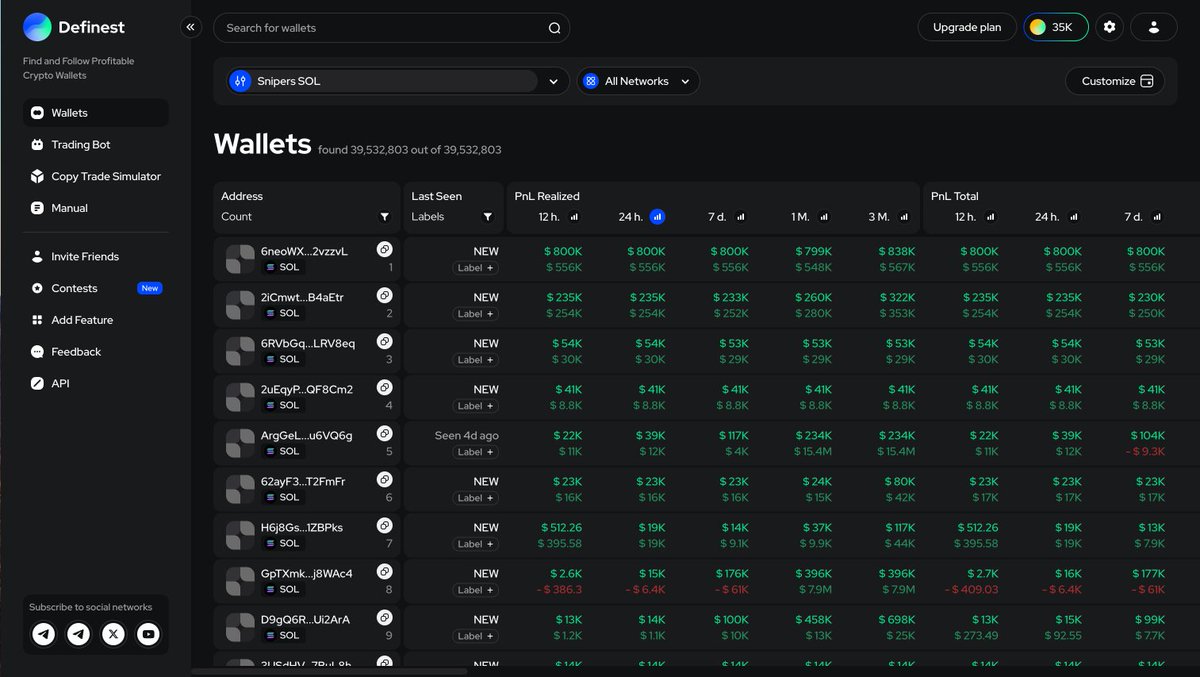

The arms race in DeFi has spawned an ecosystem of tools designed for both offense and defense in the MEV arena. Automated bots now scan mempool data at sub-second intervals to execute arbitrage or liquidation sniping strategies (source). Meanwhile, visual dashboards map transaction paths across protocols so traders can spot patterns indicative of predatory activity or systemic inefficiencies.

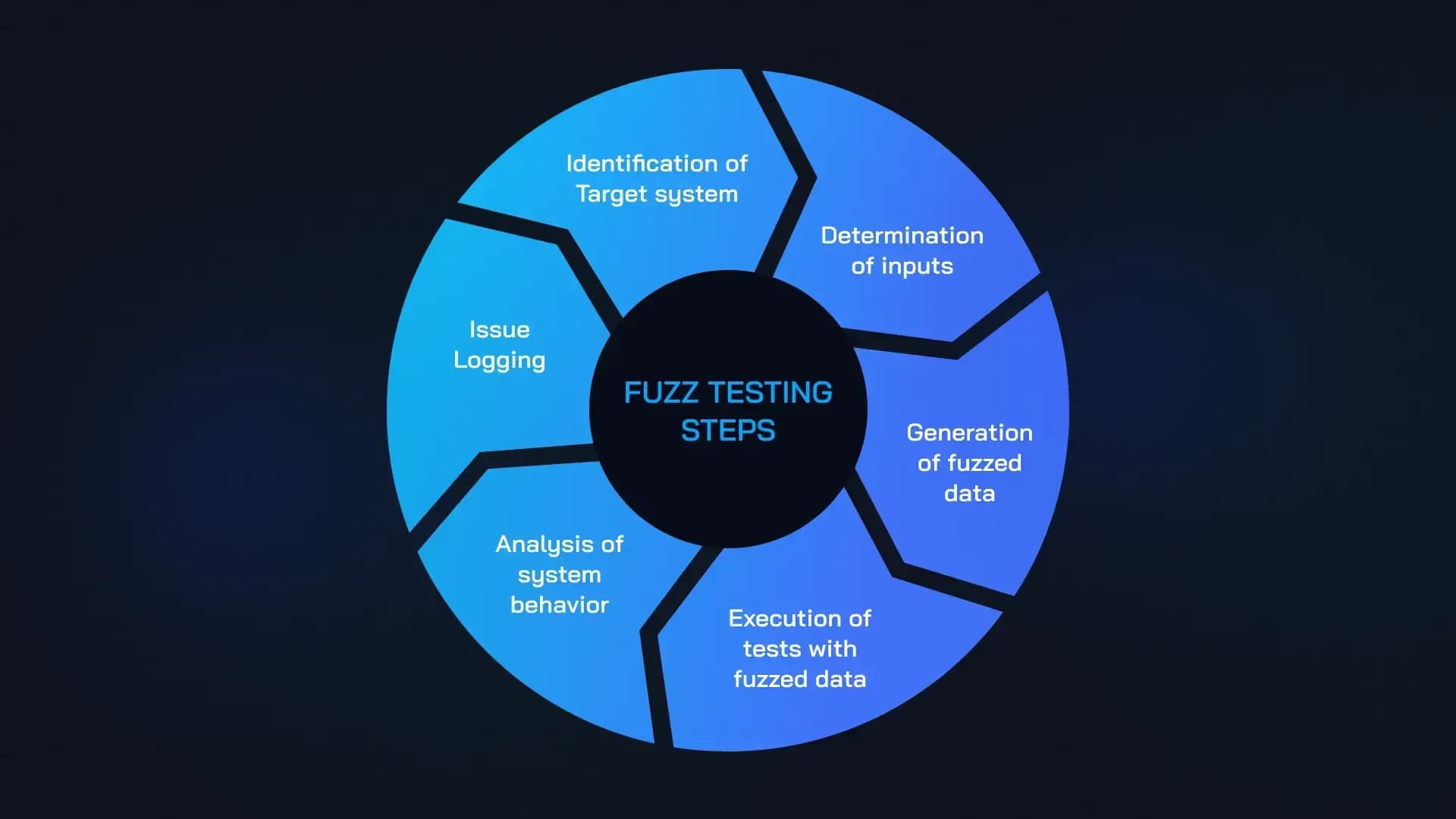

Smart contract analysis software further enhances security by flagging vulnerabilities that could be exploited for MEV extraction (source). Together, these tools form a holistic stack for both maximizing returns and safeguarding assets in an adversarial market structure.

As the sophistication of MEV strategies evolves, so too must the analytics and defensive frameworks employed by traders and protocols. The integration of real-time MEV auction analytics into trading workflows is not just about chasing profit – it’s about survival in an environment where latency, information asymmetry, and adversarial actors are ever-present forces.

Modular Mev Auctions: A Paradigm Shift in Blockspace Market Solutions

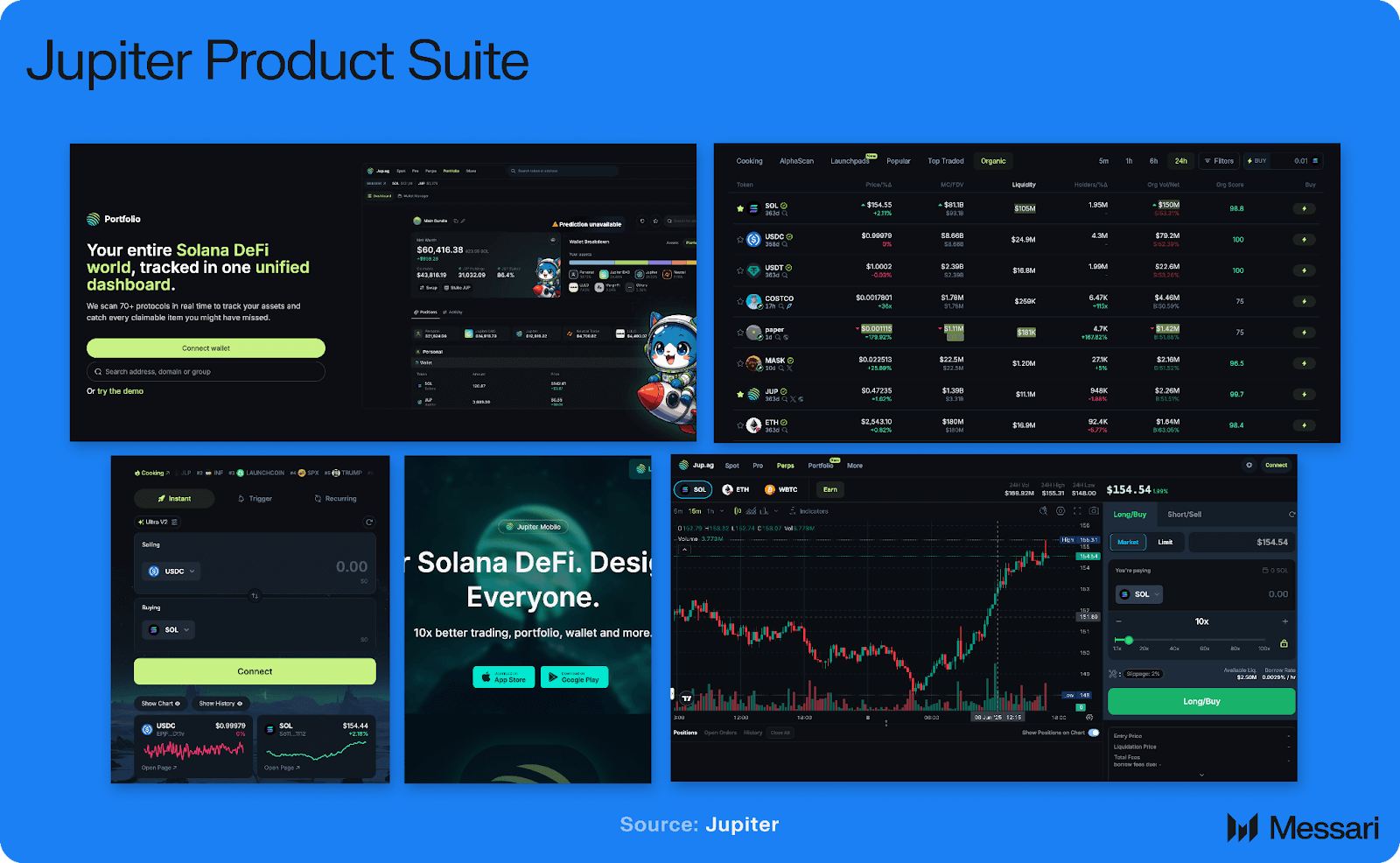

The rise of platforms like Modular Mev Auctions marks a turning point for DeFi participants. By aggregating orderflow and exposing granular auction data, these solutions deliver a transparent marketplace for blockspace. Traders gain access to real-time signals on pending MEV events, while protocols can benchmark their own vulnerability to extraction and adjust accordingly.

This transparency is critical for both individual actors and institutional players seeking sustainable edge. Rather than operating in the dark, users can now calibrate their strategies based on live market dynamics, whether that means dynamically adjusting gas fees during periods of heightened arbitrage activity or rerouting transactions to minimize exposure to sandwich attacks.

Practical Implementation: How Advanced Analytics Drive Results

Effective use of real-time analytics starts with actionable intelligence. For example, a high-frequency trader might leverage Modular Mev Auctions’ dashboard to spot a fleeting price discrepancy between two DEXs. With automated bots primed for execution, capital is deployed within milliseconds, often capturing edge before it’s visible on slower platforms.

Alternatively, protocol engineers may use smart contract analysis tools to simulate hypothetical attack vectors based on current mempool activity. This proactive approach enables rapid patching of vulnerabilities before they’re exploited in the wild.

Steps to Integrate Real-Time MEV Auction Analytics

-

2. Integrate MEV-Focused APIs: Utilize APIs like Flashbots Protect or bloXroute API to stream live transaction and MEV opportunity data directly into your trading infrastructure.

-

3. Deploy Automated MEV Bots: Implement or customize open-source MEV bots (e.g., Flashbots MEV-Bot) to monitor the mempool, identify arbitrage, and execute trades based on real-time analytics.

-

4. Analyze Transaction Pathways with Dashboards: Use platforms like WalletFinder.ai to visualize transaction flows, detect patterns, and assess potential MEV risks before executing trades.

-

5. Optimize Trade Execution Parameters: Adjust gas fees, slippage tolerances, and transaction timing based on live MEV analytics to minimize exposure to front-running or sandwich attacks.

-

6. Continuously Monitor and Update Strategies: Regularly review MEV analytics data and adapt trading algorithms to evolving MEV tactics and market conditions for sustained performance.

Ultimately, the synergy between advanced analytics and automation is what sets top performers apart. Manual monitoring simply cannot keep pace with modern blockspace markets; those leveraging quant-driven insights will consistently outmaneuver less agile competitors.

Continuous Innovation: Staying Ahead in MEV Markets

The only constant in DeFi is change. As new attack vectors emerge and consensus mechanisms evolve, so must the toolkits used by traders and developers alike. The future will be defined by modularity, solutions that can adapt rapidly to shifting market structures and regulatory landscapes.

For those serious about DeFi trading optimization, embracing real-time MEV auction analytics is no longer optional. It’s foundational to both risk management and alpha generation in a world where every millisecond counts.

If you’re ready to capture next-generation alpha or protect your protocol from predatory extraction, start by exploring live auction data and analytics offered by leading platforms like Modular Mev Auctions. The edge belongs to those who see, and act, first.