In the current landscape of decentralized finance, latency games and blockspace spam have emerged as critical bottlenecks for blockchain scalability and user experience. The proliferation of MEV (Maximal Extractable Value) bots, racing to exploit transaction ordering for profit, has led to unprecedented congestion. Recent research shows that MEV bots now consume as much as 60% of available blockspace on major networks, directly inflating transaction fees and degrading performance for everyday users (gate.com). This arms race is not merely a technical nuisance but a fundamental challenge to the sustainability of open financial infrastructure.

How Latency Games Distort Blockchain Markets

The root cause lies in the structure of traditional blockchains: transactions are often processed on a first-come, first-served basis. This incentivizes specialized actors to engage in latency games, deploying sophisticated infrastructure to submit transactions milliseconds ahead of competitors. The result is a relentless battle for priority that rewards speed over economic value or fairness. According to recent analysis from Flashbots, such spam-driven activity imposes hard economic limits on how much blockchains can scale (theblock.co). Even as raw throughput increases, MEV-driven spam soaks up capacity faster than networks can expand.

“MEV is not just an efficiency problem – it’s an existential one. If left unchecked, latency games will crowd out legitimate use cases and undermine trust in the system. “

The Modular MEV Auctions Approach

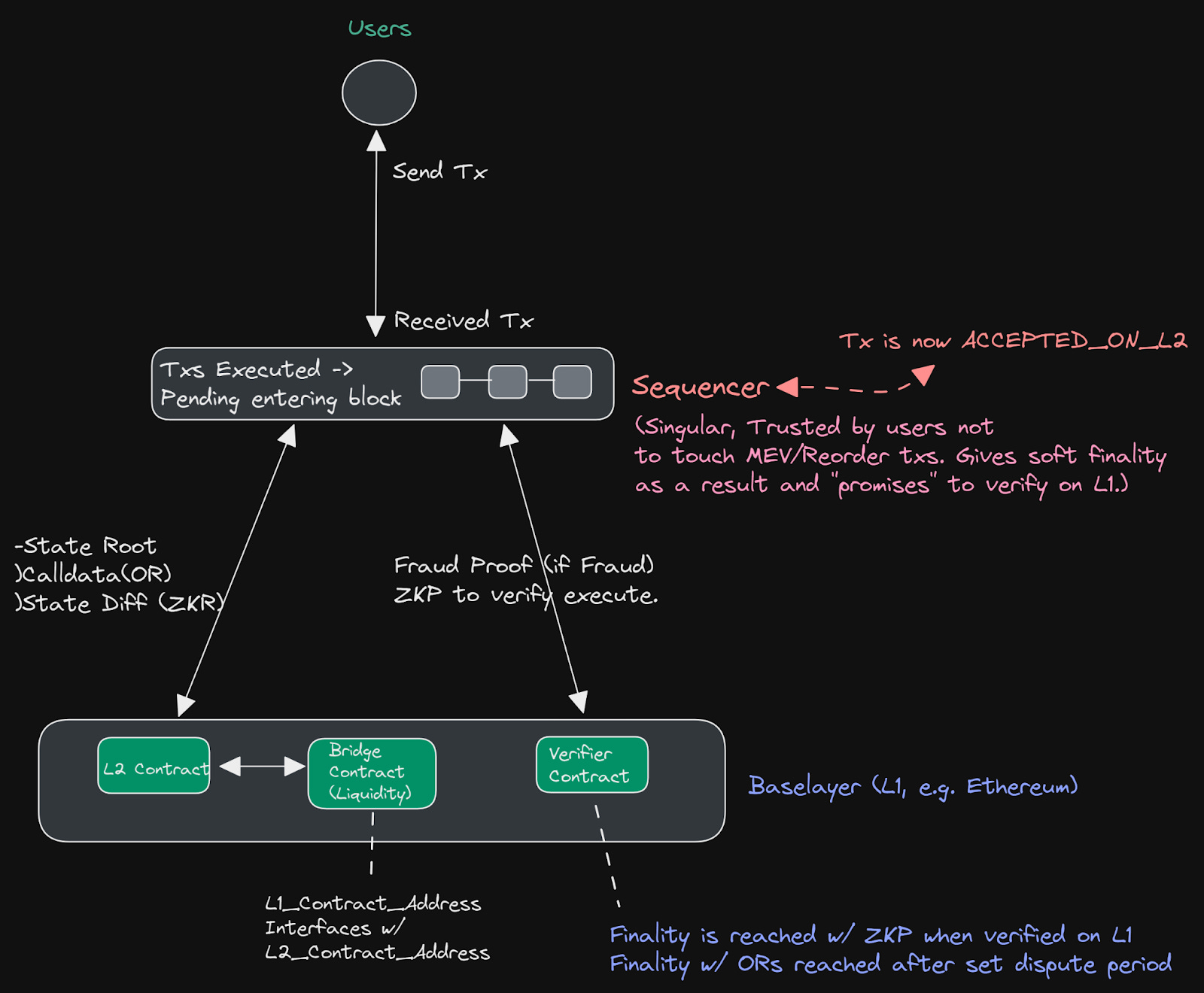

Modular MEV auctions are rapidly gaining traction as a market-driven solution to these challenges. Instead of allowing transaction order to be dictated by network latency or opaque relationships with validators, modular auctions introduce explicit bidding for blockspace rights. This approach transforms the orderflow marketplace into a transparent arena where participants compete based on willingness to pay rather than technical prowess alone.

The mechanism is elegantly simple: participants submit bids specifying how much they are willing to pay for their desired ordering position within a block. Sequencers or validators then allocate blockspace according to these bids, replacing speculative spam with clear price signals and reducing incentives for failed transactions and DeFi inefficiencies. Flashbots and other research groups have spearheaded this transition with PBS-style (Proposer-Builder Separation) auctions designed specifically to combat latency games and spam attacks.

Key Benefits: Efficiency, Fairness, and Spam Prevention

Top 5 Advantages of Modular MEV Auctions Against Blockspace Spam

-

Significant Reduction in Blockspace Spam: Modular MEV auctions replace the need for bots to flood the network with speculative transactions, directly addressing the issue of blockspace congestion. By allocating blockspace through explicit bids, these auctions have been shown to reduce spam transactions that previously consumed up to 60% of blockspace on major networks (Gate.com).

-

Mitigation of Latency Games: By introducing structured bidding for transaction ordering, modular MEV auctions diminish the advantage that low-latency actors and bots previously held. This levels the playing field and reduces the prevalence of latency-driven spam, as noted in research by Flashbots.

-

Enhanced Fairness and Transparency: Modular MEV auctions provide a transparent, rules-based framework for access to blockspace. This ensures that transaction ordering is determined by explicit bids rather than opaque or manipulative strategies, promoting broader trust in the network.

-

Improved Network Efficiency: By reducing unnecessary transaction spam, modular MEV auctions help conserve network resources, resulting in lower congestion and faster transaction processing for all users. This efficiency gain is critical as networks scale and user demand increases.

-

Adaptability Across Ecosystems: Modular MEV auctions are being explored and implemented in diverse blockchain environments, such as Arbitrum’s Timeboost and research-driven approaches by Flashbots. Their modularity allows for tailored integration, addressing spam and MEV challenges unique to each ecosystem (arXiv).

This new paradigm offers several measurable advantages:

- Reduced Latency Arbitrage: By prioritizing price over speed, modular MEV auctions neutralize the advantage held by low-latency actors.

- Blockspace Optimization: Explicit bidding mechanisms ensure that every slot within a block is allocated according to market demand rather than speculative spam.

- Transparency: All bids and outcomes are visible on-chain or through analytics dashboards, fostering trust among traders and developers alike.

- Sustainability: By discouraging wasteful failed transactions, these auctions improve network efficiency, an essential step toward long-term scalability.

- Ecosystem Flexibility: Modular design allows integration across heterogeneous chains (e. g. , HyperEVM MEV or Base chain environments), adapting auction parameters as required by each protocol’s needs.

This shift is more than theoretical; several networks have begun experimenting with auction-based sequencing models. For example, Arbitrum’s Timeboost system introduced short-term priority lanes via express auctions, though early studies reveal ongoing challenges around centralization risks and incomplete spam mitigation (arxiv.org). As research continues across Solana, Cosmos, Ethereum rollups, and beyond, it’s clear that modularity will play an integral role in shaping future blockspace markets.

While the modular MEV auction approach is still evolving, its impact on blockspace optimization and spam prevention is already measurable. By transforming the transaction sequencing process into a transparent, price-driven competition, these auctions drastically reduce the volume of failed transactions that previously saturated DeFi ecosystems. Instead of flooding the network with speculative orders, sophisticated actors now focus on optimizing their bids, aligning incentives across traders, sequencers, and protocol stakeholders.

Modular Auctions in Practice: Challenges and Opportunities

Despite their promise, modular MEV auctions are not a panacea. Real-world deployments have surfaced several nuanced trade-offs. For example, while explicit bidding reduces latency games, it can inadvertently introduce new vectors for centralization if only a handful of large players consistently win priority slots. Networks like Arbitrum and research from arxiv.org highlight that auction mechanisms must be carefully calibrated to prevent concentration of power among dominant searchers or sequencers.

Another key consideration is interoperability across heterogeneous blockchains. Modular MEV auctions must adapt to diverse execution environments, be it HyperEVM-based rollups or monolithic chains like Solana, each with unique throughput characteristics and orderflow dynamics (gate.com). The ability to fine-tune auction parameters per protocol is essential for broad adoption.

Looking Ahead: The Future of Orderflow Marketplaces

The evolution toward modularity in blockspace markets signals a fundamental shift in how value is extracted, and distributed, across the crypto stack. As protocols continue to implement PBS-style auctions and refine their anti-spam strategies, we can expect several trends to accelerate:

- Greater Market Efficiency: Explicit pricing of transaction order will drive more rational allocation of blockspace and minimize wasteful activity.

- Enhanced User Experience: Lower congestion means faster confirmation times and reduced fees for end users, a critical factor for mainstream DeFi adoption.

- Ecosystem-Wide Adoption: With modular frameworks, both established L1s and emerging rollups can deploy auction-based mechanisms tailored to their needs.

- Continuous Innovation: Ongoing research into incentive design will further mitigate centralization risks while maintaining spam resistance (theblock.co).

Should all major blockchains adopt modular MEV auctions for transaction ordering?

Modular MEV auctions are being explored as a way to reduce latency games and blockspace spam caused by MEV bots, aiming for fairer and more efficient transaction ordering. Do you think this approach should become standard across all major blockchain networks?

The battle against latency games and blockspace spam is far from over, but modular MEV auctions represent a data-driven leap forward. As these systems mature, they will underpin fairer access to decentralized finance by ensuring that network resources are allocated transparently and efficiently. For traders, developers, and ecosystem architects alike, staying informed about these innovations is no longer optional, it’s imperative for navigating the next era of blockchain scalability.