In the rapidly evolving landscape of decentralized finance (DeFi), transaction efficiency is both a technical and economic battleground. Modular MEV auctions have emerged as a transformative solution, addressing longstanding challenges around fairness, congestion, and value distribution in blockchain transaction ordering. But what exactly are these auctions, and how do they reshape the orderflow marketplace?

Understanding MEV: The Hidden Cost in DeFi Transactions

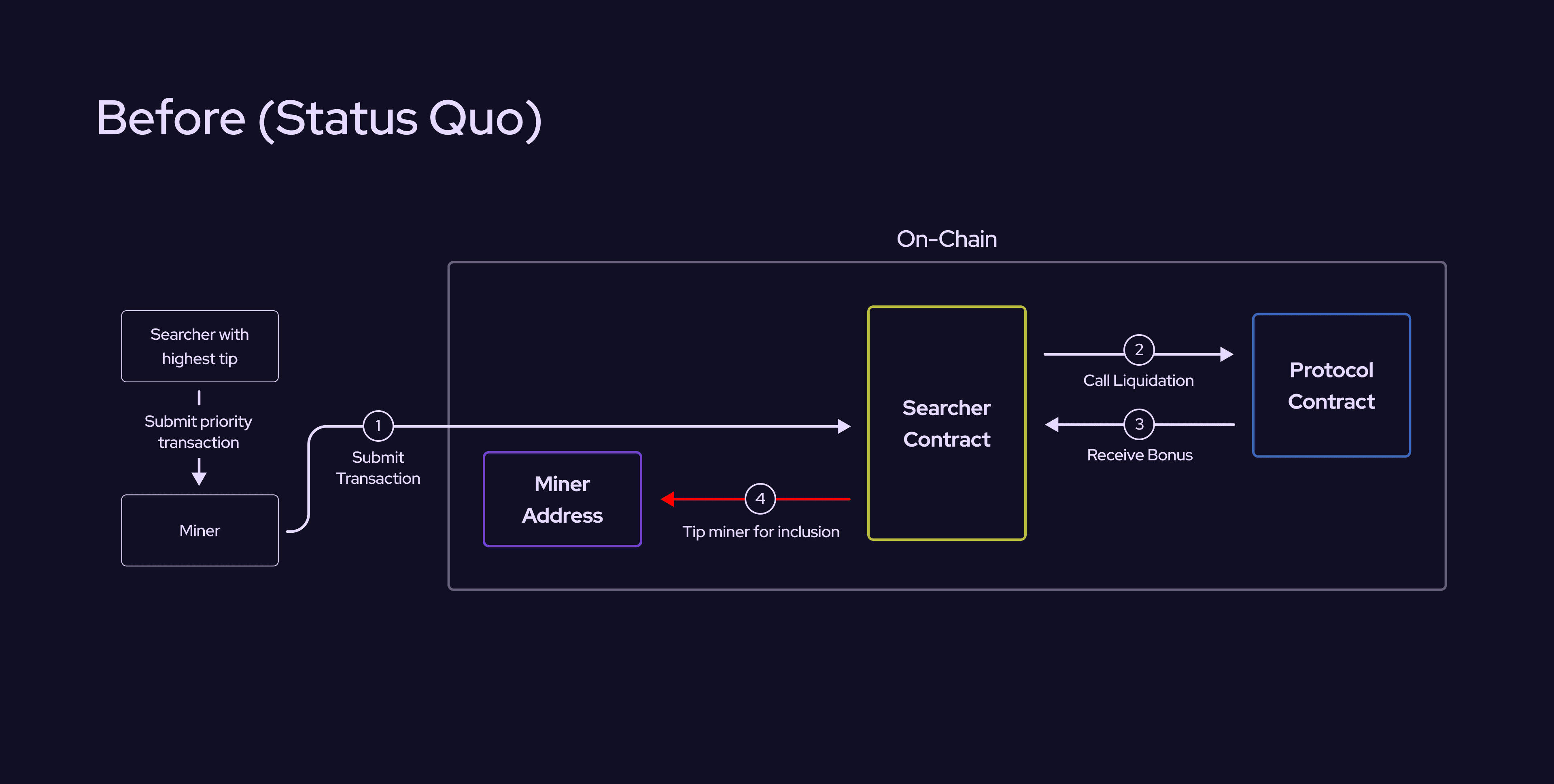

Maximal Extractable Value (MEV) refers to the additional profit that can be captured by reordering, inserting, or censoring transactions within a block. In practice, this has led to phenomena like frontrunning and sandwich attacks, where sophisticated actors exploit public mempools to extract value at the expense of regular users. According to Maven11 Research, these activities can undermine both user trust and network efficiency (source).

The traditional response to MEV has been the so-called priority gas auction (PGA): users bid higher gas fees to prioritize their transactions. However, this race drives up costs for everyone and increases network congestion, a lose-lose situation for most participants.

The Modular MEV Auction Model: Structure Over Chaos

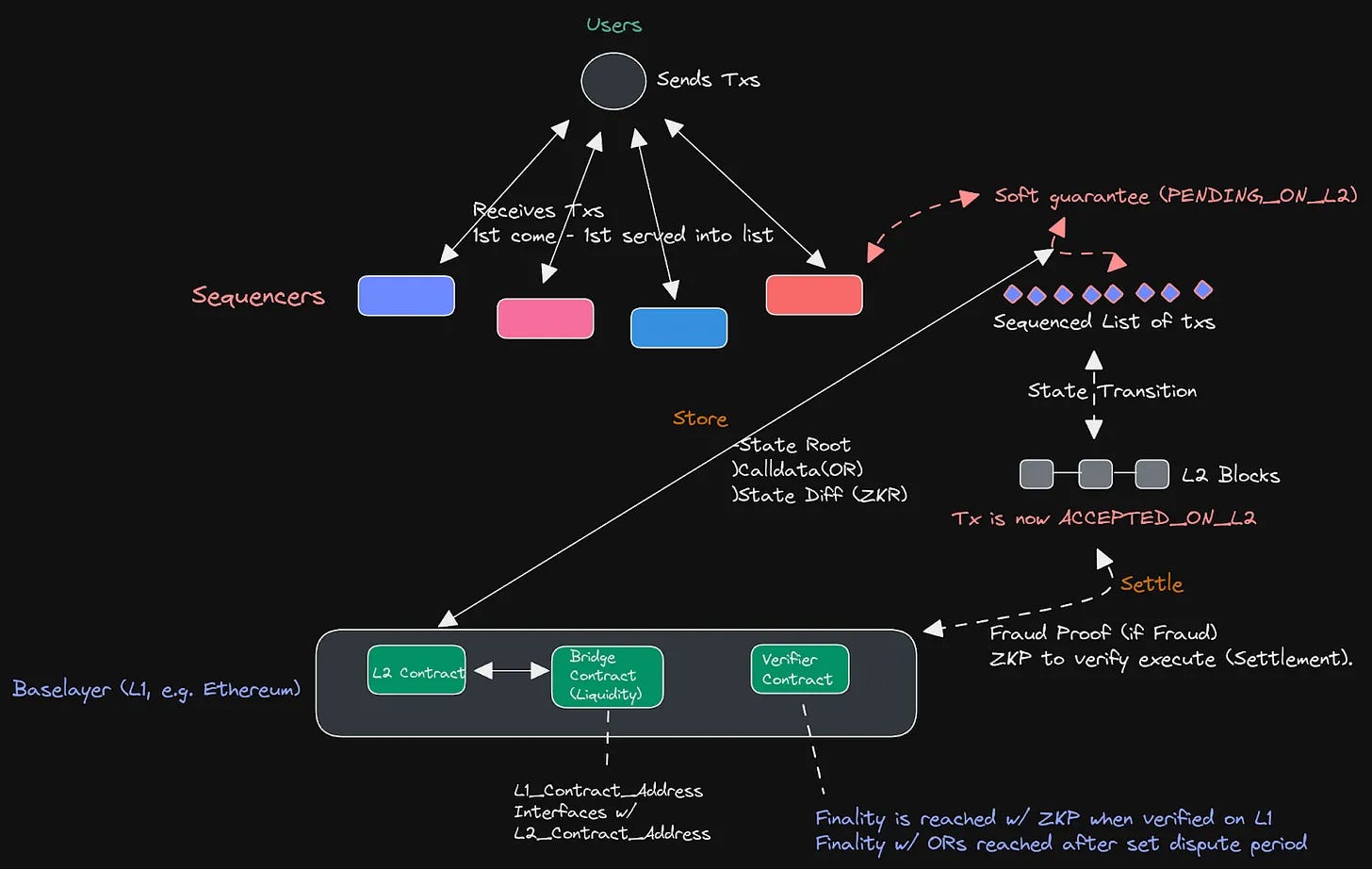

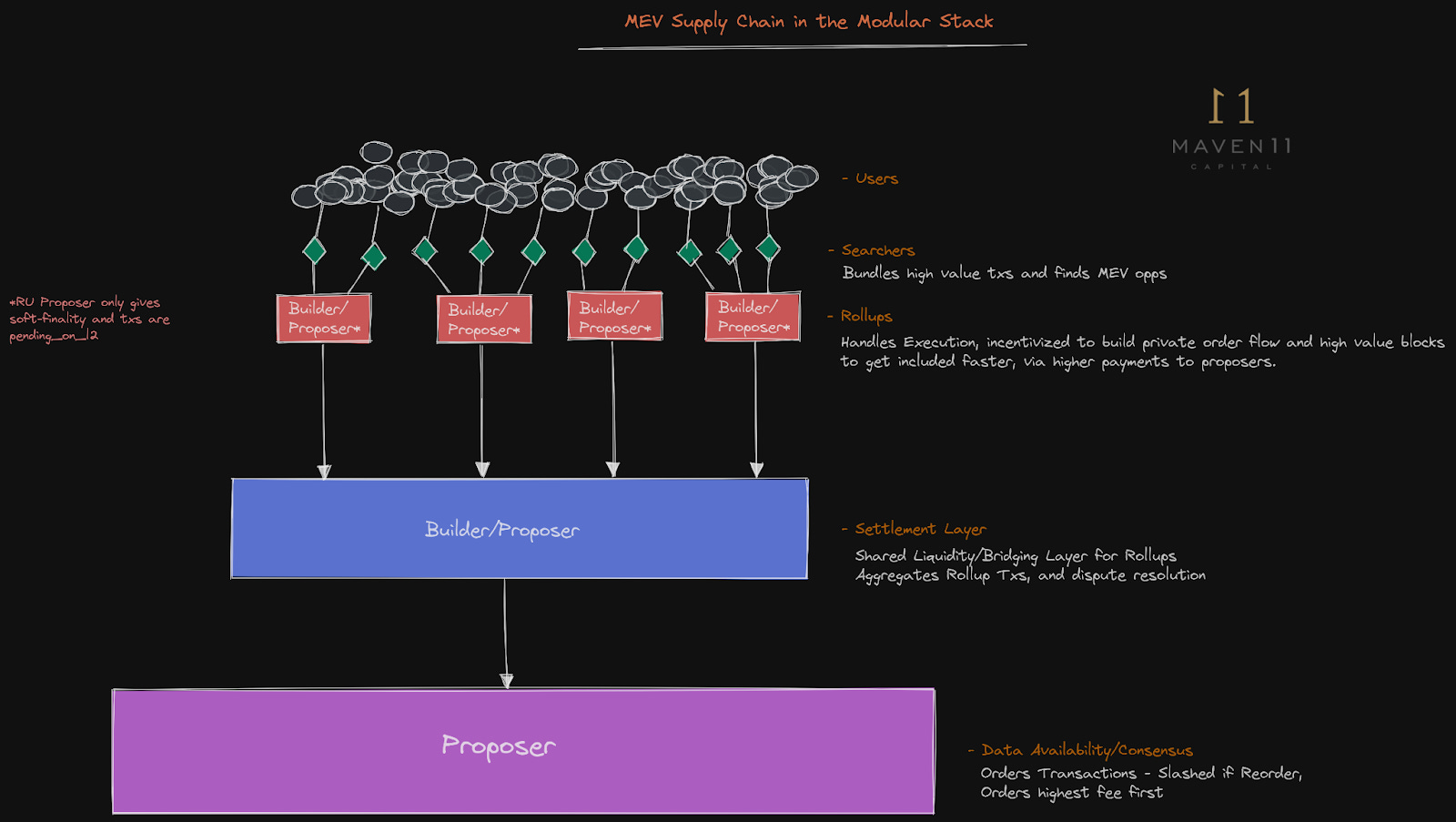

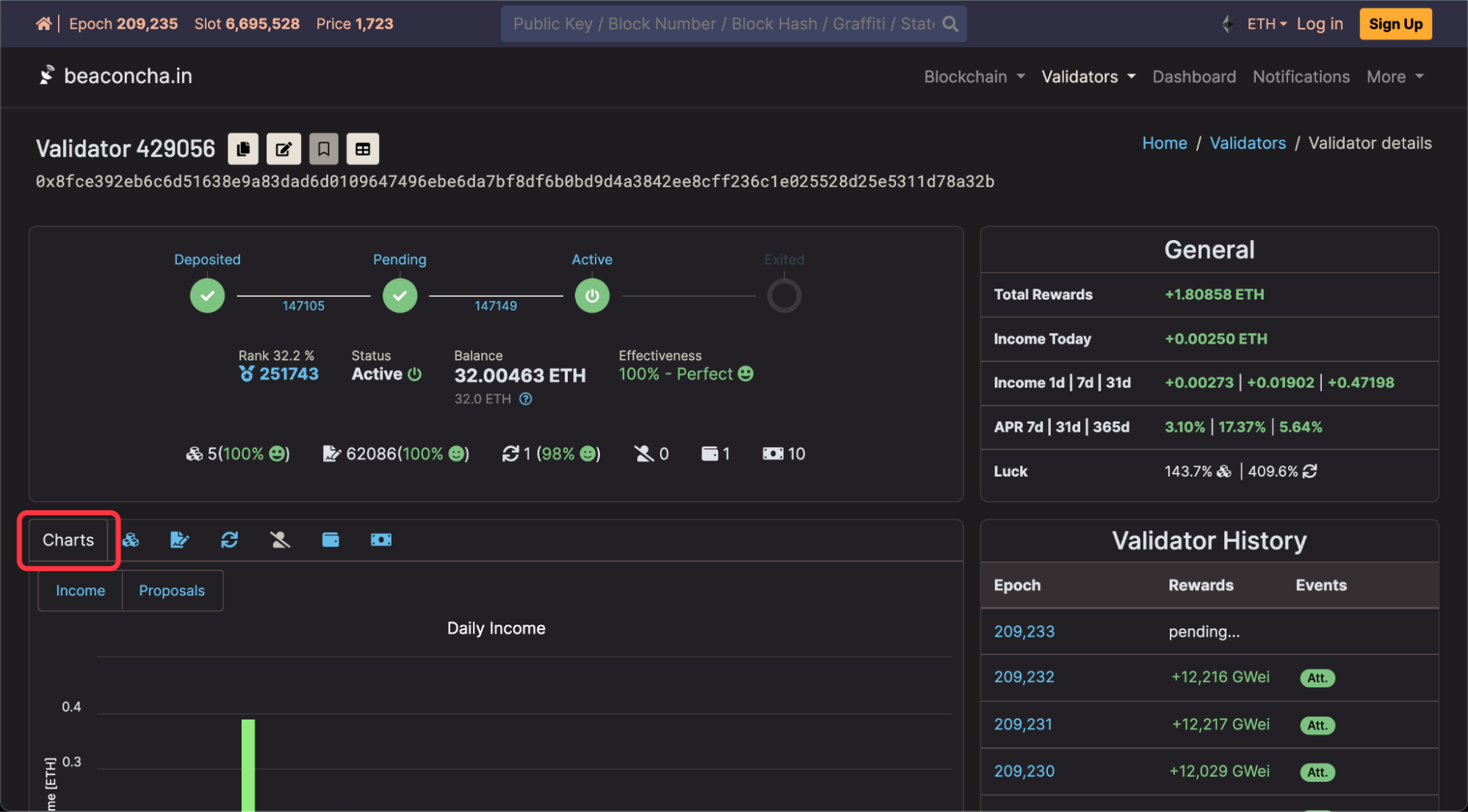

Modular MEV auctions introduce a systematic approach by auctioning off the right to reorder transactions within each block. This process involves three main actors:

- Searchers: Identify profitable opportunities by bundling user transactions.

- Builders: Assemble blocks using bundles from searchers based on potential profitability.

- Validators: Finalize blocks and receive a share of extracted value.

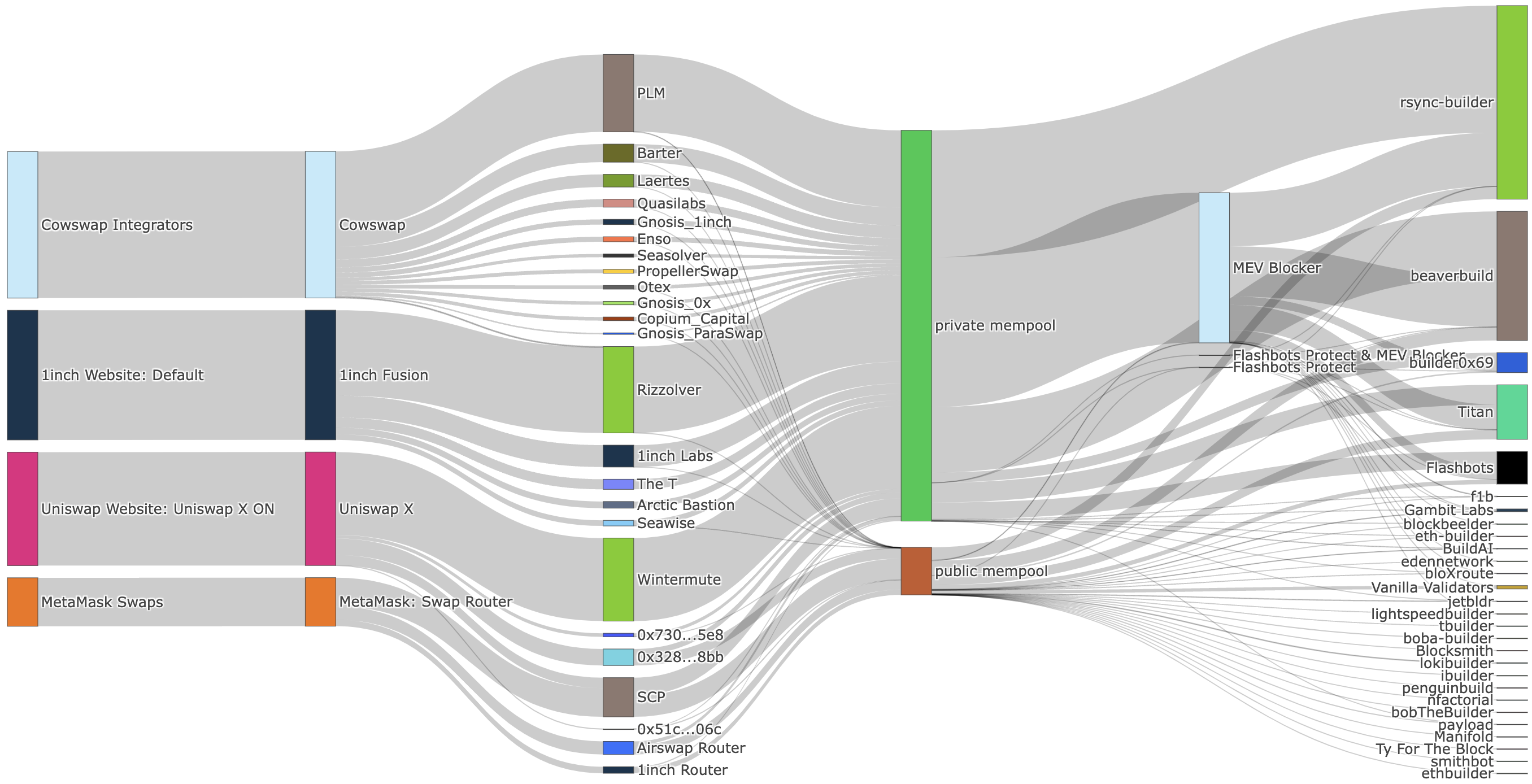

This competitive mechanism transforms blockspace into an open market, an orderflow marketplace. By doing so, it creates transparency around who benefits from transaction sequencing while redistributing value more equitably across network stakeholders. Notably, platforms like Optimism have begun implementing such models where sequencers auction off transaction ordering rights (source).

Key Benefits of Modular MEV Auctions for DeFi Users

-

Enhanced Fairness and Transparency: Modular MEV auctions create a competitive and open marketplace for transaction ordering rights, reducing the dominance of a few entities and making MEV extraction more equitable for all DeFi users.

-

Lower Transaction Costs: By replacing priority gas auctions (PGAs) with structured MEV auctions, users experience more stable and predictable transaction fees, helping to minimize costly bidding wars and slippage.

-

Reduced Network Congestion: Structured auctions decrease excessive gas bidding, leading to less network congestion and improved transaction throughput for all participants.

-

Improved Security and Protocol Stability: Modular MEV auctions help mitigate malicious reordering and sandwich attacks, enhancing the security and reliability of DeFi platforms.

-

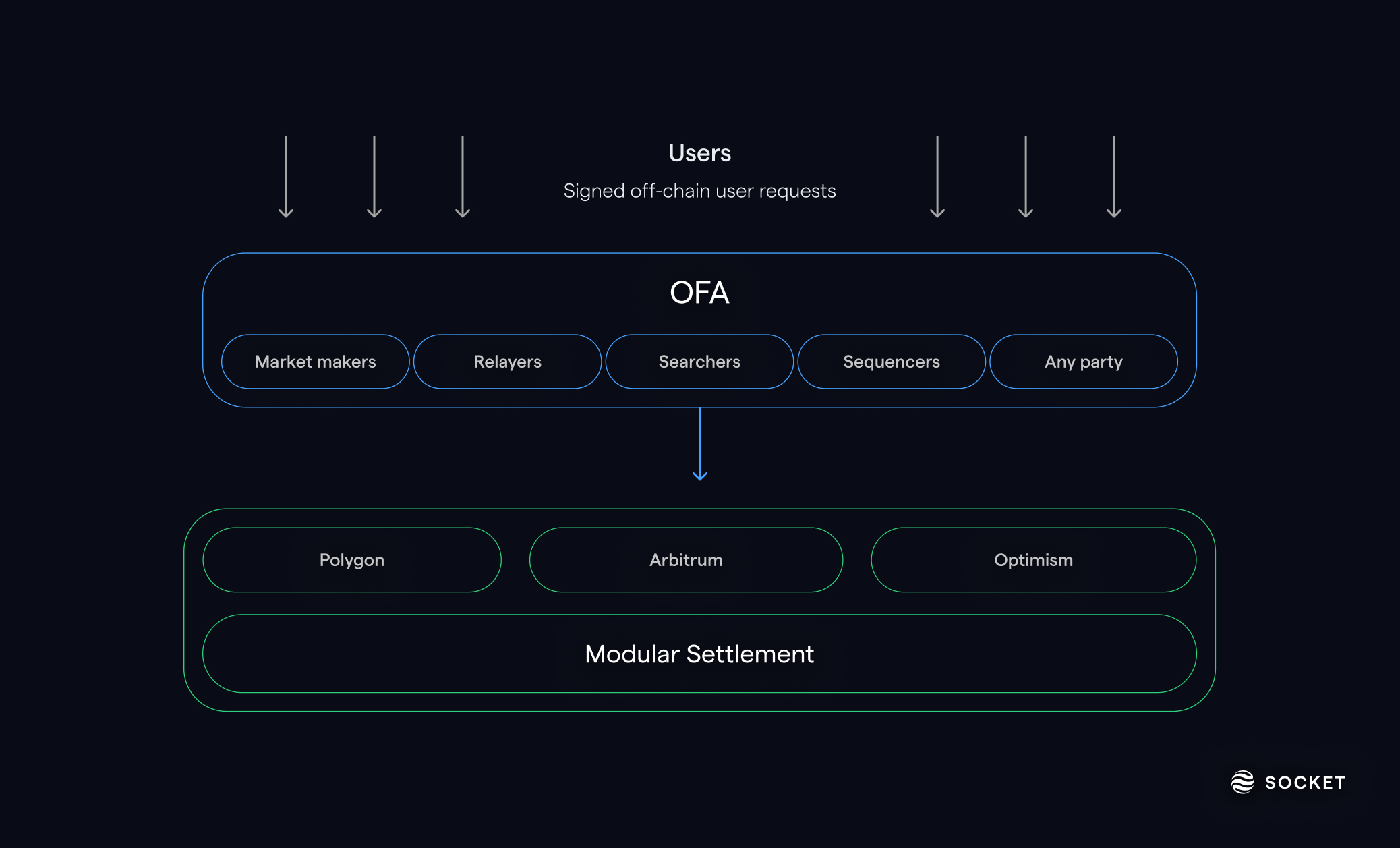

Direct User Incentives: Mechanisms like Order Flow Auctions (OFAs) and Optimism’s MEV auctions allow users to receive a portion of the value their transactions generate, aligning incentives and returning value directly to end-users.

-

Support for Protocol Development: Some modular MEV auction implementations, such as Optimism’s, allocate a share of auction proceeds to fund ongoing protocol development, fostering long-term ecosystem growth.

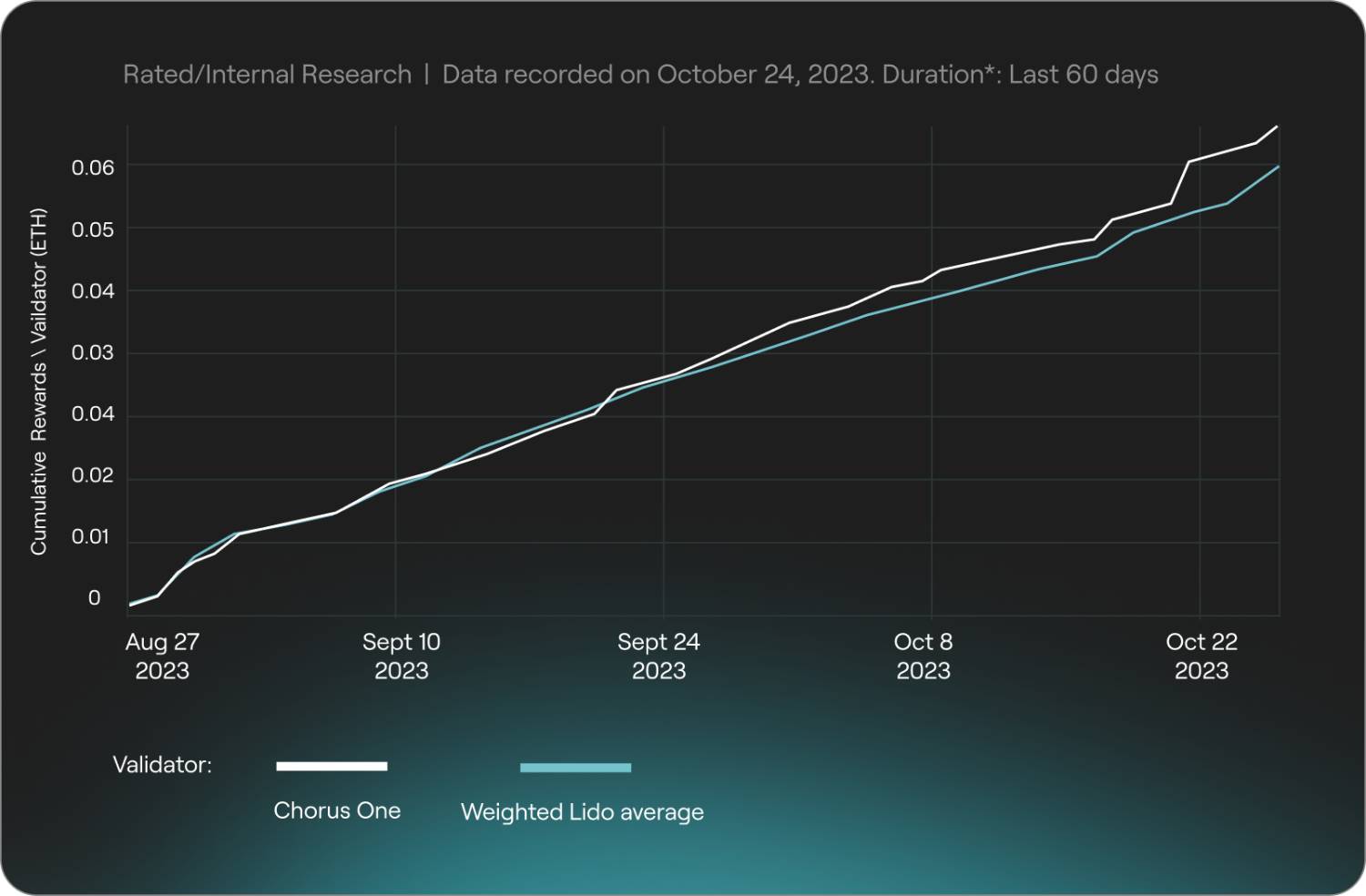

Tangible Efficiency Gains in Transaction Execution

The advantages of modular MEV auctions extend far beyond simple cost savings:

- Fairness: Multiple participants can bid for ordering rights, reducing monopolistic extraction by a few dominant players.

- Smoother Fee Dynamics: By replacing PGAs with structured auctions, networks experience less volatile fee spikes and lower average costs.

- Security Enhancement: Systematic management of transaction sequencing reduces incentives for malicious behavior that could destabilize consensus protocols.

- Ecosystem Funding: Some implementations redirect auction proceeds toward protocol development or community initiatives, aligning incentives across all layers.

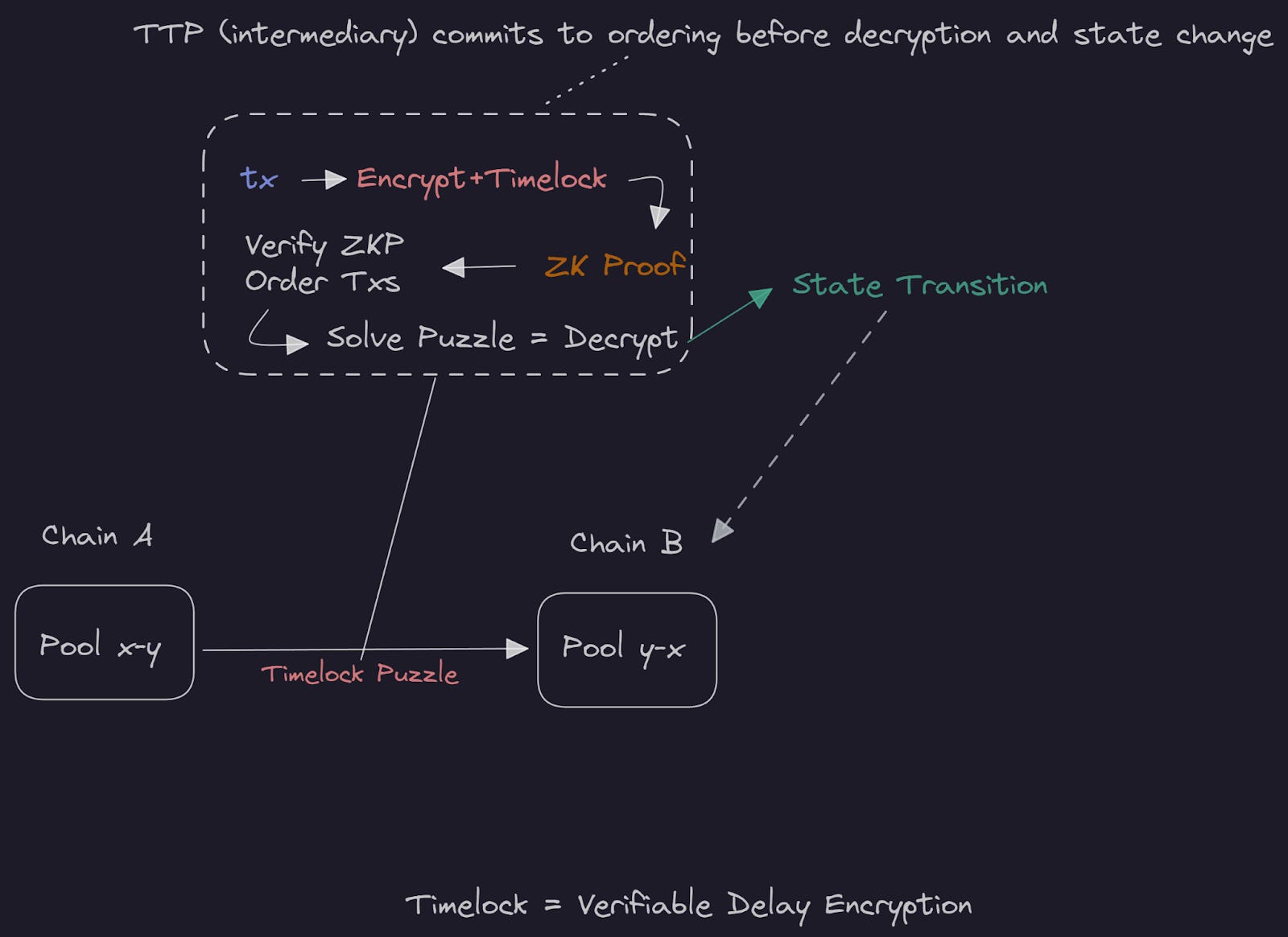

This shift is not just theoretical; real-time auction data from leading protocols demonstrates measurable improvements in slippage reduction and overall user experience. For example, Flashbots’ FBA-FCFS model blends bidding with first-come-first-served principles to balance fairness with efficiency (source). Meanwhile, Automated Arbitrage Market Makers (A2MM) aggregate liquidity across AMMs while atomically collecting MEV, lowering risks related to centralized relays (source).

The Next Era: Real-Time Analytics and Blockspace Market Solutions

The sophistication of modular MEV auctions is matched by advanced analytics platforms offering real-time data on bids, winners, and extracted value. These tools empower traders and developers alike to optimize their strategies around dynamic market conditions, driving further innovation in blockchain transaction optimization.

By leveraging real-time auction data, participants gain unprecedented transparency into the mechanics of blockspace allocation. This visibility is crucial for both institutional and retail DeFi users who seek to maximize returns while minimizing exposure to predatory MEV strategies. As orderflow marketplaces mature, access to granular analytics enables users to make informed decisions about when and how to submit transactions, further enhancing network efficiency.

Moreover, the evolution of modular MEV auctions supports the development of blockspace market solutions that dynamically price transaction inclusion based on current demand and expected value extraction. This market-driven approach replaces the blunt instrument of gas price wars with a nuanced system where value is allocated according to transparent, competitive bidding. The result is a more predictable fee environment and improved capital efficiency across DeFi protocols.

Empowering Users Through Orderflow Marketplaces

The shift toward modular MEV auctions marks a pivotal change in how value flows within decentralized finance. Instead of extractive practices benefiting only a select few, the orderflow marketplace model redistributes rewards and aligns incentives across searchers, builders, validators, and end-users. This democratization of blockspace not only curtails harmful practices like frontrunning but also channels auction proceeds into ecosystem growth.

For developers, these innovations open up new avenues for protocol design and risk management. By integrating modular MEV auction logic directly into smart contracts or infrastructure layers, projects can create tailored environments that mitigate slippage, reduce failed transactions, and foster more reliable user experiences. The flexibility inherent in modular systems also supports experimentation with alternative auction formats and incentive structures, fueling ongoing progress in blockchain transaction optimization.

Navigating the Future of DeFi Transaction Efficiency

As adoption accelerates, several best practices are emerging for those looking to harness the full potential of modular MEV auctions:

Checklist for Maximizing Efficiency in Modular MEV Auctions

-

Understand the Auction Mechanism: Familiarize yourself with the specific modular MEV auction protocol (e.g., Optimism’s MEV Auctions, Flashbots’ FBA-FCFS Model, or A2MM Protocol) to understand how bids are placed, winners are selected, and value is distributed.

-

Monitor Network Conditions: Track current network congestion and gas fee trends. Modular MEV auctions can help reduce congestion, but timing your participation during lower activity periods can further enhance efficiency.

-

Leverage Reputable Searcher and Builder Tools: Use established tools and platforms (such as Flashbots) for identifying, bundling, and submitting profitable transaction opportunities to maximize your potential returns.

-

Stay Informed on Protocol Updates: Regularly review updates from auction protocol teams (e.g., Optimism, Flashbots, A2MM) to stay ahead of changes in auction rules, fee structures, and incentive mechanisms.

-

Implement Robust Risk Management: Assess the risks of frontrunning, sandwich attacks, and failed bids. Use tools or strategies to minimize slippage and protect against adverse transaction ordering.

-

Participate Transparently and Ethically: Engage with modular MEV auctions in a manner that aligns with community standards and protocol guidelines to support fairness and long-term ecosystem health.

Staying informed about auction mechanics, leveraging analytics platforms for real-time insights, and collaborating with reputable builders are all essential steps toward optimal outcomes. The landscape remains highly dynamic, new protocols regularly introduce innovative twists on auction design or integrate additional layers like privacy-preserving orderflow or cross-chain settlement.

Key takeaway: Modular MEV auctions do not eliminate competition, they channel it productively through transparent markets that benefit all network participants.

The future will likely bring even greater integration between MEV strategies, advanced analytics tools, and open orderflow marketplaces. As these elements converge, they promise a more resilient and equitable foundation for decentralized finance, one where transaction efficiency is no longer a privilege but an accessible standard for all participants.