In the fast-moving world of decentralized finance (DeFi), the battle for fair and efficient transaction execution is relentless. Orderflow auctions (OFAs) have emerged as a transformative mechanism, tackling some of DeFi’s most persistent challenges: MEV minimization, slippage reduction, and the prevention of sandwich attacks. But how do these auctions actually work under the hood, and why are they quickly becoming a standard in modular MEV auction design?

What Is Maximal Extractable Value (MEV) and Why Does It Matter?

MEV, or Maximal Extractable Value, refers to the profit that miners or validators can extract by reordering, including, or excluding transactions within a block. This isn’t just technical jargon, it’s a real cost paid by everyday DeFi users through front-running, sandwich attacks, and increased slippage. In traditional settings, sophisticated actors exploit public mempools to spot profitable opportunities before anyone else can react.

The result? Regular traders often find themselves paying higher prices for tokens or getting less favorable trade execution. That’s where orderflow auctions step in as a powerful equalizer.

How Orderflow Auctions Minimize MEV

Orderflow auctions introduce several layers of defense against MEV extraction:

Key Benefits of Orderflow Auctions for DeFi Users

-

Minimized MEV Extraction: OFAs batch transactions and process them simultaneously, reducing opportunities for adversaries to reorder or front-run trades for profit. This directly curtails Maximal Extractable Value (MEV) at users’ expense.

-

Fairer Transaction Execution: By relying on a competitive bidding system, OFAs ensure that transactions are settled based on transparent auction rules, promoting a more equitable trading environment for all participants.

-

MEV Redistribution to Users: In protocols like Flashbots MEV-Share, a portion of the value generated from the auction is returned to users, allowing them to benefit from their own order flow.

-

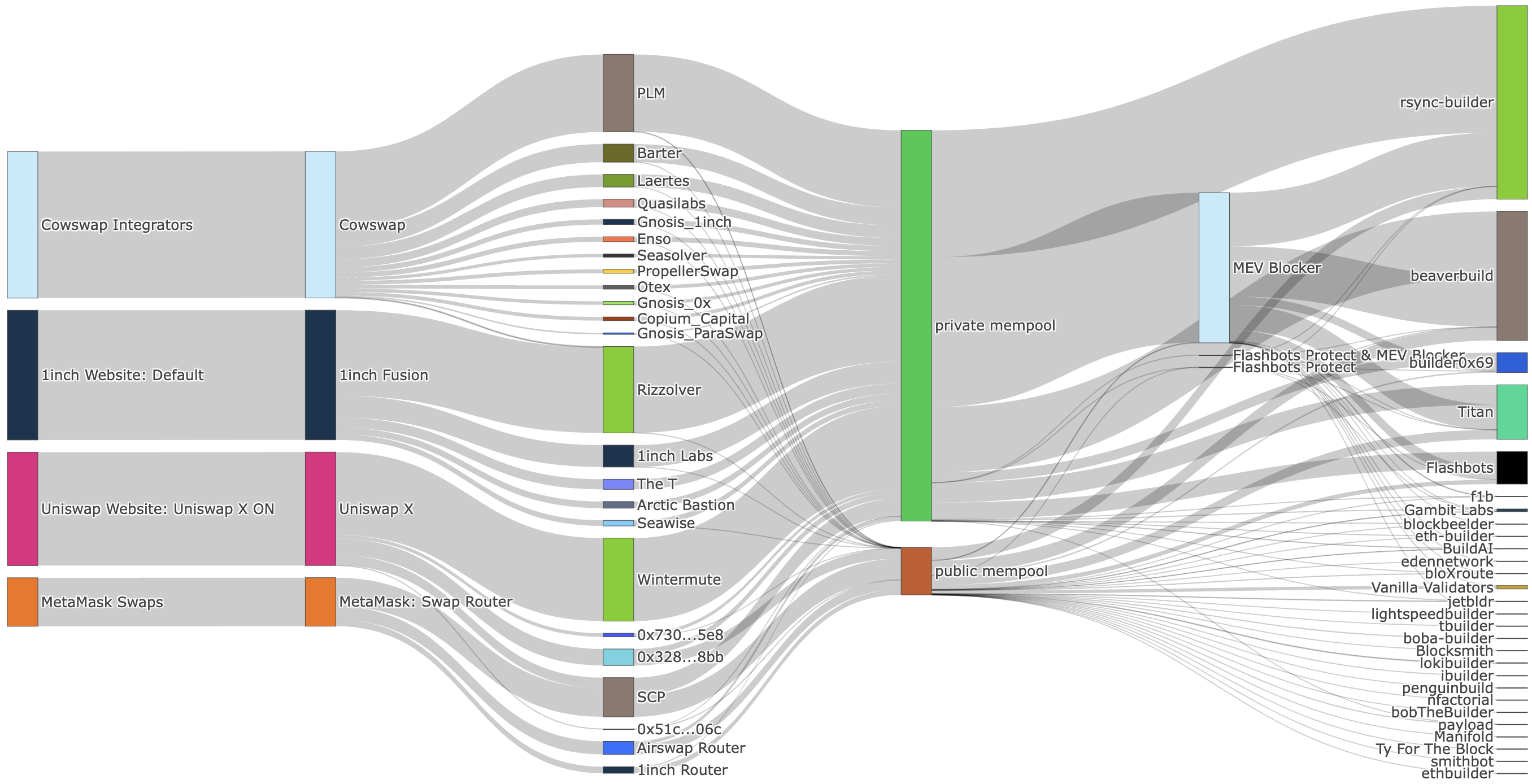

Enhanced Transaction Privacy: OFAs often utilize private mempools or encrypted transaction data, preventing malicious actors from accessing order details and reducing the risk of front-running.

-

Lower Transaction Costs: Batch processing in OFAs can lead to reduced gas fees and overall transaction costs, making DeFi trading more accessible and cost-efficient.

-

Improved Price Discovery: The open and competitive nature of OFAs enables more accurate asset pricing, as market participants can compete fairly for execution, benefiting the entire DeFi ecosystem.

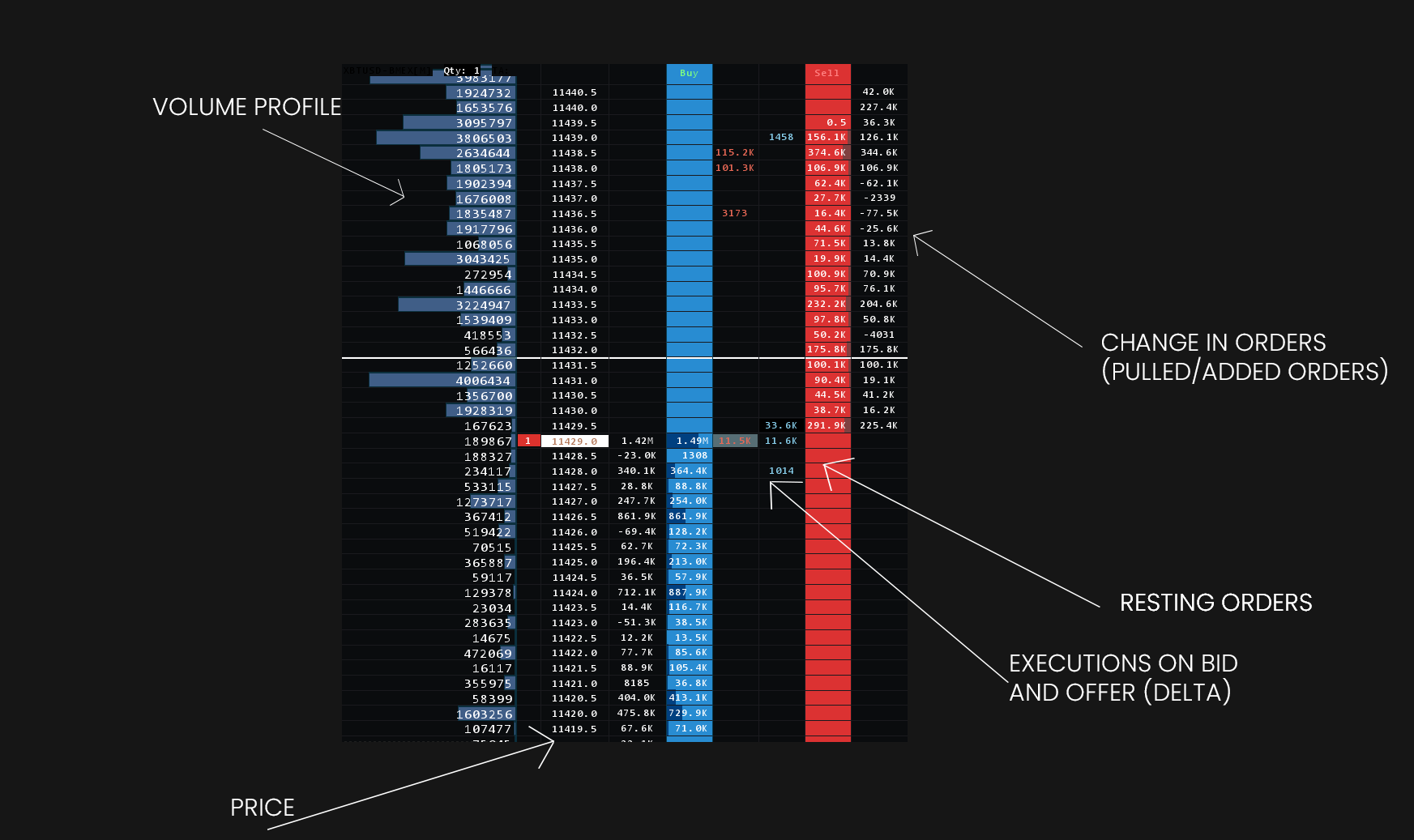

- Batch Processing: Instead of processing trades one at a time, OFAs aggregate multiple user orders into batches. These batches are then executed simultaneously, making it much harder for adversaries to manipulate transaction ordering for personal gain.

- Competitive Bidding: Searchers (also called solvers) compete for the right to execute these batches. The highest bidder wins execution rights, but here’s the twist: part of their bid is redistributed back to users whose orders are included in the batch. This dynamic not only reduces harmful MEV but also shares value with those who generate orderflow.

- Enhanced Privacy: By leveraging private mempools or encrypted transaction data, OFAs prevent bad actors from seeing pending trades before they’re finalized. This is crucial in preventing front-running and sandwich attacks that erode user trust.

The net effect is a system that flips traditional incentives on their head: instead of extractors profiting at user expense, value flows back toward those who contribute liquidity and activity to DeFi protocols.

“Order Flow Auctions (OFAs) are mechanisms in DeFi that mitigate negative MEV externalities by aggregating transactions into batches…”

The Mechanics Behind Improved Transaction Execution

The impact of OFAs goes beyond just reducing MEV extraction; they fundamentally improve how trades get executed on-chain:

- Fairness: Since all participants play by transparent auction rules, there’s less room for insiders or bots to game the system.

- Better Price Discovery: Open competition between searchers drives more accurate pricing and tighter spreads for end-users, an essential ingredient for healthy markets.

- Lower Transaction Costs: Batch processing means fewer redundant operations on-chain, translating into lower gas fees per trade versus traditional single-order settlement models.

A Modular Approach: Layering Security and Efficiency

The future of DeFi is modular, with data availability layers, settlement layers, and execution layers working together seamlessly (Maven11 Research). OFAs fit perfectly within this stack by acting as an execution layer that prioritizes both user protection and market efficiency. Protocols like Flashbots’ MEV-Share demonstrate how redistributing auction proceeds back to users can align incentives across the ecosystem (github.com/flashbots/mev-share).

As the modular DeFi landscape matures, orderflow auctions are being adopted not only by major protocols but also innovative DEXs and rollups seeking to optimize for both security and user experience. This modularity allows OFAs to be tailored for specific applications, whether it’s a high-frequency trading venue or a cross-chain bridge, ensuring that MEV minimization and fair execution aren’t just theoretical ideals but practical realities.

Consider how slippage reduction is achieved: by batching orders and providing searchers with aggregated liquidity, OFAs enable tighter spreads and more predictable pricing, even during periods of volatility. This benefits everyone from casual traders to sophisticated market makers, who can now operate in a less adversarial environment.

Orderflow Auctions in Action: Real-World Impact

Let’s break down the tangible outcomes users can expect when interacting with platforms leveraging OFA architecture:

Real-World Examples of Orderflow Auctions Improving DeFi

-

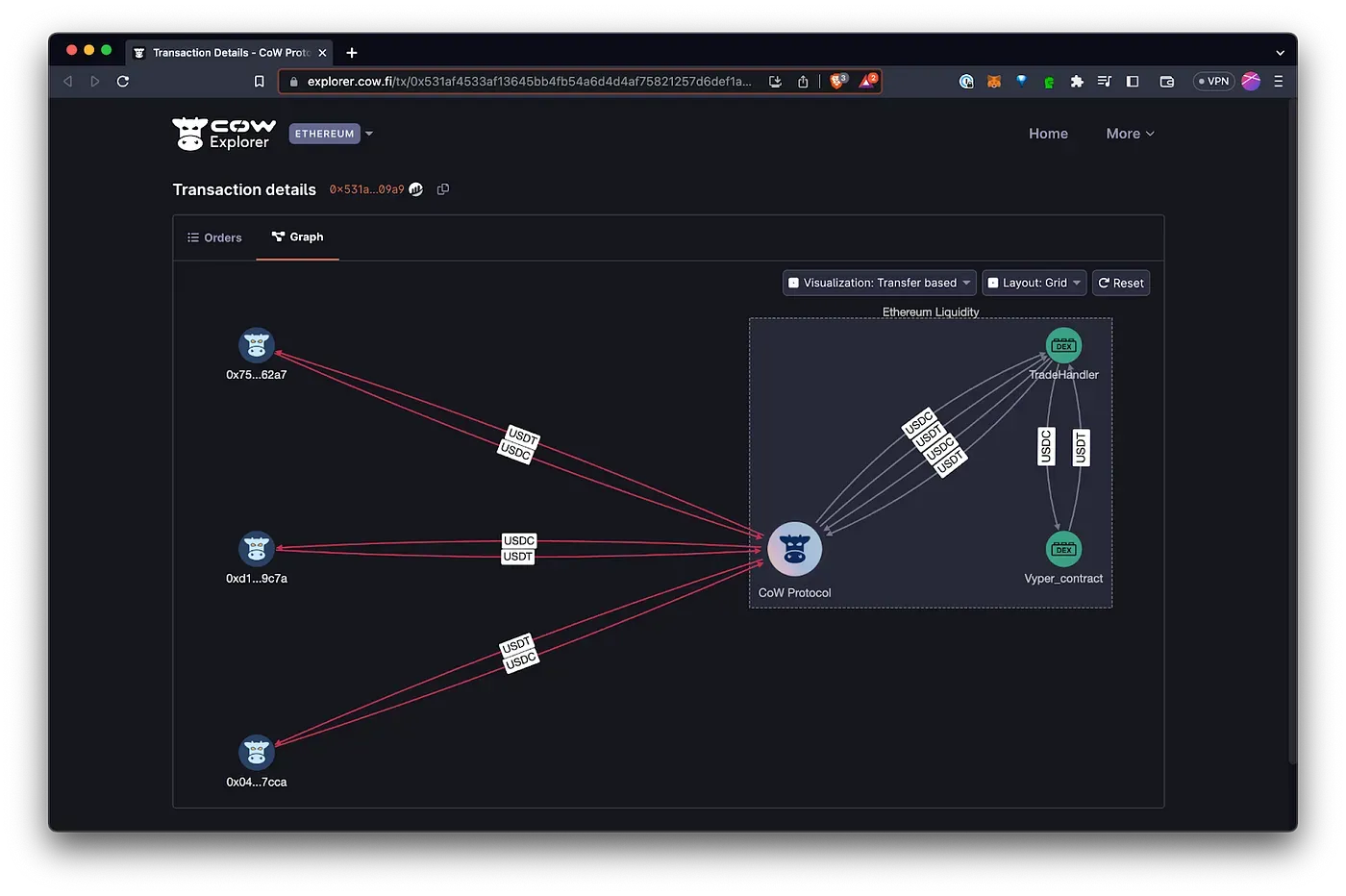

CoW Protocol: CoW Protocol uses orderflow auctions to batch user trades and route them through competitive solvers. This approach minimizes MEV by reducing front-running and sandwich attacks, while also returning a portion of solver profits to users, leading to better execution prices.

-

Flashbots MEV-Share: The MEV-Share protocol by Flashbots implements an orderflow auction system that redistributes MEV profits back to transaction originators. By auctioning off transaction bundles in a privacy-preserving way, it reduces harmful MEV extraction and improves transaction fairness.

-

Balancer’s Batch Auctions: Balancer integrates batch auctions into its platform, aggregating trades for simultaneous settlement. This method reduces gas fees and minimizes the risk of MEV attacks, resulting in more equitable outcomes for liquidity providers and traders.

-

UniswapX: UniswapX leverages orderflow auctions by allowing external fillers to compete for order execution. This competition improves price discovery and reduces slippage for users, while also redistributing some value from MEV back to traders.

-

Semantic Layer by Arrakis Finance: Semantic Layer provides a modular execution layer that enables DeFi applications to implement customized orderflow auctions. This reduces MEV extraction and enhances transaction efficiency across various DeFi protocols.

- Sandwich Attack Prevention: By hiding transaction details until execution, OFAs dramatically reduce the risk of sandwich attacks, where malicious actors manipulate prices between two legs of a trade.

- Transparent Fee Markets: Competitive bidding among searchers creates a dynamic fee market. Users gain insight into how much value their orderflow generates and receive a share of the proceeds.

- User-Centric Value Flow: Instead of extractors capturing all surplus, value is redistributed back to users or DAOs, creating new incentives for honest participation and protocol loyalty.

The adoption curve is steepening as more protocols recognize the upside. According to CoW DAO’s documentation, integrating orderflow auctions can lead to measurable improvements in transaction settlement fairness and cost savings for end-users. These advances aren’t limited to Ethereum mainnet; they’re spreading across rollups and alternative L1s as well.

What’s Next for Modular MEV Auctions?

The evolution doesn’t stop here. As research continues, like the work surveyed by Frontier Research: we’re seeing experimentation with hybrid models that combine general-purpose OFAs with app-specific logic. The goal? To further refine slippage controls, enhance privacy guarantees, and create even more robust defenses against emerging MEV threats.

If you’re building or trading in DeFi today, understanding, and participating in, orderflow auction systems isn’t optional; it’s essential for maximizing returns while minimizing risk. With ongoing innovation around modularity and incentive alignment, expect these mechanisms to become foundational pillars of tomorrow’s decentralized finance infrastructure.

Have you used Order Flow Auctions (OFAs) to minimize MEV in your DeFi transactions?

Order Flow Auctions (OFAs) are designed to reduce Maximal Extractable Value (MEV) and improve transaction fairness in DeFi. We’re curious about your experience with these mechanisms and their impact on your trading.